India Batter & Breader Premixes Market (2025-2031) Outlook | Industry, Trends, Growth, Companies, Revenue, Size, Analysis, Forecast, Value & Share

| Product Code: ETC098743 | Publication Date: Jul 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

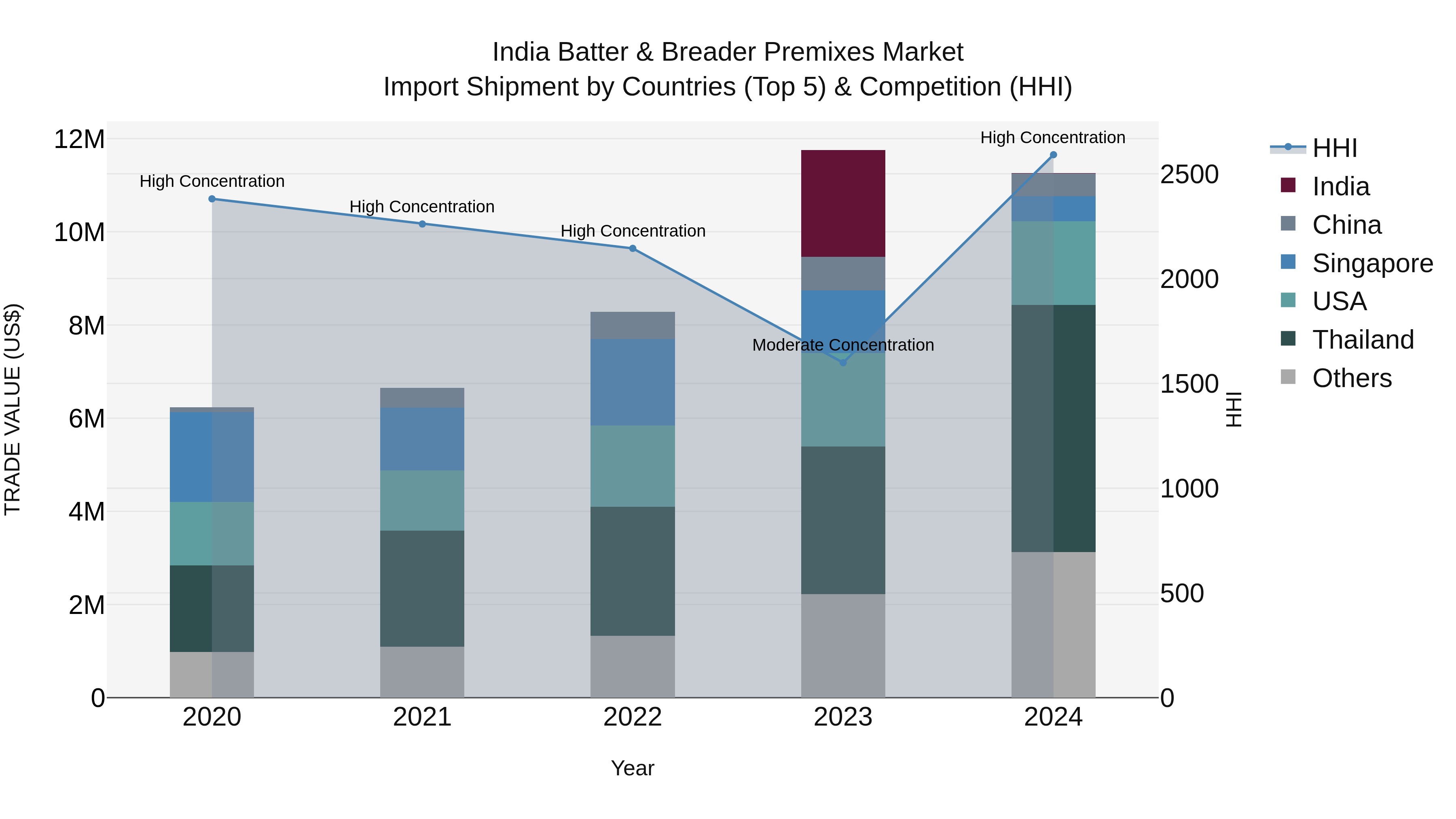

India Batter & Breader Premixes Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s import shipments of batter and breader premixes saw a significant increase in concentration levels in 2024, with top exporting countries being Thailand, USA, South Korea, Singapore, and China. The industry experienced a strong CAGR of 15.94% from 2020 to 2024, although there was a slight decline in growth rate from 2023 to 2024 at -4.16%. This shifting landscape indicates a dynamic market environment with potential opportunities for both domestic and international players in the years ahead.

India Batter & Breader Premixes Market Synopsis

The India batter and Breader Premixes Market is anticipated to witness a significant growth rate in the forecast period.The increasing demand for convenience food products, coupled with the growing preference among consumers for baked goods and snacks, is expected to drive market growth. Furthermore, changing lifestyles and rising disposable incomes are likely to fuel market demand over the forecast period. Moreover, leading players in the industry are introducing innovative product offerings such as gluten free batters that could boost consumer base further. This has created a favorable environment for companies operating in this segment of the food industry.

Market Drivers

Growing consumption of convenience foods across India due to busy lifestylesRising health consciousness amongst population which has resulted into increased adoption of healthy dietsIncreasing popularity of oil-free fried items like nuggets or samosas

Challenges of the Market

High production costs due to presence of numerous components used in these mixes Volatility in raw material prices.

Key Players in the Market

Key players operating within India Batter & Breader PreMixes market include ITC Limited (Yippee!), Nestle India Ltd., MTR Foods Pvt Ltd., Aashirvaad Atta etc..

Key Highlights of the Report:

- India Batter & Breader Premixes Market Outlook

- Market Size of India Batter & Breader Premixes Market, 2024

- Forecast of India Batter & Breader Premixes Market, 2031

- Historical Data and Forecast of India Batter & Breader Premixes Revenues & Volume for the Period 2021-2031

- India Batter & Breader Premixes Market Trend Evolution

- India Batter & Breader Premixes Market Drivers and Challenges

- India Batter & Breader Premixes Price Trends

- India Batter & Breader Premixes Porter's Five Forces

- India Batter & Breader Premixes Industry Life Cycle

- Historical Data and Forecast of India Batter & Breader Premixes Market Revenues & Volume By Product for the Period 2021-2031

- Historical Data and Forecast of India Batter & Breader Premixes Market Revenues & Volume By Batter for the Period 2021-2031

- Historical Data and Forecast of India Batter & Breader Premixes Market Revenues & Volume By Breader for the Period 2021-2031

- Historical Data and Forecast of India Batter & Breader Premixes Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of India Batter & Breader Premixes Market Revenues & Volume By Meat for the Period 2021-2031

- Historical Data and Forecast of India Batter & Breader Premixes Market Revenues & Volume By Fish & Seafood for the Period 2021-2031

- Historical Data and Forecast of India Batter & Breader Premixes Market Revenues & Volume By Poultry for the Period 2021-2031

- Historical Data and Forecast of India Batter & Breader Premixes Market Revenues & Volume By Vegetables for the Period 2021-2031

- India Batter & Breader Premixes Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Application

- India Batter & Breader Premixes Top Companies Market Share

- India Batter & Breader Premixes Competitive Benchmarking By Technical and Operational Parameters

- India Batter & Breader Premixes Company Profiles

- India Batter & Breader Premixes Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 India Batter & Breader Premixes Market Overview |

3.1 India Country Macro Economic Indicators |

3.2 India Batter & Breader Premixes Market Revenues & Volume, 2021 & 2031F |

3.3 India Batter & Breader Premixes Market - Industry Life Cycle |

3.4 India Batter & Breader Premixes Market - Porter's Five Forces |

3.5 India Batter & Breader Premixes Market Revenues & Volume Share, By Product, 2021 & 2031F |

3.6 India Batter & Breader Premixes Market Revenues & Volume Share, By Application, 2021 & 2031F |

4 India Batter & Breader Premixes Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for convenience food products due to changing lifestyles and busy schedules |

4.2.2 Growing trend of eating out and ordering food online, driving the demand for pre-mixes in restaurants and food service industry |

4.2.3 Rising awareness about food safety and hygiene, leading to higher adoption of standardized premixes in food preparation |

4.3 Market Restraints |

4.3.1 Price volatility of raw materials used in premixes, impacting the overall cost and profitability |

4.3.2 Intense competition among key market players leading to pricing pressures and margin erosion |

4.3.3 Regulatory challenges related to food labeling, quality control, and compliance, affecting market entry and product launches |

5 India Batter & Breader Premixes Market Trends |

6 India Batter & Breader Premixes Market, By Types |

6.1 India Batter & Breader Premixes Market, By Product |

6.1.1 Overview and Analysis |

6.1.2 India Batter & Breader Premixes Market Revenues & Volume, By Product, 2021-2031F |

6.1.3 India Batter & Breader Premixes Market Revenues & Volume, By Batter, 2021-2031F |

6.1.4 India Batter & Breader Premixes Market Revenues & Volume, By Breader, 2021-2031F |

6.2 India Batter & Breader Premixes Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 India Batter & Breader Premixes Market Revenues & Volume, By Meat, 2021-2031F |

6.2.3 India Batter & Breader Premixes Market Revenues & Volume, By Fish & Seafood, 2021-2031F |

6.2.4 India Batter & Breader Premixes Market Revenues & Volume, By Poultry, 2021-2031F |

6.2.5 India Batter & Breader Premixes Market Revenues & Volume, By Vegetables, 2021-2031F |

7 India Batter & Breader Premixes Market Import-Export Trade Statistics |

7.1 India Batter & Breader Premixes Market Export to Major Countries |

7.2 India Batter & Breader Premixes Market Imports from Major Countries |

8 India Batter & Breader Premixes Market Key Performance Indicators |

8.1 Customer retention rate: measuring the ability of premix manufacturers to keep customers satisfied and loyal |

8.2 New product adoption rate: tracking the rate at which new premix products are accepted and adopted in the market |

8.3 Supplier performance score: evaluating the reliability and quality consistency of raw material suppliers to ensure product quality and consistency |

9 India Batter & Breader Premixes Market - Opportunity Assessment |

9.1 India Batter & Breader Premixes Market Opportunity Assessment, By Product, 2021 & 2031F |

9.2 India Batter & Breader Premixes Market Opportunity Assessment, By Application, 2021 & 2031F |

10 India Batter & Breader Premixes Market - Competitive Landscape |

10.1 India Batter & Breader Premixes Market Revenue Share, By Companies, 2024 |

10.2 India Batter & Breader Premixes Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero