India Video Surveillance Market (2017-2023) | Growth, Revenue, Outlook, Trends, Size, Analysis, Companies, Share, Forecast, Value & Industry

Market Forecast By Surveillance Type (Analog & IP Surveillance), Software (Video Management Software, Video Analytics and Others), By Components (Cameras (Analog and IP), DVR/NVR, Encoders/Decoders), By Verticals (Government and Transportation, Banking & Financial, Retail, Industrial & Manufacturing, Commercial Offices, Residential, Hospitality & Healthcare and Education Institutions) and Regions (North India, South India, East India, West India and Central India)

| Product Code: ETC000371 | Publication Date: Nov 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 209 | No. of Figures: 90 | No. of Tables: 56 |

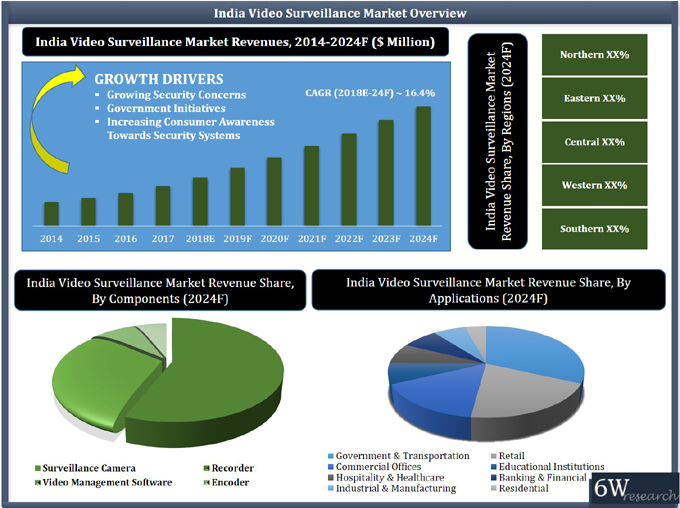

India video surveillance market has grown considerably over the past few years due to rising security concerns and sustained growth of infrastructure in the country. The constant threat of terrorist attacks post-Mumbai attack in 2008 as well as attacks on the Indian Parliament has necessitated the deployment of surveillance systems in both public and private sector buildings. Commercial offices are increasingly deploying these surveillance systems to protect their infrastructure, data and enhance security in their compounds.

According to 6Wresearch, India video surveillance market is projected to grow at a CAGR of nearly 13% during 2017-23. Although, analog-based surveillance systems have accounted for the majority of the market revenues; however, growing awareness along with declining prices are likely to proliferate IP-based surveillance systems over the coming years.

The Northern region registered the highest revenue in 2016 with states of Delhi NCR, Haryana, Punjab, Uttaranchal, and Uttar Pradesh being the major contributors. Hybrid video surveillance solutions are being widely deployed in this along with educational institutes, airports, railway stations, and power plants.

The report thoroughly covers the video surveillance market by Types, Components, Verticals, and Regions. The report provides an unbiased and detailed analysis of the ongoing trends, opportunities/ high growth areas, market drivers which would help the stakeholders to decide and align their market strategies according to the current and future market dynamics.

In recent years, growth take place in security concerns because of the incidents of theft, acts of terrorism, domestic crime, reforms in education, rapid infrastructural growth due to the video surveillance market. Government increasing efforts regarding city surveillance and smart city projects behold the growth of the market. The increasing population coupled with the rising number of crimes is further propelling the video surveillance market in India. Moreover, rising disposable income drives the need for a more secure system leading to the growth in the video surveillance market.

Key Highlights of the Report:

• Historical data of Global Video Surveillance Market for the Period 2010-2015

• Market Size & Forecast of Global Video Surveillance Market until 2022

• Historical data of India Video Surveillance Market for the Period 2011-2016

• Market Size & Forecast of India Video Surveillance Market until 2023

• Historical data of India Analog Video Surveillance Market for the Period 2011-2016

• Market Size & Forecast of India Analog Video Surveillance Market until 2023

• Historical data of India IP Video Surveillance Market for the Period 2011-2016

• Market Size & Forecast of India IP Video Surveillance Market until 2023

• Historical data of India Video Surveillance Vertical Market for the Period 2011-2016

• Market Size & Forecast of India Video Surveillance Vertical Market until 2023

• Market Revenue & Volume Share, By Specification (2015 & 2016)

• Historical data of India Video Surveillance Regional Market for the Period 2011-2016

• Market Size & Forecast of India Video Surveillance Regional Market until 2023

• Market Drivers and Restraints

• Market Trends

• Industry Life Cycle

• Value Chain Analysis

• Porter's Five Forces Analysis

• Players Volume Market Share, By Video Surveillance Types

• Company Profiles

• Key Strategic Pointers

Markets Covered

The report provides a detailed analysis of the following market segments:

• By Types:

Analog Surveillance

• Analog Camera

• DVR

IP/ Network Surveillance

• IP Camera

• NVR

• Encoder/ Decoder

Video Surveillance Software

• VMS

• Video Analytics

• Others

By Specifications:

• Outdoor/ Indoor

• PTZ

• Form Factor

• Megapixel

• ONVIF Compliant

By Verticals:

• Banking & Financial

• Government & Transportation

• Retail & Logistics

• Commercial Offices

• Industrial & Manufacturing

• Residential

• Hospitality & Healthcare

• Educational Institutions

By Regions:

• Northern

• Eastern

• Central

• Southern

• Western

Frequently Asked Questions About the Market Study (FAQs):

Table of Contents

1. Executive Summary

2. Introduction

2.1. Key Highlights of the Report

2.2. Report Description

2.3. Market Scope & Segmentation

2.4. Research Methodology

2.5. Assumptions

3. Global Video Surveillance Market Overview

3.1. Global Video Surveillance Market Revenues (2014-2024F)

3.2. Global Video Surveillance Market Volume (2014-2024F)

3.3. Global Video Surveillance Market Revenue Share, By Regions (2017)

4. India Video Surveillance Market Overview

4.1. India Video Surveillance Market Revenues & Volume (2014-2024F)

4.2. India Video Surveillance Industry Life Cycle

4.3. India Video Surveillance Market Opportunity Matrix

4.4. India Video Surveillance Market Value Chain Analysis

4.5. India Video Surveillance Market Porter's Five Forces Model

4.6. India Video Surveillance Market Revenue Share, By Components (2017 & 2024F)

4.7. India Video Surveillance Market Revenue Share, By Verticals (2017 & 2024F)

4.8. India Video Surveillance Market Revenue Share, By Region (2017 & 2024F)

5. India Video Surveillance Market Dynamics

5.1. Impact Analysis

5.2. Market Drivers

5.3. Market Restraints

5.4. Market Opportunity

6. India Video Surveillance Market Trends

6.1. Deep Learning Enabled Cameras to Propel Video Surveillance Market

6.2. Growing Demand For VSaaS

6.3. HD over Coax: The New Face of Analog Technology

6.4. Wireless Surveillance Systems

7. India Video Surveillance Camera Market Overview

7.1. India Video Surveillance Camera Market Revenues (2014-2024F)

7.1.1. India Video Surveillance Camera Market Revenues, By Types (2014-2024F)

7.2. India Video Surveillance Camera Market Volume (2014-2024F)

7.2.1. India Video Surveillance Camera Market Volume, By Types (2014-2024F)

7.3. India Video Surveillance Analog Camera Market Price Trend (2014-2024F)

7.4. India Video Surveillance IP Camera Market Price Trend (2014-2024F)

8. India Video Surveillance Recorder Market Overview

8.1. India Video Surveillance Recorder Market Revenues (2014-2024F)

8.1.1. India Video Surveillance Recorder Market Revenues, By Types (2014-2024F)

8.2. India Video Surveillance Recorder Market Volume (2014-2024F)

8.2.1. India Video Surveillance Recorder Market Volume, By Types (2014-2024F)

8.3. India Video Surveillance NVR Market Price Trend (2014-2024F)

8.4. India Video Surveillance DVR Market Price Trend (2014-2024F)

9. India Video Surveillance Encoder Market Overview

9.1. India Video Surveillance Encoder Market Revenues & Volume (2014-2024F)

9.2. India Video Surveillance Encoder Market Price Trend (2014-2024F)

10. India Video Surveillance Software Market Overview

10.1. India Video Management Software Market Revenues (2014-2024F)

11 India Video Surveillance Market Overview, By Camera Specification (Q3'2017-Q2'2018 Comparison)

11.1. India Video Surveillance Market Revenue Share, By Outdoor/ Indoor Camera (Q3'2017-Q2'2018 Comparison)

11.2. India Video Surveillance Market Volume Share, By Outdoor/ Indoor Camera (Q3'2017-Q2'2018 Comparison)

11.3. India Video Surveillance Market Revenue Share, By Form Factor (Q3'2017-Q2'2018 Comparison)

11.3.1. India Video Surveillance Market Revenue Share, By Form Factor (Analog Vs IP/ Network)

(Q3'2017-Q2'2018 Comparison)

11.4 India Video Surveillance Market Volume Share, By Form Factor (Q3'2017-Q2'2018 Comparison)

11.4.1. India Video Surveillance Market Volume Share, By Form Factor (Analog Vs IP/ Network)

(Q3'2017-Q2'2018 Comparison)

11.5 India Video Surveillance Market Revenue Share, By Megapixel (Q3'2017-Q2'2018 Comparison)

11.5.1 India Video Surveillance Market Revenue Share, By Megapixel (Analog Vs IP/ Network)

(Q3'2017-Q2'2018 Comparison)

11.6 India Video Surveillance Market Volume Share, By Megapixel (Q3'2017-Q2'2018 Comparison)

11.6.1 India Video Surveillance Market Volume Share, By Megapixel (Analog Vs IP/ Network)

(Q3'2017-Q2'2018 Comparison)

12. India Video Surveillance Market Overview, By Verticals

12.1. India Banking & Financial Institutions Video Surveillance Market Revenues (2014-2024F)

12.1.1. Market Revenues, By Segment (2014-2024F)

12.2. India Government & Transportation Video Surveillance Market Revenues (2014-2024F)

12.2.1. Market Revenues, By Segment (2014-2024F)

12.2.2. Market Opportunity Assessment, By Smart City/ City Surveillance

12.3. India Retail Video Surveillance Market Revenues (2014-2024F)

12.3.1. Market Revenues, By Segment (2014-2024F)

12.4. India Commercial Offices Video Surveillance Market Revenues (2014-2024F)

12.5. India Hospitality & Healthcare Video Surveillance Market Revenues (2014-2024F)

12.5.1. Market Revenues, By Segment (2014-2024F)

12.6. India Industrial & Manufacturing Video Surveillance Market Revenues (2014-2024F)

12.6.1. Market Revenues, By Segment (2014-2024F)

12.7. India Residential Video Surveillance Market Revenues (2014-2024F)

12.8. India Educational Institutions (Universities, Schools, etc.) Video Surveillance Market Revenues (2014-2024F)

13. India Video Surveillance Market Overview, By Regions

13.1. Northern India Video Surveillance Market Revenues (2014-2024F)

13.2. Southern India Video Surveillance Market Revenues (2014-2024F)

13.3. Eastern India Video Surveillance Market Revenues (2014-2024F)

13.4. Western India Video Surveillance Market Revenues (2014-2024F)

13.5. Central India Video Surveillance Market Revenues (2014-2024F)

14. Active Government Surveillance Cameras Tenders

15. Competitive Landscape

15.1. List of CCTV Manufacturers/ Assemblers in India

15.2. India Overall Video Surveillance Market Players Volume Share (Q3'2017-Q2'2018)

15.2.1. India Video Surveillance Market Players Volume Share, By Outdoor/ Indoor Camera

(As Per Shipment) (2H 2017 & 1H 2018)

15.2.2. India Video Surveillance Market Players Volume Share, By Form Factor Camera

(As Per Shipment) (2H 2017 & 1H 2018)

15.2.3. India Video Surveillance Market Players Volume Share, By Megapixel Camera

(As Per Shipment) (2H 2017 & 1H 2018)

15.3. India Analog Video Surveillance Market Players Volume Share (As Per Shipment) (Q3'2017-Q2'2018)

15.3.1. India Analog Video Surveillance Market Players Volume Share, By Outdoor/ Indoor Camera

(As Per Shipment) (2H 2017 & 1H 2018)

15.3.2. India Analog Video Surveillance Market Players Volume Share, By Form Factor Camera

(As Per Shipment) (2H 2017 & 1H 2018)

15.3.3. India Analog Video Surveillance Market Players Volume Share, By Megapixel Camera

(As Per Shipment) (2H 2017 & 1H 2018)

15.4. India IP/ Network Video Surveillance Market Players Volume Share (As Per Shipment) (Q3'2017-Q2'2018)

15.4.1. India IP/ Network Video Surveillance Market Players Volume Share, By Outdoor/ Indoor Camera

(As Per Shipment) (2H 2017 & 1H 2018)

15.4.2. India IP/ Network Video Surveillance Market Players Volume Share, By Form Factor Camera

(As Per Shipment) (2H 2017 & 1H 2018)

15.4.3. India IP/ Network Video Surveillance Market Players Volume Share, By PTZ Type Camera

(As Per Shipment) (2H 2017 & 1H 2018)

15.4.4. India IP/ Network Video Surveillance Market Players Volume Share, By Megapixel Camera

(As Per Shipment) (2H 2017 & 1H 2018)

15.4.5. India IP/ Network Video Surveillance Market Players Volume Share, By ONVIF Compliant Camera

(As Per Shipment) (2H 2017 & 1H 2018)

15.5. Competitive Benchmarking, By Technology

16. Company Profiles

16.1. Axis Communications AB

16.2. Bosch Building Technologies

16.3. CP Plus India Pvt. Ltd.

16.4. FLIR Systems, Inc.

16.5. Prama Hikvision India Pvt Ltd.

16.6. Hanwha Techwin Co., Ltd.

16.7. Honeywell International India Pvt. Ltd.

16.8. Panasonic India Pvt. Ltd.

16.9. Pelco by Schneider Electric

16.10. Sony Corporation

16.11. Zhejiang Dahua Technology Co., Ltd.

16.12. Zicom Electronic Security Systems Ltd.

17. Key Strategic Recommendations

18. Disclaimer

List of Figures

Figure 1. Global Video Surveillance Market Revenues, 2014-2024F ($ Billion)

Figure 2. Global Video Surveillance Market Volume, 2014-2024F (Million Units)

Figure 3. Global Video Surveillance Market Revenue Share, By Regions (2017)

Figure 4. India Video Surveillance Market Revenues, 2014-2024F ($ Million)

Figure 5. India Video Surveillance Market Volume, 2014-2024F (Million Units)

Figure 6. India Homeland Security Budget Allocation, 2012-2018 ($ Trillion)

Figure 7. India IT Industry Market Size, FY 2010-2017 ($ Billion)

Figure 8. India Video Surveillance Industry Life Cycle (2017)

Figure 9. India Video Surveillance Market Opportunity Matrix (2024F)

Figure 10. Value Chain Analysis of India Video Surveillance Market

Figure 11. India Video Surveillance Market Revenue Share, By Components (2017)

Figure 12. India Video Surveillance Market Revenue Share, By Components (2024F)

Figure 13. India Video Surveillance Market Revenue Share, By Verticals (2017)

Figure 14. India Video Surveillance Market Revenue Share, By Verticals (2024F)

Figure 15. India Video Surveillance Market Revenue Share, By Region (2017 & 2024F)

Figure 16. India Crime Incidences for Tier-I Cities, 2014-16 (As on Sep 2018)

Figure 17. India Video Surveillance Camera Market Revenues, 2014-2017 ($ Million)

Figure 18. India Video Surveillance Camera Market Revenues, 2018E-2024F ($ Million)

Figure 19. India Video Surveillance Camera Market Volume, 2014-2017 (Million Units)

Figure 20. India Video Surveillance Camera Market Volume, 2018E-2024F (Million Units)

Figure 21. India Video Surveillance Analog Camera Market Price Trend, 2014-2024F ($/Unit)

Figure 22. India Video Surveillance IP Camera Market Price Trend, 2014-2024F ($/Unit)

Figure 23. India Video Surveillance Recorder Market Revenues, 2014-2017 ($ Million)

Figure 24. India Video Surveillance Recorder Market Revenues, 2018E-2024F ($ Million)

Figure 25. India Video Surveillance Recorder Market Volume, 2014-2017 (Million Units)

Figure 26. India Video Surveillance Recorder Market Volume, 2018E-2024F (Million Units)

Figure 27. India Video Surveillance NVR Market Price Trend, 2014-2024F ($/Unit)

Figure 28. India Video Surveillance DVR Market Price Trend, 2014-2024F ($/Unit)

Figure 29. India Video Surveillance Encoder Market Revenues, 2014-2024F ($ Million)

Figure 30. India Video Surveillance Encoder Market Volume, 2014-2017 (Thousand Units)

Figure 31. India Video Surveillance Encoder Market Volume, 2018E-24F (Thousand Units)

Figure 32. India Video Surveillance Encoder Market Price Trend, 2014-2024F ($/Unit)

Figure 33. India Video Management Software Market Revenues, 2014-2017 ($ Million)

Figure 34. India Video Management Software Market Revenues, 2018E-2024F ($ Million)

Figure 35. India Video Surveillance Market Revenue Share, By Indoor/ Outdoor Camera

(Q3'2017-Q2'2018 Comparison)

Figure 36. India Video Surveillance Market Volume Share, By Indoor/ Outdoor Camera (Q3'2017-Q2'2018 Comparison)

Figure 37. India Video Surveillance Market Revenue Share, By Form Factor (Q3'2017-Q2'2018 Comparison)

Figure 38. India Video Surveillance Market Revenue Share, By Form Factor, Analog Vs. IP

(Q3'2017-Q2'2018 Comparison)

Figure 39. India Video Surveillance Market Volume Share, By Form Factor (Q3'2017-Q2'2018 Comparison)

Figure 40. India Video Surveillance Market Volume Share, By Form Factor, Analog Vs. IP

(Q3'2017-Q2'2018 Comparison)

Figure 41. India Video Surveillance Market Revenue Share, By Megapixel (Q3'2017-Q2'2018 Comparison)

Figure 42. India Video Surveillance Market Revenue Share, By Megapixel, Analog Vs. IP

(Q3'2017-Q2'2018 Comparison)

Figure 43. India Video Surveillance Market Volume Share, By Megapixel (Q3'2017-Q2'2018 Comparison)

Figure 44. India Video Surveillance Market Volume Share, By Megapixel, Analog Vs. IP (Q3'2017-Q2'2018 Comparison)

Figure 45. India Banking & Financial Institutions' Video Surveillance Market Revenues, 2014-2017 ($ Million)

Figure 46. India Banking & Financial Institutions' Video Surveillance Market Revenues, 2018E-2024F ($ Million)

Figure 47. India BFSI Video Surveillance Market Revenue Share, By Segment (2017)

Figure 48. India BFSI Video Surveillance Market Revenue Share, By Segment (2024F)

Figure 49. India Government & Transportation Video Surveillance Market Revenues, 2014-2017 ($ Million)

Figure 50. India Government & Transportation Video Surveillance Market Revenues, 2018E-2024F ($ Million)

Figure 51. India Planned Metro Network Expansion - New Lines (km) (As on Sep 2018)

Figure 52. Projected Infrastructure Investment in Railways, 2013 - 2032 ($ Billion)

Figure 53. India Government & Transportation Video Surveillance Market Revenue Share, By Segment (2017)

Figure 54. India Government & Transportation Video Surveillance Market Revenue Share, By Segment (2024F)

Figure 55. India Retail Video Surveillance Market Revenues, 2014-17($ Million)

Figure 56. India Retail Video Surveillance Market Revenues, 2018E-2024F ($ Million)

Figure 57. India Retail Sector Growth, 2010-2020F ($ Billion)

Figure 58. India Upcoming Mall Supply, 2017-20 (million sq.ft.)

Figure 59. India Retail Video Surveillance Market Revenue Share, By Segment (2017)

Figure 60. India Retail Video Surveillance Market Revenue Share, By Segment (2024F)

Figure 61. India Commercial Offices Video Surveillance Market Revenues, 2014-2017 ($ Million)

Figure 62. India Commercial Offices Video Surveillance Market Revenues, 2018E-2024F ($ Million)

Figure 63. India Hospitality & Healthcare Video Surveillance Market Revenues, 2014-2017 ($ Million)

Figure 64. India Hospitality & Healthcare Video Surveillance Market Revenues, 2018E-2024F ($ Million)

Figure 65. India Hospitality & Healthcare Video Surveillance Market Revenue Share, By Segment (2017)

Figure 66. India Hospitality & Healthcare Video Surveillance Market Revenue Share, By Segment (2024F)

Figure 67. India Industrial & Manufacturing Video Surveillance Market Revenues, 2014-2017 ($ Million)

Figure 68. India Industrial & Manufacturing Video Surveillance Market Revenues, 2018E-2024F ($ Million)

Figure 69. India Natural Gas Production, 2010-2017 (Billion Cubic Meters)

Figure 70. India Oil Production, 2010-2017 (Million Tonnes)

Figure 71. India Industrial & Manufacturing Video Surveillance Market Revenue Share, By Segment (2017)

Figure 72. India Industrial & Manufacturing Video Surveillance Market Revenue Share, By Segment (2024F)

Figure 73. India Residential Video Surveillance Market Revenues, 2014-2017 ($ Million)

Figure 74. India Residential Video Surveillance Market Revenues, 2018E-2024F ($ Million)

Figure 75. India Real Estate Market Size, 2008-2022F ($ Billion)

Figure 76. India Educational Institutions Video Surveillance Market Revenues, 2014-2017 ($ Million)

Figure 77. India Educational Institutions Video Surveillance Market Revenues, 2018E-2024F ($ Million)

Figure 78. Foreign Direct Investment in Education Sector, FY2011-FY2017 ($ Million)

Figure 79. Number of Universities in India, 2010-2018E

Figure 80. India Education Spending, 2013-19 ($ Billion)

Figure 81. Northern India Video Surveillance Market Revenues, 2014-2024F ($ Million)

Figure 82. Southern India Video Surveillance Market Revenues, 2014-2024F ($ Million)

Figure 83. Eastern India Video Surveillance Market Revenues, 2014-2017 ($ Million)

Figure 84. Western India Video Surveillance Market Revenues, 2014-2017 ($ Million)

Figure 85. Central India Video Surveillance Market Revenues, 2014-2017 ($ Million)

Figure 86. India Overall Video Surveillance Market Players Volume Share (Q3'2017-Q2'2018 Comparison)

Figure 87. India Analog Video Surveillance Market Players Volume Share (Q3'2017-Q2'2018 Comparison)

Figure 88. India IP Video Surveillance Market Players Volume Share (Q3'2017-Q2'2018 Comparison)

List of Tables

Table 1. India Analog Video Surveillance Market Revenues, By Types, 2014-2017 ($ Million)

Table 2. India Analog Video Surveillance Market Revenues, By Types, 2018E-2024F ($ Million)

Table 3. India Video Surveillance Camera Market Volume, By Types, 2014-2017 (Million Units)

Table 4. India Video Surveillance Camera Market Volume, By Types, 2018E-2024F (Million Units)

Table 5. India Video Surveillance Recorder Market Revenues, By Types, 2014-2017 ($ Million)

Table 6. India Video Surveillance Recorder Market Revenues, By Types, 2018E-2024F ($ Million)

Table 7. India Video Surveillance Recorder Market Volume, By Types, 2014-2017 (Thousand Units)

Table 8. India Video Surveillance Recorder Market Volume, By Types, 2018E-2024F (Thousand Units)

Table 9. Number of Bank Branches in India, As on 31st March 2017

Table 10. Number of ATMs in India (As on March 2017)

Table 11. India BFSI Video Surveillance Market Revenues, By Segment, 2014-2024F ($ Million)

Table 12. List of Upcoming International Airports in India (Sep 2018)

Table 13. India Airport Passenger Traffic, 2008-2017 (In Million)

Table 14. India Airport and Railways Video Surveillance Projects

Table 15. India State Police Video Surveillance Initiatives

Table 16. Upcoming Metro Line Projects in India

Table 17. India Government & Transportation Video Surveillance Market Revenues, By Segment, 2014-2024F ($ Million)

Table 18. India Retail Video Surveillance Market Revenues, By Segment, 2014-2024F ($ Million)

Table 19. Top 10 States in Terms of MSME Establishments (2016-17)

Table 20. India Hospitality & Healthcare Video Surveillance Market Revenues, By Segment, 2014-2024F ($ Million)

Table 21. Index of Industrial Production (Manufacturing), 2017-18

Table 22. India Industrial & Manufacturing Video Surveillance Market Revenues, By Segment, 2014-2024F ($ Million)

Table 23. List of Residential High-rise Building Construction Projects in India

Table 24. India Health and Education Video Surveillance Projects (As on Sep 2018)

Table 25. CCTV Manufacturers/ Assemblers in India

Table 26. India Video Surveillance Market Players Volume Share, By Indoor Camera (2H 2017 and 1H 2018)

Table 27. India Video Surveillance Market Players Volume Share, By Outdoor Camera (2H 2017 and 1H 2018)

Table 28. India Video Surveillance Market Players Volume Share, By Bullet Form Factor Camera

(2H 2017 and 1H 2018)

Table 29. India Video Surveillance Market Players Volume Share, By Dome Form Factor Camera

(2H 2017 and 1H 2018)

Table 30. India Video Surveillance Market Players Volume Share, By Other Form Factors Camera

(2H 2017 and 1H 2018)

Table 31. India Video Surveillance Market Players Volume Share, By 1-1.4 Megapixel Camera (2H 2017 and 1H 2018)

Table 32. India Video Surveillance Market Players Volume Share, By 2-2.4 Megapixel Camera (2H 2017 and 1H 2018)

Table 33. India Video Surveillance Market Players Volume Share, By 3 Megapixel Camera (2H 2017 and 1H 2018)

Table 34. India Video Surveillance Market Players Volume Share, By 4 Megapixel Camera (2H 2017 and 1H 2018)

Table 35. India Analog Video Surveillance Market Players Volume Share, By Indoor Camera (2H 2017 and 1H 2018)

Table 36. India Analog Video Surveillance Market Players Volume Share, By Outdoor Camera (2H 2017 and 1H 2018)

Table 37. India Analog Video Surveillance Market Players Volume Share, By Dome Form Factor Camera

(2H 2017 and 1H 2018)

Table 38. India Analog Video Surveillance Market Players Volume Share, By Bullet Form Factor Camera

(2H 2017 and 1H 2018)

Table 39. India Analog Video Surveillance Market Players' Volume Share, By Other Form Factors Camera (1H 2018)

Table 40. India Analog Video Surveillance Market Players Volume Share, By 1-1.4 Megapixel Camera

(2H 2017 and 1H 2018)

Table 41. India Analog Video Surveillance Market Players Volume Share, By 2-2.4 Megapixel Camera

(2H 2017 and 1H 2018)

Table 42. India Analog Video Surveillance Market Players Volume Share, By 4 Megapixel Camera

(2H 2017 and 1H 2018)

Table 43. India IP Video Surveillance Market Players Volume Share, By Indoor Camera (2H 2017 and 1H 2018)

Table 44. India IP Video Surveillance Market Players Volume Share, By Outdoor Camera (2H 2017 and 1H 2018)

Table 45. India IP Video Surveillance Market Players Volume Share, By Bullet Form Factor Camera

(2H 2017 and 1H 2018)

Table 46. India IP Video Surveillance Market Players Volume Share, By Dome Form Factor Camera

(2H 2017 and 1H 2018)

Table 47. India IP Video Surveillance Market Players Volume Share, By Other Form Factor Camera

(2H 2017 and 1H 2018)

Table 48. India IP Video Surveillance Market Players Volume Share, By PTZ Camera (2H 2017 and 1H 2018)

Table 49. India IP Video Surveillance Market Players Volume Share, By Non-PTZ Camera (2H 2017 and 1H 2018)

Table 50. India IP Video Surveillance Market Players Volume Share, By 1-1.4 Megapixel Camera

(2H 2017 and 1H 2018)

Table 51. India IP Video Surveillance Market Players Volume Share, By 2-2.4 Megapixel Camera

(2H 2017 and 1H 2018)

Table 52. India IP Video Surveillance Market Players Volume Share, By 3 Megapixel Camera (2H 2017 and 1H 2018)

Table 53. India IP Video Surveillance Market Players Volume Share, By 4 Megapixel Camera (2H 2017 and 1H 2018)

Table 54. India IP Video Surveillance Market Players Volume Share, By ONVIF Compliant Camera

(2H 2017 and 1H 2018)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero