India Lithium-Ion Batteries Market (2021-2027) | Size, Share, industry, Trends, Outlook, Revenue

Market Forecast By Power Capacity (0-3000 mAh, 3000-10000 mAh, 10000-60000 mAh, Above 60000 mAh), By Applications (Electronics, Automotive, Industrial, Others (Medical, Military, Textile)), By Materials (Lithium Cobalt Oxide, Lithium Nickel Cobalt Oxide, Lithium Iron Phosphate, Others (Lithium Manganese OxideLi Titanate)) By Regions (Northern, Eastern, Southern, Western) And Competitive Landscape

| Product Code: ETC4377998 | Publication Date: Mar 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 80 | No. of Figures: 17 | No. of Tables: 4 |

India Lithium-Ion Batteries Market Size & Growth Rate

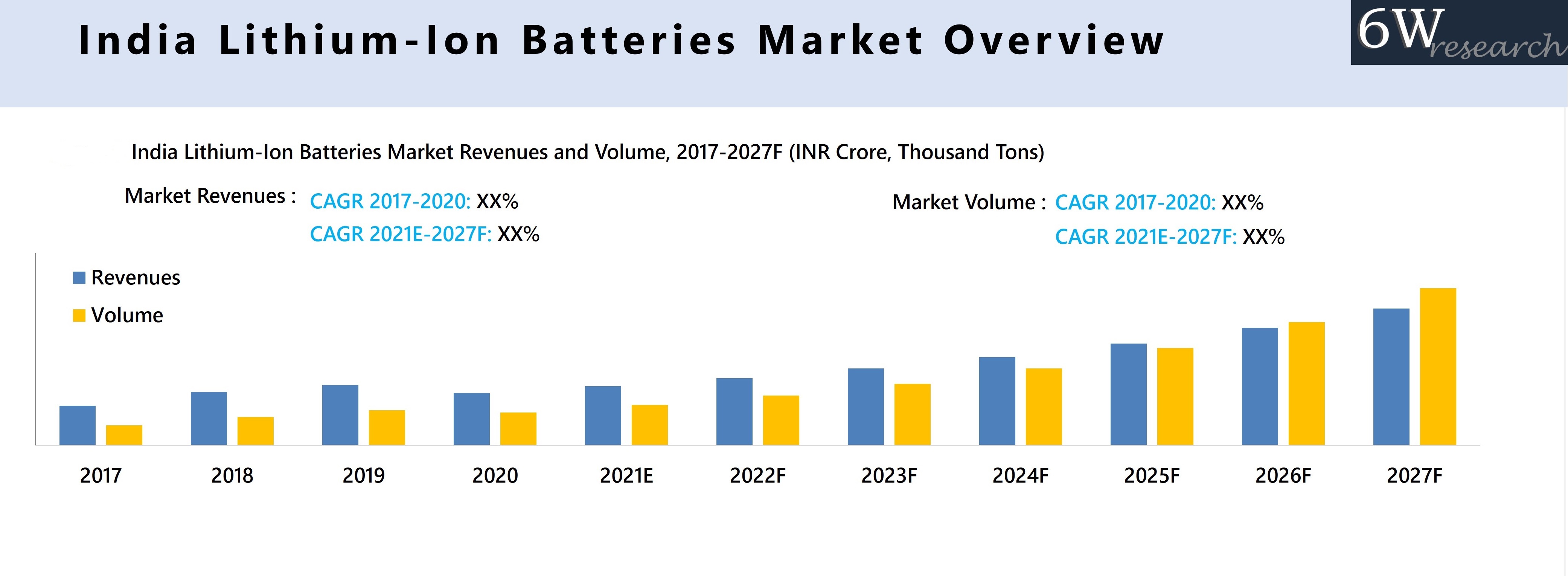

India Lithium-Ion Batteries Market is projected to grow at a CAGR of 15% during 2021–2027, driven by increasing demand for smartphones, electronic gadgets, and electric vehicles, along with supportive government initiatives.

India Lithium-Ion Batteries Market Synopsis

The India Lithium-Ion Batteries Market grew significantly in 2017-2020 on the account of rising demand for smartphones and electric vehicles in India. India is the second largest mobile phone market in the world many smartphone manufacturing firms had started their manufacturing base in India. Further, in 2020, Due to the COVID-19 pandemic, the growth of the lithium-ion batteries market declines as the majority of raw materials is being imported from China and Australia.

There was a disruption in the supply chain, owning to the lockdown measure adopted to curb the spread of the virus. Although with the casual upliftment of lockdown restrictions, and an increase in the availability of raw materials the sale of lithium-ion batteries began to get back on track as operation and production resumed which led the lithium-ion battery market back to its growth trajectory.

There was a disruption in the supply chain, owning to the lockdown measure adopted to curb the spread of the virus. Although with the casual upliftment of lockdown restrictions, and an increase in the availability of raw materials the sale of lithium-ion batteries began to get back on track as operation and production resumed which led the lithium-ion battery market back to its growth trajectory.

According to 6Wresearch, India lithium-ion batteries market size is projected to grow at a CAGR of 15% during 2021-2027. An increasing number of electronic devices and the rising disposable income in India are the major factors contributing to the growth of the Market in India. Additionally, government initiatives like Faster Adoption and Manufacturing of Hybrid & Electric Vehicles in India and the Production Linked Incentive scheme would provide opportunities for manufacturing firms to invest in India which would propel the Lithium-Ion Batteries Market share in India. With the rising demand for electric vehicles in the automotive industry owing to growing concerns regarding global warming, the adoption of lithium-ion batteries is anticipated to rise in the forthcoming period. Lithium-ion market share in India will continue to grow in the near future. The sector growth will propel more as the demand for lithium-ion is rising in the country at a faster pace.

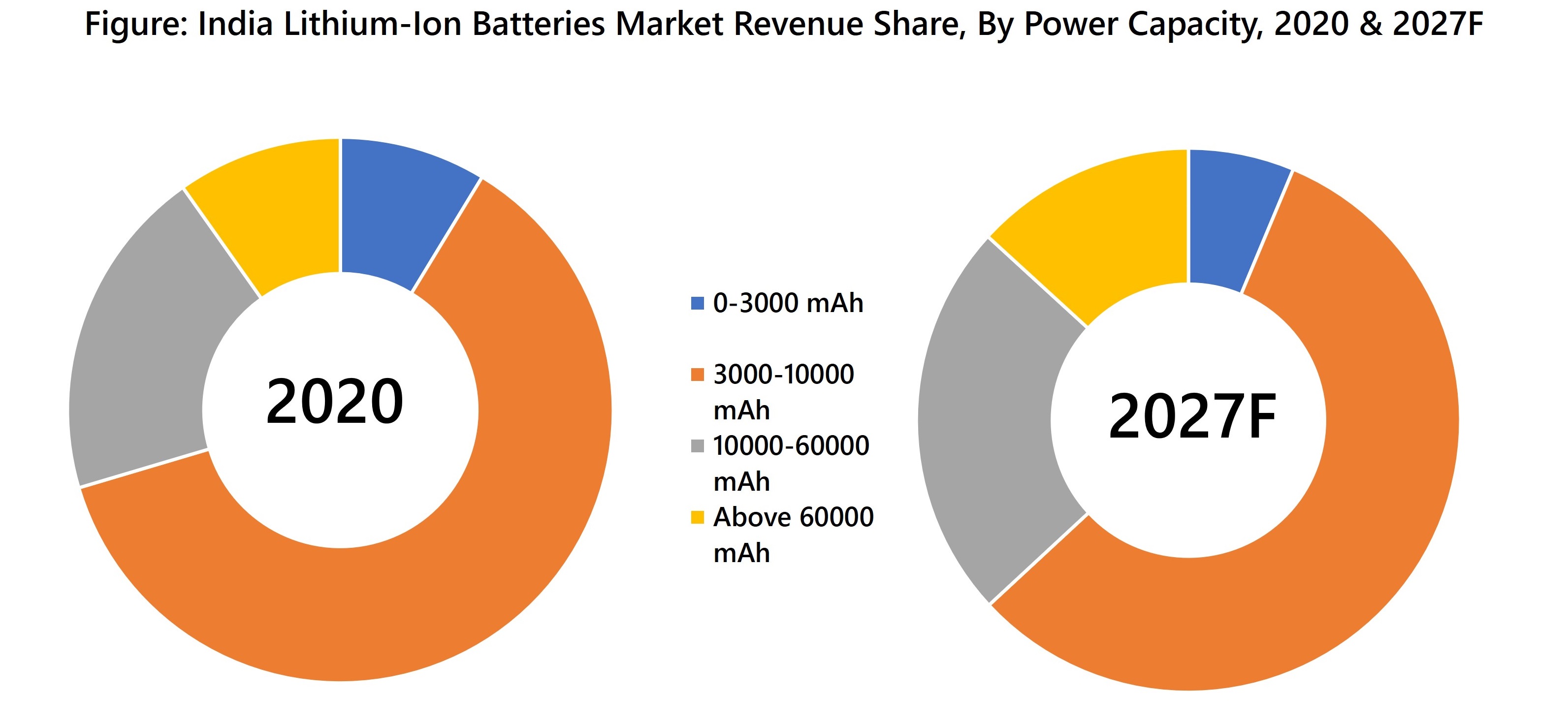

Market by Power Capacity

3000-10000 mAh lithium-ion batteries garnered the maximum revenue share in 2020 on account of the adoption of smartphones and electronic gadgets and the same trend is expected to follow in the upcoming years as well and it will propel the India Lithium-Ion Batteries Industry. Further, 10000-60000 mAh lithium-ion batteries would grow faster in the upcoming years owing to the adoption of electric vehicles among consumers in India.

Market by Applications

The Electronics sector accounted for the majority of the revenue share in 2020 on account of the adoption of smartphones and electronic gadgets and the same trend is expected to follow in the upcoming years as well. According to media reports, The Indian electronics market is considered one of the largest in the world and is expected to hit US$400 billion by 2025.

Market by Materials

Lithium Cobalt Oxide Material garnered the maximum growth in 2020 owing to its easy availability, and cheaper rates, and the same trend is expected to follow in the upcoming years in India. Further, Lithium Nickel Cobalt Oxide Material is expected to grow faster in the upcoming years owing to reduce dependency on Lithium Cobalt Oxide Material.

Market by Regions

The southern region accounted for the maximum revenue share in 2020 on account of various electric vehicle manufacturing firms concentrated in the southern states like Karnataka and Tamil Nadu. According to media reports, the electric vehicle (EV) market in India is expected to hit over 63 lakh unit mark per annum by 2027. Further, the northern region is expected to grow at a faster rate due to the rise in demand for smartphones and electronic gadgets.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020.

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Lithium-Ion Batteries Market Overview

- India Lithium-Ion Batteries Market Outlook

- India Lithium-Ion Batteries Market Forecast

- Historical Data and Forecast of India Lithium-Ion Batteries Market Revenues and Volume for the Period 2017-2027F

- Historical Data and Forecast of India Lithium-Ion Batteries Market Revenues, By Power Capacity, for the Period 2017-2027F

- Historical Data and Forecast of India Lithium-Ion Batteries Market Revenues, By Applications, for the Period 2017-2027F

- Historical Data and Forecast of India Lithium-Ion Batteries Market Revenues, By Materials, for the Period 2017-2027F

- Historical Data and Forecast of India Lithium-Ion Batteries Market Revenues, By Regions, for the Period 2017-2027F

- Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- Impact Analysis of COVID-19

- Market Trends

- India Lithium-Ion Batteries Market Revenue Share, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

Market by Power Capacity

- 0-3000 mAh

- 3000-10000 mAh

- 10000-60000 mAh

- Above 60000 mAh

Market by Applications

- Electronics

- Automotive

- Industrial

- Others (Medical, Military, Textile)

Market by Materials

- Lithium Cobalt Oxide

- Lithium Nickel Cobalt Oxide

- Lithium Iron Phosphate

- Others (Lithium Manganese Oxide, Li Titanate)

Market by Regions

- Northern

- Eastern

- Southern

- Western

India Lithium-Ion Batteries Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Lithium-Ion Batteries Market Overview |

| 3.1. India Lithium-Ion Batteries Market Revenues and Volume, 2017-2027F |

| 3.2. India Lithium-Ion Batteries Market Industry Life Cycle |

| 3.3. India Lithium-Ion Batteries Market Porter's Five Forces |

| 3.4. India Lithium-Ion Batteries Market Revenue Share, By Power Capacity, 2020 & 2027F |

| 3.5. India Lithium-Ion Batteries Market Revenue Share, By Applications, 2020 & 2027F |

| 3.6. India Lithium-Ion Batteries Market Revenue Share, By Materials, 2020 & 2027F |

| 3.7. India Lithium-Ion Batteries Market Revenue Share, By Regions, 2020 & 2027F |

| 4. Impact Analysis of Covid-19 on India Lithium-Ion Batteries Market |

| 5. India Lithium-Ion Batteries Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.2.1 Increasing adoption of electric vehicles in India |

| 5.2.2 Government initiatives and incentives to promote renewable energy sources |

| 5.2.3 Growing demand for energy storage solutions in various industries |

| 5.3. Market Restraints |

| 5.3.1 High initial costs associated with lithium-ion batteries |

| 5.3.2 Lack of recycling infrastructure for lithium-ion batteries in India |

| 5.3.3 Concerns regarding safety and environmental impact of lithium-ion batteries |

| 6. India Lithium-Ion Batteries Market Trends |

| 7. India Lithium-Ion Batteries Market Overview, By Power Capacity |

| 7.1. India Lithium-Ion Batteries Market Revenues, By 0-3000 mAh, 2017-2027F |

| 7.2. India Lithium-Ion Batteries Market Revenues, By 3000-10000 mAh, 2017-2027F |

| 7.3. India Lithium-Ion Batteries Market Revenues, By 10000-60000 mAh, 2017-2027F |

| 7.4. India Lithium-Ion Batteries Market Revenues, By Above 60000 mAh, 2017-2027F |

| 8. India Lithium-Ion Batteries Market Overview, By Applications |

| 8.1. India Lithium-Ion Batteries Market Revenues, By Electronics Application, 2017-2027F |

| 8.2. India Lithium-Ion Batteries Market Revenues, By Automotive Application, 2017-2027F |

| 8.3. India Lithium-Ion Batteries Market Revenues, By Industrial Application, 2017-2027F |

| 8.4. India Lithium-Ion Batteries Market Revenues, By Others, 2017-2027F |

| 9. India Lithium-Ion Batteries Market Overview, By Materials |

| 9.1 India Lithium-Ion Batteries Market Revenues, By Lithium Cobalt Oxide, 2017-2027F |

| 9.2 India Lithium-Ion Batteries Market Revenues, By Lithium Nickel Cobalt Oxide, 2017-2027F |

| 9.3 India Lithium-Ion Batteries Market Revenues, By Lithium Iron Phosphate, 2017-2027F |

| 9.4 India Lithium-Ion Batteries Market Revenues, By Other Materials, 2017-2027F |

| 10. India Lithium-Ion Batteries Market Overview, By Regions |

| 10.1. India Lithium-Ion Batteries Market Revenues, By Southern Region, 2017-2027F |

| 10.1. India Lithium-Ion Batteries Market Revenues, By Northern Region, 2017-2027F |

| 10.3. India Lithium-Ion Batteries Market Revenues, By Western Region, 2017-2027F |

| 10.4. India Lithium-Ion Batteries Market Revenues, By Eastern Region, 2017-2027F |

| 11. India Lithium-Ion Batteries Market - Key Performance Indicators |

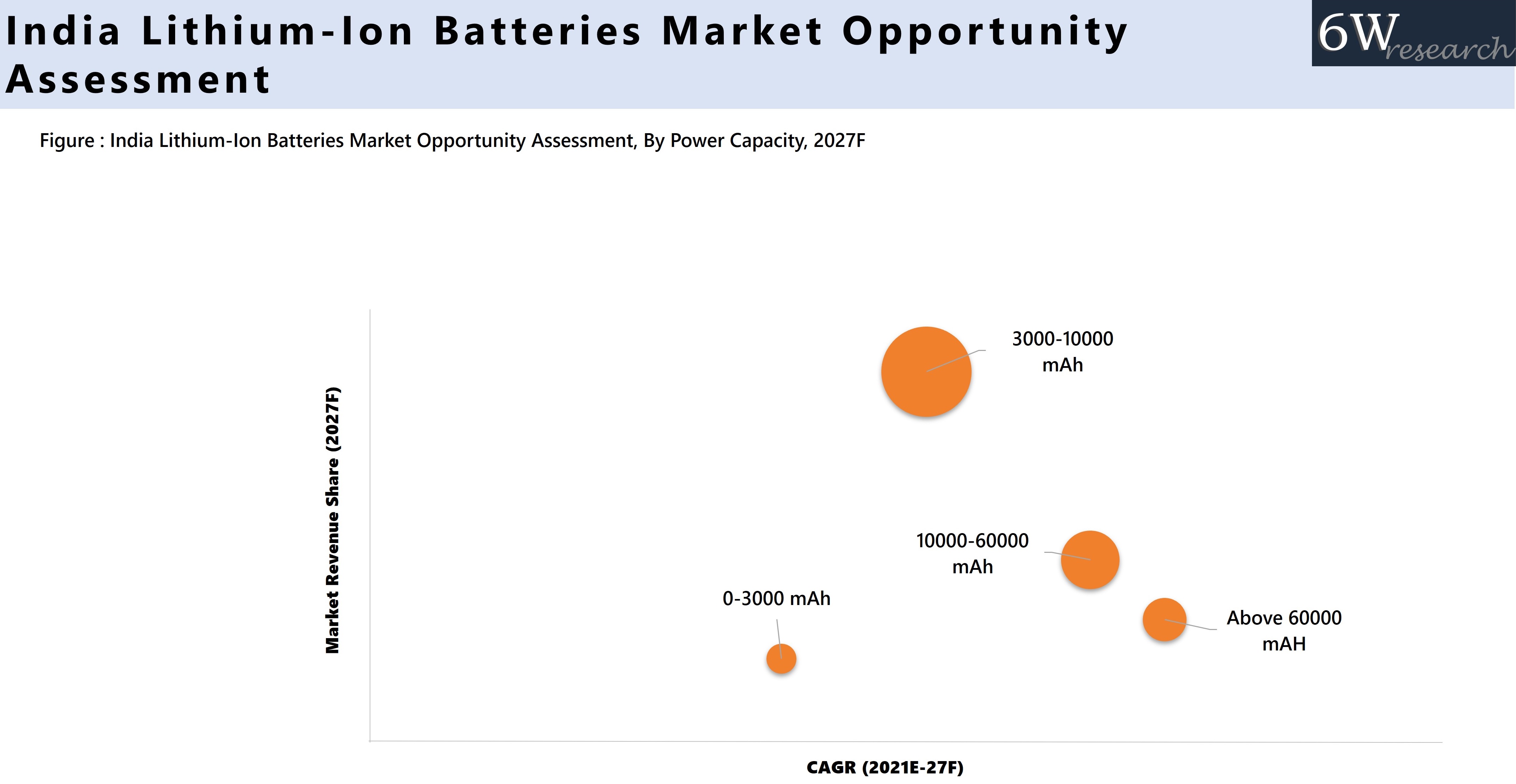

| 12. India Lithium-Ion Batteries Market Opportunity Assessment |

| 12.1. India Lithium-Ion Batteries Market Opportunity Assessment, By Power Capacity, 2027F |

| 12.2. India Lithium-Ion Batteries Market Opportunity Assessment, By Applications, 2027F |

| 12.3. India Lithium-Ion Batteries Market Opportunity Assessment, By Materials, 2027F |

| 12.4. India Lithium-Ion Batteries Market Opportunity Assessment, By Regions, 2027F |

| 13. India Lithium-Ion Batteries Market Competitive Landscape |

| 13.1. India Lithium-Ion Batteries Market Revenue Share, By Companies, 2020 |

| 13.2. India Lithium-Ion Batteries Market Competitive Benchmarking, By Operating Parameters |

| 13.3. India Lithium-Ion Batteries Market Competitive Benchmarking, By Technical Parameters |

| 14. Company Profiles |

| 14.1. Exide Leclanche Energy Private Limited |

| 14.2. Livguard Technologies Private Limited |

| 14.3. Okaya Power Pvt. Ltd |

| 14.4. Samsung SDI Co. Ltd. |

| 14.5. HBL Power Systems Limited |

| 14.6. Amperex Technologies Limited |

| 14.7. Luminous Power Technologies Pvt. Ltd. |

| 14.8. TDS Lithium-Ion Battery Gujarat Private Limited |

| 14.9. Future Hi-Tech Batteries Limited |

| 14.10. Bharat Electronics Limited |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

| List of Figures |

| 1. India Lithium-Ion Batteries Market Revenues and Volume, 2017-2027F (INR Crore, Thousand Tons) |

| 2. India Lithium-Ion Batteries Market Revenue Share, By Power Capacity, 2020 & 2027FIndia Lithium-Ion Batteries Market Revenue Share, By Power Capacity, 2020 & 2027F |

| 3. India Lithium-Ion Batteries Market Revenue Share, By Applications, 2020 & 2027F India Lithium-Ion Batteries Market Revenue Share, By Applications, 2020 & 2027F |

| 4. India Lithium-Ion Batteries Market Revenue Share, By Materials, 2020 & 2027F dia Lithium-Ion Batteries Market Revenue Share, By Materials, 2020 & 2027F |

| 5. India Lithium-Ion Batteries Market Revenue Share, By Regions, 2020 & 2027F5. |

| 6. Number of Electric Vehicles registered in India(in lakhs) |

| 7. India Disposable Personal Income (in lakhs) |

| 8. Top five states with most of the numbers of EV charging stations sanctioned under the FAME-II India Scheme |

| 9. Number of Lithium-Ion batteries imported(in lakhs) |

| 10. Annual Electric Vehicles Sold-Two Wheelers and Four Wheelers, FY2015/16-2019/20 |

| 11. India’s mobile phone production, 2015 - 2021 (in crores) |

| 12. Total Generation of power capacity, FY2015/16-2020-21(in billion units) |

| 13. India Lithium-Ion Batteries Market Opportunity Assessment, By Power Capacity, 2027F |

| 14. India Lithium-Ion Batteries Market Opportunity Assessment, By Applications, 2027F |

| 15. India Lithium-Ion Batteries Market Opportunity Assessment, By Materials, 2027F |

| 16. India Lithium-Ion Batteries Market Opportunity Assessment, By Regions, 2027F |

| 17. India Lithium-Ion Batteries Market Opportunity Assessment, By Regions, 2027F |

| List of Tables |

| 1. India Lithium-Ion Batteries Market Revenues, By Power Capacity, 2017-2027F (INR Crore) |

| 2. India Lithium-Ion Batteries Market Revenues, By Applications, 2017-2027F (INR Crore) |

| 3. India Lithium-Ion Batteries Market Revenues, By Materials, 2017-2027F (INR Crore) |

| 4. India Lithium-Ion Batteries Market Revenues, By Regions, 2017-2027F (INR Crore) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero