Middle East Power Tools Market (2018-2024) | Size, Trends, Analysis, Share, Segmentation, Growth, Value, Revenue, Industry, Outlook & COVID-19 IMPACT

Market Forecast By Types (Electric and Pneumatic), By Tool Types (Metal, Concrete, Wood Working, and Others), By Verticals (Construction, Automotive, Manufacturing, and Others), By Countries (Turkey, Iran, Saudi Arabia, UAE, Qatar, Oman, Bahrain, and Kuwait) and Competitive Landscape

| Product Code: ETC000508 | Publication Date: Sep 2022 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 290 | No. of Figures: 255 | No. of Tables: 25 |

Middle East Power Tools Market Synopsis

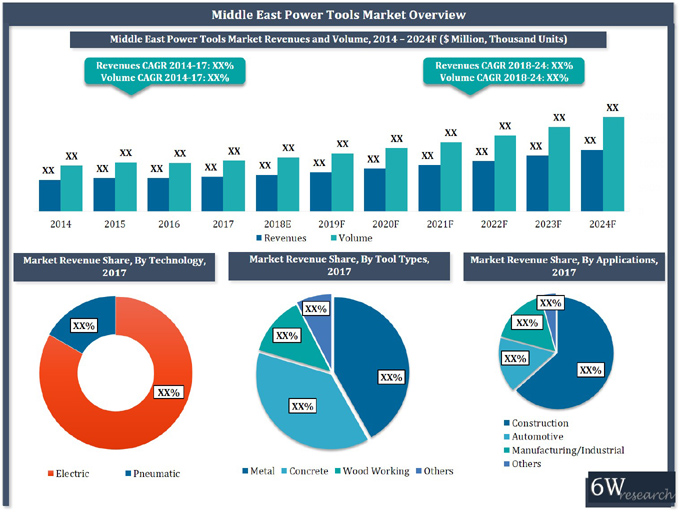

Middle East Power Tools Market is anticipated to project substantial growth during the upcoming years on account of development of advanced and automotive technology. Growing advancement of technology coupled with increasing investment in research and development is proliferating the Middle East Power Tools Market share. Growing urbanization, modernization and infrastructure development are some of the key factors proliferating the growth of the market. Growing need for automation coupled with shortage of availability of labour is providing lucrative opportunities to the growth of the market. Increasing availability of energy efficient tools is also driving the growth of the industry.

Middle East Power Tools Market Report thoroughly covers the market by tool types, technology types, applications, and countries. The Middle East Power Tools Market Outlook report provides an unbiased and detailed analysis of Middle East Power Tools Market Trends, opportunities/high growth areas, and market drivers, which would help the stakeholders to device and align market strategies according to the current and future market dynamics

The Middle East region is recording immense opportunities in the power tools industry, wherein Turkey and Iran posted the highest market revenues. In the GCC region, Saudi Arabia and UAE recorded the highest market revenue share. The power tools industry is predominantly driven by growth in the construction sector, followed by the manufacturing and automotive sectors. During 2014-16, several Middle East countries particularly, Saudi Arabia recorded a decline in economic growth, affecting the overall construction sector. This decrease in economic growth was primarily due to a decline in oil prices, however, post-2017, countries reported uplifted growth as a result of an increasing number of construction project contracts. Additionally, infrastructure, hospitality, and retail were the key growing sub-sectors.

Middle East Power Tools Market is having political and economic instabilities. On the basis of the detailed analysis, what are ongoing trends, opportunities, the factor of the high growth areas? There is a tool used for the cover of the report such as technology types, countries, and applications.

According to 6Wresearch, the Middle East Power Tools market size is projected to grow at a CAGR of 9.0% during 2018-24. From 2018 onwards, countries such as UAE and Qatar are likely to witness the highest number of construction projects, due to upcoming events such as the World Expo in 2020, and FIFA World Cup 2022. Apart from this, countries such as Turkey are likely to post further growth in the construction sector after the recovery from an economic slowdown.

In the Middle East power tools market, steady growth with the help of construction activates and expansion of the industrial sector and manufacturing. According to the research, the Middle East market in tools will grow more in the upcoming years. In the Middle East power tools market, there are multiple projects of construction in upcoming years such as the world expo and the FIFA world cup. The other country also a contributor to the power tools market in the Middle East power tools for the stabilities of the political and economic. There are different types of tools also introduce in the middle east such as electric power tools, pneumatic power tools going to increase in the growth in the automotive and manufacturing sectors during the forecast period.

The Middle East power tools market will grow more in the forecast period by using construction activities and according to that expand the manufacturing and industrial sector for increasing the revenue. The Middle East using the power tools market try to maintain stabilities in politics and economics. The power tools market having different power tools such as technology type, application type, and based on country. The report is prepared on the basis of ongoing trends and opportunities. In the Middle East to increase the expenditure of the power tools market the highest number of construction projects going to complete in the forecast period for the development of the country. The Middle East power tools market is anticipated to garner potential revenues in the coming years backed by a spur in the construction sector across the Middle Eastern countries especially Turkey, UAE, and Qatar. Also, significant growth in the automotive and manufacturing sector would propel market growth for the pneumatic power tools segment in the upcoming six years. An increase in the economic diversification plans along with government support policies would provide momentum for the growth of the construction industry in the developed countries across the Middle East region and would lead to an increased market value of the Middle East power tools market in the upcoming six years.

Market Analysis by Types

Within the power tools market, the electric power tools segment account for maximum revenue share in the overall Middle East Power Tools market share, however, the pneumatic power tools segment would register high growth during the forecast period, backed by expected growth in automotive and manufacturing sectors.

Key Players in the Middle East Power Tools Market

Some of the key players in Middle East Power Tools Market are:

- Stanley Black & Decker, Inc. (US)

- Robert Bosch GmbH (Germany)

- Techtronic Industries Co. Ltd. (Hong Kong)

- Makita Corporation (Japan)

- Hilti Corporation (Liechtenstein)

- Atlas Copco AB (Sweden)

- Ingersoll Rand (US)

- Snap-on Incorporated (US)

- Apex Tool Group (US)

- Koki Holding Co., Ltd. (Japan)

- Honeywell International Inc. (US)

- 3M (US)

- Emerson Electric Co. (US)

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2014 to 2017.

- Base Year: 2017.

- Forecast Data until 2024.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Middle East Power Tools Market Overview

- Middle East Power Tools Market Outlook.

- Middle East Power Tools Market Forecast.

- Middle East Power Tools Market Size and Middle East Power Tools Market Forecast revenues until 2024.

- Historical Data of Global Power Tools Market Revenues for the Period 2014-2017

- Market Size & Forecast of Global Power Tools Market Revenues until 2024F

- Historical Data of Middle East Power Tools Market Revenues & Volume for the Period 2014-2017

- Market Size & Forecast of Middle East Power Tools Market Revenues & Volume until 2024F

- Historical Data of Turkey Power Tools Market Revenues & Volume for the Period 2014-2017

- Market Size & Forecast of Turkey Power Tools Market Revenues & Volume until 2024F

- Historical Data of Iran Power Tools Market Revenues & Volume for the Period 2014-2017

- Market Size & Forecast of Iran Power Tools Market Revenues & Volume until 2024F

- Historical Data of Saudi Arabia Power Tools Market Revenues & Volume for the Period 2014-2017

- Market Size & Forecast of Saudi Arabia Power Tools Market Revenues & Volume until 2024F

- Historical Data of UAE Power Tools Market Revenues & Volume for the Period 2014-2017

- Market Size & Forecast of UAE Power Tools Market Revenues & Volume until 2024F

- Historical Data of Qatar Power Tools Market Revenues & Volume for the Period 2014-2017

- Market Size & Forecast of Qatar Power Tools Market Revenues & Volume until 2024F

- Historical Data of Bahrain Power Tools Market Revenues & Volume for the Period 2014-2017

- Market Size & Forecast of Bahrain Power Tools Market Revenues & Volume until 2024F

- Market Size & Forecast of Kuwait Power Tools Market Revenues & Volume until 2024F

- Historical Data of Oman Power Tools Market Revenues & Volume for the Period 2014-2017

- Market Size & Forecast of Oman Power Tools Market Revenues & Volume until 2024F

- Historical Data & Forecast of Middle Eastern Countries Power Tools Market Revenues & Volume, By Tool Types for the Period 2014-2024F

- Historical Data & Forecast of Middle Eastern Countries Power Tools Market Revenues & Volume, By Verticals for the Period 2014-2024F

- Historical Data & Forecast of Middle Eastern Countries Power Tools Market Revenues & Volume, By Technology Types for the Period 2014-2024F

- Historical Data & Forecast of Middle Eastern Countries Power Tools Market Revenues & Volume, By Regions for the Period 2014-2024F

- Middle East Power Tools Market Trends, Drivers, and Restraints.

- Middle East Power Tools Market Share, By Players

- Middle East Power Tools Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Pointers

Markets Covered

The Middle East Power Tools Market Report provides a detailed analysis of the following market segments:

By Types

- Electric

- Pneumatic

By Tool Types

- Metal

- Concrete

- Wood Working

- Others

By Verticals

- Construction

- Automotive

- Manufacturing

- Others

By Countries

- Turkey

- Iran

- Saudi Arabia

- UAE

- Qatar

- Oman

- Bahrain

- Kuwait

Middle East Power Tools Market: FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Global Power Tools Market Overview |

| 3.1 Global Power Tools Market Revenues (2014-24F) |

| 3.2 Global Power Tools Market Revenue Share, By Regions (2017) |

| 4 Middle East Power Tools Market Overview |

| 4.1 Overview & Analysis |

| 4.2 Middle East Power Tools Market Revenues & Volume (2014-24F) |

| 4.3 Middle East Power Tools Market, Industry Life Cycle |

| 4.4 Middle East Power Tools Market, Porter's Five Forces |

| 4.5 Middle East Power Tools Market Revenue Share, By Technology Types (2017 & 2024F) |

| 4.6 Middle East Power Tools Market Revenue Share, By Tools Type (2017 & 2024F) |

| 4.7 Middle East Power Tools Market Revenue Share, By Verticals (2017 & 2024F) |

| 4.8 Middle East Power Tools Market Revenue Share, By Regions (2017 & 2024F) |

| 5 Middle East Power Tools Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.3 Market Restraints |

| 6 Middle East Power Tools Market Trends |

| 7 Turkey Power Tools Market Overview |

| 7.1 Overview & Analysis |

| 7.2 Turkey Power Tools Market Revenues & Volume (2014-24F) |

| 7.3 Turkey Power Tools Market - Opportunity Matrix |

| 7.4 Turkey Power Tools Market Ecosystem |

| 7.5 Turkey Power Tools Market Overview, By Technology Types |

| 7.5.1 Turkey Electric Power Tools Market Revenues (2014-24F) |

| 7.5.2 Turkey Pneumatic Power Tools Market Revenues (2014-24F) |

| 7.6 Turkey Power Tools Market Overview, By Tools Types |

| 7.6.1 Turkey Metal Segment Power Tools Market Revenues & Volume (2014-24F) |

| 7.6.2 Turkey Concrete Segment Power Tools Market Revenue & Volume (2014-24F) |

| 7.6.3 Turkey Woodworking segment Tools Market Revenues & Volume (2014-24F) |

| 7.6.4 Turkey Other Power Tools Market Revenues & Volume (2014-24F) |

| 7.7 Turkey Power Tools Market Overview, By Verticals |

| 7.8 Turkey Power Tools Market Overview, By Regions |

| 8 Iran Power Tools Market Overview |

| 8.1 Overview & Analysis |

| 8.2 Iran Power Tools Market Revenues & Volume (2014-24F) |

| 8.3 Iran Power Tools Market - Opportunity Matrix |

| 8.4 Iran Power Tools Market Ecosystem |

| 8.5 Iran Power Tools Market Overview, By Technology Types |

| 8.5.1 Iran Electric Power Tools Market Revenues (2014-24F) |

| 8.5.2 Iran Pneumatic Power Tools Market Revenues (2014-24F) |

| 8.6 Iran Power Tools Market Overview, By Tools Types |

| 8.6.1 Iran Metal Segment Power Tools Market Revenues & Volume (2014-24F) |

| 8.6.2 Iran Concrete Segment Power Tools Market Revenue & Volume (2014-24F) |

| 8.6.3 Iran Woodworking segment Tools Market Revenues & Volume (2014-24F) |

| 8.6.4 Iran Other Power Tools Market Revenues &Volume (2014-24F) |

| 8.7 Iran Power Tools Market Overview, By Verticals |

| 8.8 Iran Power Tools Market Overview, By Regions |

| 9 Saudi Arabia Power Tools Market Overview |

| 9.1 Overview & Analysis |

| 9.2 Saudi Arabia Power Tools Market Revenues & Volume (2014-24F) |

| 9.3 Saudi Arabia Power Tools Market- Opportunity Matrix |

| 9.4 Saudi Arabia Power Tools Market Ecosystem |

| 9.5 Saudi Arabia Power Tools Market Overview, By Technology Types |

| 9.5.1 Saudi Arabia Electric Power Tools Market Revenues (2014-24F) |

| 9.5.2 Saudi Arabia Pneumatic Power Tools Market Revenues (2014-24F) |

| 9.6 Saudi Arabia Power Tools Market Overview, By Tools Types |

| 9.6.1 Saudi Arabia Metal Segment Power Tools Market Revenues & Volume (2014-24F) |

| 9.6.2 Saudi Arabia Concrete Segment Power Tools Market Revenue & Volume (2014-24F) |

| 9.6.3 Saudi Arabia Woodworking segment Tools Market Revenues & Volume (2014-24F) |

| 9.6.4 Saudi Arabia Other Power Tools Market Revenues & Volume (2014-24F) |

| 9.7 Saudi Arabia Power Tools Market Overview, By Verticals |

| 9.8 Saudi Arabia Power Tools Market Overview, By Regions |

| 10 UAE Power Tools Market Overview |

| 10.1 Overview & Analysis |

| 10.2 UAE Power Tools Market Revenues & Volume (2014-24F) |

| 10.3 UAE Power Tools Market - Opportunity Matrix |

| 10.4 UAE Power Tools Market Ecosystem |

| 10.5 UAE Power Tools Market Overview, By Technology Types |

| 10.5.1 UAE Electric Power Tools Market Revenues e (2014-24F) |

| 10.5.2 UAE Pneumatic Power Tools Market Revenues (2014-24F) |

| 10.6 UAE Power Tools Market Overview, By Tools Types |

| 10.6.1 UAE Metal Segment Power Tools Market Revenues & Volume (2014-24F) |

| 10.6.2 UAE Concrete Segment Power Tools Market Revenue & Volume (2014-24F) |

| 10.6.3 UAE Woodworking segment Tools Market Revenues & Volume (2014-24F) |

| 10.6.4 UAE Other Power Tools Market Revenues & Volume (2014-24F) |

| 10.7 UAE Power Tools Market Overview, By Verticals |

| 10.8 UAE Power Tools Market Overview, By Regions |

| 11 Qatar Power Tools Market Overview |

| 11.1 Overview & Analysis |

| 11.2 Qatar Power Tools Market Revenues & Volume (2014-24F) |

| 11.3 Qatar Power Tools Market - Opportunity Matrix |

| 11.4 Qatar Power Tools Market Ecosystem |

| 11.5 Qatar Power Tools Market Overview, By Technology Types |

| 11.5.1 Qatar Electric Power Tools Market Revenues (2014-24F) |

| 11.5.2 Qatar Pneumatic Power Tools Market Revenues (2014-24F) |

| 11.6 Qatar Power Tools Market Overview, By Tools Types |

| 11.6.1 Qatar Metal Segment Power Tools Market Revenues & Volume (2014-24F) |

| 11.6.2 Qatar Concrete Segment Power Tools Market Revenue & Volume (2014-24F) |

| 11.6.3 Qatar Woodworking segment Tools Market Revenues & Volume (2014-24F) |

| 11.6.4 Qatar Other Power Tools Market Revenues & Volume (2014-24F) |

| 11.7 Qatar Power Tools Market Overview, By Verticals |

| 11.8 Qatar Power Tools Market Overview, By Regions |

| 12 Oman Power Tools Market Overview |

| 12.1 Overview & Analysis |

| 12.2 Oman Power Tools Market Revenues & Volume (2014-24F) |

| 12.3 Oman Power Tools Market- Opportunity Matrix |

| 12.4 Oman Power Tools Market Ecosystem |

| 12.5 Oman Power Tools Market Overview, By Technology Types |

| 12.5.1 Oman Electric Power Tools Market Revenues (2014-24F) |

| 12.5.2 Oman Pneumatic Power Tools Market Revenues (2014-24F) |

| 12.6 Oman Power Tools Market Overview, By Tools Types |

| 12.6.1 Oman Metal Segment Power Tools Market Revenues & Volume (2014-24F) |

| 12.6.2 Oman Concrete Segment Power Tools Market Revenue & Volume (2014-24F) |

| 12.6.3 Oman Woodworking segment Tools Market Revenues & Volume (2014-24F) |

| 12.6.4 Oman Other Power Tools Market Revenues & Volume (2014-24F) |

| 12.7 Oman Power Tools Market Overview, By Verticals |

| 12.8 Oman Power Tools Market Overview, By Regions |

| 13 Kuwait Power Tools Market Overview |

| 13.1 Overview & Analysis |

| 13.2 Kuwait Power Tools Market Revenues & Volume (2014-24F) |

| 13.3 Kuwait Power Tools Market - Opportunity Matrix |

| 13.4 Kuwait Power Tools Market Ecosystem |

| 13.5 Kuwait Power Tools Market Overview, By Technology Types |

| 13.5.1 Kuwait Electric Power Tools Market Revenues (2014-24F) |

| 13.5.2 Kuwait Pneumatic Power Tools Market Revenues (2014-24F) |

| 13.6 Kuwait Power Tools Market Overview, By Tools Types |

| 13.6.1 Kuwait Metal Segment Power Tools Market Revenues & Volume (2014-24F) |

| 13.6.2 Kuwait Concrete Segment Power Tools Market Revenue & Volume (2014-24F) |

| 13.6.3 Kuwait Woodworking segment Tools Market Revenues & Volume (2014-24F) |

| 13.6.4 Kuwait Other Power Tools Market Revenues & Volume (2014-24F) |

| 13.7 Kuwait Power Tools Market Overview, By Verticals |

| 13.8 Kuwait Power Tools Market Overview, By Regions |

| 14 Bahrain Power Tools Market Overview |

| 14.1 Overview & Analysis |

| 14.2 Bahrain Power Tools Market Revenues & Volume (2014-24F) |

| 14.3 Bahrain Power Tools Market - Opportunity Matrix |

| 14.4 Bahrain Power Tools Market Ecosystem |

| 14.5 Bahrain Power Tools Market Overview, By Technology Types |

| 14.5.1 Bahrain Electric Power Tools Market Revenues (2014-24F) |

| 14.5.2 Bahrain Pneumatic Power Tools Market Revenues (2014-24F) |

| 14.6 Bahrain Power Tools Market Overview, By Tools Types |

| 14.6.1 Bahrain Metal Segment Power Tools Market Revenues & Volume (2014-24F) |

| 14.6.2 Bahrain Concrete Segment Power Tools Market Revenue & Volume (2014-24F) |

| 14.6.3 Bahrain Woodworking segment Tools Market Revenues & Volume (2014-24F) |

| 14.6.4 Bahrain Other Power Tools Market Revenues & Volume (2014-24F) |

| 14.7 Bahrain Power Tools Market Overview, By Verticals |

| 14.8 Bahrain Power Tools Market Overview, By Regions |

| 15 Middle East Power Tools Market - Competitive Landscape |

| 15.1 Competitive Benchmarking, By Operating Parameters |

| 15.2 Middle East Power Tools Market Revenue Share, By Companies (2017) |

| 16 Company Profiles |

| 16.1 Black and Decker GMBH |

| 16.2 Hilti Middle East FZE |

| 16.3 Hitachi Sales Middle East FZE |

| 16.4 Makita Gulf FZE |

| 16.5 Robert Bosch Middle East |

| 16.6 Techtronic Industries FZCO |

| 17 Key Strategic Pointers |

| 18 Disclaimer |

| List of Figures |

| 1. Global Power Tools Market Revenues, 2014-2024F ($ Billion) |

| 2. Global Sale of New Vehicles (all type), 2014-2017 (Thousand Units) |

| 3. Global Power Tools Market Revenue Share, By Regions (2017) |

| 4. Middle East Countries' Construction Market Revenues, 2017 ($ Billion) |

| 5. Middle East Power Tools Market Revenues, 2014-2024F ($ Million) |

| 6. Middle East Power Tools Market Volume, 2014-2024F (Thousand Units) |

| 7. GCC Total Construction Contract Awards Split By Country, 2016-2017 ($ Million) |

| 8. GCC Building & Infrastructure Construction Contract Awards Split By Country (2016-2017) |

| 9. GCC Total Construction Contract Awards Split By Sector (2016-2017) |

| 10. Middle East Power Tools Market Revenue Share, By Technology Type (2017 & 2024F |

| 11. Middle East Power Tools Market Revenue Share, By Tool Type (2017 & 2024F) |

| 12. Middle East Power Tools Market Revenue Share, By Verticals (2017 & 2024F) |

| 13. Middle East Power Tools Market Revenue Share, By Countries (2017 & 2024F) |

| 14. Budget Value of Planned & Un-awarded Projects, By GCC Country ($ Billion) |

| 15. Average Spot Crude Oil Prices in USD/Barrel, 2010-2025 (Brent, Dubai, WTI) |

| 16. Gross Domestic Product, at Current Prices of Turkey, 2014-2023F ($ Billion) |

| 17. Turkish Lira to US Dollar Exchange Rate, Quarterly Currency Exchange Trend (Q1' 2014-Q4' 2017) |

| 18. Turkey Power Tools Market Revenues, 2014-2024F ($ Million) |

| 19. Turkey Power Tools Market Volume, 2014-2024F (Thousand Units) |

| 20. Turkey Power Tools Market Opportunity Matrix, By Vertical (2024F) |

| 21. Turkey Electric Power Tools Revenues, 2014-2024F ($ Million) |

| 22. Turkey Pneumatic Power Tools Revenues, 2014-2024F ($ Million) |

| 23. Turkey Power Tools Market Revenue Share, By Tool Types (2017 & 2024F) |

| 24. Turkey Power Tools Market Revenues- By Metal Type, 2014-2024F ($ Million) |

| 25. Turkey Power Tools Market Volume- By Metal Type, 2014-2024F (Thousand Units) |

| 26. Turkey Power Tools Market Revenues- By Concrete Type, 2014-2024F ($ Million) |

| 27. Turkey Power Tools Market Volume- By Concrete Type, 2014-2024F (Thousand Units) |

| 28. Turkey Power Tools Market Revenues- By Wood Working Type, 2014-2024F ($ Million) |

| 29. Turkey Power Tools Market Volume- By Wood Working Type, 2014-2024F (Thousand Units) |

| 30. Turkey Other Power Tools Segment Types Market Revenues, 2014-2024F ($ Million) |

| 31. Turkey Other Power Tools Segment Types Market Volume, 2014-2024F (Thousand Units) |

| 32. Turkey Automotive Production Statistics, 2011-2017 (In Thousand Units) |

| 33. Turkey Housing Sales Statistics, 2013-2017 (In Thousand Units) |

| 34. Turkey Construction Power Tools Market Revenues- By Metal Type, 2014-2024F ($ Million) |

| 35. Turkey Manufacturing Power Tools Market Volume- By Metal Type, 2014-2024F (Thousand Units) |

| 36. Turkey Automotive Power Tools Market Revenues, 2014-2024F ($ Million) |

| 37. Turkey Other Power Tool Verticals Market Revenues- By Metal Type, 2014-2024F (Thousand Units) |

| 38. Turkey Power Tools Market Revenue Share, By Region (2017 & 2024F) |

| 39. Turkey Power Tools Market Revenues, By Marmara Region, 2014-2024F ($ Million) |

| 40. Turkey Power Tools Market Revenues, By Aegean Region, 2014-2024F ($ Million) |

| 41. Turkey Power Tools Market Revenues, By Mediterranean Region, 2014-2024F ($ Million) |

| 42. Turkey Power Tools Market Revenues, By Black Sea Region, 2014-2024F ($ Million) |

| 43. Turkey Power Tools Market Revenues, By Southeast Anatolia Region, 2014-2024F ($ Million) |

| 44. Turkey Power Tools Market Revenues, By East Anatolia Region, 2014-2024F ($ Million) |

| 45. Turkey Power Tools Market Revenues, By Central Anatolia Region, 2014-2024F ($ Million) |

| 46. Gross Domestic Product, at Current Prices of Iran, 2014-2023F ($ Billion) |

| 47. Iranian Rial to US Dollar Exchange Rate, Monthly Currency Exchange Trend, 2017-18 ('000) |

| 48. Iran Power Tools Market Revenues, 2014-2024F ($ Million) |

| 49. Iran Power Tools Market Volume, 2014-2024F (Thousand Units) |

| 50. Iran Power Tools Market Opportunity Matrix, By Vertical (2024F) |

| 51. Iran Electric Power Tools Revenues, 2014-2024F ($ Million) |

| 52. Iran Pneumatic Power Tools Revenues , 2014-2024F ($ Million) |

| 53. Iran Power Tools Market Revenue Share, By Tool Types (2017 & 2024F) |

| 54. Iran Power Tools Market Revenues- By Metal Type, 2014-2024F ($ Million) |

| 55. Iran Power Tools Market Volume- By Metal Type, 2014-2024F (Thousand Units) |

| 56. Iran Power Tools Market Revenues- By Concrete Type, 2014-2024F ($ Million) |

| 57. Iran Power Tools Market Volume- By Concrete Type, 2014-2024F (Thousand Unit) |

| 58. Iran Power Tools Market Revenues- By Wood Working Type, 2014-2024F ($ Million) |

| 59. Iran Power Tools Market Volume- By Wood Working Type, 2014-2024F (Thousand Unit) |

| 60. Iran Other Power Tools Segment Types Market Revenues, 2014-2024F ($ Million) |

| 61. Iran Other Power Tools Segment Types Market Volume, 2014-2024F (Thousand Units) |

| 62. Iran Automotive Production Statistics, 2011-2017 (In Thousand Units) |

| 63. Iran Construction Power Tools Market Revenues, 2014-2024F ($ Million) |

| 64. Iran Manufacturing Power Tools Market Revenues, 2014-2024F ($ Million) |

| 65. Iran Automotive Power Tools Market Revenues, 2014-2024F ($ Million) |

| 66. Iran Other Power Tool Verticals Market Revenues, 2014-2024F ($ Million) |

| 67. Iran Power Tools Market Revenues Share, By Region (2017 & 2024F) |

| 68. Iran Power Tools Market Revenues, By Tehran Region, 2014-2024F ($ Million) |

| 69. Iran Power Tools Market Revenues, By Isfahan Region, 2014-2024F ($ Million) |

| 70. Iran Power Tools Market Revenues, By Tabriz Region, 2014-2024F ($ Million) |

| 71. Iran Power Tools Market Revenues, By Kermanshah Region, 2014-2024F ($ Million) |

| 72. Iran Power Tools Market Revenues, By Mashhad Region, 2014-2024F ($ Million) |

| 73. Saudi Arabia Residential Supply, 2014-2019F (Thousand Units) |

| 74. Gross Domestic Product, at Current Prices of Saudi Arabia, 2014-2023F ($ Billion) |

| 75. Percentage of Urbanization, 2013- 2016 (% of Total Population) |

| 76. Saudi Arabia Pace of Project Cancellations, 2013-2017 ($ Billion) |

| 77. Saudi Arabia Power Tools Market Revenues, 2014-2024F ($ Million) |

| 78. Saudi Arabia Power Tools Market Volume, 2014-2024F (Thousand Units) |

| 79. Saudi Arabia Power Tools Market Opportunity Matrix, By Vertical (2024F) |

| 80. Saudi Arabia Electric Power Tools Revenues, 2014-2024F ($ Million) |

| 81. Saudi Arabia Pneumatic Power Tools Revenues, 2014-2024F ($ Million) |

| 82. Saudi Arabia Power Tools Market Revenue Share, By Tool Types (2017 & 2024F) |

| 83. Saudi Arabia Power Tools Market Revenues- By Metal Type, 2014-2024F ($ Million) |

| 84. Saudi Arabia Power Tools Market Volume- By Metal Type, 2014-2024F (Thousand Units) |

| 85. Saudi Arabia Power Tools Market Revenues- By Concrete Type, 2014-2024F ($ Million) |

| 86. Saudi Arabia Power Tools Market Volume- By Concrete Type, 2014-2024F (Thousand Unit) |

| 87. Saudi Arabia Power Tools Market Revenues- By Wood Working Type, 2014-2024F ($ Million) |

| 88. Saudi Arabia Power Tools Market Volume- By Wood Working Type, 2014-2024F (Thousand Unit) |

| 89. Saudi Arabia Other Power Tools Segment Types Market Revenues, 2014-2024F ($ Million) |

| 90. Saudi Arabia Other Power Tools Segment Types Market Volume, 2014-2024F (Thousand Units) |

| 91. Saudi Arabia Sale of New Vehicles, By Types, 2011-2017 (Thousand Units) |

| 92. Saudi Arabia Number of Retail units in Key Cities, 2014-2019E (Million sq. m) |

| 93. Saudi Arabia Number of Commercial Office in Key Cities, 2014-2019E (Million sq. m) |

| 94. Saudi Arabia Value of Contracts Awarded, By Sector, 2015-2018E ($ Billion) |

| 95. Saudi Arabia Building Construction Projects Value by Status (2017) |

| 96. Saudi Arabia Budget Allocation (2018) |

| 97. Total Number of Manufacturing Facilities in Saudi Arabia (Q1-Q3, 2017) |

| 98. Saudi Arabia Construction Power Tools Market Revenues, 2014-2024F ($ Million) |

| 99. Saudi Arabia Manufacturing Power Tools Market Revenues, 2014-2024F ($ Million) |

| 100. Saudi Arabia Automotive Power Tools Market Revenues, 2014-2024F ($ Million) |

| 101. Saudi Arabia Other Power Tool Verticals Market Revenues, 2014-2024F ($ Million) |

| 102. Saudi Arabia Power Tools Market Revenue Share, By Region (2017 & 2024F) |

| 103. Saudi Arabia Power Tools Market Revenues, By Central Region, 2014-2024F ($ Million) |

| 104. Saudi Arabia Power Tools Market Revenues, By Western Region, 2014-2024F ($ Million) |

| 105. Saudi Arabia Power Tools Market Revenues, By Eastern Region, 2014-2024F ($ Million) |

| 106. Saudi Arabia Power Tools Market Revenues, By Southern Region, 2014-2024F ($ Million) |

| 107. UAE Power Tools Market Revenues, 2014-2024F ($ Million) |

| 108. UAE Power Tools Market Volume, 2014-2024F (Thousand Units) |

| 109. UAE Power Tools Market Opportunity Matrix, By Vertical (2024F) |

| 110. UAE Electric Power Tools Market Revenues, 2014-2024F ($ Million) |

| 111. UAE Pneumatic Power Tools Market Revenues, 2014-2024F ($ Million) |

| 112. UAE Power Tools Revenue Share, By Tool Type (2017 & 2024F) |

| 113. UAE Power Tools Market Revenues- By Metal Type, 2014-2024F ($ Million) |

| 114. UAE Power Tools Market Volume- By Metal Type, 2014-2024F (Thousand Units) |

| 115. UAE Power Tools Market Revenues- By Concrete Type, 2014-2024F ($ Million) |

| 116. UAE Power Tools Market Volume- By Concrete Type, 2014-2024F (Thousand Unit) |

| 117. UAE Power Tools Market Revenues- By Wood Working Type, 2014-2024F ($ Million) |

| 118. UAE Power Tools Market Volume- By Wood Working Type, 2014-2024F (Thousand Unit) |

| 119. UAE Other Power Tools Segment Types Market Revenues, 2014-2024F ($ Million) |

| 120. UAE Other Power Tools Segment Types Market Volume, 2014-2024F (Thousand Units) |

| 121. UAE Construction Market Revenues, 2011-2019F ($ Billion) |

| 122. Residential Supply in UAE, 2014-2019F (Thousand Units) |

| 123. UAE Number of Retail units in Key Cities, 2013-2018E (Million sq. m) |

| 124. UAE Number of Commercial Office in Key Cities, 2013-2018E (Million sq. m) |

| 125. UAE Construction Market Breakdown, By Status (2018E) |

| 126. UAE Sale of new vehicles, By Types, 2005-2017 (Thousand Units) |

| 127. UAE Construction Power Tools Market Revenues, 2014-2024F ($ Million) |

| 128. UAE Manufacturing Power Tools Market Revenues, 2014-2024F ($ Million) |

| 129. UAE Automotive Power Tools Market Revenues, 2014-2024F ($ Million) |

| 130. UAE Other Power Tool Verticals Market Revenues, 2014-2024F ($ Million) |

| 131. UAE Power Tools Market Revenue Share, By Regions (2017 & 2024F) |

| 132. UAE Power Tools Market Revenues, By Northern Region, 2014-2024F ($ Million) |

| 133. UAE Power Tools Market Revenues, By Central Region, 2014-2024F ($ Million) |

| 134. Gross Domestic Product, at Current Prices of Qatar, 2014-2023F ($ Billion) |

| 135. Percentage of Urban Population, 2013- 2016 (% of Total Population) |

| 136. Qatar Power Tools Market Revenues, 2014-2024F ($ Million) |

| 137. Qatar Power Tools Market Volume, 2014-2024F (Thousand Units) |

| 138. Qatar Power Tools Market Opportunity Matrix, By Vertical (2024F) |

| 139. Qatar Electric Power Tools Market Revenues, 2014-2024F ($ Million) |

| 140. Qatar Pneumatic Power Tools Market Revenues, 2014-2024F ($ Million) |

| 141. Qatar Power Tools Market Revenue Share, By Tool Types (2017 & 2024F) |

| 142. Qatar Power Tools Market Revenues- By Metal Type, 2014-2024F ($ Million) |

| 143. Qatar Power Tools Market Volume- By Metal Type, 2014-2024F (Thousand Units) |

| 144. Qatar Power Tools Market Revenues- By Concrete Type, 2014-2024F ($ Million) |

| 145. Qatar Power Tools Market Volume- By Concrete Type, 2014-2024F (Thousand Unit) |

| 146. Qatar Power Tools Market Revenues- By Wood Working Type, 2014-2024F ($ Million) |

| 147. Qatar Power Tools Market Volume- By Wood Working Type, 2014-2024F (Thousand Unit) |

| 148. Qatar Other Power Tools Segment Types Market Revenues, 2014-2024F ($ Million) |

| 149. Qatar Other Power Tools Segment Types Market Volume, 2014-2024F (Thousand Units) |

| 150. Qatar Construction Contracts Awards and Total Construction Project Value, 2016-2017 ($ Million) |

| 151. Qatar Value of Project Status (2017) |

| 152. Qatar Number of Organized Retail Supply, 2014-2020E (Thousand sq. m GLA) |

| 153. Qatar Number of Commercial Office, 2014-2020F (Thousand Units) |

| 154. Qatar Construction Power Tools Market Revenues, 2014-2024F ($ Million) |

| 155. Qatar Manufacturing Power Tools Market Revenues, 2014-2024F ($ Million) |

| 156. Qatar Automotive Power Tools Market Revenues, 2014-2024F ($ Million) |

| 157. Qatar Other Power Tool Verticals Market Revenues, 2014-2024F ($ Million) |

| 158. Qatar Power Tools Market Revenue Share, By Region (2017 & 2024F) |

| 159. Qatar Power Tools Market Revenues, By Northern Region, 2014-2024F ($ Million) |

| 160. Qatar Power Tool Verticals Market Revenues, By Southern Region, 2014-2024F ($ Million) |

| 161. Oman Total Local Investments for the 9th Plan, 2015-2020 ($ Million) |

| 162. Oman Investment Scenario, 2011-2015 & 2016-2020 |

| 163. Oman Total Construction Contract Awards ($ Million), 2015-2017 |

| 164. Oman Government Development Spending on Infrastructure Sector, 2014 - 2016 ($ Million) |

| 165. Oman Power Tools Market Revenues, 2014-2024F ($ Million) |

| 166. Oman Power Tools Market Volume, 2014-2024F (Thousand Units) |

| 167. Oman Power Tools Market Opportunity Matrix, By Vertical (2024F) |

| 168. Oman Electric Power Tools Market Revenues, 2014-2024F ($ Million) |

| 169. Oman Pneumatic Power Tools Market Revenues, 2014-2024F ($ Million) |

| 170. Oman Power Tools Revenue Share, By Tool Type (2017 & 2024F) |

| 171. UAE Power Tools Market Revenues- By Metal Type, 2014-2024F ($ Million) |

| 172. UAE Power Tools Market Volume- By Metal Type, 2014-2024F (Thousand Units) |

| 173. UAE Power Tools Market Revenues- By Concrete Type, 2014-2024F ($ Million) |

| 174. UAE Power Tools Market Volume- By Concrete Type, 2014-2024F (Thousand Units) |

| 175. UAE Power Tools Market Revenues- By Wood Working Type, 2014-2024F ($ Million) |

| 176. UAE Power Tools Market Volume- By Wood Working Type, 2014-2024F (Thousand Units) |

| 177. UAE Other Power Tools Segment Types Market Revenues, 2014-2024F ($ Million) |

| 178. UAE Other Power Tools Segment Types Market Volume, 2014-2024F (Thousand Units) |

| 179. Oman Building & Construction GDP at Current Prices, 2014-2016 ($ Million) |

| 180. Oman Manufacturing GDP at Current Prices, 2014-2016 ($ Million) |

| 181. Oman Industrial Activities GDP at Current Prices, 2014-2016 ($ Million) |

| 182. Oman Total Vehicle Sales ('000 Units), 2014-2017 |

| 183. Oman Construction Power Tools Market Revenues, 2014-2024F ($ Million) |

| 184. Oman Manufacturing Power Tools Market Revenues, 2014-2024F ($ Million) |

| 185. Oman Automotive Power Tools Market Revenues, 2014-2024F ($ Million) |

| 186. Oman Other Power Tool Verticals Market Revenues, 2014-2024F ($ Million) |

| 187. Oman Power Tools Market Revenue Share, By Regions (2017 & 2024F) |

| 188. Oman Power Tools Market Revenues, By Northern Region, 2014-2024F ($ Million) |

| 189. Oman Power Tools Market Revenues, By Central Region, 2014-2024F ($ Million) |

| 190. Oman Power Tools Market Revenues, By Southern Region, 2014-2024F ($ Million) |

| 191. Gross Domestic Product, at Current Prices of Kuwait, 2014-2023F ($ Billion) |

| 192. Kuwait Power Tools Market Revenues, 2014-2024F ($ Million) |

| 193. Kuwait Power Tools Market Volume, 2014-2024F (Thousand Units) |

| 194. Kuwait Power Tools Market Opportunity Matrix, By Vertical (2024F) |

| 195. Kuwait Electric Power Tools Revenues, 2014-2024F ($ Million) |

| 196. Kuwait Pneumatic Power Tools Revenues, 2014-2024F ($ Million) |

| 197. Kuwait Power Tools Market Revenue Share, By Technology Types (2017 & 2024F) |

| 198. Kuwait Power Tools Market Revenues- By Metal Type, 2014-2024F ($ Million) |

| 199. Kuwait Power Tools Market Volume- By Metal Type, 2014-2024F (Thousand Units) |

| 200. Kuwait Power Tools Market Revenues- By Concrete Type, 2014-2024F ($ Million) |

| 201. Kuwait Power Tools Market Volume- By Concrete Type, 2014-2024F (Thousand Units) |

| 202. Kuwait Power Tools Market Revenues- By Wood Working Type, 2014-2024F ($ Million) |

| 203. Kuwait Power Tools Market Volume- By Wood Working Type, 2014-2024F (Thousand Units) |

| 204. Kuwait Other Power Tools Segment Types Market Revenues, 2014-2024F ($ Million) |

| 205. Kuwait Other Power Tools Segment Types Market Volume, 2014-2024F (Thousand Units) |

| 206. Kuwait Construction Power Tools Market Revenues, 2014-2024F ($ Million) |

| 207. Kuwait Manufacturing Power Tools Market Revenues, 2014-2024F ($ Million) |

| 208. Kuwait Automotive Power Tools Market Revenues, 2014-2024F ($ Million) |

| 209. Kuwait Other Power Tool Verticals Market Revenues, 2014-2024F ($ Million) |

| 210. Kuwait Power Tools Market Revenue Share, By Region (2017 & 2024F) |

| 211. Kuwait Power Tools Market Revenues, By Kuwait City, 2014-2024F ($ Million) |

| 212. Kuwait Power Tools Market Revenues, By Other Regions, 2014-2024F (Thousand Units) |

| 213. Bahrain Total FDI, 2015-2017 ($ Million) |

| 214. Bahrain Total FDI in Manufacturing & Logistics, 2015-2017 ($ Million) |

| 215. Bahrain Power Tools Market Revenues, 2014-2024F ($ Million) |

| 216. Bahrain Power Tools Market Volume, 2014-2024F (Thousand Units) |

| 217. Bahrain Power Tools Market Opportunity Matrix, By Vertical (2024F) |

| 218. Bahrain Electric Power Tools Market Revenues, 2014-2024F ($ Million) |

| 219. Bahrain Pneumatic Power Tools Market Revenues, 2014-2024F ($ Million) |

| 220. Bahrain Power Tools Market Revenue Share, By Tool Types (2017 & 2024F) |

| 221. Bahrain Power Tools Market Revenues- By Metal Type, 2014-2024F ($ Million) |

| 222. Bahrain Power Tools Market Volume- By Metal Type, 2014-2024F (Thousand Units) |

| 223. Bahrain Power Tools Market Revenues- By Concrete Type, 2014-2024F ($ Million) |

| 224. Bahrain Power Tools Market Volume- By Concrete Type, 2014-2024F (Thousand Units) |

| 225. Bahrain Power Tools Market Revenues- By Wood Working Type, 2014-2024F ($ Million) |

| 226. Bahrain Power Tools Market Volume- By Wood Working Type, 2014-2024F (Thousand Units) |

| 227. Bahrain Other Power Tools Segment Types Market Revenues, 2014-2024F ($ Million) |

| 228. Bahrain Other Power Tools Segment Types Market Volume, 2014-2024F (Thousand Units) |

| 229. Bahrain Construction Sector Real Growth Rate, 2015-2017 |

| 230. Bahrain Manufacturing Sector Real Growth Rate, 2015-2017 |

| 231. Bahrain Total Vehicle Sales ('000 Units), 2014-2017 |

| 232. Bahrain Construction Power Tools Market Revenues, 2014-2024F ($ Million) |

| 233. Bahrain Manufacturing Power Tools Market Revenues, 2014-2024F ($ Million) |

| 234. Bahrain Automotive Power Tools Market Revenues, 2014-2024F ($ Million) |

| 235. Bahrain Other Power Tool Verticals Market Revenues, 2014-2024F ($ Million) |

| 236. Bahrain Power Tools Market Revenue Share, By Regions (2017 & 2024F) |

| 237. Bahrain Power Tools Market Revenues, By Northern Region, 2014-2024F ($ Million) |

| 238. Bahrain Power Tools Market Revenues, By Central Region, 2014-2024F ($ Million) |

| 239. Bahrain Power Tools Market Revenues, By Southern Region, 2014-2024F ($ Million) |

| 240. Turkey Power Tools Market Revenues, By Companies, 2017 ($ Million) |

| 241. Turkey Power Tools Market Revenue Share, By Companies (2017) |

| 242. Iran Power Tools Market Revenues, By Companies, 2017 ($ Million ) |

| 243. Iran Power Tools Market Revenue Share, By Companies (2017) |

| 244. UAE Power Tools Market Revenues, By Companies, 2017 ($ Million) |

| 245. UAE Power Tools Market Revenue Share, By Companies (2017) |

| 246. Saudi Arabia Power Tools Market Revenues, By Companies, 2017 ($ Million) |

| 247. Saudi Arabia Power Tools Market Revenue Share, By Companies (2017) |

| 248. Qatar Power Tools Market Revenues, By Companies, 2017 ($ Million) |

| 249. Qatar Power Tools Market Revenue Share, By Companies (2017) |

| 250. Kuwait Power Tools Market Revenues, By Companies, 2017 ($ Million) |

| 251. Kuwait Power Tools Market Revenue Share, By Companies (2017) |

| 252. Oman Power Tools Market Revenues, By Companies, 2017 ($ Million) |

| 253. Oman Power Tools Market Revenue Share, By Companies (2017) |

| 254. Bahrain Power Tools Market Revenues, By Companies, 2017 ($ Million) |

| 255. Bahrain Power Tools Market Revenue Share, By Companies (2017) |

| List of Tables |

| 1. Turkey Construction Sector Confidence Index on a Measurement Basis (January 2011 - May 2018) |

| 2. Turkey Impacted Industrial Turnover Index, Abroad & Domestic Index on a Measurement Basis (January 2014 - December 2017) |

| 3. Retail Supply Shopping Center Development, Unit GLA (Sq.m) |

| 4. List of Residential & Commercial High-Rise Building Construction Projects in Turkey |

| 5. FDI Inflows and Outflows in Iran, 2011-2017 ($ Million) |

| 6. Key Projects in Iran Across Different Verticals |

| 7. List of Residential & Commercial High-Rise Building Construction Projects in Iran |

| 8. List of Construction Projects in Saudi Arabia |

| 9. Under Construction Manufacturing Units in Saudi Arabia (2017) |

| 10. Upcoming Manufacturing Plants in Saudi Arabia |

| 11. List of Residential High-rise Building Construction Projects in UAE |

| 12. List of Commercial High-rise Building Construction Projects in UAE |

| 13. Upcoming Construction Projects in Dubai |

| 14. Upcoming Construction Projects in Abu Dhabi |

| 15. Upcoming Construction Projects in Sharjah |

| 16. Qatar Investments By Sector Up to 2022 |

| 17. List of Proposed Upcoming Skyscrapers in Qatar |

| 18. List of Projects in Qatar |

| 19. Qatar Ongoing and Planned Projects Value Estimation |

| 20. Kuwait Automobile, Light Trucks, Van and Utility Vehicles Market Size, 2014-2016 (In Million Units) |

| 21. Kuwait Automotive Parts and Supplies Market Size, 2014-2016 (In Million Units) |

| 22. List of Proposed Upcoming Skyscrapers in Kuwait |

| 23. List of Upcoming Healthcare Projects in Kuwait |

| 24. List of Major Ongoing/Upcoming Projects in Kuwait |

| 25. Kuwait Oil & Gas Projects |

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Related Reports

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero