South Africa Air Conditioner Market (2025-2031) | Trends, Value, Companies, Analysis, Industry, Revenue, Size, Growth, Forecast & Share

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others) And Competitive Landscape

| Product Code: ETC090107 | Publication Date: Dec 2023 | Updated Date: Sep 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

South Africa Air Conditioner Market Growth Rate

According to 6Wresearch internal database and industry insights, The South Africa Air Conditioner Market is projected to grow at a compound annual growth rate (CAGR) of 6.1% during the forecast period 2025-2031.

| Report Name | South Africa Air Conditioner Market |

| Forecast Period | 2025-2031 |

| CAGR | 6.1% |

| Growing Sector | Commercial & Hospitality |

Topics Covered in the South Africa Air Conditioner Market Report

The South Africa Air Conditioner Market report thoroughly covers the market by type and by applications. The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders to devise and align their market strategies according to the current and future market dynamics.

South Africa Air Conditioner Market Synopsis

South Africa Air Conditioner Market is set for robust growth during the forecast period. Over the years, the population of South Africa affect from the frequent heatwaves and rising average temperatures which have accelerated air conditioner adoption across households and industries. Sectors such as construction boom and hospitality sector is expanding, the deployment of air conditioners in malls, offices or residential places or commercial places.

Evaluation of Growth Drivers in the South Africa Air Conditioner Market

Below mentioned are some prominent drivers and their influence to the market dynamics:

| Driver | Primary Segments Affected | Why it matters (evidence) |

| Urbanization & Real Estate Growth | Ducted & Centralized ACs; Commercial & Hospitality | Growing construction of malls, offices, and hotels drives high-capacity air conditioning systems. |

| Climate Change & Rising Temperatures | Room & Ductless ACs; Residential | Increasing heatwaves encourage residential adoption of AC systems. |

| Healthcare Expansion | Centralized & Ducted ACs; Healthcare | Investments in hospitals/clinics increase demand for reliable cooling systems. |

| Industrial Development | Ducted & Centralized ACs; Industrial | Manufacturing growth requires controlled cooling environments. |

| Tourism & Hospitality Growth | Room & Centralized ACs; Hospitality | Expanding tourism boosts hotel and resort AC installations. |

South Africa Air Conditioner Market is predicted to expand at a substantial CAGR of 6.1% during the forecast period of 2025-2031. The climate of south Africa is a major driver of this market which create an uncomfortable environment for population and the need of AC arises. Also, other factors are contributing in the market expansion rapid urbanization, rising temperatures, and the growing need for energy-efficient cooling solutions across residential and commercial spaces. Further, the healthcare and hospitality sectors are highly investing in advanced air conditioning systems which ensure the comfort, patient safety, and customer satisfaction. This industry is reshaped by the evolving consumers preference with increasing disposable incomes and government-backed housing initiatives.

Evaluation of Restraints in the South Africa Air Conditioner Market

Below mentioned are some major restraints and their influence to the market dynamics:

| Restraint | Primary Segments Affected | What this means (evidence) |

| High Electricity Tariffs | Residential & Commercial | Power bills discourage adoption in low/mid-income households. |

| Power Supply Instability (Load Shedding) | Commercial & Hospitality | Frequent outages reduce efficiency and AC deployment. |

| High Import Dependency | All Segments | Reliance on imported AC units raises procurement costs. |

| Environmental Regulations | All Types | HFC restrictions increase compliance and manufacturing costs. |

| High Maintenance Costs | Ducted & centralized | Regular servicing required, deterring smaller businesses. |

South Africa Air Conditioner Market Challenges

Despite of favourable environment, the market deals with several challenges which could hinder the progress in the future. Due to frequent load shedding, the consistent AC usage affects. Further, rising energy costs also discourage adoption among low and middle-income households. Furthermore, competition is growing from alternative cooling technologies such as evaporative coolers poses a restraint. Also, concerns related to environmental regarding high carbon emissions and refrigerant regulations increase compliance costs for manufacturers.

South Africa Air Conditioner Market Trends

Key developments influencing the growth of the market are:

- Inverter & Energy-Efficient Models: Increasing demand for inverter-based ACs to reduce the electricity bills.

- Smart AC Solutions: Adoption of IoT-enabled air conditioners which offers remote monitoring and control.

- Green Cooling Technologies: Growing use of R32 and R290 refrigerants aligned with environmental goals.

- Hybrid Power Integration: Systems compatible with solar and battery backup to overcome load shedding.

- Compact & Aesthetic Designs: Rising preference for stylish and space-saving units, especially in premium residential and hospitality projects.

Investment Opportunities in the South Africa Air Conditioner Industry

There are some main areas of investment opportunity in the market which includes:

- Solar-Integrated Air Conditioning Systems – Develop AC units integrated with rooftop solar to counteract load shedding and high tariffs.

- Rental AC Services – To provide temporary AC solutions for events, hospitality, and seasonal needs.

- Expansion into Tier-II Cities – To direct the emerging urban centres beyond Johannesburg and Cape Town.

- Green Refrigerant AC Manufacturing – Introducing eco-friendly cooling systems aligned with government sustainability plans.

- High-Capacity Commercial Contracts – Securing long-term supply for malls, airports, and mega-infrastructure projects.

Top 5 Leading Players in the South Africa Air Conditioner Market

Some leading players operating in the market include:

1. Daikin Airconditioning South Africa (Pty) Ltd

| Company Name | Daikin Airconditioning South Africa (Pty) Ltd |

| Established Year | 2009 |

| Headquarters | Johannesburg, South Africa |

| Official Website | Click Here |

This company offers energy-efficient air conditioning solutions, that includes VRV and split systems for residential and commercial needs.

2. LG Electronics South Africa

| Company Name | LG Electronics South Africa |

| Established Year | 1958 (Parent Company) |

| Headquarters | Midrand, South Africa |

| Official Website | Click Here |

This company provides a wide range of smart and inverter air conditioners tailored for residential and hospitality applications.

3. Samsung Electronics South Africa (Pty) Ltd

| Company Name | Samsung Electronics South Africa (Pty) Ltd |

| Established Year | 1969 (Parent Company) |

| Headquarters | Johannesburg, South Africa |

| Official Website | Click Here |

This brand specializes in energy-efficient, eco-friendly ACs, with strong penetration in both the residential and commercial segments.

4. Midea South Africa

| Company Name | Midea South Africa |

| Established Year | 1968 (Parent Company) |

| Headquarters | Cape Town, South Africa |

| Official Website | Click Here |

This company provides a broad product line, including ducted, centralized, and ductless systems, emphasizing focus on affordability and reliability.

5. Carrier South Africa

| Company Name | Carrier South Africa |

| Established Year | 1902 (Parent Company) |

| Headquarters | Johannesburg, South Africa |

| Official Website | Click Here |

This is a global leader in HVAC solutions, who offers the advanced centralized cooling systems for industrial and large-scale projects.

Government Regulations Introduced in the South Africa Air Conditioner Market

According to South African Government Data, South Africa Air Conditioner Market is introduced policies & regulations which aimed at reducing energy consumption and promoting green technology. For instance, the Department of Energy’s Energy Efficiency Strategy mandates the use of eco-friendly appliances, while SANS 941 sets energy performance standards for ACs. Governments are also promoting the solar-integrated cooling solutions under its Renewable Energy Independent Power Producer Procurement Programme (REIPPPP). Further, import duties on environmentally friendly AC units have been reduced to encourage the adoption of sustainable cooling systems.

Future Insights of the South Africa Air Conditioner Market

South Africa Air Conditioner Market Growth is anticipated to gain momentum with the factors such as rising urbanization, hospitality growth, and healthcare infrastructure investments. In the coming years, the adoption of smart and hybrid cooling technologies will play a crucial role in overcoming challenges like load shedding and high energy costs. Also, governments are supporting through their incentives related to eco-friendly solutions, manufacturers focusing on green refrigerants and solar-powered ACs are expected to lead future growth.

Market Segmentation Analysis

Room Air Conditioner to Dominate the Market – By Type

According to Parth, Senior Research Anlayst,6Wresearch, room air conditioner is expected to lead the market due to high adoption in households and small businesses. Growing middle-class income and increasing temperature levels have made room ACs the most popular choice, particularly in urban centres like Johannesburg, Cape Town, and Durban.

Commercial & Hospitality to Dominate the Market – By Application

Commercial & Hospitality segment is likely to hold the largest South Africa Air Conditioner Market Share. Rapid development of shopping malls, office spaces, hotels, and resorts has significantly boosted the demand for ducted and centralized ACs.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- South Africa Air Conditioner Market Outlook

- Market Size of South Africa Air Conditioner Market, 2024

- Forecast of South Africa Air Conditioner Market, 2031

- Historical Data and Forecast of South Africa Air Conditioner Revenues & Volume for the Period 2021 - 2031

- South Africa Air Conditioner Market Trend Evolution

- South Africa Air Conditioner Market Drivers and Challenges

- South Africa Air Conditioner Price Trends

- South Africa Air Conditioner Porter's Five Forces

- South Africa Air Conditioner Industry Life Cycle

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Residential for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Healthcare for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Hospitality for the Period 2021 - 2031

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Others for the Period 2021 - 2031

- South Africa Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- South Africa Air Conditioner Top Companies Market Share

- South Africa Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- South Africa Air Conditioner Company Profiles

- South Africa Air Conditioner Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Applications

- Residential

- Healthcare

- Commercial & Retail

- Transportation & Infrastructure

- Hospitality

- Others

South Africa Air Conditioner Market (2025-2031):FAQ's

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 South Africa Air Conditioner Market Overview |

| 3.1 South Africa Air Conditioner Market Revenues & Volume, 2021 - 2031F |

| 3.2 South Africa Air Conditioner Market - Industry Life Cycle |

| 3.3 South Africa Air Conditioner Market - Porter's Five Forces |

| 3.4 South Africa Air Conditioner Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.5 South Africa Air Conditioner Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 4 South Africa Air Conditioner Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing urbanization in South Africa leading to higher demand for air conditioning in residential and commercial buildings. |

| 4.2.2 Rising temperatures and changing climate patterns driving the need for air conditioning to maintain comfortable indoor environments. |

| 4.2.3 Growth in disposable income and middle-class population in South Africa increasing the affordability of air conditioners. |

| 4.3 Market Restraints |

| 4.3.1 High initial cost of purchasing and installing air conditioning units limiting adoption rates, especially among lower-income households. |

| 4.3.2 Energy efficiency concerns and the high electricity consumption of air conditioners leading to increased operating costs. |

| 4.3.3 Lack of proper infrastructure and skilled workforce for installation, maintenance, and repair of air conditioning systems. |

| 5 South Africa Air Conditioner Market Trends |

| 6 South Africa Air Conditioner Market Segmentation |

| 6.1 South Africa Air Conditioner Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 South Africa Air Conditioner Market Revenues & Volume, By Type, 2021 - 2031F |

| 6.1.3 South Africa Air Conditioner Market Revenues & Volume, By Room Air Conditioner, 2021 - 2031F |

| 6.1.4 South Africa Air Conditioner Market Revenues & Volume, By Ducted Air Conditioner, 2021 - 2031F |

| 6.1.5 South Africa Air Conditioner Market Revenues & Volume, By Ductless Air Conditioner, 2021 - 2031F |

| 6.1.6 South Africa Air Conditioner Market Revenues & Volume, By Centralized Air Conditioner, 2021 - 2031F |

| 6.2 South Africa Air Conditioner Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 South Africa Air Conditioner Market Revenues & Volume, By Residential, 2021 - 2031F |

| 6.2.3 South Africa Air Conditioner Market Revenues & Volume, By Healthcare, 2021 - 2031F |

| 6.2.4 South Africa Air Conditioner Market Revenues & Volume, By Commercial & Retail, 2021 - 2031F |

| 6.2.5 South Africa Air Conditioner Market Revenues & Volume, By Transportation & Infrastructure, 2021 - 2031F |

| 6.2.6 South Africa Air Conditioner Market Revenues & Volume, By Hospitality, 2021 - 2031F |

| 6.2.7 South Africa Air Conditioner Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 South Africa Air Conditioner Market Import-Export Trade Statistics |

| 7.1 South Africa Air Conditioner Market Export to Major Countries |

| 7.2 South Africa Air Conditioner Market Imports from Major Countries |

| 8 South Africa Air Conditioner Market Key Performance Indicators |

| 8.1 Energy efficiency rating of air conditioners sold in the South African market. |

| 8.2 Number of new residential and commercial construction projects integrating air conditioning systems. |

| 8.3 Adoption rate of smart and connected air conditioning technologies in South Africa. |

| 9 South Africa Air Conditioner Market - Opportunity Assessment |

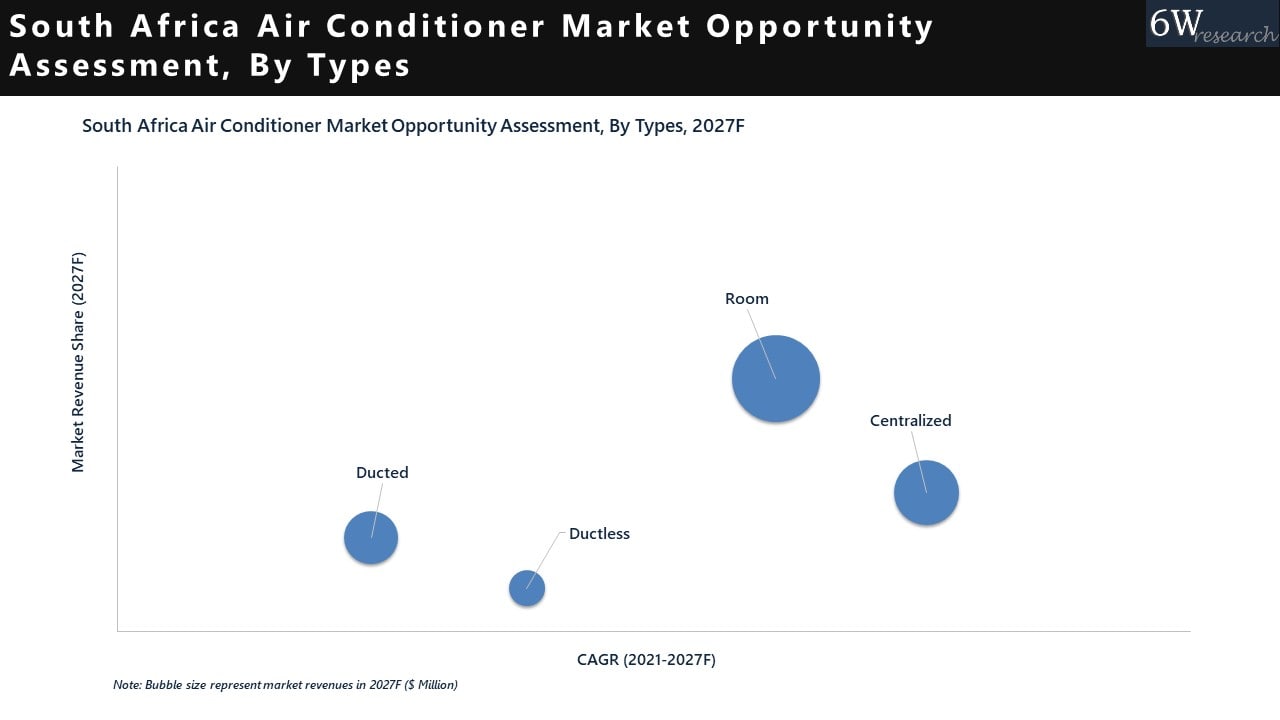

| 9.1 South Africa Air Conditioner Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 South Africa Air Conditioner Market Opportunity Assessment, By Application, 2021 & 2031F |

| 10 South Africa Air Conditioner Market - Competitive Landscape |

| 10.1 South Africa Air Conditioner Market Revenue Share, By Companies, 2024 |

| 10.2 South Africa Air Conditioner Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others) And Competitive Landscape

| Product Code: ETC090107 | Publication Date: Aug 2021 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

South Africa Air Conditioner (AC) Market is projected to grow over the coming years. South Africa Air Conditioner (AC) Market report is a part of our periodical regional publication Africa Air Conditioner (AC) Market outlook report. 6W tracks air conditioner market for over 60 countries with individual country-wise market opportunity assessment and publishes with the report titled Global Air Conditioner (AC) Market outlook report annually.

South Africa Air conditioner (AC) Market report comprehensively covers the market type and application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

South Africa Air Conditioner Market Synopsis

South Africa Air Conditioner Market is anticipated to gain momentum during the upcoming period owing to the increasing disposable income and rising standard of living. The growing migration towards urban areas led to increasing per capita income further boosting the purchasing power of the consumer beholds the growth of the market. Also, increasing establishment of government offices, hotels, shopping complex and restaurants is driving the demand of the South Africa AC Market.

According to 6Wresearch, South Africa Air Conditioner (AC) Market size is projected to grow at a CAGR of 4.2% during 2021-2027. South Africa occupies 3rd position in terms of the market size in the Africa Air Conditioner Market. Expansion of international hospitality brands are driving the growth of the market. Additionally, growing construction sector is further contributing to the development of the market. However, high initial cost still acts as a hurdle in the Air Conditioner Market Growth. The market showed a rapid decline due to the global pandemic COVID-19 led to the shutting down of retail stores coupled with closure of manufacturing units affecting the supply chain of the air conditioner. The market is expected to re-gain its growth during the coming period owing to the resumption of manufacturing units and retail stores.

In terms of market by types, Room Air Conditioner dominates the market and is expected to remain in a dominant position in the coming years. However, Centralized Air Conditioner is expected to have the fastest growth rate among all types.

In terms of application, Commercial & Retail dominates the market and is expected to remain in a dominant position in the coming years with the fastest growth rate among all applications.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- South Africa Air Conditioner Market Outlook

- Market Size of South Africa Air Conditioner Market, 2020

- Forecast of South Africa Air Conditioner Market, 2027

- Historical Data and Forecast of South Africa Air Conditioner Revenues & Volume for the Period 2017 - 2027

- South Africa Air Conditioner Market Trend Evolution

- South Africa Air Conditioner Market Drivers and Challenges

- South Africa Air Conditioner Price Trends

- South Africa Air Conditioner Porter's Five Forces

- South Africa Air Conditioner Industry Life Cycle

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Type for the Period 2018 - 2027

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Application for the Period 2017 - 2027

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Healthcare for the Period 2018 - 2027

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2017 - 2027

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2017 - 2027

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Hospitality for the Period 2017 - 2027

- Historical Data and Forecast of South Africa Air Conditioner Market Revenues & Volume By Others for the Period 2018 - 2027

- South Africa Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- South Africa Air Conditioner Top Companies Market Share

- South Africa Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- South Africa Air Conditioner Company Profiles

- South Africa Air Conditioner Key Strategic Recommendations

Market Segmentation:

The report provides a detailed analysis of the following market segments:

- By Types:

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

- By Application:

- Residential

- Commercial & Retail

- Healthcare

- Hospitality

- Transportation & Infrastructure

- Others

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero