Australia UPS Systems Market (2018-2024) | Value, Revenue, Companies, Growth, Outlook, Trends, Industry, Size, Analysis, Share & Forecast

Market Forecast By KVA Ratings (Up to 1 KVA, 1.1-5 KVA, 5.1-20 KVA, 20.1-50 KVA, 50.1-200 KVA and Above 200 KVA), By Applications (Residential, Industrial and Commercial including Offices, Healthcare, BFSI, Hospitality, Education, Data Center and Others), By Regions (New South Wales, Southern Australia, Western Australia, Queensland, Tasmania, Victoria and Northern Territory Australia) and Competitive Landscape

| Product Code: ETC000543 | Publication Date: Nov 2018 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 125 | No. of Figures: 45 | No. of Tables: 27 | |

Australian Government has identified infrastructure development as a priority for the economic development of the country. As a result, the Government is enabling the development in the industrial sector and commercial sub-sectors such as ICT, hospitality, and healthcare, where UPS systems are used to overcome the power outages and power fluctuation problems. Further, foreign investment in Australian commercial property is staging a comeback, with hotels the most popular asset in almost every state would also catalyze the growth of the UPS market in the country.

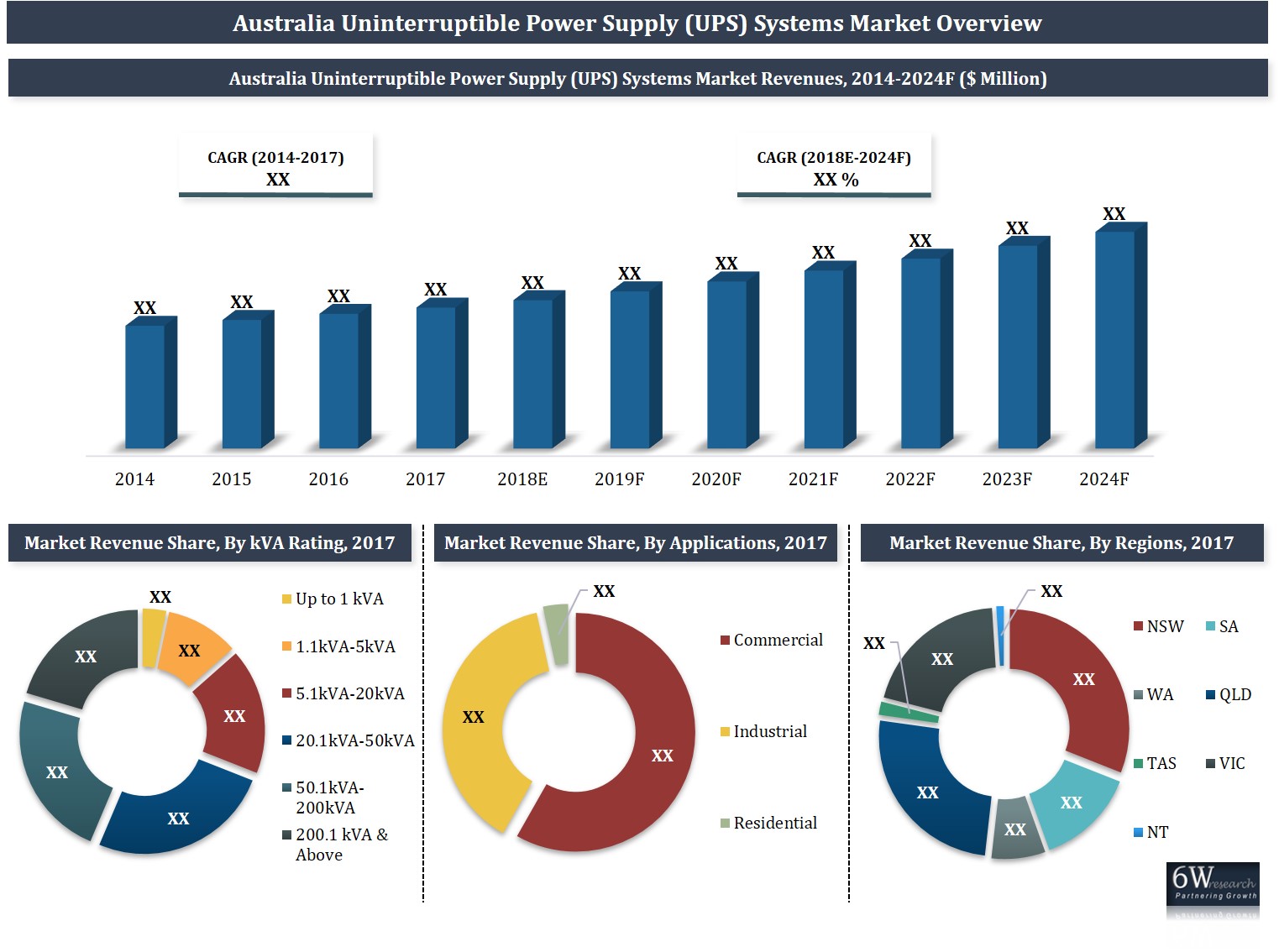

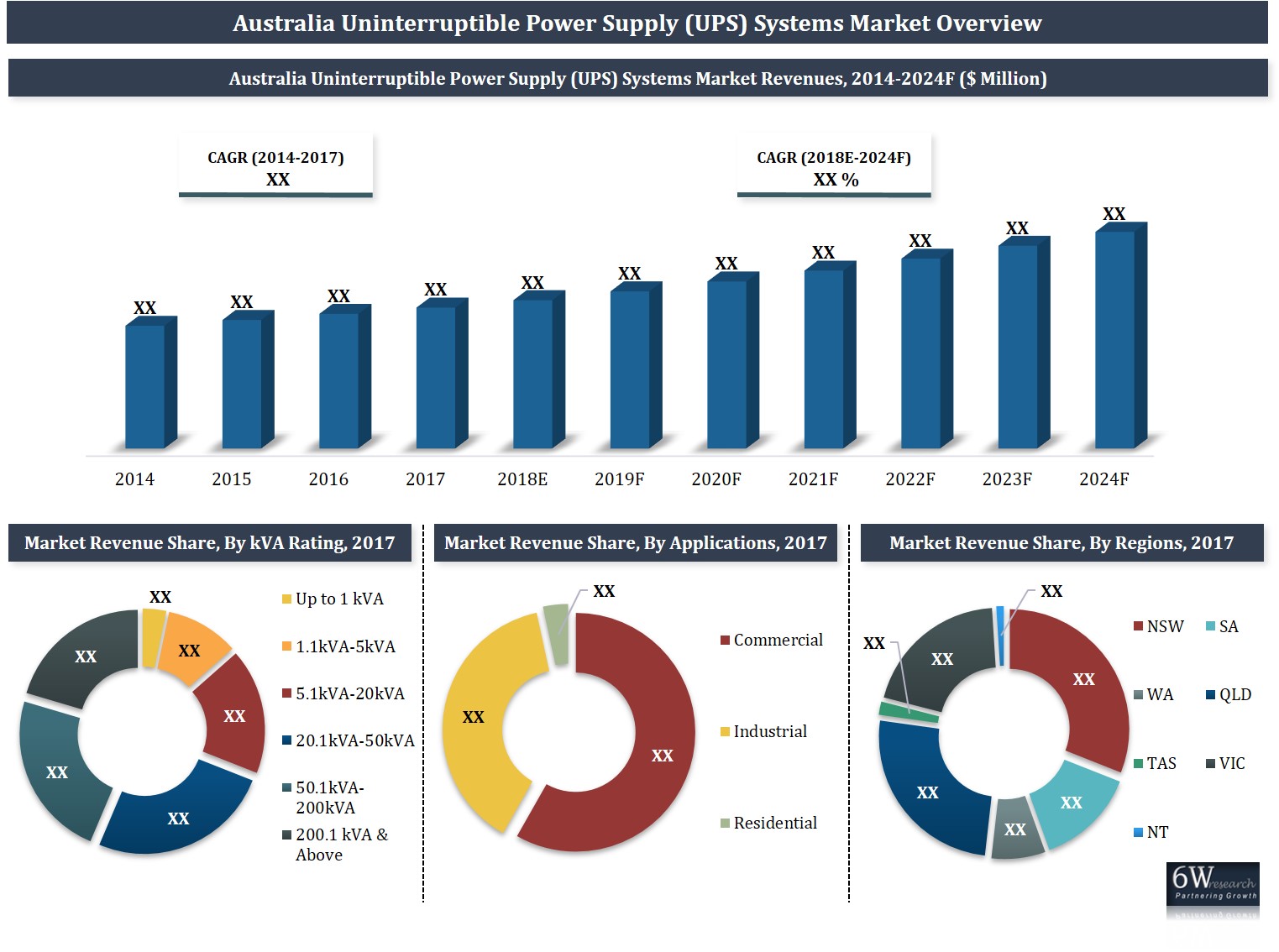

According to 6Wresearch, Australia UPS Market Size is projected to grow at a CAGR of 6.5% during 2018-24. Expected growth in the country's commercial and industrial sector on account of significant emphasis on the manufacturing industry, healthcare sector especially the medical tourism and transportation sector would drive the demand for UPS systems during the forecast period. Australian Government's 10 Year Infrastructure Investment Plan to boost the country's infrastructure would also play a key role in driving the UPS systems market over the coming years. Further, rising investment for technological advancement of sectors such as Healthcare, Banking & Finance, Education, and Transportation & Logistics would strengthen the ICT sector which in turn would also drive the growth of Australia UPS Market.

New South Wales region is projected to witness the highest Australia UPS market share over the coming years on account of The NSW State Infrastructure Strategy 2018-2038 for infrastructure investment and land-use planning for the region. Further, rising investment in digital technologies for innovation in service delivery and better management of assets and to improve service quality and efficiency in various sectors through more connected infrastructure, and data and technology investment would also help the New South Wales region to continue its dominance in the future as well.

New South Wales region is projected to witness the highest Australia UPS market share over the coming years on account of The NSW State Infrastructure Strategy 2018-2038 for infrastructure investment and land-use planning for the region. Further, rising investment in digital technologies for innovation in service delivery and better management of assets and to improve service quality and efficiency in various sectors through more connected infrastructure, and data and technology investment would also help the New South Wales region to continue its dominance in the future as well.

The Australia UPS market report thoroughly covers the Australia Uninterruptible Power Supply (UPS) Systems Market by kVA ratings, applications, and regions. The Australia UPS Market outlook report provides an unbiased and detailed analysis of the Australia UPS market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Australia UPS system market is anticipated to register sound growth in the coming timeframe on the back of the rising growth of the BFSI sector. Further, the growing digitalization healthcare and food sector as well has led to augment the demand for UPS systems owing to the rising expansion of supermarket stores with the growing population base which use systems to run store digitally, as a result, the growth of the UPS system would also increase to ensure continuous activity in case of power supply and this is estimated to boost the growth of the Australia UPS system market in the upcoming six years.

Key Highlights of the Report:

• Australia UPS Market Overview

• Australia UPS Market Outlook

• Australia UPS Market Forecast

• Historical Data of Global Uninterruptible Power Supply (UPS) Systems Market For The Period 2014-2017

• Market Size & Forecast of Global Uninterruptible Power Supply (UPS) Systems Market, Until 2024

• Historic Data of Australia UPS Market Revenues and Volume, 2014-2017

• Australia UPS Market Size & Australia UPS Market Forecast, Until 2024

• Historic Data of Australia UPS Systems Market Revenues & Volume for up to 1 kVA During 2014-2017

• Market Size & Forecast of Australia UPS Market Revenues & Volume for up to 1 kVA, Until 2024

• Historic Data of Australia 1.1 kVA - 5 kVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Australia 1.1 kVA - 5 kVA UPS Systems Market Revenues & Volume, Until 2024

• Historic Data of Australia 5.1 kVA - 20 kVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Australia 5.1 kVA - 20 kVA UPS Systems Market Revenues & Volume, Until 2024

• Historic Data of Australia 20.1 kVA - 50 kVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Australia 20.1 kVA - 50 kVA UPS Systems Market Revenues & Volume, Until 2024

• Historic Data of Australia 50.1 kVA - 200 kVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Australia 50.1 kVA - 200 kVA UPS Systems Market Revenues & Volume Until 2024

• Historic Data of Australia Above 200 kVA UPS Systems Market Revenues & Volume 2014-2017

• Market Size & Forecast of Australia 200 kVA & Above UPS Systems Market Revenues & Volume until 2024

• Historical data and Forecast of Australia Uninterruptible Power Supply (UPS) Systems Market, By Applications

• Historical data and Forecast of Australia Uninterruptible Power Supply (UPS) Systems Market, By Regions

• Australia UPS Market Drivers and Restraints

• Australia UPS Market Trends and Opportunities

• Australia UPS Market Overview on Competitive Landscape

• Australia UPS Market Share, By Players

• Company Profiles

• Strategic Recommendations

Markets Covered

The Australia UPS Market Report provides a detailed analysis of the following market segments:

• By KVA Ratings

o Up to 1 KVA

o 1.1-5 KVA

o 5.1-20 KVA

o 20.1-50 KVA

o 50.1-200 KVA

o Above 200 KVA

• By Applications

o Residential

o Industrial

o Commercial (Offices, healthcare, BFSI, hospitality, education, Data Center & Others.)

• By Regions

o New South Wales

o Southern Australia

o Western Australia

o Queensland

o Tasmania

o Victoria

o Northern Territory Australia

Frequently Asked Questions About the Market Study (FAQs):

1. Executive Summary

1. Executive Summary

2. Introduction

2.1 Report Description

2.2 Key Highlights of The Report

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumptions

3. Global Uninterruptible Power Supply (UPS) Systems Market Overview

3.1 Global Uninterruptible Power Supply (UPS) Systems Market Revenues, 2014-2024F

3.2 Global Uninterruptible Power Supply (UPS) Systems Market Revenue Share, By Regions (2017)

4. Australia Uninterruptible Power Supply (UPS) Systems Market Overview

4.1 Australia Country Overview

4.2 Australia Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume, 2014-2024F

4.3 Australia Uninterruptible Power Supply (UPS) Systems Market Revenue Share, By kVA Rating (2017 & 2024F)

4.4 Australia Uninterruptible Power Supply (UPS) Systems Market Volume Share, By kVA Rating (2017 & 2024F)

4.5 Australia Uninterruptible Power Supply (UPS) Systems Market Revenue Share, By Applications (2017 & 2024F)

4.6 Australia Uninterruptible Power Supply (UPS) Systems Market Volume Share, By Applications (2017 & 2024F)

4.7 Australia Uninterruptible Power Supply (UPS) Systems Market Revenue Share, By Regions (2017 & 2024F)

4.8 Australia Uninterruptible Power Supply (UPS) Systems Market Industry Life Cycle

4.9 Australia Uninterrupted Power Supply (UPS) Systems Market - Porter's Five Forces Model

5. Australia Uninterruptible Power Supply (UPS) Systems Market Dynamics

5.1 Impact Analysis

5.2 Market Drivers

5.3 Market Restraints

6. Australia Uninterruptible Power Supply (UPS) Systems Market Trends

7. Australia Uninterruptible Power Supply (UPS) Systems Market Overview, By kVA Rating

7.1 Australia Up to 1 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume, 2014-2024F

7.1.1 Australia Up to 1 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

By Applications, 2014-2024F

7.2 Australia 1.1-5 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume, 2014-2024F

7.2.1 Australia 1.1-5 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

By Applications, 2014-2024F

7.3 Australia 5.1-20 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume, 2014-2024F

7.3.1 Australia 5.1-20 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

By Applications, 2014-2024F

7.4 Australia 20.1-50 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume, 2014-2024F

7.4.1 Australia 20.1-50 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

By Applications, 2014-2024F

7.5 Australia 50.1-200 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume, 2014-2024F

7.5.1 Australia 50.1-200 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

By Applications, 2014-2024F

7.6 Australia Above 200 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume, 2014-2024F

7.6.1 Australia Above 200 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

By Applications, 2014-2024F

7.7 Australia Up to 1 kVA rated Uninterruptible Power Supply (UPS) Systems Price Trend, 2014-2024F

7.8 Australia 1.1-5 kVA rated Uninterruptible Power Supply (UPS) Systems Price Trend, 2014-2024F

7.9 Australia 5.1-20 kVA rated Uninterruptible Power Supply (UPS) Systems Price Trend, 2014-2024F

7.10 Australia 20.1-50 kVA rated Uninterruptible Power Supply (UPS) Systems Price Trend, 2014-2024F

7.11 Australia 50.1-200 kVA rated Uninterruptible Power Supply (UPS) Systems Price Trend, 2014-2024F

7.12 Australia Above 200 kVA rated Uninterruptible Power Supply (UPS) Systems Price Trend, 2014-2024F

8. Australia Uninterruptible Power Supply (UPS) Systems Market Overview, By Applications

8.1 Australia Commercial Applications Uninterruptible Power Supply (UPS) Systems Market

Revenues & Volume, 2014-2024F

8.1.1 Australia Commercial Applications Uninterruptible Power Supply (UPS) Systems Market

Revenues, By Sub-Segment, 2014-2024F

8.2 Australia Industrial Applications Uninterruptible Power Supply (UPS) Systems Market

Revenues & Volume, 2014-2024F

8.3 Australia Residential Applications Uninterruptible Power Supply (UPS) Systems Market

Revenues & Volume, 2014-2024F

9. Australia Uninterruptible Power Supply (UPS) Systems Market Overview, By Regions

9.1 Australia New South Wales Region Uninterruptible Power Supply (UPS) Systems Market Revenues, 2014-2024F

9.2 Southern Australia Region Uninterruptible Power Supply (UPS) Systems Market Revenues, 2014-2024F

9.3 Western Australia Region Uninterruptible Power Supply (UPS) Systems Market Revenues, 2014-2024F

9.4 Australia Queensland Region Australia Uninterruptible Power Supply (UPS) Systems Market

Revenues, 2014-2024F

9.5 Australia Tasmania Region Uninterruptible Power Supply (UPS) Systems Market Revenues, 2014-2024F

9.6 Australia Victoria Region Australia Uninterruptible Power Supply (UPS) Systems Market Revenues, 2014-2024F

9.7 Australia Northern Territory Region Uninterruptible Power Supply (UPS) Systems Market Revenues, 2014-2024F

10. Australia Uninterruptible Power Supply (UPS) Systems Market Key Performance Indicators

10.1 Australia Government Spending Outlook

11. Australia Uninterruptible Power Supply (UPS) Systems Market Opportunity Assessment

11.1 Australia UPS Systems Market Opportunity Assessment, By kVA Rating

11.2 Australia UPS Systems Market Opportunity Assessment, By Applications

12. Competitive Landscape

12.1 Competitive Benchmarking, By kVA Rating

12.2 Australia Uninterruptible Power Supply (UPS) Systems Market Revenue Share, By Company, 2017

13. Company Profiles

13.1 Schneider Electric (Australia) Pty Ltd.

13.2 Eaton Industries Pty Ltd.

13.3 Vertiv Co.

13.4 General Electric Australia Pty Ltd.

13.5 ABB Australia Pty Limited

13.6 Socomec Group S.A.

13.7 Tripp Lite

13.8 Delta Energy Systems (Australia) Pty Ltd.

13.9 RIELLO UPS AUSTRALIA Pty. Ltd.

13.10 Fuji Electric Asia Pacific Pte. Ltd.

14. Key Strategic Recommendations

15. Disclaimer

List of Figures

1. Global Uninterruptible Power Supply (UPS) Systems Market Revenues, 2014-2024F ($ Billion)

2. Global Uninterruptible Power Supply (UPS) Market Revenue Share, By Regions (2017)

3. Australia Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

2014-2024F ($ Million, Thousand Units)

4. Australia Uninterruptible Power Supply (UPS) Systems Market Revenue Share, By kVA Rating (2017 & 2024F)

5. Australia Uninterruptible Power Supply (UPS) Systems Market Volume Share, By kVA Rating (2017 & 2024F)

6. Australia Uninterruptible Power Supply (UPS) Systems Market Revenue Share, By Applications (2017 & 2024F)

7. Australia Uninterruptible Power Supply (UPS) Systems Market Volume Share, By Applications (2017 & 2024F)

8. Australia Uninterruptible Power Supply (UPS) Systems Market Revenue Share, By Regions (2017 & 2024F)

9. Australia Cloud Services Comparative Market Size, 2016 & 2022

10. Australia Cloud Services Comparative CAGR For, 2015-2021

11. Australia Digital Services Market Revenues, 2015-2021F ($ Million)

12. Australia Break Down of Rooms In Pipeline By Projected Opening Years, 2018-2024F

13. Global Significance of Australia's Financial Markets

14. Australia Healthcare Market, 2010-2020F ($ Billion)

15. Australia Up to 1 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

2014-2024F ($ Million, Thousand Units)

16. Australia 1.1-5 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

2014-2024F ($ Million, Thousand Units)

17. Australia 5.1-20 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

2014-2024F ($ Million, Thousand Units)

18. Australia 20.1-50 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

2014-2024F ($ Million, Thousand Units)

19. Australia 50.1-200 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

2014-2024F ($ Million, Thousand Units)

20. Australia Above 200 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

2014-2024F ($ Million, Thousand Units)

21. Australia Up to 1 kVA rated Uninterruptible Power Supply (UPS) Systems Price Trend, 2014-2024F ($ per Unit)

22. Australia 1.1-5 kVA rated Uninterruptible Power Supply (UPS) Systems Price Trend, 2014-2024F ($ per Unit)

23. Australia 5.1-20 kVA rated Uninterruptible Power Supply (UPS) Systems Price Trend, 2014-2024F ($ per Unit)

24. Australia 20.1-50 kVA rated Uninterruptible Power Supply (UPS) Systems Price Trend, 2014-2024F ($ per Unit)

25. Australia 50.1-200 kVA rated Uninterruptible Power Supply (UPS) Systems Price Trend, 2014-2024F ($ per Unit)

26. Australia Above 200 kVA rated Uninterruptible Power Supply (UPS) Systems Price Trend, 2014-2024F ($ per Unit)

27. Australia Commercial Applications Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

2014-2024F ($ Million, Thousand Units)

28. Australia Industrial Applications Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

2014-2024F ($ Million, Thousand Units)

29. Australia Upcoming Infrastructure Development Projects (2018)

30. Australia Residential Applications Uninterruptible Power Supply (UPS) Systems Market Revenues & Volume,

2014-2024F ($ Million, Thousand Units)

31. Australia New South Wales Region Uninterruptible Power Supply (UPS) Systems Market Revenues,

2014-2024F ($ Million)

32. Southern Australia Region Uninterruptible Power Supply (UPS) Systems Market Revenues, 2014-2024F ($ Million)

33. Western Australia Region Uninterruptible Power Supply (UPS) Systems Market Revenues, 2014-2024F ($ Million)

34. Australia Queensland Region Australia Uninterruptible Power Supply (UPS) Systems Market Revenues,

2014-2024F ($ Million)

35. Australia Tasmania Region Uninterruptible Power Supply (UPS) Systems Market Revenues, 2014-2024F ($ Million)

36. Australia Victoria Region Australia Uninterruptible Power Supply (UPS) Systems Market Revenues,

2014-2024F ($ Million)

37. Australia Northern Territory Region Uninterruptible Power Supply (UPS) Systems Market Revenues,

2014-2024F ($ Million)

38. Australia Actual Government Spending Vs Actual Government Revenues, 2015-2023F (AUD Billion)

39. Australian Government Revenue Share, By Segments, 2018-19

40. Australian Government Revenues Contribution, By Segments, 2018-19

41. Australian Government Expenses Percentages, By Segments, 2018-19

42. Australian Government Expenses Contribution, By Segments, 2018-19

43. Australia UPS Systems Market Opportunity Assessment, By kVA Rating, 2024F

44. Australia UPS Systems Market Opportunity Assessment, By Application, 2024F

45. Australia Uninterruptible Power Supply (UPS) Systems Market Revenue Share, By Company, 2017

List of Tables

1. Key Data Center Operators In Australia

2. Australia Up to 1 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues, By Applications, 2014-2024F (Units)

3. Australia Up to 1 kVA Uninterruptible Power Supply (UPS) Systems Market Volume, By Applications, 2014-2024F (Units)

4. Australia 1.1-5 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues, By Applications, 2014-2024F ($ Million)

5. Australia 1.1-5 kVA Uninterruptible Power Supply (UPS) Systems Market Volume, By Applications, 2014-2024F (Units)

6. Australia 5.1-20 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues, By Applications, 2014-2024F ($ Million)

7. Australia 5.1-20 kVA Uninterruptible Power Supply (UPS) Systems Market Volume, By Applications, 2014-2024F (Units)

8. Australia 20.1-50 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues, By Applications, 2014-2024F ($ Million)

9. Australia 20.1-50 kVA Uninterruptible Power Supply (UPS) Systems Market Volume, By Applications, 2014-2024F (Units)

10. Australia 50.1-200 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues,By Applications, 2014-2024F ($ Million)

11. Australia 50.1-200 kVA Uninterruptible Power Supply (UPS) Systems Market Volume, By Applications, 2014-2024F (Units)

12. Australia Above 200 kVA Uninterruptible Power Supply (UPS) Systems Market Revenues, By Applications, 2014-2024F ($ Million)

13. Australia Above 200 kVA Uninterruptible Power Supply (UPS) Systems Market Volume, By Applications, 2014-2024F (Units)

14. Australia Uninterruptible Power Supply (UPS) Systems Market Revenues, Commercial Sub-Segment, 2014-2017 ($ Million)

15. Australia Uninterruptible Power Supply (UPS) Systems Market Revenues, Commercial Sub-Segment, 2018E-2024F ($ Million)

16. Offices Expected To Be Completed Within the Next Two Years Across Australia's Major Cities, (2019-20)

17. Australia Hospitality Industry Overview

18. New Hotels in Perth CBD: Committed & Under Construction

19. Number of Apartments Supply Pipeline By Stage & Precinct, as at 2017

20. New South Wales Number of Dwelling Commencements, (2010-2021)

21. Victoria Number of Dwelling Commencements, (2010-2021)

22. Queensland Number of Dwelling Commencements, (2010-2021)

23. South Australia Number of Dwelling Commencements, (2010-2021)

24. Western Australia Number of Dwelling Commencements, (2010-2021)

25. Tasmania Australia Number of Dwelling Commencements, (2010-2021)

26. Australia Upcoming National Rail Program Projects

27. Infrastructure Investment Program Projects Under 10 Year Infrastructure Investment Pipeline

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero