Colombia Air Heaters Market (2025-2031) | Companies, Forecast, Revenue, Value, Share, Size, Industry, Trends, Analysis, Outlook & Growth

Market Forecast By Type (Indirect Fired Air Heaters, Direct Fired Air Heaters, Duct Heater, Portable Air Heater, Others), By End-users (Packaging, Drying, Sealing, Others) And Competitive Landscape

| Product Code: ETC030684 | Publication Date: Oct 2020 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Colombia Air Heaters Market | Country-Wise Share and Competition Analysis

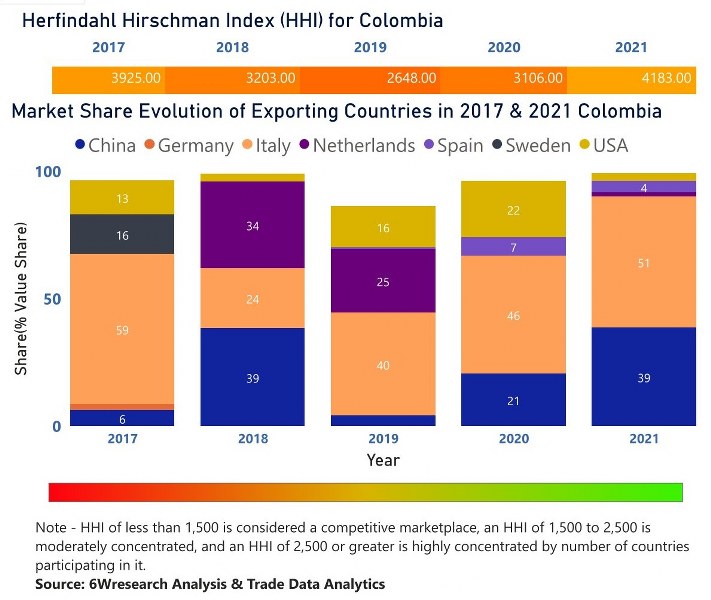

In the year 2021, Italy was the largest exporter in terms of value, followed by China. It has registered a growth of 15.23% over the previous year. While China registered a growth of 93.14% as compared to the previous year. In the year 2017, Italy was the largest exporter followed by Sweden. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, Colombia has a Herfindahl index of 3925 in 2017 which signifies high concentration also in 2021 it registered a Herfindahl index of 4183 which signifies high concentration in the market.

![Colombia Air Heaters Market | Country-Wise Share and Competition Analysis]() Colombia Air Heaters Market Highlights

Colombia Air Heaters Market Highlights

| Report Name | Colombia Air Heaters Market |

| Forecast period | 2025-2031 |

| Market Size | USD 130 Million – USD 220 Million |

| CAGR | 7.4% |

| Growing Sector | Industrial Manufacturing |

Topics Covered in the Colombia Air Heaters Market Report

The Colombia Air Heaters market report thoroughly covers the market by type and by end user. The report provides an unbiased and detailed analysis of the on-going market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Colombia Air Heaters Market Size & Analysis

In 2025, the Colombia Air Heaters market is valued at approximately $ 130 million, with a projected compound annual growth rate (CAGR) of 7.4% over the next five years. Additionally, by 2031, the market is expected to reach around $ 220 million. The industrial manufacturing sector holds significant position in the overall market.

Colombia Air Heaters Market Synopsis

The Colombia air heaters market is poised for significant growth, driven by increasing industrial activities, urbanization, and a rising demand for efficient heating solutions across various sectors. As the country continues to develop its manufacturing and agricultural sectors, the need for reliable air heating systems for processes such as drying, climate control, and temperature regulation is becoming increasingly critical. The agricultural sector, in particular, is adopting air heaters for applications like greenhouse heating and crop drying, reflecting a broader trend towards enhancing productivity and product quality. Additionally, government initiatives promoting energy efficiency and sustainability are encouraging investments in modern heating technologies, further fueling market expansion. With a growing emphasis on energy-efficient solutions and a diverse industrial landscape, the Colombia air heaters market is well-positioned for continued growth in the coming years.

According to 6Wresearch, Colombia Air Heaters market size is projected to grow at a CAGR of 7.4% during 2025-2031. The Colombia air heaters market is propelled by several growth drivers, including the rapid industrialization of the country, increased urbanization, and a growing focus on energy efficiency and sustainability. The manufacturing sector’s expansion requires reliable heating solutions for various processes such as drying, curing, and temperature regulation, leading to a rising demand for air heaters. In agriculture, the adoption of advanced heating systems for greenhouse climate control and crop drying is enhancing productivity and product quality, further stimulating market growth. Government initiatives promoting energy-efficient technologies and investments in infrastructure development also play a significant role in driving demand. However, the market faces challenges such as high initial capital costs associated with advanced air heating systems, which may deter small and medium-sized enterprises from making necessary investments. Additionally, fluctuations in fuel prices can impact operating costs, while regulatory changes and economic uncertainties could affect business investments in heating solutions. Addressing these challenges while capitalizing on emerging opportunities will be crucial for the sustained growth of the air heaters market in Colombia.

Colombia Air Heaters Market Trends

Increased Focus on Energy Efficiency - Growing demand for energy-efficient air heating solutions to reduce operational costs and comply with environmental regulations.

Adoption of Smart Technologies - Rising integration of IoT and smart controls in air heaters, allowing for real-time monitoring and enhanced energy management.

Growth in Agricultural Applications - Expanding use of air heaters in agriculture for greenhouse heating and crop drying, driven by the need for improved yield and quality.

Sustainability Initiatives - A shift towards eco-friendly heating solutions, including low-emission air heaters and systems compatible with renewable energy sources.

Temporary and Portable Heating Solutions - Increasing demand for portable air heaters in the construction industry for efficient temporary heating in work sites.

Technological Advancements - Innovations in air heater designs and materials are enhancing performance, efficiency, and safety features.

Investment Opportunities in the Colombia Air Heaters Market

Energy-Efficient Air Heater Development - Investing in the research and production of high-efficiency air heaters to meet the growing demand for sustainable heating solutions.

Smart Heating Solutions - Opportunities in developing IoT-enabled air heating systems that provide remote monitoring and energy management capabilities.

Agricultural Heating Technologies - Targeting the agricultural sector with specialized heating solutions for greenhouses and crop drying, capitalizing on the need for improved agricultural practices.

Renewable Energy Integration - Developing air heaters that can be integrated with renewable energy sources, such as solar or biomass, to attract environmentally conscious consumers.

Portable and Temporary Heating Solutions - Investing in portable air heaters tailored for construction and industrial applications to address the rising demand for flexible heating options.

Key Players in the Colombia Air Heaters Market

The Colombia air heaters market features several key companies that are instrumental in shaping the industry landscape through innovation and diverse product offerings. Trane Technologies, a leader in heating and cooling solutions, provides a range of energy-efficient air heaters tailored for industrial applications. Carrier, another major player, is known for its advanced HVAC systems, including air heaters that prioritize energy efficiency and sustainability. Mitsubishi Electric offers a variety of heating solutions, emphasizing performance and technology integration. Additionally, Honeywell contributes with its smart heating technologies that enhance energy management and operational efficiency. Local manufacturers such as Industrias de Calefacción also play a significant role, focusing on meeting regional demands with cost-effective heating solutions. Additionally, some of these players hold majority of the Colombia Air Heaters market share. Moreover, the presence of these companies’ fosters competition and drives innovation.

Government Regulations in the Colombia Air Heaters Market

Government regulations in Colombia significantly influence the air heaters market, primarily through initiatives aimed at promoting energy efficiency and environmental sustainability. The Ministry of Mines and Energy establishes regulations and standards that require manufacturers to comply with energy efficiency norms, encouraging the development of more efficient heating technologies. Additionally, the National Environmental Licensing Authority (ANLA) oversees emissions regulations, pushing companies to adopt low-emission heating solutions to mitigate environmental impacts. There are also incentives for businesses that invest in energy-efficient technologies, which are part of the government’s broader strategy to reduce greenhouse gas emissions and promote sustainable development. Further, these initiatives have further boosted the Colombia Air Heaters market revenues. Moreover, compliance with these regulations not only ensures environmental protection but also enhances the competitiveness of companies that prioritize innovation and sustainability in their heating solutions.

Future Insights of the Colombia Air Heaters Market

The future of the Colombia air heaters market appears promising, with anticipated growth driven by increasing industrial activities, urbanization, and a growing emphasis on energy efficiency and sustainability. As various sectors, including manufacturing, agriculture, and construction, expand, the demand for reliable and efficient air heating solutions is expected to rise. Technological advancements, such as the integration of smart features and IoT capabilities, will enhance the functionality and energy management of air heaters, making them more attractive to consumers. The agricultural sector is likely to adopt advanced heating technologies for greenhouse applications and crop drying, reflecting a trend toward optimizing productivity. Additionally, as regulatory frameworks become more stringent regarding energy efficiency and emissions, manufacturers will be motivated to innovate, leading to the development of advanced, low-emission heating solutions.

Direct Fired Air Heaters to Dominate the Market - By Type

According to Nitesh Kumar, Research Manager, 6Wresearch, the direct fired air heaters market is witnessing robust growth, driven by their ability to provide rapid and efficient heating solutions for a variety of applications across industries such as manufacturing, agriculture, and construction. These systems are favored for their cost-effectiveness and high thermal efficiency, making them ideal for processes that require immediate heat, such as drying, curing, and temperature regulation. The increasing need for effective climate control in agricultural settings, including greenhouses and livestock facilities, is further fueling demand, as direct fired heaters can significantly enhance productivity and product quality. Additionally, technological advancements are leading to improved safety features and reduced emissions, making these systems more appealing to environmentally conscious consumers.

Drying Category to Dominate the Market – By End User

The drying end-user segment is experiencing substantial growth, primarily driven by rising demands in industries such as food processing, pharmaceuticals, textiles, and construction. In the food sector, effective drying techniques are essential for preserving product quality and extending shelf life, leading to increased adoption of advanced drying technologies. The pharmaceutical industry requires precise drying processes for active ingredients and formulations, further contributing to market expansion. Additionally, textile manufacturers are seeking efficient drying solutions to accelerate production cycles, while the construction sector increasingly adopts drying equipment to quickly remove moisture from buildings and materials. As industries prioritize operational efficiency and product quality, the demand for innovative drying solutions continues to rise, positioning the drying end-user segment for significant growth in the coming years.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year - 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- ColombiaAir Heaters Market Outlook

- Market Size of Colombia Air Heaters Market, 2024

- Forecast of Colombia Air Heaters Market, 2031

- Historical Data and Forecast ofColombiaAir Heaters Revenues & Volume for the Period 2021 - 2031

- ColombiaAir Heaters Market Trend Evolution

- ColombiaAir Heaters Market Drivers and Challenges

- ColombiaAir Heaters Price Trends

- ColombiaAir Heaters Porter's Five Forces

- ColombiaAir Heaters Industry Life Cycle

- Historical Data and Forecast ofColombiaAir Heaters Market Revenues & Volume By Type for the Period 2021 - 2031

- Historical Data and Forecast ofColombiaAir Heaters Market Revenues & Volume By Indirect Fired Air Heaters for the Period 2021 - 2031

- Historical Data and Forecast ofColombiaAir Heaters Market Revenues & Volume By Direct Fired Air Heaters for the Period 2021 - 2031

- Historical Data and Forecast ofColombiaAir Heaters Market Revenues & Volume By Duct Heater for the Period 2021 - 2031

- Historical Data and Forecast ofColombiaAir Heaters Market Revenues & Volume By Portable Air Heater for the Period 2021 - 2031

- Historical Data and Forecast ofColombiaAir Heaters Market Revenues & Volume By Others for the Period 2021 - 2031

- Historical Data and Forecast ofColombiaAir Heaters Market Revenues & Volume By End-users for the Period 2021 - 2031

- Historical Data and Forecast ofColombiaAir Heaters Market Revenues & Volume By Packaging for the Period 2021 - 2031

- Historical Data and Forecast ofColombiaAir Heaters Market Revenues & Volume By Drying for the Period 2021 - 2031

- Historical Data and Forecast ofColombiaAir Heaters Market Revenues & Volume By Sealing for the Period 2021 - 2031

- Historical Data and Forecast ofColombiaAir Heaters Market Revenues & Volume By Others for the Period 2021 - 2031

- ColombiaAir Heaters Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By End-users

- ColombiaAir Heaters Top Companies Market Share

- ColombiaAir Heaters Competitive Benchmarking By Technical and Operational Parameters

- ColombiaAir Heaters Company Profiles

- ColombiaAir Heaters Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Indirect Fired Air Heaters

- Direct Fired Air Heaters

- Duct Heater

- Portable Air Heater

- Others

By End-Users

- Packaging

- Drying

- Sealing

- Others

Colombia Air Heaters Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Colombia Air Heaters Market Overview |

| 3.1 Colombia Country Macro Economic Indicators |

| 3.2 Colombia Air Heaters Market Revenues & Volume, 2021 & 2031F |

| 3.3 Colombia Air Heaters Market - Industry Life Cycle |

| 3.4 Colombia Air Heaters Market - Porter's Five Forces |

| 3.5 Colombia Air Heaters Market Revenues & Volume Share, By Type, 2021 & 2031F |

| 3.6 Colombia Air Heaters Market Revenues & Volume Share, By End-users, 2021 & 2031F |

| 4 Colombia Air Heaters Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Colombia Air Heaters Market Trends |

| 6 Colombia Air Heaters Market, By Types |

| 6.1 Colombia Air Heaters Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Colombia Air Heaters Market Revenues & Volume, By Type, 2021 - 2031F |

| 6.1.3 Colombia Air Heaters Market Revenues & Volume, By Indirect Fired Air Heaters, 2021 - 2031F |

| 6.1.4 Colombia Air Heaters Market Revenues & Volume, By Direct Fired Air Heaters, 2021 - 2031F |

| 6.1.5 Colombia Air Heaters Market Revenues & Volume, By Duct Heater, 2021 - 2031F |

| 6.1.6 Colombia Air Heaters Market Revenues & Volume, By Portable Air Heater, 2021 - 2031F |

| 6.1.7 Colombia Air Heaters Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.2 Colombia Air Heaters Market, By End-users |

| 6.2.1 Overview and Analysis |

| 6.2.2 Colombia Air Heaters Market Revenues & Volume, By Packaging, 2021 - 2031F |

| 6.2.3 Colombia Air Heaters Market Revenues & Volume, By Drying, 2021 - 2031F |

| 6.2.4 Colombia Air Heaters Market Revenues & Volume, By Sealing, 2021 - 2031F |

| 6.2.5 Colombia Air Heaters Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 Colombia Air Heaters Market Import-Export Trade Statistics |

| 7.1 Colombia Air Heaters Market Export to Major Countries |

| 7.2 Colombia Air Heaters Market Imports from Major Countries |

| 8 Colombia Air Heaters Market Key Performance Indicators |

| 9 Colombia Air Heaters Market - Opportunity Assessment |

| 9.1 Colombia Air Heaters Market Opportunity Assessment, By Type, 2021 & 2031F |

| 9.2 Colombia Air Heaters Market Opportunity Assessment, By End-users, 2021 & 2031F |

| 10 Colombia Air Heaters Market - Competitive Landscape |

| 10.1 Colombia Air Heaters Market Revenue Share, By Companies, 2024 |

| 10.2 Colombia Air Heaters Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero

Colombia Air Heaters Market Highlights

Colombia Air Heaters Market Highlights