North America Chocolate Market (2019-2025) | Size, Share, Industry, Revenue, Forecast, Trends, Analysis, Growth, Value & Outlook

Market Forecast By Product Type (Dark Chocolate, Milk Chocolate, White Chocolate), By Chocolate Type (Count Lines & Straight Lines, Molded or Bar Chocolates, Choco-Panned & Sugar Panned and Others including Box Chocolates and Novelties), By Distribution Channels (Supermarket and Hypermarkets, Convenience Stores, Online Channels, Grocery/ Mom n Pop Stores and Others including Specialized Retailers, Pharmacy, etc), By Countries (the United States and Canada) and Competitive Landscape

| Product Code: ETC001359 | Publication Date: Sep 2021 | Updated Date: Jun 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 200 | No. of Figures: 11 | No. of Tables: 6 | |

Latest 2023 Developments of the North America Chocolate Market

The North America Chocolate Market is innovating as now it is consumed in many forms whether in a solid bar, cold and hot beverages, or baked into many different meals and desserts. Organic ingredients are considered more natural and healthier, therefore demand for organic cocoa and chocolate ingredients continues to grow. To improve transparency, Hershey helped develop an industry-wide technology for U.S. products called SmartLabel. With a simple scan of a QR code on the product package, consumers are taken to Hershey’s SmartLabel site and provided with a wide range of product information including information on nutrition, ingredients and their definitions, allergens and whether the product is gluten-free or contains any GMO ingredients.

Mergers And Acquisitions:

- On 29 July 2019, The Ferrero Group finalized the previously announced purchase of Kellogg Company's cookie, fruit and fruit-flavoured snack, ice cream cone, and pie crust operations.

- On 30 April 2021, Nestlé and KKR reached an agreement in which Nestlé will buy The Bountiful Company's key brands.

- On 26 May 2021, Chipita S.A. agreed to be acquired by Mondelez International, Inc.

- On 5 Jan 2021, Hu was acquired by Mondelez International.

- On 28 June 2021, Lily's, a high-growth developer of low-sugar confectionery items, was acquired by Hershey Company.

- On 27 June 2019, Mars announced the signing of a definitive deal to purchase a significant majority stake in Foodspring, a company that provides products for athletes, healthy living, and fitness, as well as a leading nutrition and fitness platform.

North America Chocolate Market Synopsis

The North America chocolate market is the second-largest chocolate market globally. The impulse buying behaviour of consumers and rising demand for premium chocolates has propelled the growth of the chocolate market in the North America region. Rising demand for flavoured chocolates, as well as confectionery items, is expected to drive the growth of the chocolate market over the coming years.

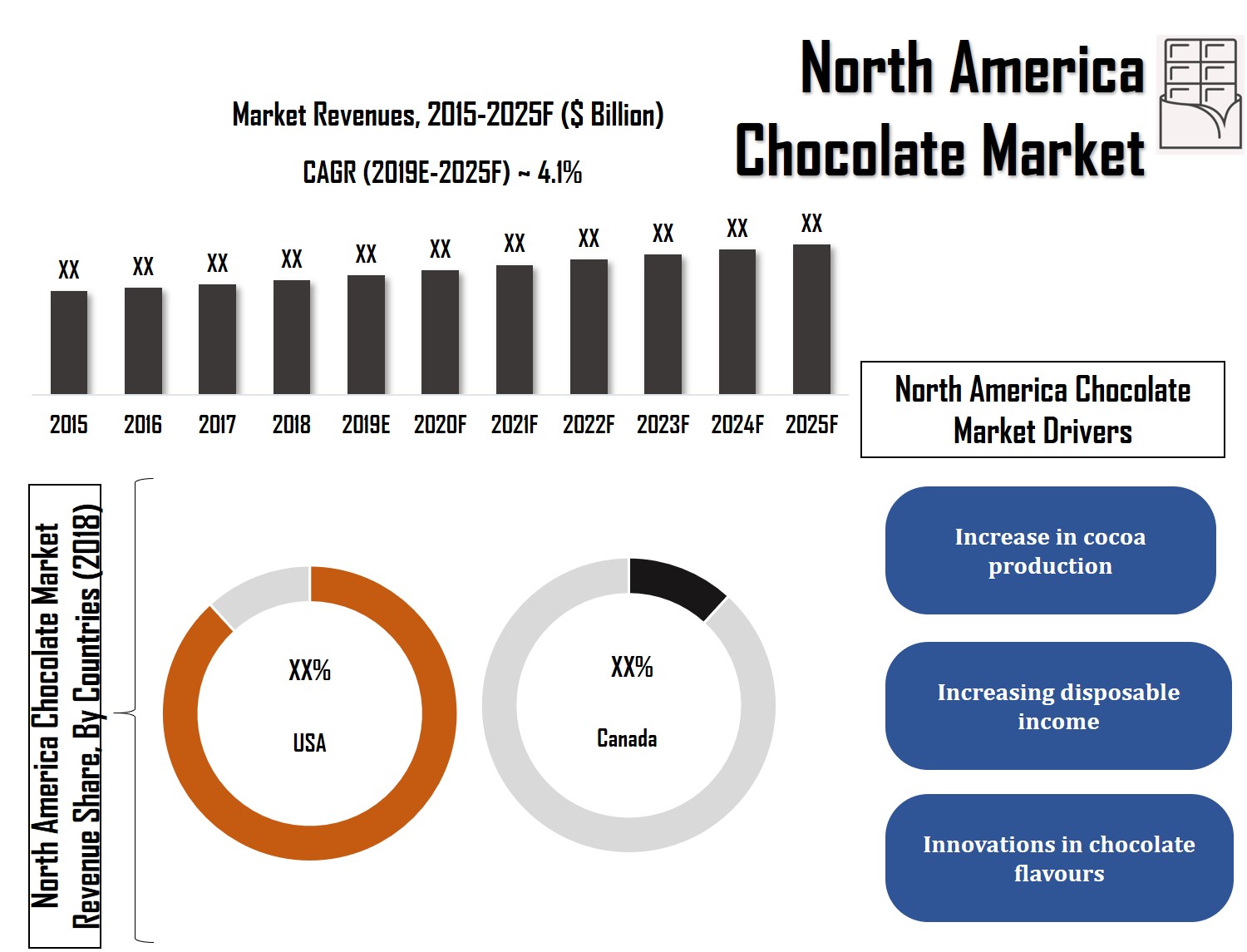

According to 6Wresearch, North America's chocolate market size is projected to grow at a CAGR of 3.9% during 2019–25. On the basis of distribution channels, supermarkets and hypermarkets captured the majority of the market revenues in 2018 and are expected to lead the market during the forecast period owing to the easy availability of products coupled with increasing impulse purchasing among consumers. However, the online channel is projected to witness substantial growth over the next six years due to growing digitalization as well as a leading sedentary lifestyle among the population.

The United States dominated the North America chocolate market owing to the presence of a large number of companies dealing in the product as well as increased consumer demand in the region. Moreover, increasing investment by companies in attractive packaging would further propel the market growth over the forecast period. Further, the growing focus of companies on the innovative flavor of chocolates would fuel the market demand for chocolates over the coming years.

The North America chocolate market report comprehensively covers the market by product type, distribution channels, chocolate type, and by key countries including the United States and Canada. The North America chocolate market outlook report provides an unbiased and detailed analysis of the North America chocolate market trends, North America chocolate market share, opportunities, high growth areas, and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Chocolates have been gaining sight of a vast population owing to the premium taste and flavors it has available. As a result, the adoption of the same is increasing. the tradition of advertisements to catch consumer sites along with an increase in the hypermarkets and supermarket trends that tend to display the product over the shelf also tends to grasp consumer sight and the beautiful packing used attracts consumers towards the product and as a result, instigates its purchase. As a result, the market is witnessing proliferating growth since the last decade and the introduction of new variants is attracting more customers and not only children, but adults are also loving the new flavors and variants of the chocolates and this is leading to an increased demand for the product and increasing its purchase. In overall conclusion, the North America chocolate market is expected to register significant growth prospects in the coming timeframe.

Key Highlights of the Report:

- North America Chocolate Market Overview

- North America Chocolate Market Outlook

- North America Chocolate Market Forecast

- Historical Data of North America Chocolate Market Revenues for the Period 2015-2018

- North America Chocolate Market Size & North America Chocolate Market Forecast of Revenues, Until 2025

- Historical Data of North America Chocolate Market Revenues, By Product Type, for the Period 2015-2018

- Market Size & Forecast of North America Chocolate Market Revenues, By Product Type, Until 2025

- Historical Data of North America Chocolate Market Revenues, By Distribution Channels, for the Period 2015-2018

- Market Size & Forecast of North America Chocolate Market Revenues, By Distribution Channels, Until 2025

- Historical Data of North America Chocolate Market Revenues, By Chocolate Type, for the Period 2015-2018

- Market Size & Forecast of North America Chocolate Market Revenues, By Chocolate Type, Until 2025

- Historical Data of the United States Chocolate Market Revenues and Volume, for the Period 2015-2018

- Market Size & Forecast of the United States Chocolate Market Revenues, Until 2025

- Historical Data of Canada Chocolate Market Revenues and Volume, for the Period 2015-2018

- Market Size & Forecast of the Canada Chocolate Market Revenues, Until 2025

- Market Drivers and Restraints

- North America Chocolate Market Price Trends

- North America Chocolate Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- North America Chocolate Market Share, By Countries

- North America Chocolate Market Share, By Players

- North America Chocolate Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The North America chocolate market report provides a detailed analysis of the following market segments:

By Product Type

- Milk Chocolate

- White Chocolate

- Dark Chocolate

By Distribution Channels

- Supermarkets/ Hypermarkets

- Grocery/ Mom n Pop Stores

- Convenience Stores

- Online Channel

- Others (Specialized Retailers, pharmacy, etc.)

By Chocolate Type

- Count lines & Straight-lines

- Molded or Bar Chocolates

- Choco-panned & Sugar panned

- Others (Box chocolates, novelties)

By Countries

- United States

- Canada

North America Chocolate Market (2019-2025): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 North America Chocolate Market Overview |

| 3.1 North America Country Indicators |

| 3.2 North America Chocolate Market Revenues, 2015-2025F |

| 3.3 North America Chocolate Market Revenue Share, By Product Type, 2015-2025F |

| 3.4 North America Chocolate Market Revenue Share, By Distribution Channel, 2015-2025F |

| 3.5 North America Chocolate Market Revenue Share, By Chocolate Type, 2015-2025F |

| 3.6 North America Chocolate Market Revenue Share, By Countries, 2018 & 2025F |

| 3.7 North America Chocolate Market Industrial Life Cycle |

| 3.8 North America Chocolate Market Porter’s Five Force Model |

| 4 North America Chocolate Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 North America Chocolate Market Trends |

| 6 US Chocolate Market Overview |

| 6.1 US Chocolate Market Revenues, 2015-2025F |

| 6.2 US Chocolate Market Revenue Share, By Product Type, 2015-2025F |

| 6.2.1 US Milk Chocolate Market Revenues, 2015-2025F |

| 6.2.2 US White Chocolate Market Revenues, 2015-2025F |

| 6.2.3 US Dark Chocolate Market Revenues, 2015-2025F |

| 6.3 US Chocolate Market Revenue Share, By Distribution Channel, 2015-2025F |

| 6.3.1 US Chocolate Market Revenues, By Supermarkets/ Hypermarkets, 2015-2025F |

| 6.3.2 US Chocolate Market Revenues, By Grocery/ Mom n Pop Stores, 2015-2025F |

| 6.3.3 US Chocolate Market Revenues, By Convenience Stores, 2015-2025F |

| 6.3.4 US Chocolate Market Revenues, By Online Channel, 2015-2025F |

| 6.3.5 US Chocolate Market Revenues, By Other Distribution Channel, 2015-2025F |

| 6.4 US Chocolate Market Revenue Share, By Chocolate Type, 2015-2025F |

| 6.4.1 US Chocolate Market Revenues, By Count lines & Straight-lines, 2015-2025F |

| 6.4.2 US Chocolate Market Revenues, By Moulded or Bar, 2015-2025F |

| 6.4.3 US Chocolate Market Revenues, By Box Chocolates and Novelties, 2015-2025F |

| 6.4.4 US Chocolate Market Revenues, By Other Chocolate Type, 2015-2025F |

| 7 Canada Chocolate Market Overview |

| 7.1 Canada Chocolate Market Revenues, 2015-2025F |

| 7.2 Canada Chocolate Market Revenue Share, By Product Type, 2015-2025F |

| 7.2.1 Canada Milk Chocolate Market Revenues, 2015-2025F |

| 7.2.2 Canada White Chocolate Market Revenues, 2015-2025F |

| 7.2.3 Canada Dark Chocolate Market Revenues, 2015-2025F |

| 7.3 Canada Chocolate Market Revenue Share, By Distribution Channel, 2015-2025F |

| 7.3.1 Canada Chocolate Market Revenues, By Supermarkets/ Hypermarkets, 2015-2025F |

| 7.3.2 Canada Chocolate Market Revenues, By Grocery/ Mom n Pop Stores, 2015-2025F |

| 7.3.3 Canada Chocolate Market Revenues, By Convenience Stores, 2015-2025F |

| 7.3.4 Canada Chocolate Market Revenues, By Online Channel, 2015-2025F |

| 7.3.5 Canada Chocolate Market Revenues, By Other Distribution Channel, 2015-2025F |

| 7.4 Canada Chocolate Market Revenue Share, By Chocolate Type, 2015-2025F |

| 7.4.1 Canada Chocolate Market Revenues, By Countlines & Straight-lines, 2015-2025F |

| 7.4.2 Canada Chocolate Market Revenues, By Moulded or Bar, 2015-2025F |

| 7.4.3 Canada Chocolate Market Revenues, By Choco-Panned & Sugar Panned, 2015-2025F |

| 7.4.4 Canada Chocolate Market Revenues, By Other Chocolate Type, 2015-2025F |

| 8 North America Chocolate Market – Key Performance Indicators |

| 9 North America Chocolate Market – Opportunity Assessment |

| 9.1 North America Chocolate Market Opportunity Assessment, By Countries |

| 10 North America Chocolate Market Competitive Landscape |

| 10.1 North America Chocolate Market Revenue Share, By Company |

| 10.1.1 US Chocolate Market Revenue Share, By Companies, 2018 |

| 10.1.2 Canada Chocolate Market Revenue Share, By Companies, 2018 |

| 10.2 North America Chocolate Market Competitive Benchmarking, By Operating & Technical Parameters |

| 11 Company Profiles |

| 12 Key Strategic Recommendations |

| 13 Disclaimer |

| LIST OF FIGURES |

| Figure 1. North America Chocolate Market Revenues, 2015-2025F ($ Billion) |

| Figure 2. North America Chocolate Market Revenue Share, By Countries, 2018 |

| Figure 3. US Chocolate Market Revenues, 2015-2025F ($ Million) |

| Figure 4. US Chocolate Market Revenue Share, By Product Type, 2018 & 2025F |

| Figure 5. US Chocolate Market Revenue Share, By Distribution Channel, 2018 & 2025F |

| Figure 6. US Chocolate Market Revenue Share, By Chocolate Type, 2018 & 2025F |

| Figure 7. Canada Chocolate Market Revenues, 2015-2025F ($ Million) |

| Figure 8. Canada Chocolate Market Revenue Share, By Product Type, 2018 & 2025F |

| Figure 9. Canada Chocolate Market Revenue Share, By Distribution Channel, 2018 & 2025F |

| Figure 10. Canada Chocolate Market Revenue Share, By Chocolate Type, 2018 & 2025F |

| Figure 11. North America Market Opportunity Assessment, By Countries, 2025F |

| LIST OF TABLES |

| Table 1. US Chocolate Market Revenues, By Product Type, 2015-2025F ($ Million) |

| Table 2. US Chocolate Market Revenues, By Distribution Channel, 2015-2025F ($ Million) |

| Table 3. US Chocolate Market Revenues, By Chocolate Type, 2015-2025F ($ Million) |

| Table 4. Canada Chocolate Market Revenues, By Product Type, 2015-2025F ($ Million) |

| Table 5. Canada Chocolate Market Revenues, By Distribution Channel, 2015-2025F ($ Million) |

| Table 6. Canada Chocolate Market Revenues, By Chocolate Type, 2015-2025F ($ Million) |

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Related Reports

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero