Egypt Construction Equipment Rental Market (2022-2028) | Industry, Share, Size, Analysis, Trends, Revenue, Growth, Value, Outlook, Segmentation & COVID-19 IMPACT

Market Forecast by Types (Crane, Bulldozer, Earth Moving, Material Handling, Dump Trucks, Forklift), by Region (The Nile Valley And The Delta, The Western Desert,The Eastern Desert, The Sinai Peninsula), and Competitive Landscape

| Product Code: ETC4378007 | Publication Date: Apr 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 90 | No. of Figures: 33 | No. of Tables: 7 | |

Egypt Construction Equipment Rental Market Synopsis

Egypt Construction Equipment Rental Market grew significantly in recent years on account of government expenditure on infrastructure development activities. However, the Egypt was negatively impacted by COVID-19 in 2020, owing to the contraction of the construction sector. According to the Central Bank of Egypt (CBE), the construction industry's value-addition contracted by 5.7% year on year (YoY) in Q2 2020, due to the disruption caused by the COVID-19 epidemic and the six-month ban on new construction licenses for private buildings in major cities, resulting in a decline in demand for construction equipment. Furthermore, the Ukraine-Russia war has deepened economic uncertainty as the country’s debt to GDP ratio has risen to 93.8%, which in turn consumed 54% of the state’s budget for loan and interest repayment. Budget cuts of major projects coupled with restrictions on import of machinery would contract the growth of the rental construction equipment market in the near future.

According to 6Wresearch, Egypt Construction Equipment Rental Market size is projected to decline at a CAGR of 0.9% during 2022-28. Egypt construction equipment is expected to decline in forecast years owing to economic downfall of country. From March to May 2022, the foreign exchange reserves decreased from $37 billion to $35.5 billion. The currency devaluation of more than 14% against USD coupled with import restrictions imposed by Egyptian government has soared the prices of rental construction equipment. In Egypt, construction equipment market is a import based market as all of the construction machinery whether new or used ones are imported from Europe and other countries. The conflict between Ukraine and Russia has also made the economy more unstable since the country's debt to GDP ratio rose to 93.8%, necessitating the allocation of 54% of the national budget for loan and interest repayment. Rising prices of construction material and lack of liquidity in economy would further decline demand for rental construction equipment.

According to 6Wresearch, Egypt Construction Equipment Rental Market size is projected to decline at a CAGR of 0.9% during 2022-28. Egypt construction equipment is expected to decline in forecast years owing to economic downfall of country. From March to May 2022, the foreign exchange reserves decreased from $37 billion to $35.5 billion. The currency devaluation of more than 14% against USD coupled with import restrictions imposed by Egyptian government has soared the prices of rental construction equipment. In Egypt, construction equipment market is a import based market as all of the construction machinery whether new or used ones are imported from Europe and other countries. The conflict between Ukraine and Russia has also made the economy more unstable since the country's debt to GDP ratio rose to 93.8%, necessitating the allocation of 54% of the national budget for loan and interest repayment. Rising prices of construction material and lack of liquidity in economy would further decline demand for rental construction equipment.

![Egypt Construction Equipment Rental Market Revenue Share]() Market by Types

Market by Types

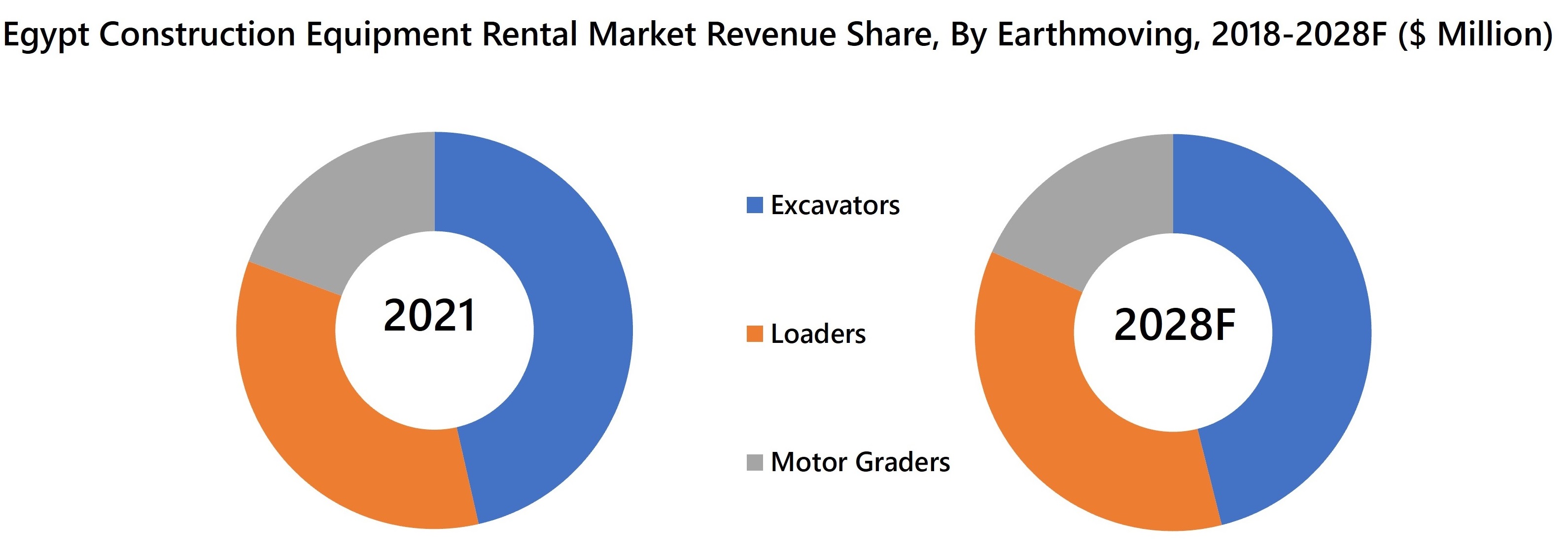

The earthmoving equipment segment held 33.7% construction equipment rental market share in 2021. This is attributable to large infrastructure development projects such as King Salman Corridor Project, the Firdous Highway, and the duplication of Matrouh / Siwa Road, two fast electric train projects, one of which links Ain Sokhna with the new administrative capital and the new city of El Alamein, and the second connects the tenth of Ramadan in the Administrative Capital. This segment will grow more in the coming years.

Market by Region

The Nile valley and the delta accounted for the highest revenue share in Egypt construction equipment rental market on the back of the construction of ‘8 new cities’ in the region such as New Administrative Capital, Galala City, Mostakbal City, New Alamein City, New Ismailia City, New Aswan City, New Damietta City, New Mansoura City The region will continue dominating the market.

![Egypt Construction Equipment Rental Market Opportunity Assessment]() Key Attractiveness of the Report

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2018 to 2021.

- Base Year: 2022

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Egypt Construction Equipment Rental Market Overview

- Egypt Construction Equipment Rental Market Outlook

- Egypt Construction Equipment Rental Market Forecast

- Historical Data and Forecast of Egypt Construction Equipment Rental Market Revenues for the Period 2018-2028F

- Historical Data and Forecast of Egypt Construction Equipment Rental Market Revenues, By Types for the Period 2018-2028F

- Historical Data and Forecast of Egypt Construction Equipment Rental Market Revenues, By Regions for the Period 2018-2028F

- Market Drivers and Restraints

- Market Trends

- Industry Life Cycle

- Egypt Construction Equipment Rental Market – Porter’s Five Forces

- Market Opportunity Assessment

- Company Shares

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Types

- Crane

- Bulldozer

- Earth Moving

- Material Handling

- Dump Trucks

- Forklift

By Region

- The Nile Valley And The Delta

- The Western Desert

- The Eastern Desert

- The Sinai Peninsula

Egypt Construction Equipment Rental Market: FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Egypt Construction Equipment Rental Market Overview |

| 3.1 Egypt Construction Equipment Rental Market Revenues, 2018-2028F |

| 3.2 Egypt Construction Equipment Rental Market Industry Life Cycle |

| 3.3 Egypt Construction Equipment Rental Market Porter’s Five Forces Model |

| 3.4 Egypt Construction Equipment Rental Market Revenue Share, By Equipment Types, 2021 & 2028F |

| 3.5 Egypt Construction Equipment Rental Market Revenue Share, By Regions, 2021 & 2028F |

| 4 Impact Analysis of COVID-19 on Egypt Construction Equipment Rental Market |

| 5 Egypt Construction Equipment Rental Market Russia-Ukraine War Impact Analysis |

| 6 Egypt Construction Equipment Rental Market Dynamics |

| 6.1 Impact Analysis |

| 6.2 Market Drivers |

| 6.2.1 Growth in construction activities in Egypt |

| 6.2.2 Increasing demand for specialized construction equipment |

| 6.2.3 Infrastructure development projects in the country |

| 6.3 Market Restraints |

| 6.3.1 Economic instability and fluctuations in currency exchange rates |

| 6.3.2 High initial investment and operating costs for construction equipment rental companies |

| 6.3.3 Regulatory challenges and compliance requirements in the construction industry |

| 7 Egypt Construction Equipment Rental Market Trends |

| 8 Egypt Construction Equipment Rental Market Overview, By Crane |

| 8.1 Egypt Construction Equipment Rental Market Revenues, By Crane,2018-2028F |

| 8.1.1 Mobile Crane Rental Market Revenues, 2018-2028F |

| 8.1.2 Crawler Crane Rental Market Revenues, 2018-2028F |

| 8.1.3 Tower Crane Rental Market Revenues, 2018-2028F |

| 9 Egypt Construction Equipment Rental Market Overview, By Bulldozer |

| 9.1 Egypt Construction Equipment Rental Market Revenues, By Bulldozer, 2018-2028F |

| 10 Egypt Construction Equipment Rental Market Overview, By Earth Moving Equipment |

| 10.1 Egypt Construction Equipment Rental Market Revenue Share and Revenues, By Earth Moving Equipment, 2018-2028F |

| 10.1.1 Loader Rental Market Revenues Share and Revenue, 2018-2028F |

| 10.1.1.1 Wheeled Loader Rental Market Revenues and Revenue share, 2018-2028F |

| 10.1.1.2 Backhoe Loader Rental Market Revenues and Revenue share, 2018-2028F |

| 10.1.1.3 Skid Steer Loader Rental Market Revenues and Revenue share, 2018-2028F |

| 10.1.2 Excavator Rental Market Revenues, 2018-2028F |

| 10.1.2.1 Wheeled Excavator Rental Market Revenues and Revenue Share, 2018-2028F |

| 10.1.2.2 Tracked Excavator Rental Market Revenues and Revenue Share, 2018-2028F |

| 10.1.2.3 Mini Excavator Rental Market Revenues and Revenue Share, 2018-2028F |

| 10.1.3 Motor Grader Rental Market Revenues, 2018-2028F |

| 11 Egypt Construction Equipment Rental Market Overview, By Material Handling Equipment |

| 11.1 Egypt Construction Equipment Rental Market Revenues, By Material Handling Equipment, 2018-2028F |

| 11.1.1 Articulated Boom Lift Rental Market Revenues, 2018-2028F |

| 11.1.2 Telescopic Boom Lift Rental Market Revenues, 2018-2028F |

| 11.1.3 Telescopic Handler Rental Market Revenues, 2018-2028F |

| 11.1.4 Aerial Work Platform Rental Market Revenues, 2018-2028F |

| 11.1.5 Scissor Lift Rental Market Revenues, 2018-2028F |

| 12 Egypt Construction Equipment Rental Market Overview, By Dump Trucks |

| 12.1 Egypt Construction Equipment Rental Market Revenues, By Dump Trucks, 2018-2028F |

| 13 Egypt Construction Equipment Rental Market Overview, By Forklift |

| 13.1 Egypt Construction Equipment Rental Market Revenues, By Forklift, 2018-2028F |

| 14 Egypt Construction Equipment Rental Market Overview, By Regions |

| 14.1 Egypt Construction Equipment Rental Market Revenues, By the Nile Valley and the Delta, 2018-20228F |

| 14.2 Egypt Construction Equipment Rental Market Revenues, By the Western Desert, 2018-2028F |

| 14.3 Egypt Construction Equipment Rental Market Revenues, By the Eastern Desert, 2018-2028F |

| 14.4 Egypt Construction Equipment Rental Market Revenues, By the Sinai Peninsula, 2018-2028F |

| 15 Egypt Construction Equipment Rental Market - Key Performance Indicators |

| 15.1 Utilization rate of construction equipment |

| 15.2 Average rental duration of equipment |

| 15.3 Maintenance and repair costs as a percentage of total revenue |

| 16 Egypt Construction Equipment Rental Market - Opportunity Assessment |

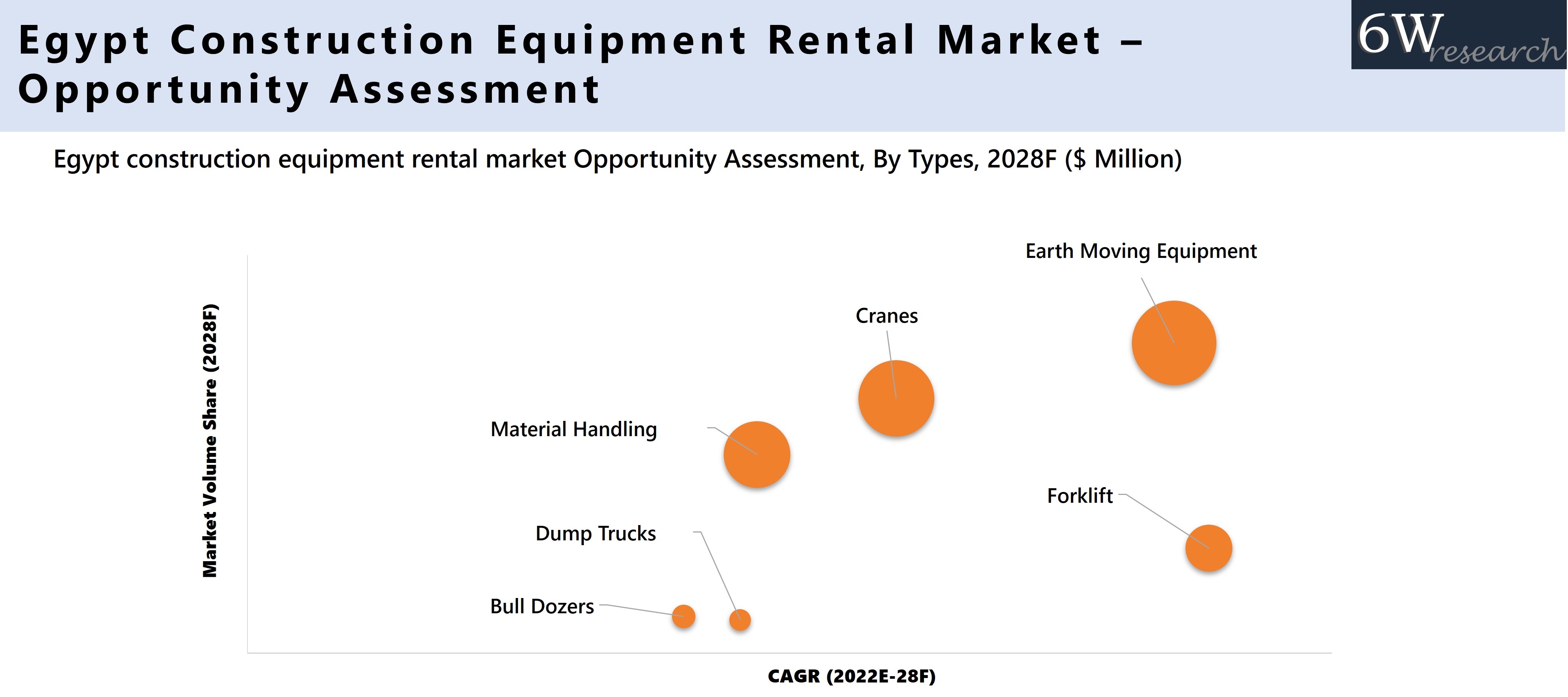

| 16.1 Egypt Construction Equipment Rental Market Opportunity Assessment, By Equipment Types, 2028F |

| 16.2 Egypt Construction Equipment Rental Market Opportunity Assessment, By Regions, 2028F |

| 17 Egypt Construction Equipment Rental Market - Competitive Landscape |

| 17.1 Egypt Construction Equipment Rental Market Revenue Share Ranking, By Top 3/5 Companies, 2021 |

| 17.2 Egypt Construction Equipment Rental Market Key Companies Competitive Benchmarking, By Technical and Operating Parameters |

| 18 Company Profiles |

| 18.1 MAGNOM logistics |

| 18.2 Orascom Services |

| 18.3 TECKMAN Heavy Equipment Solution |

| 18.4 Triangle Heavy Equipment |

| 18.5 Big Rental |

| 18.6 Adrighem & Aldibiki Co. |

| 18.7 Flash Cranes & Equipment |

| 18.8 Cranes Co. |

| 18.9 Mantrac Group |

| 18.10 The Arab Contractors |

| 19 Key Strategic Recommendations |

| 20 Disclaimer |

| List of Figures |

| 1. Egypt Construction Equipment Rental Market Revenues, 2018-2028F ($ Million) |

| 2. Egypt Construction Equipment Rental Market Revenue Share, By Types, 2021 & 2028F |

| 3. Egypt Construction Equipment Rental Market Revenue Share, By Region, 2021 & 2028F |

| 4. Impact Of The COVID-19 Pandemic On Risk Factors in Construction Industry in Egypt |

| 5. EGP Inflation rate rise over 4 months owing to the Russia’s invasion over Ukraine , January- April 2022 |

| 6. Egypt Percent Rise in Prices due to Russia-Ukraine War, June 2022 |

| 7. Egypt Value Of Upcoming And Ongoing Projects By Sectors, 2022, (Million USD), |

| 8 . Egypt Value Of Upcoming And Ongoing Projects, By Project Type, 2022 |

| 9. Foreign liabilities of Egyptian banks exceeded foreign assets in July 2021 |

| 10. Top 10 Factors That Affecting Mostly The Market Risks For Construction Projects in Egypt (in %) |

| 11. Rise in Foreign Exchange Value of USD to EGP (May-August) (2022) |

| 12. Egyptian foreign Reserves from March-July (2022) (in $bn) |

| 13. Rise in External Debt December(2021)-March(2022) (in $bn) |

| 14. Egypt Construction Equipment Rental Market Revenue Share, By Crane, 2021 & 2028F |

| 15. Egypt Construction Equipment Rental Market Revenues, By Crane, 2018-2028F ($ Million) |

| 16. Egypt Construction Equipment Rental Market Revenues, By Bulldozer, 2018-2028F ($ Million) |

| 17. Egypt Construction Equipment Rental Market Revenue Share, By Earthmoving, 2018-2028F ($ Million) |

| 18. Egypt Construction Equipment Rental Market Revenues, By Earthmoving, 2018-2028F ($ Million) |

| 19 . Egypt Construction Equipment Rental Market Revenue Share, By Loader, 2021 & 2028F |

| 20. Egypt Construction Equipment Rental Market Revenues, By Loader, 2018-2028F ($ Million) |

| 21. Egypt Construction Equipment Rental Market Revenue Share, By Excavator, 2021 & 2028F |

| 22. Egypt Construction Equipment Rental Market Revenues, By Excavator, 2018-2028F ($ Million) |

| 23. Egypt Construction Equipment Rental Market Revenues, By Motor Grader, 2018-2028F ($ Million) |

| 24 . Egypt Construction Equipment Rental Market Revenue Share, By Material Handling, 2021 & 2028F |

| 25. Egypt Construction Equipment Rental Market Revenues, By Material Handling, 2018-2028F ($ Million) |

| 26. Egypt Construction Equipment Rental Market Revenues, By Dump trucks, 2018-2028F ($ Million) |

| 27. Egypt Construction Equipment Rental Market Revenue Share, By Forklift, 2021 & 2028F |

| 28. Egypt Construction Equipment Rental Market Revenue Share, By Region, 2021 & 2028F |

| 29.Average annual investment in ($ Bn) and Infrastructure Investment in Egypt, as a percentage of GDP(%), 2016-40 Average annual investment in ($ Bn) and Infrastructure Investment in Egypt, as a percentage of GDP(%), 2016-40Average annual investment in ($ Bn) and Infrastructure Investment in Egypt, as a percentage of GDP(%), 2016-40 |

| 30. Egypt’s transport budget, FY 2021/22 (LE bn) |

| 31. Egypt Key Upcoming Projects |

| 32. Egypt construction equipment rental market Opportunity Assessment, By Types, 2028F ($ Million) |

| 33. Egypt construction equipment rental market Opportunity Assessment, By Regions, 2028F ($ Million) |

| List of Tables |

| 1. Egypt Construction Equipment Rental Market Revenues, By Crane, 2018-2028F ($ Million) |

| 2. Egypt Construction Equipment Rental Market Revenues, By Loader, 2018-2028F ($ Million) |

| 3. Egypt Construction Equipment Rental Market Revenues, By Excavator, 2018-2028F ($ Million) |

| 4. Egypt Construction Equipment Rental Market Revenues, By Material Handling, 2018-2028F ($ Million) |

| 5. Egypt Construction Equipment Rental Market Revenues, By Region, 2018-2028F ($ Million) |

| 6. Sustainable Development Plan (FY 2021/22) Infrastructure Spending, USD bn) |

| 7. Geographic Distribution Of Mineral Resources In The Golden Triangle Area, 2021 |

| 8. Egypt Major Ongoing Construction Projects near Cairo, 2021 |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero