India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

Market ForecastBy Voltage (Low Voltage (0-1.1 KV), Medium Voltage (1.1-36 KV), High Voltage (>36 KV)), By Low Voltage (Types (MCB, MCCB, ACB, Others), Applications (Residential, Commercial, Power Utilities, Industrial, Others (Transportation, Oil And Gas))), By Medium Voltage (Insulation Types (AIS, GIS), Applications (Residential, Commercial, Power Utilities, Industrial, Others (Transportation, Oil And Gas))), By High Voltage (Insulation Types (AIS, GIS), Applications (Residential, Commercial, Power Utilities, Industrial, Others (Transportation, Oil And Gas))) And Competitive Landscape.

| Product Code: ETC060880 | Publication Date: Feb 2026 | Updated Date: Feb 2026 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

India Switchgear Market Growth Rate

According to 6Wresearch internal database and industry insights, the India Switchgear Market is projected to grow at a compound annual growth rate (CAGR) of 8.4% during the forecast period (2026-2032).

Five-Year Growth Trajectory of the India Switchgear Market with Core Drivers

Below mentioned is the evaluation of year-wise growth rate along with key growth drivers:

| Year | Est. Annual Growth (%) | Growth Drivers |

| 2021 | 4.6% | Increased investments in power distribution network modernization |

| 2022 | 5.3% | Expansion of renewable energy integration into the grid |

| 2023 | 6.1% | Growth in industrial and commercial construction activities |

| 2024 | 6.9% | Government focus on rural electrification and smart grid projects |

| 2025 | 7.5% | Rising demand for reliable power infrastructure driven by rapid urbanisation |

Topics Covered in the India Switchgear Market Report

The India Switchgear Market report thoroughly covers the market by voltage and applications. The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which help stakeholders devise and align their market strategies according to the current and future market dynamics.

India Switchgear Market Highlights

| Report Name | India Switchgear Market |

| Forecast Period | 2026–2032 |

| CAGR | 8.4% |

| Growing Sector | Medium Voltage Switchgear for Power Utilities |

India Switchgear Market Synopsis

India Switchgear Market is anticipated to witness strong growth driven by increase in the investments in transmission and distribution infrastructure and rising demand for electricity. Due to rapid urbanization, industrial growth, and major infrastructure projects, power control and protection systems, the market is set to double in the years to come. The market is also growing as the government is working to modernize old electrical networks, set up smart grids, and bring electricity to rural areas. Moreover, the industry's journey ahead will be shaped by the widespread implementation of energy, efficient and digitally enabled switchgear solutions.

Evaluation of Growth Drivers in India Switchgear Market

Below mentioned are some prominent drivers and their influence on the market dynamics:

| Drivers | Primary Segments Affected | Why it Matters (Evidence) |

| Expansion of Power Infrastructure | Medium & High Voltage; Utilities | Rising power demand is driving new transmission and distribution projects, increasing the need for advanced switchgear systems. |

| Renewable Energy Integration | Medium Voltage; Utilities & Industrial | Solar and wind energy projects require grid connection, protection, and control equipment to assure reliable power supply. |

| Growth in Industrialization | Low & Medium Voltage; Industrial | Expansion of manufacturing and industrial facilities is increasing the demand for electrical safety, control, and distribution systems. |

| Urbanization and Commercial Construction | Low Voltage; Commercial & Residential | Immense growth in real estate, commercial buildings, and urban infrastructure is boosting installations of low-voltage switchgear. |

| Government Electrification Programs | All Voltage Levels; Utilities | National electrification initiatives are supporting grid expansion, strengthening, and modernization across both rural and urban areas. |

India Switchgear Market is expected to grow at the CAGR of 8.4% during the forecast period of 2026-2032. The growth is mainly driven by increasing electricity consumption, fast renewal energy deployment, and a continuous rise in investment in transmission and distribution infrastructures. Further, there is support from smart city development, industrial corridor projects, and government programs, which are all working towards enhancing grid reliability and efficiency. Besides this, the ever, increasing demand for constant power supply from the commercial and industrial sectors is compelling them to use advanced and digital switchgear technologies, which, in turn, is helping to maintain the market growth across voltage segments.

Evaluation of Restraints in India Switchgear Market

Below mentioned are some major restraints and their influence on the market dynamics:

| Restraints | Primary Segments Affected | What This Means (Evidence) |

| High Initial Installation Costs | Medium & High Voltage; Utilities & Industrial | Advanced switchgear systems involve substantial upfront capital investment, which can limit adoption, especially in cost-sensitive projects. |

| Raw Material Price Fluctuations | Across Segments; Manufacturers | Fluctuations in the prices of metals and insulating materials leads to inconsistent production costs and impacts profit margins. |

| Delays in Land Acquisition and Project Approvals | High Voltage; Utilities | Delays in infrastructure planning and regulatory clearances slow down power projects, postponing switchgear procurement. |

| Limited Skilled Workforce | Advanced Digital Switchgear; Industrial | A shortage of trained professionals restricts the installation, operation, and maintenance of smart and digital switchgear systems. |

| Dependence on Imports for Components | Medium & High Voltage; Manufacturers | Supply chain disruptions and import dependency can delay project timelines and affect equipment availability. |

India Switchgear Industry Challenges

Despite robust growth potentials, the India Switchgear Industry is burdened with various operational and structural issues that determine the speed of its expansion. Firstly, and most significantly, the large initial investment needed for advanced and gas insulated systems hinders their adoption, especially among smaller utilities and industries. Besides that, the suppliers of manufacturers hardly feel the effects of project delays in megaprojects of power and infrastructure as they still have a large pipeline of orders to generate their turnover. Besides that, the changing prices of raw materials and the reliance on imported parts for components give rise to cost uncertainties that have an impact on the whole project planning and execution process in the value chain.

India Switchgear Market Trends

Some of the emerging trends shaping the India Switchgear Market Growth include:

- Digital and Smart Switchgear Adoption: More utilities and industries are switching to IoT, enabled switchgear for predictive maintenance and real, time monitoring. This not only results in higher operational efficiency but also in less downtime and lower maintenance costs.

- Shift Toward Gas Insulated Switchgear (GIS): Due to their small size and higher dependability in urban and other space, limited areas, GIS solutions are becoming more popular. Besides, their being low maintenance makes them a great fit for new infrastructure projects.

- Increasing Demand from Renewable Energy Projects: Advanced systems for protection and grid integration are needed at solar parks and wind farms. The medium, voltage switchgear demand is thus being raised on the back of resourcing the renewable installations.

- Energy Efficiency and Safety Focus: Companies are looking for energy efficient solutions that minimize the losses and make the work operations safer. This trend leads to the substitution of the old switchgear with the new ones.

Investment Opportunities in the India Switchgear Market

Some of the best Investment Opportunities in the India Switchgear Market include:

- Expansion of Smart Grid Infrastructure – Investments in smart grid technologies offer strong growth potential as utilities modernize aging networks. Digital switchgear and automation systems are likely to be used more widely in residential and industrial areas.

- Renewable Energy Grid Connectivity Solutions: Large renewable energy projects need special switchgear to ensure smooth grid integration. Solar parks, wind farms, and hybrid energy systems are places where investor can help by making solutions fit the needs.

- Urban Infrastructure and Metro Projects: The quick development of metro rail, airports, and smart cities is creating a need for compact and reliable switchgear systems. These projects need high, performance equipment with advanced safety features.

- Medium Voltage Equipment Manufacturing: Utilities and industrial sectors are the major driving forces behind strong demand for the medium voltage segment. Setting up manufacturing units close to the market can help in cost reduction and thus making the market competitive.

Top 5 Leading Players in the India Switchgear Market

Some leading players operating in the India Switchgear Market include:

1. Siemens AG

| Company Name | Siemens AG |

| Established Year | 1847 |

| Headquarters | Munich, Germany |

| Official Website | Click Here |

Siemens offers a wide portfolio of low, medium, and high voltage switchgear solutions designed for utilities, industries, and infrastructure projects. The company focuses on digital switchgear technologies, smart grid integration, and energy-efficient systems to support reliable power distribution in India.

2. ABB Ltd.

| Company Name | ABB Ltd. |

| Established Year | 1988 |

| Headquarters | Zurich, Switzerland |

| Official Website | Click Here |

ABB provides advanced air-insulated and gas-insulated switchgear solutions across voltage levels. Its products support renewable energy integration, industrial automation, and grid modernization projects while emphasizing safety, reliability, and digital monitoring capabilities for power infrastructure applications.

3. Schneider Electric SE

| Company Name | Schneider Electric SE |

| Established Year | 1836 |

| Headquarters | Rueil-Malmaison, France |

| Official Website | Click Here |

Schneider Electric delivers comprehensive low and medium voltage switchgear solutions for residential, commercial, and industrial applications. The company focuses on smart energy management, connected equipment, and sustainable electrical infrastructure to improve efficiency and operational performance.

4. Larsen & Toubro Limited

| Company Name | Larsen & Toubro Limited |

| Established Year | 1938 |

| Headquarters | Mumbai, India |

| Official Website | Click Here |

Larsen & Toubro manufactures a wide range of low and medium voltage switchgear tailored for Indian power distribution and industrial needs. The company leverages strong domestic manufacturing capabilities and engineering expertise to support infrastructure and utility projects nationwide.

5. Eaton Corporation plc

| Company Name | Eaton Corporation plc |

| Established Year | 1911 |

| Headquarters | Dublin, Ireland |

| Official Website | Click Here |

Eaton supplies reliable low and medium voltage switchgear designed for commercial buildings, data centers, and industrial facilities. The company emphasizes energy-efficient technologies, electrical safety, and intelligent power management solutions to support India’s growing power demand.

Government Regulations Introduced in the India Switchgear Market

According to Indian Government Data, they have introduced several initiatives, that can be the strengthening of power infrastructure. A scheme like the Revamped Distribution Sector Scheme (RDSS) aims at loss of power reduction and distribution network efficiency improvement, thus, creating considerable demand for modern switchgear systems. Besides, the Smart Cities Mission is promoting the development of an intelligent electrical infrastructure in cities.

Energy policies that focus on climbing up renewable energy capacity also include the upgrading of the grid and using strong protection equipment. Additionally, the Make in India campaign and Production Linked Incentive (PLI) schemes are propelling the domestic manufacturing of the electrical equipment industry, which in the long run will reduce the dependence on imports and improve supply chain resilience.

Future Insights of the India Switchgear Market

The outlook for the India Switchgear Market remains positive as it is backed by uninterrupted investments in power generation, transmission, and distribution infrastructure. The increase in renewable energy targets and the requirement for grid stability will be the key factors that will fuel the demand for advanced medium and high voltage switchgear solutions. Besides that, rapid urbanization, infrastructure development, and industrialization will contribute to the strong demand for low voltage equipment. The rollout of digital monitoring, automation, and predictive maintenance technologies is likely to change the industry landscape drastically.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Medium Voltage to Dominate the Market – By Voltage

According to Mohit, Senior Research Analyst, 6Wresearch, the Medium Voltage segment holds the largest segment in the India Switchgear Market Share due to its extensive use in power distribution networks, renewable energy integration, and industrial applications.

Low Voltage Segment Leader – MCCB by Type and Industrial by Application

MCCBs prevail as the leading type mainly as they offer higher capacity and safety features which are essential for commercial and industrial installations. The industrial sector is at the forefront of application demand, which is being supported by the expansion of manufacturing and the increasing need for power reliability.

Medium Voltage Segment Leader – GIS by Insulation and Power Utilities by Application

GIS dominates as the leading type mainly due to its space, saving feature and being the best choice for urban and other space, limited substations. Power utilities still constitute the major application segment as they are the main customers of grid expansion and modernization that presently happen.

High Voltage Segment Leader – AIS by Insulation and Power Utilities by Application

AIS takes the lead in terms of insulation due to low of costs and its suitability for large outdoor substations. Power utilities continue to hold the dominant position as the transmission network expansion marches on across the regions.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2022 to 2025.

- Base Year: 2025.

- Forecast Data until 2032.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Switchgear Market Overview

- India Switchgear Market Outlook

- India Switchgear Market Forecast

- India Switchgear Market Size

- Historical Data of India Switchgear Market Revenues for the Period 2022-2032F

- Market Size & Forecast of India Switchgear Market Revenues until 2032F

- Historical Data of India Switchgear Market Revenues for the Period 2022-2032F, By Types

- Market Size & Forecast of India Switchgear Market Revenues until 2032F, By Types

- Historical Data of India Low Voltage Switchgear Market Revenues for the Period 2022-2032F, By Types

- Market Size & Forecast of India Low Voltage Switchgear Market Revenues until 2032F, By Types

- Historical Data of India Low Voltage Switchgear Market Revenues for the Period 2022-2032F, By Applications

- Market Size & Forecast of India Low Voltage Switchgear Market Revenues until 2032F, By Applications

- Historical Data of India Medium Voltage Switchgear Market Revenues for the Period 2022-2032F, By Insulation Type

- Market Size & Forecast of India Medium Voltage Switchgear Market Revenues until 2032F, By Insulation Type

- Historical Data of India Medium Voltage Switchgear Market Revenues for the Period 2022-2032F, By Types

- Market Size & Forecast of India Medium Voltage Switchgear Market Revenues until 2032F, By Types

- Historical Data of India Medium Voltage Switchgear Market Revenues for the Period 2022-2032F, By Applications

- Historical Data of India High Voltage Switchgear Market Revenues for the Period 2022-2032F, By Insulation Type

- Market Size & Forecast of India High Voltage Switchgear Market Revenues until 2032F, By Insulation Type

- Historical Data of India High Voltage Switchgear Market Revenues for the Period 2022-2032F, By Types

- Market Size & Forecast of India High Voltage Switchgear Market Revenues until 2032F, By Types

- Historical Data of India High Voltage Switchgear Market Revenues for the Period 2022-2032F, By Applications

- Historical Data of India Switchgear Market Revenues for the Period 2022-2032F, By Applications

- Market Size & Forecast of India Switchgear Market Revenues until 2032F, By Applications

- Market Drivers and Restraints

- India Switchgear Market Trends

- Players Market Share

- Company Profiles

- Strategic Recommendations

Market Scope and Segmentation

Thereport provides a detailed analysis of the following market segments:

By Voltage

- Low Voltage (0-1.1 KV)

- Medium Voltage (1.1-36 KV)

- High Voltage (>36 KV)

By Low Voltage

- Types

- MCB

- MCCB

- ACB

- Others

- Applications

- Residential

- Commercial

- Power Utilities

- Industrial

- Others (Transportation, Oil, and Gas)

By Medium Voltage

- Insulation Types

- AIS

- GIS

- Applications

- Residential

- Commercial

- Power Utilities

- Industrial

- Others

- Transportation

- Oil And Gas

By High Voltage

- Insulation Types

- AIS

- GIS

- Applications

- Residential

- Commercial

- Power Utilities

- Industrial

- Others (Transportation Oil, And Gas)

India Switchgear Market Outlook (2026-2032): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2 Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Switchgear Market Overview |

| 3.1 India Switchgear Market Revenues (2017- 2027F) |

| 3.2 India Switchgear Market - Industry Life Cycle, 2020 |

| 3.3 India Switchgear Market - Porter’s Five Forces |

| 3.4 Impact Analysis of COVID-19 on the India Switchgear Market |

| 4. India Switchgear Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for electricity in India |

| 4.2.2 Growing industrial sector driving the need for reliable power distribution infrastructure |

| 4.2.3 Government initiatives promoting renewable energy sources |

| 4.3 Market Restraints |

| 4.3.1 High initial investment costs associated with switchgear equipment |

| 4.3.2 Lack of proper infrastructure in remote areas hindering market growth |

| 4.3.3 Intense competition among market players leading to pricing pressures |

| 5. India Switchgear Market Trends |

| 6. India Low Voltage Switchgear Market Overview |

| 6.1 India Low Voltage Switchgear and Panels Market Revenues (2017- 2027F) |

| 6.2 India Low Voltage Switchgear Market Overview, By Types |

| 6.2.1 India Low Voltage Switchgear Market Revenue Share, By Types (2020 & 2027F) |

| 6.2.2 India Low Voltage Switchgear Market Revenues, By Types (2017- 2027F) |

| 6.3 India Low Voltage Switchgear Market Overview, By Applications |

| 6.3.1 India Low Voltage Switchgear Market Revenue Share, By Applications (2020 & 2027F) |

| 6.3.2 India Low Voltage Switchgear Market Revenues, By Applications (2017- 2027F) |

| 7. India Medium Voltage Switchgear Market Overview |

| 7.1 India Medium Voltage Switchgear Market Revenues (2017- 2027F) |

| 7.2 India Medium Voltage Switchgear Market Overview, By Insulation Types |

| 7.2.1 India Medium Voltage Switchgear Market Revenue Share, By Insulation Types (2020 & 2027F) |

| 7.2.2 India Medium Voltage Switchgear Market Revenues, By Insulation Types (2017- 2027F) |

| 7.3 India Medium Voltage Switchgear Market Overview, By Applications |

| 7.3.1 India Medium Voltage Switchgear Market Revenue Share, By Applications (2020 & 2027F) |

| 7.3.2 India Medium Voltage Switchgear Market Revenues, By Applications (2017- 2027F) |

| 8. India High Voltage Switchgear Market Overview |

| 8.1 India High Voltage Switchgear Market Revenues (2017- 2027F) |

| 8.2 India High Voltage Switchgear Market Overview, By Insulation Types |

| 8.2.1 India High Voltage Switchgear Market Revenue Share, By Insulation (2020 & 2027F) |

| 8.2.2 India High Voltage Switchgear Market Revenues, By Insulation (2017- 2027F) |

| 8.3 India High Voltage Switchgear Market Overview, By Application Types |

| 8.3.1 India High Voltage Switchgear Market Revenue Share, By Application Types (2020 & 2027F) |

| 8.3.2 India High Voltage Switchgear Market Revenues, By Application Types (2017- 2027F) |

| 9. India Switchgear Market Overview, By Applications |

| 9.1 India Switchgear Market Revenues, By Residential Application (2017- 2027F) |

| 9.2 India Switchgear Market Revenues, By Commercial Application (2017- 2027F) |

| 9.3 India Switchgear Market Revenues, By Industrial Application (2017- 2027F) |

| 9.4 India Switchgear Market Revenues, By Power Utilities Application (2017- 2027F) |

| 9.5 India Switchgear Market Revenues, By Other Application (2017- 2027F) |

| 10. India Switchgear Market Key Performance Indicators |

| 10.1 Average capacity utilization rate of switchgear equipment in India |

| 10.2 Percentage of switchgear equipment meeting international quality standards |

| 10.3 Number of new renewable energy projects in India utilizing switchgear technology |

| 11. India Switchgear Market Opportunity Assessment |

| 11.1 India Switchgear Market Opportunity Assessment, By Voltage (2027F) |

| 11.2 India Switchgear Market Opportunity Assessment, By Applications (2027F) |

| 12. India Switchgear Market Competitive Landscape |

| 12.1 India Switchgear Market Revenue Share, By Voltage, By Company (2020) |

| 12.2 India Switchgear Market Competitive Benchmarking, By Technical Parameters |

| 12.3 India Switchgear Market Competitive Benchmarking, By Operational Parameters |

| 13. Company Profiles |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

Market ForecastBy Voltage (Low Voltage (0-1.1 KV), Medium Voltage (1.1-36 KV), High Voltage (>36 KV)), By Low Voltage (Types (MCB, MCCB, ACB, Others), Applications (Residential, Commercial, Power Utilities, Industrial, Others (Transportation, Oil And Gas))), By Medium Voltage (Insulation Types (AIS, GIS), Applications (Residential, Commercial, Power Utilities, Industrial, Others (Transportation, Oil And Gas))), By High Voltage (Insulation Types (AIS, GIS), Applications (Residential, Commercial, Power Utilities, Industrial, Others (Transportation, Oil And Gas))) And Competitive Landscape.

| Product Code: ETC060880 | Publication Date: Aug 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

India Switchgear Market Size and Growth Rate

[/According to 6Wresearch, the India Switchgear Market Size is estimated to grow at a CAGR of 7.17% during the forecast period. This growth is attributed to urbanization and increasing demand for renewable energy./]

India Switchgear Market Synopsis

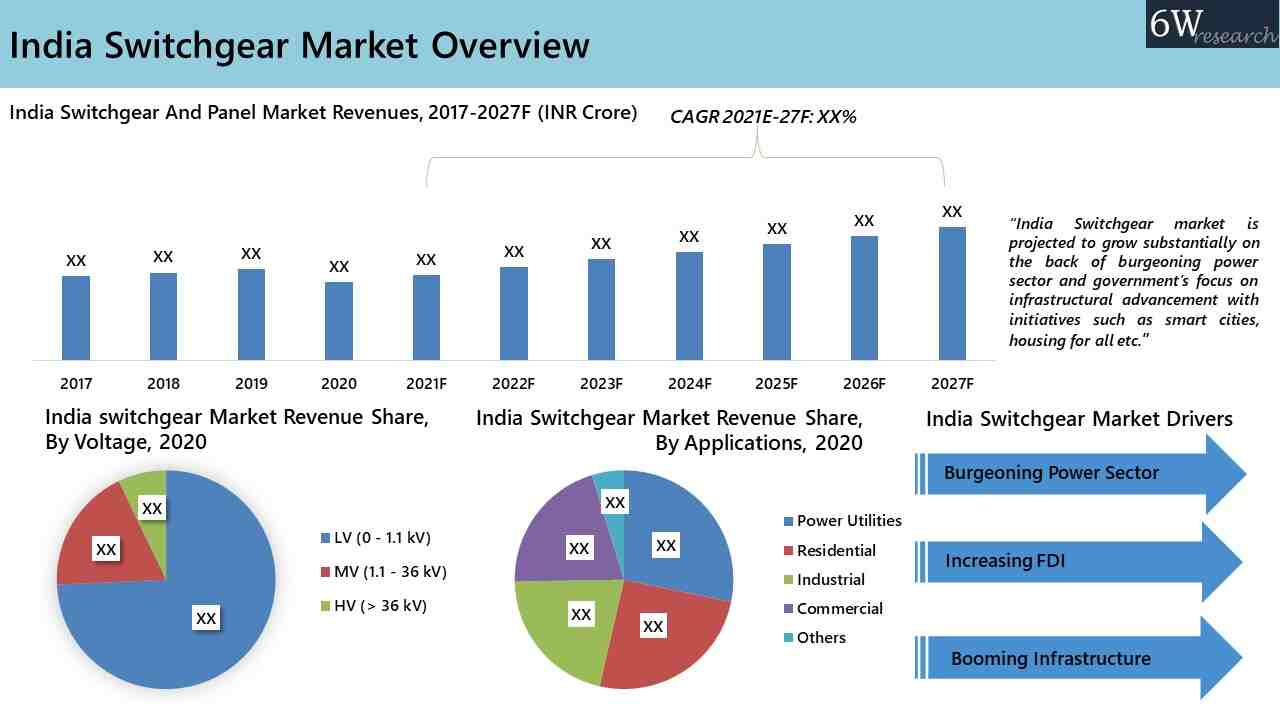

India Switchgear Market is expected to register significant growth over the coming years on account of rising population, increasing energy requirement, and major infrastructural development projects being carried out across the country. Furthermore, government initiatives such as Deen Dayal Upadhyaya Gram Jyoti Yojana, Integrated Power Development Scheme, and Green Energy Corridor, and initiatives such as Housing for All in would lead to the development of the power and real estate sector. These sectors would, in turn, lead to an increase in demand for switchgear in the country. The market saw a sharp decline in 2020 as a result of the complete lockdown brought in force by the Indian Government to prevent the spread of coronavirus, which disrupted the supply chain, manufacturing processes and put a halt to all the developmental activities residential and commercial sectors. However, the decline in the market is expected to be temporary and is anticipated to return to a healthy growth rate on account of declining COVID-19 cases and the vaccination drive, which started in early 2021.

According to 6Wresearch, the India Switchgear Market size is projected to grow at a CAGR of 7.17% during 2021-27. The Government of India plans to reduce the emissions caused by thermal energy plants and increase its renewable energy production to 220 GW by 2022 to meet its commitment made towards the Paris Agreement. As a result, the renewable energy sector is seeing a major rush in investments. This capacity addition of the sector is growing at a rate of ~14% over the last five years. Additionally, to reduce emissions caused by conventional vehicles, the government is promoting electric vehicles, which would require a huge charging infrastructure over the coming years. Railways are also moving towards renewable energy by installing solar panels on top of their buildings and on unused land. Under the ‘UDAAN’ scheme, the government is planning to build several airports across the country and upgrade the existing ones. All these sectors have a direct impact on the switchgear market in India.

India Switchgear Market Competitive Landscape

- The market for switchgear in India is highly fragmented with significant competition observed between domestic as well as international players.

- Some players are world-renowned global players, Schneider Electric, Siemen,s and ABB, as well as local companies like L&T Electrical & Automation.

- The market competition is intensifying due to the increasing urbanization and development of the industry.

- Pricing strategies, technological innovation, and expanded distribution networks are among the competitive advantages.

Switchgear Technology Trends: What’s on the Horizon?

- Such energy monitoring and analytics in real-time is gaining popularity in industrial and commercial space in the form of smart and digital switchgear.

- IoT (Internet of Things) technology has improved predictive maintenance and reduced downtime.

- Alternating current (AC) high-voltage and gas-insulated switchgear (GIS) are being designed for maximum scaling and space saving.

- Modern designs are incorporating improved safety features, including arc flash detection systems and advanced insulation materials.

Import Export Trade Statistics of India Switchgear Industry

- With government incentives, India is slowly increasing self-reliance and slashing reliance on imports through domestic production.

- As far as imports are concerned in the past, high-end products such as advanced gas-insulated switchgear from China and Germany have also been at the top of the list.

- Exports are booming, especially to neighbouring countries and newly emerging markets that are exploring advanced electrical systems.

- To encourage domestic players competitively through protectionist measures like higher import duties.

Future Trends in the India Switchgear Market

- A drastic transition to adopting green and sustainable switchgear, utilizing environmentally friendly materials and designs in line with the worldwide green certification.

- Increasing deployment of AI-enabled switchgear offering that will lead to better predictive maintenance and operational efficiency in large-scale facilities.

- Growing investment in smart grids and microgrids as India shifts to renewable power generation through advanced generation management technology.

- Increase in demand for modular and compact designs due to the growing requirement for efficient space utilization in broader city developments.

Market Analysis by Voltage

Based on the voltage, low-voltage switchgear accounted for the major market revenue share in 2020, and it is anticipated to maintain the same over the forthcoming years, owing to its application in residential and commercial sectors. MCB dominated the low switchgear market, followed by ACB. The medium voltage switchgear market is also expected to grow generously over the coming years on account of reliable operations, safety, and easy maintenance. Additionally, rising demand to curb fire hazards, short circuits, and electricity faults would also drive the market growth.

Market Analysis by Application

Residential and Power Utilities sector accounted for the major revenue share in the India Switchgear Market in 2020 and is expected to retain its dominance for the coming years owing to the increasing population, increasing investment in the renewable energy sector and major expansion and upgradation programs carried out by the government of India in the power sector. The growth in the real estate and transportation sectors would directly contribute to the growth of the switchgear market in the forthcoming years.

Key Attractiveness of the Report

- Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2018 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators

- Factors Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Switchgear Market Overview

- India Switchgear Market Outlook

- India Switchgear Market Forecast

- India Switchgear Market Size

- Historical Data of India Switchgear Market Revenues for the Period 2017-2020

- Market Size & Forecast of India Switchgear Market Revenues until 2027F

- Historical Data of India Switchgear Market Revenues for the Period 2017-2020, By Types

- Market Size & Forecast of India Switchgear Market Revenues until 2027F, By Types

- Historical Data of India Low Voltage Switchgear Market Revenues for the Period 2017-2020, By Types

- Market Size & Forecast of India Low Voltage Switchgear Market Revenues until 2027F, By Types

- Historical Data of India Low Voltage Switchgear Market Revenues for the Period 2017-2020, By Applications

- Market Size & Forecast of India Low Voltage Switchgear Market Revenues until 2027F, By Applications

- Historical Data of India Medium Voltage Switchgear Market Revenues for the Period 2017-2020, By Insulation Type

- Market Size & Forecast of India Medium Voltage Switchgear Market Revenues until 2027F, By Insulation Type

- Historical Data of India Medium Voltage Switchgear Market Revenues for the Period 2017-2020, By Types

- Market Size & Forecast of India Medium Voltage Switchgear Market Revenues until 2027F, By Types

- Historical Data of India Medium Voltage Switchgear Market Revenues for the Period 2017-2020, By Applications

- Historical Data of India High Voltage Switchgear Market Revenues for the Period 2017-2020, By Insulation Type

- Market Size & Forecast of India High Voltage Switchgear Market Revenues until 2027F, By Insulation Type

- Historical Data of India High Voltage Switchgear Market Revenues for the Period 2017-2020, By Types

- Market Size & Forecast of India High Voltage Switchgear Market Revenues until 2027F, By Types

- Historical Data of India High Voltage Switchgear Market Revenues for the Period 2017-2020, By Applications

- Historical Data of India Switchgear Market Revenues for the Period 2017-2020, By Applications

- Market Size & Forecast of India Switchgear Market Revenues until 2027F, By Applications

- Market Drivers and Restraints

- India Switchgear Market Trends

- Players Market Share

- Company Profiles

- Strategic Recommendations

Market Scope and Segmentation

Thereport provides a detailed analysis of the following market segments:

By Voltage

- Low Voltage (0-1.1 KV)

- Medium Voltage (1.1-36 KV)

- High Voltage (>36 KV)

By Low Voltage

- Types

- MCB

- MCCB

- ACB

- Others

- Applications

- Residential

- Commercial

- Power Utilities

- Industrial

- Others (Transportation, Oil, and Gas)

By Medium Voltage

- Insulation Types

- AIS

- GIS

- Applications

- Residential

- Commercial

- Power Utilities

- Industrial

- Others

- Transportation

- Oil And Gas

By High Voltage

- Insulation Types

- AIS

- GIS

- Applications

- Residential

- Commercial

- Power Utilities

- Industrial

- Others (Transportation Oil, And Gas)

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero