Egypt Cyber Security Market (2020-2026) | Size, Share, Trends, Revenue, Analysis, Forecast, Outlook & COVID-19 IMPACT

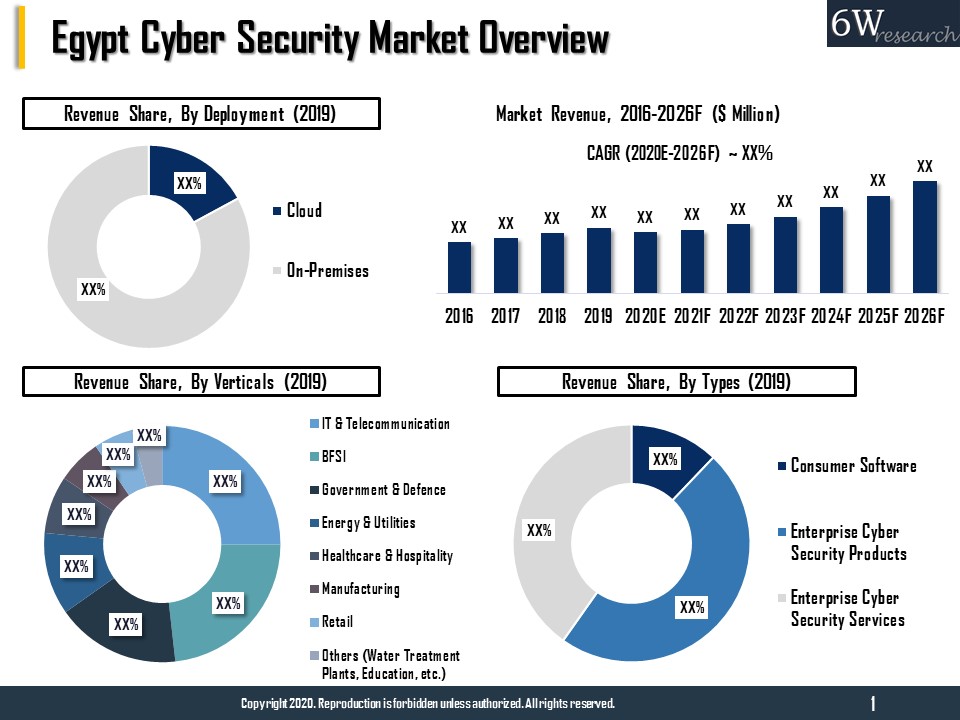

Market Forecast By Components (Solutions, Services), By Offerings (Identity And Access Management, Infrastructure Security, Governance, Risk And Compliance, Unified Vulnerability Management Service, Data Security And Privacy Service And others), By Deployments (Cloud, On-Premises), By Verticals (Aerospace And Defense, BFSI (Banking Finance Services And Insurance), Retail, Healthcare And Hospitality, IT And Telecom, Energy And Utilities, Manufacturing, Commercial Offices, And Others) And Competitive Landscape.

| Product Code: ETC003249 | Publication Date: Feb 2023 | Product Type: Report | ||

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 79 | No. of Figures: 16 | No. of Tables: 3 |

Egypt Cyber Security Market report thoroughly covers the market by types, deployment and verticals. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, key performance indicators and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Latest 2023 Development of Egypt Cyber Security Market

Egypt Cyber Security Market has been experiencing growth as the government has recognized the importance of cyber security and has taken steps to improve the country's cyber security posture. The increasing number of cyber-attacks and data breaches in Egypt has raised the need for robust cybersecurity solutions and services, thereby driving the Egypt cyber security market growth. The market has undergone various developments such as the development of a national incident response system to respond to cyber security incidents and to coordinate with other government agencies. The establishment of the National Authority for Cybersecurity (NAC) to oversee the implementation of national cyber security strategy and to coordinate with other government agencies and the private sector on cyber security issues.

The NAC has developed and implemented a comprehensive national cyber security strategy to improve the country's cyber security posture and protect critical infrastructure and sensitive information. Moreover, the NAC has established a cyber security research and development centre to support the development of new technologies and techniques for improving cyber security in Egypt. These developments demonstrate the government's commitment to improving the country's cyber security posture and protecting its citizens and critical infrastructure from cyber threats.

Egypt Cyber Security Market Synopsis

Egypt cyber security market size is anticipated to witness strong growth over the coming years on account of the government strategy, National Cybersecurity Strategy 2021, which aims to establish rules and regulations to deal with cyber-crime and cyber-attacks at various levels of the country, develop the human capital and expertise required to implement cybersecurity system across various sectors. Further, in recent years, at the national level, the government has formed an autonomous body for critical information infrastructure protection and cybersecurity namely the Egyptian Supreme Cybersecurity Council (ESCC) with an aim to develop a strategy to fight back against cyber threats. However, sluggish growth is expected in the year 2020 due to suspended economic activities on account of the outbreak of the COVID-19 pandemic in different domains such as manufacturing and retail. However, the ongoing global pandemic COVID-19 hampered the overall economic growth of Egypt, thus, restraining the growth of the cyber security market as well.

According to 6Wresearch, the Egypt Cyber Security Market size is projected to grow at a CAGR of 10.7% during 2020-2026. On account of several government initiatives to digitalize the country such as the formulation of the Information and Communication Strategy 2030 that aims to achieve digital transformation by investing in developing IT infrastructure, the “Our Future is Digital” initiative and personal data protection law, along with a rising number of internet users, the Egypt cybersecurity market is anticipated to flourish over the coming years. Additionally, projects such as making Egypt a ‘smart’ city and the development of the largest international data centre by Telecom Egypt would further propel the cyber security market in Egypt during the forecast period.

Market Analysis by Verticals

Based on verticals, in 2019, IT & Telecommunication, BFSI and Government sector accounted for a cumulative market share of around 55% in the overall market revenues. IT & Telecommunication vertical acquired the highest revenue share in the overall cyber security market on account of the heavy application of cyber security products and availing cyber security services due to increasing ICT and IT spending by tech-savvy IT & telecommunication companies. Further, BFSI, government & defence domains would witness significant growth in the forecast period on account of an increase in the application of digital technology for banking and financial services due to the increase in cyber-attacks on the aforementioned domains.

Market Analysis by Types

Further, in 2019, based on types, enterprise cyber security products dominated the market revenue share in the overall cyber security market owing to the increasing number of cybercrimes of all forms such as identity theft, violating personal data and attacks on private or state-owned websites. Additionally, as awareness about data protection and cyber security increases, the services market which includes managed security services, consulting and outsourcing services is also anticipated to grow significantly. Additionally, strong support is provided by the government in form of building and educating cybersecurity experts which would augment the demand for solutions and supply of services in years to come.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Egypt Cyber Security Market Overview

- Egypt Cyber Security Market Outlook

- Egypt Cyber Security Market Forecast, Until 2027

- Historical Data and Forecast of Egypt Cyber Security Market Revenues, for the period 2017-2027

- Market Drivers and Restraints

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Competitive Benchmarking

- Egypt Cyber Security Market Trends

- Egypt Cyber Security Market Share, By Players

- Company Profiles

- Key Strategic Recommendation

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Types

- Identity and Access Management (IAM)

- Data Loss Prevention (DLP)

- Endpoint Protection

- Firewall

- Intrusion Prevention System (IPS)

- Secure Email Gateway (SEG)

- Secure Web Gateway (SWG)

- Security Information and Event Management (SIEM)

- Testing

- Other Software (DDoS, Risk and Compliance etc.)

- Managed Security Services

- Outsourcing, Implementation, and Hardware Support

- Consulting Services

- Consumer Software

- Enterprise Cyber Security Products

- Enterprise Cyber Security Services

By Deployment

- Cloud

- On-Premises

By Verticals

- Government and Defense

- BFSI

- Retail

- Healthcare and Hospitality

- IT and Telecom

- Energy and Utilities

- Manufacturing

- Others (Water Treatment Plants, Chemical Industry etc.)

Egypt Cyber Security Market: FAQs

| TABLE OF CONTENTS |

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Egypt Cyber Security Market Overview |

| 3.1 Egypt Cyber Security Market Revenues, 2016-2026F |

| 3.2 Egypt Cyber Security Market Revenue Share, By Types, 2019 & 2026F |

| 3.3 Egypt Cyber Security Market Revenue Share, By Deployment, 2019 & 2026F |

| 3.4 Egypt Cyber Security Market Revenue Share, By Verticals, 2019 & 2026F |

| 3.5 Egypt Cyber Security Market Revenue Share, By Types, 2019 & 2026F |

| 3.6 Egypt Cyber Security Market- Industry Life Cycle |

| 3.7 Egypt Cyber Security - Porter’s Five Forces |

| 4. Egypt Cyber Security Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Egypt Cyber Security Market Trends & Evolution |

| 6. Egypt Cyber Security Market Overview, By Types |

| 6.1. Egypt Cyber Security Market Revenues, By Solutions, 2016-2026F |

| 6.1.1. Egypt Cyber Security Market Revenue Share, By Solution Types, 2019 & 2026F |

| 6.1.2. Egypt Cyber Security Market Revenues, By Solution Types, 2016-2026F |

| 6.2. Egypt Cyber Security Market Revenues, By Services, 2016-2026F |

| 6.2.1. Egypt Cyber Security Market Revenue Share, By Service Types, 2019 & 2026F |

| 6.2.2. Egypt Cyber Security Market Revenues, By Service Types, 2016-2026F |

| 7. Egypt Cyber Security Market Overview, By Deployment |

| 7.1. Egypt Cyber Security Market Revenues, By Cloud, 2016-2026F |

| 7.2. Egypt Cyber Security Market Revenues, By On Premises, 2016-2026F |

| 8. Egypt Cyber Security Market Overview, By Verticals |

| 8.1. Egypt Cyber Security Market Revenues, By Government & Defence, 2016-2026F |

| 8.2. Egypt Cyber Security Market Revenues, By BFSI, 2016-2026F |

| 8.3. Egypt Cyber Security Market Revenues, By Retail, 2016-2026F |

| 8.4. Egypt Cyber Security Market Revenues, By Healthcare & Hospitality, 2016-2026F |

| 8.5. Egypt Cyber Security Market Revenues, By IT & Telecommunication, 2016-2026F |

| 8.6. Egypt Cyber Security Market Revenues, By Energy & Utilities, 2016-2026F |

| 8.7. Egypt Cyber Security Market Revenues, By Manufacturing 2016-2026F |

| 8.8. Egypt Cyber Security Market Revenues, By Others, 2016-2026F |

| 9. Egypt Cyber Security Market – Key Performance Indicators |

| 10. Egypt Cyber Security Market - Opportunity Assessment |

| 10.1. Egypt Cyber Security Market Opportunity Assessment, By Types, 2026F |

| 10.2. Egypt Cyber Security Market Opportunity Assessment, By Deployment, 2026F |

| 10.3. Egypt Cyber Security Market Opportunity Assessment, By Verticals, 2026F |

| 11. Egypt Cyber Security Market – Competitive Landscape |

| 11.1. Egypt Cyber Security Market Revenue Share By Company, 2019 |

| 11.2. Egypt Cyber Security Market, By Operating and Technical Parameters, 2019 |

| 12. Company Profiles |

| 12.1. Cisco Systems Inc. |

| 12.2. Check Point Software Technologies Ltd. |

| 12.3 Palo Alto Networks Inc. |

| 12.4. STC |

| 12.5. Dell Technologies |

| 12.6. Kaspersky Lab |

| 12.7. IBM Corporation |

| 12.8. NEC Corporation |

| 12.9 NortonLifeLock Inc. |

| 12.10. FireEye Inc. |

| 12.11. TrendMicro Inc. |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero