Saudi Arabia Switchgear Market (2023-2029) | Size, Share, Trends, Revenue, industry, Growth & Outlook

Market Forecast By Voltage (Low Voltage (By Type (MCB, MCCB, ACB & Others), By Application (Residential, Commercial, Industrial, Power Utilities & Others)), Medium Voltage (By Application (Residential, Commercial, Industrial, Power Utilities & Others), By Insulation Type (Air Insulated Switchgear & Other Insulated Switchgear)), High Voltage Switchgear (By Application (Residential, Commercial, Industrial, Power Utilities & Others)), By Insulation Type (Air Insulated Switchgear, Other Insulated Switchgear)), By Applications (Residential, Commercial, Industrial, Power Utilities & Others) And Competitive Landscape.

| Product Code: ETC001520 | Publication Date: Oct 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 22 | No. of Tables: 6 |

Saudi Arabia Switchgear Market Synopsis

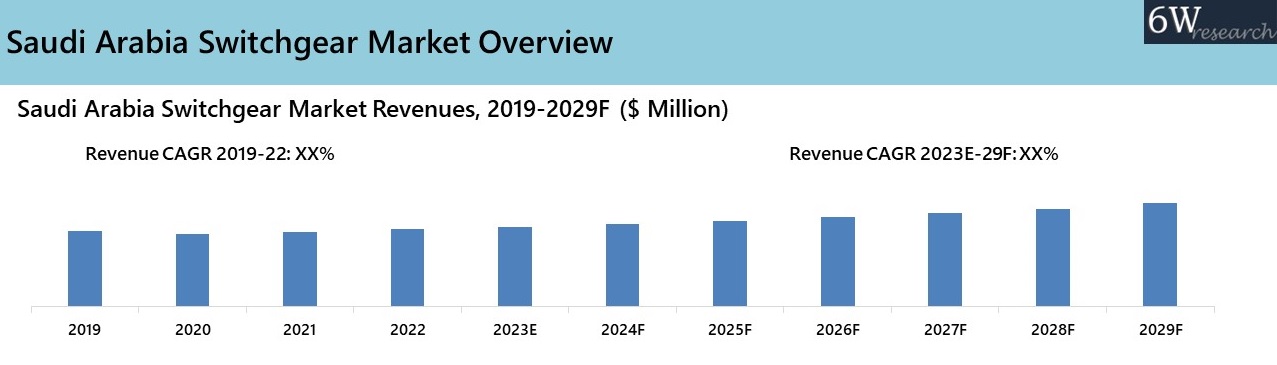

Saudi Arabia Switchgear Market grew at a significant rate during the period 2019-2022 on account of residential, commercial and other infrastructure developments. However, market got affected in 2020 by the COVID-19 pandemic, which caused disruptions in the supply chain and brought a temporary halt in construction activities. Although, burgeoning infrastructure in the region would drive the market for switchgear. For instance, in September 2023, country has announced project worth over SR65 billion ($17.3 billion) in the housing sector and also, the government’s aim to established the nation as manufacturing hub in order to diversify the economy from oil to non-oil would introduce more industrial construction in coming years which, therefore, is expected to boost the demand for switchgear in the years ahead.

According to 6Wresearch, Saudi Arabia Switchgear market size is anticipated to grow at a CAGR of 4.4% respectively during 2023-2029. Under, National Renewable Energy Program, nation aims to generate 50 percent electricity through renewable sources by 2030 and the achievement could be seen with launch of solar and wind projects in the power utility sector. For instance, Al-Shuaibah 2.6 GW solar project along with 13 ongoing renewable energy projects with a collective capacity of 11.3 GW would be witness by the country in the coming years which would propel the demand for switchgear. Additionally, Saudi Arabia would see the development of 71 schools and education complexes, mega-projects such as Amaala, Qiddiya, King Salman Park, New Murabba, Red-Sea project which would be featuring residential units, commercial development such as hotels, malls, retail spaces and other entertainment related infrastructure during the forthcoming years and thus, would contribute to the growth of switchgear market.

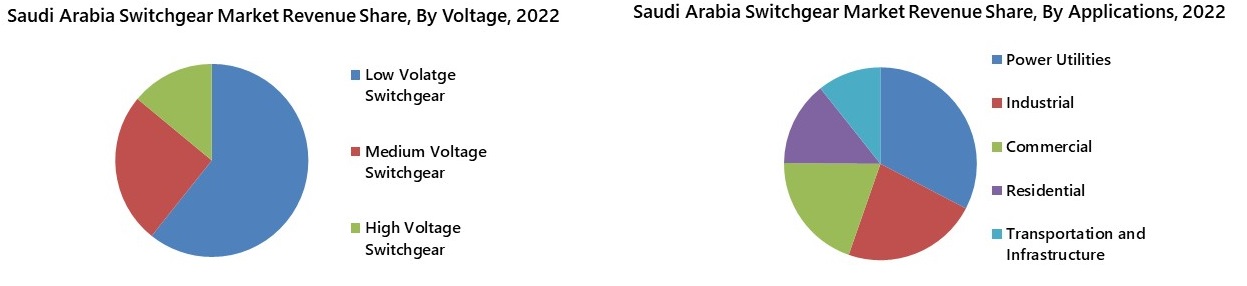

Market by Voltage

Low voltage Switchgear has accounted highest revenue share in Saudi Arabia switchgear market owing to its wide usage in residential, commercial and other sectors. Further, growing demand for residential units, such as Northwestern Red Sea Coast project spread over 3,300 square km includes 2,500 luxury hotel rooms and 700 residential villas. establishment of commercial offices, hotels including Addition of 24,550 and 15,000 hotel keys in Riyadh and DMA by 2024 would create more demand for low voltage switchgear in Saudi Arabia market.

Market by Insulation

MCCB accounted for the highest revenue share and same is expected to continue in the upcoming years on the back of upcoming mixed-use projects such as Northwestern edge of Saudi Arabia, Southwest Riyadh. Moreover, upcoming hotel projects Sindalah project, Trojena project 2026 and others would also add a growth in the market share of MCCB.

Market by Applications

In switchgear market of Saudi Arabia, Power Utilities sector followed by Industrial Sector has acquired major revenue share on the back of government plans to develop 30 solar and wind projects with $50 billion program along with rising industrial projects such as the nation has signed five agreements worth more than $11.4 billion in 2023 for the construction of key industrial projects in the cities of Ras Al Khair and Yanbu would boost the demand for switchgear products in power utilities and industrial sector during forthcoming years.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia Switchgear Market Overview

- Saudi Arabia Switchgear Market Outlook

- Saudi Arabia Switchgear Market Forecast

- Historical Data and Forecast of Saudi Arabia Switchgear Market Revenues for the Period 2019-2029F

- Historical Data and Forecast of Saudi Arabia Switchgear Market Revenues, By Voltage, for the Period 2019-2029F

- Historical Data and Forecast of Saudi Arabia Switchgear Market Revenues, By Applications, for the Period 2019-2029F

- Historical Data and Forecast of Saudi Arabia Switchgear Market Revenues, By Insulation, for the Period 2019-2029F

- Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Trends

- Saudi Arabia Switchgear Market Revenue Share, By Companies, 2022

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Voltage

- Low Voltage Switchgear

- Medium Voltage Switchgear

- High Voltage Switchgear

By Insulation

- Low Voltage Switchgear

- Medium Voltage Switchgear

- High Voltage Switchgear

By Applications

- Residential

- Commercial

- Industrial

- Power Utilities

- Transportation and Infrastructure

Saudi Arabia Switchgear Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Saudi Arabia Switchgear Market Overview |

| 3.1 Saudi Arabia Switchgear Market Revenues, 2019–2029F |

| 3.2 Saudi Arabia Switchgear Market- Industry Life Cycle |

| 3.3 Saudi Arabia Switchgear Market- Porter's Five Forces |

| 3.2 Saudi Arabia Switchgear Market Revenue Share, By Voltage 2022 & 2029F |

| 3.3 Saudi Arabia Switchgear Market Revenue Share, By Applications 2022 & 2029F |

| 4. Saudi Arabia Switchgear Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing investments in infrastructure projects in Saudi Arabia |

| 4.2.2 Growing focus on renewable energy sources driving the demand for switchgear |

| 4.2.3 Technological advancements leading to the development of smart switchgear solutions |

| 4.3 Market Restraints |

| 4.3.1 Fluctuations in raw material prices impacting manufacturing costs |

| 4.3.2 Stringent regulations and standards affecting market entry for new players |

| 4.3.3 Competition from alternative energy sources impacting the demand for traditional switchgear |

| 5. Saudi Arabia Switchgear Market Trends and Evolution |

| 6. Saudi Arabia Low Voltage Switchgear Market Overview |

| 6.1 Saudi Arabia Low Voltage Switchgear Market Revenues |

| 6.2 Saudi Arabia Low Voltage Switchgear Market Revenue Share and Revenues, By Insulation, 2019-2029F |

| 6.2.1 Saudi Arabia Low Voltage Switchgear Market Revenue Share and Revenues, MCCB, 2019-2029F |

| 6.2.2 Saudi Arabia Low Voltage Switchgear Market Revenue Share and Revenues, MCB, 2019-2029F |

| 6.2.3 Saudi Arabia Low Voltage Switchgear Market Revenue Share and Revenues, ACB, 2019-2029F |

| 6.2.4 Saudi Arabia Low Voltage Switchgear Market Revenue Share and Revenues, RCD, 2019-2029F |

| 6.2.5 Saudi Arabia Low Voltage Switchgear Market Revenue Share and Revenues, Distribution Board, 2019-2029F |

| 6.2.6 Saudi Arabia Low Voltage Switchgear Market Revenue Share and Revenues, Contractors and Relays, 2019-2029F |

| 6.3 Saudi Arabia Low Voltage Switchgear Market Revenue Share and Revenues, By Applications, 2019-2029F |

| 6.3.1 Saudi Arabia Low Voltage Switchgear Market Revenue Share and Revenues, Residential, 2019-2029F |

| 6.3.2 Saudi Arabia Low Voltage Switchgear Market Revenue Share and Revenues, Commercial, 2019-2029F |

| 6.3.3 Saudi Arabia Low Voltage Switchgear Market Revenue Share and Revenues, Industrial, 2019-2029F |

| 6.3.4 Saudi Arabia Low Voltage Switchgear Market Revenue Share and Revenues, Power Utilities, 2019-2029F |

| 6.3.5 Saudi Arabia Low Voltage Switchgear Market Revenue Share and Revenues, Transportation and Infrastructure, 2019-2029F |

| 7. Saudi Arabia Medium Voltage Switchgear Market Overview |

| 7.1 Saudi Arabia Medium Voltage Switchgear Market Revenues |

| 7.2 Saudi Arabia Medium Voltage Switchgear Market Revenue Share and Revenues, By Insulation, 2019-2029F |

| 7.2.1 Saudi Arabia Medium Voltage Switchgear Market Revenue Share and Revenues, By GIS, 2019-2029F |

| 7.2.2 Saudi Arabia Medium Voltage Switchgear Market Revenue Share and Revenues, By AIS, 2019-2029F |

| 7.3 Saudi Arabia Medium Voltage Switchgear Market Revenue Share and Revenues, By Applications, 2019-2029F |

| 7.3.1 Saudi Arabia Medium Voltage Switchgear Market Revenue Share and Revenues, By Commercial, 2019-2029F |

| 7.3.2 Saudi Arabia Medium Voltage Switchgear Market Revenue Share and Revenues, By Industrial, 2019-2029F |

| 7.3.3 Saudi Arabia Medium Voltage Switchgear Market Revenue Share and Revenues, By Power Utilities, 2019-2029F |

| 7.3.4 Saudi Arabia Medium Voltage Switchgear Market Revenue Share and Revenues, By Transportation and Infrastructure, 2019-2029F |

| 8. Saudi Arabia High Voltage Switchgear Market Overview |

| 8.1 Saudi Arabia High Voltage Switchgear Market Revenues |

| 8.2 Saudi Arabia High Voltage Switchgear Market Revenue Share and Revenues, By Insulation, 2019-2029F |

| 8.2.1 Saudi Arabia High Voltage Switchgear Market Revenue Share and Revenues, By GIS, 2019-2029F |

| 8.2.2 Saudi Arabia High Voltage Switchgear Market Revenue Share and Revenues, By AIS, 2019-2029F |

| 8.2.3 Saudi Arabia High Voltage Switchgear Market Revenue Share and Revenues, By Others (Hybrid Switchgear), 2019-2029F |

| 8.3 Saudi Arabia High Voltage Switchgear Market Revenue Share and Revenues, By Applications, 2019-2029F |

| 8.3.1 Saudi Arabia High Voltage Switchgear Market Revenue Share and Revenues, By Power Utilities, 2019-2029F |

| 8.3.2 Saudi Arabia High Voltage Switchgear Market Revenue Share and Revenues, By Industrial, 2019-2029F |

| 9. Saudi Arabia Switchgear Market Key Performance Indicators |

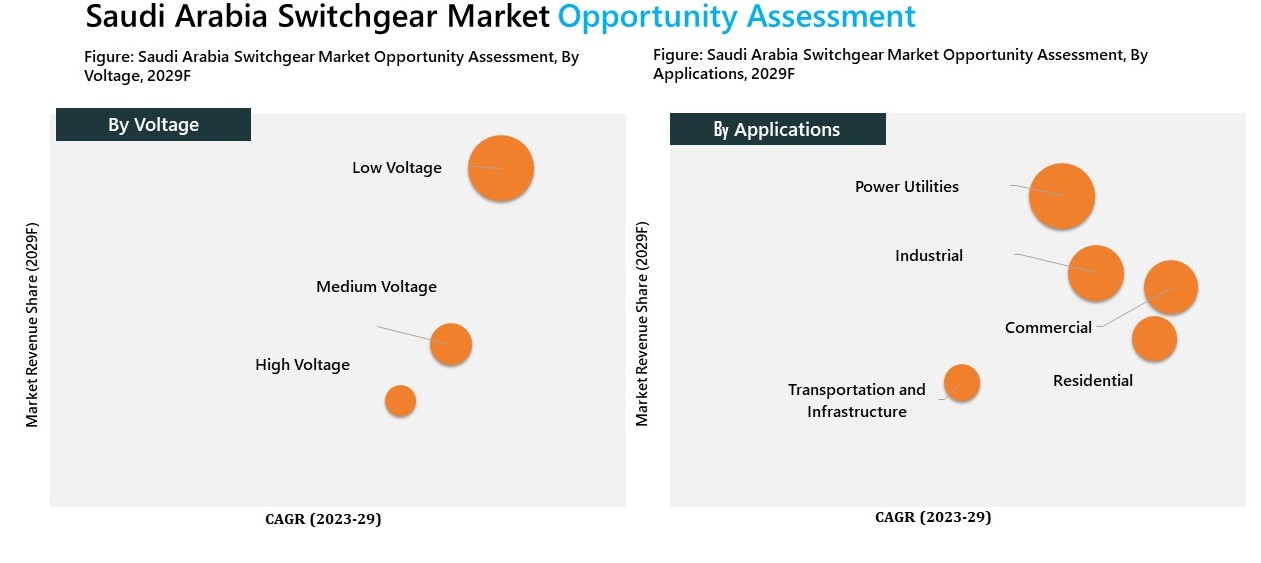

| 10. Saudi Arabia Switchgear Market Opportunity Assessment |

| 10.1 Saudi Arabia Switchgear Market Opportunity Assesment, By Voltage, 2029F |

| 10.2 Saudi Arabia Switchgear Market Opportunity Assesment, By Applications, 2029F |

| 11. Saudi Arabia Switchgear Market Competitive Landscape |

| 11.1 Saudi Arabia Switchgear Market Revenue Share, By Companies |

| 11.2 Saudi Arabia Switchgear Market Competitive Benchmarking, By Technical Parameters |

| 11.3 Saudi Arabia Switchgear Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 12.1 ABB Ltd |

| 12.2 Schneider Electric |

| 12.3 Eaton Corporation |

| 12.4 Siemens AG |

| 12.5 HD Hyundai Electric |

| 12.6 Alfanar Group |

| 12.7 Mitsubishi Electric Corporation |

| 12.8 Lucy Electric |

| 12.9 KFB Holding Group |

| 12.10 Musaid Switchgear Factory Company Ltd |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| 1. Saudi Arabia Switchgear Market Revenues, 2019-2029F ($ Million) |

| 2. Saudi Arabia Switchgear Market Revenue Share, By Voltage, 2022 & 2029F |

| 3. Saudi Arabia Switchgear Market Revenue Share, By Applications, 2022 & 2029F |

| 4. Saudi Arabia Low Voltage Switchgear Market Revenues, 2019-2029F ($ Million) |

| 5. Saudi Arabia Low Voltage Switchgear Market Revenue Share, By Insulation, 2022 & 2029F |

| 6. Saudi Arabia Low Voltage Switchgear Market Revenue Share, By Applications, 2022 & 2029F |

| 7. Saudi Arabia Medium Voltage Switchgear Market Revenues, 2019-2029F ($ Million) |

| 8. Saudi Arabia Medium Voltage Switchgear Market Revenue Share, By Insulation, 2022 & 2029F |

| 9. Saudi Arabia Medium Voltage Switchgear Market Revenue Share, By Applications, 2022 & 2029F |

| 10. Saudi Arabia High Voltage Switchgear Market Revenues, 2019-2029F ($ Million) |

| 11. Saudi Arabia High Voltage Switchgear Market Revenue Share, By Insulation, 2022 & 2029F |

| 12. Saudi Arabia High Voltage Switchgear Market Revenue Share, By Applications, 2022 & 2029F |

| 13. Saudi Arabia Year-on-Year % Change in Hotel Supply, Q3 2020 - Q3 2021 |

| 14. Saudi Arabia Hotel Supply (No. of Branded Hotel Keys), Q3 2020-FY 2023E |

| 15. Saudi Arabia Home Ownership (%), 2017-2030F |

| 16. Saudi Arabia Housing Stock Supply (Thousand Units), 2019-2023F |

| 17. Saudi Arabia Total Number of Industrial Projects, Sep’2021-Sep’2022 |

| 18. Saudi Arabia Number Of Factories that Commenced Operations, 1st Half 2020 - 1st Half 2021 |

| 19. Saudi Arabia’s Investors of 79 Industrial Projects (%), September’2022 |

| 20. Saudi Arabia Switchgear Market Opportunity Assessment, By Voltage, 2029F |

| 21. Saudi Arabia Switchgear Market Opportunity Assessment, By Applications, 2029F |

| 22. Saudi Arabia Switchgear Market Revenue Share, By Companies, 2022 |

| List of Tables |

| 1. Saudi Arabia Low Voltage Switchgear Market Revenues, By Insulation, 2019-2029F ($ Million) |

| 2. Saudi Arabia Low Voltage Switchgear Market Revenues, By Applications, 2019-2029F ($ Million) |

| 3. Saudi Arabia Medium Voltage Switchgear Market Revenues, By Insulation, 2019-2029F ($ Million) |

| 4. Saudi Arabia Medium Voltage Switchgear Market Revenues, By Applications, 2019-2029F ($ Million) |

| 5. Saudi Arabia High Voltage Switchgear Market Revenues, By Insulation, 2019-2029F ($ Million) |

| 6. Saudi Arabia High Voltage Switchgear Market Revenues, By Applications, 2019-2029F ($ Million) |

Market Forecast By Voltage (Low Voltage (By Type (MCB, MCCB, ACB & Others), By Application (Residential, Commercial, Industrial, Power Utilities & Others)), Medium Voltage (By Application (Residential, Commercial, Industrial, Power Utilities & Others), By Insulation Type (Air Insulated Switchgear & Other Insulated Switchgear)), High Voltage Switchgear (By Application (Residential, Commercial, Industrial, Power Utilities & Others)), By Insulation Type (Air Insulated Switchgear, Other Insulated Switchgear)), By Applications (Residential, Commercial, Industrial, Power Utilities & Others) And Competitive Landscape.

| Product Code: ETC001520 | Publication Date: Feb 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Saudi Arabia Switchgear Market is projected to grow over the coming year. Saudi Arabia Switchgear Market report is a part of our periodical regional publication Middle East Switchgear Market outlook report. 6W tracks the Switchgear market for over 60 countries with individual country-wise market opportunity assessment and publishes the report titled Global Switchgear Market outlook report annually.

Latest 2023 Development of the Saudi Arabia Switchgear Market

The Saudi Arabia Medium Voltage Switchgear Market is currently experiencing a number of developments.

- One key development in the sector is the growing demand for medium voltage switchgear owing to the rising construction as well as infrastructure sectors in the country. The government of the country focuses on diversifying the economy as well as reducing dependence on oil revenue, driving the demand for efficient and reliable power distribution equipment such as medium voltage switchgear.

- Another significant development taking place in the market is the rising adoption of smart and virtual technologies in the medium voltage switchgear market in Saudi Arabia. This trend is driven by the requirement for more efficient as well as automated power distribution systems which can respond to the transforming demand patterns as well as reduce downtime. Key players in the sector are investing in research and development activities in order to integrate advanced virtual technologies such as AI, IoT, and cloud computing into their medium-voltage switchgear items.

- Additionally, there are a number of collaborations and partnerships between key players in the medium voltage switchgear sector and local players in the nation. These partnerships aim to leverage local expertise as well as resources to better serve the requirements of the Saudi Arabian market.

- Overall, the Saudi Arabia Medium Voltage Switchgear Market is projected to continue evolving and growing in response to the nation's economic as well as technological developments.

Saudi Arabia Switchgear Market Synopsis

Saudi Arabia Switchgear Market is expected to gain momentum during the forthcoming years owing to rising industrialization. The rapidly growing petrochemical industry backed by the increasing development of infrastructure is driving the Saudi Arabia Switchgear Market Growth. Additionally, the growing efforts of the government of Saudi Arabia to develop renewable power infrastructure is one of the key factors adding to the development of the market.

According to 6Wresearch, Saudi Arabia Switchgear Market size is projected to register growth during 2022-2028. Increasing consumption of electricity owing to rising urbanization, modernization and industrialization is adding to the Saudi Arabia Switchgear Market Share. Rising space constraints along with ongoing investment for the enhancement of compact control equipment will complement the growth of the market. Furthermore, ongoing investment in the commercial and residential sectors is also proliferating the growth of the market. The global health emergency due to the outburst of COVID-19 is expected to hamper the growth of the market owing to partial or complete lockdown by the government.

Market Analysis by Voltage

On the basis of voltage, the low voltage segment is expected to gain a substantial share during the forthcoming years on account of usage in a wide range of industries such as residential and commercial sectors.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2018 to 2021.

- Base Year: 2021.

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

Key Highlights of Switchgear Report

- Saudi Arabia Switchgear Market Overview

- Saudi Arabia Switchgear Market Outlook

- Saudi Arabia Switchgear Market Forecast

- Historical Data and Forecast of Saudi Arabia Switchgear Market Revenues, By Voltage and By Applications for the Period 2018-2028F

- Historical Data and Forecast of Saudi Arabia Low Voltage Switchgear Market Revenues, By Types for the Period 2018-2028F

- Historical Data and Forecast of Saudi Arabia Low Voltage Switchgear Market Revenues, By Applications for the Period 2018-2028F

- Historical Data and Forecast of Saudi Arabia Medium Voltage Switchgear Market Revenues, By Insulation Types for the Period 2018-2028F

- Historical Data and Forecast of Saudi Arabia Medium Voltage Switchgear Market Revenues, By Applications for the Period 2018-2028F

- Historical Data and Forecast of Saudi Arabia High Voltage Switchgear Market Revenues, By Types for the Period 2018-2028F

- Historical Data and Forecast of Saudi Arabia High Voltage Switchgear Market Revenues, By Applications for the Period 2018-2028F

- Market Drivers and Restraints

- Saudi Arabia Switchgear Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Market Player’s Revenue Shares

- Market Competitive Benchmarking

- Saudi Arabia Switchgear Market Share, By Company

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

-

By Voltage

- Low Voltage (0-1.1 kV)

- Medium Voltage (1.1-36 kV)

- High Voltage (>36 kV)

-

By Low Voltage

- Types

- MCB

- MCCB

- ACB

- Others (Distribution Boards, Contactors, Relays, Starters, Fuses, COS, MPCB)

- Applications

- Residential

- Commercial

- Power Utilities

- Industrial

- Others (Transportation, Oil and Gas)

-

By Medium Voltage

- Insulation Types

- AIS

- GIS

- Applications

- Residential

- Commercial

- Power Utilities

- Industrial

- Others (Transportation, Oil and Gas)

-

By High Voltage

- Insulation Types

- AIS

- Others (GIS, Oil Insulated)

- Applications

- Residential

- Commercial

- Power Utilities

- Industrial

- Others (Transportation, Oil and Gas)

By Voltage (Low Voltage Switchgear, Medium Voltage Switchgear, High Voltage Switchgear), By Insulation (Medium Voltage Switchgear (Air Insulated, Gas Insulated, and Others), High Voltage Switchgear (Air Insulated, Gas Insulated, and Others)), By Types (Low Voltage Switchgear (MCB, MCCB, C&R, ACB, COS, and Others), Medium Voltage Switchgear (Indoor Switchgear (ISG), Outdoor Switchgear (OSG) and Others)), By Applications (Residential, Commercial, Industrial, Power Utilities & Other), By Regions (Central Region, Western Region, Eastern Region, Southern Region) And Competitive Landscape.

| Product Code: ETC001520 | Publication Date: Sep 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Latest 2021 Developments:

Saudi Arabia Switchgear Market is witnessing innovation as ABB introduced a new switchgear which reduce expenditure up to 30% and reduce footprints and unplanned downtime. Condition monitoring solutions from ABB Ability collect, analyze, and visualize a variety of data in order to deliver useful process insights. ABB offers digital versions of most of its low and medium-voltage switchgear. ABB will optimize the design of solid insulating components switchgear modules using direct numerical simulations and ultrafast imaging studies. On 29 June 2021, Siemens Energy was given a contract by Saudi Arabia government to power Saudi housing megaproject. Siemens Energy will provide reliable power to a community of over 30,000 residences in Riyadh, Saudi Arabia's capital.

Mergers And Acquisition:

- On 01 Oct 2020, Codian Robotics B.V., a prominent provider of delta robots, was bought by ABB. Delta robots are used largely for high-precision pick and place applications.

- On 20 July 2020, ABB announced it will acquire ASTI Mobile Robotics Group (ASTI)

To enquire about latest release please click here

Previous Release:

Growing commercial and industrial sectors on the back of Saudi Arabia Vision 2030, increasing infrastructure development activities and large-scale investments in the power transmission & distribution sectors has propelled the demand for switchgear market in Saudi Arabia. Currently, the Saudi Arabia Switchgear market is dominated by gas-insulated switchgear on account of technological and economic advantages associated with it over air insulated switch gears.

According to 6Wresearch, Saudi Arabia Switchgear Market size is anticipated to register growth during 2019-25. Based on voltage, low voltage switchgear is expected to capture the majority of the market revenues over the coming years, owing to increasing urbanization and rising demand for switchgear from the industrial sector. Moreover, the grid strengthening and interconnection of regions that involve the establishment of substations in the country is likely to fuel the demand for switchgear during the forecast period.

Increasing government spending to replace the old electric framework with the new efficient framework would propel market growth. Further, rising focus on the construction of new power plants to meet energy demands such as the Dumat Al Jandal wind power plant which would cost around $500 million would positively influence the market growth during the forecast period.

The Saudi Arabia Switchgear market report thoroughly covers the market by types, voltage, insulation, applications, and regions including the central region, western region, eastern region, and southern region. The Saudi Arabia Switchgear market outlook report provides an unbiased and detailed analysis of the on-going Saudi Arabia Switchgear market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

The increase in the massive industrial development and construction with regard to the commercial and the hospitality sector is leading to an increase in the newly adopted and technically upgraded infrastructural equipment and is expected to boost the deployment of switchgear in the market. Further, some of the upcoming projects in the kingdom of Saudi Arabia, where some them to be mentioned are Makkah Grand Mosque Developer, Kind Abdullah Financial District, Kingdom Tower, and Jabal Omar Developers are anticipated to bring in bountiful opportunities for the growth of switchgear deployment in various industrial applications in Saudi Arabia which as a result is anticipated to leave a positive impact on the growth of the overall Saudi Arabia switchgear market in the coming timeframe. Additionally, a rise in the present infrastructure up-gradation in the residential sector is leading to an increased deployment of switchgear especially in the circuit breaker segment to avoid short circuits since almost the whole building process is run electrically now and this would bring in new horizons for the market growth in the coming timeframe.

Key Highlights of the Report:

- Saudi Arabia Switchgear Market Overview

- Saudi Arabia Switchgear Market Outlook

- Saudi Arabia Switchgear Market Forecast

- Historical Data of Saudi Arabia Switchgear Market Revenues & Volume for the Period 2015-2018

- Saudi Arabia Switchgear Market Size and Saudi Arabia Switchgear Market Forecast of Revenues & Volume, Until 2025

- Historical Data of Saudi Arabia Switchgear Market Revenues & Volume, by Types, for the Period 2015-2018

- Market Size & Forecast of Saudi Arabia Switchgear Market Revenues & Volume, by Types, Until 2025

- Historical Data of Saudi Arabia Switchgear Market Revenues & Volume, by Voltage types, for the Period 2015-2018

- Market Size & Forecast of Saudi Arabia Switchgear Market Revenues & Volume, by Voltage types, Until 2025

- Historical Data of Saudi Arabia Switchgear Market Revenues & Volume, By Applications, for the Period 2015-2018

- Market Size & Forecast of Saudi Arabia Switchgear Market Revenues & Volume, By Applications, Until 2025

- Historical Data of Central Region Switchgear Market Revenues and Volume, for the Period 2015-2018

- Market Size & Forecast of Central Region Switchgear Market Revenues and Volume, Until 2025

- Historical Data of Western Region Switchgear Market Revenues and Volume, for the Period 2015-2018

- Market Size & Forecast of Western Region Switchgear Market Revenues and Volume, Until 2025

- Historical Data of Eastern Region Switchgear Market Revenues and Volume, for the Period 2015-2018

- Market Size & Forecast of Eastern Region Switchgear Market Revenues and Volume, Until 2025

- Historical Data of Southern Region Switchgear Market Revenues and Volume, for the Period 2015-2018

- Market Size & Forecast of Southern Region Switchgear Market Revenues and Volume, Until 2025

- Market Drivers and Restraints

- Saudi Arabia Switchgear Market Price Trends

- Saudi Arabia Switchgear Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Saudi Arabia Switchgear Market Share, By Players

- Saudi Arabia Switchgear Market Share, By Regions

- Saudi Arabia Switchgear Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The Saudi Arabia Switchgear Market report provides a detailed analysis of the following market segments:

- By Voltage:

- Low Voltage Switchgear

- Medium Voltage Switchgear

- High Voltage Switchgear

- By Insulation:

- Medium Voltage Switchgear

- Air Insulated

- Gas Insulated

- Others

- High Voltage Switchgear

- Air Insulated

- Gas Insulated

- Others

- Medium Voltage Switchgear

- By Types:

- Low Voltage Switchgear

-

- MCB

- MCCB

- C&R

- ACB

- COS

- Others

-

- Medium Voltage Switchgear

-

- Indoor Switchgear (ISG)

- Outdoor Switchgear (OSG)

- Others

-

- Low Voltage Switchgear

- By Applications:

- Residential

- Commercial

- Industrial

- Power Utilities

- Other

- By Regions:

- Central Region

- Western Region

- Eastern Region

- Southern Region

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero