India Cable Tray Market (2018-2024) | Companies, Forecast, Revenue, Size, Industry, Trends, Outlook, Share, Value, Growth & Analysis

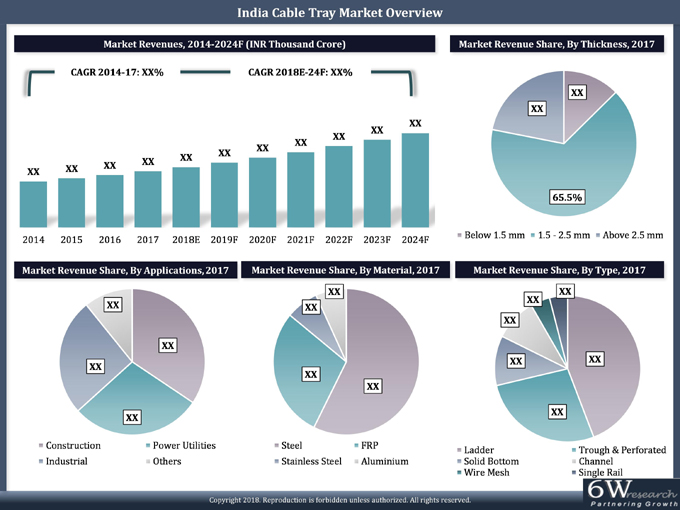

Market Forecast By Material (Aluminium, Steel, Stainless Steel and FRP including Fiber Reinforced Plastic), By Types (Ladder, Solid Bottom, Trough & Perforated, Channel, Wire Mesh and Single Rail), By Thickness (Below 1.5 mm, 1.5 - 2.5 mm and Above 2.5 mm), By Applications (Power Utilities, Construction, Industrial and Others), By Regions (Eastern, Western, Northern and Southern) and Competitive Landscape

| Product Code: ETC000492 | Publication Date: Dec 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 125 | No. of Figures: 70 | No. of Tables: 11 |

Strengthening the existing power infrastructure, expansion of power transmission, and distribution network along with the overall development of the infrastructural sector would act as few key drivers for the growth of the cable tray market in India during 2018-24. Further, initiatives such as the Smart Cities Mission and the Make in India campaign would continue to boost the commercial and industrial sectors in the country, thereby generating more demand for cable trays in these domains over the coming years.

According to 6Wresearch, India cable tray market size is projected to grow at a CAGR of 7.8% during 2018-24. The Union Budget for FY2019 put special emphasis on infrastructure development in the country, with railway and road transportation sectors receiving hefty budget allocations. The cable tray industry is an ancillary for the construction industry and thus is expected to benefit significantly from the development of the infrastructure vertical in India. The India cable tray market is dominated by metal-based cable trays in revenue terms with ladder type cable trays holding the majority of the revenue share by type.

The construction and power utilities segments held the largest collective revenue share in the overall India cable tray market share in 2017. Further, the construction segment is expected to continue dominating the market in terms of revenue owing to a large number of upcoming infrastructure projects in the country.

The India cable tray market report comprehensively covers the India cable tray market by materials, types, thickness, applications, and regions. The India cable tray market outlook report provides an unbiased and detailed analysis of the India cable tray market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics. India Cable Tray Market is the largest collection of revenue share all over the world by the cable tray. There are upcoming projects based on the infrastructure according to the revenue-generating. According to the current and future conditions, the report is made based on the detailed analysis of the market and opportunities, high growth areas that are is why cable tray share all over the world.

India cable tray market put to effect by the India government drives the development to several domestic sectors upcoming years. In India the cable tray market has the smart cities mission, saubhagya scheme, and India campaign. The cable tray market experience a healthy grown the forecast period and having a strengthening in the different sectors. The demand for the metal-based cable tray is increase due to stunted even-fluctuating prices. According to the research in India, the cable tray market is growing more in the upcoming years. The India cable tray market is more dominated by the metal-based cable tray revenue terms in the country.

According to the research, the India cable tray markets it's having a scope to grow more in upcoming years. The special emphasis on infrastructure development in the country, with railway and road transportation sectors receiving hefty budget allocations. The India cables tray market dominated by different wired such as metal-based cable which going to generated revenue in the forecast period. There is the large collective revenue of the cable tray market India the construction going to increase more for the development of the country. The project of different infrastructure is planned on a large number for the development of the country.

Key Highlights of the Report:

• India Cable Tray Market Overview

• India Cable Tray Market Outlook

• India Cable Tray Market Forecast

• Historical Data of India Cable Tray Market Revenues for the Period 2014-2017

• India Cable Tray Market Size and India Cable Tray Market Forecast by Revenues, until 2024

• Historical Data of India Cable Tray Market Revenues for the Period 2014-2017, By Materials

• Market Size & Forecast of India Cable Tray Market Revenues until 2024, By Materials

• Historical Data of India Cable Tray Market Revenues for the Period 2014-2017, By Types

• Market Size & Forecast of India Cable Tray Market Revenues until 2024, By Types

• Historical Data of India Cable Tray Market Revenues for the Period 2014-2017, By Thickness

• Market Size & Forecast of India Cable Tray Market Revenues until 2024, By Thickness

• Historical Data of India Cable Tray Market Revenues for the Period 2014-2017, By Applications

• Market Size & Forecast of India Cable Tray Market Revenues until 2024, By Applications

• Historical Data of India Cable Tray Market Revenues for the Period 2014-2017, By Regions

• Market Size & Forecast of India Cable Tray Market Revenues until 2024, By Regions

• Market Drivers and Restraints

• India Cable Tray Market Trends and Developments

• India Cable Tray Market Share, By Players

• India Cable Tray Market Overview on Competitive Landscape

• Company Profiles

• Strategic Recommendations

Markets Covered

The India cable tray market report provides a detailed analysis of the following market segments:

• By Materials:

o Aluminum

o Steel

o Stainless Steel

o FRP (Fiber Reinforced Plastic)

• By Types:

o Ladder

o Solid Bottom

o Trough & Perforated

o Channel

o Wire Mesh

o Single Rail

• By Thickness:

o Below 1.5 mm

o 1.5 - 2.5 mm

o Above 2.5 mm

• By Applications:

o Power Utilities

o Construction

o Industrial

o Others

• By Regions:

o Eastern

o Western

o Northern

o Southern

Frequently Asked Questions About the Market Study (FAQs):

1. Executive Summary

2. Introduction

2.1 Report Description

2.2 Key Highlights of The Report

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumptions

3. India Cable Tray Market Overview

3.1 India Country Overview

3.2 India Cable Tray Market Revenues (2014 - 2024F)

3.3 India Cable Tray Market Revenue Share, By Material (2017 & 2024F)

3.4 India Cable Tray Market Revenue Share, By Types (2017 & 2024F)

3.5 India Cable Tray Market Revenue Share, By Thickness (2017 & 2024F)

3.6 India Cable Tray Market Revenue Share, By Applications (2017 & 2024F)

3.7 India Cable Tray Market Revenue Share, By Regions (2017 & 2024F)

3.8 India Cable Tray Market Industry Life Cycle (2017)

3.9 India Cable Tray Market Porter's Five Forces (2017)

4. India Cable Tray Market Dynamics

4.1 Impact Analysis

4.2 Market Drivers

4.3 Market Restraints

5. India Cable Tray Market Trends

5.1 Modern Design Implications

6. India Cable Tray Market Overview, By Material

6.1 India Steel Cable Tray Market Revenues (2014-2024F)

6.2 India Stainless Steel Cable Tray Market Revenues (2014-2024F)

6.3 India Aluminium Cable Tray Market Revenues (2014-2024F)

6.4 India FRP Cable Tray Market Revenues (2014-2024F)

7. India Cable Tray Market Overview, By Types

7.1 India Ladder Cable Tray Market Revenues (2014-2024F)

7.2 India Trough & Perforated Cable Tray Market Revenues (2014-2024F)

7.3 India Solid Bottom Cable Tray Market Revenues (2014-2024F)

7.4 India Single Rail Cable Tray Market Revenues (2014-2024F)

7.5 India Channel Cable Tray Market Revenues (2014-2024F)

7.6 India Wire Mesh Cable Tray Market Revenues (2014-2024F)

8. India Cable Tray Market Overview, By Thickness

8.1 India Below 1.5 mm Cable Tray Market Revenues (2014-2024F)

8.2 India 1.5 - 2.5 mm Cable Tray Market Revenues (2014-2024F)

8.2 India Above 2.5 mm Cable Tray Market Revenues (2014-2024F)

9. India Cable Tray Market Overview, By Applications

9.1 India Power Utilities Application Cable Tray Market Revenues (2014-2024F)

9.1.1 India Power Sector Outlook

9.2 India Construction Application Cable Tray Market Revenues (2014-2024F)

9.2.1 India Construction Sector Outlook

9.2.2 India Commercial Sector Outlook

9.2.3 India Hospitality Sector Outlook

9.3 India Industrial Application Cable Tray Market Revenues (2014-2024F)

9.3.1 India Industrial Sector Overview

9.3.2 India Industrial Sector Outlook

9.4 India Other Application Cable Tray Market Revenues (2014-2024F)

9.4.1 India Telecom Sector Overview

10. India Cable Tray Market Overview, By Regions

10.1 Southern India Cable Tray Market Revenues (2014-2024F)

10.2 Western India Cable Tray Market Revenues (2014-2024F)

10.3 Northern India Cable Tray Market Revenues (2014-2024F)

10.4 Eastern India Cable Tray Market Revenues (2014-2024F)

10.5 India Power Sector Regional Outlook

11. India Cable Tray Market Key Performance Indicators

11.1 India Government Spending Outlook

11.2 Building Better Transportation Infrastructure

12. India Cable Tray Market Opportunity Assessment

12.1 India Cable Tray Market Opportunity Assessment, By Applications (2024)

12.2 India Cable Tray Market Opportunity Assessment, By Material (2024)

13. Competitive Landscape

13.1 India Cable Tray Market Revenue Share, By Company, 2017

13.2 Competitive Benchmarking, By Material

13.3 Competitive Benchmarking, By Thickness

14. Company Profiles

14.1 Elcon Cable Trays Pvt. Ltd.

14.2 Superfab Inc.

14.3 Universal Engineering & Fabricators Pvt. Ltd.

14.4 Indiana Group

14.5 Ercon Composites Private Limited

14.6 Profab Engineers Pvt. Ltd.

14.7 Ratan Projects & Engineering Co. Pvt. Ltd.

14.8 Patny Systems Pvt. Ltd.

14.9 Slotco Steel Products Pvt. Ltd.

14.10 OBO Bettermann India Private Limited

15. Strategic Recommendations

16. Disclaimer

List of Figures

1. India Installed Capacity, By Sectors, Q1 2018

2. India Energy Mix, Q1 2018

3. India Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

4. India Cable Tray Market Revenue Share, By Material, 2017

5. India Cable Tray Market Revenue Share, By Material, 2024F

6. India Cable Tray Market Revenue Share, By Types, 2017

7. India Cable Tray Market Revenue Share, By Types, 2024F

8. India Cable Tray Market Revenue Share, By Thickness, 2017

9. India Cable Tray Market Revenue Share, By Thickness, 2024F

10. India Cable Tray Market Revenue Share, By Applications, 2017

11. India Cable Tray Market Revenue Share, By Applications, 2024F

12. India Cable Tray Market Revenue Share, By Regions, 2017 & 2024F

13. India Cable Tray Market- Industry Life Cycle 2017

14. Upcoming Infrastructure Projects

15. Expected Contribution of Manufacturing Sector to GDP, 2012 - 2022

16. India Crude Steel Production, 2010 - 2017 (Million Metric Tonnes)

17. NMDC Benchmark Iron Ore Prices, April 2017 - March 2018 ($/tonne)

18: India Steel Cable Tray Market Revenues, 2014 - 2024F (INR Thousand Crore)

19. India Stainless Steel Cable Tray Market Revenues, 2014 - 2024F (INR Thousand Crore)

20. India Aluminium Cable Tray Market Revenues, 2014 - 2024F (INR Thousand Crore)

21. India FRP Cable Tray Market Revenues, 2014 - 2024F (INR Thousand Crore)

22. India Ladder Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

23. India Trough & Perforated Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

24. India Solid Bottom Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

25. India Single Rail Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

26. India Channel Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

27. India Wire Mesh Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

28. India Below 1.5 mm Cable Tray Market Revenues, 2014 - 2024F (INR Thousand Crore)

29. India 1.5 - 2.5 mm Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

30. India Above 2.5 mm Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

31. India Power Utilities Application Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

32. India Construction Application Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

33. India Construction Industry Value, FY19 - FY21 (INR Lakh Crore)

34. India Infrastructure Investment Forecast, 2017-2040 (INR Lakh Crore)

35. India Infrastructure Investment Forecast, By Sector, 2017-2040 (INR Lakh Crore)

36. India Retail Market Size, 2016-2020F (INR Lakh Crore)

37. India e-Tailing Market Size, 2016-2020F (INR Lakh Crore)

38: Gurugram New Office Supply, 2018-20F (Million sq. ft.)

39. Noida New Office Supply, 2018-20F (Million sq. ft.)

40. Delhi New Office Supply, 2018-20F (Million sq. ft.)

41. Bengaluru New Office Supply, 2018-20F (Million sq. ft.)

42. Mumbai New Office Supply, 2018-20F (Million sq. ft.)

43. Chennai New Office Supply, 2018-20F (Million sq. ft.)

44. Hyderabad New Office Supply, 2018-20F (Million sq. ft.)

45. Pune New Office Supply, 2018-20F (Million sq. ft.)

46. India Industrial Application Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

47. India Proposed Industrial Investment, By Sub-Sectors, 2016 - March 2018 (INR Thousand Crore)

48. India Existing and Upcoming SEZ Supply, 2017-2020F (Million Sq. Ft.)

49. India Oil Demand, 2016 - 2022F (Million B/D)

50. India Other Application Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

51. India Cumulative Telecom Towers, 2014 - 2023F (Thousand Units)

52. India 4G Sites, FY15-FY20 (Thousand Units)

53. India Mobile Subscribers, 2015 & 2020F (Million)

54. Southern India Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

55. Western India Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

56. Northern India Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

57. Eastern India Cable Tray Market Revenues, 2014-2024F (INR Thousand Crore)

58: Region-Wise Renewable Energy Target, 2022

59. Projected State-Wise Renewable Energy Installed Capacity, 2022

60. India Actual Government Spending Vs Actual Government Revenues, 2015-2023F (INR Lakh Crore)

61. India Expected Government Budget Outlook, 2018 - 2019

62. Projected Infrastructure Investment in Railways, 2013 - 2032 (INR Thousand Crore)

63. Planned Metro Network Expansion - New Lines (km)

64. India Cable Tray Market Opportunity Assessment, By Applications, 2024F

65. India Cable Tray Market Opportunity Assessment, By Materials, 2024F

66. India Cable Tray Market Revenue Share, By Company, 2017

67. India Electricity Capacity Additions, FY2017 - FY2027 (GW)

68. India Electricity Demand Scenario, 2018-2030 (Billing Unit)

69. India State-Wise Existing and Target Renewable Energy Installed Capacity (MW)

70. India Foreign Tourist Arrivals, 2016 - 2018 (Lakhs)

List of Tables

1. India Transmission Network Overview, 2017

2. Index of Industrial Production (Manufacturing), 2017-18

3. India Transmission Network Expected Additions, 2017-2022

4. India Upcoming Power Plant Projects

5. Proposed Branded New Hotel Room Supply, FY2021 (Number of Rooms)

6. India Under Construction LNG Import Terminals

7. State-Wise Planned Investment in Intra-State Transmission Infrastructure By 2018 - 2019 (INR Crore)

8. Proposed Solar Parks in India Under Green Corridors Phase II Plan

9. India Solar Capacity Additions Till FY2027

10. India Wind Capacity Additions Till FY2027

11. India Tourism Sector Indicators, 2028F

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero