China Commercial Dishwasher Market (2025-2031) | Strategic Insights, Competitive, Trends, Supply, Demand, Revenue, Investment Trends, Growth, Drivers, Share, Restraints, Segments, Forecast, Segmentation, Opportunities, Consumer Insights, Strategy, Pricing Analysis, Value, Competition, Size, Outlook, Companies, Challenges, Industry, Analysis

Market Forecast By Product Type (Undercounter, Door-Type, Conveyor, Flight-Type), By Capacity (Low-Capacity, Medium-Capacity, High-Capacity, Industrial-Scale), By Operation Mode (Manual, Semi-Automatic, Automatic, Smart-Controlled), By End User (Hotels, Hospitals, Schools, Airports) And Competitive Landscape

| Product Code: ETC11512389 | Publication Date: Apr 2025 | Updated Date: Sep 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Shubham Deep | No. of Pages: 88 | No. of Figures: 31 | No. of Tables: 9 |

Topics Covered in the China Commercial Dishwasher Market Report

China Commercial Dishwasher Market Report thoroughly covers the market by product type, capacity, operation mode, and end user. China Commercial Dishwasher Market Outlook report provides an unbiased and detailed analysis of the ongoing China Commercial Dishwasher Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

China Commercial Dishwasher Market Synopsis

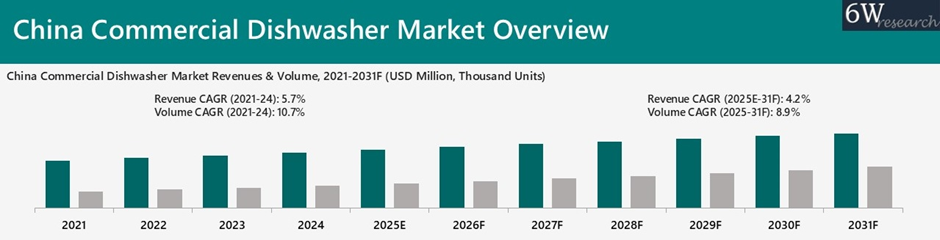

The China Commercial Dishwasher Market posted steady growth between 2021 and 2024, supported by the rapid expansion of the HoReCa sector, rising tourism, and favourable government policies. During this period, restaurants, cafes, and hotel chains proliferated across the country. In 2024 alone, China added some new coffee shops, resulting in a net increase of outlets and lifting the total store count year on year.

This made China the world’s largest branded coffee shop market and significantly amplified the demand for reliable commercial dishwashers. At the same time, the tourism sector contributed to China’s economy in 2024, an increase over the previous year, with domestic travel accounting for tourism spending. This surge in tourism directly boosted hotels, restaurants, cafes, and catering services, further fueling demand for commercial dishwashers across the country.

According to 6Wresearch, the China Commercial Dishwasher Market is projected to grow at a CAGR of 4.2% from 2025 to 2031F. The China commercial dishwasher market is poised to maintain its growth momentum, driven by the expansion of the HoReCa sector alongside rising demand from non-hospitality segments. The restaurant and foodservice industry have staged a strong post-pandemic recovery, reaching high in 2023 with a year-on-year increase, and is expected to climb further by 2025.

This steady growth reinforces the need for reliable, large-scale dishwashing systems as hotels, restaurants, and catering providers focus on operational efficiency, food safety, and customer experience. Beyond hospitality, the non-hospitality sector is also fueling adoption. For instance, China plans to increase its number of airports by 2035, a development that would directly boost dishwasher demand in airline catering kitchens, airport food courts, and premium lounges.

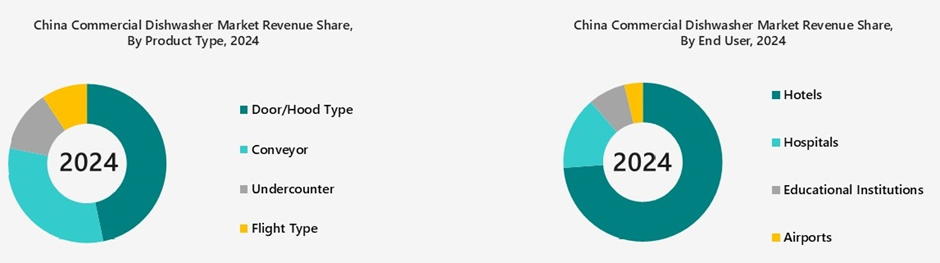

Market Segmentation By Product Type

By 2031, flight-type dishwashers are expected to post the fastest growth in the China Commercial Dishwasher Market. Their high-capacity design appeals to large hotels, airports, and institutional kitchens, while rising labor costs improve the case for automation. Operators value their efficiency and hygiene consistency compared to smaller models. Expanding infrastructure projects and non-hospitality demand would further boost adoption, driving rapid expansion.

Market Segmentation By Capacity

By 2031, industrial-scale dishwashers would post the fastest growth in the China Commercial Dishwasher Market. Rising hotel chains, expanding airports, and larger hospital and university kitchens are fueling demand for high-capacity systems. Stricter hygiene regulations, rising labor costs, and supplier innovations would further accelerate adoption, making this the most dynamic growth category.

Market Segmentation By Operation Mode

By 2031, smart-controlled dishwashers are expected to post the fastest growth in the China Commercial Dishwasher Market. Rising demand for automation, energy efficiency, and hygiene compliance makes smart features attractive for hotels, hospitals, and large kitchens. IoT connectivity, predictive maintenance, and government incentives for green, smart appliances would further accelerate adoption, driving rapid expansion of this segment.

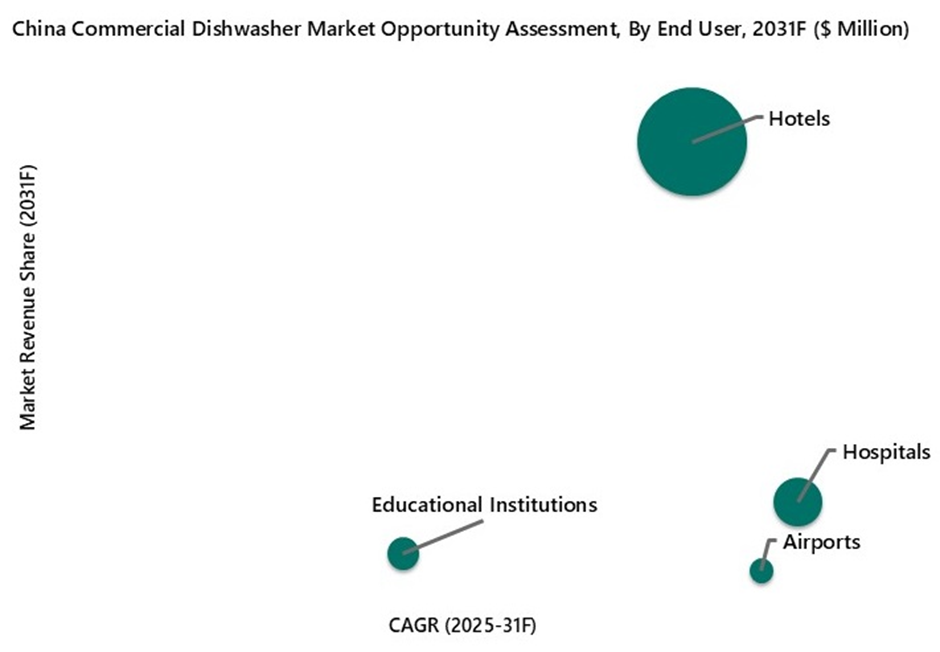

Market Segmentation By End User

By 2031, hospitals are expected to post the fastest growth in the China Commercial Dishwasher Market. Rising healthcare investments, an aging population, and the expansion of both public and private hospitals are driving demand. Strict hygiene regulations and the need for large-scale, high-spec disinfection systems in hospital kitchens and central facilities would further accelerate adoption, making hospitals the fastest-growing end-user segment.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data: Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- China Commercial Dishwasher Market Overview

- China Commercial Dishwasher Market Outlook

- China Commercial Dishwasher Market Forecast

- Historical Data and Forecast of China Commercial Dishwasher Market Revenues for the Period 2021-2031F

- Historical Data and Forecast of China Commercial Dishwasher Market Volumes for the Period 2021-2031F

- Historical Data and Forecast of China Commercial Dishwasher Market Revenues, By Product Type, for the Period 2021-2031F

- Historical Data and Forecast of China Commercial Dishwasher Market Volume, By Product Type, for the Period 2021-2031F

- Historical Data and Forecast of China Commercial Dishwasher Market Revenues, By Capacity, for the Period 2021-2031F

- Historical Data and Forecast of China Commercial Dishwasher Market Volume, By Capacity, for the Period 2021-2031F

- Historical Data and Forecast of China Commercial Dishwasher Market Revenues, By Operation Mode, for the Period 2021-2031F

- Historical Data and Forecast of China Commercial Dishwasher Market Revenues, By End User, for the Period 2021-2031F

- Porter’s Five Force Analysis

- China Commercial Dishwasher Market Drivers and Restraints

- China Commercial Dishwasher Market Trends and Evolution

- Market Opportunity Assessment, By Product Type

- Market Opportunity Assessment, By Capacity

- Market Opportunity Assessment, By Operation Mode

- Market Opportunity Assessment, By End User

- China Commercial Dishwasher Market Revenue Ranking, By Top 3 Companies

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Product Type

- Undercounter

- Door-Type

- Conveyor

- Flight-Type

By Capacity

- Low-Capacity

- Medium-Capacity

- High-Capacity

- Industrial-Scale

By Operation Mode

- Manual

- Semi-Automatic

- Automatic

- Smart-Controlled

By End User

- Hotels

- Hospitals

- Schools

- Airports

China Commercial Dishwasher Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 4. China Commercial Dishwasher Market Overview |

| 4.1. China Macro Economic Indicators |

| 4.2. China Commercial Dishwasher Market Revenues and Volumes, 2021-2031F |

| 4.3. China Commercial Dishwasher Market Industry Life Cycle |

| 4.4. China Commercial Dishwasher Market Porter's Five Forces |

| 4. China Commercial Dishwasher Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers (Favorable Government Initiatives) |

| 4.3. Market Restraints (High Initial Investment & Operating Costs) |

| 5. China Commercial Dishwasher Market Trends |

| 6. China Commercial Dishwasher Market Overview, By Product Type |

| 6.1. China Commercial Dishwasher Market Revenue Share and Volume Share, By Product Type, 2024 & 2031F |

| 6.1.1. China Commercial Dishwasher Market Revenues and Volume, By Undercounter, 2021-2031F |

| 6.1.2. China Commercial Dishwasher Market Revenues and Volume, By Door-Type, 2021-2031F |

| 6.1.3. China Commercial Dishwasher Market Revenues and Volume, By Conveyor, 2021-2031F |

| 6.1.4. China Commercial Dishwasher Market Revenues and Volume, By Flight-Type, 2021-2031F |

| 7. China Commercial Dishwasher Market Overview, By Capacity |

| 7.1. China Commercial Dishwasher Market Revenue Share and Volume Share, By Capacity, 2024 & 2031F |

| 7.1.1. China Commercial Dishwasher Market Revenues and Volume, By Low-Capacity, 2021-2031F |

| 7.1.2. China Commercial Dishwasher Market Revenues and Volume, By Medium-Capacity, 2021-2031F |

| 7.1.3. China Commercial Dishwasher Market Revenues and Volume, By High-Capacity, 2021-2031F |

| 7.1.4. China Commercial Dishwasher Market Revenues and Volume, By Industrial-Scale, 2021-2031F |

| 8. China Commercial Dishwasher Market Overview, By Operation Mode |

| 8.1. China Commercial Dishwasher Market Revenue Share, By Operation Mode, 2024 & 2031F |

| 8.1.1. China Commercial Dishwasher Market Revenues, By Manual, 2021-2031F |

| 8.1.2. China Commercial Dishwasher Market Revenues, By Semi-Automatic, 2021-2031F |

| 8.1.3. China Commercial Dishwasher Market Revenues, By Automatic, 2021-2031F |

| 8.1.4. China Commercial Dishwasher Market Revenues, By Smart-Controlled, 2021-2031F |

| 9. China Commercial Dishwasher Market Overview, By End User |

| 9.1. China Commercial Dishwasher Market Revenue Share, By End User, 2024 & 2031F |

| 9.1.1. China Commercial Dishwasher Market Revenues, By Hotels, 2021-2031F |

| 9.1.2. China Commercial Dishwasher Market Revenues, By Hospitals, 2021-2031F |

| 9.1.3. China Commercial Dishwasher Market Revenues, By Schools, 2021-2031F |

| 9.1.4. China Commercial Dishwasher Market Revenues, By Airports, 2021-2031F |

| 10. China Commercial Dishwasher Market Key Performance Indicators (HoReCa Industry Outlook) |

| 11. China Commercial Dishwasher Market Price Trend Analysis |

| 12. China Commercial Dishwasher Market Regulatory Landscape |

| 13. China Commercial Dishwasher Market Import-Export Analysis |

| 13.1. China Commercial Dishwasher Market Imports, By Major Countries |

| 13.2. China Commercial Dishwasher Market Exports, By Major Countries |

| 14. China Commercial Dishwasher Market Opportunity Assessment |

| 14.1. China Commercial Dishwasher Market Opportunity Assessment, By Product Type, 2031F |

| 14.2. China Commercial Dishwasher Market Opportunity Assessment, By Capacity, 2031F |

| 14.3. China Commercial Dishwasher Market Opportunity Assessment, By Operation Mode, 2031F |

| 14.4. China Commercial Dishwasher Market Opportunity Assessment, By End User, 2031F |

| 15. China Commercial Dishwasher Market Competitive Landscape |

| 15.1. China Commercial Dishwasher Market Revenue Ranking, By Top 3 Companies, 2024 |

| 15.2. China Commercial Dishwasher Market Competitive Benchmarking, By Technical Parameters |

| 15.3. China Commercial Dishwasher Market Competitive Benchmarking, By Operating Parameters |

| 16. Company Profiles |

| 16.1 Shenzhen Davosa Electric Equipment Co., Ltd |

| 16.2 Hobart |

| 16.3 MEIKO Maschinenbau GmbH & Co. KG |

| 16.4 Winterhalter Group |

| 16.5 Electrolux Professional's Group |

| 16.6 SYOWA (Xiamen) Automation Washing Equipment Co., Ltd |

| 16.7 Zhejiang Hatton Cleaning Technology Co., Ltd. |

| 16.8 Sichuan Huidatong Mechanical Equipment Manufacturing Co., Ltd |

| 16.9 Mayers Intelligent Catering Equipment (Shenzhen) Co., Ltd. |

| 16.10 Champion Group International Ltd |

| 17. Key Strategic Recommendations |

| 18. Disclaimer |

| List of Figures |

| 1. China Annual GDP Growth 2021-2024 (%) |

| 2. China GDP/Capita, 2020-2024 ($ Thousand) |

| 3. China Unemployment Rate 2021-2024 (%) |

| 4. China GDP, 2018-2024 ($ Trillion) |

| 5. China Commercial Dishwasher Market Revenues & Volume, 2021-2031F (USD Million, Thousand Units) |

| 6. China Capital Investments in Tourism Sector 2023-2034F ($ Billion) |

| 7. China Tourism Contribution to GDP 2023-2034F (%) |

| 8. China International Tourist Spending 2023-2034F ($ Billion) |

| 9. China Spending on Leisure Tourism 2023-2034F ($ Billion) |

| 10. China Tourist Arrival 2024-2027F (Million) |

| 11. China Tourist Arrival March-May 2025 (Million) |

| 12. China Revenue from Hospitals ($ Billion), 2020-2027F |

| 13. China Healthcare Key Figures 2021 |

| 14. China Commercial Dishwasher Market Revenue Share, By Product Type, 2024 & 2031F |

| 15. China Commercial Dishwasher Market Volume Share, By Product Type, 2024 & 2031F |

| 16. China Commercial Dishwasher Market Revenue Share, By Capacity, 2024 & 2031F |

| 17. China Commercial Dishwasher Market Volume Share, By Capacity, 2024 & 2031F |

| 18. China Commercial Dishwasher Market Revenue Share, By Operation Mode, 2024 & 2031F |

| 19. China Commercial Dishwasher Market Revenue Share, By End User, 2024 & 2031F |

| 20. China Number of Hotels Chains Breakdown, By Hotel Scale 2024-2029F (Thousand) |

| 21. China Number of Hotels Breakdown, By Type of Hotel 2022-2029F (Thousand) |

| 22. China Commercial Dishwasher Price Trend Analysis 2021-2031F ($) |

| 23. Share of Top 3 Import Partners, 2024 |

| 24. China Commercial Dishwasher Import Data, By Country, 2024 (in $ Thousand) |

| 25. Share of Top 3 Export Partners, 2024 |

| 26. China Commercial Dishwasher Export Data, By Country, 2024 (in $ Thousand) |

| 27. China Commercial Dishwasher Market Opportunity Assessment, By Product Type, 2031F ($ Million) |

| 28. China Commercial Dishwasher Market Opportunity Assessment, By Capacity, 2031F ($ Million) |

| 29. China Commercial Dishwasher Market Opportunity Assessment, By Operation Mode, 2031F ($ Million) |

| 30. China Commercial Dishwasher Market Opportunity Assessment, By End User, 2031F ($ Million) |

| 31. China Top 3 Cities With Highest Tourist 2024 (Million) |

| List of tables |

| 1. China City Wise Tourism Trend January-June 2025 |

| 2. China Upcoming Healthcare Sector Projects |

| 3. China Commercial Dishwasher Market Revenues, By Product Type, 2021-2031F, (USD Million) |

| 4. China Commercial Dishwasher Market Volume, By Product Type, 2021-2031F, (Thousand Units) |

| 5. China Commercial Dishwasher Market Revenues, By Capacity, 2021-2031F, (USD Million) |

| 6. China Commercial Dishwasher Market Volume, By Capacity, 2021-2031F, (Units) |

| 7. China Commercial Dishwasher Market Revenues, By Operation Mode, 2021-2031F, (USD Million) |

| 8. China Commercial Dishwasher Market Revenues, By End User, 2021-2031F, (USD Million) |

| 9. Upcoming Hotels in China, 2025 |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero