Philippines UPS System Market (2023-2029) | Companies, Share, Analysis, Growth, Revenue, Value, Industry, Size, Outlook, Forecast & Trends

Market Forecast By KVA Ratings (Up to 1 KVA, 1.1-5 KVA, 5.1-20 KVA, 20.1-50 KVA, 50.1-200 KVA and Above 200 KVA), By Applications (Residential, Industrial and Commercial including Offices, Healthcare, BFSI, Hospitality, Education, Data Center, and Others.), By Regions (Luzon, Visayas, and Mindanao) and Competitive Landscape

| Product Code: ETC000542 | Publication Date: Jan 2024 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 72 | No. of Figures: 16 | No. of Tables: 8 | |

Philippines UPS System Market Synopsis

Philippines UPS system market is anticipated to register significant growth in the coming years owing to surging development in the commercial and industrial sectors along with the proliferation of data centres and colocation facilities in the country. For instance, Beeinfotech opened its first data centre in the Philippines called "The Hive" in 2021, which is the largest telco-neutral data center facility in the country, with an initial capacity of at least 3,000 server racks that can accommodate up to 45U rack height. Additionally, ST Telemedia Global Data Centers (STT GDC) Philippines, is earmarking a $1 billion investment to establish the largest data center in the Philippines which is scheduled to initiate operations in 2025 with an initial capacity of 28 megawatts, expandable to 124 MW in its full operational phase. Furthermore, with 60 hotel projects currently under construction in the Philippines expected to be completed by 2025, there is an anticipated surge in demand for UPS Systems as backup power sources for critical equipment in the coming years. Moreover, UPS manufacturers such as APC by Schneider Electric, Eaton, and Vertiv have established a strong presence which is expected to foster heightened competition and innovation in the UPS market, potentially driving advancements in technology and service offerings.

According to 6Wresearch, Philippines UPS System market size is projected to grow at a CAGR of 6.3% during 2023-2029. Philippines Department of Budget and Management had submitted a budget proposal of $222.35 million for ICT and digitalization in the coming year. This transformation is expected to generate a large volume of data and is anticipated to gain the attention of international data center providers to host in the country, thereby expected to increase the demand for uninterrupted power supply systems in the coming years. These factors are driving the Philippines UPS Systems Market Growth. Moreover, rising tech startups such as MoneyMax.PH, Serious MD in the country has surged the demand for zero power downtime as most industries and businesses in the Philippines have begun to implement UPS systems as a few seconds of power outage causes abrupt data and financial losses.

The UPS system industry in the Philippines faces impediments to reaching its potential due to increased raw material costs, particularly a surge in aluminium prices, coupled with infrastructure limitations, prompting end-users to optimize with high-performance batteries despite the resulting cost challenges.

Market Segmentation by kVA Rating

50.1KVA-200KVA UPS dominates the Philippines UPS system industry owing to rising data centres. However, the UPS system ranging between 20.1-50 KVA rating is expected to grow at the fastest rate in the coming years on account of its growing application in the industrial and commercial office sector.

Market Segmentation by Phases

Phase 3 UPS system dominates the Philippines market due to its expansive power capacity, especially in the high-powered and high-capacity range, which makes them well-suited for a diverse array of applications, ranging from small businesses to large enterprises.

Market Segmentation by Applications

Commercial use of the UPS system is expected to increase significantly in the coming years owing to the government's substantial investment of $222.35 million in digital transformation initiatives. This investment is expected to drive increased data traffic, leading to a growing demand for data centers. Thus, to ensure a reliable power supply for these data centers, there will be a corresponding boost in demand for UPS market in Philippines.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years of Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Philippines UPS System Market Overview

- Philippines UPS System Market Outlook

- Philippines UPS System Market Forecast

- Historical Data and Forecast of Philippines UPS System Market Revenues and Volume, for the Period 2019-2029F

- Historical Data and Forecast of Philippines UPS System Market Revenues and Volume, By kVA Rating, for the Period 2019-2029F

- Historical Data and Forecast of Philippines UPS System Market Revenues, By Phases, for the Period 2019-2029F

- Historical Data and Forecast of Philippines UPS System Market Revenues, By Applications, for the Period 2019-2029F

- Market Drivers and Restraints

- Philippines UPS System Market Trends

- Porter’s Five Forces Analysis

- Market Opportunity Assessment

- Philippines UPS System Market Revenue Ranking, By Companies, 2022

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By kVA Rating

- Up to 1kVA

- 1.1- 5kVA

- 5.1- 20kVA

- 20.1- 50kVA

- 50.1- 200kVA

- Above 200kVA

By Phases

- 1 Phase

- 3 Phase

By Applications

- Residential

- Industrial

- Commercial

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Methodology |

| 2.5 Assumptions |

| 3. Philippines UPS System Market Overview |

| 3.1 Philippines UPS System Market Revenues & Volume, 2019-2029F |

| 3.2 Philippines UPS System Market Industry Life Cycle |

| 3.4 Philippines UPS System Market Porter’s Five Forces |

| 4. Philippines UPS System Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for uninterrupted power supply in commercial, industrial, and residential sectors due to frequent power outages |

| 4.2.2 Growing awareness about the importance of safeguarding electronic equipment from power surges and fluctuations |

| 4.2.3 Government initiatives to improve infrastructure and reliability of power supply in the Philippines |

| 4.3 Market Restraints |

| 4.3.1 High initial investment costs associated with UPS systems |

| 4.3.2 Limited awareness and understanding of UPS systems among small and medium-sized enterprises |

| 4.3.3 Challenges in battery disposal and environmental concerns related to UPS systems |

| 5. Philippines UPS System Market Evolution & Trends |

| 6. Philippines UPS System Market Overview, By kVA Ratings |

| 6.1 Philippines UPS System Market Revenue Share and Revenues, By kVA Ratings, 2022 & 2029F |

| 6.1.1 Philippines UPS System Market Revenues, By Up to 1kVA, 2019-2029F |

| 6.1.2 Philippines UPS System Market Revenues, By 1.1- 5kVA, 2019-2029F |

| 6.1.3 Philippines UPS System Market Revenues, By 5.1-20kVA, 2019-2029F |

| 6.1.4 Philippines UPS System Market Revenues, By 20.1-50kVA, 2019-2029F |

| 6.1.5 Philippines UPS System Market Revenues, By 50.1-200kVA, 2019-2029F |

| 6.1.6 Philippines UPS System Market Revenues, By Above 200kVA, 2019-2029F |

| 6.2 Philippines UPS System Market Volume Share and Volume, By kVA Ratings, 2022 & 2029F |

| 6.2.1 Philippines UPS System Market Volume, By Up to 1kVA, 2019-2029F |

| 6.2.2 Philippines UPS System Market Volume, By 1.1- 5kVA, 2019-2029F |

| 6.2.3 Philippines UPS System Market Volume, By 5.1-20kVA, 2019-2029F |

| 6.2.4 Philippines UPS System Market Volume, By 20.1-50kVA, 2019-2029F |

| 6.2.5 Philippines UPS System Market Volume, By 50.1-200kVA, 2019-2029F |

| 6.2.6 Philippines UPS System Market Volume, By Above 200kVA, 2019-2029F |

| 7. Philippines UPS System Market Overview, By Phase |

| 7.1 Philippines UPS System Market Revenue Share & Revenues, By Phase, 2022 & 2029F |

| 7.1.1 Philippines UPS System Market Revenues, By Phase 1, 2019-2029F |

| 7.1.2 Philippines UPS System Market Revenues, By Phase 3, 2019-2029F |

| 8. Philippines UPS System Market Overview, By Applications |

| 8.1 Philippines UPS System Market Revenue Share & Revenues, By Applications, 2022 & 2029F |

| 8.1.1 Philippines UPS System Market Revenues, By Residential, 2019-2029F |

| 8.1.2 Philippines UPS System Market Revenues, By Industrial, 2019-2029F |

| 8.1.3 Philippines UPS System Market Revenues, By Commercial, 2019-2029F |

| 9. Philippines UPS System Market Key Performance Indicators |

| 9.1 Average uptime percentage of UPS systems in key sectors |

| 9.2 Number of UPS system installations in critical infrastructure projects |

| 9.3 Energy efficiency rating of UPS systems deployed in the market |

| 10. Philippines UPS System Market Opportunity Assessment |

| 10.1 Philippines UPS System Market Opportunity Assessment, By kVA Rating, 2029F |

| 10.2 Philippines UPS System Market Opportunity Assessment, By Phases, 2029F |

| 10.4 Philippines UPS System Market Opportunity Assessment, By Applications, 2029F |

| 11. Philippines UPS System Market Competitive Landscape |

| 11.1 Philippines UPS System Market Revenue Ranking, By Company, 2022 |

| 11.2 Philippines UPS System Market Competitive Benchmarking, By Technical Parameters |

| 11.3 Philippines UPS System Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 12.1 Vertiv Group Corporation |

| 12.2 Schneider Electric SE |

| 12.3 Eaton Corporation plc |

| 12.4 Delta Electronics, Inc. |

| 12.5 ABB Ltd. |

| 12.6 Socomec Group S.A. |

| 12.7 Riello Elettronica Group |

| 12.8 Fuji Electric Sales Philippines Inc |

| 12.9 Huawei Digital Power Technologies Co., Ltd. |

| 12.10 Kehua Data Co., Ltd. |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| 1. Philippines UPS System Market Revenues and Volume, 2019-2029F ($ Million and Units) |

| 2. Under construction Hotel projects in Philippines |

| 3. Philippines UPS System Market Revenue Share, By kVA Rating, 2022 & 2029F |

| 4. Philippines UPS System Market Volume Share, By kVA Rating, 2022 & 2029F |

| 5. Philippines UPS System Market Revenue Share, By Phases, 2022 & 2029F |

| 6. Philippines UPS System Market Revenue Share, By Applications, 2022 & 2029F |

| 7. Share of Digital Payments in Philippines, 2018-202 ($ Billion) |

| 8. Philippines GDP Value added by Industrial Sector (2020-2022) in $ Billion |

| 9. Philippines ICT Sector Market, 2021 & 2031F ($ Billion) |

| 10. Philippines ICT Budget, 2023 & 2024F ($ Million) |

| 11. Philippines Number of Data Centers, By Regions, As of Aug 2023 |

| 12. Philippines UPS System Market Opportunity Assessment, By kVA Rating (2029F) |

| 13. Philippines UPS System Market Opportunity Assessment, By Phases (2029F) |

| 14. Philippines UPS System Market Opportunity Assessment, By Applications (2029F) |

| 15. Philippines UPS System Market Revenue Ranking, By Company, 2022 |

| 16. Upcoming Supply for Office Spaces in Metro Manila, By Cities, Q2 2022-2025F (in %) |

| List of Tables |

| 1. Philippines Upcoming Data Center Project |

| 2. Philippines Ongoing Office Projects |

| 3. Philippines UPS System Market Revenues, By kVA Rating, 2019-2029F ($ Million) |

| 4. Philippines UPS System Market Volume, By kVA Rating, 2019-2029F (Units) |

| 5. Philippines UPS System Market Revenues, By Phases, 2019-2029F ($ Million) |

| 6. Philippines UPS System Market Revenues, By Applications, 2019-2029F ($ Million) |

| 7. Philippines Operational Data Center List |

| 8. Under Construction Data Center Projects In Metro Manila |

Market Forecast By KVA Ratings (Up to 1 KVA, 1.1-5 KVA, 5.1-20 KVA, 20.1-50 KVA, 50.1-200 KVA and Above 200 KVA), By Applications (Residential, Industrial and Commercial including Offices, Healthcare, BFSI, Hospitality, Education, Data Center, and Others.), By Regions (Luzon, Visayas, and Mindanao) and Competitive Landscape

| Product Code: ETC000542 | Publication Date: Nov 2018 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 115 | No. of Figures: 38 | No. of Tables: 18 |

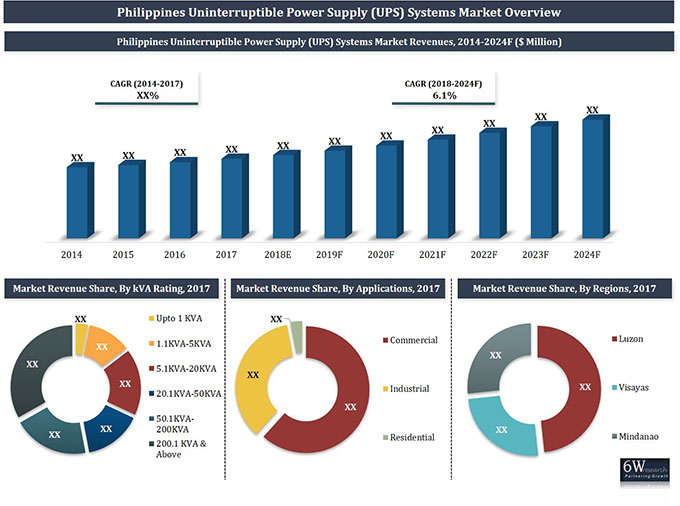

Favorable demographics, growing middle-class population, large infrastructure projects in the commercial and industrial sectors as well as expanding export market have driven the growth of the UPS systems market in the Philippines during the past few years. Further, the development of the healthcare and hospitality sectors owing to an increase in medical tourism in the country had also disposed of vast business potential for the UPS systems market in the country. An increasing number of data centers owing to the growing ICT sector, as well as a growing number of hotels are also expected to drive the growth of the UPS systems market over the coming years.

According to 6Wresearch, Philippines UPS market size is projected to grow at a CAGR of 6.1% during 2018-24. Increasing use of technology across all the segments of the society such as industrial, commercial, and residential sectors under the country's government plan "Build, Build, Build" and the rapidly growing demand of information and technology industry would demonstrate vast opportunity for the UPS systems market in the country during the forecast period. Additionally, the growth of transportation infrastructure in Manila and Luzon islands of Philippines along with an increase in the energy demand, especially from the commercial and industrial sectors would further increase the requirement for UPS systems as a backup source of power for critical equipment over the coming years.

Amongst all the applications of UPS systems, the commercial application captured the highest Philippines UPS market share in 2017. In the commercial sector, data centers, BFSI, and hospitality segments were the major revenue shareholders and are expected to maintain their dominance over the coming years on account of the government's emphasis on developing the country's social infrastructure.

Amongst all the applications of UPS systems, the commercial application captured the highest Philippines UPS market share in 2017. In the commercial sector, data centers, BFSI, and hospitality segments were the major revenue shareholders and are expected to maintain their dominance over the coming years on account of the government's emphasis on developing the country's social infrastructure.

The Philippines UPS market report thoroughly covers the Philippines Uninterruptible Power Supply (UPS) Systems Market by kVA ratings, applications, and regions. The Philippines UPS market outlook report provides an unbiased and detailed analysis of the Philippines UPS market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Philippines UPS Market Overview

• Philippines UPS Market Outlook

• Philippines UPS Market Forecast

• Historical Data of Global Uninterruptible Power Supply (UPS) Systems Market For The Period 2014-2017

• Market Size & Forecast of Global Uninterruptible Power Supply (UPS) Systems Market Until 2024

• Historic Data of Philippines UPS Market Revenues and Volume 2014-2017

• Philippines UPS Market Size & Philippines UPS Market Forecast, Until 2024

• Historic Data of Philippines UPS market revenues for up to 1 kVA UPS Systems & Volume, during 2014-2017

• Market Size & Forecast of Philippines Up to 1 kVA UPS Systems Market Revenues & Volume, Until 2024

• Historic Data of Philippines 1.1 kVA - 5 kVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Philippines 1.1 kVA - 5 kVA UPS Systems Market Revenues & Volume, Until 2024

• Historic Data of Philippines 5.1 kVA - 20 kVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Philippines 5.1 kVA - 20 kVA UPS Systems Market Revenues & Volume, Until 2024

• Historic Data of Philippines 20.1 kVA - 50 kVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Philippines 20.1 kVA - 50 kVA UPS Systems Market Revenues & Volume, Until 2024

• Historic Data of Philippines 50.1 kVA - 200 kVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Philippines 50.1 kVA - 200 kVA UPS Systems Market Revenues & Volume, Until 2024

• Historic Data of Philippines Above 200 kVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Philippines 200 kVA & Above UPS Systems Market Revenues & Volume, Until 2024

• Historical data and Forecast of Philippines UPS Systems Market, By Applications 2014-2024

• Historical data and Forecast of Philippines UPS Systems Market, By Regions 2014-2024

• Market Drivers and Restraints

• Philippines UPS Market Trends and opportunities

• Philippines UPS Market Overview on Competitive Landscape

• Philippines UPS Market Share, By Players

• Company Profiles

• Strategic Recommendations

Markets Covered

The Philippines UPS market report provides a detailed analysis of the following market segments:

• By KVA Ratings

o Up to 1 KVA

o 1.1-5 KVA

o 5.1-20 KVA

o 20.1-50 KVA

o 50.1-200 KVA

o Above 200 KVA

• By Applications

o Residential

o Industrial

o Commercial (Offices, healthcare, BFSI, hospitality, education, data center, and others.)

• By Regions

o Luzon

o Visayas

o Mindanao

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero