India Structured Cabling Market (2018-2024) | Analysis, Size, Revenue, Trends, Growth, Forecast, Industry, Outlook, Value & Segmentation

Market Forecast By Product Types (Cables and Components), By Cable Types (Copper Cables and Fiber Optics), By Component Types (Racks & Cabinets, Patch Panel & Cross Connects, Communication Outlets and Patch Cords & Cable Assemblies), By Applications (Commercial, Residential, Industrial, Education and Others including Govt. Buildings and Transportation), By Regions (Eastern, Western, Northern and Southern) and Competitive Landscape

| Product Code: ETC000553 | Publication Date: Sep 2021 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 110 | No. of Figures: 68 | No. of Tables: 6 | |

India Structured Cabling Market Import Shipment Trend (2020-2024)

The India structured cabling market import shipment demonstrated robust growth with a notable CAGR from 2020-2024. The growth rate accelerated between 2023 and 2024, indicating increasing momentum. The market expanded significantly over the period, showcasing a strong upward trend.

Latest 2023 Developments of the India Structured Cabling Market

India Structured Cabling Market is innovating as the country's desire for higher bandwidth and transmission rates is growing. Furthermore, government initiatives to establish 100 smart towns and provide free Wi-Fi in trains, as well as rising demand for artificial intelligence-based buildings, are boosting market development in the country. The innovation is the introduction of contactless connectors. Contactless connections are an emerging solution for high-reliability markets that have typically pushed connectors through a large number of mating cycles, such as manufacturing and other automation-driven industries.

India Structured Cabling Market Synopsis

Upcoming infrastructural projects along with the establishment of new and expansion of existing metro railway networks would be some of the key drivers for the growth of the structured cabling market in India over the coming years. Further, government initiatives such as the Smart Cities Mission and Make in India campaign, would also strengthen the commercial and industrial sectors of the country which would generate more demand for structured cabling solutions in these domains during 2018-24.

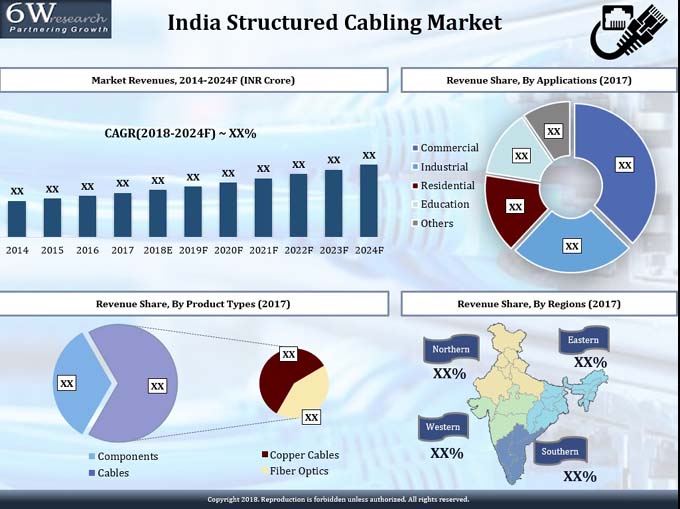

According to 6Wresearch, India structured cabling market size is projected to grow at a CAGR of 7.5% during 2018-2024. The Union Budget for 2019 laid special emphasis on infrastructure development in the country and with a continued focus on setting up new data centres, office spaces, hotels, healthcare facilities, and other commercial establishments in India, the market for structured cabling solutions is expected to reap the benefits as well during the forecast period.

The cables segment occupied the majority of the overall India structured cabling market share, by product type, in 2017. Structured cabling is extensively used across multiple applications such as transportation infrastructure projects, IT & telecom industries, and smart homes as well. However, due to a shorter life cycle, the components market is also expected to grow at a healthy pace over the years to come.

The India structured cabling market report thoroughly covers India's structured cabling market by product types, applications, and regions. The India structured cabling market outlook report provides an unbiased and detailed analysis of the India structured cabling market trends, opportunities/high growth areas, and market drivers, which would help stakeholders device and align market strategies according to the current and future market dynamics. India structured cabling market's increasing demand for copper cables, increasing number of product launches in the market, centre market, growing data centre market and rising demand for bandwidth solution is the major factor in the increasing growth rate of the market. India-based structure of the cabling market has been divided into such as cat5e, cat6, cat6A, and cat7 cables having different categories in the large market of structured cabling in India. The Cat6 cable is the most popular among all these cables such as cat5, cat5e, and cat3. In the forecast period, cat6A cable is expected to register high, and demand also increases in the market for Cat6A.

India structured cabling market is projected to grow more in the forecast period. There is a lot of products which going to increase in demand such as copper cables, an increase in the number of product that is launched and different activities, and growth in the data center market. There are key players in how going to rise the demand for the structured cabling market. There is an application that has been categorized in many sectors of the data center and LAN facilities. The data center people going to register more and more chances to register faster growth in the market in the upcoming years.

India structured cabling market is anticipated to register significant market growth in the coming years backed by the growth and development of the telecommunications industry in the country. Structured cabling is the buzzword in the cable management world and with an increased demand for technology upgrades and advancements in the telecommunications grid, the structured cabling market is expected to garner potential revenues in India in the coming years. Technical advantages of structured cabling such as reduced jungle wiring system, reduction in the risk of downtime, cost-effectiveness, and less time consumption are, further, expected to trigger the market value for India structured cabling market during the forecast period 2020-26F. The right structured cabling system ensures increased data transmission speed, reduced power consumption costs, and enhanced network performance and is the center of attraction for the cable management world and would contribute towards generating significant demand projections in the coming and benefit the healthy growth of India structured cabling market in the near future.

India structured cabling market is projected to witness tremendous growth in the forthcoming years on the back of the rising wide scope of applications in the automotive and energy sector. Further, the residential sector is estimated to generate high sales revenues in the market underpinned by the rising cosmetics sectors expansion like malls, and offices as a result structured cabling also rises to ensure adequate power supply.

The top players operating in the structured cabling market include Belden Inc., 3C3 India Pvt. Ltd.., Molex LLC., Legrand Holding SA and ABB Group.

Key Highlights of the Report:

• India Structured Cabling Market Overview

• India Structured Cabling Market Outlook

• India Structured Cabling Market Forecast

• Historical data of Global Structured Cabling Market Revenues, 2014-2017

• Market Size & Forecast of Global Structured Cabling Market Revenues, until 2024

• Historical data of India Structured Cabling Market Revenues, 2014-2017

• India Structured Cabling Market Size & India Structured Cabling Market Forecast of Revenues, until 2024

• Historical Data of India Structured Cabling Market Revenues, By Product Types, 2014-2017

• Market Size & Forecast of India Structured Cabling Market Revenues, By Product Types until, 2024

• Historical Data of India Structured Cabling Market Revenues, By Applications, 2014-2017

• Market Size & Forecast of India Structured Cabling Market Revenues, By Applications, Until 2024

• Historical Data of India Structured Cabling Market Revenues, By Regions, 2014-2017

• Market Size & Forecast of India Structured Cabling Market Revenues, By Regions, Until 2024

• Market Drivers and Restraints

• India Structured Cabling Market Trends and Opportunities

• Porter's Five Force Analysis and Market Opportunity Assessment

• India Structured Cabling Market Share, By Players

• India Structured Cabling Market Overview on Competitive Landscape

• Company Profiles and Key Strategic Recommendations

Markets Covered

The India Structured Cabling Market report provides a detailed analysis of the following market segments:

By Product Types

- Cables

- Components

By Cable Types

- Copper Cables

- Fiber Optics

By Component Types

- Racks & Cabinets

- Patch Panel & Cross Connects

- Communication Outlets

- Patch Cords & Cable Assemblies

By Applications

- Commercial

- Residential

- Industrial

- Education

- Others (Govt. Buildings, Transportation, etc.)

By Regions

- Eastern

- Western

- Northern

- Southern

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Global Structured Cabling Market Overview |

| 3.1. Global Structured Cabling Market Revenues, 2014-2024F |

| 3.2. Global Structured Cabling Market Revenues, By Regions, 2014-2024F |

| 4. India Structured Cabling Market Overview |

| 4.1. India Country Indicators |

| 4.2. India Structured Cabling Market Revenues, 2014-2024F |

| 4.3. India Structured Cabling Market - Industry Life Cycle |

| 4.4. India Structured Cabling Market - Porter's Five Forces Model |

| 4.5. India Structured Cabling Market Revenue Share, By Product Types, 2017 & 2024F |

| 4.6. India Structured Cabling Market Revenue Share, By Cable Types, 2017 & 2024F |

| 4.7. India Structured Cabling Market Revenue Share, By Component Types, 2017 & 2024F |

| 4.8. India Structured Cabling Market Revenue Share, By Applications, 2017 & 2024F |

| 4.9. India Structured Cabling Market Revenue Share, By Regions, 2017 & 2024F |

| 5. India Structured Cabling Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.2.1 Increasing demand for high-speed internet and data connectivity in India |

| 5.2.2 Growing adoption of cloud services and data centers in the country |

| 5.2.3 Government initiatives to promote digitalization and smart city projects |

| 5.3. Market Restraints |

| 5.3.1 High initial investment and installation costs associated with structured cabling systems |

| 5.3.2 Lack of skilled professionals for designing and implementing structured cabling solutions |

| 5.3.3 Rapidly changing technology leading to the need for frequent upgrades and replacements |

| 6. India Structured Cabling Market Trends |

| 7. India Structured Cabling Market Overview, By Product Types |

| 7.1. India Cables Market Revenues, 2014-2024F |

| 7.2. India Cables Market Revenues, By Types, 2017 & 2024F |

| 7.2.1. India Fiber Cables Market Revenues, 2014-2024F |

| 7.2.2. India Copper Cables Market Revenues, 2014-2024F |

| 7.2.2.1 India Shielded Copper Cables Market Revenues, 2014-2024F |

| 7.2.2.2 India Unshielded Copper Cables Market Revenues, 2014-2024F |

| 7.3. India Structured Cabling Components Market Revenues, 2014-2024F |

| 7.4. India Structured Cabling Components Market Revenues, By Types, 2017 & 2024F |

| 7.4.1. India Communication Outlets Market Revenues, 2014-2024F |

| 7.4.2. India Patch Panels & Cross Connects Market Revenues, 2014-2024F |

| 7.4.3. India Patch Cords & Cable Assemblies Market Revenues, 2014-2024F |

| 7.4.4. India Racks & Cabinets Market Revenues, 2014-2024F |

| 8. India Structured Cabling Market Overview, By Applications |

| 8.1. India Structured Cabling Market Revenues, By Commercial Application, 2014-2024F |

| 8.1.1. India Office Sector Outlook |

| 8.1.2. India Retail Sector Outlook |

| 8.1.3. India Hospitality Sector Outlook |

| 8.1.4. India Airport Sector Outlook |

| 8.2. India Structured Cabling Market Revenues, By Residential Application, 2014-2024F |

| 8.2.1. India Residential Sector Outlook |

| 8.3. India Structured Cabling Market Revenues, By Industrial Application, 2014-2024F |

| 8.3.1. India Industrial Sector Outlook |

| 8.4. India Structured Cabling Market Revenues, By Education Application, 2014-2024F |

| 8.4.1. India Education Sector Outlook |

| 8.5. India Structured Cabling Market Revenues, By Other Applications, 2014-2024F |

| 8.5.1. India Transportation Sector Outlook |

| 9. India Structured Cabling Market Overview, By Regions |

| 9.1. India Structured Cabling Market Revenues, By Northern Region, 2014-2024F |

| 9.2. India Structured Cabling Market Revenues, By Western Region, 2014-2024F |

| 9.3. India Structured Cabling Market Revenues, By Eastern Region, 2014-2024F |

| 9.4. India Structured Cabling Market Revenues, By Southern Region, 2014-2024F |

| 10. India Structured Cabling Market - Key Performance Indicators |

| 10.1. India Government Spending Outlook |

| 10.2. India Transportation Infrastructure Outlook |

| 11. India Structured Cabling Market Opportunity Assessment |

| 11.1. By Product Types |

| 11.2. By Component Types |

| 11.3. By Application Types |

| 12. India Structured Cabling Market - Competitive Landscape |

| 12.1. Competitive Benchmarking, By Product Types |

| 12.2. India Structured Cabling Market Revenue Share, By Company, 2017 |

| 13. Company Profiles |

| 13.1. CommScope Holding Company, Inc. |

| 13.2. Schneider Electric India Pvt. Ltd. |

| 13.3. Belden Inc. |

| 13.4. Molex Incorporated |

| 13.5. D-Link (India) Limited. |

| 13.6. Legrand (India) Pvt. Ltd. |

| 13.7. The Siemon Company LLC. |

| 13.8. Digisol Systems Ltd. |

| 13.9. Corning Incorporated |

| 13.10. Sterlite Technologies Ltd. |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| 1. Global Structured Cabling Market Revenues, 2014-2024F ($ Billion) |

| 2. Global Structured Cabling Market Revenues, By Region, 2014-2024F ($ Billion) |

| 3. India Structured Cabling Market Revenues, 2014-2024F (INR Crore) |

| 4. India Structured Cabling Market Revenue Share, By Product Types, 2017 & 2024F |

| 5. India Structured Cabling Market Revenue Share, By Cable Types, 2017 & 2024F |

| 6. India Structured Cabling Market Revenue Share, By Component Types, 2017 & 2024F |

| 7. India Structured Cabling Market Revenue Share, By Applications, 2017 & 2024F |

| 8. India Structured Cabling Market Revenue Share, By Regions, 2017 & 2024F |

| 9. India Construction Industry Value, 2017-22F (INR Trillion) |

| 10. Copper Stock Prices, Aug-Nov 2018 (INR/kg) |

| 11. India Cables Market Revenues, 2014-2024F (INR Crore) |

| 12. India Cables Market Revenue Share, 2017 & 2024F |

| 13. India Copper Cables Market Revenues, 2014-2024F (INR Crore) |

| 14. India Copper Cables Market Revenue Share, 2017 & 2024F |

| 15. India Fiber Optics Market Revenues, 2014-2024F (INR Crore) |

| 16. India Fiber Optics Market Revenue Share, 2017 & 2024F |

| 17. India Shielded Copper Cables Market Revenues, 2014-2024F (INR Crore) |

| 18. India Shielded Copper Cables Market Revenue Share, 2017 & 2024F |

| 19. India Unshielded Copper Cables Market Revenues, 2014-2024F (INR Crore) |

| 20. India Unshielded Copper Cables Market Revenue Share, 2017 & 2024F |

| 21. India Structured Cabling Components Market Revenues, 2014-2024F (INR Crore) |

| 22. India Structured Cabling Components Market Revenue Share, 2017 & 2024F |

| 23. India Communication Outlets Market Revenues, 2014-2024F (INR Crore) |

| 24. India Communication Outlets Market Revenue Share, 2017 & 2024F |

| 25. India Patch Panels & Cross Connects Market Revenues, 2014-2024F (INR Crore) |

| 26. India Patch Panels & Cross Connects Market Revenue Share, 2017 & 2024F |

| 27. India Patch Cords & Cable Assemblies Market Revenues, 2014-2024F (INR Crore) |

| 28. India Patch Cords & Cable Assemblies Market Revenue Share, 2017 & 2024F |

| 29. India Racks and Cabinets Market Revenues, 2014-2024F (INR Crore) |

| 30. India Racks and Cabinets Market Revenue Share, 2017 & 2024F |

| 31. India Structured Cabling Market Revenues, By Commercial Application, 2014-2024F (INR Crore) |

| 32. India Structured Cabling Market Revenue Share, By Commercial Application, 2017 & 2024F |

| 33. Gurugram New Office Supply, 2018-20F (Million sq. ft.) |

| 34. Noida New Office Supply, 2018-20F (Million sq. ft.) |

| 35. Mumbai New Office Supply, 2018-20F (Million sq. ft.) |

| 36. Bengaluru New Office Supply, 2018-20F (Million sq. ft.) |

| 37. Pune New Office Supply, 2018-20F (Million sq. ft.) |

| 38. Chennai New Office Supply, 2018-20F (Million sq. ft.) |

| 39. India Retail Market Size, 2016-2020F (INR Lakh Crore) |

| 40. India e-Tailing Market Size, 2016-2020F (INR Lakh Crore) |

| 41. India Upcoming Mall Supply, 2017-20 (million sq.ft.) |

| 42. India Structured Cabling Market Revenues, By Residential Application, 2014-2024F (INR Crore) |

| 43. India Structured Cabling Market Revenue Share, By Residential Application, 2017 & 2024F |

| 44. Housing Needs in Top 10 Indian States by 2022 (Lakh Units) |

| 45. India Structured Cabling Market Revenues, By Industrial Application, 2014-2024F (INR Crore) |

| 46. India Structured Cabling Market Revenue Share, By Industrial Application, 2017 & 2024F |

| 47. India Existing and Upcoming SEZ Supply, 2017-20F (Million Sq. Ft.) |

| 48. India Structured Cabling Market Revenues, By Educational Application, 2014-2024F (INR Crore) |

| 49. India Structured Cabling Market Revenue Share, By Educational Application, 2017 & 2024F |

| 50. India Education Spending, 2013-19 (INR Thousand Crore) |

| 51. India Structured Cabling Market Revenues, By Other Applications, 2014-2024F (INR Crore) |

| 52. India Structured Cabling Market Revenue Share, By Other Applications, 2017 & 2024F |

| 53. Investment Projections for Urban Rail Segment, 2018-25F (INR Billion) |

| 54. India Structured Cabling Market Revenues, By Northern Region, 2014-2024F (INR Crore) |

| 55. India Structured Cabling Market Revenue Share, By Northern Region, 2017 & 2024F |

| 56. India Structured Cabling Market Revenues, By Western Region, 2014-2024F (INR Crore) |

| 57. India Structured Cabling Market Revenue Share, By Western Region, 2017 & 2024F |

| 58. India Structured Cabling Market Revenues, By Eastern Region, 2014-2024F (INR Crore) |

| 59. India Structured Cabling Market Revenue Share, By Eastern Region, 2017 & 2024F |

| 60. India Structured Cabling Market Revenues, By Southern Region, 2014-2024F (INR Crore) |

| 61. India Structured Cabling Market Revenue Share, By Southern Region, 2017 & 2024F |

| 62. India Actual Government Spending Vs Actual Government Revenues, FY2014-FY2019 (INR Lakh Crore) |

| 63. India Expected Government Budget Outlook, FY2019 |

| 64. India Planned Metro Network Expansion - New Lines (km) |

| 65. India Structured Cabling Market Opportunity Assessment, By Product Types, 2024F |

| 66. India Structured Cabling Market Opportunity Assessment, By Component Types, 2024F |

| 67. India Structured Cabling Market Opportunity Assessment, By Applications, 2024F |

| 68. India Structured Cabling Market Revenue Share, By Company, 2017 |

| List of Tables |

| 1. India Proposed Branded New Hotel Room Supply, FY2021 (Number of Rooms) |

| 2. India Upcoming Airport Projects |

| 3. India Additional Housing Requirement By 2022 (Million Units) |

| 4. India State-Wise Housing Requirement by 2022 (Lakh Units) |

| 5. India Under Construction LNG Import Terminals |

| 6. India Upcoming Infrastructure Projects |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero