India AFC Systems Market (2019-2025) | Share, Analysis, Trends, Industry, Outlook, Companies, Size, Growth, Revenue, Value & Forecast

Market Forecast By Applications (Metro Railway, Bus/BRTS Transport, Railway Transport, Parking Solution and Others), By AFC Technology (Near-Field Communication, Magnetic Strips & Tokens, QR Code/Barcode, and Smart Cards), By Types (Hardware, Software, and Services), By Regions (Northern, Eastern, Western and Southern) and Competitive Landscape

| Product Code: ETC000584 | Publication Date: Apr 2019 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 148 | No. of Figures: 53 | No. of Tables: 23 | |

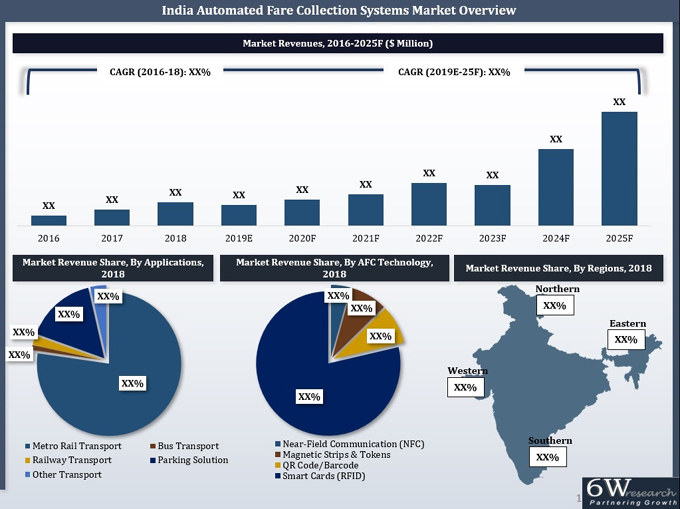

The rising need for faster payment process owing to the increase in a number of daily travelers /commuters has buoyed the demand for rapid payment solutions across India. Additionally, with smart city projects, the government is taking several key measures for the growth of rapid transport solutions in India, especially in the Tier-I and Tier-II cities. With the swift development of transport solutions, the Automated Fare Collection Systems (AFC) market has registered high growth over the past few years.According to 6Wresearch, India Automated Fare Collection (AFC) Market Size is projected to grow at a CAGR of 33.1% during 2019-25. In terms of market applications, metro railway transport dominated the overall market revenues due to the ability of these systems to deliver better management, revenue generation, and fraud prevention. Additionally, with increasing adoption of public transportation primarily, metro railways and rapid bus transport systems in Tier-I and II cities by daily commuters, the deployment of the AFC system is anticipated to increase in the existing facilities as well over the coming years.

In terms of regions, the Northern region accounted for the largest revenue share in India AFC market share in 2018. Moreover, the region is likely to generate key revenues in India AFC market forecast period owing to upcoming/ongoing metro railway projects and parking solutions, especially in the Delhi/NCR region.Some of the key players in India AFC market include- Samsung SDS, AGS Transact, Indra Sistemas, Thales India, AUM Infotech, Efkon India, Cubic Transportation, MCML Projects, Ingenico International, and NEC Technologies.The India AFC market report thoroughly covers the market by applications, AFC technology types, hardware & software systems, and regions. India AFC market outlook report provides an unbiased and detailed analysis of the on-going India AFC market trends, opportunities/high growth areas and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

India AFC Systems Market is the growing market and covers all market applications such as hardware systems, AFC technology, software system, and the region also. AFC systems are a detailed analysis of the market trends and opportunities growth areas that align their strategies for the growth of the AFRC systems based on the current and future market. AFC stands for the Automated Fare Collection Systems. India AFC system market according to the research it will grow faster in the upcoming years. The AFC systems market covers any type of application and introduces new technology such as software systems and hardware systems and detailed analysis of the on-going AFC systems market. In India, the AFC systems market has trends, high growth areas/ opportunities and market drivers help the stakeholders align the market strategies according to the market condition based on the current and future market. The government of India also taking several steps for the growth of transport in the Tier-I and Tier-II cities.

Key Highlights of the Report:

• India AFC Market Overview

• India AFC Market Outlook

• India AFC Market Size and India AFC Market Forecast until 2025

• Historical Data & Forecast of India AFC Market Revenues, By Metro Railway Application, 2016-25F

• Historical Data & Forecast of India AFC Market Revenues, By Bus Transport Application, 2016-25F

• Historical Data & Forecast of India AFC Market Revenues, By Railway Application, 2016-25F

• Historical Data & Forecast of India AFC Market Revenues, By Parking Solution Application, 2016-25F

• Historical Data & Forecast of India AFC Market Revenues, By Other Application, 2016-25F

• Historical Data & Forecast of India AFC Market Revenues, By Metro Railway Hardware Vs. Software Vs. Services, 2016-25F

• Historical Data & Forecast of India AFC Market Revenues, By Bus Transport Hardware Vs.Software Vs. Services, 2016-25F

• Historical Data & Forecast of India AFC Market Revenues, By Railway Hardware Vs. Software Vs. Services, 2016-25F

• Historical Data & Forecast of India AFC Market Revenues, By Parking Solution Hardware Vs. Software Vs. Services, 2016-2025F

• Historical Data & Forecast Data of India AFC Market Revenues, By Technology, 2016-25F

• Historical Data & Forecast Data of India AFC Market Revenues, By Regions, 2016-2025F

• Market Drivers and Restraints

• India AFC Market Trends

• Porter's Five Forces Analysis and Market Opportunity Assessment

• India AFC Market Overview on Competitive Benchmarking

• India AFC Market Share, By Players

• Company Profiles

• Strategic Recommendations

Markets Covered:

India AFC Market report provides a detailed analysis of the following market segments:

• By Applications

o Metro Railway

o Bus/BRTS Transport

o Railway Transport

o Parking Solution

o Others

• By AFC Technology

o Near-Field Communication

o Magnetic Strips & Tokens

o QR Code/Barcode

o Smart Cards

• By Types

o Hardware

o Software

o Services

• By Regions

o Northern

o Eastern

o Western

o Southern

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary

2 Introduction

2.1 Report Description

2.2 Key Highlights Of The Report

2.3 Market Scope & Segmentation

2.4 Research Methodology

2.5 Assumptions

3 India Automated Fare Collection Systems Market Overview

3.1 Overview & Analysis

3.2 India Automated Fare Collection Systems Market Revenues (2016-2025F)

3.3 India Automated Fare Collection Systems Market Revenue Share, By Applications (2018 & 2025F)

3.4 India Automated Fare Collection Systems Market Revenue Share, By Technology (2018 & 2025F)

3.5 India Automated Fare Collection Systems Market Revenue Share, By Regions (2018 & 2025F)

3.6 India Automated Fare Collection Systems Market-Industry Life Cycle, 2018

3.7 India Automated Fare Collection Systems Market- Porter's Five Forces

4 India Automated Fare Collection Systems Market Dynamics

4.1 Impact Analysis

4.2 Market Drivers

4.3 Market Restraints

5 India Automated Fare Collection Systems Market Trends

5.1 National Common Mobility Card (NCMC) Upgradation Requirements For Open Loop Ticketing For Metro/Bus

5.2 QR Ticketing Requirements

6 India Automated Fare Collection Systems Market Overview, By Metro Railway Application

6.1 India Automated Fare Collection Systems Market Revenues, By Metro Railway Application, 2016-25F ($ Million)

6.2 India Metro Railway Automated Fare Collection Systems Market Revenue Share,

By Hardware Vs. Software Vs. Services (2018 & 2025F)

6.2.1 India Metro Railway Automated Fare Collection Systems Market Revenues,

By Hardware Vs. Software Vs. Services (2018 & 2025F)

6.3 India Automated Fare Collection Systems Market Revenues Share, By Hardware Type (2018 & 2025F)

6.3.1 India Metro Railway Automated Fare Collection Systems Market Revenues,

By Hardware Type, 2016-25F ($ Million)

6.4 India Metro Railway Projects Overview

6.4.1 India Metro Railway Market, By Annual AFC Ridership, 2016-25F (Million)

6.4.2 Key Metro Projects Market, By Annual AFC Ridership, in Million (2016-2025F)

6.4.3 India Metro Railway Market Revenues, By Segments, 2016-25F (Ticketing/Fare, Advertisement, Others)

6.4.4 India Metro Railway Market, By Fare Trend Analysis (2016-25F)

6.5 India Metro Automated Fare Collection Projects Outlook

6.6 India Monorail/LRT Automated Fare Collection Projects Outlook

7 India Automated Fare Collection Systems Market Overview, By Bus/BRTS Transport Application

7.1 India Automated Fare Collection Systems Market Revenues, By Bus/BRTS Transport Application,

2016-25F ($ Million)

7.2 India Bus/BRTS Transport Automated Fare Collection Systems Market Revenue Share,

By Hardware Vs. Software Vs. Services (2018 & 2025F)

7.2.1 India Bus/BRTS Transport Automated Fare Collection Systems Market Revenues,

By Hardware Vs. Software Vs. Services, 2016-25F ($ Million)

8 India Automated Fare Collection Systems Market Overview, By Railway Transport Application

8.1 India Automated Fare Collection Systems Market Revenues, By Railway Transport Application,

2016-25F ($ Million)

8.2 India Railway Transport Automated Fare Collection Systems Market Revenue Share,

By Hardware Vs. Software Vs. Services (2018 & 2025F)

8.2.1 India Railway Transport Automated Fare Collection Systems Market Revenues,

By Hardware Vs. Software Vs. Services, 2016-25F ($ Million)

8.3 India Railway Transport Automated Fare Collection Projects Outlook

9 India Automated Fare Collection Systems Market Overview, By Parking Solution Application

9.1 India Automated Fare Collection Systems Market Revenues, By Parking Solution Application,

2016-25F ($ Million)

9.2 India Parking Solution Automated Fare Collection Systems Market Revenue Share,

By Hardware Vs. Software Vs. Services (2018 & 2025F)

9.2.1 India Parking Solution Automated Fare Collection Systems Market Revenues,

By Hardware Vs. Software Vs. Services, 2016-25F ($ Million)

10 India Automated Fare Collection Systems Market Overview, By Other Applications

10.1 India Automated Fare Collection Systems Market Revenues, By Other Applications, 2016-25F ($ Million)

11 India Metro Information System Market Projects Overview

11.1 India Metro Information System Market Revenues, 2016-2025F ($ Million)

11.2 India Metro Information System Market Revenue Share, By Projects (2018 & 2025F)

11.2.1 India Metro Information System Market Revenues, By Projects, 2016-2025F ($ Million)

12 India Automated Fare Collection Systems Market Overview, By Technology

12.1 India Automated Fare Collection Systems Market Revenues, By NFC Technology, 2016-2025F ($ Million)

12.2 India Automated Fare Collection Systems Market Revenues, By Magnetic Strips & Tokens

Technology, 2016-2025F ($ Million)

12.3 India Automated Fare Collection Systems Market Revenues, By QR Code Technology

Technology, 2016-2025F ($ Million)

12.4 India Automated Fare Collection Systems Market Revenues, By Smart Cards Technology

Technology, 2016-2025F ($ Million)

13 India Automated Fare Collection Systems Market Overview, By Regions

13.1 India Automated Fare Collection Systems Market Revenues, By Northern Region, 2016-2025F ($ Million)

13.2 India Automated Fare Collection Systems Market Revenues, By Southern Region, 2016-2025F ($ Million)

13.3 India Automated Fare Collection Systems Market Revenues, By Western Region, 2016-2025F ($ Million)

13.4 India Automated Fare Collection Systems Market Revenues, By Eastern Region, 2016-2025F ($ Million)

14 India Automated Fare Collection Systems Market- Key Performance Indicators

15 India Automated Fare Collection Systems Market- Opportunity Assessment

15.1 India Automated Fare Collection Systems Market Opportunity Assessment, By Technology (2025F)

15.2 India Automated Fare Collection Systems Market Opportunity Assessment, By Applications (2025F)

16 India Automated Fare Collection Systems Market Competitive Landscape

16.1 India Automated Fare Collection Systems Market Revenue Share, By Company (2018)

16.2 India Automated Fare Collection Systems Market Competitive Benchmarking, By Operaing Parameters

17 Company Profiles

17.1 Samsung SDS India Pvt. Ltd.

17.2 AGS Transact Technologies Ltd.

17.3 Indra Sistemas India Pvt. Ltd.

17.4 Thales India Pvt. Ltd

17.5 AUM Infotech Pvt. Ltd.

17.6 Efkon India Pvt. Ltd.

17.7 Cubic Transportation System India Pvt. Ltd.

17.8 MCML Projects Pvt. Ltd.

17.9 Ingenico International India Pvt. Ltd.

17.10 NEC Technologies India Pvt. Ltd.

18 Strategic Recommendations

19 Disclaimer

List of Figures

Figure1 India Automated Fare Collection Systems Market Revenues, 2016-2025F ($ Million)

Figure2 Cumulative FDI inflows in India Construction Market, FY 2013-FY 1Q 2018 ($ Billion)

Figure3 India Automated Fare Collection Systems Market Revenue Share, By Applications, 2018 & 2025F

Figure4 India Automated Fare Collection Systems Market Revenue Share, By Technology (2018 & 2025F)

Figure5 India Automated Fare Collection Systems Market Revenue Share, By Regions , 2018 & 2025F

Figure6 India Automated Fare Collection Systems Market - Industry Life Cycle, 2018

Figure7 India Upcoming Infrastructure Projects

Figure8 India AFC Systems Market Revenue Share, By Metro Railway Application (2018 & 2025F)

Figure9 India AFC Systems Market Revenues, By Metro Railway Application, 2016-2025F ($ Million)

Figure10 India Metro Railway Automated Fare Collection Systems Market Revenue Share, By Hardware Vs. Software Vs. Services (2018 & 2025F)

Figure11 India Metro Railway AFC Systems Market Revenues Share, By Hardware Type (2018 & 2025F)

Figure12 Metro Railway Market, By Annual AFC Ridership, 2016-25F (Billion)

Figure13 India Metro Railway Market Revenues, By Segments (Ticketing/Fare, Advertisement, Others), 2016-25F ($ Million)

Figure14 India Metro Railway Market, By Fare Trend Analysis (2016-2025F)

Figure15 Details Of Metro Projects

Figure16 Details Of Ongoing & Upcoming Monorail/LRT Projects

Figure17 India AFC Systems Market Revenue Share, By Bus/BRTS Transport Application (2018 & 2025F)

Figure18 India AFC Systems Market Revenues, By Bus/BRTS Transport Application, 2016-2025F ($ Million)

Figure19 India Bus/BRTS Transport AFC Systems Market Revenue Share, By Hardware Vs. Software Vs. Services (2018 & 2025F)

Figure20 India AFC Systems Market Revenue Share, By Railway Transport Application (2018 & 2025F)

Figure21 India AFC Systems Market Revenues, By Railway Transport Application, 2016-2025F ($ Million)

Figure22 Projected Infrastructure Investment in Railways, 2013 - 2032 (INR Thousand Crore)

Figure23 India Railway Transport Automated Fare Collection Systems Market Revenue Share, By Hardware Vs. Software Vs. Services (2018 & 2025F)

Figure24 India AFC Systems Market Revenue Share, By Parking Solution Application (2018 & 2025F)

Figure25 India AFC Systems Market Revenues, By Parking Solution Application , 2016-2025F ($ Million)

Figure26 India Parking Solution AFC Systems Market Revenue Share, By Hardware Vs. Software Vs. Services (2018 & 2025F)

Figure27 India AFC Systems Market Revenue Share, By Other Applications (2018 & 2025F)

Figure28 India AFC Systems Market Revenues, By Other Applications, 2016-2025F ($ Million)

Figure29 India Metro Information System Market Revenues, 2016-2025F ($ Million)

Figure30 India Metro Information System Market Revenue Share (2018 & 2025F)

Figure31 India Metro Information System Market Revenues, By Signalling & Telecommunication System, 2016-2025F

Figure32 India Metro Information System Market Revenues, By Passenger Information System, 2016-2025F

Figure33 India AFC Systems Market Revenue Share, By NFC Technology (2018 & 2025F)

Figure34 India AFC Systems Market Revenues, By NFC Technology , 2016-2025F ($ Million)

Figure35 India AFC Systems Market Revenue Share, By Magnetic Strips & Tokens Technology, (2018 & 2025F)

Figure36 India AFC Systems Market Revenues, By Magnetic Strips & Tokens Technology, 2016-2025F ($ Million)

Figure37 India AFC Systems Market Revenue Share, By QR Code Technology, (2018 & 2025F)

Figure38 India AFC Systems Market Revenues, By QR Code Technology, 2016-2025F ($ Million)

Figure39 India AFC Systems Market Revenue Share, By Smart Cards Technology, (2018 & 2025F)

Figure40 India AFC Systems Market Revenues, By Smart Cards Technology, 2016-2025F ($ Million)

Figure41 India Automated Fare Collection Systems Market Revenue Share, By Northern Region (2018 & 2025F)

Figure42 India Automated Fare Collection Systems Market Revenue Share, By Southern Region (2018 & 2025F)

Figure43 India Automated Fare Collection Systems Market Revenue Share, By Western Region (2018 & 2025F)

Figure44 India Automated Fare Collection Systems Market Revenue Share, By Eastern Region (2018 & 2025F)

Figure45 India Actual Government Spending Vs Actual Government Revenues, FY2014-FY2019 (INR Lakh Crore)

Figure46 India Expected Government Budget Outlook, FY2019

Figure47 India Construction Industry Value, FY19 - FY21 (INR Lakh Crore)

Figure48 India Infrastructure Investment Forecast, 2017-2040 (INR Lakh Crore)

Figure49 India Infrastructure Investment Forecast, By Sector, 2017-2040 (INR Lakh Crore)

Figure50 India Automated Fare Collection Systems Market Opportunity Assessment, By Technology (2025F)

Figure51 India Automated Fare Collection Systems Market Opportunity Assessment, By Applications (2025F)

Figure52 India Automated Fare Collection Systems Market Revenue Share, By Company (2018)

Figure53 Expected Network Addition in Urban Rail Segment in India, 2019-2025 (km)

List of Tables

Table1 Shortlisted Smart Cities in First Round

Table2 India Metro Railway Fare At a Glance, in 2016 & 2018

Table3 India Delhi Metro Railway Revised Fare Prices (As on Dec. 2017)

Table4 India Metro Railway AFC Systems Market Revenues, By Hardware Vs. Software Vs. Services, 2016-2018 ($ Million)

Table5 India Metro Railway AFC Systems Market Revenues, By Hardware Vs. Software Vs. Services, 2019E-2025F ($ Million)

Table6 India Metro Railway AFC Systems Market Revenues, By Hardware Type, 2016-2018 ($ Million)

Table7 India Metro Railway AFC Systems Market Revenues, By Hardware Systems, 2019E-2025F ($ Million)

Table8 Key Metro Projects Analysis, By Annual Ridership, in Million (2016-2025F)

Table9 India DMRC Phase I and II Network At a Glance (As on April 2018)

Table10 India DMRC Phase III Network At a Glance (As on April 2018)

Table11 India Key BRTS Projects at a Glance (As on Nov 2017)

Table12 India Bus/BRTS Transport AFC Systems Market Revenues, By Hardware Vs. Software Vs. Services, 2016-2018 ($ Million)

Table13 India Bus/BRTS Transport AFC Systems Market Revenues, By Hardware Vs. Software Vs. Services, 2019E-2025F ($ Million)

Table14 India Railway Transport AFC Systems Market Revenues, By Hardware Vs. Software Vs. Services, 2016-2018 ($ Million)

Table15 India Railway Transport AFC Systems Market Revenues, By Hardware Vs. Software Vs. Services, 2019E-2025F ($ Million)

Table16 India Parking Solution AFC Systems Market Revenues, By Hardware Vs. Software Vs. Services, 2016-2018 ($ Million)

Table17 India Parking Solution AFC Systems Market Revenues, By Hardware Vs. Software Vs. Services, 2019E-2025F ($ Million)

Table18 India Key Amusement Parks, By States (2017)

Table19 India Under Construction and Planning Phase Metro Projects, By Northern Region

Table20 India Under Construction and Planning Phase Metro Projects, By Southern Region

Table21 India Under Construction and Planning Phase Metro Projects, By Eastern Region

Table22 India Under Construction and Planning Phase Metro Projects, By Western Region

Table23 India Top 5 Metro Railway Corporations, By Number of Metro Railway Stations (As on April 2018)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero