India Medical Furniture Market Outlook (2022-2028) | Revenue, Share, Size, Forecast, COVID-19 IMPACT, Growth, Analysis, Industry, Companies, Trends & Value

Market Forecast By Product Type (Beside Tables, Operations Theater Tables, Instrument Stands, Stretchers, Hospital Beds, Trolley, Foldable Wheelchairs, Fixed Wheelchairs), By Hospital Beds (Manual Beds, Semi-Electric Beds, Fully-Electric Beds), By Applications (Hospitals, Diagnostic Centers, Clinics), By Regions (Northern, Southern, Eastern, Western) and competitive landscape

| Product Code: ETC180921 | Publication Date: Mar 2022 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 84 | No. of Figures: 16 | No. of Tables: 09 | |

India Medical Furniture Market Size & Growth Rate

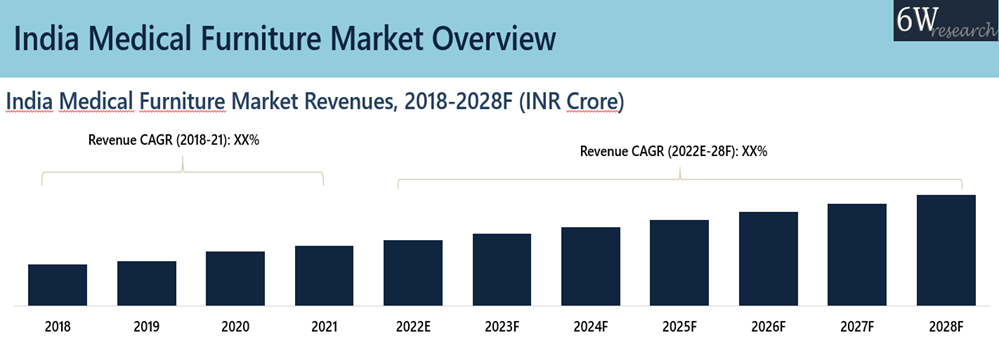

The India Medical Furniture Market is projected to grow at a CAGR of 8.9% during 2022–2028, driven by the rise in chronic diseases, expansion of healthcare infrastructure, growing medical tourism, and government initiatives to increase hospital bed capacity across the country.

India medical furniture market report comprehensively covers the market by product type, applications, hospital beds and regions. India medical furniture market report provides an unbiased and detailed analysis of the on-going trends, opportunities/high growth areas, market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Medical Furniture Market Synopsis

India medical furniture market experienced a significant growth in the previous years owing to rise in chronic diseases, rising middle class expenditure and burgeoning medical tourism in India. The market continued to witness growth during 2020 as the number of patients requiring advanced medical furniture and intensive care increased considerably in several states such that national capital led to a 35% increase in the demand for beds in hospitals. The covid-19 pandemic has not only presented challenges but also several opportunities for businesses in India to grow. The crisis has opened the gates for Indian start-ups, many of whom have risen to the occasion and accelerated the development of low-cost, scalable, and quick medical solutions. Further, the pandemic has provided an impetus to the expansion of telemedicine and the home healthcare market in the country.

According to 6Wresearch, India Medical Furniture Market size is projected to grow at a CAGR of 8.9% during 2022-2028. India medical furniture market is in the growing stage of industry life cycle as the healthcare market is rapidly witnessing growth in the country such that the healthcare industry size is estimated to reach Rs 27.7 lakh crore by 2022. Also, rapid urbanization, increasing geriatric population, disposable income and increasing per capita income that is expected to reach $2.48 thousand in 2024, is also contributing significantly to the market growth. India medical furniture market is expected to drive positively during the forecast period due to rising number of chronic diseases along with increasing number of hospitals and clinics.

Market by Regions

Southern region captured majority of revenues in India medical furniture market as Kerala has emerged as the top-ranking state in terms of overall health performance among states. Chennai tops the list for medical tourism in India and has been termed India's health capital. Multi and super-specialty hospitals across the city bring in an estimated 150 international patients every day. On the other hand, states such as Bihar, Odisha, Chhattisgarh and Jharkhand lag behind and rank lowest in hospital beds and infrastructure.

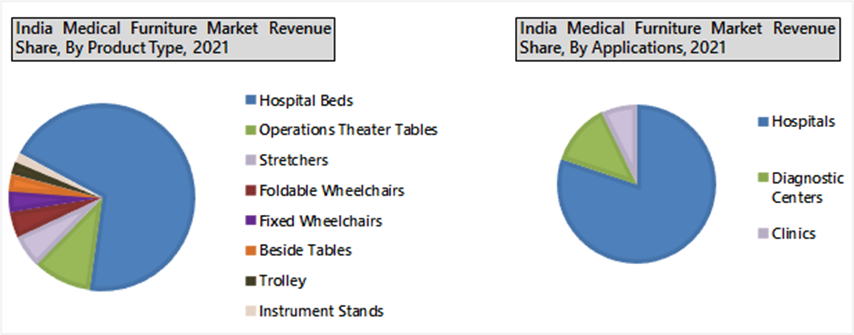

Market by Product Type

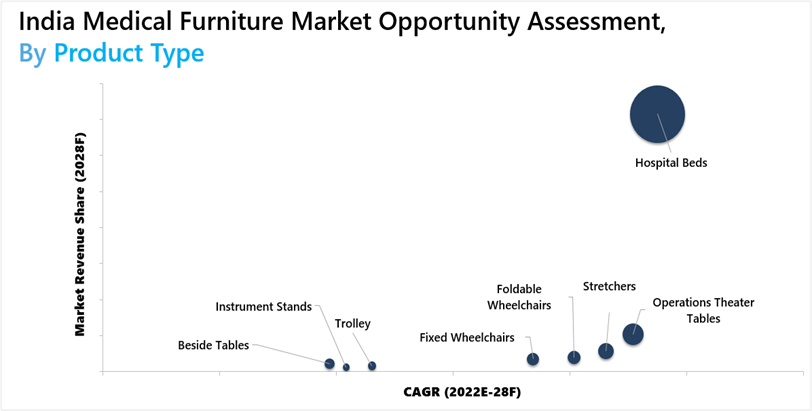

Hospital beds acquired largest revenue share in the market owing to their high price and government objective to increase number of beds by atleast 30% in the coming years to ensure equitable access to healthcare facilities. India’s hospital bed density is less than half the global average of 3 hospital beds per 1,000 population, implying that an estimated 2.2 million beds will be required over the next 15 years in the country.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2018 to 2028.

- Base Year: 2021

- Forecast Data until 2028.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Medical Furniture Market Overview

- India Medical Furniture Market Outlook

- India Medical Furniture Market Forecast

- Historical Data and Forecast of India Medical Furniture Market Revenues for the Period 2018-2028F

- Historical Data and Forecast of India Medical Furniture Market Revenues, By Product Type, for the Period 2018-2028F

- Historical Data and Forecast of India Medical Furniture Market Revenues, By Hospital Beds, for the Period 2018-2028F

- Historical Data and Forecast of India Medical Furniture Market Revenues, By Applications, for the Period 2018-2028F

- Historical Data and Forecast of India Medical Furniture Market Revenues, By Regions, for the Period 2018-2028F

- Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- Impact Analysis of COVID-19

- India Medical Furniture Market Trends

- India Medical Furniture Market Revenue Ranking, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

- By Product Type

- Beside Tables

- Operations Theater Tables

- Instrument Stands

- Stretchers

- Hospital Beds

- Trolley

- Foldable Wheelchairs

- Fixed Wheelchairs

- ByHospital Beds

- Manual Beds

- Semi-Electric Beds

- Fully-Electric Beds

- ByApplications

- Hospitals

- Diagnostic Centers

- Clinics

- ByRegions

- Northern

- Southern

- Eastern

- Western

India Medical Furniture Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. India Medical Furniture Market Overview |

| 3.1. India Medical Furniture Market Revenues, 2018-2028F |

| 3.2. India Medical Furniture Market - Industry Life Cycle |

| 3.3. India Medical Furniture Market Porter's Five Forces |

| 3.4. India Medical Furniture Market Revenue Share, By Product Type, 2021 & 2028F |

| 3.5. India Hospital Furniture Market Revenue Share, By Applications, 2021 & 2028F |

| 3.6. India Hospital Furniture Market Revenue Share, By Hospital Beds, 2021 & 2028F |

| 3.7. India Hospital Furniture Market Revenue Share, By Regions, 2021 & 2028F |

| 4. Impact Analysis of Covid-19 on India Medical Furniture Market |

| 5. India Medical Furniture Market Dynamics |

| 5.1. Impact Analysis |

| 5.2. Market Drivers |

| 5.2.1 Increasing healthcare infrastructure development in India |

| 5.2.2 Growing demand for specialized medical furniture in hospitals and clinics |

| 5.2.3 Rising healthcare expenditure and increasing focus on patient comfort and care |

| 5.3. Market Restraints |

| 5.3.1 Stringent regulatory requirements for medical furniture in India |

| 5.3.2 High cost associated with advanced medical furniture technologies |

| 5.3.3 Limited awareness and adoption of ergonomic medical furniture solutions |

| 6. India Medical Furniture Market Trends & Evolution |

| 7. India Medical Furniture Market Overview, By Product Type |

| 7.1. India Medical Furniture Market Revenues, By Bedside Tables, 2018-2028F |

| 7.2. India Medical Furniture Market Revenues, By Operation Theater Tables, 2018-2028F |

| 7.3. India Medical Furniture Market Revenues, By Instrument Stands, 2018-2028F |

| 7.4. India Medical Furniture Market Revenues, By Stretchers, 2018-2028F |

| 7.5. India Medical Furniture Market Revenues, By Hospital Beds, 2018-2028F |

| 7.6. India Medical Furniture Market Revenues, By Trolley, 2018-2028F |

| 7.7. India Medical Furniture Market Revenues, By Foldable Wheelchairs, 2018-2028F |

| 7.8. India Medical Furniture Market Revenues, By Fixed Wheelchairs, 2018-2028F |

| 8. India Medical Furniture Market Overview, By Hospital Beds |

| 8.1. India Medical Furniture Market Revenues, By Manual Beds, 2018-2028F |

| 8.2. India Medical Furniture Market Revenues, By Semi-Electric Beds, 2018-2028F |

| 8.3. India Medical Furniture Market Revenues, By Fully-Electric Beds, 2018-2028F |

| 9. India Medical Furniture Market Overview, By Applications |

| 9.1. India Medical Furniture Market Revenues, By Hospitals, 2018-2028F |

| 9.2. India Medical Furniture Market Revenues, By Diagnostic Centers, 2018-2028F |

| 9.3. India Medical Furniture Market Revenues, By Clinics, 2018-2028F |

| 10. India Medical Furniture Market Overview, By Regions |

| 10.1. India Medical Furniture Market Revenues, By Northern Region, 2018-2028F |

| 10.2. India Medical Furniture Market Revenues, By Southern Region, 2018-2028F |

| 10.3. India Medical Furniture Market Revenue, By Eastern Region, 2018-2028F |

| 10.4. India Medical Furniture Market Revenue, By Western Region, 2018-2028F |

| 11. India Medical Furniture Market – Key Performance Indicators |

| 11.1 Average length of stay in hospitals (related to patient comfort and care) |

| 11.2 Number of healthcare facilities adopting ergonomic medical furniture |

| 11.3 Percentage increase in healthcare expenditure allocated to medical furniture research and development |

| 12. India Medical Furniture Market – Price Trend Analysis |

| 13. India Medical Furniture Market Opportunity Assessment |

| 13.1. India Medical Furniture Market Opportunity Assessment, By Product Type, 2028F |

| 13.2. India Medical Furniture Market Opportunity Assessment, By Applications, 2028F |

| 13.3. India Medical Furniture Market Opportunity Assessment, By Hospital Beds, 2028F |

| 13.4. India Medical Furniture Market Opportunity Assessment, By Regions, 2028F |

| 14. India Medical Furniture Market - Competitive Landscape |

| 14.1. India Medical Furniture Market Revenue Ranking, By Companies, 2021 |

| 14.2. India Medical Furniture Market Key Companies Target Upcoming Trends and Technology |

| 14.3. India Medical Furniture Market Competitive Benchmarking, By Operating Parameters |

| 15. Company Profiles |

| 15.1. Arjo Huntleigh Healthcare India Pvt Ltd. |

| 15.2. Paramount Bed India Pvt. Ltd. |

| 15.3. Stryker India Pvt Ltd. |

| 15.4. Narang Medical Ltd. |

| 15.4. PMT Healthcare Pvt Limited |

| 15.6. Meditech Technologies India Private Limited |

| 15.7. Midmark India Pvt Ltd. |

| 15.8. United Surgical Industries |

| 15.9. Gita Mediquip Pvt. Ltd. |

| 15.10. GPC Medical Limited |

| 15.11. Godrej & Boyce Mfg. Co. Ltd., |

| 16. Key Strategic Recommendations |

| 17. Disclaimer |

| List of Figures |

| Figure 1. India Medical Furniture Market Revenues, 2018-2028F (INR Crore) |

| Figure 2. India Medical Furniture Market Revenue Share, By Product Type, 2021 & 2028F |

| Figure 3. India Medical Furniture Market Revenue Share, By Hospital Beds, 2021 & 2028F |

| Figure 4. India Medical Furniture Market Revenue Share, By Applications, 2021 & 2028F |

| Figure 5. India Medical Furniture Market Revenue Share, By Regions, 2021 & 2028F |

| Figure 6. Government Healthcare Expenditure in India, 2020-2025F |

| Figure 7. Medical Value Tourism in India, (thousand crore), 2019-2022E |

| Figure 8. Top 15 Countries in Medical Tourism Index, 2020-2021 |

| Figure 9. India Medical Furniture Market Average Price Trend Analysis, By Product Type, 2021 (INR/Unit) |

| Figure 10. India Medical Furniture Market Average Price Trend Analysis, By Hospital Beds 2018-2028F (INR/Unit) |

| Figure 11. India Medical Furniture Market Opportunity Assessment, By Product Type, 2028F |

| Figure 12. India Medical Furniture Market Opportunity Assessment, By Hospital Beds, 2028F |

| Figure 13. India Medical Furniture Market Opportunity Assessment, By Applications, 2028F |

| Figure 14. India Medical Furniture Market Opportunity Assessment, By Regions, 2028F |

| Figure 15. India Organised Medical Furniture Market Revenue Ranking, By Companies, 2021 |

| Figure 16. India Medical Furniture Market Revenue Share, By Sectors, 2021 |

| List of Tables |

| Table 1. Number of Covid Beds Across India as of December 2020 |

| Table 2. Number of Hospitals and Hospital Beds in India, 2020 (April) |

| Table 3. Government Policies and Initiatives for Healthcare Sector |

| Table 4. India Medical Furniture Market Revenues, By Product Type, 2018-2028F (INR Crore) |

| Table 5. India Medical Furniture Market Revenues, By Hospital Beds, 2018-2028F (INR Crore) |

| Table 6. India Medical Furniture Market Revenues, By Applications, 2018-2028F (INR Crore) |

| Table 7. India Medical Furniture Market Revenues, By Regions, 2018-2028F (INR Crore) |

| Table 8. India Medical Furniture Market Average Price Trend Analysis, By Product Type 2018-2028F (INR/Unit) |

| Table 9. India Medical Furniture Market Key Companies Target Upcoming Trends and Technology |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero