Kuwait Dairy products Market (2025-2031) | Companies, Outlook, Analysis, Share, Forecast, Value, Size, Trends, Revenue, Industry & Growth

Market Forecast By Product Type (Butter , Cheese, Milk, Cream, Yoghurt, Buttermilk, Ice Cream , Lactose-Free Dairy Products), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Store, Online) And Competitive Landscape

| Product Code: ETC018002 | Publication Date: Jun 2023 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

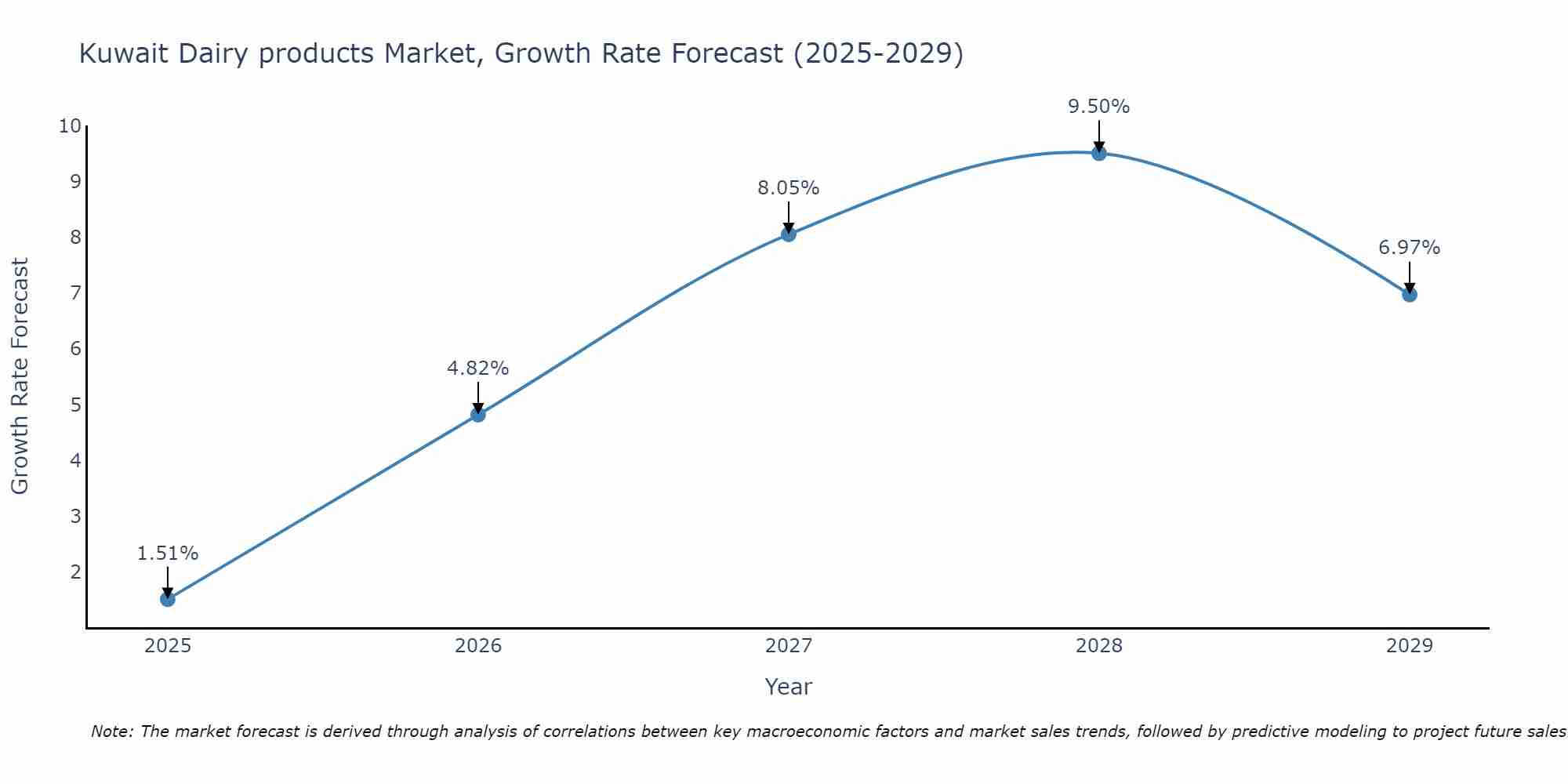

Kuwait Dairy products Market Size Growth Rate

The Kuwait Dairy products Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 1.51% in 2025, the market peaks at 9.50% in 2028, and settles at 6.97% by 2029.

Kuwait Dairy products Market Highlights

| Report Name | Kuwait Dairy products Market |

| Forecast period | 2025-2031 |

| CAGR | 7.2% |

| Growing Sector | Milk |

Topics Covered in Kuwait Dairy Products Market Report

Kuwait Dairy Products Market report thoroughly covers the market by Product Type and Distribution Channel. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Kuwait Dairy Products Market Synopsis

The Kuwait Dairy Products Market is experiencing steady growth, driven by increasing consumer demand for dairy products across various segments such as milk, cheese, and yoghurt.

According to 6Wresearch, the Kuwait Dairy Products Market is projected to grow at a CAGR of 7.2% from 2025-2031. The milk sector is witnessing the most significant growth, supported by rising health consciousness and increasing preference for natural and nutritious food products. The availability of diverse dairy products such as lactose-free options is further fueling market expansion. The shift towards online distribution channels, coupled with the growth of supermarkets and hypermarkets, is enhancing product accessibility and boosting sales.

However, the market faces challenges, including fluctuating prices of raw materials and the growing competition from plant-based alternatives. The reliance on imported raw materials for dairy production leads to price volatility, impacting the profitability of local producers. Additionally, the rising popularity of plant-based dairy substitutes poses a threat to traditional dairy products, forcing manufacturers to innovate and diversify their product offerings.

Kuwait Dairy Products Market: Leading Players

Leading players in the Kuwait Dairy Products Market include Almarai, KDD (Kuwait Danish Dairy Company), and Lactalis Group. Almarai is recognized for its extensive range of dairy products, including milk, yoghurt, and cheese, which cater to various consumer preferences. KDD offers a wide selection of dairy products with a focus on high quality and freshness, making it a trusted brand in the region. Lactalis Group provides a variety of dairy products, including lactose-free options, catering to the growing demand for specialized dietary needs.

Kuwait Dairy Products Industry: Government Initiatives

The government of Kuwait is actively supporting the dairy industry through various initiatives aimed at enhancing food security and promoting local production. Efforts to reduce dependency on imports and encourage domestic dairy farming are gaining momentum. Subsidies and incentives for local dairy producers are helping to strengthen the industry and improve product quality. Moreover, the government is investing in modernizing distribution channels, including the expansion of online platforms, to ensure the availability of dairy products across the country.

Future Insights of the Market

The Kuwait Dairy Products Market is anticipated to witness significant growth over the next five years. Market growth is expected to be driven by increasing consumer demand for health-oriented dairy products, such as lactose-free and fortified options. Technological advancements in dairy processing and packaging are likely to enhance product quality and shelf life, making dairy products more appealing to consumers. The growing preference for convenient and ready-to-consume dairy products is also expected to boost sales, particularly in urban areas. In summary, the market is set to expand due to innovation in product offerings and the increasing focus on health and wellness.

Market Segmentation By Product Type

According to Ravi Bhandari, Research Head, 6Wresearch, milk is leading the market due to its fundamental role in daily nutrition and its widespread consumption across all age groups.

Market Segmentation By Distribution Channel

Supermarkets and hypermarkets are the most popular distribution channels for dairy products, offering consumers convenience and a wide range of options.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Kuwait Dairy products Market Outlook

- Market Size of Kuwait Dairy products Market, 2031

- Forecast of Kuwait Dairy products Market, 2031

- Historical Data and Forecast of Kuwait Dairy products Revenues & Volume for the Period 2021 - 2031

- Kuwait Dairy products Market Trend Evolution

- Kuwait Dairy products Market Drivers and Challenges

- Kuwait Dairy products Price Trends

- Kuwait Dairy products Porter's Five Forces

- Kuwait Dairy products Industry Life Cycle

- Historical Data and Forecast of Kuwait Dairy products Market Revenues & Volume By Product Type for the Period 2021 - 2031

- Historical Data and Forecast of Kuwait Dairy products Market Revenues & Volume By Butter for the Period 2021 - 2031

- Historical Data and Forecast of Kuwait Dairy products Market Revenues & Volume By Cheese for the Period 2021 - 2031

- Historical Data and Forecast of Kuwait Dairy products Market Revenues & Volume By Milk for the Period 2021 - 2031

- Historical Data and Forecast of Kuwait Dairy products Market Revenues & Volume By Cream for the Period 2021 - 2031

- Historical Data and Forecast of Kuwait Dairy products Market Revenues & Volume By Yoghurt for the Period 2021 - 2031

- Historical Data and Forecast of Kuwait Dairy products Market Revenues & Volume By Buttermilk for the Period 2021 - 2031

- Historical Data and Forecast of Kuwait Dairy products Market Revenues & Volume By Ice Cream for the Period 2021 - 2031

- Historical Data and Forecast of Kuwait Butter Dairy products Market Revenues & Volume By Lactose-Free Dairy Products for the Period 2021 - 2031

- Historical Data and Forecast of Kuwait Dairy products Market Revenues & Volume By Distribution Channel for the Period 2021 - 2031

- Historical Data and Forecast of Kuwait Dairy products Market Revenues & Volume By Supermarkets & Hypermarkets for the Period 2021 - 2031

- Historical Data and Forecast of Kuwait Dairy products Market Revenues & Volume By Convenience Store for the Period 2021 - 2031

- Historical Data and Forecast of Kuwait Dairy products Market Revenues & Volume By Online for the Period 2021 - 2031

- Kuwait Dairy products Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Distribution Channel

- Kuwait Dairy products Top Companies Market Share

- Kuwait Dairy products Competitive Benchmarking By Technical and Operational Parameters

- Kuwait Dairy products Company Profiles

- Kuwait Dairy products Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Product Type

- Butter

- Cheese

- Milk

- Cream

- Yoghurt

- Buttermilk

- Ice Cream

- Lactose-Free Dairy Products

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Store

- Online

Kuwait Dairy products Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Kuwait Dairy products Market Overview |

| 3.1 Kuwait Country Macro Economic Indicators |

| 3.2 Kuwait Dairy products Market Revenues & Volume, 2021 & 2031F |

| 3.3 Kuwait Dairy products Market - Industry Life Cycle |

| 3.4 Kuwait Dairy products Market - Porter's Five Forces |

| 3.5 Kuwait Dairy products Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 3.6 Kuwait Dairy products Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

| 4 Kuwait Dairy products Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Kuwait Dairy products Market Trends |

| 6 Kuwait Dairy products Market, By Types |

| 6.1 Kuwait Dairy products Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Kuwait Dairy products Market Revenues & Volume, By Product Type, 2021 - 2031F |

| 6.1.3 Kuwait Dairy products Market Revenues & Volume, By Butter , 2021 - 2031F |

| 6.1.4 Kuwait Dairy products Market Revenues & Volume, By Cheese, 2021 - 2031F |

| 6.1.5 Kuwait Dairy products Market Revenues & Volume, By Milk, 2021 - 2031F |

| 6.1.6 Kuwait Dairy products Market Revenues & Volume, By Cream, 2021 - 2031F |

| 6.1.7 Kuwait Dairy products Market Revenues & Volume, By Yoghurt, 2021 - 2031F |

| 6.1.8 Kuwait Dairy products Market Revenues & Volume, By Buttermilk, 2021 - 2031F |

| 6.1.9 Kuwait Dairy products Market Revenues & Volume, By Lactose-Free Dairy Products, 2021 - 2031F |

| 6.1.10 Kuwait Dairy products Market Revenues & Volume, By Lactose-Free Dairy Products, 2021 - 2031F |

| 6.2 Kuwait Dairy products Market, By Distribution Channel |

| 6.2.1 Overview and Analysis |

| 6.2.2 Kuwait Dairy products Market Revenues & Volume, By Supermarkets & Hypermarkets, 2021 - 2031F |

| 6.2.3 Kuwait Dairy products Market Revenues & Volume, By Convenience Store, 2021 - 2031F |

| 6.2.4 Kuwait Dairy products Market Revenues & Volume, By Online, 2021 - 2031F |

| 7 Kuwait Dairy products Market Import-Export Trade Statistics |

| 7.1 Kuwait Dairy products Market Export to Major Countries |

| 7.2 Kuwait Dairy products Market Imports from Major Countries |

| 8 Kuwait Dairy products Market Key Performance Indicators |

| 9 Kuwait Dairy products Market - Opportunity Assessment |

| 9.1 Kuwait Dairy products Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 9.2 Kuwait Dairy products Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

| 10 Kuwait Dairy products Market - Competitive Landscape |

| 10.1 Kuwait Dairy products Market Revenue Share, By Companies, 2024 |

| 10.2 Kuwait Dairy products Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero