Vietnam Agriculture Equipment Market (2025-2031) | Value, Trends, Companies, Growth, Share, Analysis, Size, Industry, Forecast & Revenue

Market Forecast By Products (Tractors (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Harvesters (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Threshers (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Pumps (Up To 30 HP, 30.1 HP- 70 HP, 70.1 HP- 130 HP, 130.1 HP- 200 HP And Above 200 HP), Power Tillers (Up To 30 HP And 30.1 HP- 70 HP), Rotavators (Up To 30 HP, 30.1 HP- 70 HP And 70.1 HP- 130 HP) And Others Including Rice Transplanters, Weeders, Excavators And Farm Carriers)) And Competitive Landscape

| Product Code: ETC160077 | Publication Date: Feb 2022 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

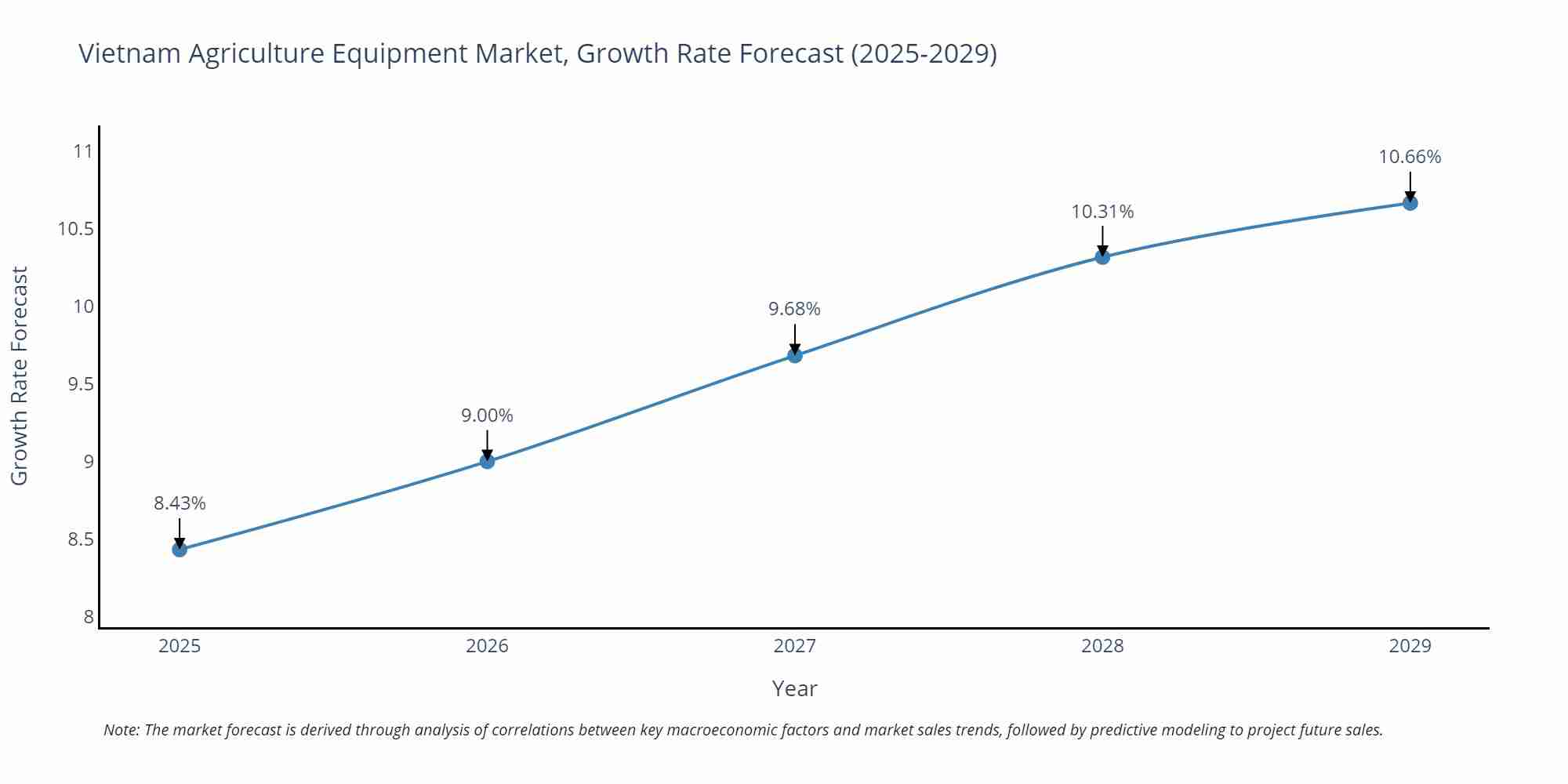

Vietnam Agriculture Equipment Market Size Growth Rate

The Vietnam Agriculture Equipment Market is poised for steady growth rate improvements from 2025 to 2029. From 8.43% in 2025, the growth rate steadily ascends to 10.66% in 2029.

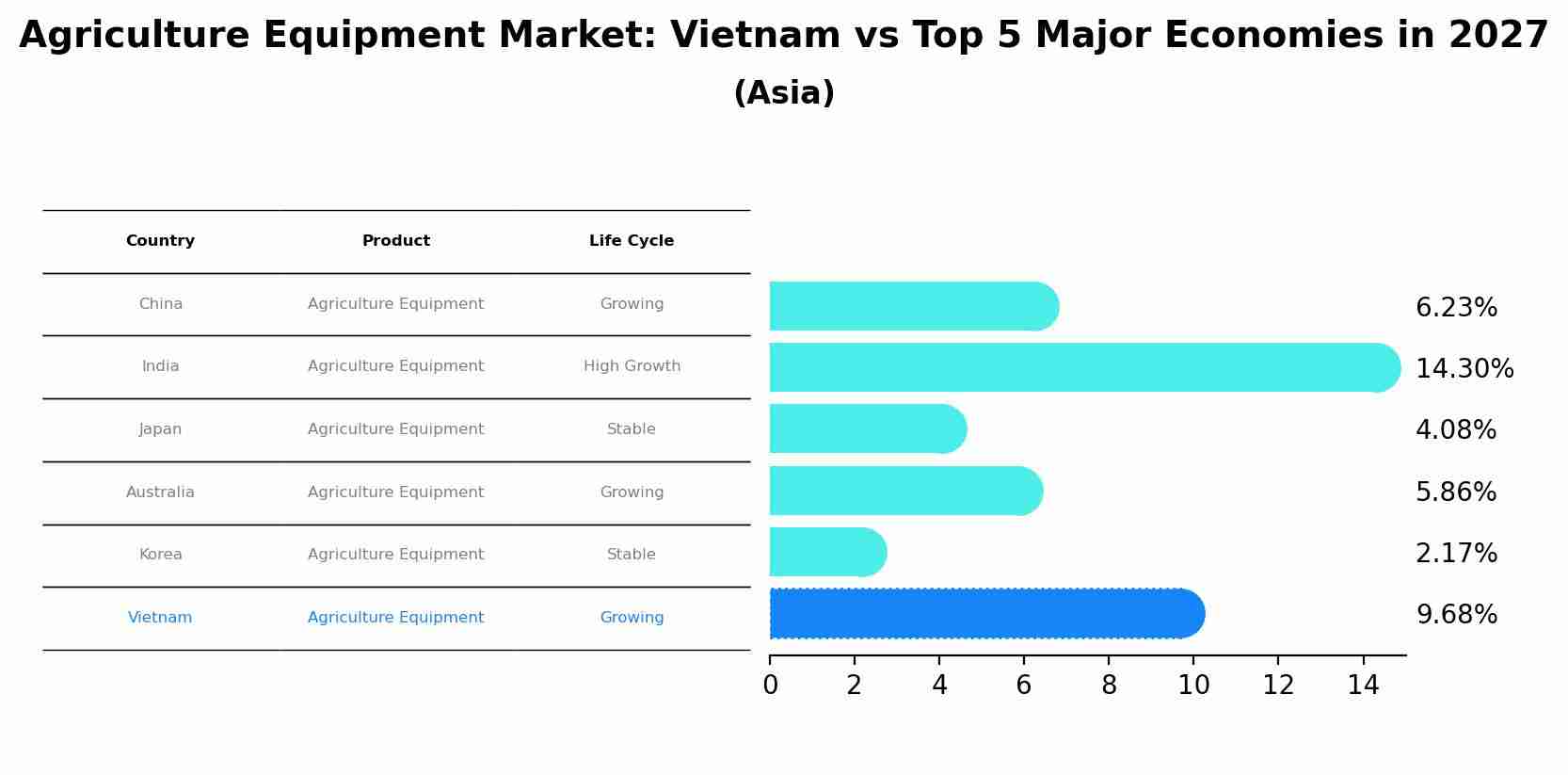

Agriculture Equipment Market: Vietnam vs Top 5 Major Economies in 2027 (Asia)

The Agriculture Equipment market in Vietnam is projected to grow at a growing growth rate of 9.68% by 2027, within the Asia region led by China, along with other countries like India, Japan, Australia and South Korea, collectively shaping a dynamic and evolving market environment driven by innovation and increasing adoption of emerging technologies.

Vietnam Agriculture Equipment Market Report Highlights

| Report Name | Vietnam Agriculture Equipment Market Report |

| Forecast period | 2025-2031 |

| CAGR | 6.3% |

| Growing Sector | Agriculture |

Topics Covered in the Vietnam Agriculture Equipment Market Report

Vietnam Agriculture Equipment Market report thoroughly covers the market by product. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Vietnam Agriculture Equipment Market Synopsis

The Vietnam Agriculture Equipment market is projected to grow significantly from 2025 and 2031, driven by advances in farming technology, greater mechanization, government assistance, and rising need for effective agricultural solutions to fulfill rising food production needs. Expanding agribusiness investments and the use of sophisticated equipment are important growth drivers in the market.

According to 6Wresearch, Vietnam Agriculture Equipment Market size is expected to grow at a significant CAGR of 6.3% during 2025-2031. The market for agricultural equipment in Vietnam is expanding rapidly due to a number of important factors. Demand for premium products is being driven by altering consumer preferences brought on by an expanding middle class and rising disposable income. Modern agricultural equipment is required as a result of this shift in order to match customer expectations and increase crop output. Another important growth driver is the need for greater efficiency and productivity. Vietnam's agriculture sector is under pressure to increase output while maximizing resources due to the country's growing population. Modern machinery provides answers by allowing farmers to increase yields, save time, and use less work. These trends, combined with government initiatives and technological advancements, are fostering the adoption of modern farming tools, contributing to the Vietnam agriculture equipment market growth.

Despite its encouraging growth, the Vietnam Agriculture Equipment Market is confronted with obstacles that could prevent it from growing further. High upfront investment prices continue to be a major obstacle, especially for small-scale farmers who find it difficult to purchase contemporary farming equipment. Adoption is also hampered by the fact that many farmers lack technical expertise and awareness. Integration into conventional farming methods is slowed by a lack of knowledge about the advantages and appropriate use of cutting-edge technology. Overcoming these obstacles and encouraging a wider acceptance of contemporary agricultural equipment throughout Vietnam may be greatly aided by addressing these problems via funding, subsidies, and training initiatives.

Vietnam Agriculture Equipment Market Trends

The Vietnam Agriculture Equipment Industry is undergoing significant trends that are influencing its growth trajectory. Vietnamese farmers are increasingly using precision farming methods, like drones and GPS-guided tractors, to increase crop yields, maximize resources, and boost productivity. Furthermore, the need for environmentally friendly machinery that reduces environmental impact and encourages effective resource management is being driven by the increased focus on sustainable agricultural methods. Farmers are increasingly looking for solutions that support sustainable farming objectives, such as using less water and emitting fewer pollutants. These patterns demonstrate how the market is moving to combine sustainability and cutting-edge technology to satisfy Vietnam's changing agricultural demands.

Investment Opportunities in the Vietnam Agriculture Equipment Market

The Vietnam Agriculture Equipment Market presents promising investment prospects for both domestic and international investors. One important area is the creation of small-scale, reasonably priced equipment that is suited to the requirements of smallholder farmers, who make up a sizable section of Vietnam's agricultural industry. There is a sizable market for affordable solutions in this sector. Furthermore, growing distribution networks are essential to fulfilling the growing demand for contemporary machinery, especially in rural regions where access is still restricted. By improving market penetration and accessibility, strengthening these networks can enable more farmers to use cutting-edge equipment. These prospects demonstrate Vietnam's agricultural sector's capacity for innovation and expansion.

Leading Players in the Vietnam Agriculture Equipment Market

The Vietnam Agriculture Equipment Market is dominated by notable global and regional manufacturers. One major competitor in the industry is John Deere, which is well-known for its powerful tractors and farming equipment. A large variety of agricultural equipment is offered by Kubota Corporation, especially for small-scale and rice farming activities. CNH Industrial N.V. provides a variety of farming equipment under well-known brands including Case IH and New Holland. Mahindra & Mahindra Ltd., Mitsubishi Agricultural Machinery Co. Ltd., AGCO Corporation, Yanmar Co. Ltd., and Escorts Limited are some other noteworthy participants. These companies support the expansion of the market by providing dependable, cutting-edge machinery intended to boost agricultural output.

Government Regulations

The Vietnamese government has launched a number of programs to encourage modernization in agriculture. Enhancing infrastructure, implementing new technologies, and increasing agricultural production efficiency in rural areas are the main objectives of the National Target Program on New Rural Development. The goal of this initiative is to develop a more successful and sustainable rural economy. The Sustainable Agriculture Development Program also promotes the use of contemporary farming methods and technology that maximize resource management. This effort contributes to increased agricultural product quality, less environmental impact, and increased productivity by supporting sustainable practices. These policies are intended to promote long-term growth and hasten the transition of Vietnam's agricultural economy.

Future Insights of the Vietnam Agriculture Equipment Market

The Vietnam Agriculture Equipment Market is expected to grow significantly in the future years, driven by increased mechanization and government measures to promote sustainable farming. To remain competitive, companies must focus on developing affordable, efficient equipment and expanding distribution networks to reach rural areas. Growing consumer demand for premium products and technological developments in farming equipment will fuel industry expansion. There are a lot of chances for investment and innovation as the agriculture industry modernizes. The market has a lot of potential for both domestic and foreign companies looking to capitalize on Vietnam's developing agricultural landscape because of the robust government support and rising use of contemporary equipment.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Tractors to dominate the Market - by Product

According to Ravi Bhandari, Research Head, 6Wresearch, tractors dominate the Vietnam agriculture equipment market due to their broad application in numerous farming tasks. Tractors are highly adaptable, making them suited for a variety of terrains, increasing their demand among farmers seeking to improve productivity and efficiency in agricultural operations.

Key Attractiveness

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Vietnam Agriculture Equipment Market Outlook

- Vietnam Agriculture Equipment Market Overview

- Vietnam Agriculture Equipment Market Forecast

- Vietnam Agriculture Equipment Market Size

- Vietnam Agriculture Equipment Market Share, by-products

- Vietnam Agriculture Equipment Market Forecast of revenues until 2031

- Historical Data of Vietnam Agriculture Equipment Market Revenues and Volume, by-products for the Period 2021-2031

- Market Size & Forecast of Vietnam Agriculture Equipment Market Revenues and Volume, by-products until 2031

- Vietnam Tractor Market Revenue and Volume Share, By HP Range

- Historical Data of Vietnam Tractor Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Vietnam Tractor Market Revenues and Volume, By HP range until 2031

- Vietnam Harvester Market Revenue and Volume Share, By HP Range

- Historical Data of Vietnam Harvester Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Vietnam Harvester Revenue and Volume Share, By HP range until 2031

- Vietnam Thresher Market Revenue and Volume Share, By HP Range

- Historical Data of Vietnam Thresher Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Vietnam Thresher Market Revenues and Volume, By HP range until 2031

- Vietnam Pumps Market Revenue and Volume Share, By HP Range

- Historical Data of Vietnam Pumps Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Vietnam Pumps Market Revenues and Volume, By HP range until 2031

- Vietnam Power Tiller Market Revenue and Volume Share, By HP Range

- Historical Data of Vietnam Power Tiller Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Vietnam Power Tiller Market Revenues and Volume, By HP range until 2031

- Vietnam Rotavator Market Revenue and Volume Share, By HP Range

- Historical Data of Vietnam Rotavator Market Revenues and Volume, by HP range for the Period 2021-2031

- Market Size & Forecast of Vietnam Rotavator Market Revenues and Volume, By HP range until 2031

- Vietnam Agriculture Equipment Market Drivers and Restraints

- Vietnam Agriculture Equipment Market Trends

- Porter’s Five Forces Analysis and Market Opportunity Assessment

- Vietnam Agriculture Equipment Market Share, by Companies

- Vietnam Agriculture Equipment Market Overview, by Competitive Benchmarking

- Company Profiles

- Strategic Recommendations

Market Covered

The Vietnam Agriculture Equipment market report provides a detailed analysis of the following market segments

By Product

-

Tractors

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

-

Harvesters

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

-

Threshers

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

-

Pumps

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

- 130.1 HP- 200 HP

- Above 200 HP

-

Power Tillers

- Up to 30 HP

- 30.1 HP- 70 HP

-

Rotavators

- Up to 30 HP

- 30.1 HP- 70 HP

- 70.1 HP- 130 HP

-

Others (Rice Transplanter, Weeders, Excavators and Farm Carriers)

Vietnam Agriculture Equipment Market Report (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Methodology Adopted and Key Data Points |

| 2.5. Assumptions |

| 3. Vietnam Agriculture Equipment Market Overview |

| 3.1. Vietnam Agriculture Equipment Market Revenues and Volume, 2021-2031F |

| 3.2. Vietnam Agriculture Equipment Market Industry Life Cycle, 2031 |

| 3.3. Vietnam Agriculture Equipment Market Porter’s Five Forces |

| 3.4. Vietnam Agriculture Equipment Market Revenue and Volume Share, By Equipment, 2021 & 2031F |

| 4. Vietnam Agriculture Equipment Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Vietnam Tractor Market Overview |

| 5.1. Vietnam Tractor Market Revenues and Volume, 2021-2031F |

| 5.2. Vietnam Tractor Market Revenue Share, By HP Range, 2021 & 2031F |

| 5.3. Vietnam Tractor Market Volume Share, By HP Range, 2021 & 2031F |

| 5.4. Vietnam Tractor Market Revenues and Volume, By HP Range, 2021-2031F |

| 5.5. Vietnam Tractor Market Price Trend, By HP Range, 2021-2031F |

| 6. Vietnam Harvester Market Overview |

| 6.1. Vietnam Harvester Market Revenues and Volume, 2021-2031F |

| 6.2. Vietnam Harvester Market Revenue Share, By HP Range, 2021 & 2031F |

| 6.3. Vietnam Harvester Market Volume Share, By HP Range, 2021 & 2031F |

| 6.4. Vietnam Harvester Market Revenues and Volume, By HP Range, 2021-2031F |

| 6.5. Vietnam Harvester Market Price Trend, By HP Range, 2021-2031F |

| 7. Vietnam Thresher Market Overview |

| 7.1. Vietnam Thresher Market Revenues and Volume, 2021-2031F |

| 7.2. Vietnam Thresher Market Revenue Share, By HP Range, 2021 & 2031F |

| 7.3. Vietnam Thresher Market Volume Share, By HP Range, 2021 & 2031F |

| 7.4. Vietnam Thresher Market Revenues and Volume, By HP Range, 2021-2031F |

| 7.5. Vietnam Thresher Market Price Trend, By HP Range, 2021-2031F |

| 8. Vietnam Pumps Market Overview |

| 8.1. Vietnam Pumps Market Revenues and Volume, 2021-2031F |

| 8.2. Vietnam Pumps Market Revenue Share, By HP Range, 2021 & 2031F |

| 8.3. Vietnam Pumps Market Volume Share, By HP Range, 2021 & 2031F |

| 8.4. Vietnam Pumps Market Revenues and Volume, By HP Range, 2021-2031F |

| 8.5. Vietnam Pumps Market Price Trend, By HP Range, 2021-2031F |

| 9. Vietnam Power Tiller Market Overview |

| 9.1. Vietnam Power Tiller Market Revenues and Volume, 2021-2031F |

| 9.2. Vietnam Power Tiller Market Revenue Share, By HP Range, 2021 & 2031F |

| 9.3. Vietnam Power Tiller Market Volume Share, By HP Range, 2021 & 2031F |

| 9.4. Vietnam Power Tiller Market Revenues and Volume, By HP Range, 2021-2031F |

| 9.5. Vietnam Power Tiller Market Price Trend, By HP Range, 2021-2031F |

| 10. Vietnam Rotavator Market Overview |

| 10.1. Vietnam Rotavator Market Revenues and Volume, 2021-2031F |

| 10.2. Vietnam Rotavator Market Revenue Share, By HP Range, 2021 & 2031F |

| 10.3. Vietnam Rotavator Market Volume Share, By HP Range, 2021 & 2031F |

| 10.4. Vietnam Rotavator Market Revenues and Volume, By HP Range, 2021-2031F |

| 10.5. Vietnam Rotavator Market Price Trend, By HP Range, 2021-2031F |

| 11. Vietnam Other Agriculture Equipment Market Overview |

| 11.1. Vietnam Other Agriculture Equipment Market Revenues and Volume, 2021-2031F |

| 12. Vietnam Key Performance Indicators |

| 13. Vietnam Agriculture Equipment Market Opportunity Assessment |

| 13.1. Vietnam Agriculture Equipment Market, Opportunity Assessment, By Equipment, 2031F |

| 14. Vietnam Agriculture Equipment Market Competitive Landscape |

| 14.1. Vietnam Agriculture Equipment Market Revenue Share, By Companies, 2024 |

| 15. Company Profiles |

| 16. Strategic Recommendations |

| 17. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero