Saudi Arabia Natural & Organic Food Market (2020-2026) | Growth, COVID-19 IMPACT, Forecast, Trends, Outlook, Analysis, Industry, Value, Size, Revenue, Companies & Share

Market Forecast By Types (Organic Fruits & Vegetables, Organic Dairy Products, Organic Meat, Fish & Poultry, Organic Cereals & Pulses & Processed & Other Organic Food (Spices, Bread & Bakery, Juices etc.)), By Distribution Channel (Online, Offline), By Origin (Import, Domestic Production), By Regions (Central, Western, Eastern, Southern) and competitive landscape

| Product Code: ETC037258 | Publication Date: Nov 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 69 | No. of Figures: 23 | No. of Tables: 2 |

Saudi Arabia Natural & Organic Food Market report comprehensively covers Saudi Arabia Natural & Organic Food market by technology, by types, by applications and by regions. Saudi Arabia Natural & Organic Food market outlook report provides an unbiased and detailed analysis of the Natural & Organic Food market trends, opportunities/high growth areas and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia Natural & Organic Food Market Synopsis

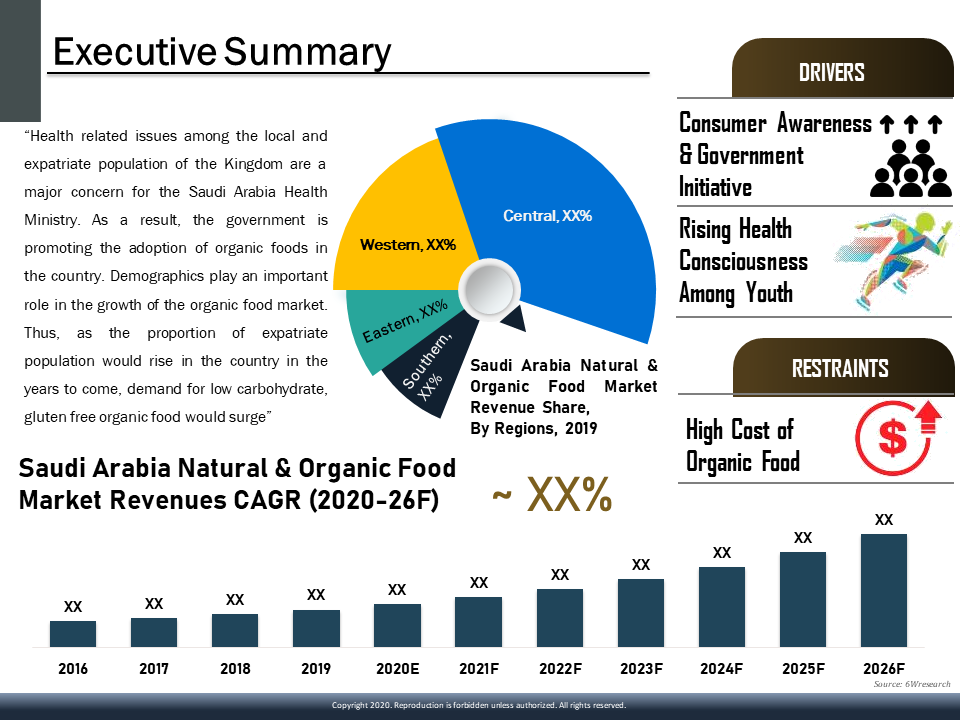

Saudi Arabia Natural & Organic Food Market size is expected to gain momentum during the forecast period as the country offers huge market potential for natural & organic food items. The market witnessed noticeable growth in recent years that can be attributed to factors such as changing consumer preferences, fast-paced lifestyle, and growing acceptance for chemical & synthetic-free food. The market growth is further supported by the growing young population, rising disposable income and government support towards organic farming. Additionally, on account of the pandemic spread of COVID-19, the government of Saudi Arabia implemented the ‘complete lockdown’ policy which in turn, proved an optimistic situation for the natural & organic food market in the country as the citizens started stocking up the food items and preferred chemical and pesticide-free food products. This, in turn, provided an uncertain push to the revenues of the natural & organic food market in the early months of 2020.

The outburst of coronavirus has adversely impacted the country’s Diesel Generator market in 2020 as the government imposed nationwide lockdown has led to the closure of all economical foundational work in the country and has led to a massive disruption in the overall market competitive landscape.

According to 6Wresearch, Saudi Arabia Natural & Organic Food Market size is projected to grow at CAGR of 17.4% during 2020-2026. Saudi Arabia Natural & Organic Food market is estimated to register sound revenues in the upcoming six years backed by the rising logistics industry in the country. Increased eCommerce platforms have boosted the logistic industry coupled with a rise in the need for vehicles on rent in order to transport goods to the warehouse which is expected to accelerate the Natural & Organic Food deployment in the country in the forthcoming years. Moreover, increased urbanization is estimated to generate high sales revenue in the market owing to the increased vehicle on rent during traveling for a few days. Is expected to proliferate the demand for the Natural & Organic Food and would leave a positive impact on the market and is estimated to secure optimistic growth of Saudi Arabia Natural & Organic Food market in the upcoming six years.

Market Analysis by Origin

By origin, the imports segment captured the highest market revenue share in the country for the year 2019 owing to a low production rate of domestic organic farming and growing demand for natural and organic food items such as vegetables, palms, coffee, fruits, etc in country. However, the Saudi government launched few initiatives to promote organic farming in the country such as the Sustainable Agricultural Rural Development Program and Organic Action Plan for providing financial assistance to farmers for organic cultivation. The Organic Action Plan aims at increasing organic production in the country by 300% by 2023. All Such ongoing programs would energize the growth of the natural & organic food market in the coming years.

Market Analysis by Distribution Channel

Based on the distribution channel, the online channel for distribution acquired the highest revenue share in 2019 and would continue to mark its presence in the coming years. Additionally, during the forecast period, significant growth would be witnessed in the aforementioned segment owing to the growing inclination towards e-commerce shopping platforms in the country.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Historical Data of Saudi Arabia Natural & Organic Food Market Revenues for the Period, 2016-2019

- Market Size & Forecast of Saudi Arabia Natural & Organic Food Market Revenues until 2026F

- Historical Data of Saudi Arabia Natural & Organic Food Market Revenues, By Types, for the Period, 2016-2019

- Market Size & Forecast of Saudi Arabia Natural & Organic Food Market Revenues, By Types, until 2026F

- Historical Data of Saudi Arabia Natural & Organic Food Market Revenues, By Distribution Channel, for the Period, 2016-2019

- Market Size & Forecast of Saudi Arabia Natural & Organic Food Market Revenues, By Distribution Channel, until 2026F

- Historical Data of Saudi Arabia Natural & Organic Food Market Revenues, By Origin, for the Period, 2016-2019

- Market Size & Forecast of Saudi Arabia Natural & Organic Food Market Revenues, By Origin, until 2026F

- Historical Data of Saudi Arabia Natural & Organic Food Market Revenues, By Regions, for the Period, 2016-2019

- Market Size & Forecast of Saudi Arabia Natural & Organic Food Market Revenues, By Regions, until 2026F

- Saudi Arabia Natural & Organic Food Market Drivers and Restraints

- Porter’s Five Forces

- Saudi Arabia Natural & Organic Food Market Revenue Share/ Ranking, By Company

- Saudi Arabia Natural & Organic Food Market Competitive Benchmarking

- Saudi Arabia Natural & Organic Food Market Opportunity Assessment

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Types

- Organic Fruits & Vegetables

- Organic Dairy Products

- Organic Meat

- Fish & Poultry

- Organic Cereals &

- Pulses & Processed &

- Other (Organic Food Spices Bread & Bakery Juices etc)

By Distribution Channel

- Online

- Offline

By Origin

- Import

- Domestic

- Production

By Regions

- Central

- Western

- Eastern

- Southern

Saudi Arabia Natural & Organic Food Market: FAQs

How much growth is expected in the Saudi Arabia Natural & Organic Food Market over the coming years?

|

Table of Contents |

|

1. Executive Summary |

|

2. Introduction |

|

2.1 Report Description |

|

2.2 Key Highlights of The Report |

|

2.3 Market Scope & Segmentation |

|

2.4 Research Methodology |

|

2.5 Assumptions |

|

3. Saudi Arabia Natural & Organic Food Market Overview |

|

3.1 Saudi Arabia Natural & Organic Food Market Revenues, 2016-2026F |

|

3.2 Saudi Arabia Natural & Organic Food Market Revenue Share, By Types, 2019 & 2026F |

|

3.3 Saudi Arabia Natural & Organic Food Market Revenue Share, By Distribution Channel, 2019 & 2026F |

|

3.4 Saudi Arabia Natural & Organic Food Market Revenue Share, By Origin, 2019 & 2026F |

|

3.5 Saudi Arabia Natural & Organic Food Market Revenue Share, By Regions, 2019 & 2026F |

|

3.6 Saudi Arabia Natural & Organic Food Market Industry Life Cycle, 2019 |

|

3.7 Saudi Arabia Natural & Organic Food Market Porter’s Five Forces |

|

4. Saudi Arabia Natural & Organic Food Market Dynamics |

|

4.1 Impact Analysis |

|

4.2 Market Drivers |

|

4.3 Market Restraints |

|

5. Saudi Arabia Natural & Organic Food Market Overview, By Types |

|

5.1 Saudi Arabia Organic Fruits & Vegetables Market Revenues, 2016-2026F |

|

5.2 Saudi Arabia Organic Meat, Fish & Poultry Market Revenues, 2016-2026F |

|

5.3 Saudi Arabia Organic Cereal & Pulses Market Revenues, 2016-2026F |

|

5.4 Saudi Arabia Organic Dairy Products Market Revenues, 2016-2026F |

|

5.5 Saudi Arabia Processed & Other Organic Food Market Revenues, 2016-2026F |

|

6. Saudi Arabia Natural & Organic Food Market Overview, By Distribution Channel |

|

6.1 Saudi Arabia Natural & Organic Food Market Revenues, By Online Distribution, 2016-2026F |

|

6.2 Saudi Arabia Natural & Organic Food Market Revenues, By Offline Distribution, 2016-2026F |

|

7. Saudi Arabia Natural & Organic Food Market Overview, By Origin |

|

7.1 Saudi Arabia Natural & Organic Food Market Revenues, By Import, 2016-2026F |

|

7.2 Saudi Arabia Natural & Organic Food Market Revenues, By Domestic Production, 2016-2026F |

|

8. Saudi Arabia Natural & Organic Food Market Overview, By Regions |

|

8.1 Saudi Arabia Natural & Organic Food Market Revenues, By Central Region, 2016-2026F |

|

8.2 Saudi Arabia Natural & Organic Food Market Revenues, By Western Region, 2016-2026F |

|

8.3 Saudi Arabia Natural & Organic Food Market Revenues, By Eastern Region, 2016-2026F |

|

8.4 Saudi Arabia Natural & Organic Food Market Revenues, By Southern Region, 2016-2026F |

|

9. Saudi Arabia Natural & Organic Food Market Opportunity Assessment |

|

9.1 Saudi Arabia Natural & Organic Food Market Opportunity Assessment, By Types |

|

9.2 Saudi Arabia Natural & Organic Food Market Opportunity Assessment, By Distribution Channel |

|

9.3 Saudi Arabia Natural & Organic Food Market Opportunity Assessment, By Origin |

|

10. Saudi Arabia Natural & Organic Food Market Competitive Landscape |

|

10.1 Saudi Arabia Natural & Organic Food Market Revenue Share, By Companies, 2019 |

|

10.2 Saudi Arabia Natural & Organic Food Market Competitive Benchmarking, By Operating Parameters |

|

10.3 Saudi Arabia Natural & Organic Food Market Competitive Benchmarking, By Types |

|

11. Company Profiles |

|

11.1 Arla Foods |

|

11.2 General Mills, Inc. |

|

11.3 Organic Valley |

|

11.4 Danone |

|

11.5 HiPP GmbH & Co. Vertrieb KG |

|

11.6 NADEC |

|

11.7 Windmill Organics |

|

11.8 Clearspring Ltd. |

|

11.9 Dean Foods Company |

|

11.10 The Kraft Heinz Company |

|

12. Key Strategic Recommendations |

|

13. Disclaimer |

|

List of Figures |

|

Figure 1. Saudi Arabia Natural & Organic Food Market Revenues, 2016-2026F ($ Billion) |

|

Figure 2. Saudi Arabia Natural & Organic Food Market Revenue Share, By Types, 2019 & 2026F |

|

Figure 3. Saudi Arabia Natural & Organic Food Market Revenue Share, By Distribution Channel, 2019 & 2026F |

|

Figure 4. Saudi Arabia Natural & Organic Food Market Revenue Share, By Origin, 2019 & 2026F |

|

Figure 5. Saudi Arabia Natural & Organic Food Market Revenue Share, By Regions, 2019 & 2026F |

|

Figure 6. Countries with the Highest Prevalence of Obesity in Adult Population, 2020 |

|

Figure 7. Saudi Arabia Total and Youth Population, 2015-2035F (Million Persons) |

|

Figure 8. Saudi Arabia Natural & Organic Food Market Revenue, By Online Distribution Channel, 2016-2026F ($Billion) |

|

Figure 9. Saudi Arabia Natural & Organic Food Market Revenue, By Offline Distribution Channel, 2016-2026F ($Billion) |

|

Figure 10. Saudi Arabia Natural & Organic Food Market Revenue, By Import, 2016-2026F ($Billion) |

|

Figure 11. Saudi Arabia Natural & Organic Food Market Revenue, By Domestic Production, 2016-2026F ($Billion) |

|

Figure 12. Saudi Arabia Natural & Organic Food Market Revenue, By Central Region, 2016-2026F ($ Billion) |

|

Figure 13. Saudi Arabia Natural & Organic Food Market Revenue, By Western Region, 2016-2026F ($ Billion) |

|

Figure 14. Saudi Arabia Natural & Organic Food Market Revenue, By Eastern Region, 2016-2026F ($ Billion) |

|

Figure 15. Saudi Arabia Natural & Organic Food Market Revenue, By Southern Region, 2016-2026F ($ Billion) |

|

Figure 16. Saudi Arabia Natural & Organic Food Market Opportunity Assessment, By Types, 2026F |

|

Figure 17. Saudi Arabia Natural & Organic Food Market Opportunity Assessment, By Distribution Channel, 2026F |

|

Figure 18. Saudi Arabia Natural & Organic Food Market Opportunity Assessment, By Origin, 2026F |

|

Figure 19. Saudi Arabia Natural & Organic Food Market Revenue Share, By Company, 2019 |

|

Figure 20. Saudi Arabia e-Commerce Market Revenues, 2017-2021F ($ Billion) |

|

Figure 21. E-Shoppers in Saudi Arabia, 2018-2022F (Million Users) |

|

Figure 22. Saudi Arabia E-commerce Market Revenues, 2018–2024F ($ Million) |

|

Figure 23. Number of Online Shoppers in Saudi Arabia, 2016-2022F (Million) |

|

List of Tables |

|

Table 1. Saudi Arabia Population, By Age Group, 2020E-2040F (%) |

|

Table 2. Saudi Arabia Natural & Organic Food Market Revenue, By Types, 2016-2026F ($Billion) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Saudi Arabia Genset Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- India OOH Advertising Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- Vietnam Twisted Pair Cables Market (2024-2030) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- South Africa B2B Cleaning Market (2025-2031) | Size & Revenue, Forecast, Share, Companies, Competitive Landscape, Analysis, Trends, Value, Segmentation, Outlook, Industry, Growth

- Mexico Dispersion Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- United States Video Conferencing Market (2025-2031) | Outlook, Industry, Size, Revenue, Share, Trends, Forecast, Growth, Companies, Analysis & Value

- Australia Electric Motor Market (2025-2031) | Trends, Share, Size, Value, Revenue, Industry, Growth, Analysis, Segmentation & Outlook

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines