Mexico Flour Market (2025-2031) | Companies, Growth, Outlook, Size, Value, Forecast, Revenue, Share, Industry, Analysis & Trends

Market Forecast By Raw Material (Wheat, Rice, Maize, Others), By Applications (Bread & Bakery Products, Noodles & Pasta, Animal Feed, Wafers, Crackers, & Biscuits, Non-Food Application, Others), By Technology (Dry Technology, Wet Technology) And Competitive Landscape

| Product Code: ETC039944 | Publication Date: Jan 2021 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

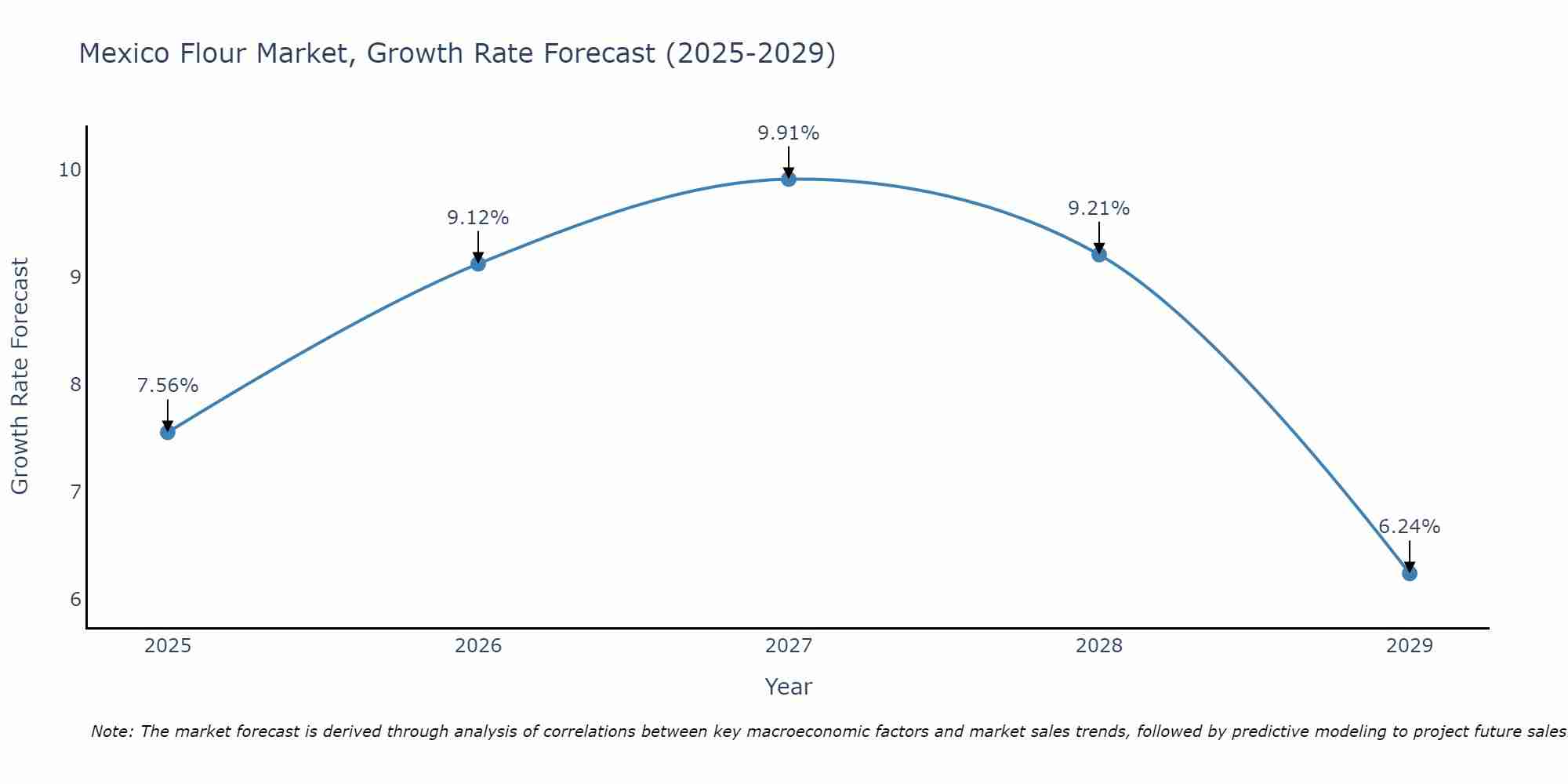

Mexico Flour Market Size Growth Rate

The Mexico Flour Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 7.56% in 2025, climbs to a high of 9.91% in 2027, and moderates to 6.24% by 2029.

Mexico Flour Market Highlights

| Report Name | Mexico Flour Market |

| Forecast period | 2025-2031 |

| CAGR | 5% |

| Growing Sector | Bread and bakery products |

Topics Covered in the Mexico Flour Market Report

The Mexico Flour Market report thoroughly covers the market by Raw Material, by Applications, and by Technology. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Mexico Flour Market Synopsis

The Mexico flour market is steadily growing, fueled by the expansion of the food and agriculture industries and rising demand for high-quality flour products. This market includes a variety of flour types, such as wheat, rice, and maize, essential for food production, animal feed, and even non-food applications. With Mexico’s industrial growth, flour has become a vital component, supporting both the domestic and industrial sectors across the country. As a key ingredient in the economy, flour is indispensable in meeting the needs of Mexico’s evolving market landscape.

According to 6Wresearch, the Mexico Flour Market revenue is projected to grow at a significant CAGR of 5% during the forecast period 2025-2031. Mexico flour market is growing rapidly due to urbanization, changing diets, and a rising demand for high-quality flour products. Advances in milling technology and a growing interest in diverse flour types are fueling this trend. Innovation in flour production is also essential to meet the evolving needs of various sectors, ensuring that the industry aligns with technological and sustainability standards. This focus on continuous improvement keeps Mexico’s flour industry competitive and responsive to changing consumer preferences are further boosting Mexico Flour Market growth. Despite the growth, the market faces challenges such as maintaining consistently high performance, meeting diverse flour production requirements, and managing complex operational and supply chain costs. Additionally, environmental concerns and the need for sustainable grain farming practices could potentially affect market growth.

Mexico Flour Market Trends

The Mexico flour market is shaped by several key trends that highlight changing consumer preferences, technological advancements, and industry shifts. Increasing urbanization and evolving dietary habits have driven demand for high-quality, diverse flours, including whole grain, organic, and gluten-free options, as more consumers prioritize health and wellness. Additionally, advancements in milling technology, especially in dry processing, are making production more efficient, sustainable, and capable of meeting these niche demands.

Investment Opportunities in the Mexico Flour Market

The Mexico flour market offers promising investment opportunities driven by rising demand for specialty and high-quality flours, including gluten-free, whole grain, and organic varieties. As consumer preferences shift towards healthier and more sustainable food options, there is significant potential for companies that focus on producing alternative flours. Investment in advanced milling technology, particularly energy-efficient dry milling processes, can enhance production efficiency and lower costs, appealing to eco-conscious consumers.

Leading Players in the Mexico Flour Market

The Mexico flour market is characterized by the presence of several key players who have established themselves as front-runners due to their extensive distribution networks and high-quality product offerings. Prominent companies such as Gruma, S.A.B. de C.V., Grupo Bimbo, and Molinos de México dominate the market landscape. These companies have capitalized on their robust production capabilities and innovative product lines to cater to diverse consumer preferences, from traditional Mexican flour varieties to specialty and organic options. Continuous investment in technology and infrastructure has further solidified their market presence, allowing them to maintain competitive advantages and expand their reach both domestically and internationally.

Government Regulations Introduced in the Mexico Flour Market

In recent years, the government of Mexico has introduced a series of regulations aimed at ensuring the quality, safety, and nutritional value of flour products. These policies are designed to align with international food safety standards and address public health concerns, particularly regarding the reduction of harmful additives and contaminants. Regulations mandate comprehensive labeling requirements, providing consumers with detailed information about the nutritional content and potential allergens in flour products. Additionally, these rules encourage local producers to adopt sustainable practices, promoting environmentally friendly agricultural methods and reducing carbon footprints. Compliance with these regulations not only enhances consumer confidence but also fosters a more resilient and sustainable flour market in Mexico.

Future Insights of the Mexico Flour Market

The future of Mexico flour industry looks promising, driven by urbanization, technological innovation, and changing consumer preferences. As the demand for healthier flour, energy-efficient solutions, and diversified product offerings rises, manufacturers will focus on developing advanced milling processes that cater to these needs. With ongoing infrastructure development and a shift towards sustainability, opportunities for growth will expand in areas like energy-efficient milling, healthy flour choices, and environmentally friendly practices, making the market ripe for investment and innovation.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories

Wheat to Dominate the Market - By Raw Material

According to Ravi Bhandari, Research Head, 6wresearch, wheat dominates among raw materials due to its widespread use across industries, especially in the food and bakery sector. Wheat is valued for its versatility and cost-effectiveness, making it the preferred choice for flour production.

Bread & Bakery Products to Dominate the Market -By Applications

In Mexico’s flour market, bread and bakery products dominate. As one of the world’s largest food markets, Mexico has a high demand for flour used in bread, cakes, and other bakery items. The food industry requires high-quality, consistent flour that can meet the diverse baking demands, making flour a critical manufacturing process.

Dry technology to Dominate the Market -By Technology

In Mexico flour market, dry technology is the dominant milling method. Known for its efficiency and cost-effectiveness, dry technology requires less water and energy, making it a preferred choice for large-scale flour production. This method produces a variety of flour types, meeting the needs of both commercial and consumer markets while supporting sustainability goals.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Mexico Flour Market Outlook

- Market Size of Mexico Flour Market,2024

- Forecast of Mexico Flour Market, 2031

- Historical Data and Forecast of Mexico Flour Revenues & Volume for the Period 2021 - 2031

- Mexico Flour Market Trend Evolution

- Mexico Flour Market Drivers and Challenges

- Mexico Flour Price Trends

- Mexico Flour Porter's Five Forces

- Mexico Flour IndMexico try Life Cycle

- Historical Data and Forecast of Mexico Flour Market Revenues & Volume By Raw Material for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Flour Market Revenues & Volume By Wheat for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Flour Market Revenues & Volume By Rice for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Flour Market Revenues & Volume By Maize for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Flour Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Flour Market Revenues & Volume By Applications for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Flour Market Revenues & Volume By Bread & Bakery Products for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Flour Market Revenues & Volume By Noodles & Pasta for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Flour Market Revenues & Volume By Animal Feed for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Flour Market Revenues & Volume By Wafers, Crackers, & Biscuits for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Flour Market Revenues & Volume By Non-Food Application for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Flour Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Flour Market Revenues & Volume By Technology for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Flour Market Revenues & Volume By Dry Technology for the Period 2021 - 2031

- Historical Data and Forecast of Mexico Flour Market Revenues & Volume By Wet Technology for the Period 2021 - 2031

- Mexico Flour Import Export Trade Statistics

- Market Opportunity Assessment By Raw Material

- Market Opportunity Assessment By Applications

- Market Opportunity Assessment By Technology

- Mexico Flour Top Companies Market Share

- Mexico Flour Competitive Benchmarking By Technical and Operational Parameters

- Mexico Flour Company Profiles

- Mexico Flour Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Raw Material

- Wheat

- Rice

- Maize

- Others

By Applications

- Bread & Bakery Products

- Noodles & Pasta

- Animal Feed

- Wafers

- Crackers

- Biscuits

- Non-Food Application

- Others

By Technology

- Dry Technology

- Wet Technology

Mexico Flour Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Mexico Flour Market Overview |

| 3.1 Mexico Country Macro Economic Indicators |

| 3.2 Mexico Flour Market Revenues & Volume, 2021 & 2031F |

| 3.3 Mexico Flour Market - Industry Life Cycle |

| 3.4 Mexico Flour Market - Porter's Five Forces |

| 3.5 Mexico Flour Market Revenues & Volume Share, By Raw Material, 2021 & 2031F |

| 3.6 Mexico Flour Market Revenues & Volume Share, By Applications, 2021 & 2031F |

| 3.7 Mexico Flour Market Revenues & Volume Share, By Technology, 2021 & 2031F |

| 4 Mexico Flour Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Mexico Flour Market Trends |

| 6 Mexico Flour Market, By Types |

| 6.1 Mexico Flour Market, By Raw Material |

| 6.1.1 Overview and Analysis |

| 6.1.2 Mexico Flour Market Revenues & Volume, By Raw Material, 2021 - 2031F |

| 6.1.3 Mexico Flour Market Revenues & Volume, By Wheat, 2021 - 2031F |

| 6.1.4 Mexico Flour Market Revenues & Volume, By Rice, 2021 - 2031F |

| 6.1.5 Mexico Flour Market Revenues & Volume, By Maize, 2021 - 2031F |

| 6.1.6 Mexico Flour Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.2 Mexico Flour Market, By Applications |

| 6.2.1 Overview and Analysis |

| 6.2.2 Mexico Flour Market Revenues & Volume, By Bread & Bakery Products, 2021 - 2031F |

| 6.2.3 Mexico Flour Market Revenues & Volume, By Noodles & Pasta, 2021 - 2031F |

| 6.2.4 Mexico Flour Market Revenues & Volume, By Animal Feed, 2021 - 2031F |

| 6.2.5 Mexico Flour Market Revenues & Volume, By Wafers, Crackers, & Biscuits, 2021 - 2031F |

| 6.2.6 Mexico Flour Market Revenues & Volume, By Non-Food Application, 2021 - 2031F |

| 6.2.7 Mexico Flour Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.3 Mexico Flour Market, By Technology |

| 6.3.1 Overview and Analysis |

| 6.3.2 Mexico Flour Market Revenues & Volume, By Dry Technology, 2021 - 2031F |

| 6.3.3 Mexico Flour Market Revenues & Volume, By Wet Technology, 2021 - 2031F |

| 7 Mexico Flour Market Import-Export Trade Statistics |

| 7.1 Mexico Flour Market Export to Major Countries |

| 7.2 Mexico Flour Market Imports from Major Countries |

| 8 Mexico Flour Market Key Performance Indicators |

| 9 Mexico Flour Market - Opportunity Assessment |

| 9.1 Mexico Flour Market Opportunity Assessment, By Raw Material, 2021 & 2031F |

| 9.2 Mexico Flour Market Opportunity Assessment, By Applications, 2021 & 2031F |

| 9.3 Mexico Flour Market Opportunity Assessment, By Technology, 2021 & 2031F |

| 10 Mexico Flour Market - Competitive Landscape |

| 10.1 Mexico Flour Market Revenue Share, By Companies, 2024 |

| 10.2 Mexico Flour Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero