Saudi Arabia Flour Market (2025-2031) | Analysis, Trends, Value, Forecast, Share, Outlook, Size, Companies, Revenue, Growth & Industry

| Product Code: ETC039980 | Publication Date: Jul 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

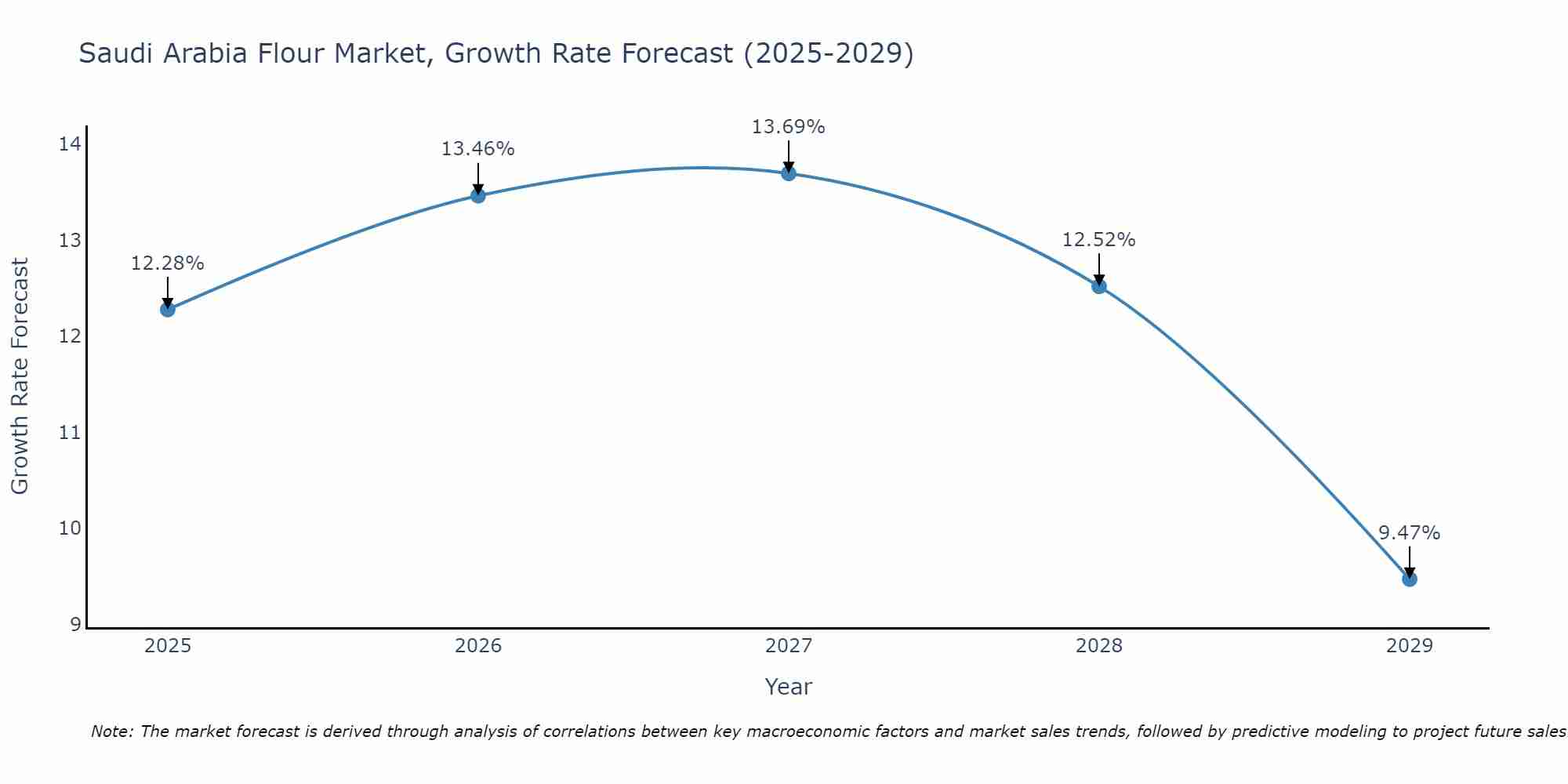

Saudi Arabia Flour Market Size Growth Rate

The Saudi Arabia Flour Market is projected to witness mixed growth rate patterns during 2025 to 2029. Growth accelerates to 13.69% in 2027, following an initial rate of 12.28%, before easing to 9.47% at the end of the period.

Saudi Arabia Flour Market Synopsis

Saudi Arabia flour market is expected to register a CAGR of 8.3% during the forecast period (2025-2031). Flour is considered as one of the most important food ingredients and has been used since ages for preparing various bakery products, such as breads, cakes, biscuits, etc. In addition to bakeries, flour finds its applications in many other industries like confectionaries and pasta manufacturing plants. Saudi Arabia has been witnessing an impressive growth in its baking industry over the last few years due to rising consumer preferences for bakery goods coupled with growing disposable incomes. The country??s flour production capacity increased from 721 thousand metric tons in 2018 to 973 thousand metric tons by 2025.

Market Drivers

The baking industry in Saudi Arabia has witnessed significant growth over the last decade due to increasing consumer preference for bakery goods combined with high disposable incomes and changing lifestyle patterns across urban areas of the country. This upsurge in demand can be attributed largely towards rising popularity of new varieties of baked products along with convenience provided by packaged items available at stores throughout KSA region that are becoming increasingly popular among citizens today. Rising trend towards processed foods consumption owing to busy lifestyles have further contributed towards positive outlook on flour sales across Saudi Arabia region as it finds major application within these industries. Further, introduction of modernized milling techniques combined with advanced technology are some other factors driving consumption levels upwards.

Challenges of the Market

One key challenge faced by local producers within this market landscape is their reliance upon imported raw materials which affects availability levels while also leading them vulnerable to fluctuating currency prices. Additionally , presence of stringent import regulations across this space adds further complexity into existing scenario affecting profitability margins considerably. Another key factor restraining overall growth prospects within this regional market remains price sensitivity among consumers who usually opt for low cost alternatives when purchasing related items thus leading decline rates amongst premium products manufacturers operating here.

Covid 19 Impact on the Market

The outbreak of COVID-19 pandemic has caused major disruption in international trade activities which have further affected many aspects such as supply chain logistics and production processes related to the food industry including grain milling or other processed foods. The global lockdown imposed by several nations have disrupted cross border transportation that resulted into shutting down bakeries or fast food restaurants causing huge drop in sales volume thereby affecting overall demand for flours from these industries significantly leading shortage of product availability on shelves across retail stores. However with gradual relaxations post pandemic situation there are chances that certain categories will be witnessing recovering trend over 2025-2031 time frame but still effects due to Novel Coronavirus will remain persistent over short term horizon due to lack of availability & affordability factors among end use customers particularly lower income earners & middle class segment who might face purchasing power constraints while buying premium quality flours at higher rates.

key players of the Market

Key players operating in Saudi Arabia Flour Market include, Al Kabeer Group, National Food Industries Co LLC, Saudi Grains Organization (SAGO), Modern Milling Company Ltd., and Sunbulah Group.

Key Highlights of the Report:

- Saudi Arabia Flour Market Outlook

- Market Size of Saudi Arabia Flour Market, 2024

- Forecast of Saudi Arabia Flour Market, 2031

- Historical Data and Forecast of Saudi Arabia Flour Revenues & Volume for the Period 2021-2031

- Saudi Arabia Flour Market Trend Evolution

- Saudi Arabia Flour Market Drivers and Challenges

- Saudi Arabia Flour Price Trends

- Saudi Arabia Flour Porter's Five Forces

- Saudi Arabia Flour Industry Life Cycle

- Historical Data and Forecast of Saudi Arabia Flour Market Revenues & Volume By Raw Material for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Flour Market Revenues & Volume By Wheat for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Flour Market Revenues & Volume By Rice for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Flour Market Revenues & Volume By Maize for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Flour Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Flour Market Revenues & Volume By Applications for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Flour Market Revenues & Volume By Bread & Bakery Products for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Flour Market Revenues & Volume By Noodles & Pasta for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Flour Market Revenues & Volume By Animal Feed for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Flour Market Revenues & Volume By Wafers, Crackers, & Biscuits for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Flour Market Revenues & Volume By Non-Food Application for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Flour Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Flour Market Revenues & Volume By Technology for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Flour Market Revenues & Volume By Dry Technology for the Period 2021-2031

- Historical Data and Forecast of Saudi Arabia Flour Market Revenues & Volume By Wet Technology for the Period 2021-2031

- Saudi Arabia Flour Import Export Trade Statistics

- Market Opportunity Assessment By Raw Material

- Market Opportunity Assessment By Applications

- Market Opportunity Assessment By Technology

- Saudi Arabia Flour Top Companies Market Share

- Saudi Arabia Flour Competitive Benchmarking By Technical and Operational Parameters

- Saudi Arabia Flour Company Profiles

- Saudi Arabia Flour Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Saudi Arabia Flour Market Overview |

3.1 Saudi Arabia Country Macro Economic Indicators |

3.2 Saudi Arabia Flour Market Revenues & Volume, 2021 & 2031F |

3.3 Saudi Arabia Flour Market - Industry Life Cycle |

3.4 Saudi Arabia Flour Market - Porter's Five Forces |

3.5 Saudi Arabia Flour Market Revenues & Volume Share, By Raw Material, 2021 & 2031F |

3.6 Saudi Arabia Flour Market Revenues & Volume Share, By Applications, 2021 & 2031F |

3.7 Saudi Arabia Flour Market Revenues & Volume Share, By Technology, 2021 & 2031F |

4 Saudi Arabia Flour Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Saudi Arabia Flour Market Trends |

6 Saudi Arabia Flour Market, By Types |

6.1 Saudi Arabia Flour Market, By Raw Material |

6.1.1 Overview and Analysis |

6.1.2 Saudi Arabia Flour Market Revenues & Volume, By Raw Material, 2021-2031F |

6.1.3 Saudi Arabia Flour Market Revenues & Volume, By Wheat, 2021-2031F |

6.1.4 Saudi Arabia Flour Market Revenues & Volume, By Rice, 2021-2031F |

6.1.5 Saudi Arabia Flour Market Revenues & Volume, By Maize, 2021-2031F |

6.1.6 Saudi Arabia Flour Market Revenues & Volume, By Others, 2021-2031F |

6.2 Saudi Arabia Flour Market, By Applications |

6.2.1 Overview and Analysis |

6.2.2 Saudi Arabia Flour Market Revenues & Volume, By Bread & Bakery Products, 2021-2031F |

6.2.3 Saudi Arabia Flour Market Revenues & Volume, By Noodles & Pasta, 2021-2031F |

6.2.4 Saudi Arabia Flour Market Revenues & Volume, By Animal Feed, 2021-2031F |

6.2.5 Saudi Arabia Flour Market Revenues & Volume, By Wafers, Crackers, & Biscuits, 2021-2031F |

6.2.6 Saudi Arabia Flour Market Revenues & Volume, By Non-Food Application, 2021-2031F |

6.2.7 Saudi Arabia Flour Market Revenues & Volume, By Others, 2021-2031F |

6.3 Saudi Arabia Flour Market, By Technology |

6.3.1 Overview and Analysis |

6.3.2 Saudi Arabia Flour Market Revenues & Volume, By Dry Technology, 2021-2031F |

6.3.3 Saudi Arabia Flour Market Revenues & Volume, By Wet Technology, 2021-2031F |

7 Saudi Arabia Flour Market Import-Export Trade Statistics |

7.1 Saudi Arabia Flour Market Export to Major Countries |

7.2 Saudi Arabia Flour Market Imports from Major Countries |

8 Saudi Arabia Flour Market Key Performance Indicators |

9 Saudi Arabia Flour Market - Opportunity Assessment |

9.1 Saudi Arabia Flour Market Opportunity Assessment, By Raw Material, 2021 & 2031F |

9.2 Saudi Arabia Flour Market Opportunity Assessment, By Applications, 2021 & 2031F |

9.3 Saudi Arabia Flour Market Opportunity Assessment, By Technology, 2021 & 2031F |

10 Saudi Arabia Flour Market - Competitive Landscape |

10.1 Saudi Arabia Flour Market Revenue Share, By Companies, 2024 |

10.2 Saudi Arabia Flour Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero