Vietnam Air Conditioner Market (2025-2031) | Outlook, Revenue, Companies, Growth, Trends, Forecast, Analysis, Value, Industry, Size & Share

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others) And Competitive Landscape

| Product Code: ETC090089 | Publication Date: Oct 2023 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Topics Covered in the Vietnam Air Conditioner Market

Vietnam Air Conditioner (AC) Market report thoroughly covers the market by type and by application. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Vietnam Air Conditioner (AC) Market Synopsis

Vietnam Air Conditioner (AC) Market has been experiencing significant growth in recent years. The Vietnam Air Conditioner (AC) Market Growth is mainly attributed to several factors, including increasing urbanization, rising disposable incomes, and a surging demand for relaxed environments. Additionally, the country's hot and humid climate, especially during summer months, makes air conditioning a necessity for both residential and commercial spaces. As a result, both domestic and international AC manufacturers have recognized Vietnam as a lucrative market and have been actively expanding their presence.

According to 6Wresearch, the Vietnam Air Conditioner Market is expected to grow at a CAGR of 4.78% during the forecast period 2025-2031. Vietnam is experiencing a significant shift from rural to urban areas, leading to higher demand for residential and commercial AC units in densely populated cities. In addition to this, the country's robust economic growth has boosted consumer purchasing power, enabling households and businesses to have enough money for air conditioning systems. Moreover, increasing awareness of energy conservation and environmental concerns has led to a demand for energy-efficient AC units. However, the availability of reliable electricity supply and infrastructure for installing AC units in some areas can be a major hindrance in the market development. The growing use of AC units raises concerns about increased energy consumption. Also, the market is competitive, with both domestic and international brands vying for market share, leading to pricing pressures. Nevertheless, the adoption of smart and IoT-enabled AC units is on the rise, offering consumers greater control and energy efficiency. The growth of e-commerce platforms has made it easier for consumers to research and purchase AC units online. Furthermore, the push for energy efficiency and sustainability presents opportunities for manufacturers to develop and market eco-friendly AC units. Collaborations with local businesses and government initiatives can help expand market reach and address infrastructure challenges.

Government policies and schemes introduced in the Vietnam Air Conditioner (AC) Market

The Vietnam government has been focusing on energy efficiency and environmental sustainability. They have implemented regulations for air conditioners to encourage the use of more energy-efficient models. Various incentives and tax breaks have been introduced to promote the adoption of green and energy-efficient technologies. This has encouraged the use of inverter technology and other energy-saving features in air conditioners. The government has run campaigns to educate consumers about the importance of energy-efficient appliances and their long-term cost benefits. This has influenced purchasing decisions in the AC market.

Vietnam Air Conditioner Market Forecast

The Vietnam air conditioner market is expected to grow steadily. The market is driven by both residential and commercial sectors, with increasing adoption of energy-efficient and smart AC systems.

The Impact of COVID-19 on the Vietnam Air Conditioner (AC) Market

The COVID-19 pandemic had a massive impact on the AC market as well as on the Vietnam air conditioner market price as the pandemic disrupted global supply chains, affecting the availability of components and materials required for air conditioner production. Additionally, lockdown measures led to changes in consumer behavior. Some consumers delayed purchasing new air conditioning units due to a financial crisis. With physical stores temporarily closed, there was a rapid surge in online sales of air conditioners and other appliances. Moreover, the augmented prevalence of remote work led to a higher demand for ACs in home offices, which boosted sales of residential air conditioners.

Leading players in the Vietnam Air Conditioner (AC) Market

Some of the leading players in the Vietnam Air Conditioner (AC) Industry included both domestic and international companies:

- Daikin: Daikin is a prominent brand known for its energy-efficient air conditioning systems.

- Mitsubishi Electric: Mitsubishi Electric is known for its high-quality air conditioners.

- Panasonic: Panasonic is another well-established brand in the market, offering a range of residential and commercial solutions.

- Samsung: Samsung offers a wide range of air conditioning products for both residential and commercial use.

- LG: LG is known for its innovative features in the market.

Market Analysis by Application

According to Ravi Bhandari, Research Head, 6Wresearch, Residential dominates the Vietnam Air Conditioner (AC) Market share and is expected to remain in a dominant position in the coming years. However, Commercial and retail are expected to have the fastest growth rate among all applications.

Key attractiveness of the report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Vietnam Air Conditioner Market Outlook

- Market Size of Vietnam Air Conditioner Market, 2024

- Forecast of Vietnam Air Conditioner Market, 2031

- Historical Data and Forecast of Vietnam Air Conditioner Revenues & Volume for the Period 2021 - 2031

- Vietnam Air Conditioner Market Trend Evolution

- Vietnam Air Conditioner Market Drivers and Challenges

- Vietnam Air Conditioner Price Trends

- Vietnam Air Conditioner Porter's Five Forces

- Vietnam Air Conditioner Industry Life Cycle

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Residential for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Healthcare for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Hospitality for the Period 2021 - 2031

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Others for the Period 2021 - 2031

- Vietnam Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Vietnam Air Conditioner Top Companies Market Share

- Vietnam Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- Vietnam Air Conditioner Company Profiles

- Vietnam Air Conditioner Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Application

- Residential

- Healthcare

- Commercial & Retail

- Transportation & Infrastructure

- Hospitality

- Others

Vietnam Air Conditioner Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Vietnam Air Conditioner Market Overview |

| 3.1 Vietnam Country Macro Economic Indicators |

| 3.2 Vietnam Air Conditioner Market Revenues & Volume, 2021 & 2031F |

| 3.3 Vietnam Air Conditioner Market - Industry Life Cycle |

| 3.4 Vietnam Air Conditioner Market - Porter's Five Forces |

| 3.5 Vietnam Air Conditioner Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.6 Vietnam Air Conditioner Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 4 Vietnam Air Conditioner Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Vietnam Air Conditioner Market Trends |

| 6 Vietnam Air Conditioner Market, By Types |

| 6.1 Vietnam Air Conditioner Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Vietnam Air Conditioner Market Revenues & Volume, By Type, 2021 - 2031F |

| 6.1.3 Vietnam Air Conditioner Market Revenues & Volume, By Room Air Conditioner, 2021 - 2031F |

| 6.1.4 Vietnam Air Conditioner Market Revenues & Volume, By Ducted Air Conditioner, 2021 - 2031F |

| 6.1.5 Vietnam Air Conditioner Market Revenues & Volume, By Ductless Air Conditioner, 2021 - 2031F |

| 6.1.6 Vietnam Air Conditioner Market Revenues & Volume, By Centralized Air Conditioner, 2021 - 2031F |

| 6.2 Vietnam Air Conditioner Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Vietnam Air Conditioner Market Revenues & Volume, By Residential, 2021 - 2031F |

| 6.2.3 Vietnam Air Conditioner Market Revenues & Volume, By Healthcare, 2021 - 2031F |

| 6.2.4 Vietnam Air Conditioner Market Revenues & Volume, By Commercial & Retail, 2021 - 2031F |

| 6.2.5 Vietnam Air Conditioner Market Revenues & Volume, By Transportation & Infrastructure, 2021 - 2031F |

| 6.2.6 Vietnam Air Conditioner Market Revenues & Volume, By Hospitality, 2021 - 2031F |

| 6.2.7 Vietnam Air Conditioner Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 Vietnam Air Conditioner Market Import-Export Trade Statistics |

| 7.1 Vietnam Air Conditioner Market Export to Major Countries |

| 7.2 Vietnam Air Conditioner Market Imports from Major Countries |

| 8 Vietnam Air Conditioner Market Key Performance Indicators |

| 9 Vietnam Air Conditioner Market - Opportunity Assessment |

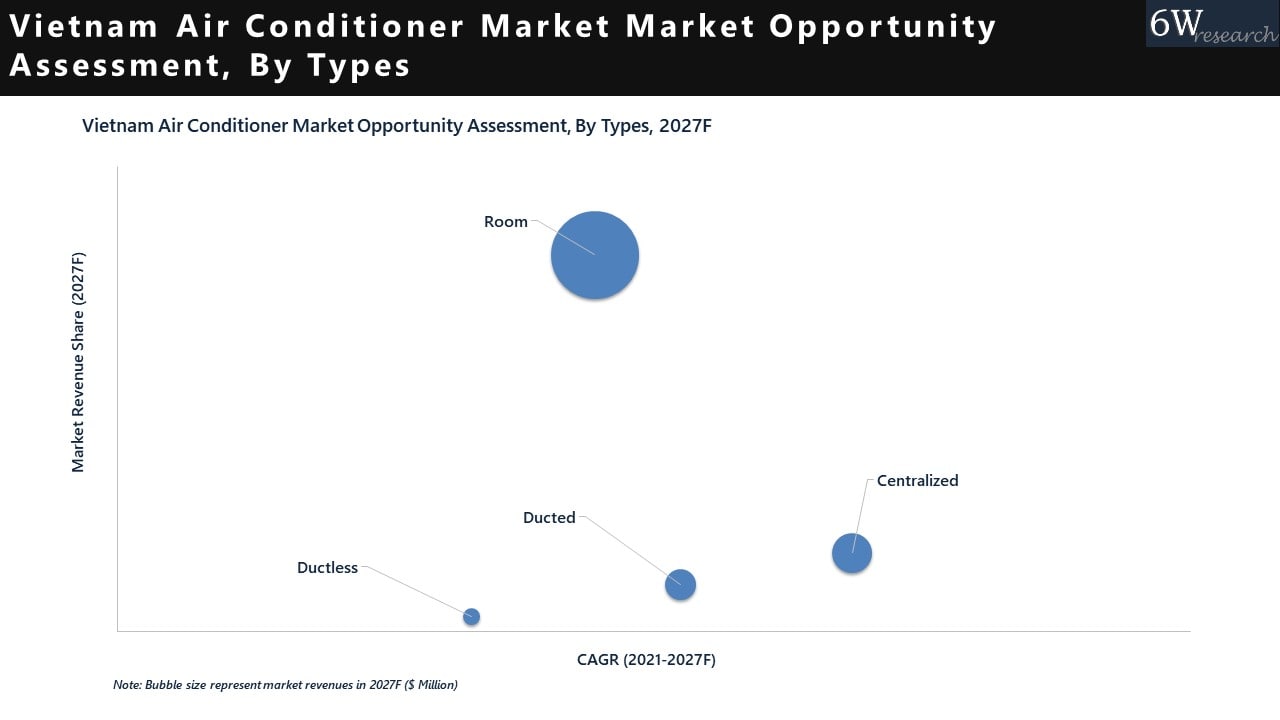

| 9.1 Vietnam Air Conditioner Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 Vietnam Air Conditioner Market Opportunity Assessment, By Application, 2021 & 2031F |

| 10 Vietnam Air Conditioner Market - Competitive Landscape |

| 10.1 Vietnam Air Conditioner Market Revenue Share, By Companies, 2024 |

| 10.2 Vietnam Air Conditioner Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others) And Competitive Landscape

| Product Code: ETC090089 | Publication Date: Aug 2021 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Vietnam Air Conditioner (AC) Market is projected to grow over the coming years. Vietnam Air Conditioner (AC) Market report is a part of our periodical regional publication Asia Pacific Air Conditioner (AC) Market outlook report. 6W tracks air conditioner market for over 60 countries with individual country-wise market opportunity assessment and publishes with the report titled Global Air Conditioner (AC) Market outlook report annually.

Vietnam Air Conditioner Market grew by 4.2% in 2017- 2020 and is expected to grow at a CAGR of 9.6% during 2021- 2027. Vietnam occupies 5th position in terms of the market size in the APAC Air Conditioner Market.

In terms of market by types, Room Air Conditioner dominates the market and is expected to remain in a dominant position in the coming years. However, Centralized Air Conditioner is expected to have the fastest growth rate among all types.

In terms of application, Residential dominates the market and is expected to remain in a dominant position in the coming years. However, Commercial & Retail is expected to have the fastest growth rate among all applications.

In terms of components, VRF dominates the market and is expected to remain in a dominant position in the coming years with the fastest growth rate among all components.

Vietnam Air Conditioner Market report comprehensively covers the market by types, applications, and regions. The Vietnam Air Conditioner Market outlook report provides an unbiased analysis of the ongoing Vietnam Air Conditioner Market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

- Vietnam Air Conditioner Market Outlook

- Market Size of Vietnam Air Conditioner Market, 2020

- Forecast of Vietnam Air Conditioner Market, 2027

- Historical Data and Forecast of Vietnam Air Conditioner Revenues & Volume for the Period 2018 - 2027

- Vietnam Air Conditioner Market Trend Evolution

- Vietnam Air Conditioner Market Drivers and Challenges

- Vietnam Air Conditioner Price Trends

- Vietnam Air Conditioner Porter's Five Forces

- Vietnam Air Conditioner Industry Life Cycle

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Type for the Period 2018 - 2027

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2018 - 2027

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2018 - 2027

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2018 - 2027

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2018 - 2027

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Application for the Period 2018 - 2027

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Residential for the Period 2018 - 2027

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Healthcare for the Period 2018 - 2027

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2018 - 2027

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2018 - 2027

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Hospitality for the Period 2018 - 2027

- Historical Data and Forecast of Vietnam Air Conditioner Market Revenues & Volume By Others for the Period 2018 - 2027

- Vietnam Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Vietnam Air Conditioner Top Companies Market Share

- Vietnam Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- Vietnam Air Conditioner Company Profiles

- Vietnam Air Conditioner Key Strategic Recommendations

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

- Kenya Road Stabilization Equipment Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

- North America Sodium chloride Market (2025-2031) | Analysis, Revenue, Forecast, Trends, Companies, Size, Growth, Share, Industry, Outlook & Value

- North America Vinyl Flooring Market (2025-2031) | Value, Growth,Size, Analysis, Revenue, Industry, Forecast, Share, Outlook, Companies & Trends

- Tajikistan Thermal Camera Market (2025-2031) | Trends, Size, Growth, Share, Industry, Companies, Value, Analysis, Revenue, Forecast & Outlook

- Singapore Professional AV Market (2025-2031) | Industry, Size, Growth, Revenue, Value, Companies, Forecast, Analysis, Share & Trends

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero