Cambodia Asphalt Market (2023-2029) | Trends, Value, Revenue, Outlook, Forecast, Size, Analysis, Growth, Industry, Share, Segmentation & COVID-19 IMPACT

Market Forecast By Type (Paving Petroleum Asphalt, Industrial Petroleum Asphalt, Others), By Application (Paving, Roofing, Others) And Competitive Landscape

| Product Code: ETC029213 | Publication Date: Feb 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 59 | No. of Figures: 17 | No. of Tables: 4 |

Cambodia Asphalt Market Synopsis

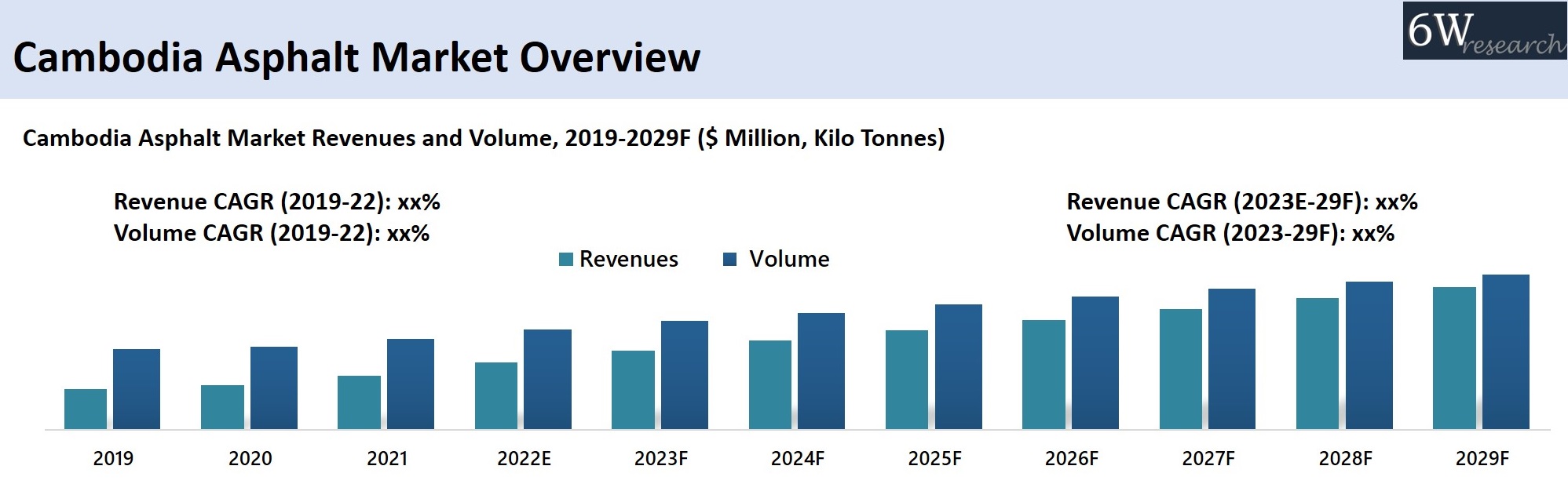

The Cambodia Asphalt Market is anticipated to grow at a tremendous growth in the coming years. The demand for asphalt in 2020 decreased owing to the COVID-19 pandemic which created halt in the construction activities and the government announced to postpone the construction projects which were likely to begin, thereby the construction sector in the country decreased by 1.8%. However, the construction industry revived and observed growth by 2.1% in 2021 on the back of resumption of construction activities. Further the project such as South Cambodia-Bokor Road Development, Sre Ambel to Koh Kong Road Renovation, Kratie-Kampong Thom bridge has increased the demand for asphalt.

According to 6Wresearch, Cambodia Asphalt Market revenue size is projected to grow at a CAGR of 10.3% during 2023-2029. The road infrastructure in Cambodia is set to witness massive boost after the approval of government's forthcoming $50 billion, 10-year infrastructure master plan that would include around 330 projects, including construction of roads, road repairs and other road improvements which is expected to drive the Cambodia Asphalt Industry in the coming years. This sector is one of the fastest-growing market and it is a crucial part of the Asia Pacific Asphalt Market.

The market in the country is rising effortlessly and construction sector is the driving the demand fir asphalt in Cambodia. Owing to major construction projects such as upgradation of national road 5 and Korea-Cambodia Friendship Bridge, the demand for asphalt is expected to increase in the coming years. Infrastructure projects such as new Phnom Penh International airport and road infrastructure projects such as Phnom-Penh-bavet expressway are expected to boost the demand for asphalt in the upcoming years.

Airport infrastructure in Cambodia is expected to grow at a rapid pace as the investment in airport infrastructure would rise significantly in the years ahead. The construction of New Phnom Penh International Airport (NPPIA) worth of $1.5 billion, is scheduled to be fully developed by 2050, and it is anticipated to serve 30 million passengers by 2030 and 50 million passengers annually by the year 2050.

Cambodia Road Infrastructure is on the rise and in the upcoming years road infrastructure is expected to play a pivotal role in the growth of asphalt market in Cambodia. In Siem Reap, Sihanoukville, Koh Kong, and other provinces, the Government of Cambodia has undertaken several significant road construction projects such as Phnom-Penh-Bavet Expressway, National Roads 1 and 5. Asphalt is primarily used in construction of roads henceforth, the rise in road projects in the years ahead would drive the market for asphalt in Cambodia.

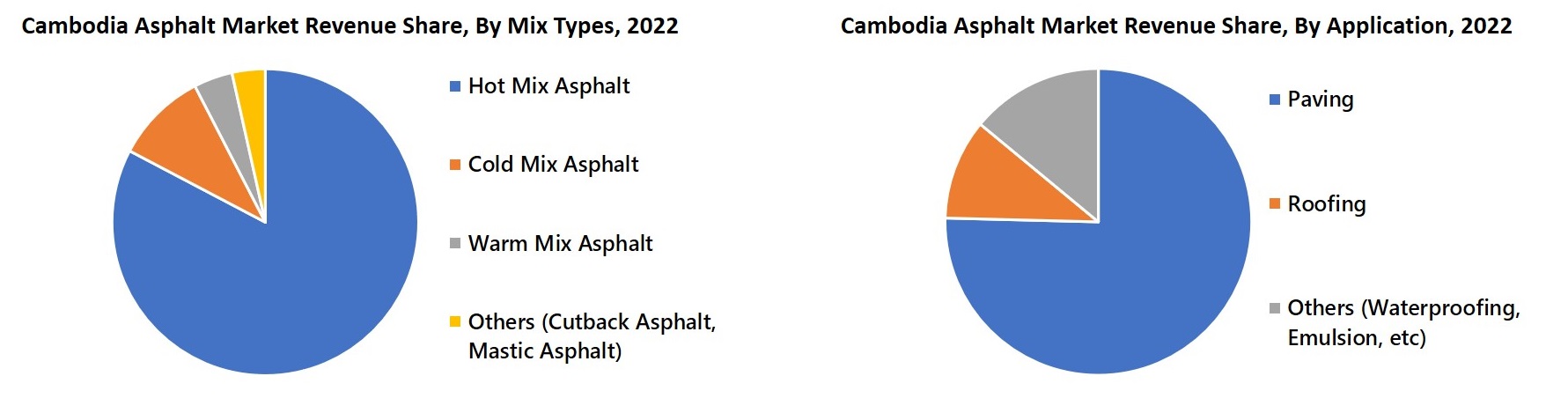

Market by Mix Type

By Mix Type, hot mix segment is expected to garnered highest revenue share in the upcoming years owing to rising demand for hot mix in paving and restructuring of roads. However, warm mix asphalt is expected to grow at a faster rate as it reduces fuel consumption and emission.

Market by Application

By Application, paving is expected register highest growth in the upcoming years owing to rising roadway construction projects such as Korea-Cambodia Friendship Bridge with project value of the USD $1.5 billion is expected to be completed by 2023 and $110 million NR4 road rehabilitation project which is expected to be finished by 2026.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2023

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Cambodia Asphalt Market Outlook

- Forecast of Cambodia Asphalt Market, 2029

- Historical Data and Forecast of Cambodia Asphalt Revenues & Volume for the Period 2019 - 2029

- Cambodia Asphalt Market Trend and Evolution

- Cambodia Asphalt Market Drivers and Restraints

- Cambodia Asphalt Porter's Five Forces

- Cambodia Asphalt Industry Life Cycle

- Historical Data and Forecast of Cambodia Asphalt Market Revenue Share & Revenues, By Type for the Period 2019 - 2029

- Historical Data and Forecast of Cambodia Asphalt Market Revenue Share & Revenues, By Application for the Period 2019 - 2029

- Market Opportunity Assessment

- Cambodia Asphalt Competitive Benchmarking By Operational Parameters

- Cambodia Asphalt Company Profiles

- Cambodia Asphalt Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Type

- Paving Petroleum Asphalt

- Industrial Petroleum Asphalt

- Others

By Application

- Paving

- Roofing

- Others

Cambodia Asphalt Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Cambodia Asphalt Market Overview |

| 3.1. Cambodia Asphalt Market Revenues & Volume, 2019-2029F |

| 3.2. Cambodia Asphalt Market Industry Life Cycle |

| 3.3. Cambodia Asphalt Market Porter's Five Forces |

| 4. Impact Analysis of COVID-19 on Cambodia Asphalt Market |

| 5. Cambodia Asphalt Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.3. Market Restraints |

| 6. Cambodia Asphalt Market Trends and Evolution |

| 7. Cambodia Asphalt Market Overview, By Mix Type |

| 7.1. Cambodia Asphalt Market Revenue Share & Revenues, By Mix Types, 2019- 2029F |

| 7.1.1 Cambodia Asphalt Market Revenues, By Hot Mix Asphalt, 2019- 2029F |

| 7.1.2 Cambodia Asphalt Market Revenues, By Cold Mix Asphalt, 2019- 2029F |

| 7.1.3 Cambodia Asphalt Market Revenues, By Warm Mix Asphalt, 2019- 2029F |

| 7.1.4 Cambodia Asphalt Market Revenues, By Others, 2019- 2029F |

| 8. Cambodia Asphalt Market Overview, By Application |

| 8.1. Cambodia Asphalt Market Revenue Share and Revenues, By Application, 2019- 2029F |

| 8.1.1 Cambodia Asphalt Market Revenues, By Paving, 2019- 2029F |

| 8.1.2 Cambodia Asphalt Market Revenues, By Roofing, 2019- 2029F |

| 8.1.3 Cambodia Asphalt Market Revenues, By Others, 2019- 2029F |

| 9. Cambodia Asphalt Market Import Trade Statistics |

| 10. Cambodia Asphalt Market Key Performance Indicators |

| 11. Cambodia Asphalt Market - Opportunity Assessment |

| 11.1 Cambodia Asphalt Market Opportunity Assessment, By Mix Type, 2029F |

| 11.2 Cambodia Asphalt Market Opportunity Assessment, By Application, 2029F |

| 12. Cambodia Asphalt Market - Competitive Landscape |

| 12.1. Cambodia Asphalt Market Revenue Ranking, By Companies, 2022 |

| 12.2. Cambodia Asphalt Market Competitive Benchmarking, By Operating Parameters |

| 13. Company Profiles |

| 13.1. Tipco Asphalt Public Company Limited |

| 13.2. Chevron Corporation |

| 13.3. ExxonMobil Corporation |

| 13.4. IRPC Public Company Limited |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| 1. Cambodia Asphalt Market Revenues and Volume, 2019-2029F ($ Million, Kilo Tonnes) |

| 2. Cambodia Airport Infrastructure Investment, 2020-2040F ($ Million) |

| 3. Cambodia Road Infrastructure Investment, 2020-2040F ($ Million) |

| 4. Cambodia Precipitation, 2019-2021, in millimeter |

| 5. Cambodia Maximum Temperature, 2018-2021, in Degree Celsius |

| 6. Brent Crude Oil Prices, 2018-2022, in $ |

| 7. Cambodia Asphalt Market Revenue Share, By Mix Type, 2022 & 2029F |

| 8. Cambodia Asphalt Market Revenue Share, By Application, 2022 & 2029F |

| 9. Share of Top 3 Import Partners, 2021 |

| 10. Cambodia Asphalt Import Data, By Top 3 Country, 2021 (in $ Million) |

| 11. Cambodia Total Road Length (km), 2020 |

| 12. Siem Reap Housing Supply, 2019-2023E |

| 13. Sihanoukville Condominium Supply, 2020-2024F |

| 14. Phnom Penh Condominium Supply, 2020-2024F |

| 15. Cambodia Asphalt Market Opportunity Assessment, By Mix Type, 2029F |

| 16. Cambodia Asphalt Market Opportunity Assessment, By Application, 2029F |

| 17. Cambodia Asphalt Market Revenue Ranking, By Companies, 2022 |

| List of Tables |

| 1. Cambodia Asphalt Market Revenues, By Mix Type, 2019-2029F ($ Million) |

| 2. Cambodia Asphalt Market Revenues, By Application,, 2019-2029F ($ Million) |

| 3. Key Road Projects in Cambodia |

| 4. Upcoming Infrastructure Construction Projects in Cambodia |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero