Singapore Flour Market (2024-2030) | Companies, Value, Trends, Revenue, Industry, Growth, Forecast, Share, Outlook, Analysis & Size

| Product Code: ETC039968 | Publication Date: Jul 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

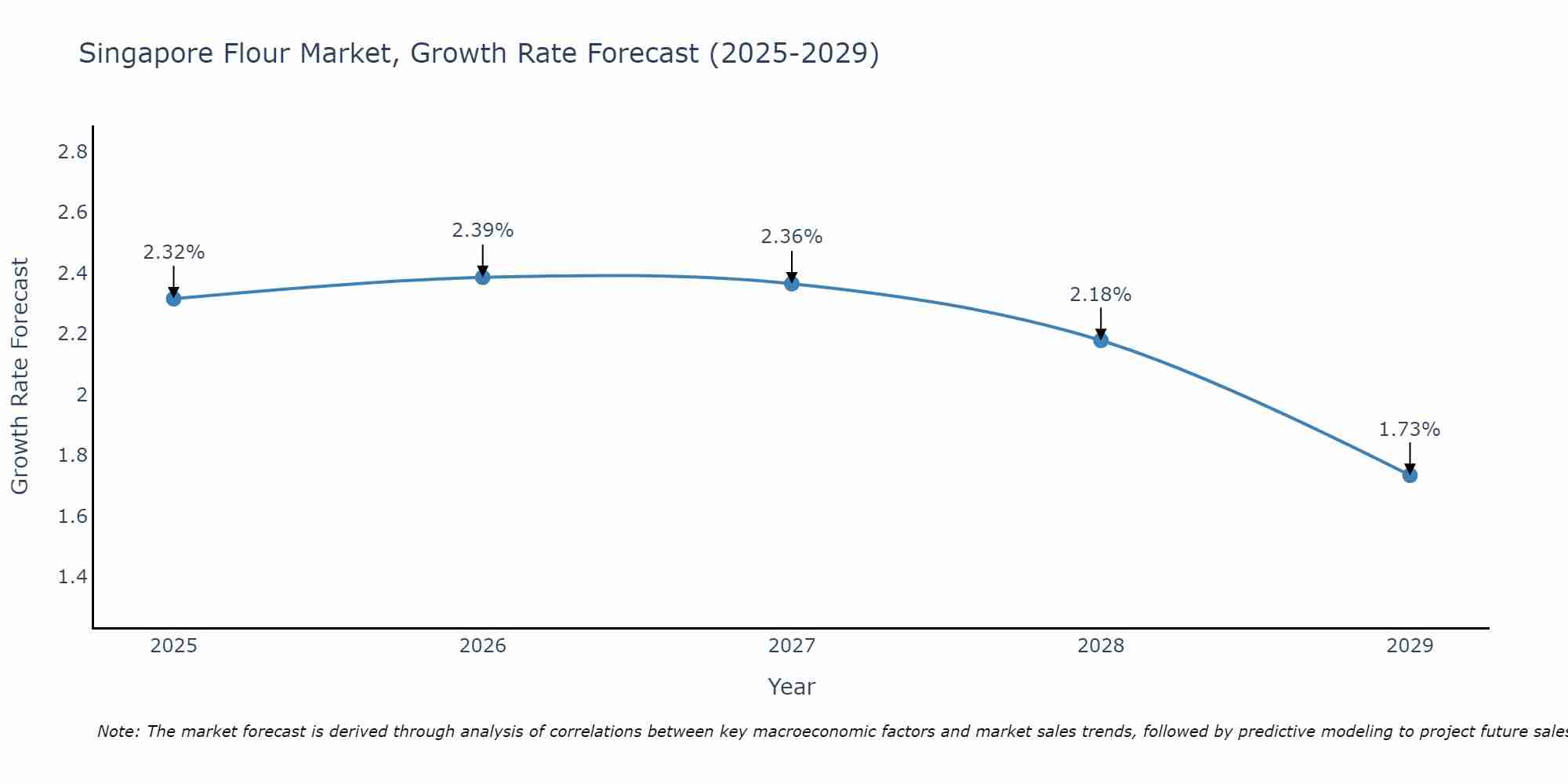

Singapore Flour Market Size Growth Rate

The Singapore Flour Market is projected to witness mixed growth rate patterns during 2025 to 2029. The growth rate begins at 2.32% in 2025, climbs to a high of 2.39% in 2026, and moderates to 1.73% by 2029.

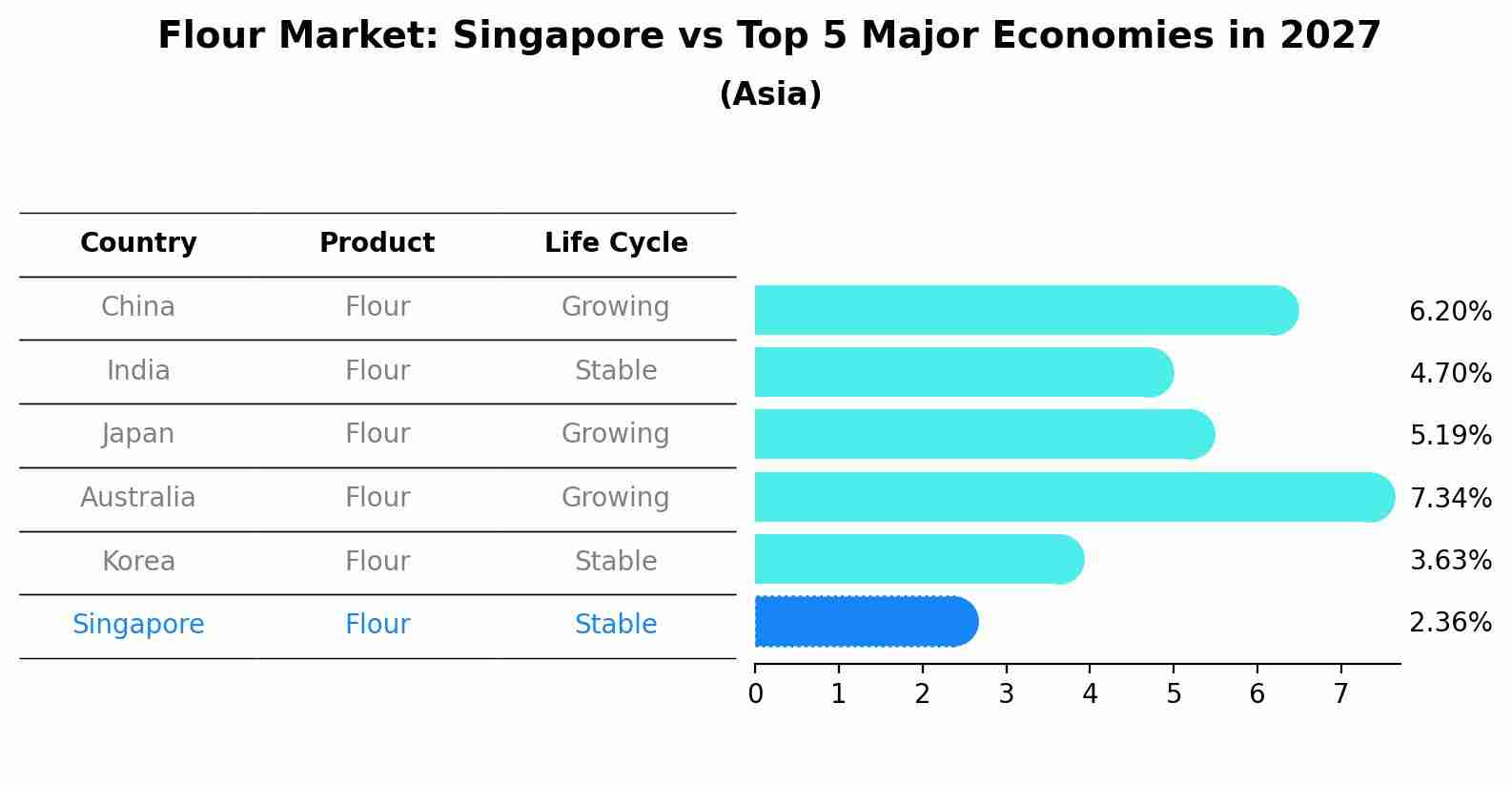

Flour Market: Singapore vs Top 5 Major Economies in 2027 (Asia)

By 2027, the Flour market in Singapore is anticipated to reach a growth rate of 2.36%, as part of an increasingly competitive Asia region, where China remains at the forefront, supported by India, Japan, Australia and South Korea, driving innovations and market adoption across sectors.

Singapore Flour Market Synopsis

The Singapore flour market is expected to show steady growth over the forecast period of 2020-2026. This is due to increasing demand for convenience foods, increasing population, and interest in Western cuisine among consumers. The rising trend of health consciousness has also been driving the market. Moreover, technological advancements such as the development of new baking products are also contributing to increased demand for flour in Singapore. Additionally, government initiatives aimed at encouraging local production and consumption of wheat are predicted to further boost the market growth during this period.

Market Drivers

Increasing Demand for Convenience Foods ??? With busy lifestyles becoming increasingly common amongst individuals in Singapore, there has been a growing preference towards processed food items that can be cooked quickly or even consumed directly without any preparation time required. Flour is one such ingredient used widely in various convenience foods like frozen doughs and pre-made mixes which are gaining popularity among consumers looking for convenient options when it comes to their daily meals or snacks.Rising Population ??? With migration into the country steadily on an increase since 2018, there has been a corresponding rise in grain consumption due to an expanding population base with more mouths needing food needs met each day. This increased need will be fulfilled by available stocks from both local as well as imported sources thus providing additional impetus on flour sales over this forecast period (2020-2026).

Market challenges

Price Hike Due To Low Production Levels??? Despite positive trends seen with regards to consumer demand for flour based products between 2020 - 2026; producers may find themselves facing higher costs due to low levels of production leading up till this point making it difficult for them keep prices competitive while still meeting desired profits margins set out priorly by companies operating within this space.

Key players

Some major players operating within Singapore Flour Market include Prima Group ; GrainCorp Limited ; Wilmar International Ltd & Interflour

Covid-19 Impact

The COVID-19 pandemic had impacted both supply side disruptions across key producing regions like North America, Europe & Asia Pacific resulting lower availability coupled with reduced costumer spending given economic downturn associated with lockdowns implemented globally, causing negative pressure being exerted on domestic & international prices.Further developments such as restrictions on travel have affected export opportunities adding additional strain onto industry participants.However continued focus on fortifying immunity through diet during crisis might result into positively influencing overall domestic sales post lockdown measures being lifted gradually throughout 2021.

Key Highlights of the Report:

- Singapore Flour Market Outlook

- Market Size of Singapore Flour Market, 2023

- Forecast of Singapore Flour Market, 2030

- Historical Data and Forecast of Singapore Flour Revenues & Volume for the Period 2020-2030

- Singapore Flour Market Trend Evolution

- Singapore Flour Market Drivers and Challenges

- Singapore Flour Price Trends

- Singapore Flour Porter's Five Forces

- Singapore Flour Industry Life Cycle

- Historical Data and Forecast of Singapore Flour Market Revenues & Volume By Raw Material for the Period 2020-2030

- Historical Data and Forecast of Singapore Flour Market Revenues & Volume By Wheat for the Period 2020-2030

- Historical Data and Forecast of Singapore Flour Market Revenues & Volume By Rice for the Period 2020-2030

- Historical Data and Forecast of Singapore Flour Market Revenues & Volume By Maize for the Period 2020-2030

- Historical Data and Forecast of Singapore Flour Market Revenues & Volume By Others for the Period 2020-2030

- Historical Data and Forecast of Singapore Flour Market Revenues & Volume By Applications for the Period 2020-2030

- Historical Data and Forecast of Singapore Flour Market Revenues & Volume By Bread & Bakery Products for the Period 2020-2030

- Historical Data and Forecast of Singapore Flour Market Revenues & Volume By Noodles & Pasta for the Period 2020-2030

- Historical Data and Forecast of Singapore Flour Market Revenues & Volume By Animal Feed for the Period 2020-2030

- Historical Data and Forecast of Singapore Flour Market Revenues & Volume By Wafers, Crackers, & Biscuits for the Period 2020-2030

- Historical Data and Forecast of Singapore Flour Market Revenues & Volume By Non-Food Application for the Period 2020-2030

- Historical Data and Forecast of Singapore Flour Market Revenues & Volume By Others for the Period 2020-2030

- Historical Data and Forecast of Singapore Flour Market Revenues & Volume By Technology for the Period 2020-2030

- Historical Data and Forecast of Singapore Flour Market Revenues & Volume By Dry Technology for the Period 2020-2030

- Historical Data and Forecast of Singapore Flour Market Revenues & Volume By Wet Technology for the Period 2020-2030

- Singapore Flour Import Export Trade Statistics

- Market Opportunity Assessment By Raw Material

- Market Opportunity Assessment By Applications

- Market Opportunity Assessment By Technology

- Singapore Flour Top Companies Market Share

- Singapore Flour Competitive Benchmarking By Technical and Operational Parameters

- Singapore Flour Company Profiles

- Singapore Flour Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Singapore Flour Market Overview |

3.1 Singapore Country Macro Economic Indicators |

3.2 Singapore Flour Market Revenues & Volume, 2020 & 2030F |

3.3 Singapore Flour Market - Industry Life Cycle |

3.4 Singapore Flour Market - Porter's Five Forces |

3.5 Singapore Flour Market Revenues & Volume Share, By Raw Material, 2020 & 2030F |

3.6 Singapore Flour Market Revenues & Volume Share, By Applications, 2020 & 2030F |

3.7 Singapore Flour Market Revenues & Volume Share, By Technology, 2020 & 2030F |

4 Singapore Flour Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Singapore Flour Market Trends |

6 Singapore Flour Market, By Types |

6.1 Singapore Flour Market, By Raw Material |

6.1.1 Overview and Analysis |

6.1.2 Singapore Flour Market Revenues & Volume, By Raw Material, 2020-2030F |

6.1.3 Singapore Flour Market Revenues & Volume, By Wheat, 2020-2030F |

6.1.4 Singapore Flour Market Revenues & Volume, By Rice, 2020-2030F |

6.1.5 Singapore Flour Market Revenues & Volume, By Maize, 2020-2030F |

6.1.6 Singapore Flour Market Revenues & Volume, By Others, 2020-2030F |

6.2 Singapore Flour Market, By Applications |

6.2.1 Overview and Analysis |

6.2.2 Singapore Flour Market Revenues & Volume, By Bread & Bakery Products, 2020-2030F |

6.2.3 Singapore Flour Market Revenues & Volume, By Noodles & Pasta, 2020-2030F |

6.2.4 Singapore Flour Market Revenues & Volume, By Animal Feed, 2020-2030F |

6.2.5 Singapore Flour Market Revenues & Volume, By Wafers, Crackers, & Biscuits, 2020-2030F |

6.2.6 Singapore Flour Market Revenues & Volume, By Non-Food Application, 2020-2030F |

6.2.7 Singapore Flour Market Revenues & Volume, By Others, 2020-2030F |

6.3 Singapore Flour Market, By Technology |

6.3.1 Overview and Analysis |

6.3.2 Singapore Flour Market Revenues & Volume, By Dry Technology, 2020-2030F |

6.3.3 Singapore Flour Market Revenues & Volume, By Wet Technology, 2020-2030F |

7 Singapore Flour Market Import-Export Trade Statistics |

7.1 Singapore Flour Market Export to Major Countries |

7.2 Singapore Flour Market Imports from Major Countries |

8 Singapore Flour Market Key Performance Indicators |

9 Singapore Flour Market - Opportunity Assessment |

9.1 Singapore Flour Market Opportunity Assessment, By Raw Material, 2020 & 2030F |

9.2 Singapore Flour Market Opportunity Assessment, By Applications, 2020 & 2030F |

9.3 Singapore Flour Market Opportunity Assessment, By Technology, 2020 & 2030F |

10 Singapore Flour Market - Competitive Landscape |

10.1 Singapore Flour Market Revenue Share, By Companies, 2023 |

10.2 Singapore Flour Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero