South Africa Industrial Water & Wastewater Treatment Chemicals Market (2019-2025) | Trends, Share, Forecast, Outlook, Growth, Size, Analysis, Industry, Revenue, Companies & Value

Market Forecast Chemical Types (Antifoams, Biocides, Boiler Water Chemical, Coagulants, Corrosion Inhibitors, Disinfectants, Neutralizing Agents, Oxidants, Oxygen Scavengers, pH Conditioners, Resin Cleansers, Scale Inhibitors, Algaecides, Chelating Agents, Flocculants and Others including Reducing Agents, Defoamers, Odour Controllers, Softeners, Cleaners and Fluorescent Dyes), By Industry Type (Food & Beverage, Oil & Gas, Mining, Pharmaceuticals, Power Generation and Others including Pulp & Paper, Petrochemicals and Automotive), By Applications (Raw Water Treatment, Water Desalination, Cooling & Boilers and Effluent Water Treatment), By Regions (Northern Cape, Western Cape, Eastern Cape, Free State and Other Regions including Gauteng, Limpopo, Northwest, Kwazulu Natal) and Competitive Landscape

| Product Code: ETC131538 | Publication Date: Apr 2022 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 130 | No. of Figures: 43 | No. of Tables: 19 | |

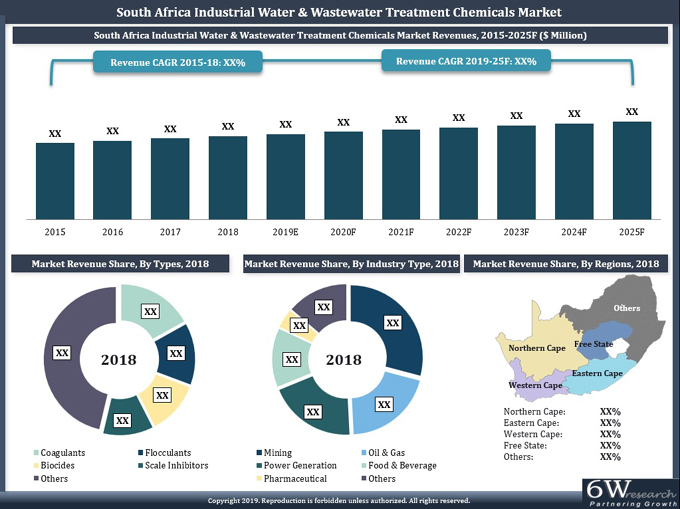

South Africa is one of the major consumers of industrial water & wastewater treatment chemicals. With an average annual rainfall of 464mm, South Africa is the 31st driest country in the world. Hence, the government is implementing appropriate measures in the water treatment sector to meet the growing water demand for the country. Rapidly growing population along with rising industrialization is expected to impose pressure on water demand across the country. The factor is expected to decently enhance the utilization of wastewater treatment chemicals across the industrial sector in the coming years.

According to 6Wresearch, South Africa Industrial Water And Wastewater Treatment Chemicals Market Size is projected to grow at a CAGR of 2.3% during 2019-2025. South Africa has signed the Action Plan on Deepening Industrial Cooperation among BRICS [Brazil, Russia, India, China, and South Africa] countries. Under the agreement, the mentioned countries would cooperate in fields such as the development of new industrial infrastructure, technology development, and innovation, small and medium-sized enterprises. Further, the country’s government has framed Industrial Policy Action Plan in order to further strengthen the industrial sector across the country in the coming years, paving way for South Africa industrial water and wastewater treatment chemicals market forecast period growth.

Amongst all the types, flocculants and coagulants captured key South Africa Industrial Water and Wastewater Treatment Chemicals market share and are expected to maintain their leadership during the forecast period as well. Whereas, Mining application was the key revenue generating application followed by Power generation application in South Africa wastewater treatment chemicals market. Some of the key companies in South Africa industrial water & wastewater treatment chemicals include Dow Chemicals, Buckman Africa, BASF, Protea Chemicals, Veolia Water Technologies, and ImproChem.

The South Africa Industrial Water and Wastewater Treatment Chemicals market report thoroughly covers the market by types, applications, and regions. The South Africa industrial water and wastewater treatment chemicals market outlook report provide an unbiased and detailed analysis of the on-going South Africa Industrial Water and Wastewater Treatment Chemicals market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• South Africa industrial water and wastewater treatment chemicals market overview

• South Africa industrial water and wastewater treatment chemicals market outlook

• South Africa industrial water and wastewater treatment chemicals market size and South Africa industrial

water and wastewater treatment chemicals market forecast

• South Africa industrial water and wastewater treatment chemicals market revenues, by Types

• South Africa industrial water and wastewater treatment chemicals market revenues, by Industry Types

• South Africa industrial water and wastewater treatment chemicals market revenues, by Applications

• South Africa industrial water and wastewater treatment chemicals market revenues, by Regions

• Historical data of South Africa industrial water and wastewater treatment chemicals market revenues

for the period 2015-2018.

• Market drivers and restraints.

• South Africa industrial water and wastewater treatment chemicals market trends

• South Africa industrial water and wastewater treatment chemicals market overview on competitive landscape

• South Africa industrial water and wastewater treatment chemicals market share, By Players

• Company Profiles.

• Strategic Recommendations.

Markets Covered

The South Africa industrial water and wastewater treatment chemicals market report provides a detailed analysis of the following market segments:

By Types

- Antifoams

- Biocides

- Coagulants

- Corrosion Inhibitors

- Disinfectants

- Neutralizing Agents

- Oxidants

- Scale Inhibitors

- Algaecides

- Flocculants

- Chelating Agents

- Others (Reducing agents, defoamers, odour controllers, softeners, cleaners, fluorescent dyes)

By Industry Type

- Food and Beverage

- Oil and Gas

- Mining

- Pharmaceuticals

- Power Generation

- Others (Pulp and Paper, Petrochemicals, Automotive)

By Applications

- Raw Water Treatment

- Water Desalination

- Cooling and Boilers

- Effluent Water Treatment

By Regions

- Northern Cape

- Western Cape

- Eastern Cape

- Free State

- Other Regions (Gauteng, Limpopo, Northwest, Kwazulu Natal)

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. South Africa Industrial Water and Waste Water Treatment Chemicals Market Overview |

| 3.1 South Africa Country Indicators |

| 3.2 South Africa Industrial Water and Waste Water Treatment Chemicals Market Revenues, 2015-2025F |

| 3.3. South Africa Industrial Water and Waste Water Treatment Chemicals Market - Industry Value Chain Analysis |

| 3.4 South Africa Industrial Water and Waste Water Treatment Chemicals Market Industry Life Cycle |

| 3.5 South Africa Industrial Water and Waste Water Treatment Chemicals Market Porter's 5 Forces Model, 2018 |

| 3.6 South Africa Industrial Water and Waste Water Treatment Chemicals Market Revenue Share, By Types, 2018 & 2025F |

| 3.7 South Africa Industrial Water and Waste Water Treatment Chemicals Market Revenue Share,By Industry Type, 2018 & 2025F |

| 3.8 South Africa Industrial Water and Waste Water Treatment Chemicals Market Revenue Share, By Applications, 2018 & 2025F |

| 3.9 South Africa Industrial Water and Waste Water Treatment Chemicals Market Revenue Share, By Regions, 2018 & 2025F |

| 4. South Africa Waste Water Treatment Chemicals Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing industrial activities and urbanization leading to higher demand for water and wastewater treatment chemicals |

| 4.2.2 Stringent government regulations and environmental policies promoting the adoption of water treatment solutions |

| 4.2.3 Growing awareness about water scarcity and the importance of water conservation driving the market |

| 4.3 Market Restraints |

| 4.3.1 High initial investment and operational costs associated with advanced water treatment technologies |

| 4.3.2 Limited availability of fresh water sources impacting the market growth |

| 4.3.3 Presence of alternative water treatment methods affecting the demand for chemical treatment solutions |

| 5. South Africa Waste Water Treatment Chemicals Market Trends |

| 6. South Africa Industrial Water & Wastewater Treatment Chemicals Market Overview, By Types |

| 6.1 South Africa Wastewater Treatment Chemicals Market Revenues, By Disinfectants, 2015-2025F |

| 6.2 South Africa Wastewater Treatment Chemicals Market Revenues, By Coagulants, 2015-2025F |

| 6.3 South Africa Wastewater Treatment Chemicals Market Revenues, By Flocculants, 2015-2025F |

| 6.4 South Africa Wastewater Treatment Chemicals Market Revenues, By Corrosion Inhibitors, 2015-2025F |

| 6.5 South Africa Wastewater Treatment Chemicals Market Revenues, By Oxidants, 2015-2025F |

| 6.6 South Africa Wastewater Treatment Chemicals Market Revenues, By Scale Inhibitors, 2015-2025F |

| 6.7 South Africa Wastewater Treatment Chemicals Market Revenues, By Chelating Agents, 2015-2025F |

| 6.8 South Africa Wastewater Treatment Chemicals Market Revenues, By Algaecides, 2015-2025F |

| 6.9 South Africa Wastewater Treatment Chemicals Market Revenues, By Antifoams, 2015-2025F |

| 6.10 South Africa Wastewater Treatment Chemicals Market Revenues, By Biocides, 2015-2025F |

| 6.11 South Africa Wastewater Treatment Chemicals Market Revenues, By Neutralizing agents, 2015-2025F |

| 6.12 South Africa Wastewater Treatment Chemicals Market Revenues, By Other Chemicals, 2015-2025F |

| 7. South Africa Industrial Water & Wastewater Treatment Chemicals Market Overview, By Industry Types |

| 7.1 South Africa Food & Beverage Industry Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F |

| 7.2 South Africa Mining Industry Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F |

| 7.3 South Africa Oil & Gas Industry Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F |

| 7.4 South Africa Power Generation Industry Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F |

| 7.5 South Africa Pharmaceutical Industry Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F |

| 7.6 South Africa Other Industries Industrial Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F |

| 8. South Africa Industrial Water and Waste Water Treatment Chemicals Market Overview, By Applications |

| 8.1 South Africa Industrial Water and Waste Water Treatment Chemicals Market Revenues, By Raw Water Treatment, 2015-2025F |

| 8.2 South Africa Industrial Water and Waste Water Treatment Chemicals Market Revenues, By Water Desalination, 2015-2025F |

| 8.3 South Africa Industrial Water and Waste Water Treatment Chemicals Market Revenues, By Cooling & Boilers, 2015-2025F |

| 8.4 South Africa Industrial Water and Waste Water Treatment Chemicals Market Revenues, By Effluent Water Treatment, 2015-2025F |

| 9. South Africa Industrial Water and Waste Water Treatment Chemicals Market Overview, By Regions |

| 9.1 South Africa Northern Cape Industrial Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F |

| 9.2 South Africa Western Cape Industrial Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F |

| 9.3 South Africa Eastern Cape Industrial Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F |

| 9.4 South Africa Free State Industrial Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F |

| 9.5 South Africa Other Provinces Industrial Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F |

| 10. South Africa Waste Water Treatment Chemicals Market-Key Performance Indicators |

| 10.1 South Africa Government Spending Outlook |

| 10.2 South Africa Water Sector Outlook |

| 10.3 South Africa Manufacturing Sector Outlook |

| 10.4 South Africa Industrial Sector Outlook |

| 10.5 Upcoming Water Related Projects |

| 11. South Africa Industrial Water & Wastewater Treatment Chemicals Market-Opportunity Assessment |

| 11.1 South Africa Industrial Water & Wastewater Treatment Chemicals Market Opportunity Assessment, By Types, 2025F |

| 11.2 South Africa Industrial Water & Wastewater Treatment Chemicals Market Opportunity Assessment, By Industry Type, 2025F |

| 11.3 South Africa Industrial Water & Wastewater Treatment Chemicals Market Opportunity Assessment, By Applications, 2025F |

| 12. South Africa Industrial Wastewater Treatment Chemicals Market-Competitive Landscape |

| 12.1 South Africa Industrial Wastewater Treatment Chemicals Market Revenue Share, By Company, 2018 |

| 12.2 South Africa Industrial Wastewater Treatment Chemicals Market Competitive Benchmarking, By Types |

| 13. Company Profiles |

| 13.1 BASF South Africa (Pty) Ltd |

| 13.2 Buckman Laboratories PTY LTD. |

| 13.3 Dow Southern Africa |

| 13.4 ImproChem (Pty) Ltd |

| 13.5 NALCO Water |

| 13.6 Prosep Chemicals |

| 13.7 Protea Chemicals Pty Ltd |

| 13.8 NCP Chlorchem (PTY) LTD |

| 13.9 Veolia Water Technologies South Africa |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| Figure1. South Africa Industrial Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F ($ Million) |

| Figure2. South Africa Industrial Water & Wastewater Treatment Chemicals Market industry Life Cycle, 2018 |

| Figure3. South Africa Industrial Water & Wastewater Treatment Chemicals Market Revenue Share, By Types, 2018 & 2025F |

| Figure4. South Africa Industrial Water & Wastewater Treatment Chemicals Market Revenue Share, By Industry Type, 2018 & 2025F |

| Figure5. South Africa Industrial Water & Wastewater Treatment Chemicals Market Revenue Share, By Applications, 2018 & 2025F |

| Figure6. South Africa Industrial Water & Wastewater Treatment Chemicals Market Revenue Share, By Regions, 2018 & 2025F |

| Figure7. South Africa Capital Replacement Cost Per Water Supply Element, 2017 ($ Billion) |

| Figure8. South Africa Provinces Water Consumption (Litres/Person/Day) |

| Figure9. South Africa Wastewater Treatment Chemicals Market Revenues, By Disinfectants, 2015-2025F ($ Million) |

| Figure10. South Africa Wastewater Treatment Chemicals Market Revenues, By Coagulants, 2015-2025F ($ Million) |

| Figure11. South Africa Wastewater Treatment Chemicals Market Revenues, By Flocculants, 2015-2025F ($ Million) |

| Figure12. South Africa Wastewater Treatment Chemicals Market Revenues, By Corrosion Inhibitors, 2015-2025F ($ Million) |

| Figure13. South Africa Wastewater Treatment Chemicals Market Revenues, By Oxidants, 2015-2025F ($ Million) |

| Figure14. South Africa Wastewater Treatment Chemicals Market Revenues, By Scale Inhibitors, 2015-2025F ($ Million) |

| Figure15. South Africa Wastewater Treatment Chemicals Market Revenues, By Chelating Agents, 2015-2025F ($ Million) |

| Figure16. South Africa Wastewater Treatment Chemicals Market Revenues, By Algaecides, 2015-2025F ($ Million) |

| Figure17. South Africa Wastewater Treatment Chemicals Market Revenues, By Antifoams, 2015-2025F ($ Million) |

| Figure18. South Africa Wastewater Treatment Chemicals Market Revenues, By Biocides, 2015-2025F ($ Million) |

| Figure19. South Africa Wastewater Treatment Chemicals Market Revenues, By Neutralizing agents, 2015-2025F ($ Million) |

| Figure20. South Africa Wastewater Treatment Chemicals Market Revenues, By Other Chemicals, 2015-2025F ($ Million) |

| Figure21. South Africa Food & Beverage Application Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F ($ Million) |

| Figure22. South Africa Mining Application Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F ($ Million) |

| Figure23. South Africa Oil & Gas Application Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F ($ Million) |

| Figure24. South Africa Power Generation Application Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F ($ Million) |

| Figure25. South Africa Pharmaceutical Application Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F ($ Million) |

| Figure26. South Africa Other Applications Industrial Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F ($ Million) |

| Figure27. South Africa Northern Cape Industrial Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F ($ Million) |

| Figure28. South Africa Western Cape Industrial Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F ($ Million) |

| Figure29. South Africa Eastern Cape Industrial Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F ($ Million) |

| Figure30. South Africa Free State Industrial Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F ($ Million) |

| Figure31. South Africa Other Provinces Industrial Water & Wastewater Treatment Chemicals Market Revenues, 2015-2025F ($ Million) |

| Figure32. South Africa Actual Government Spending Vs Actual Government Revenues, 2015-2023F (RAND Trillion) |

| Figure33. South Africa Government Budget Spending Outlook, 2018 ($ Billion) |

| Figure34. Distribution of Wastewater Treatment Works, By Size Category In South Africa |

| Figure35. Wastewater treatment works capacity and performance in South Africa |

| Figure36. South Africa Water Reliability, By Provinces, 2018 |

| Figure37. Water Quality Problems Across South Africa |

| Figure38. Deterioration of South African rivers, 1999 & 2011 |

| Figure39. South Africa Map Of Strategic, High Yielding Ground & Surface Water Areas |

| Figure40. South Africa Industrial Water & Wastewater Treatment Chemicals Market Opportunity Assessment, By Types, 2025F |

| Figure41. South Africa Industrial Water & Wastewater Treatment Chemicals Market Opportunity Assessment, By Industry Type, 2025F |

| Figure42. South Africa Industrial Water & Wastewater Treatment Chemicals Market Opportunity Assessment, By Applications, 2025F |

| Figure43. South Africa Industrial Wastewater Treatment Chemicals Market Revenue Share, By Company, 2017 |

| List of Tables |

| Table1. Government Regulations For Waste Water Treatment Chemicals Concentration In Water |

| Table2. South Africa Water Tariffs, FY2017-2018 |

| Table3. South Africa Industrial Water & Wastewater Treatment Chemicals Market Revenues, By Applications, 2015-2018 ($ Million) |

| Table4. South Africa Industrial Water & Wastewater Treatment Chemicals Market Revenues, By Applications, 2019E-2025F ($ Million) |

| Table5. South Africa Annual Water Investment Requirement, 2018 ($ Billion) |

| Table6. South Africa Public-sector Infrastructure Expenditure and Estimates, FY2015-2021 ($ Billion) |

| Table7. South Africa Allocation From The Fiscus To Strategic Infrastructure Projects ($ Billion) |

| Table8. Energy Consumption in the South African Water Value Chain |

| Table9. South Africa Capital Replacement Value Per Province For Pipelines, 2017 |

| Table10. South Africa Financial Position & Contributions By The Key Sector Role Players, 2017 |

| Table11. South Africa 2030 Demand Projections (mm3) |

| Table12. South Africa Utilisation of Production Capacity in the Manufacturing Industry, By Division, Feb 2018-2019 |

| Table13. South Africa Year-on-year Percentage Change in the Volume of Mining Production, 2014-March 2019 |

| Table14. South Africa Year-on-year Percentage Change in the Volume of Mining Production, 2014-March 2019 |

| Table15. South Africa Mineral Sales at Current Prices, 2014-March 2019 (R Billion) |

| Table16. South Africa Upcoming Industrial Projects |

| Table17. South Africa Upcoming Energy Projects |

| Table18. South Africa Upcoming Construction Projects |

| Table19. South Africa Upcoming Coal & Mining Projects |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero