Thailand Air Conditioner Market (2025-2031) | Analysis, Size, Revenue, Forecast, Trends, Growth, industry, Outlook & Value.

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others) And Competitive Landscape

| Product Code: ETC090084 | Publication Date: Jul 2024 | Updated Date: Sep 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 200 | No. of Figures: 90 | No. of Tables: 30 | |

Thailand Air Conditioner Market Growth Rate

According to 6Wresearch internal database and industry insights, the Thailand Air Conditioner Market is projected to grow at a compound annual growth rate (CAGR) of 8.15% during the forecast period (2025-2031).

Thailand Air Conditioner Market Highlights

| Report Name | Thailand Air Conditioner Market |

| Forecast Period | 2025-2031 |

| CAGR | 8.15% |

| Growing Sector | Residential & Commercial |

Topics Covered in the Thailand Air Conditioner Market Report

The Thailand Air Conditioner Market report thoroughly covers the market by types and applications. The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Thailand Air Conditioner Market Synopsis

Thailand Air Conditioner Market is experiencing significant growth and projected to attain more growth in the coming years due to rising temperatures, urbanization, and increasing disposable incomes, the demand for air conditioning units has soared. The market comprises a diverse range of products such as residential, commercial, and industrial air conditioning systems. In general, energy efficiency is a key consideration for consumers and businesses alike, leading to a growing preference for inverter technology and eco-friendly refrigerants.

Evaluation of Growth Drivers in the Thailand Air Conditioner Market

Below mentioned are some prominent drivers and their influence on market dynamics:

| Driver | Primary Segments Affected | Why it matters (evidence) |

| Urbanization & Rising Population | Residential & Commercial | With rapid urbanization and growing middle-class income, the demand for air conditioners has surged, especially in major cities like Bangkok. |

| Energy Efficiency Policies | All Types; Residential, Commercial & Industrial | The Thai government has been encouraging energy-efficient air conditioners through incentives and regulations, leading to a rise in the demand for high-efficiency models. |

| Tourism Growth | Hospitality | Thailand's thriving tourism sector increases the need for air conditioning in hotels and resorts, driving demand for cooling solutions in the hospitality industry. |

| Climate Change & Heatwaves | Residential, Commercial & Industrial | Rising temperatures and prolonged heatwaves are pushing the demand for air conditioners across all sectors, especially in urban areas. |

| Technological Advancements | Commercial & Residential | Growing adoption of smart air conditioners and HVAC systems, integrated with IoT and AI technologies, is revolutionizing the air conditioning market. |

Thailand air conditioner market is expected to witness massive transformation, growing at a CAGR of 8.15% during the forecast period of 2025-2031. Several factors are driving the growth of this market such as the country's rising average temperatures, which are pushing both individuals and businesses to invest in effective cooling solutions. Apart from this, increasing urbanization. more people moving to cities and thereby increasing the demand for residential and commercial air conditioning systems.

Evaluation of Restraints in the Thailand Air Conditioner Market

Below mentioned are some major restraints and their influence on market dynamics:

| Restraint | Primary Segments Affected | What this means (evidence) |

| High Initial Costs | All Types; Residential & Commercial | Advanced air conditioning systems, particularly those with energy-efficient technologies, require significant upfront investments. |

| Limited Consumer Awareness | Residential | Despite the government's push for energy efficiency, many consumers remain unaware of the long-term savings offered by energy-efficient AC models. |

| Increased Competition from Local Brands | Residential & Commercial | Local AC brands often provide cheaper alternatives, making it challenging for premium international brands to gain market share. |

| Energy Consumption Concerns | Industrial & Commercial | High power consumption of air conditioners could deter businesses from investing in new systems, especially in high-energy-cost regions. |

Thailand Air Conditioner Market Challenges

Thailand Air Conditioner Industry faces few restraints such as high initial costs associated with advanced and energy-efficient air conditioning systems. Additionally, the ongoing economic uncertainty and fluctuations can affect consumer spending power, impacting sales negatively. The availability and cost of eco-friendly refrigerants also present challenges, as they can be more expensive and harder to procure compared to traditional refrigerants.

Thailand Air Conditioner Market Trends

Several prominent trends reshaping the market growth are:

- Increasing Number of Energy-Efficient Air Conditioning Units: With a governmental focus on energy efficiency, manufacturers of air conditioning units are beginning to transition toward greater energy-efficient units to address the increasing pressure from environmentally focused consumers and companies.

- Developments in Air Conditioning Technology: There is an increased adoption of smart air conditioners, and internet of things systems in residential and commercial buildings. For increased energy efficiency and control.

- Rising Demand for Split and Ductless Air Conditioning Units: There is an increasing demand for split and ductless air conditioning units because they are typically less expensive, easier to install and less energy consuming.

- Continued Uptake of Smart Air Conditioning Units and Automation: The ongoing integration of automation and smart controls in the air conditioning units is becoming more popularized in residential and commercial spaces enabling improved management of energy.

Investment Opportunities in the Thailand Air Conditioner Industry

Some prominent investment opportunities in the market are:

- Development of Energy Efficient Air Conditioning Units: Providing an emphasis on the creation of energy-efficient models with superior smart technology, and both initial and running costs reduced.

- Expansion in Smart Air Conditioning Solutions: Higher development of smart air conditioning units with the integration of smart design factors, internet of things and artificial intelligence features and characteristics.

- Customized Solutions for Commercial Use: Providing customized air conditioning solutions for hotels, resorts, and shopping malls to cater to the growing needs of the hospitality sector.

Top 5 Leading Players in the Thailand Air Conditioner Market

Some of the leading players dominating the industry includes:

1. Daikin Industries Ltd.

| Company Name | Daikin Industries Ltd. |

| Established Year | 1924 |

| Headquarters | Osaka, Japan |

| Official Website | Click Here |

Daikin is a leading provider of air conditioning solutions in Thailand, offering a wide range of energy-efficient products for residential, commercial, and industrial applications.

2. Panasonic Corporation

| Company Name | Panasonic Corporation |

| Established Year | 1918 |

| Headquarters | Osaka, Japan |

| Official Website | Click Here |

Panasonic is renowned for its energy-efficient air conditioners that provide optimal performance and lower energy consumption, with a strong market presence in Thailand.

3. LG Electronics

| Company Name | LG Electronics |

| Established Year | 1958 |

| Headquarters | Seoul, South Korea |

| Official Website | Click Here |

LG is a prominent player in Thailand's AC market, providing smart air conditioning solutions with advanced features such as energy-saving modes and air purifiers.

4. Mitsubishi Electric

| Company Name | Mitsubishi Electric |

| Established Year | 1921 |

| Headquarters | Tokyo, Japan |

| Official Website | Click Here |

Mitsubishi Electric offers a wide variety of air conditioning systems, including split units, ducted systems, and energy-efficient solutions, catering to both residential and commercial segments in Thailand.

5. Samsung Electronics

| Company Name | Samsung Electronics |

| Established Year | 1969 |

| Headquarters | Seoul, South Korea |

| Official Website | Click Here |

Samsung provides cutting-edge air conditioning systems with a focus on advanced cooling technologies and smart features for residential and commercial applications in Thailand.

Government Regulations Introduced in the Thailand Air Conditioner Market

According to Thai Government Data, the government has introduced many measures to encourage energy efficiency and reduce air conditioning's environmental effects. For instance, the Energy Efficiency and Conservation Promotion Act (EECPA) provide tax incentives and rebates for consumers and businesses that purchase energy efficient units. The government also requires new air conditioning units to use environmentally friendly refrigerants to comply with international environmental standards.

Future Insights of the Thailand Air Conditioner Market

The future of the Thailand air conditioner industry seems promising due to continued technological advancement, urbanization, and increased awareness of energy efficiency. Future trends indicate a move towards more intelligent and connected air conditioning units, utilizing artificial intelligence (AI) and machine learning (ML) to optimize energy use and improve the user experience. In addition, the growing focus on sustainability will continue to impact the air conditioning market, as manufacturers look at ways to develop eco-friendly refrigerants and recyclable materials.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories:

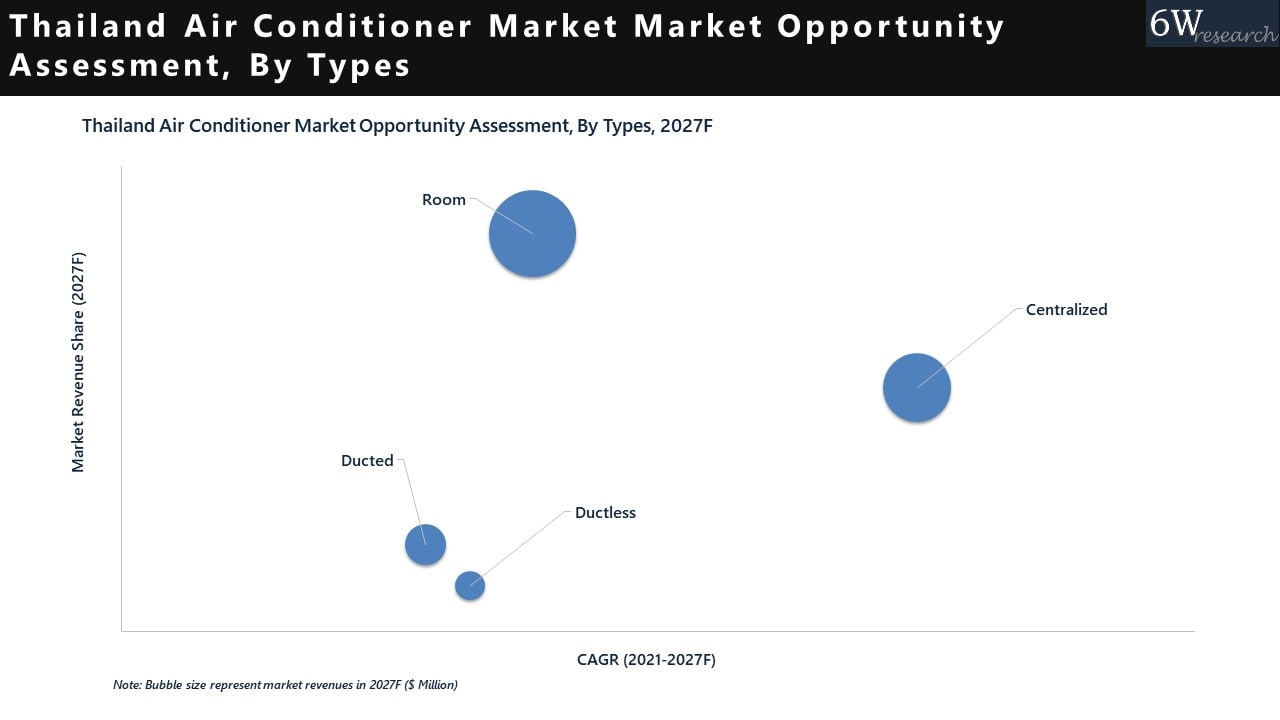

Room Air Conditioner Dominates the Market- By Type

Among the various types, Room Air Conditioners are expected to dominate the Thailand Air Conditioner Market Share in the coming years. This is due to their widespread use in residential buildings and the fact that they offer flexible installation options and affordable pricing. The increasing number of apartment dwellers in urban areas is also contributing to the demand for room air conditioners.

Residential Dominates the Market- By Application

According to Shubhamdeep, Senior Research Analyst, 6Wresearch, the Residential segment is expected to lead the growth due to the expanding urban population and the growing trend of higher living standards. The increasing use of air conditioners in homes due to rising temperatures is a key factor contributing to this growth.

Key attractiveness of the report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Thailand Air Conditioner Market Outlook

- Market Size of Thailand Air Conditioner Market, 2024

- Forecast of Thailand Air Conditioner Market, 2031

- Historical Data and Forecast of Thailand Air Conditioner Revenues & Volume for the Period 2021-2031

- Thailand Air Conditioner Market Trend Evolution

- Thailand Air Conditioner Market Drivers and Challenges

- Thailand Air Conditioner Price Trends

- Thailand Air Conditioner Porter's Five Forces

- Thailand Air Conditioner Industry Life Cycle

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Residential for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Healthcare for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Hospitality for the Period 2021-2031

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Others for the Period 2021-2031

- Thailand Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Thailand Air Conditioner Top Companies Market Share

- Thailand Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- Thailand Air Conditioner Company Profiles

- Thailand Air Conditioner Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Types

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Application

- Residential

- Commercial & Retail

- Healthcare

- Hospitality

- Transportation & Infrastructure

- Others

Thailand Air Conditioner Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Thailand Air Conditioner Market Overview |

| 3.1 Thailand Air Conditioner Market Revenues & Volume, 2021 - 2031F |

| 3.2 Thailand Air Conditioner Market - Industry Life Cycle |

| 3.3 Thailand Air Conditioner Market - Porter's Five Forces |

| 3.4 Thailand Air Conditioner Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.5 Thailand Air Conditioner Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 4 Thailand Air Conditioner Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing urbanization and population growth leading to higher demand for air conditioning units. |

| 4.2.2 Rising average temperatures and changing climate patterns driving the need for air conditioning in Thailand. |

| 4.2.3 Technological advancements leading to more energy-efficient and cost-effective air conditioner models. |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating raw material prices impacting manufacturing costs of air conditioners. |

| 4.3.2 Seasonal demand fluctuations affecting sales and production planning for air conditioner manufacturers. |

| 4.3.3 Competition from alternative cooling technologies such as fans or evaporative coolers. |

| 5 Thailand Air Conditioner Market Trends |

| 6 Thailand Air Conditioner Market Segmentation |

| 6.1 Thailand Air Conditioner Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Thailand Air Conditioner Market Revenues & Volume, By Type, 2021 - 2031F |

| 6.1.3 Thailand Air Conditioner Market Revenues & Volume, By Room Air Conditioner, 2021 - 2031F |

| 6.1.4 Thailand Air Conditioner Market Revenues & Volume, By Ducted Air Conditioner, 2021 - 2031F |

| 6.1.5 Thailand Air Conditioner Market Revenues & Volume, By Ductless Air Conditioner, 2021 - 2031F |

| 6.1.6 Thailand Air Conditioner Market Revenues & Volume, By Centralized Air Conditioner, 2021 - 2031F |

| 6.2 Thailand Air Conditioner Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Thailand Air Conditioner Market Revenues & Volume, By Residential, 2021 - 2031F |

| 6.2.3 Thailand Air Conditioner Market Revenues & Volume, By Healthcare, 2021 - 2031F |

| 6.2.4 Thailand Air Conditioner Market Revenues & Volume, By Commercial & Retail, 2021 - 2031F |

| 6.2.5 Thailand Air Conditioner Market Revenues & Volume, By Transportation & Infrastructure, 2021 - 2031F |

| 6.2.6 Thailand Air Conditioner Market Revenues & Volume, By Hospitality, 2021 - 2031F |

| 6.2.7 Thailand Air Conditioner Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 Thailand Air Conditioner Market Import-Export Trade Statistics |

| 7.1 Thailand Air Conditioner Market Export to Major Countries |

| 7.2 Thailand Air Conditioner Market Imports from Major Countries |

| 8 Thailand Air Conditioner Market Key Performance Indicators |

| 8.1 Energy Efficiency Ratio (EER) of air conditioner units sold in Thailand. |

| 8.2 Adoption rate of inverter technology in air conditioner models. |

| 8.3 Average lifespan of air conditioning units in Thailand. |

| 8.4 Percentage of households with air conditioning units installed. |

| 8.5 Number of new residential and commercial construction projects in Thailand. |

| 9 Thailand Air Conditioner Market - Opportunity Assessment |

| 9.1 Thailand Air Conditioner Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 Thailand Air Conditioner Market Opportunity Assessment, By Application, 2021 & 2031F |

| 10 Thailand Air Conditioner Market - Competitive Landscape |

| 10.1 Thailand Air Conditioner Market Revenue Share, By Companies, 2024 |

| 10.2 Thailand Air Conditioner Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others) And Competitive Landscape

| Product Code: ETC090084 | Publication Date: Aug 2021 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Thailand Air Conditioner (AC) Market | Country-Wise Share and Competition Analysis

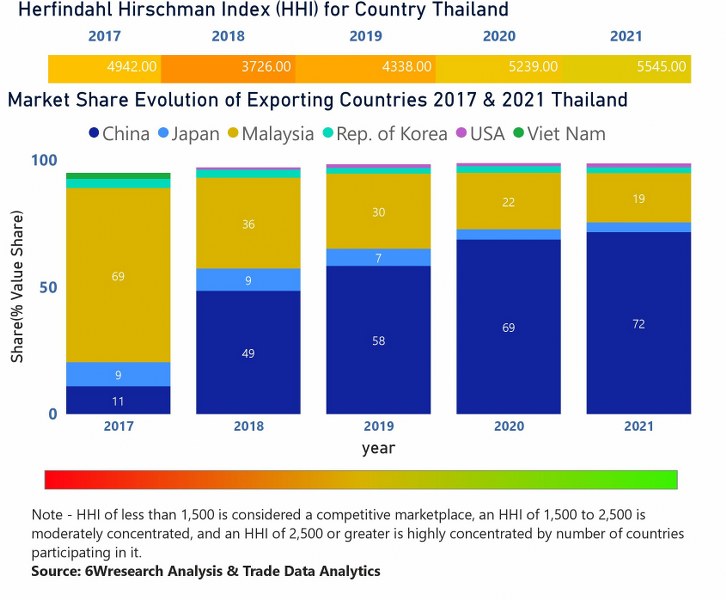

In the year 2021, China was the largest exporter in terms of value, followed by Malaysia. It has registered a growth of 7.67% over the previous year. While Malaysia registered a decline of -9.76% over the previous year. While in 2017 Malaysia was the largest exporter followed by China. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, Thailand had a Herfindahl index of 4942 in 2017 which signifies high concentration while in 2021 it registered a Herfindahl index of 5545 which signifies high concentration in the market

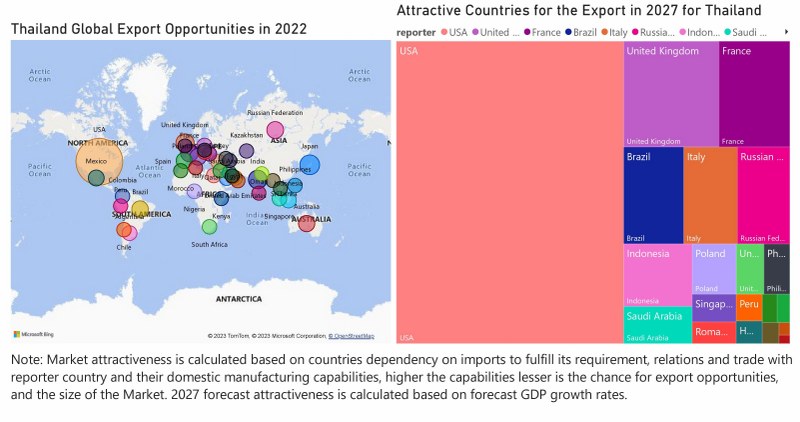

Thailand Air Conditioner (AC) Market - Export Market Opportunities

Thailand Air Conditioner (AC) Market - Export Market Opportunities

Topics Covered in the Thailand Air Conditioner (AC) Market

The Thailand Air Conditioner (AC) Market report thoroughly covers the market by type and by application. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Thailand Air Conditioner (AC) Market Synopsis

Thailand air conditioner market is presently ranked fourth in the world. With the rise of the middle class, urbanisation, and technological advancements, the air conditioner market is expected to grow further soon. The primary reason driving the market is the increasing number of middle-class households, along with the rapid urbanisation of the country, leading to a higher demand for air conditioners in both residential and commercial buildings.

According to 6Wresearch, the Thailand Air Conditioner (AC) Market size is expected to grow at a remarkable CAGR of 10.9% during the forecast period 2023-2029. The Thailand Air Conditioner (AC) Market is attaining growth owing to the number of innovations and developments being introduced in the market to align with the demands of consumers. The rising popularity of air conditioners with inverter features is one of the major developments going on in the Thailand Air Conditioner (AC) Industry. These units are more energy-efficient as compared to traditional models as they help save money on electricity bills while decreasing environmental impact. Smart home technology in AC systems is another development of the sector. Several manufacturers released products which can be controlled via smartphones and voice assistants such as Google Home and Alexa. The adoption of advanced technologies also helps to fuel the Thailand Air Conditioner (AC) Market Share. Increasing government penetration towards energy consumption would further lead to the development of the inverter air conditioner market.

Government Initiatives introduced in the Thailand Air Conditioner (AC) Market

Thailand Air Conditioner (AC) industry has been growing due to the introduction of government favourable policies in the country. The government launched several initiatives under its energy-saving policy for air conditioners. These policies are designed to encourage the use of energy-efficient air conditioners and reduce energy consumption. The government has introduced a rating system for air conditioners called the Thailand Energy Label, which measures the energy efficiency of air conditioners on a scale from 1 to 5 stars. The system mandates that all air conditioners sold in Thailand must carry an energy efficiency rating, making it easier for consumers to choose energy-efficient models.

Key Players in the Thailand Air Conditioner (AC) Market

Several players exist in the sector and it is with their constant efforts and strategies that the sector is boosting more and more with each passing day. Some crucial market players include LG Electronics Inc., Carrier Corporation, Midea Group Co. Ltd., Daikin Industries Ltd., Samsung Electronics Co. Ltd., Gree Electric Appliances Inc., Fujitsu General Limited, Haier Group Corporation, Johnson Controls International PLC, Mitsubishi Electric Corporation.

Market Analysis by Application

According to Dhaval, Research Manager, 6Wresearch, the Residential dominates the market and is expected to remain in a dominant position in the coming years. However, Commercial and retail are expected to have the fastest growth rate among all applications.

Key attractiveness of the report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022.

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Thailand Air Conditioner Market Outlook

- Market Size of Thailand Air Conditioner Market, 2022

- Forecast of Thailand Air Conditioner Market, 2029

- Historical Data and Forecast of Thailand Air Conditioner Revenues & Volume for the Period 2019 - 2029

- Thailand Air Conditioner Market Trend Evolution

- Thailand Air Conditioner Market Drivers and Challenges

- Thailand Air Conditioner Price Trends

- Thailand Air Conditioner Porter's Five Forces

- Thailand Air Conditioner Industry Life Cycle

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Type for the Period 2019 - 2029

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2019 - 2029

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2019 - 2029

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2019 - 2029

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2019 - 2029

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Application for the Period 2019 - 2029

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Residential for the Period 2019 - 2029

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Healthcare for the Period 2019 - 2029

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2019 - 2029

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2019 - 2029

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Hospitality for the Period 2019 - 2029

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Others for the Period 2019 - 2029

- Thailand Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Thailand Air Conditioner Top Companies Market Share

- Thailand Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- Thailand Air Conditioner Company Profiles

- Thailand Air Conditioner Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Application

- Residential

- Healthcare

- Commercial & Retail

- Transportation & Infrastructure

- Hospitality

- Others

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others) And Competitive Landscape

| Product Code: ETC090084 | Publication Date: Aug 2021 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Latest 2023 Developments of Thailand Air Conditioner (AC) Market

The Thailand Air Conditioner (AC) Market is attaining growth owing to the number of innovations and developments being introduced in the market in order to align with the demands of consumers. The rising popularity of air conditioners with inverter features is one of the major developments going on in the Thailand Air Conditioner (AC) Industry. These units are more energy-efficient as compared to traditional models as it helps in saving money on electricity bills while decreasing environmental impact. Smart home technology in AC systems is another development of the sector. A number of manufacturers released products which have the ability to be controlled via smartphones and voice assistants such as Google Home and Alexa. The adoption of advanced technologies also helps to fuel the Thailand Air Conditioner (AC) Market Share.

Topics Covered in The Thailand Air Conditioner (AC) Market

Thailand Air Conditioner (AC) Market report comprehensively covers the market type and application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, high growth areas, and market drivers, which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Thailand's Air Conditioner (AC) Market is projected to grow over the coming years. Thailand Air Conditioner (AC) Market report is a part of our periodical regional publication Asia Pacific Air Conditioner (AC) Market Outlook report. 6W tracks air conditioner market for over 60 countries with individual country-wise market opportunity assessment and publishes the report titled Global Air Conditioner (AC) Market outlook report annually.

Thailand Air Conditioner (AC) Market Synopsis

Thailand Air Conditioner (AC) Market is anticipated to register sound revenue during the upcoming period on account of an upsurge in the tourism sector. Growing industrialization and urbanization behold the increasing growth of the market. The rising population along with the building of houses and the development of the residential sector is driving the growth of the market. Moreover, hot weather and rising temperature are also adding to the potential development of the AC market in Thailand.

According to 6Wresearch, Thailand's Air Conditioner (AC) Market size is projected to grow at a CAGR of 9.6% during 2021-2027. Thailand occupies 3rd position in terms of the market size in the APAC Air Conditioner Market. The expansion of the healthcare sector due to the emergence of the global pandemic is driving the growth of the market. Increasing government penetration towards energy consumption would further lead to the development of the inverter air conditioner market. Also, the increasing preference of consumers regarding usage of the latest technology would lead to the growing demand for smart air conditioner further beholds the development of the market. However, the COVID-19 global pandemic hampered the growth of the market backed by the nationwide lockdown leading to the temporary shutting down of manufacturing units.

Market Analysis By Type

In terms of market by type, Room Air Conditioner dominates the market and is expected to remain in a dominant position in the coming years. However, Centralized Air Conditioner is expected to have the fastest growth rate among all types

Market Analysis by Application

In terms of application, Residential dominates the market and is expected to remain in a dominant position in the coming years. However, Commercial & Retail is expected to have the fastest growth rate among all applications

COVID-19 Impact on Thailand Air Conditioner (AC) Industry

Due to the slowdown in the economy of the country caused by the coronavirus pandemic, numerous consumers became more price-conscious as well as opted for cheaper AC models. Since factories shut down temporarily, the manufacturing sector had to face many challenges and as a result, there was a shortage of products which led to supply chain disruptions. Tourism in Thailand also decreased as there was a restriction on the tourism sector as well and the demand for air conditioners was reduced from large hotels, which affected the Thailand Air Conditioner (AC) Market Growth. People neglect spending on non-essential items when the pandemic hit, which, in turn, affected the market for air conditioners in Thailand.

Key Players Operating in Thailand Air Conditioner (AC) Market

A number of players exist in the sector and it is with their constant efforts and strategies that the sector is boosting more and more with each passing day. Some crucial market players include LG Electronics Inc., Carrier Corporation, Midea Group Co. Ltd., Daikin Industries Ltd., Samsung Electronics Co. Ltd., Gree Electric Appliances Inc., Fujitsu General Limited, Haier Group Corporation, Johnson Controls International PLC, Mitsubishi Electric Corporation.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Thailand Air Conditioner Market Outlook

- Market Size of Thailand Air Conditioner Market, 2020

- Forecast of Thailand Air Conditioner Market, 2027

- Historical Data and Forecast of Thailand Air Conditioner Revenues & Volume for the Period 2017 - 2027

- Thailand Air Conditioner Market Trend Evolution

- Thailand Air Conditioner Market Drivers and Challenges

- Thailand Air Conditioner Price Trends

- Thailand Air Conditioner Porter's Five Forces

- Thailand Air Conditioner Industry Life Cycle

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Type for the Period 2017 - 2027

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Application for the Period 2017 - 2027

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Healthcare for the Period 2017 - 2027

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2017 - 2027

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2017 - 2027

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Hospitality for the Period 2017 - 2027

- Historical Data and Forecast of Thailand Air Conditioner Market Revenues & Volume By Others for the Period 2017 - 2027

- Thailand Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Thailand Air Conditioner Top Companies Market Share

- Thailand Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- Thailand Air Conditioner Company Profiles

- Thailand Air Conditioner Key Strategic Recommendations

Market Segmentation:

The report provides a detailed analysis of the following market segments:

By Types:

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Application:

- Residential

- Commercial & Retail

- Healthcare

- Hospitality

- Transportation & Infrastructure

- Others

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero