Indonesia Video Surveillance Market (2023-2029) | Analysis, Growth, Industry, Trends, Value, Revenue, Outlook, Forecast, Size, Share, Segmentation & COVID-19 IMPACT

Market Forecast By Components (Camera, Recorder, Software, and Encoder), By Applications (Banking & Financial, Government & Transportation, Retail & Logistics, Commercial Offices, Residential, Hospitality & Healthcare, Industrial & Manufacturing & Others), By Regions (Northern, Central, and Southern) and Competitive Landscape

| Product Code: ETC004501 | Publication Date: Feb 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 77 | No. of Figures: 20 | No. of Tables: 9 | |

Indonesia Video Surveillance Market Synopsis

Indonesia Video Surveillance Market is expected to grow in the coming years on account of rising government transportation projects such as construction of Phase 2 of Jakarta metro, MRT Phase 3 East-West Line, $224 million Indonesia Mass Transit (MASTRAN) Project.

The video surveillance market in Indonesia in 2020 registered decline due to covid-19, as all the economic activities came to standstill, therefore the construction sector also witnessed decline of 11%. Furthermore, due to the pandemic the government announced lockdown which led to temporarily shutdown of hotels, malls, offices etc. Moreover, 51% of total working class in Indonesia was forced to do work from home to maintain social distancing which resulted in temporary closure of public and commercial spaces leading to fall in demand for video surveillance in the country. However, the market in 2021 observed slight recovery on the back of upliftment of lockdown and due to the government initiative for installation of video surveillance security systems in various public places.

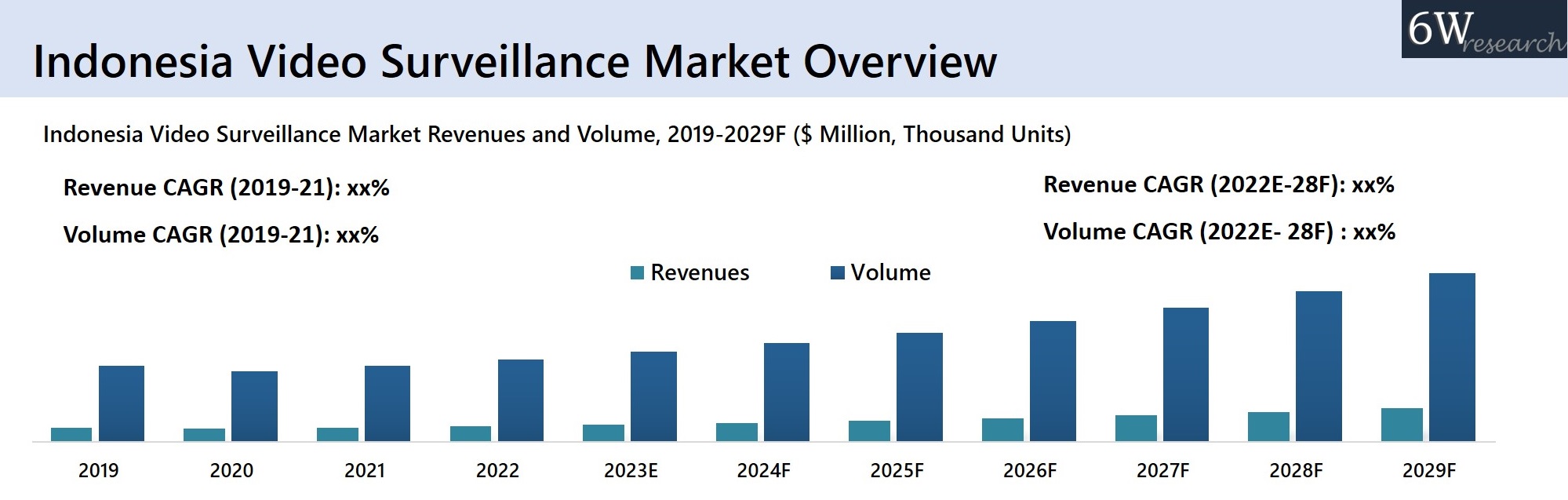

According to 6Wresearch, Indonesia Video Surveillance Market revenue size is anticipated to grow at a CAGR of 12.1% during 2023-2029. The rise in infrastructure projects such as Phase 2 of Jakarta metro, AMSL – Delta Mas City Mall, Jakarta 6 subway network expansion are expected to boost the market for video surveillance in Indonesia. Moreover, increasing crime rate in Jakarta and Bali would further drive the market for video surveillance in Indonesia as video surveillance systems would be installed to monitor safety and curb violent crimes. This sector is a pivotal part of the Asia Pacific Video Surveillance Market.

Rising crime rate is one of the major factors spurring the demand for video surveillance systems in the region. Additionally, Jakarta recorded around 52.44 crime index in 2021, while Bali recorded 48.37 per 1000 population crime rate which is rising from past 3 years. Moreover, Indonesia ranked 3rd of 11 of 11 countries in South-Eastern Asia and 9th of 46 countries in Asia in criminality score.

With growing need for intelligent security system and rising government initiatives, the video surveillance market has been gaining traction in the recent years. In 2019, home affair minister asked to install CCTV systems connected to local police to address the crime and provide digital security measures for the residents.

Government policies and schemes introduced in the Indonesia Video Surveillance Market

The government issued Presidential Regulation 20/2018 to strengthen domestic industries, including the video surveillance sector. This regulation requires government agencies to prioritize the use of domestically produced goods and services, including video surveillance equipment, for government projects. The government has introduced tax incentives for businesses that want to purchase and install video surveillance systems, such as CCTV cameras. The government launched the Safe City Initiative, aimed at establishing safer cities through increased video surveillance. The initiative provides funding for the installation of CCTV cameras and software across Indonesian cities to monitor public spaces, traffic, and crime. The government has also allocated funds for research and development in the video surveillance industry, encouraging innovation and growth. In 2020, the government provided funding for a research project aimed at developing artificial intelligence-powered video analytics software that could detect threats in real-time

Market by Components

In 2022, video surveillance cameras held the majority share in Indonesia video surveillance market owing to increasing public investment towards deployment of security systems & devices throughout several public infrastructure areas, predominantly airports, metros and key crowded places. The demand of video surveillance cameras will continue to propel.

Market by Applications

Government & transportation sector held for the highest revenue share in 2022 owing to increased investment in infrastructure development projects like airports, roads and others which are further expected to drive the growth of segment in the upcoming years.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2023

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Indonesia Video Surveillance Market Overview

- Indonesia Video Surveillance Market Outlook

- Indonesia Video Surveillance Market Forecast

- Historical Data and Forecast of Indonesia Video Surveillance Market Revenues & Volume for the Period 2019-2029F

- Historical Data and Forecast of Indonesia Video Surveillance Market Revenues & Volume, By Components, for the Period 2019-2029F

- Historical Data and Forecast of Indonesia Video Surveillance Camera Market Revenues & Volume, By Camera Type, for the Period 2019-2029F

- Historical Data and Forecast of Indonesia Video Surveillance Recorder Market Revenues & Volume, By Recorder Type, for the Period 2019-2029F

- Historical Data and Forecast of Indonesia Video Surveillance Market Revenues, By Applications, for the Period 2019-2029F

- Market Drivers and Restraints

- Indonesia Video Surveillance Market Trends

- Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Indonesia Video Surveillance Market Revenue Ranking, By Companies

- COVID-19 impact on Video Surveillance Market

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Component

- Video Surveillance Cameras

- Video Surveillance Recorder

- Video Surveillance Encoder

- Video Management Software

By Application

- Banking & Financial Institutions

- Government & Transportation

- Retail & Logistics

- Commercial Offices

- Industrial & Manufacturing

- Residential

- Hospitality & Healthcare

- Education Institutions

Indonesia Video Surveillance Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Indonesia Video Surveillance Market Overview |

| 3.1 Indonesia Video Surveillance Market Revenues and Volume, 2019-2029F |

| 3.2 Indonesia Video Surveillance Market Industry Life Cycle |

| 3.3 Indonesia Video Surveillance Market Porter's Five Forces |

| 4. Impact Analysis of COVID-19 on Indonesia Video Surveillance Market |

| 5. Indonesia Video Surveillance Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.2.1 Increasing concerns regarding public safety and security in Indonesia |

| 5.2.2 Rising adoption of advanced video surveillance technologies for crime prevention and monitoring |

| 5.2.3 Government initiatives to enhance surveillance infrastructure in key sectors such as transportation and critical infrastructure |

| 5.3 Market Restraints |

| 5.3.1 High initial investment costs associated with deploying video surveillance systems |

| 5.3.2 Concerns regarding data privacy and security related to video surveillance |

| 5.3.3 Lack of skilled professionals for managing and maintaining video surveillance systems |

| 6. Indonesia Video Surveillance Market Trends |

| 7. Indonesia Video Surveillance Market Overview, By Components |

| 7.1 Indonesia Video Surveillance Market Revenues and Revenue Share, By Components, 2019-2029F |

| 7.1.1 Indonesia Video Surveillance Market Revenues and Revenue Share, By Video Surveillance Camera, 2019-2029F |

| 7.1.2 Indonesia Video Surveillance Market Revenues and Revenue Share, By Video Surveillance Recorder, 2019-2029F |

| 7.1.3 Indonesia Video Surveillance Market Revenues and Revenue Share, By Video Surveillance Encoder, 2019-2029F |

| 7.1.4 Indonesia Video Surveillance Market Revenues and Revenue Share, By Video Surveillance Software, 2019-2029F |

| 7.2 Indonesia Video Surveillance Market Volume and Volume Share, By Components, 2019-2029F |

| 7.2.1 Indonesia Video Surveillance Market Volume and Volume Share, By Video Surveillance Camera, 2019-2029F |

| 7.2.2 Indonesia Video Surveillance Market Volume and Volume Share, By Video Surveillance Recorder, 2019-2029F |

| 7.2.3 Indonesia Video Surveillance Market Volume and Volume Share, By Video Surveillance Encoder, 2019-2029F |

| 8. Indonesia Video Surveillance Market Overview, By Camera Type |

| 8.1 Indonesia Video Surveillance Market Revenues and Revenue Share, By Camera Type, 2019-2029F |

| 8.1.1 Indonesia Video Surveillance Market Revenues and Revenue Share, By Analog Camera, 2019-2029F |

| 8.1.2 Indonesia Video Surveillance Market Revenues and Revenue Share, By IP Camera, 2019-2029F |

| 8.2 Indonesia Video Surveillance Market Volume and Volume Share, By Camera Type, 2019-2029F |

| 8.1.1 Indonesia Video Surveillance Market Volume and Volume Share, By Analog Camera, 2019-2029F |

| 8.1.2 Indonesia Video Surveillance Market Volume and Volume Share, By IP Camera, 2019-2029F |

| 9. Indonesia Video Surveillance Market Overview, By IP Camera Type |

| 9.1 Indonesia Video Surveillance Market Revenues and Revenue Share, By IP Camera Type, 2019-2029F |

| 9.1.1 Indonesia Video Surveillance Market Revenues and Revenue Share, By Wireless IP Camera, 2019-2029F |

| 9.1.2 Indonesia Video Surveillance Market Revenues and Revenue Share, By Wired IP Camera, 2019-2029F |

| 10. Indonesia Video Surveillance Market Overview, By Recorder Type |

| 10.1 Indonesia Video Surveillance Market Revenues and Revenue Share, By Recorder Type, 2019-2029F |

| 10.1.1 Indonesia Video Surveillance Market Revenues and Revenue Share, By NVR, 2019-2029F |

| 10.1.2 Indonesia Video Surveillance Market Revenues and Revenue Share, By DVR, 2019-2029F |

| 10.2 Indonesia Video Surveillance Market Volume and Volume Share, By Recorder Type, 2019-2029F |

| 10.2.1 Indonesia Video Surveillance Market Volume and Volume Share, By NVR, 2019-2029F |

| 10.2.2 Indonesia Video Surveillance Market Volume and Volume Share, By DVR, 2019-2029F |

| 11. Indonesia Video Surveillance Camera Market Overview, By Applications |

| 11.1 Indonesia Video Surveillance Market Revenue Share, By Applications, 2022 & 2029F |

| 11.2 Indonesia Video Surveillance Market Revenues, By Applications, 2019-2029F |

| 11.2.1 Indonesia Video Surveillance Market Revenues, By Government & Transportation, 2019-2029F |

| 11.2.2 Indonesia Video Surveillance Market Revenues, By Banking & Financial Institutions, 2019-2029F |

| 11.2.3 Indonesia Video Surveillance Market Revenues, By Retail & Logistics, 2019-2029F |

| 11.2.4 Indonesia Video Surveillance Market Revenues, By Commercial Offices & Buildings, 2019-2029F |

| 11.2.5 Indonesia Video Surveillance Market Revenues, By Industrial & Manufacturing, 2019-2029F |

| 11.2.6 Indonesia Video Surveillance Market Revenues, By Hospitality & Healthcare, 2019-2029F |

| 11.2.7 Indonesia Video Surveillance Market Revenues, By Residential, 2019-2029F |

| 11.2.8 Indonesia Video Surveillance Market Revenues, By Educational Institutions, 2019-2029F |

| 12. Indonesia Video Surveillance Camera Market Key Performance Indicators |

| 13. Indonesia Video Surveillance Camera Market Opportunity Assessment |

| 13.1 Indonesia Video Surveillance Market Opportunity Assessment, By Components |

| 13.1 Indonesia Video Surveillance Market Opportunity Assessment, By Applications |

| 14. Indonesia Video Surveillance Camera Market Competitive Landscape |

| 14.1 Indonesia Video Surveillance Market Revenue Ranking, By Companies, 2022 |

| 14.2 Indonesia Video Surveillance Market Competitive Benchmarking, By Operating and Technical Parameters |

| 15. Company Profiles |

| 15.1 Axis Communications AB |

| 15.2 Bosch Security System Inc. |

| 15.3 Hanwha Corporation |

| 15.4 Honeywell International Inc. |

| 15.5 Hangzhou Hikvision Digital Technology Co. Ltd. |

| 15.6 Panasonic Holdings Corporation |

| 15.7 Zhejiang Dahua Technology Co. Ltd. |

| 15.8 Cisco Systems Inc. |

| 15.9 Avigilon Corporation |

| 15.10 Pelco Corporation |

| 16. Key Strategic Recommendations |

| 17. Disclaimer |

| List of Figures |

| 1. Indonesia Video Surveillance Market Revenues, 2019-2029F, ($ Million, Thousand Units) |

| 2. Indonesia Crime Index, 2018-2021 |

| 3. Indonesia Cyber Crimes, 2021-2022, (Million) |

| 4. Indonesia Video Surveillance Market Revenue Share, By Components, 2022 & 2029F |

| 5. Indonesia Video Surveillance Market Volume Share, By Components, 2022 & 2029F |

| 6. Indonesia Video Surveillance Market Revenue Share, By Camera Type, 2022 & 2029F |

| 7. Indonesia Video Surveillance Market Volume Share, By Camera Type, 2022 & 2029FIndonesia Video Surveillance Market Volume Share, By Camera Type, 2022 & 2029F |

| 8. Indonesia IP/Network Video Surveillance Camera Market Revenue Share, By Type, 2022 & 2029F |

| 9. Indonesia Video Surveillance Market Revenue Share, By Recorder Type, 2022 & 2029F |

| 10. Indonesia Video Surveillance Market Revenue Share, By Recorder Type, 2022 & 2029F |

| 11. Indonesia Video Surveillance Market Revenue Share, By Applications, 2022 & 2029F |

| 12. Indonesia Upcoming First Class & Luxury Hotel Projects, 2021-2024F, (No. of Projects) Indonesia Upcoming First Class & Luxury Hotel Projects, 2021-2024F, (No. of Projects) |

| 13. Indonesia Number of Upcoming Hotel Projects, By Cities, 2024F |

| 14. Indonesia Percentage Use Of Public Transportation Target, 2016-2029F |

| 15. Indonesia Airport Infrastructure Investment Current Trends, 2020- 2040F ($ Million) |

| 16. Indonesia Railway Infrastructure Investment Current Trends, 2020- 2040F ($ Million) |

| 17. Indonesia Planned Projects and Programs (2020-2024) |

| 18. Indonesia Video Surveillance Market Opportunity Assessment, By Components, 2029F |

| 19. Indonesia Video Surveillance Market Opportunity Assessment, By Applications, 2029F |

| 20. Indonesia Video Surveillance Market Revenue Ranking, By Companies, 2022Indonesia Video Surveillance Market Revenue Ranking, By Companies, 2022 |

| List of Tables |

| 1. Indonesia Video Surveillance Market Revenues, By Components, 2019-2029F ($ Million) |

| 2. Indonesia Video Surveillance Market Volume, By Components, 2019-2029F ($ Million)Indonesia Video Surveillance Market Volume, By Components, 2019-2029F ($ Million) |

| 3. Indonesia Video Surveillance Market Revenues, By Camera Types, 2019-2029F ($ Million)Indonesia Video Surveillance Market Revenues, By Camera Types, 2019-2029F ($ Million) |

| 4. Indonesia Video Surveillance Market Volume, By Camera Types, 2019-2029F ($ Thousand Units) |

| 5. Indonesia IP/Network Video Surveillance Camera Market Revenues, By Type, 2019-2029F ($ Million)Indonesia IP/Network Video Surveillance Camera Market Revenues, By Type, 2019-2029F ($ Million) |

| 6. Indonesia Video Surveillance Market Revenues, By Recorder Types, 2019-2029F ($ Million) |

| 7. Indonesia Video Surveillance Market Revenues, By Recorder Types, 2019-2029F ($ Million) |

| 8. Indonesia Video Surveillance Market Revenues, By Applications, 2019-2029F ($ Million) |

| 9. Indonesia Major Upcoming Hotels |

Market Forecast By Components (Camera, Recorder, Software, and Encoder), By Applications (Banking & Financial, Government & Transportation, Retail & Logistics, Commercial Offices, Residential, Hospitality & Healthcare, Industrial & Manufacturing & Others), By Regions (Northern, Central, and Southern) and Competitive Landscape

| Product Code: ETC004501 | Publication Date: May 2022 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 90 | No. of Figures: 22 | No. of Tables: 11 |

Indonesia Video Surveillance Market report comprehensively covers the Indonesia video surveillance market by component types, by applications and by regions. Indonesia video surveillance market report provides an unbiased and detailed analysis of the video surveillance market on-going trends, opportunities/high growth areas, market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Indonesia Video Surveillance Market Synopsis

Indonesia Video Surveillance market is anticipated to grow during the forecast period, on account of the growing construction sector, upcoming hospitality and retail projects, as well as rising urbanization in the country. The Indonesia Video Surveillance Market Share is likely to witness continued growth, owing to growing concerns related to public safety and security, along with growing adoption of IP cameras and rising demand for wireless cameras during the forecast period. The market has seen a halt owing to the massive outbreak of COVID-19 which resulted in nationwide lockdowns to combat the spread of the virus and has led to a decline in the overall market growth. Rising theft along with increasing penetration towards safety is driving the Indonesia Video Surveillance Market Share. The introduction of privacy protection laws is also one of the key factors driving the development of the market. However, the expensive installation system owing to the strong network connection is restraining the growth of the market.

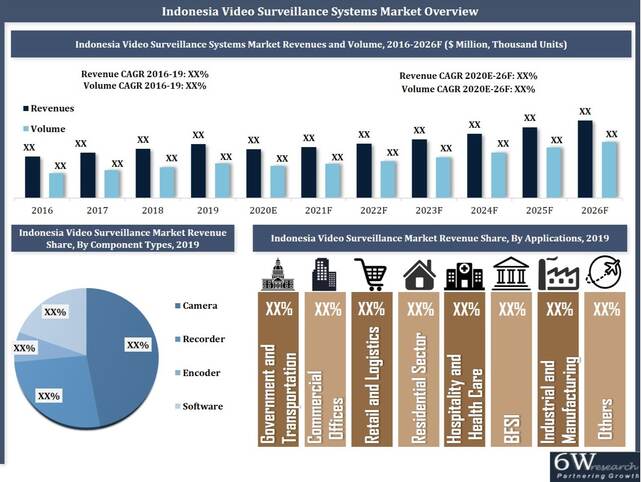

According to 6Wresearch, Indonesia Video Surveillance Market size is projected to grow at CAGR of 11.8% during 2020-2026. The coronavirus outbreak is expected to adversely impact the Indonesia video surveillance market in 2020 due to the nation-wide lockdown imposed by the government, resulting in the closure of all business operations which impacted the demand and supply of video surveillance systems. However, the video surveillance market is expected to recover post-2020 as the economy is projected to recover after a protracted period of nationwide lockdown and economic slowdown. Additionally, the development of new smart city projects in Indonesia would create more avenues for the deployment of surveillance systems in the coming years.

Market Analysis by Component Types

By component types, the camera component held the highest revenue share in 2019 in overall Indonesia Video Surveillance Market Growth due to the universal application of video surveillance for security in various establishments and is likely to maintain its dominance during the forecast period as well. The government and transportation application held the major revenue share in the Indonesia video surveillance market in 2019 and would continue to maintain its dominance during the forecast period as well, due to several advantages of video surveillance such as remote monitoring, transportation management, and increased public safety. Further, the rising security concerns among people, along with the growing number of residential sector developments in the country would bolster the demand for video surveillance solutions in the residential domain in the years to come.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- Indonesia Video Surveillance Market Overview

- Indonesia Video Surveillance Market Outlook

- Indonesia Video Surveillance Market Size and Forecast for the period, 2016-2026F

- Historical Data of Indonesia Video Surveillance Market Revenues and Volume for the period, 2016-2019

- Market size and Forecast of Indonesia Video Surveillance Market Revenues and Volume until 2026F

- Historical Data of Indonesia Video Surveillance Market Revenues for the period, By Applications, 2016-2019

- Market size and Forecast of Indonesia Video Surveillance Market Revenues, By Applications until 2026F

- Historical Data of Indonesia Video Surveillance Market Revenues and Volume for the period, By Component Types, 2016-2019

- Market size and Forecast of Indonesia Video Surveillance Market Revenues and Volume, By Component Types until 2026F

- Historical Data of Indonesia Video Surveillance Market Revenues and Volume for the period, By Regions, 2016-2019

- Market size and Forecast of Indonesia Video Surveillance Market Revenues and Volume, By Regions until 2026F

- Market Drivers and Restraints

- Indonesia Video Surveillance Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Indonesia Video Surveillance Market Opportunity Assessment

- Indonesia Video Surveillance Market Revenue Share, By Company

- Indonesia Video Surveillance Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

Component Types

- Camera

- Software

- Recorder

- Encoder

Applications

- Banking & Financial

- Government & Transportation

- Retail & Logistics

- Commercial Offices

- Residential

- Hospitality & Healthcare

- Industrial & Manufacturing

- Others

Regions

- Northern

- Central

- Southern

Frequently Asked Questions About the Market Study:

- Does the report consider COVID-19 impact?

The report not only has considered the COVID-19 impact but also current market dynamics, trends, and KPIs into consideration.

- How much growth is expected in the Indonesia Video Surveillance Market over the coming years?

The Indonesia Video Surveillance Market revenue is anticipated to record a CAGR of 11.8% during 2020-to 2026.

- Which segment has captured a key share of the market?

Cameras are the leading market segment in the overall market revenues in the year 2019.

- Which segment is exhibited to gain traction over the forecast period?

Recorders are expected to record key growth throughout the forecast period 2020-2026.

- Who are key the key players in the market?

The key players in the market include- Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International Inc., Panasonic Indonesia Co., Ltd., Hanwha Techwin Co. Ltd., Axis Communications AB, Sony Corporation, Robert Bosch Indonesia Co., Ltd., Axxonsoft., Avigilon Corporation, Zhejiang Dahua Technology Co. Ltd - Is customization available in the market study?

Yes, we can do customization as per your requirements. Please feel free to write to us sales@6wresearch.com for any customized or any other requirements

- We also want to have market reports for other countries/regions.

6Wresearch has a database of more than 60 countries globally, which can make us your first choice of all your research needs.

Other Key Reports Available:

- GCC Video Surveillance Market (2020-2026)

- Asia Pacific Video Surveillance Market (2020-2026)

- Southeast Asia Video Surveillance Market (2020-2026)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero