Europe Chocolate Market (2024-2030) | Size, Share, Growth, Analysis, Forecast, Trends, Value, Outlook & Revenue

Market Forecast By Product Type (Dark Chocolate, Milk Chocolate, White Chocolate), By Chocolate Type (Count Lines & Straight Lines, Molded or Bar Chocolates, Choco-Panned & Sugar Panned and Others including Box Chocolates and Novelties), By Distribution Channels (Supermarket and Hypermarkets, Convenience Stores, Online Channels, Grocery/ Mom n Pop Stores and Others including Specialized Retailers, Pharmacy, etc), By Counties (Russia, United Kingdom, France, Germany and Rest of Europe) and Competitive Landscape

| Product Code: ETC001356 | Publication Date: Jun 2023 | Updated Date: Apr 2024 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 1 | No. of Figures: 1 | No. of Tables: -3 | |

Topics Covered in the Europe Chocolate Market

Europe Chocolate Market report thoroughly covers the market by product type, chocolate type, distribution channel, and countries. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

| Report Name | Europe Chocolate Market |

| Base Year | 2023 |

| Historical Period | 2020-2023 |

| Forecast Period | 2024-2030 |

| Growth Rate (CAGR) | 4.85% |

| Report Coverage | Revenues & Volume, Market Trends, Drivers & Challenges, Market Forecast, Market Share |

| Segment Coverage | By Product Type, By Chocolate Type, By Distribution Channels, By Counties |

| Customization Scope | 100% customized reports available along with reliable data. Moreover, you can alter the segments, countries, and regions according to your needs. For further details, you can contact our research expert at sales@6wresearch.com |

| Pricing and Purchase Options | Avail customization purchase option to know the exact pricing of your research needs |

Europe Chocolate Market Synopsis

Europe Chocolate Market has been progressing faster and it will continue to accomplish major success during the forecast period due to the rise in demand for artisanal and premium chocolates, growing awareness of health-conscious consumption, and growth of e-commerce platforms across the European countries.

According to 6Wresearch, Europe Chocolate Market size is predicted to grow at a CAGR of 4.85% during 2024–2030. The European chocolate industry has witnessed a growing demand for premium and artisanal chocolates. Consumers are increasingly seeking unique and high-quality chocolate experiences, driving the market towards innovative and specialized products. There is a rising awareness of health-conscious consumption, leading to an increased demand for dark chocolate and products with reduced sugar content. Manufacturers have responded by introducing healthier formulations and incorporating functional ingredients, aligning with evolving consumer preferences. Consumers in Europe are placing a greater emphasis on sustainability and ethical sourcing. Chocolate manufacturers are responding by adopting fair trade practices, using responsibly sourced cocoa, and engaging in environmentally friendly production processes to meet the growing demand for socially responsible products. The expansion of e-commerce platforms has provided consumers with convenient access to a wide range of chocolate products. Online channels have become increasingly popular for purchasing chocolates, enabling companies to reach a broader audience and adapt to changing consumer shopping habits.

Increased awareness of health issues, such as obesity and diabetes, has led to greater scrutiny of the sugar and fat content in chocolate products. Regulatory pressures to address these concerns may pose challenges for manufacturers in terms of reformulating products and adapting to changing dietary preferences. While sustainability practices are a driver, they also present challenges. Meeting sustainability goals requires investments in ethical sourcing and environmentally friendly production, which can increase operational costs. Balancing sustainability with economic viability poses a continuous challenge for chocolate manufacturers. Economic factors, such as inflation and economic downturns, can impact consumer spending on discretionary items like premium chocolates. Economic uncertainties may influence purchasing behaviour and pose challenges for companies operating in the chocolate market. These factors can majorly hamper Europe Chocolate Market Growth.

Europe Chocolate Industry: Key Players

Some of the widely known players in European chocolate market include:

- Mars, Inc.

- Mondelez International, Inc.

- Nestlé S.A.

- Ferrero Group

- Lindt & Sprüngli AG

- Hershey Company

- Barry Callebaut

- Fazer Group

- Ritter Sport

- Cte d'Or (Part of Mondelez International)

Chocolate Market in Europe: Government Initiatives

European governments, in coordination with the European Food Safety Authority (EFSA), have established strict regulations to ensure the safety and quality of chocolate products. These regulations cover aspects such as hygiene standards in production, permissible ingredients, and maximum levels of contaminants. The European Union (EU) has specific regulations regarding the labelling of food products, including chocolate. These regulations require accurate and transparent labelling of ingredients, nutritional information, allergens, and other relevant details.

Labels must comply with standardized formats to provide consumers with clear and easily understandable information. The European chocolate market has seen increasing attention on sustainable and ethically sourced cocoa. Some governments encourage or regulate the use of fair trade practices, aiming to ensure that cocoa farmers receive fair compensation for their products and work in humane conditions. Authorities enforce regulations to protect consumers from deceptive practices, false advertising, or misleading claims regarding chocolate products. This includes measures to prevent the misrepresentation of ingredients, origin, and health benefits.

Market Segmentation by Distribution Channel

According to Dhaval, Research Manager, 6Wresearch, the online distribution channel is projected to generate the fastest share. The online channel has attained traction in the last few years owing to increased internet penetration. The rising internet user population, availability of a variety of brands, as well as convenience of buying from home are the vital factors promoting the use of online distribution channels.

Key attractiveness of the report

- 10 Years of Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

s

- Europe Chocolate Market Overview

- Europe Chocolate Market Outlook

- Europe Chocolate Market Forecast

- Historical Data of Europe Chocolate Market Revenues for the Period 2020-2030

- Europe Chocolate Market Size & Europe Chocolate Market Forecast of Revenues, Until 2030

- Historical Data of Europe Chocolate Market Revenues, By Product Type, for the Period 2020-2030

- Market Size & Forecast of Europe Chocolate Market Revenues, By Product Type, Until 2030

- Historical Data of Europe Chocolate Market Revenues, By Distribution Channels, for the Period 2020-2030

- Market Size & Forecast of Europe Chocolate Market Revenues, By Distribution Channels, Until 2030

- Historical Data of Europe Chocolate Market Revenues, By Chocolate Type, for the Period 2020-2030

- Market Size & Forecast of Europe Chocolate Market Revenues, By Chocolate Type, Until 2030

- Historical Data of Russia Chocolate Market Revenues and Volume, for the Period 2020-2030

- Market Size & Forecast of Russia Chocolate Market Revenues, Until 2030

- Historical Data of Germany Chocolate Market Revenues and Volume, for the Period 2020-2030

- Market Size & Forecast of the Germany Chocolate Market Revenues, Until 2030

- Historical Data of United Kingdom Chocolate Market Revenues and Volume, for the Period 2020-2030

- Market Size & Forecast of the United Kingdom Chocolate Market Revenues, Until 2030

- Historical Data of France Chocolate Market Revenues and Volume, for the Period 2020-2030

- Market Size & Forecast of the France Chocolate Market Revenues, Until 2030

- Market Drivers and Restraints

- Europe Chocolate Market Price Trends

- Europe Chocolate Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Europe Chocolate Market Share, By Countries

- Europe Chocolate Market Share, By Players

- Europe Chocolate Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Product Type

- Milk Chocolate

- White Chocolate

- Dark Chocolate

By Distribution Channels

- Supermarkets/ Hypermarkets

- Grocery/Mom-n-Pop Stores

- Convenience Stores

- Online Channel

- Others (Specialized Retailers, pharmacy, etc.)

By Chocolate Type

- Count lines and straight lines

- Molded or Bar Chocolates

- Choco panned & Sugar panned

- Others (Box chocolates, novelties)

By Countries

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Rest Of Europe

Europe Chocolate Market: FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Europe Chocolate Market Overview |

| 3.1 Europe Country Indicators |

| 3.2 Europe Chocolate Market Revenues, 2019-2029F |

| 3.3 Europe Chocolate Market Revenue Share, By Product Type, 2020-2030F |

| 3.4 Europe Chocolate Market Revenue Share, By Distribution Channel, 2020-2030F |

| 3.5 Europe Chocolate Market Revenue Share, By Chocolate Type, 2020-2030F |

| 3.6 Europe Chocolate Market Revenue Share, By Countries, 2020 & 2030F |

| 3.7 Europe Chocolate Market Industrial Life Cycle |

| 3.8 Europe Chocolate Market Porter’s Five Force Model |

| 4 Europe Chocolate Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Europe Chocolate Market Trends |

| 6 Russia Chocolate Market Overview |

| 6.1 Russia Chocolate Market Revenues, 2020-2030F |

| 6.2 Russia Chocolate Market Revenue Share, By Product Type, 2020-2030F |

| 6.2.1 Russia Milk Chocolate Market Revenues, 2020-2030F |

| 6.2.2 Russia White Chocolate Market Revenues, 2020-2030F |

| 6.2.3 Russia Dark Chocolate Market Revenues, 2020-2030F |

| 6.3 Russia Chocolate Market Revenue Share, By Distribution Channel, 2020-2030F |

| 6.3.1 Russia Chocolate Market Revenues, By Supermarkets/ Hypermarkets, 2020-2030F |

| 6.3.2 Russia Chocolate Market Revenues, By Grocery/ Mom n Pop Stores, 2020-2030F |

| 6.3.3 Russia Chocolate Market Revenues, By Convenience Stores, 2020-2030F |

| 6.3.4 Russia Chocolate Market Revenues, By Online Channel, 2020-2030F |

| 6.3.5 Russia Chocolate Market Revenues, By Other Distribution Channel, 2020-2030F |

| 6.4 Russia Chocolate Market Revenue Share, By Chocolate Type, 2020-2030F |

| 6.4.1 Russia Chocolate Market Revenues, By Countlines & Straight-lines, 2020-2030F |

| 6.4.2 Russia Chocolate Market Revenues, By Moulded or Bar, 2020-2030F |

| 6.4.3 Russia Chocolate Market Revenues, By Box Chocolates and Novelties, 2020-2030F |

| 6.4.4 Russia Chocolate Market Revenues, By Other Chocolate Type, 2020-2030F |

| 7 Germany Chocolate Market Overview |

| 7.1 Germany Chocolate Market Revenues, 2020-2030F |

| 7.2 Germany Chocolate Market Revenue Share, By Product Type, 2020-2030F |

| 7.2.1 Germany Milk Chocolate Market Revenues, 2020-2030F |

| 7.2.2 Germany White Chocolate Market Revenues, 2020-2030F |

| 7.2.3 Germany Dark Chocolate Market Revenues, 2020-2030F |

| 7.3 Germany Chocolate Market Revenue Share, By Distribution Channel, 2020-2030F |

| 7.3.1 Germany Chocolate Market Revenues, By Supermarkets/ Hypermarkets, 2020-2030F |

| 7.3.2 Germany Chocolate Market Revenues, By Grocery/ Mom n Pop Stores, 2020-2030F |

| 7.3.3 Germany Chocolate Market Revenues, By Convenience Stores, 2020-2030F |

| 7.3.4 Germany Chocolate Market Revenues, By Online Channel, 2020-2030F |

| 7.3.5 Germany Chocolate Market Revenues, By Other Distribution Channel, 2020-2030F |

| 7.4 Germany Chocolate Market Revenue Share, By Chocolate Type, 2020-2030F |

| 7.4.1 Germany Chocolate Market Revenues, By Countlines & Straight-lines, 2020-2030F |

| 7.4.2 Germany Chocolate Market Revenues, By Moulded or Bar, 2020-2030F |

| 7.4.3 Germany Chocolate Market Revenues, By Choco-Panned & Sugar Panned, 2020-2030F |

| 7.4.4 Germany Chocolate Market Revenues, By Other Chocolate Type, 2020-2030F |

| 8 UK Chocolate Market Overview |

| 8.1 UK Chocolate Market Revenues, 2020-2030F |

| 8.2 UK Chocolate Market Revenue Share, By Product Type, 2020-2030F |

| 8.2.1 UK Milk Chocolate Market Revenues, 2020-2030F |

| 8.2.2 UK White Chocolate Market Revenues, 2020-2030F |

| 8.2.3 UK Dark Chocolate Market Revenues, 2020-2030F |

| 8.3 UK Chocolate Market Revenue Share, By Distribution Channel, 2020-2030F |

| 8.3.1 UK Chocolate Market Revenues, By Supermarkets/ Hypermarkets, 2020-2030F |

| 8.3.2 UK Chocolate Market Revenues, By Grocery/ Mom n Pop Stores, 2020-2030F |

| 8.3.3 UK Chocolate Market Revenues, By Convenience Stores, 2020-2030F |

| 8.3.4 UK Chocolate Market Revenues, By Online Channel, 2020-2030F |

| 8.3.5 UK Chocolate Market Revenues, By Other Distribution Channel, 2020-2030F |

| 8.4 UK Chocolate Market Revenue Share, By Chocolate Type, 2020-2030F |

| 8.4.1 UK Chocolate Market Revenues, By Countlines & Straight-lines, 2020-2030F |

| 8.4.2 UK Chocolate Market Revenues, By Moulded or Bar, 2020-2030F |

| 8.4.3 UK Chocolate Market Revenues, By Choco-Panned & Sugar Panned, 2020-2030F |

| 8.4.4 UK Chocolate Market Revenues, By Other Chocolate Type, 2020-2030F |

| 9 France Chocolate Market Overview |

| 9.1 France Chocolate Market Revenues, 2020-2030F |

| 9.2 France Chocolate Market Revenue Share, By Product Type, 2020-2030F |

| 9.2.1 France Milk Chocolate Market Revenues, 2020-2030F |

| 9.2.2 France White Chocolate Market Revenues, 2020-2030F |

| 9.2.3 France Dark Chocolate Market Revenues, 2020-2030F |

| 9.3 France Chocolate Market Revenue Share, By Distribution Channel, 2020-2030F |

| 9.3.1 France Chocolate Market Revenues, By Supermarkets/ Hypermarkets, 2020-2030F |

| 9.3.2 France Chocolate Market Revenues, By Grocery/ Mom n Pop Stores, 2020-2030F |

| 9.3.3 France Chocolate Market Revenues, By Convenience Stores, 2020-2030F |

| 9.3.4 France Chocolate Market Revenues, By Online Channel, 2020-2030F |

| 9.3.5 France Chocolate Market Revenues, By Other Distribution Channel, 2020-2030F |

| 9.4 France Chocolate Market Revenue Share, By Chocolate Type, 2020-2030F |

| 9.4.1 France Chocolate Market Revenues, By Countlines & Straight-lines, 2020-2030F |

| 9.4.2 France Chocolate Market Revenues, By Moulded or Bar, 2020-2030F |

| 9.4.3 France Chocolate Market Revenues, By Choco-Panned & Sugar Panned, 2020-2030F |

| 9.4.4 France Chocolate Market Revenues, By Other Chocolate Type, 2020-2030F |

| 10 Rest of Europe Chocolate Market Overview |

| 10.1 Rest of Europe Chocolate Market Revenues, 2020-2030F |

| 11 Europe Chocolate Market – Key Performance Indicators |

| 12 Europe Chocolate Market – Opportunity Assessment |

| 12.1 Europe Chocolate Market Opportunity Assessment, By Countries |

| 13 Europe Chocolate Market Competitive Landscape |

| 13.1 Europe Chocolate Market Revenue Share, By Company |

| 13.1.1 Russia Chocolate Market Revenue Share, By Companies, 2023 |

| 13.1.2 Germany Chocolate Market Revenue Share, By Companies, 2023 |

| 13.1.3 UK Chocolate Market Revenue Share, By Companies, 2023 |

| 13.1.4 France Chocolate Market Revenue Share, By Companies, 2023 |

| 13.2 Europe Chocolate Market Competitive Benchmarking, By Operating & Technical Parameters |

| 14 Company Profiles |

| 15 Key Strategic Recommendations |

| 16 Disclaimer |

Market Forecast By Product Type (Dark Chocolate, Milk Chocolate, White Chocolate), By Chocolate Type (Count Lines & Straight Lines, Molded or Bar Chocolates, Choco-Panned & Sugar Panned and Others including Box Chocolates and Novelties), By Distribution Channels (Supermarket and Hypermarkets, Convenience Stores, Online Channels, Grocery/ Mom n Pop Stores and Others including Specialized Retailers, Pharmacy, etc), By Counties (Russia, United Kingdom, France, Germany and Rest of Europe) and Competitive Landscape

| Product Code: ETC001356 | Publication Date: Nov 2023 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 200 | No. of Figures: 19 | No. of Tables: 12 |

Latest 2023 Developments of the Europe Chocolate Market

The Europe Chocolate Market is witnessing innovation as manufacturers are trying new ingredients to add new essence to the product. Manufacturers are cutting down the usage of chemical additives like Cargill and have gone a step ahead and removed lecithin from its cocoa and chocolate offerings. Lindt & Sprüngli debuted a new Lindt Chocolate Boutique at Zurich Airport in May 2019, a new counter where Lindt Master Chocolatiers produce daily fresh chocolate masterpieces.

Mergers And Acquisition:

- On 29 July 2019, The Ferrero Group finalized the previously announced purchase of Kellogg Company's cookie, fruit and fruit-flavoured snack, ice cream cone, and pie crust operations.

- On 30 April 2021, Nestlé and KKR reached an agreement in which Nestlé will buy The Bountiful Company's key brands.

- On 26 May 2021, Chipita S.A. agreed to be acquired by Mondelez International, Inc.

- On 5 Jan 2021, Hu was acquired by Mondelez International.

- On 28 June 2021, Lily's, a high-growth developer of low-sugar confectionery items, was acquired by Hershey Company.

Europe Chocolate Market Synopsis

Europe Chocolate Market is projected to find its true potential growth throughout the forecast period underpinned by the increased availability of a wide range of products that has led to an attraction of a large consumer base in the market. Additionally, the Dark chocolate segment is estimated to acquire a major sales revenue in the market owing to the rising health-conscious population along with the growing awareness about the benefits of dark chocolates such as enhanced brain function and reduce risk of heart disease is estimated to proven efficient in bolstering the major growth of the Europe chocolate market in the coming timeframe.

Increasing disposable income coupled with impulse purchasing among consumers at supermarkets and convenience stores is driving the growth of the chocolate market in Europe. Moreover, the rising demand for natural and pure organic chocolates would propel the demand for chocolates in the region. Furthermore, the growing trend of gifting premium chocolates with custom packing for occasions such as Easter and Christmas would also be one of the major factors responsible for the growth of the chocolate market over the coming years.

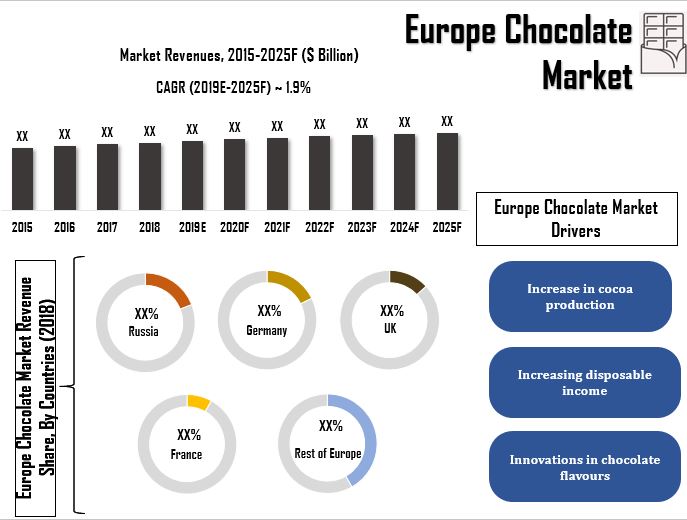

According to 6Wresearch, the Europe Chocolate market size is projected to grow at a CAGR of 1.9% during 2019–2025. Overall Europe, Russia captured the majority of the market revenues in 2018 and are expected to lead the market over the coming years owing to increasing demand for chocolates in supermarkets and hypermarkets. Moreover, the growing popularity of vegan and organic chocolates would positively influence Russia’s chocolate market growth.

Increasing investment by companies in innovative product solutions such as flavored chocolates with different ingredients and creative packaging to attract more customers are the key factors that would catalyze the growth of the chocolate market in Europe over the coming years. Dark chocolate is projected to capture the majority of the market revenues over the next few years owing to growing consumer awareness regarding the health benefits of dark chocolate such as managing blood pressure and the presence of high content of antioxidants which is beneficial for the skin.

The Europe chocolate market report comprehensively covers the market by product type, distribution channels, chocolate type, and key countries including Russia, Germany, the United Kingdom, France, and the Rest of Europe. The Europe chocolate market outlook report provides an unbiased and detailed analysis of the European chocolate market trends, Europe chocolate market share, opportunities, high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Europe Chocolate market is anticipated to grow throughout the forecast period 2020-26F on the back of the increasing preferences of consumers across the region and enhancement in the tastes and preferences. Europe Chocolate Market is the second-largest market across the globe as chocolate is preferred as a sweet snack available with a wide range of varieties across the region. Furthermore, it is estimated that the impulsive purchase of products in supermarkets would instigate an increase in the sales of chocolate in Europe coupled with seasonal demand, especially at festivals such as Easter and Christmas. As the European chocolate market is highly competitive with the involvement of various players in the competition, it would lead to the sound generation of revenue and growth of the European chocolate market in the coming years.

Key Highlights of the Reports

- Europe Chocolate Market Overview

- Europe Chocolate Market Outlook

- Europe Chocolate Market Forecast

- Historical Data of Europe Chocolate Market Revenues for the Period 2015-2018

- Europe Chocolate Market Size & Europe Chocolate Market Forecast of Revenues, Until 2025

- Historical Data of Europe Chocolate Market Revenues, By Product Type, for the Period 2015-2018

- Market Size & Forecast of Europe Chocolate Market Revenues, By Product Type, Until 2025

- Historical Data of Europe Chocolate Market Revenues, By Distribution Channels, for the Period 2015-2018

- Market Size & Forecast of Europe Chocolate Market Revenues, By Distribution Channels, Until 2025

- Historical Data of Europe Chocolate Market Revenues, By Chocolate Type, for the Period 2015-2018

- Market Size & Forecast of Europe Chocolate Market Revenues, By Chocolate Type, Until 2025

- Historical Data of Russia Chocolate Market Revenues and Volume, for the Period 2015-2018

- Market Size & Forecast of Russia Chocolate Market Revenues, Until 2025

- Historical Data of Germany Chocolate Market Revenues and Volume, for the Period 2015-2018

- Market Size & Forecast of the Germany Chocolate Market Revenues, Until 2025

- Historical Data of United Kingdom Chocolate Market Revenues and Volume, for the Period 2015-2018

- Market Size & Forecast of the United Kingdom Chocolate Market Revenues, Until 2025

- Historical Data of France Chocolate Market Revenues and Volume, for the Period 2015-2018

- Market Size & Forecast of the France Chocolate Market Revenues, Until 2025

- Market Drivers and Restraints

- Europe Chocolate Market Price Trends

- Europe Chocolate Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Europe Chocolate Market Share, By Countries

- Europe Chocolate Market Share, By Players

- Europe Chocolate Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The Europe chocolate market report provides a detailed analysis of the following market segments:

By Product Type

- Milk Chocolate

- White Chocolate

- Dark Chocolate

By Distribution Channels

- Supermarkets/ Hypermarkets

- Grocery/ Mom n Pop Stores

- Convenience Stores

- Online Channel

- Others (Specialized Retailers, pharmacy, etc.)

By Chocolate Type

- Count lines & Straight lines

- Molded or Bar Chocolates

- Choco panned & Sugar panned

- Others (Box chocolates, novelties)

By Countries

- Russia

- United Kingdom

- France

- Germany

- Rest of Europe

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Related Reports

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero