Australia Healthcare Logistics Market (2025-2031) | Analysis, Forecast, Industry, Growth, Outlook, Segmentation, Competitive Landscape, Value, Companies, Size & Revenue, Share, Trends

Market Forecast By Type (Non-Cold Chain, Cold Chain), By Components (Hardware, Services, Software), By Temperature Type (Ambient, Chilled/Refrigerated, Frozen, Cryogenic), By Logistics (Transportation, Packaging, Storage, Others), By Logistics Type (Overland Logistics, Sea Freight Logistics, Air Freight Logistics, Contract Logistics), By Application (Medicine, Bulk Drug Handlers, Vaccine, Chemical & Other Raw Material, Biological Material and Organs, Hazardous Cargo, Others), By End User (Biopharmaceutical Companies, Hospital & Clinics, Research Institutes, Others) And Competitive Landscape

| Product Code: ETC6182175 | Publication Date: Sep 2024 | Updated Date: Oct 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Sachin Kumar Rai | No. of Pages: 75 | No. of Figures: 26 | No. of Tables: 6 |

Topics Covered in Australia Healthcare Logistics Market Report

Australia Healthcare Logistics Market Report thoroughly covers the market by service type, product type, logistics type and end-user. Australia Healthcare Logistics Market Outlook report provides an unbiased and detailed analysis of the ongoing Australia Healthcare Logistics Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Australia Healthcare Logistics Market Synopsis

The Australia Healthcare Logistics Market is driven by large-scale investments and rising demand across research, consumer health, and exports. Between 2017–2024, the biotech sector already saw a raise in deals, and with life sciences organizations clustered in Victoria and New South Wales. Complementary medicines emerged as a strong driver, with more numbers of households using vitamins, dietary supplements, sports nutrition, and herbal products, generating more in offline retail sales in 2024, where pharmacies led with high revenue share followed by e-commerce.

Exports of complementary medicines reached higher in 2023. Broader life sciences also fueled demand, generating medical product exports. Transport infrastructure supported this growth, with freight volumes climbing from 2020 to 2021. While public investment commitments also reached high in December 2024.

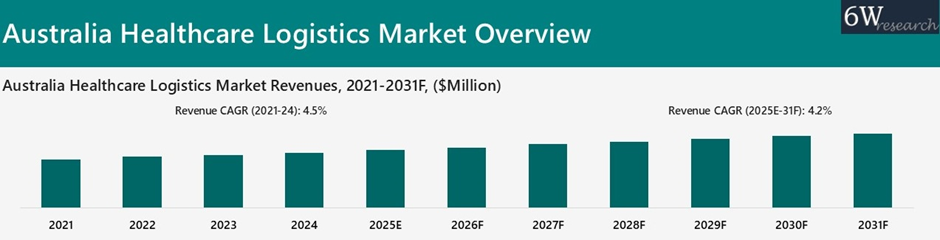

According to 6Wresearch, Australia Healthcare Logistics Market is projected to grow at a CAGR of 4.2% from 2025-2031F. The Medical Research Future Fund (MRFF) investment through 2034, including the Clinical Trials Activity initiative, would expand international research collaboration, boosting demand for specialized clinical trial logistics. Complementary medicines are projected by CSIRO to reach high by 2030, driven by ageing demographics, preventive health, and chronic condition management, which will require tailored cold chain, e-commerce, and export logistics.

Infrastructure investment remains central, with rail construction and maintenance projected to grow from 2021–22 to 2026–27. This would increase the demand for regulatory-compliant distribution, digital tracking, warehousing, and last-mile healthcare delivery. Together, these forward investments and forecasts underline the need for logistics modernization to support Australia’s expanding life sciences and healthcare exports.

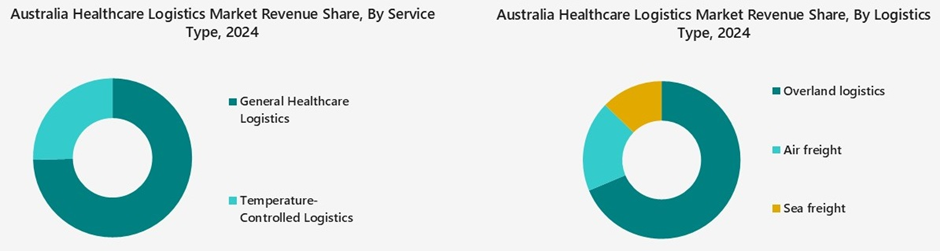

Market Segmentation By Service Type

General Healthcare Logistics is expected to see the highest revenue potential in the Australia Healthcare Logistics market due to the increasing need for efficient transportation of medical supplies, pharmaceuticals and hospital equipment across the country. Additionally, the expansion of healthcare infrastructure and growing focus on final mile delivery services are accelerating its adoption among hospitals, pharmacies and healthcare providers nationwide.

Market Segmentation By Product Type

Pharmaceutical is expected to see the greatest opportunity in the Australia Healthcare Logistics market due to increasing healthcare spending, expansion of the pharmaceutical sector, and the rising need for widespread distribution of medicines across urban and regional areas. Additionally, ongoing government initiatives to improve access to essential drugs and the continuous introduction of new medications are creating significant opportunities for logistics providers to expand their services in this segment.

Market Segmentation By Logistics Type

Overland logistics is expected to provide stable revenue stream in the Australia Healthcare Logistics market due to its extensive connectivity between major cities such as Sydney, Melbourne, Brisbane, Perth and Adelaide, as well as regional areas, enabling efficient transportation of medical supplies, pharmaceuticals and hospital equipment. Additionally, growing investments in road and rail infrastructure and the ability to serve remote and rural regions are driving its adoption among healthcare providers and logistics companies nationwide.

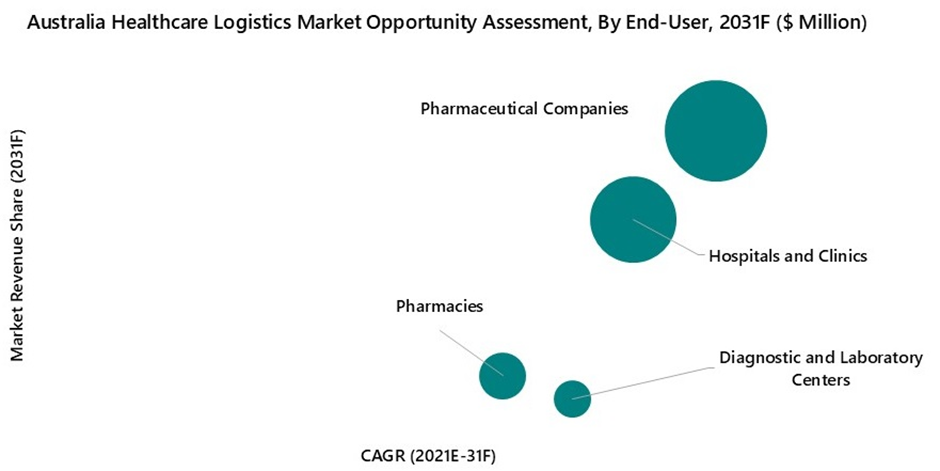

Market Segmentation By End-User

Pharmaceutical companies are expected to remain the cash cow in the Australia Healthcare Logistics market due to the increasing need for efficient distribution of medicines, medical supplies and raw materials across the country. Additionally, expanding pharmaceutical operations, a growing product portfolio, and the critical role of these companies in healthcare delivery are creating significant opportunities for healthcare logistics providers.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Australia Healthcare Logistics Market Overview

- Australia Healthcare Logistics Market Outlook

- Australia Healthcare Logistics Market Forecast

- Historical Data and Forecast of Australia Healthcare Logistics Market Revenues for the Period 2021-2031F

- Historical Data and Forecast of Australia Healthcare Logistics Market Revenues, By Service Type for the Period 2021-2031F

- Historical Data and Forecast of Australia Healthcare Logistics Market Revenues, By Product Type for the Period 2021-2031F

- Historical Data and Forecast of Australia Healthcare Logistics Market Revenues, By Logistics Type for the Period 2021-2031F

- Historical Data and Forecast of Australia Healthcare Logistics Market Revenues, By End-User for the Period 2021-2031F

- Porter’s Five Force Analysis

- Australia Healthcare Logistics Market Drivers and Restraints

- Australia Healthcare Logistics Market Trends

- Australia Healthcare Logistics Market Opportunity Assessment, By Service Type

- Australia Healthcare Logistics Market Opportunity Assessment, By Product Type

- Australia Healthcare Logistics Market Opportunity Assessment, By Logistics Type

- Australia Healthcare Logistics Market Opportunity Assessment, By End-User

- Australia Healthcare Logistics Market Revenue Ranking, By Top 3 Companies

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Service Type

- Temperature-Controlled Logistics

- General Healthcare Logistics

By Product Type

- Pharmaceuticals

- Medical Devices & Equipment

- Vaccines

- Diagnostics & Laboratory Samples

- Clinical Trial Materials

By Logistics Type

- Overland logistics

- Sea freight

- Air freight

By End-User

- Pharmaceutical Companies

- Hospitals and Clinics

- Pharmacies

- Diagnostic and Laboratory Centers

Australia Healthcare Logistics Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Australia Healthcare Logistics Market Overview |

| 3.1. Australia Healthcare Logistics Market Revenues (2021-2031F) |

| 3.2. Australia Healthcare Logistics Market Industry Life Cycle |

| 3.3. Australia Healthcare Logistics Market Porter’s Five Forces Model |

| 4. Australia Healthcare Logistics Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Australia Healthcare Logistics Market Trends |

| 6. Australia Healthcare Logistics Market Overview, By Service Type |

| 6.1. Australia Healthcare Logistics Market Revenue Share and Revenues, By Service Type (2024 & 2031F) |

| 6.1.1. Australia Healthcare Logistics Market Revenues, By Temperature-Controlled Logistics (2021–2031F) |

| 6.1.2. Australia Healthcare Logistics Market Revenues, By General Healthcare Logistics (2021–2031F) |

| 7. Australia Healthcare Logistics Market Overview, By Product Type (2021-2031F) |

| 7.1. Australia Healthcare Logistics Market Revenue Share and Revenues, By Product Type (2024 & 2031F) |

| 7.1.1. Australia Healthcare Logistics Market Revenues, By Pharmaceuticals (2021–2031F) |

| 7.1.2. Australia Healthcare Logistics Market Revenues, By Medical Devices & Equipment (2021–2031F) |

| 7.1.3. Australia Healthcare Logistics Market Revenues, By Vaccines (2021–2031F) |

| 7.1.4. Australia Healthcare Logistics Market Revenues, By Diagnostics & Laboratory Samples (2021–2031F) |

| 7.1.5. Australia Healthcare Logistics Market Revenues, By Clinical Trial Materials (2021–2031F) |

| 8. Australia Healthcare Logistics Market Overview, By Logistics Type (2021-2031F) |

| 8.1. Australia Healthcare Logistics Market Revenue Share and Revenues, By Logistics Type (2024 & 2031F) |

| 8.1.1. Australia Healthcare Logistics Market Revenues, By Overland Logistics (2021–2031F) |

| 8.1.2. Australia Healthcare Logistics Market Revenues, By Sea Freight (2021–2031F) |

| 8.1.3. Australia Healthcare Logistics Market Revenues, By Air Freight (2021–2031F) |

| 9. Australia Healthcare Logistics Market Overview, By End-User (2021-2031F) |

| 9.1. Australia Healthcare Logistics Market Revenue Share and Revenues, By End-User (2024 & 2031F) |

| 9.1.1. Australia Healthcare Logistics Market Revenues, By Pharmaceutical Companies (2021–2031F) |

| 9.1.2. Australia Healthcare Logistics Market Revenues, By Hospitals and Clinics (2021–2031F) |

| 9.1.3. Australia Healthcare Logistics Market Revenues, By Pharmacies (2021–2031F) |

| 9.1.4. Australia Healthcare Logistics Market Revenues, By Diagnostic and Laboratory Centers (2021–2031F) |

| 10. Australia Healthcare Logistics Market Key Performance Indicators |

| 11. Australia Healthcare Logistics Market Opportunity Assessment |

| 11.1. Australia Healthcare Logistics Market Opportunity Assessment, By Service Type (2031F) |

| 11.2. Australia Healthcare Logistics Market Opportunity Assessment, By Product Type (2031F) |

| 11.3. Australia Healthcare Logistics Market Opportunity Assessment, By Logistics Type (2031F) |

| 11.4. Australia Healthcare Logistics Market Opportunity Assessment, By End-User (2031F) |

| 12. Australia Healthcare Logistics Market Analysis of Vaccine Distribution Process |

| 13. Australia Healthcare Logistics Market Competitive Landscape |

| 13.1. Australia Healthcare Logistics Market Revenue Ranking, By Top 3 Companies (2024) |

| 13.2. Australia Healthcare Logistics Market Competitive Benchmarking, By Technical and Operating Parameters |

| 14. Company Profiles |

| 14.1. Smartways Logistics Holdings Pty Ltd |

| 14.2. Yusen Logistics Australia Pty Ltd |

| 14.3. CEVA Logistics (Australia) Pty Ltd |

| 14.4. Toll Holdings Pty Limited |

| 14.5. Linfox Australia Pty Ltd |

| 14.6. Sigma Healthcare Limited |

| 14.7. GEODIS Australia Pty Ltd |

| 14.8. Healthcare Logistics (HCL) |

| 14.9. Schenker Australia Pty Ltd |

| 14.10. DHL Group |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

| List of Figures |

| 1. Australia Healthcare Logistics Market Revenues, 2021-2031F (USD Million) |

| 2. Australia’s MRFF 3rd 10-year Investment Plan Fundings for 4 Major Themes, 2024-25 to 2033F-34F, (in US$ Million) |

| 3. Australia’s MRFF 3rd 10-year Investment Plan Fundings for Clinical Trials Activity Under Patients Theme, (in US$ Million) |

| 4. Australia Demand for Vitamins and Supplements 2018 and 2030F, (in US$ Billion) |

| 5. Australia Share of Vitamin and Dietary Supplements (VDS) Retail Purchases by Mode, 2024 (in %) |

| 6. Australia TGA-licensed Manufacturing Facilities for Complementary Medicines, 2023 |

| 7. Australia Share of Vitamin and Dietary Supplements (VDS) Retail Purchases by Marketplace, 2024 (in %) |

| 8. Australia Complementary Medicine Products Export Revenues by Top Destinations, 2024, (in US$ Billion) |

| 9. Australia Reasons for Shortages in Manufacturing Medicines, 2023, (in %) |

| 10. Australia Healthcare Logistics Market Revenue Share, By Service Type, 2024 & 2031F |

| 11. Australia Healthcare Logistics Market Revenue Share, By Product Type, 2024 & 2031F |

| 12. Australia Healthcare Logistics Market Revenue Share, By Logistics Type, 2024 & 2031F |

| 13. Australia Healthcare Logistics Market Revenue Share, By End User, 2024 & 2031F |

| 14. Australia Domestic Freight by Transport Mode – Total Bulk And Non–bulk, Goods Moved (billion tkm), 2023 and 2024 |

| 15. Australia Number of Deals in Pharmaceuticals/Biotechnology industry by Type, 2023 and 2024 |

| 16. Australia Number of Biotechnology Companies 2017 and 2024 |

| 17. Australia’s Life Science Ecosystem, 2024, (in %) |

| 18. Australian Exports of Medical Products, 2021-2023, (in US$ billion) |

| 19. Australia Number of Companies in Biotech Industry, 2022 |

| 20. Australia Healthcare Logistics Market Opportunity Assessment, By Service Type, 2031F ($ Million) |

| 21. Australia Healthcare Logistics Market Opportunity Assessment, By Product Type, 2031F ($ Million) |

| 22. Australia Healthcare Logistics Market Opportunity Assessment, By Logistics Type, 2031F ($ Million) |

| 23. Australia Healthcare Logistics Market Opportunity Assessment, By End User, 2031F ($ Million) |

| 24. Australia Healthcare Logistics Market Revenue Ranking, By Top 3 Companies, 2024 |

| 25. Total Domestic Freight, By State/Territory, By Road, 2024, (in billion tonne-kilometres) |

| 26. Total Domestic Freight, By State/Territory, By Rail, 2024, (in billion tonne-kilometres) |

| List of tables |

| 1. Australia Healthcare Logistics Market Revenues, By Service Type, 2021-2031F, ($ Millions) |

| 2. Australia Healthcare Logistics Market Revenues, By Product Type, 2021-2031F, ($ Millions) |

| 3. Australia Healthcare Logistics Market Revenues, By Logistics Type, 2021-2031F, ($ Millions) |

| 4. Australia Healthcare Logistics Market Revenues, By End User , 2021-2031F, ($ Millions) |

| 5. Australia’s Road Infrastructure Projects, 2024-2030F |

| 6. Comparative Vaccine Distribution Pathways in Australia |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero