India Industrial PC Market (2020-2026) | Analysis, Value, COVID-19 IMPACT, Companies, Trends, Outlook, Industry, Size, Forecast, Growth, Revenue & Share

Market Forecast By Type (Panel, Rack Mount, Box, Din Rail, Embedded Box), By Data Storage (HDD, SSD), By Maximum RAM Capacity (Up to512 MB, 512 MB-3 GB, 3 GB-8 GB, 8 GB-32 GB, 32 GB-64 GB and Above 64 GB), By Verticals (Healthcare & Pharmaceuticals, Transportation, Smart Cities & Infrastructure, Manufacturing, Automotive, Mining & Metals, Semiconductors & Electronics, and Others (Chemicals, F&B, Personal Care, etc.)), By Region (Eastern Region, Western Region, Northern Region, Southern Region) and competitive landscape

| Product Code: ETC004108 | Publication Date: Sep 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 95 | No. of Figures: 18 | No. of Tables: 13 |

India Industrial Pc Market Import Shipment Trend (2020-2024)

The India industrial PC market import shipment exhibited a declining trend with a CAGR from 2020-2024 at -6.5%. However, there was a significant growth spurt between 2023 and 2024, with a growth rate of 106.0%. Despite the overall negative trend, this surge indicates potential market recovery and expansion in the near future.

India Industrial PC Market report thoroughly covers the market by type, data storage, maximum RAM capacity, verticals, and regions. The India industrial PC market outlook report provides an unbiased and detailed analysis of the ongoing India industrial PC market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

India Industrial PC Market Synopsis

India industrial PC market is expected to show robust growth on the back of various factors such as the emergence of IoT in industries, the trend of digital manufacturing, and virtualization. Various manufacturing industries are adopting automation solutions for improved process flexibility, resource optimization, and cost reduction measures. The coronavirus outbreak would hamper the industrial PC market growth, resulting in negative growth in the current year owing to the shutdown of industries and cost-cutting measures implemented across the economy causing a slump in the demand for industrial PC. However, demand would pick up during the second half of FY21 with the containment of the virus and revival in capacity utilization. The market has seen a halt owing to the massive outbreak of COVID-19 which resulted in nationwide lockdowns to combat the spread of the virus and has led to a decline in the overall market growth.

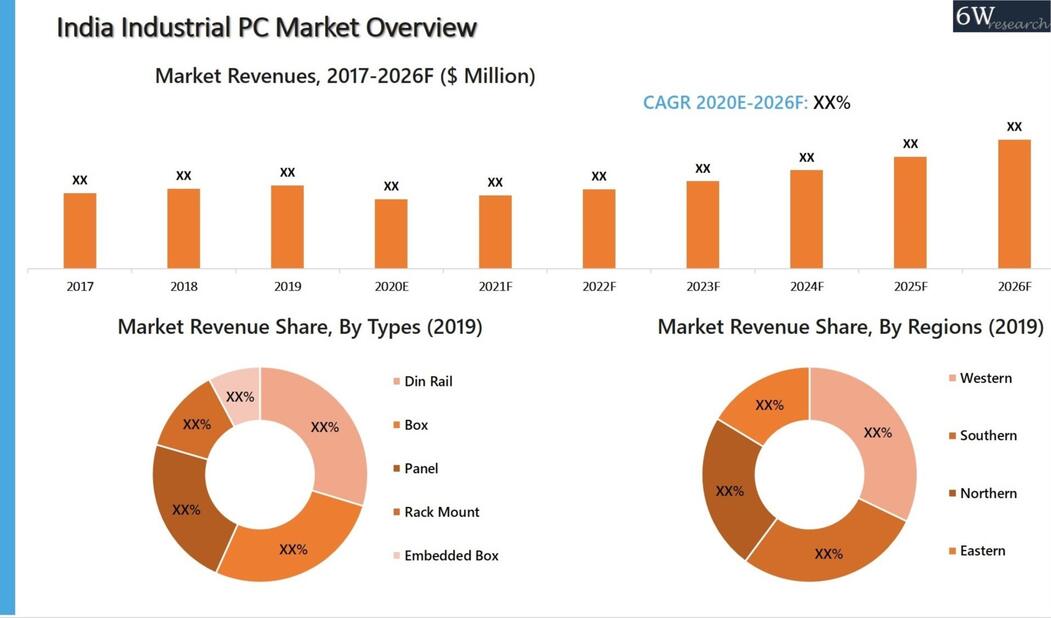

According to 6Wresearch, India Industrial PC Market size is projected to grow at CAGR of 10.1% during 2020-2026. In India, rapid industrialization, growing demand for high-end server and virtualization, increasing infrastructural investment in the transportation sector coupled with favorable government policies are some of the factors which would propel the market growth during the forecast period. Emerging applications of IoT in automotive, manufacturing, transportation, oil & gas industries for smoother and reliable operations with extensive integration of quality and regulatory requirements would further fuel the demand for industrial PC in India over the coming years.

Market Analysis by Types

By type, din rail PC has acquired the major revenue share in the overall market revenues in 2019 owing to its compact design with flexible display options coupled with various I/O modules for better performance and efficiency and is preferably used in military, transportation, and healthcare sectors. Based on verticals, the healthcare & pharmaceuticals segment captures the largest revenue share on account of rising demand for healthcare services along with rising investment in research & development. Moreover, the transportation vertical is expected to exhibit the fastest growth over the forecast period driven by public sector investments for large scale public transportation infrastructure development projects.

Market Analysis by Verticals

By verticals, the healthcare & pharmaceutical sector captures the highest revenue share in Indian industrial PC market in 2019 followed by the manufacturing sector. The growing demand for healthcare services, high-end diagnostics machines coupled with significant capital inflow and investments in research & development would continue to generate high demand for industrial PCs during the forecast period. Further, the transportation segment is anticipated to show the highest growth in India industrial PC market during the forecast period on account of the government’s ambitious plans for rail & road infrastructure development over the coming years and increasing applications in metros and shipping sector which would result in significant growth of industrial PC market.

The state-of-art technical upgrades in the computer and software industry have no doubt, bought about significant technological standards for the adoption and integration, and have led to the migration from traditional PC usage to modern and more sophisticated data storage and other well-established high data-based and technological task performance. Additionally, many private players have come about with the industrial PCs and are offering bountiful opportunities to the factory owners to bring about a revolution in the present system of their working and invest in the future of their business growth. Also, a rise in software technology and investments for the same have brought in new horizons for the growth and development of such technologies and as a result, is assisting the product to gain popularity in the industry. Since the era of revolutionization is taking place in the country backed by the increased initiatives of the government and many private players to bring in state-of-art software development, industrial PC market in India is expected to gain momentum in the market in the next five to ten years and as a result, it is also expected to bring in vast avenues for the growth and establishment of many business platforms related to the product and bring in opportunities for the private players and to be investors of the market to gain huge growth potential in the coming timeframe.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2020.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Industrial PC Market Overview

- India Industrial PC Market Outlook

- India Industrial PC Market Forecast

- Historical data & Forecast of India Industrial PC Market Revenues for the Period 2017-2026F

- Historical data & Forecast of India Industrial PC Market Revenues, By Type, Data Storage, Maximum RAM Capacity, Verticals and Regions for the Period 2017-2026F

- Market Drivers, Restraints, and Trends

- Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Market Player’s Revenue Shares

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Type

- Panel

- Rack Mount

- Box

- Din Rail

- Embedded Box

By Data Storage

- HDD

- SSD

By Maximum RAM Capacity

- Up to 512 MB

- 512 MB-3 GB

- 3 GB-8 GB

- 8 GB-32 GB

- 32 GB-64 GB

- Above 64 GB

By Verticals

- Healthcare & Pharmaceuticals

- Transportation

- Smart Cities & Infrastructure

- Manufacturing

- Automotive

- Mining & Metals

- Semiconductors & Electronics

- Others (Chemicals, F&B, Personal Care, etc.)

By Region

- Eastern Region

- Western Region

- Northern Region

- Southern Region

Other Key Reports Available:

- China Industrial PC Market (2020-2026F)

- Japan Industrial PC Market (2020-2026F)

- Australia Industrial PC Market (2020-2026F)

- Singapore Industrial PC Market (2020-2026F)

India Industrial PC Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. India Industrial PC Market Overview |

| 3.1 Overview & Analysis |

| 3.2 India Industrial PC Market Revenues (2017-2026F) |

| 3.3 India Industrial PC Market - Industry Life Cycle |

| 3.4 India Industrial PC Market Porter's Five Force Model |

| 3.5 India Industrial PC Market Value Chain & Ecosystem |

| 3.6 India Industrial PC Market Revenue Share, By Type (2019 & 2026F) |

| 3.7 India Industrial PC Market Revenue Share, By Data Storage (2019 & 2026F) |

| 3.8 India Industrial PC Market Revenue Share, By Maximum RAM Capacity (2019 & 2026F) |

| 3.9 India Industrial PC Market Revenue Share, By Verticals (2019 & 2026F) |

| 3.10 India Industrial PC Market Revenue Share, By Regions (2019 & 2026F) |

| 4. India Industrial PC Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing adoption of automation in industries leading to higher demand for industrial PCs |

| 4.2.2 Growing emphasis on digitalization and Industry 4.0 initiatives in India |

| 4.2.3 Rise in the use of industrial PCs for data analysis and real-time monitoring in manufacturing processes |

| 4.3 Market Restraints |

| 4.3.1 High initial investment required for implementing industrial PCs in manufacturing facilities |

| 4.3.2 Lack of skilled workforce proficient in industrial PC technology |

| 4.3.3 Concerns regarding cybersecurity threats and data breaches in industrial environments |

| 5. India Industrial PC Market Trends & Evolution |

| 6. India Industrial PC Market Overview, By Type |

| 6.1 Overview & Analysis |

| 6.2 Panel Market Revenues (2017-2026F) |

| 6.3 Rack Mount Market Revenues (2017-2026F) |

| 6.4 Box Market Revenues (2017-2026F) |

| 6.5 Din Rail Market Revenues (2017-2026F) |

| 6.6 Embedded Box Market Revenues (2017-2026F) |

| 7. India Industrial PC Market Overview, By Data Storage |

| 7.1 Overview & Analysis |

| 7.2 HDD Market Revenues (2017-2026F) |

| 7.3 SDD Market Revenues (2017-2026F) |

| 8. India Industrial PC Market Overview, By Maximum RAM Capacity |

| 8.1 Overview & Analysis |

| 8.2 Upto 512 MB Market Revenues (2017-2026F) |

| 8.3 512-3 GB Market Revenues (2017-2026F) |

| 8.4 3 GB - 8 GB Market Revenues (2017-2026F) |

| 8.5 8 GB - 32 GB Market Revenues (2017-2026F) |

| 8.6 32 GB - 64 GB Market Revenues (2017-2026F) |

| 8.7 Above 64 GB Market Revenues (2017-2026F) |

| 9. India Industrial PC Market Overview, By Verticals |

| 9.1 Overview & Analysis |

| 9.2 Healthcare & Pharmaceuticals Market Revenues (2017-2026F) |

| 9.2.1 Healthcare & Pharmaceuticals Market Revenues, By Types (2017-2026F) |

| 9.3 Transportation Market Revenues (2017-2026F) |

| 9.3.1 Transportation Market Revenues, By Types (2017-2026F) |

| 9.4 Smart Cities & Infrastructure Market Revenues (2017-2026F) |

| 9.4.1 Smart Cities & Infrastructure Market Revenues, By Types (2017-2026F) |

| 9.5 Food & Beverages Market Revenues (2017-2026F) |

| 9.6 Mining & Metals Market Revenues (2017-2026F) |

| 9.7 Semiconductor & Electronics Market Revenues (2017-2026F) |

| 9.8 Other Industries Market Revenues (2017-2026F) |

| 10. India Industrial PC Market Overview, By Regions |

| 10.1 Overview & Analysis |

| 10.2 India Industrial PC Market Revenues, By Northern Region (2017-2026F) |

| 10.3 India Industrial PC Market Revenues, By Southern Region (2017-2026F) |

| 10.4 India Industrial PC Market Revenues, By Eastern Region (2017-2026F) |

| 10.5 India Industrial PC Market Revenues, By Western Region (2017-2026F) |

| 11. India Industrial PC Market - Key Performance Indicators |

| 11.1 Mean Time Between Failures (MTBF) of industrial PCs in use |

| 11.2 Percentage increase in the number of manufacturing facilities implementing industrial PCs |

| 11.3 Average percentage improvement in operational efficiency after adopting industrial PCs |

| 11.4 Number of new industrial PC models introduced with advanced features |

| 11.5 Rate of adoption of IoT-enabled industrial PCs in India |

| 12. India Industrial PC Market Overview - Opportunity Assessment |

| 12.1 India Industrial PC Market Opportunity Assessment, By Type (2026F) |

| 12.2 India Industrial PC Market Opportunity Assessment, By Data Storage (2026F) |

| 12.3 India Industrial PC Market Opportunity Assessment, By Maximum RAM Capacity (2026F) |

| 12.4 India Industrial PC Market Opportunity Assessment, By Verticals (2026F) |

| 12.5 India Industrial PC Market Opportunity Assessment, By Regions (2026F) |

| 13. India Industrial PC Market Overview - Competitive Landscape |

| 13.1 India Industrial PC Market Revenue Share, By Companies (2019) |

| 13.2 India Industrial PC Companies Competitive Benchmarking, By Technical & Operating Parameters |

| 14. Company Profiles (Top 10) |

| 14.1 Business Description |

| 14.2 Geographical Presence |

| 14.3 Ownership (Top 5 Shareholders) |

| 14.4 Key Financials (If Available) |

| 14.5 Historical Timeline (If Available) |

| 14.6 Key Clients |

| 14.7 Product Segmentation |

| 14.8 Key Distributors / Dealers |

| 14.9 Key Executives |

| 14.10 Number of Employees |

| 15. Key Strategic Recommendations (Target Market, Business Strategies, Local Manufacturing, etc.) |

| 16. Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero