India Digital Signage Market Outlook (2022-2028) | Trends, Industry, Growth, Size, Analysis, Share, Value, Revenue, Forecast & Companies

Test Market Forecast By Product Type (Display Screen, Content Player, Software. Kiosk), By Display Screen Type (Panel Based, True Color LED), By Panel Based Display Screen Technology (LED, OLED, QLED), By True Color Application (Indoor, Outdoor), By Pixel Pitch (Indoor (0.9-2mm, 2.1-3mm, 3.1-4mm, Above 4mm), Outdoor (3-4mm, 5-8mm, Above 8mm)), By Verticals (Commercial (office Spaces), Transportation, Retail, Hospitality, Healthcare, Entertainment (Sports, Cultural and Reality Events, Amusement Parks), Others (Education & BFSI), By Regions (Northern, Southern, Eastern, Western) and competitive landscape

| Product Code: ETC131534 | Publication Date: May 2022 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 119 | No. of Figures: 47 | No. of Tables: 13 | |

India Digital Signage Market Import Shipment Trend (2020-2024)

The India digital signage market import shipments demonstrated robust growth with a CAGR of 23.7% from 2020 to 2024. The growth rate between 2023 and 2024 accelerated by 14.4%, indicating a significant uptick in market momentum. The market expanded steadily over the period, showcasing a strong and upward trend.

India Digital Signage Market report comprehensively covers the market by components, display screen types, display screen size, display screen technology applications, verticals and regions. India digital signage market report provides an unbiased and detailed analysis of the on-going trends, opportunities/high growth areas, market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Digital Signage Market Synopsis

India digital signage market grew significantly in the period of 2017-2019 on account of rising advertising expenditure that is expected to reach INR 94,896 crore by 2022 in India from INR 68,475 crore in 2019 along with robust demand for office spaces that surged by 40% touching 69.4 million sq ft in Pan India in the year 2019, compared to 49.5 million sq. ft. in the year 2018. During 2020, Covid-19 significantly impacted the overall India digital signage market growth as the country faced nationwide lockdown that led to shutting down of international borders and impacted the supply chain in market which has resulted in the declined in OOH advertising industry by 55% in H1, 2020, which resulted in the downfall of outdoor digital signage market share . Most of the commercial spaces, shopping malls, cinemas and stadiums were closed where digital signage screens are heavily deployed that impacted the market demand during that year.

According to 6Wresearch, India Digital Signage Market size is projected to grow at a CAGR of 15.4% during. 2022–2028. The market is expected to witness significant growth in the coming years owing to rising spending expenditure of government on infrastructure projects. The government is building 1,000 km of metro rail network across 27 cities in India along with 100 airports with 1000 new flight routes by the end of 2024. Also, the central government presented a roadmap to invest ?91,000 crore to develop new airports and upgrading existing ones in different parts of India in the coming 5 years which would boost the digital signage market in India in coming years. India digital signage market is in the growing stage of industry life cycle owing to the increased demand for digitized promotion of products and services and rapid innovation in the field of digital signage in order to produce high quality viewing experience.

Market by Display Screen Type

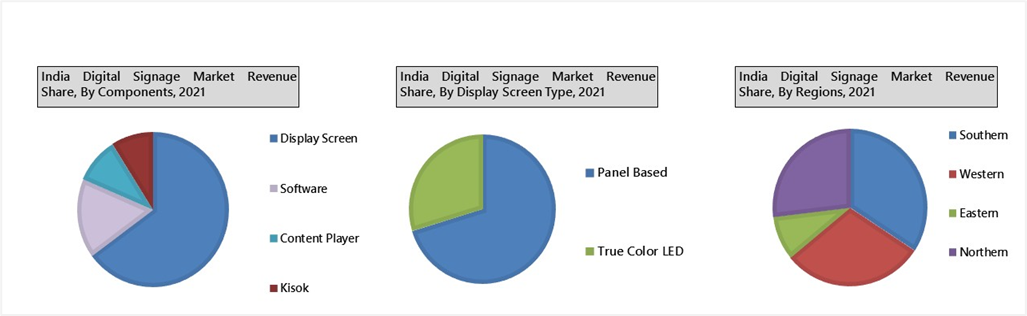

Panel Based acquired major revenue share in India digital signage market as they are comparatively cheaper than true color LED, owing to which it is preferred in retail and commercial sectors extensively. Construction of multiple commercial malls across tier-I and tier-II Indian cities like Noida, Bengaluru, Mumbai, Lucknow and Amravati with approximately 4.5 million sq. ft. of new spaces is planned would drive the market for panel base display screen over the coming years.

Market by Components

Display screens would be the focal point in India’s digital signage market owing to growing OOH (Out-of-home) advertising. Out of Home (OOH) has seen a growth of 9% from 2018 to 2019 to sustain the media spends share of 6%. Rapid development of infrastructure, including upcoming smart city projects, malls, bus shelters, shops and an overall increase in advertising opportunities in tier-II and tier-III cities would lead to the growth in use of display screens during the forecast period.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2017 to 2028.

- Base Year: 2021

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Digital Signage Market Overview

- India Digital Signage Market Outlook

- India Digital Signage Market Forecast

- Historical Data and Forecast of India Digital Signage Market Revenues for the Period 2017-2028F

- Historical Data and Forecast of India Digital Signage Market Revenues, By Components, for the Period 2017-2028F

- Historical Data and Forecast of India Digital Signage Market Revenues, By Display Screen Type, for the Period 2017-2028F

- Historical Data and Forecast of India Panel Based Display Screen Revenues & Volume, By Technology, for the Period 2017-2028F

- Historical Data and Forecast of India Digital Signage Market Revenues, By Display Screen Size, for the Period 2017-2028F

- Historical Data and Forecast of India Digital Signage Market Revenues, By Verticals, for the Period 2017-2028F

- Historical Data and Forecast of India Digital Signage Market Revenues, By Regions, for the Period 2017-2028F

- Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- Impact Analysis of COVID-19

- India Digital Signage Market Trends

- India Digital Signage Market Revenue Share, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

- By Product Type

- Display Screen

- Content Player

- Software

- Kiosk

- By Display Screen Type

- Panel Based

- True Color LED

- By Panel Based Display Screen Technology

- LED

- OLED

- QLED

- By True Color Application

- Indoor

- Outdoor

- By Pixel Pitch

- Indoor

- 9-2mm

- 1-3mm

- 1-4mm

- Above 4mm

- Outdoor

- 3-4mm

- 5-8mm

- Above 8mm

- Indoor

- By Verticals

- Commercial (office Spaces)

- Transportation

- Retail

- Hospitality

- Healthcare

- Entertainment (Sports, Cultural and Reality Events, Amusement Parks)

- Others (Education & BFSI)

- By Regions

- Northern

- Southern

- Eastern

- Western

India Digital Signage Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Digital Signage Market Overview |

| 3.1 India Digital Signage Market Revenues, 2017-2028F |

| 3.2 India Digital Signage Market – Industry Life Cycle |

| 3.3 India Digital Signage Market – Porter’s Five Forces |

| 3.4 India Digital Signage Market Revenue Share, By Display Screen Type, 2021 & 2028F |

| 3.5 India Digital Signage Market Revenue Share, By Verticals, 2021 & 2028F |

| 3.6 India Digital Signage Market Revenue Share, By Regions, 2021 & 2028F |

| 4. Impact Analysis of Covid-19 on India Digital Signage Market |

| 5. India Digital Signage Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.2.1 Increasing adoption of digital signage for advertising and promotional activities by businesses in India. |

| 5.2.2 Growth in the retail sector leading to a higher demand for digital signage solutions. |

| 5.2.3 Technological advancements and innovation in display technologies driving the market forward. |

| 5.3. Market Restraints |

| 5.3.1 High initial investment costs associated with setting up digital signage networks. |

| 5.3.2 Lack of awareness and understanding among small and medium enterprises about the benefits of digital signage. |

| 5.3.3 Connectivity and infrastructure challenges in certain regions hindering the implementation of digital signage solutions. |

| 6. India Digital Signage Market Trends & Evolution |

| 7. India Digital Signage Market Overview, By Components |

| 7.1. India Digital Signage Market Revenues, By Display Screen, 2017-2028F |

| 7.2. India Digital Signage Content Players Market Revenues & Volume, 2017-2028F |

| 7.2.1. India Digital Signage Market Revenue & Volume Share, By Content Player Types, 2021 & 2028F |

| 7.2.1.1. India Digital Signage Market Revenues & Volume, By Content Player Types, 2017-2028F |

| 7.3. India Digital Signage Software Market Revenues, 2017-2028F |

| 7.3.1. India Digital Signage Market Revenue Share, By Software Type, 2021 & 2028F |

| 7.3.1.1 India Digital Signage Market Revenues, By Software Type, 2017-2028F |

| 8. India Panel Based Display Digital Signage Market Overview |

| 8.1. India Panel Based Display Digital Signage Market Revenues & Volume, 2017-2028F |

| 8.2. India Panel Based Display Digital Signage Market Revenue & Volume Share, By Technology, 2021 & 2028F |

| 8.2.1. India LED Panel Based Display Digital Signage Market Revenues & Volume, 2017-2028F |

| 8.2.1.1. India LED Panel Based Display Digital Signage Market Revenue Share, By Size, 2021 & 2028F |

| 8.2.1.1.1 India LED Panel Based Display Digital Signage Market Revenues, By Size, 2017-2028F |

| 8.2.2 India OLED Panel Based Display Digital Signage Market Revenues & Volume, 2017-2028F |

| 8.2.2.1 India OLED Panel Based Display Digital Signage Market Revenue Share, By Size, 2021 & 2028F |

| 8.2.2.1.1 India OLED Panel Based Display Digital Signage Market Revenues, By Size, 2017-2028F |

| 8.2.3 India QLED Panel Based Display Digital Signage Market Revenues & Volume, 2017-2028F |

| 8.2.3.1 India QLED Panel Based Display Digital Signage Market Revenue Share, By Size, 2021 & 2028F |

| 8.2.3.1.1 India QLED Panel Based Display Digital Signage Market Revenues, By Size, 2017-2028F |

| 9. India True Color LED Display Digital Signage Market Overview |

| 9.1. India True Color LED Display Digital Signage Market Revenues, 2017-2028F |

| 9.2. India True Color LED Display Digital Signage Market Revenue Share, By Applications, 2017-2028F |

| 9.2.1. India True Color LED Display Digital Signage Market Revenues, By Indoor Application, 2017-2028F |

| 9.2.2. India True Color LED Display Digital Signage Market Revenues, By Outdoor Application, 2017-2028F |

| 9.2.1.1 India Indoor True Color LED Display Digital Signage Market Revenue Share, By Pixel Pitch, 2021 & 2028F |

| 9.2.1.1.1 India Indoor True Color LED Display Digital Signage Market Revenues, By Pixel Pitch, 2017-2028F |

| 9.2.2.1 India Outdoor True Color LED Display Digital Signage Market Revenue Share, By Pixel Pitch, 2021 & 2028F |

| 9.2.2.1.1 India Outdoor True Color LED Display Digital Signage Market Revenues, By Pixel Pitch, 2017-2028F |

| 10. India Kiosk Digital Signage Market Overview |

| 10.1. Kiosk Digital Signage Market Revenues & Volume, 2017-2028F |

| 11. India Digital Signage Market Overview, By Verticals |

| 11.1. India Digital Signage Market Revenues, By Commercial, 2017-2028F |

| 11.2. India Digital Signage Market Revenues, By Healthcare, 2017-2028F |

| 11.3. India Digital Signage Market Revenues, By Retail, 2017-2028F |

| 11.4 India Digital Signage Market Revenues, By Transportation, 2017-2028F |

| 11.5. India Digital Signage Market Revenues, By Hospitality, 2017-2028F |

| 11.6. India Digital Signage Market Revenues, By Entertainment, 2017-2028F |

| 11.7. India Digital Signage Market Revenues, By Others, 2017-2028F |

| 12. India Digital Signage Market Overview, By Regions |

| 12.1. India Digital Signage Market Revenues, By Northern, 2017-2028F |

| 12.2. India Digital Signage Market Revenues, By Southern, 2017-2028F |

| 12.3. India Digital Signage Market Revenues, By Eastern, 2017-2028F |

| 12.4. India Digital Signage Market Revenues, By Western, 2017-2028F |

| 13. India Digital Signage Market - Government Policies and Regulations |

| 14. India Digital Signage Market – Key Performance Indicators |

| 14.1 Average daily impressions per digital signage display. |

| 14.2 Percentage increase in interactive digital signage installations. |

| 14.3 Average dwell time or engagement metrics of viewers with digital signage content. |

| 14.4 Adoption rate of cloud-based digital signage solutions. |

| 14.5 Percentage increase in the use of data analytics for personalized content delivery. |

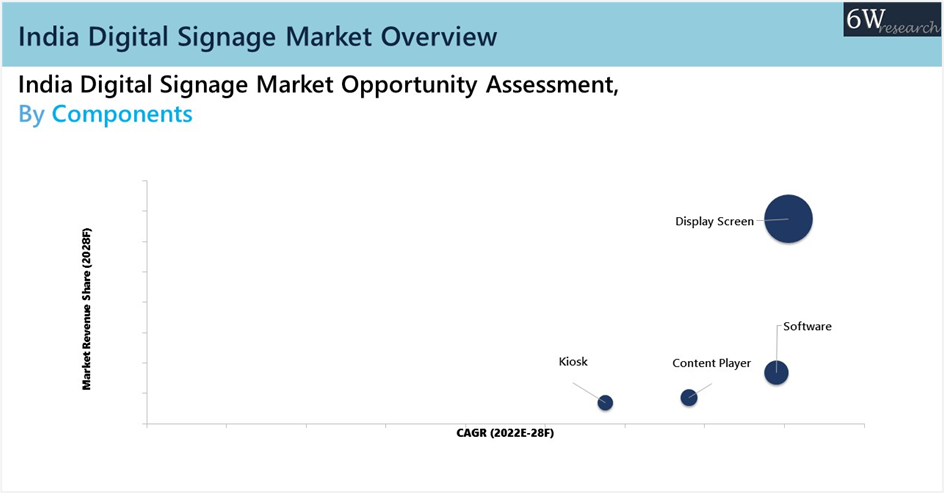

| 15. India Digital Signage Market Opportunity Assessment |

| 15.1. India Digital Signage Market Opportunity Assessment, By Components, 2028F |

| 15.2. India Digital Signage Market Opportunity Assessment, By Verticals, 2028F |

| 16. India Digital Signage Market – Voice of Customer Analysis |

| 16.1 Identification of Key Pain Points in Existing Digital Signage Solutions |

| 16.2 Identification of Key Motivational Factors to Switch Towards Other Solution Providers of Digital Signage Market |

| 16.3 Analyzing Key Preferred Products and Solutions in Digital Signage Market |

| 17. India Digital Signage Market – Competitive Landscape |

| 17.1 India Digital Signage Display Screens Market Revenue Share, By Companies, 2021 |

| 17.2 India Digital Signage Market Competitive Benchmarking, By Technical Parameters |

| 17.3 India Digital Signage Market Competitive Benchmarking, By Operating Parameters |

| 18. Company Profiles |

| 18.1 Samsung India Electronics Pvt Ltd. |

| 18.2 LG Electronics India Pvt Ltd. |

| 18.3 Panasonic India Pvt. Ltd. |

| 18.4 BenQ Corporation |

| 18.5 Sharp Corporation |

| 18.6 Sony India Pvt Ltd |

| 18.7 Vyoma Technologies Private Limited |

| 18.8 Xtreme Media Pvt. Ltd. |

| 18.9 Nusyn Digital Solutions Pvt. Ltd. |

| 18.10 Delta Electronics Inc. |

| 18.11 Christie Digital Systems (India) Pvt. Ltd. |

| 18.12 Leyard Group (Planar Systems) |

| 18.13 Yodeck (Flipnode LLC) |

| 18.14 Spectrio Inc. (Enplug Inc.) |

| 18.15 Scala Inc. |

| 18.16 Pickcel (LaneSquare Technology Pvt. Ltd.) |

| 18.17 ONELAN (TriplePlay Services Ltd) |

| 19. India Economic Profile |

| 20. Key Strategic Recommendations |

| 21. Disclaimer |

| List of Figures |

| Figure 1. India Digital Signage Market Revenues, 2017-2028F (INR Crore) |

| Figure 2. India Digital Signage Market Revenue Share, By Display Screen Type, 2021 & 2028F |

| Figure 3. India Digital Signage Market Revenue Share, By Verticals, 2021 & 2028F |

| Figure 4. India Digital Signage Market Revenue Share, By Regions, 2021 & 2028F |

| Figure 5. India Out of Home (OOH) Media Industry (INR crore), 2019-2023F |

| Figure 6. India Advertisement Expenditure (INR crore), 2019-2025F |

| Figure 7. India Current Investment Trends in Airport Infrastructure ($ Million), 2015-2040F |

| Figure 8. India Current Investment Trends in Railways Infrastructure ($ Million), 2015-2040F |

| Figure 9. India Digital Signage Market Revenues, By Display Screen, 2017-2028F (INR Crore) |

| Figure 10. India Digital Signage Market Revenues and Volume, By Content Players, 2017-2028F (INR Crore, Thousand Units) |

| Figure 11. India Digital Signage Market Revenue Share, By Content Player Type, 2021 & 2028F |

| Figure 12. India Digital Signage Market Volume Share, By Content Player Type, 2021 & 2028F |

| Figure 13. India Digital Signage Market Revenues, By Software, 2017-2028F (INR Crore) |

| Figure 14. India Digital Signage Market Revenue Share, By Software Type, 2021 & 2028F |

| Figure 15. India Panel Based Display Digital Signage Market Revenues and Volume, 2017-2028F (INR Crore, Thousand Units) |

| Figure 16. India Panel Based Display Digital Signage Market Revenue Share, By Technology, 2021 & 2028F |

| Figure 17. India Panel Based Display Digital Signage Market Volume Share, By Technology, 2021 & 2028F |

| Figure 18. India LED Panel Based Display Digital Signage Market Revenue Share, By Size, 2021 & 2028F |

| Figure 19. India OLED Panel Based Display Digital Signage Market Revenue Share, By Size, 2021 & 2028F |

| Figure 20. India QLED Panel Based Display Digital Signage Market Revenue Share, By Size, 2021 & 2028F |

| Figure 21. India True Color LED Display Digital Signage Market Revenues, 2017-2028F (INR Crore) |

| Figure 22. India True Color LED Display Digital Signage Market Revenue Share, By Applications, 2021 & 2028F |

| Figure 23. India True Color LED Display Digital Signage Market Revenues, By Indoor Application, 2017-2028F (INR Crore) |

| Figure 24. India True Color LED Display Digital Signage Market Revenues, By Outdoor Application, 2017-2028F (INR Crore) |

| Figure 25. India Indoor True Color LED Display Digital Signage Market Revenue Share, By Pixel Pitch, 2021 & 2028F |

| Figure 26.India Outdoor True Color LED Display Digital Signage Market Revenue Share, By Pixel Pitch, 2021 & 2028F |

| Figure 27.India Kiosk Digital Signage Market Revenues and Volume, 2017-2028F (INR Crore, Thousand Units) |

| Figure 28. India Digital Signage Market Revenue Share, By Regions, 2021 & 2028F |

| Figure 29. Number of Hotel Sites/ Outlets in India, 2018- 2023F |

| Figure 30. New Sites/Outlets of Full- Service Restaurants and Cafes/ Bars added per year in India, 2017-2022E |

| Figure 31. Retail market in India, 2020-2025 (INR Lakh Crore) |

| Figure 32. Number of Airports in India, 2022E-2025 |

| Figure 33. India New Office Space Supply, Jan-June 2020-2021 (Million sq. ft.) |

| Figure 34. India New Office Space supply, By Cities, H1 2020 & H1 2021 (Million sq. ft.) |

| Figure 35. India Digital Signage Market Opportunity Assessment, By Components, 2028F |

| Figure 36. India Digital Signage Market Opportunity Assessment, By Verticals, 2028F |

| Figure 37. : Rating of Customer Preference while Purchasing Digital Signage |

| Figure 38. Rating of Customer Preference while Switching towards other Digital Signage |

| Figure 39. Customer Preference while Purchasing Display Screen Digital Signage (% of Respondents) |

| Figure 40. Customer Preference while Purchasing Display Screen Digital Signage by Technology (% of Respondents) |

| Figure 41. Customer Preference while Purchasing LED Display Screen Digital Signage (% of Respondents) |

| Figure 42. Customer Preference while Purchasing OLED Display Screen Digital Signage (% of Respondents) |

| Figure 43. Customer Preference while Purchasing QLED Display Screen Digital Signage (% of Respondents) |

| Figure 44. India Digital Signage Market Revenue Share, By Companies, 2021 |

| Figure 45. India GDP at Constant Prices, 2018-2024F (INR Trillion) |

| Figure 46. India GDP per capita at Constant Prices, 2018-2024F (INR Trillion) |

| Figure 47. Urban Population in India 2015-2020 (INR Crore) |

| List of Tables |

| Table 1. India Digital Signage Market Revenues, By Content Player Type, 2017-2028F (INR Crore) |

| Table 2. India Digital Signage Market Volume, By Content Player Type, 2017-2028F (Thousand Units) |

| Table 3. India Digital Signage Market Revenues, By Software Type, 2017-2028F (INR Crore) |

| Table 4. India Panel Based Display Digital Signage Market Revenues, By Technology, 2017-2028F (INR Crore) |

| Table 5. India Panel Based Display Digital Signage Market Volume, By Technology, 2017-2028F (Thousand Units) |

| Table 6. India LED Panel Based Display Digital Signage Market Revenues, By Size, 2017-2028F (INR Crore) |

| Table 7. India OLED Panel Based Display Digital Signage Market Revenues, By Size, 2017-2028F (INR Crore) |

| Table 8. India QLED Panel Based Display Digital Signage Market Revenues, By Size, 2017-2028F (INR Crore) |

| Table 9. India Indoor True Color LED Display Digital Signage Market Revenues, By Pixel Pitch, 2017-2028F (INR Crore) |

| Table 10. India Outdoor True Color LED Display Digital Signage Market Revenues, By Pixel Pitch, 2017-2028F (INR Crore) |

| Table 11. India Digital Signage Market Revenues, By Verticals, 2021 & 2028F (INR Crore) |

| Table 12. India Digital Signage Market Revenues, By Regions, 2017-2028F (INR Crore) |

| Table 13. Taxation Laws while Importing with and without HSN Code 8528 |

Test Market Forecast By Components (Display Screen, Kiosk, Content Player, and Software), By Display Screen Type (Panel Based and True Color), By Panel based Display Screen Technology (LED, OLED and QLED), By Panel based Display Screen Size (LED (Below 40”, 40-55” and Above 55”), OLED (Below 60”, 60-65” and Above 65”), QLED (Below 50”, 50-65” and Above 65”)), By Pixel Pitch (Indoor (0.9-2mm, 2.1-3mm, 3.1-4mm and Above 4mm), Outdoor (3-4mm, 5-8mm and Above 8mm)), By True Color LED Application (Indoor and Outdoor), By Verticals (Commercial (Office Spaces & Out-of-Home Advertising), Transportation, Retail, Hospitality, Healthcare, Entertainment (Sports, Cultural, and Reality Events, Amusement Parks) and Others (BFSI, Education)), By Regions (Northern, Eastern, Western and Southern) and Competitive Landscape

| Product Code: ETC131534 | Publication Date: Mar 2022 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 80 | No. of Figures: 40 | No. of Tables: 20 |

6Wresearch aims at delivering unbiased content along with market trends across 60 Countries and is obliged to be a part of the upcoming Mediaexpo Mumbai event 2022. To view 6W's collaboration with other various events do check our event page.

India digital signage market is expected to grow on account of increasing advertising spending by companies in the number of promotional campaigns and volume of marketing activities in the Indian market. Many of these players are resorting to the use of attractive commercial displays and various other digital signage solutions to display promotional information. Further, infrastructure development and developing of retail and tourism sectors would also propel the India Digital Signage Market Growth during the forecast period.

According to 6Wresearch, India Digital Signage Market size is projected to grow at a CAGR of 15.1% during 2019–2025. The digital signage market of India is yet to develop on a larger scale owing to the low degree of awareness and thus the adoption of such solutions in the semi-urban and rural parts of the country. The strengthening of public infrastructure is leading to an increase in areas of application of digital signage systems across the country. Within the digital signage market in India, the display screens segment accounted for the majority of the India Digital Signage Market revenue share, followed by content players and software, in 2018. By display type, the single screen display segment accounts for the majority of the revenue share in the overall market owing to a high number of installations of such screens in major infrastructural projects in the retail and hospitality domains.

Moreover, the retail, hospitality, and transportation application segments of the digital signage market of India would grow significantly during the forecast period as the public infrastructure sector in the country is predicted to flourish in the coming years. Some of the key players in the Indian digital signage market include LG, Samsung, BenQ, and Panasonic.

The India digital signage market report comprehensively covers the market by components, display screen types, display screen size, display screen technology, applications, verticals, and region. The India digital signage market outlook report provides an unbiased and detailed analysis of the India digital signage market trends, opportunities, high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India digital signage market is anticipated to gain traction in the upcoming six years on the back of the rising growth of the commercial sector. The increase in the growth of the retail outlets, malls, and food courts with the rising growth of the urban population coupled with tiring young working population spending high on food and shopping simultaneously increasing the installation of digital signage such as digital menu and is expected to boost the impressive growth of the India digital signage market on the upcoming six years.

India digital signage market is estimated to boost growth of the market in the upcoming six years on the back of the rising scope of application, especially in the commercial sector. The increase in the expansion of the commercial sector like shopping centres, and food courts with the rising population visits and growing urban population in the country, and with the growing technology up-gradation is contributing to the India Digital Signage Market Share. Also, the growing business sector has been focusing on digital signage installation to display its product ads which ensure efficient product promotion and is estimated to bolster the growth of India digital signage during the coming years.

Key Highlights of the Report:

- India Digital Signage Market Overview

- India Digital Signage Market Outlook

- India Digital Signage Market Forecast

- Historical Data of India Digital Signage Market Revenues for the Period 2015-2018

- Market Size & Forecast of India Digital Signage Market Revenues until 2025

- Historical Data of India Digital Signage Market Revenues & Volume for the Period 2015-2018, By Display Screen Type

- Market Size & Forecast of India Digital Signage Market Revenues & Volume until 2025, By Display Screen Type

- Historical Data of India Digital Signage Market Revenues & Volume for the Period 2015-2018, By Display Screen Size

- Market Size & Forecast of India Digital Signage Market Revenues & Volume until 2025, By Display Screen Size

- Historical Data of India Digital Signage Market Revenues for the Period 2015-2018, By Applications

- Market Size & Forecast of India Digital Signage Market Revenues until 2025, By Applications

- Historical Data of India Digital Signage Market Revenues for the Period 2015-2018, By Verticals

- Market Size & Forecast of India Digital Signage Market Revenues until 2025, By Verticals

- Historical Data of India Digital Signage Market Revenues for the Period 2015-2018, By Regions

- Market Size & Forecast of India Digital Signage Market Revenues until 2025, By Regions

- Market Drivers and Restraints

- India Digital Signage Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- India Digital Signage Market Forecast and Opportunity Assessment

- India Digital Signage Market Overview on Competitive Benchmarking

- India Digital Signage Market Share, By Players

- India Digital Signage Market Share, By Regions

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The report provides a detailed analysis of the following market segments:

-

By Components

- Display Screen

- Kiosk

- Content Player

- Software

-

By Display Screen Type

- Panel Based

- True Color

-

By Panel based Display Screen Technology

- LED

- OLED

- QLED

-

By Panel based Display Screen Size

- LED

- Below 40”

- 40-55”

- Above 55”

- OLED

- Below 60”

- 60-65”

- Above 65”

- QLED

- Below 50”

- 50-65”

- Above 65”

- LED

-

By Pixel Pitch

- Indoor

- 9-2mm

- 1-3mm

- 1-4mm

- Above 4mm

- Outdoor

- 3-4mm

- 5-8mm

- Above 8mm

- Indoor

-

By True Color LED Application

- Indoor

- Outdoor

-

By Verticals

- Commercial (Office Spaces & Out-of-Home Advertising)

- Transportation

- Retail

- Hospitality

- Healthcare

- Entertainment (Sports, Cultural and Reality Events, Amusement Parks)

- Others (BFSI, Education)

-

By Regions

- Northern

- Eastern

- Western

- Southern

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero