India Water Heater Market Outlook (2021-2027) | Size, Share, Revenue, Forecast, Analysis, Trends, Growth, Value, Outllook & COVID-19 IMPACT

Market Forecast By Types (Electric Water Heater, Gas Water Heater, Solar Water Heater), By Capacity (Upto 5 Litre, 5.1 -10 Litre, 10.1 -20 Litre, Above 20 Litre), By Application (Residential, Commercial), By Distribution Channel (Online, Offline), By Regions (Northern, Southern, Western, Eastern) and competitive landscape

| Product Code: ETC150053 | Publication Date: Aug 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 93 | No. of Figures: 30 | No. of Tables: 8 |

Latest 2023 Development of The India Water Heater Market

India Water Heater Market has been growing on the back of increased consumer awareness and rising disposable income. The major development in the Water Heater Market in India is the growing demand for energy-efficient and cost-effective water heaters. This has led to an increase in the adoption of solar water heaters and electric storage water heaters. The market is also witnessing a rise in the popularity of instant water heaters which provide hot water instantly and are suitable for small households and offices. The government has introduced energy-efficient policies and programs which promote the use of energy-efficient appliances. As a result, it increases the demand for energy-efficient water heaters. Owing to these factors, the water heater market size in India is growing and will continue to grow. This sector is an important part of the Asia Pacific water Heater Market.

Online sales channels are becoming increasingly popular in India, and companies are expanding their online presence to reach more customers. Online sales platforms provide a convenient and cost-effective way for customers to purchase water heaters. Apart from this, electric water heaters are gaining popularity in India due to their low cost and ease of installation. Companies are now focusing on expanding their electric water heater market to tap into the growing demand. Also, the demand for solar heaters is becoming increasingly popular owing to the rising environmental concerns and the increasing cost of electricity. The major companies are now investing in R&D to improve the efficiency and cost-effectiveness of solar water heaters to sustain their presence in the Water Heater Market of India.

India Water Heater Market Synopsis

The India water heater market is smaller as compared to other consumer durables as heaters have seasonal demand and high energy cost leading to low penetration of the product in the country. Further, the availability of substitutes like immersion rods and cooking stoves further leads to low demand for the product. Although, the Covid-19 outbreak had no negative impact on the water heater market, as the lockdown was implemented in summer by the government when the demand remains the least, and most of the restrictions were revoked during the peak season of water heater sales.

According to 6Wresearch, the India Water Heater Market revenue size is projected to grow at a CAGR of 6.9% during 2021-27F. Rising household demand owing to the increasing disposable income of the middle-class population and the growing hospitality sector are the major factors contributing to the growth of India water heater market. The household sector has majorly provided opportunities for growth in the energy-efficient electric water heater segment, i.e, 4 or 5-star rated water heaters. Further, the solar water heater segment is anticipated to contribute towards the market in coming years owing to government policies to incentivise the use of renewable sources of energy. Tier I and Tier II cities customer base of companies are also growing after covid outbreak due to rising adoption and focus on e-commerce platforms.

According to 6Wresearch, the India Water Heater Market revenue size is projected to grow at a CAGR of 6.9% during 2021-27F. Rising household demand owing to the increasing disposable income of the middle-class population and the growing hospitality sector are the major factors contributing to the growth of India water heater market. The household sector has majorly provided opportunities for growth in the energy-efficient electric water heater segment, i.e, 4 or 5-star rated water heaters. Further, the solar water heater segment is anticipated to contribute towards the market in coming years owing to government policies to incentivise the use of renewable sources of energy. Tier I and Tier II cities customer base of companies are also growing after covid outbreak due to rising adoption and focus on e-commerce platforms.

Market by Types Analysis

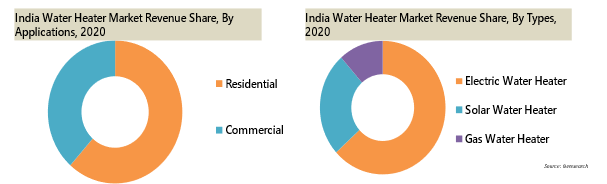

In terms of Types, electric water and solar water heater cumulatively have captured 85% of the market revenues in 2020, with electric water heater leading the market. Electric water heaters have garnered the majority share in the India water heater market in terms of revenue and volume on account of the lower price and easy installation.

Market by Distribution Channel Analysis

In India water heater market, the offline segment occupied the majority share of the market revenues accounting for more than 90% of the market revenues in 2020 as the consumers have the option of comparing the different brands available at the store physically and choosing the right product as per their requirement. However, the growing popularity of e-commerce websites among millennials is likely to drive significant growth in the online distribution channel segment over the coming years.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Water Heater Market Overview

- India Water Heater Market Outlook

- India Water Heater Market Forecast

- Historical Data and Forecast of India Water Heater Market Revenues & Volume for the Period 2017-2027F

- Historical Data and Forecast of Revenues & Volume, By Types, for the Period 2017-2027F

- Historical Data and Forecast of Revenues & Volume, By Capacity, for the Period 2017-2027F

- Historical Data and Forecast of Revenues, By Applications, for the Period 2017-2027F

- Historical Data and Forecast of Revenues, By Distribution Channels, for the Period 2017-2027F

- Historical Data and Forecast of Revenues, By Regions, for the Period 2017-2027F

- Market Drivers

- Market Restraints

- India Water Heater Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- India Water Heater Market Player’s Revenue Shares

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Types

- Electric Water Heater

- Gas Water Heater

- Solar Water Heater

By Capacity

- Upto 5 Litre

- 1 -10 Litre

- 1 -20 Litre

- Above 20 Litre

By Application

- Residential

- Commercial

By Distribution Channel

- Online

- Offline

By Regions

- Northern

- Southern

- Western

- Eastern

India Water Heater Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. India Water Heater Market Overview |

| 3.1 India Water Heater Market Revenues and Volume (2017-2027F) |

| 3.2 India Water Heater Market-Industry Life Cycle |

| 3.3 India Water Heater Market-Porter’s Five Forces |

| 3.4 India Water Heater Market – Ecosystem |

| 3.5 India Water Heater Market Revenue and Volume Share, By Types (2020 & 2027F) |

| 3.6 India Water Heater Market Revenue and Volume Share, By Capacity (2020 & 2027F) |

| 3.7 India Water Heater Market Revenue Share, By Applications (2020 & 2027F) |

| 3.8 India Water Heater Market Revenue Share, By Distribution Channels (2020 & 2027F) |

| 3.9 India Water Heater Market Revenue Share, By Regions (2020 & 2027F) |

| 4. Impact Analysis of Covid-19 on India Water Heater Market |

| 5. India Water Heater Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.2.1 Increasing urbanization and population growth in India leading to higher demand for water heaters. |

| 5.2.2 Rising disposable income of consumers, driving the adoption of more advanced and energy-efficient water heater models. |

| 5.2.3 Government initiatives promoting the use of energy-efficient appliances, including water heaters. |

| 5.3 Market Restraints |

| 5.3.1 Fluctuating raw material prices impacting the manufacturing cost of water heaters. |

| 5.3.2 Intense competition among key market players leading to price wars and margin pressures. |

| 5.3.3 Lack of awareness among consumers about the benefits of using energy-efficient water heaters. |

| 6. India Water Heater Market Trends |

| 7. India Water Heater Market Overview, By Types |

| 7.1 India Water Heater Market Revenues, By Types |

| 7.1.1 India Electric Water Heater Market Revenues (2017-2027F) |

| 7.1.2 India Solar Water Heater Market Revenues (2017-2027F) |

| 7.1.3 India Gas Water Heater Market Revenues (2017-2027F) |

| 7.2 India Water Heater Market Volume, By Types |

| 7.2.1 India Electric Water Heater Market Volume (2017-2027F) |

| 7.2.2 India Solar Water Heater Market Volume (2017-2027F) |

| 7.2.3 India Gas Water Heater Market Volume (2017-2027F) |

| 8. India Water Heater Market Overview, By Capacity |

| 8.1 India Water Heater Market Revenues, By Capacity |

| 8.1.1 India Water Heater Market Revenues, By Upto 5 Litre Capacity (2017-2027F) |

| 8.1.2 India Water Heater Market Revenues, By Upto 5.1 - 10 Litre Capacity (2017-2027F) |

| 8.1.3 India Water Heater Market Revenues, By Upto 10.1-20 Litre Capacity (2017-2027F) |

| 8.1.4 India Water Heater Market Revenues, By Above 20 Litre Capacity (2017-2027F) |

| 8.2 India Water Heater Market Volume, By Capacity |

| 8.2.1 India Water Heater Market Volume, By Upto 5 Litre Capacity (2017-2027F) |

| 8.2.2 India Water Heater Market Volume, By Upto 5.1 - 10 Litre Capacity (2017-2027F) |

| 8.2.3 India Water Heater Market Volume, By Upto 10.1-20 Litre Capacity (2017-2027F) |

| 8.2.4 India Water Heater Market Volume, By Above 20 Litre Capacity (2017-2027F) |

| 9. India Water Heater Market Overview, By Applications |

| 9.1 India Water Heater Market Revenues, By Applications |

| 9.1.1 India Water Heater Market Revenues, By Residential Application (2017-2027F) |

| 9.1.2 India Water Heater Market Revenues, By Commercial Application (2017-2027F) |

| 10. India Water Heater Market Overview, By Distribution Channels |

| 10.1 India Water Heater Market Revenues, By Distribution Channels |

| 10.1.1 India Water Heater Market Revenues, By Offline Distribution Channels (2017-2027F) |

| 10.1.2 India Water Heater Market Revenues, By Online Distribution Channels (2017-2027F) |

| 11. India Water Heater Market Overview, By Regions |

| 11.1 India Water Heater Market Revenues, By Regions |

| 11.1.1 India Water Heater Market Revenues, By Northern Region (2017-2027F) |

| 11.1.2 India Water Heater Market Revenues, By Western Region (2017-2027F) |

| 11.1.3 India Water Heater Market Revenues, By Eastern Region (2017-2027F) |

| 11.1.4 India Water Heater Market Revenues, By Southern Region (2017-2027F) |

| 12. India Water Heater Market Key Performance Indicators |

| 12.1 India Real Estate Sector Outlook |

| 12.2 Hospitality and Tourism Sector Outlook |

| 12.3 Retail Sector Outlook |

| 12.4 India Consumer Durables Industry Outlook |

| 12.5 India E-Commerce Market Outlook |

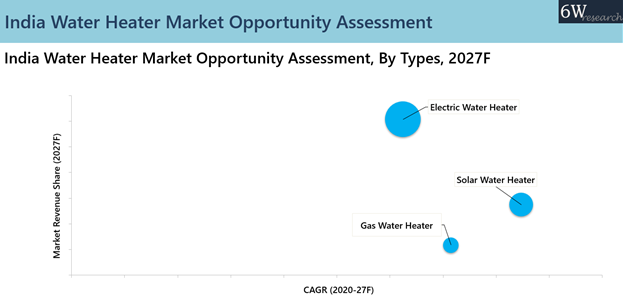

| 13. India Water Heater Market Opportunity Assessment |

| 13.1 India Water Heater Opportunity Assessment, By Types (2027F) |

| 13.2 India Water Heater Opportunity Assessment, By Capacity (2027F) |

| 13.3 India Water Heater Opportunity Assessment, By Applications (2027F) |

| 13.4 India Water Heater Opportunity Assessment, By Distribution Channels (2027F) |

| 13.5 India Water Heater Opportunity Assessment, By Regions (2027F) |

| 14. India Water Heater Market – Competitive Landscape |

| 14.1 India Water Heater Market Revenue Share, By Company (2020) |

| 14.2 India Water Heater Market Competitive Benchmarking |

| 14.2.1 India Water Heater Market Competitive Benchmarking, By Technical Parameters |

| 14.2.2 India Water Heater Market Competitive Benchmarking, By Operating Parameters |

| 15. Company Profiles |

| 15.1 V-Guard Industries Ltd. |

| 15.2 Havells India Ltd. |

| 15.3 Ariston Thermo Spa |

| 15.4 A. O. Smith India Water Products Private Limited |

| 15.5 Haier Appliances India Pvt Ltd |

| 15.6 Jaquar Group |

| 15.7 Bajaj Electricals Limited |

| 15.8 Crompton Greaves Consumer Electricals Limited |

| 15.9 Usha International Limited |

| 15.10 Venus Home Appliances Ltd. |

| 16. Key Strategic Recommendations |

| 17. Disclaimer |

| List of Figures |

| Figure 1. India Water Heater Market Revenues and Volume, 2017-2027F (INR Crore, Thousand Units) |

| Figure 2. India Water Heater Market Revenue Share, By Types, 2020 & 2027F |

| Figure 3. India Water Heater Market Volume Share, By Types, 2020 & 2027F |

| Figure 4. India Water Heater Market Revenue Share, By Capacity, 2020 & 2027F |

| Figure 5. India Water Heater Market Volume Share, By Capacity, 2020 & 2027F |

| Figure 6. India Water Heater Market Revenue Share, By Applications, 2020 & 2027F |

| Figure 7. India Water Heater Market Revenue Share, By Distribution Channels, 2020 & 2027F |

| Figure 8. India Water Heater Market Revenue Share, By Regions, 2020 & 2027F |

| Figure 9. Urban population of India (Millions) |

| Figure 10. India Per Capita Income (current $) |

| Figure 11. India Travel and Tourism direct contribution to GDP, 2010-2019 ($ Billions) |

| Figure 12. India-Arrivals of non-resident tourists at national borders, 2008- 2019 (in million) |

| Figure 13. India Water Heater/Geyser Market, Organized Sector Vs Unorganized Sector |

| Figure 14. India Residential Water Heater Market Revenues, 2017-2027F (INR Crores) |

| Figure 15. India Commercial Water Heater Market Revenues, 2017-2027F (INR Crores) |

| Figure 16. India Offline Water Heater Market Revenues, 2017-2027F (INR Crores) |

| Figure 17. India Online Water Heater Market Revenues, 2017-2027F (INR Crores) |

| Figure 18. The market size of real estate in India ($ billion) |

| Figure 19. Number of Hotel Sites/ Outlets in India, (2018- 2023F) |

| Figure 20. Market Size of the Retail Industry, 2016- 2026F (INR Billion) |

| Figure 21. Market Share of the Retail Industry, 2019 & 2021F |

| Figure 22. Revenue Share of Urban and Rural Areas in the Consumer Durable Market, 2019 |

| Figure 23. Sector-wise share of goods sold on E-Commerce Platform, 2019 |

| Figure 24. Total Number of Internet Users in India (Million) |

| Figure 25. India Water Heater Market Opportunity Assessment, By Types, 2027F |

| Figure 26. India Water Heater Market Opportunity Assessment, By Capacity, 2027F |

| Figure 27. India Water Heater Market Opportunity Assessment, By Applications, 2027F |

| Figure 28. India Water Heater Market Opportunity Assessment, By Distribution Channels, 2027F |

| Figure 29. India Water Heater Market Opportunity Assessment, By Regions, 2027F |

| Figure 30. India Water Heater Market Revenue Share, By Companies, 2020 |

| List of Tables |

| Table 1. Sectoral Deployment of Bank Credit based on Major Sectors, September 2020 |

| Table 2. List of Major Upcoming Residential Projects in India |

| Table 3. India Residential Sector Ongoing Projects |

| Table 4. India Water Heater Market Revenues, Types, 2017-2027F (INR Crores) |

| Table 5. India Water Heater Market Volume, Types, 2017-2027F (Million Units) |

| Table 6. India Water Heater Market Revenues, By Capacity, 2017-2027F (INR Crores) |

| Table 7. India Water Heater Market Volume, By Capacity, 2017-2027F (Million Units) |

| Table 8. India Water Heater Market Revenues, By Regions, 2017-2027F (INR Crores) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero