Kenya Farm Tractor Market (2023-2029) | Trends, Industry, Analysis, Outlook, COVID-19 IMPACT, Growth, Size, Revenue, Value, Share, Forecast & Companies

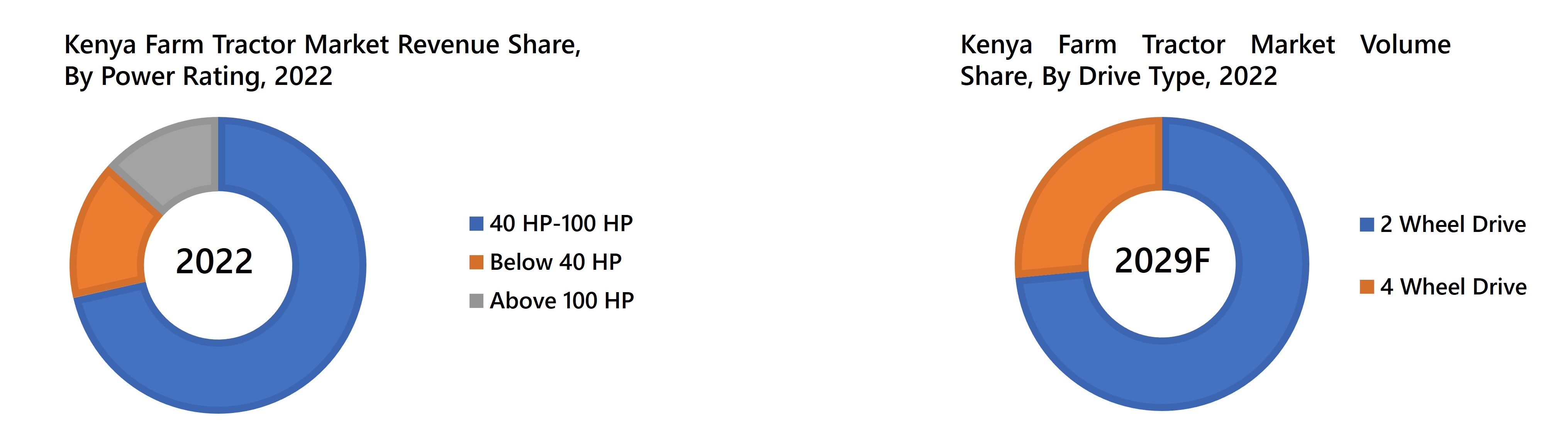

Market Forecast By Power Rating (Below 40 Hp, 40 Hp – 100 Hp, Above 100 Hp), By Drive Type (Two-wheel Drive, Four-wheel Drive), and competitive Landscape

| Product Code: ETC002117 | Publication Date: Jul 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 64 | No. of Figures: 17 | No. of Tables: 6 | |

Kenya Farm Tractor Market Synopsis

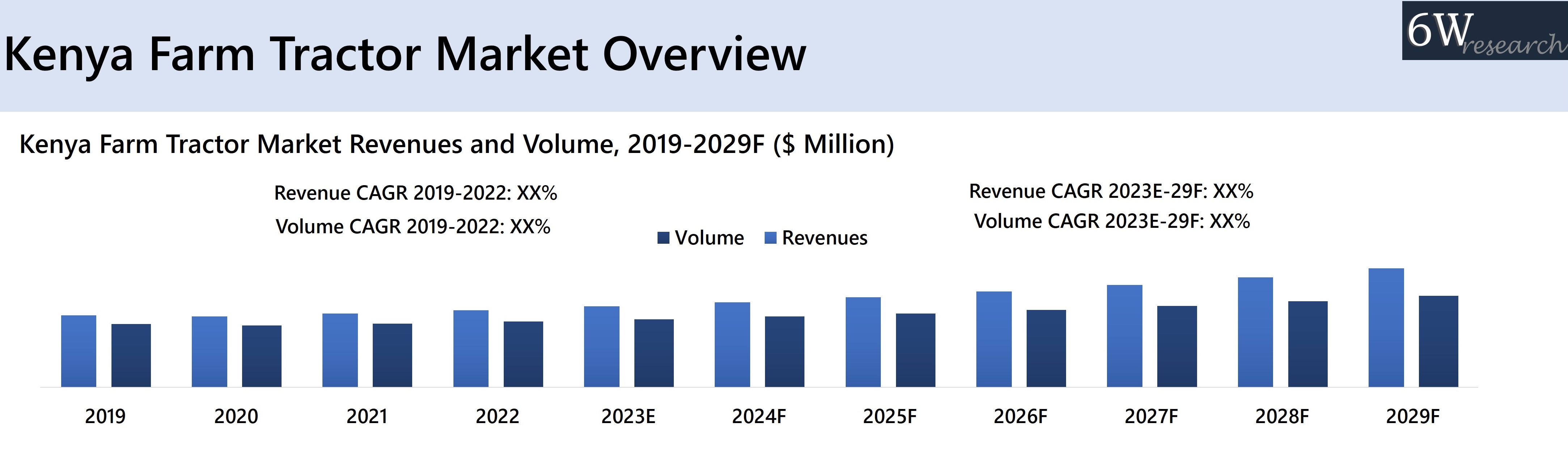

The Kenya farm tractor market experienced moderate growth from 2019 to 2022. This growth can be attributed to government initiatives such as the national agriculture and rural growth prospects introduced in 2017, as well as the Agricultural Sector Transformation and Growth Strategy implemented in 2019, which aimed to empower farmers. The agriculture sector witnessed a growth of 2.2% in Q1 2020, compared to 2.31% in Q4 2019 and 3.2% in Q1 2019. Similarly, crop production in the agriculture sector grew by 2.38% in Q1 2020, in contrast to 2.52% in Q4 2019 and 3.26% in Q1 2019. However, the market revenues faced a decline due to supply chain disruptions caused by the COVID-19 pandemic, which led to lockdowns in Kenya and various other countries in 2020.

According to 6Wresearch, the Kenya Farm Tractor Market size is projected to increase at a CAGR of 6.6% during 2023-29. The Kenya farm tractor market is anticipated to experience significant growth in the coming years, owing to various initiatives taken by the Kenyan government to increase investments in the agriculture sector. One such initiative is the National Agriculture Investment Plan 2019-24, which aims to uplift the livelihoods of farmers, positively influence their purchasing power, and consequently, drive an increased demand for farm tractors across the country in the years to come. The ongoing war between Ukraine and Russia in 2022 further increased economic uncertainty, resulting in a significant decrease in wheat and maize import from Ukraine by 12% and 8% respectively. To address this crisis, the Kenyan government implemented significant measures to ensure food security and enhance the resilience of the economy. Notably, investments have been made in the agricultural sector, exemplified by the Agricultural Sector Transformation and Growth Strategy. Moreover, collaborations with various non-governmental organizations have facilitated the testing, promotion, and distribution of cost-effective irrigation technology. These efforts aim to uplift the livelihoods of farmers, increase their purchasing power, and consequently, drive the demand for farm tractors across the country in the coming years.

According to 6Wresearch, the Kenya Farm Tractor Market size is projected to increase at a CAGR of 6.6% during 2023-29. The Kenya farm tractor market is anticipated to experience significant growth in the coming years, owing to various initiatives taken by the Kenyan government to increase investments in the agriculture sector. One such initiative is the National Agriculture Investment Plan 2019-24, which aims to uplift the livelihoods of farmers, positively influence their purchasing power, and consequently, drive an increased demand for farm tractors across the country in the years to come. The ongoing war between Ukraine and Russia in 2022 further increased economic uncertainty, resulting in a significant decrease in wheat and maize import from Ukraine by 12% and 8% respectively. To address this crisis, the Kenyan government implemented significant measures to ensure food security and enhance the resilience of the economy. Notably, investments have been made in the agricultural sector, exemplified by the Agricultural Sector Transformation and Growth Strategy. Moreover, collaborations with various non-governmental organizations have facilitated the testing, promotion, and distribution of cost-effective irrigation technology. These efforts aim to uplift the livelihoods of farmers, increase their purchasing power, and consequently, drive the demand for farm tractors across the country in the coming years.

![Kenya Farm Tractor Market Revenue Share]() Market by Power Rating

Market by Power Rating

40 HP-100 HP segment of tractors is expected to maintain its dominance in the Kenya farm tractor industry, driving significant revenue during the forecast period owing to the government's increasing support for the agricultural sector by facilitating the testing, promotion, and distribution of cost-effective irrigation technology, along with improved access to credit and investment funds, would contribute to the substantial growth in revenue for the 40 HP-100 HP tractors.

Market by Driver Type

Two-wheel drive tractors are expected to grow in Kenya for several reasons. Firstly, these tractors are more affordable compared to four-wheel drive tractors, making them accessible to small-scale farmers with limited financial resources. Additionally, two-wheel drive tractors are suitable for use in smaller farms and areas with less challenging terrain, which aligns with the farming landscape in Kenya. The rising number of small and micro-farms in the country further contributes to the growing demand for two-wheel drive tractors.

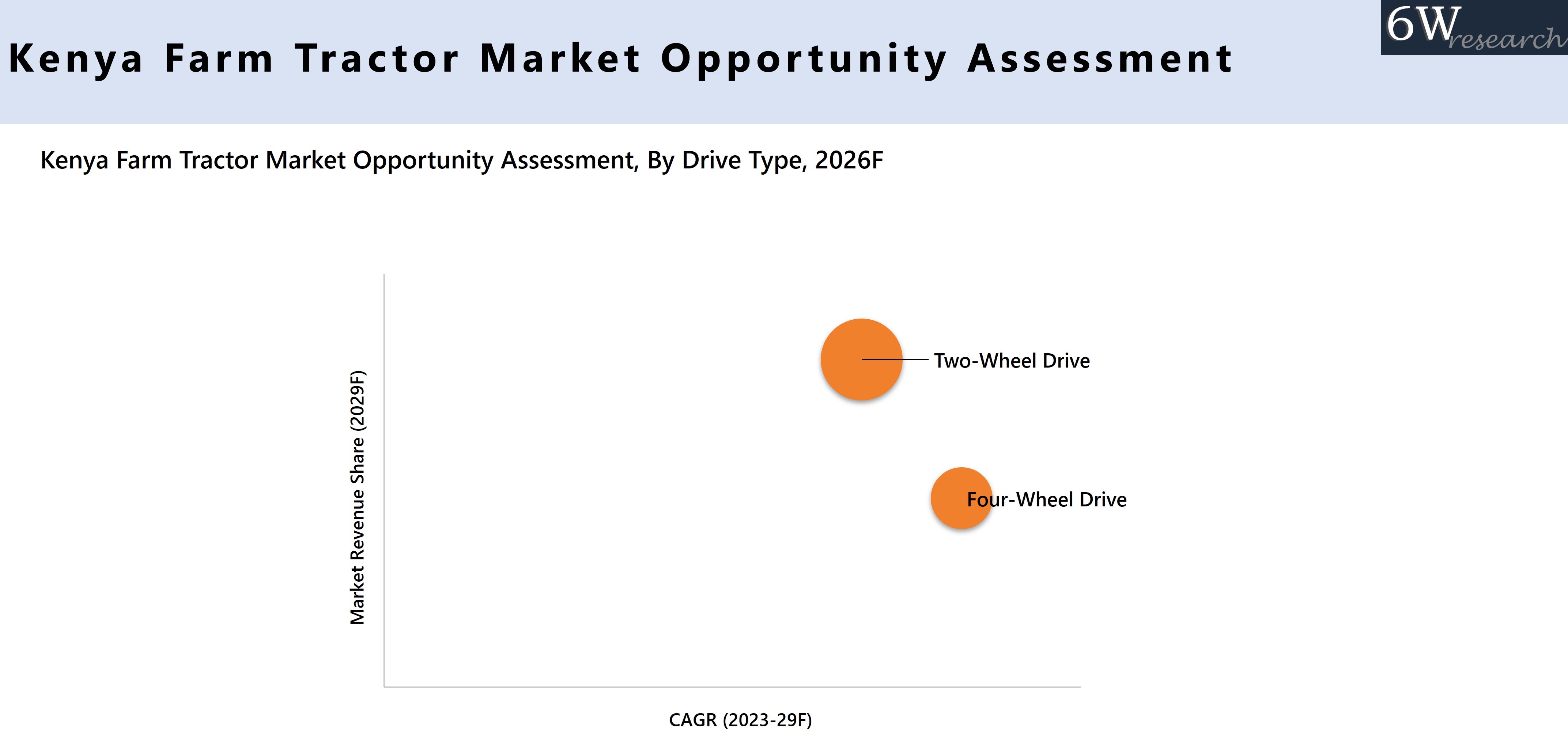

![Kenya Farm Tractor Market Opportunity Assessment]() Key Attractiveness of the Report

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Kenya Farm Tractor Market Overview

- Kenya Farm Tractor Market Outlook

- Kenya Farm Tractor Market Forecast

- Historical Data and Forecast of Kenya Farm Tractor Market Revenues, for the Period 2019-2029F

- Historical Data and Forecast of Kenya Farm Tractor Market Revenues, By Power Rating, for the Period 2019-2029F

- Historical Data and Forecast of Kenya Farm Tractor Market Revenues, By Drive Type, for the Period 2019-2029F

- Kenya Farm Tractor Market Drivers and Restraints

- Kenya Farm Tractor Market Trends

- Kenya Farm Tractor Market Porters Five Forces

- Kenya Farm Tractor Market Opportunity Assessment, By Power Rating, 2029F

- Kenya Farm Tractor Market Opportunity Assessment, By Drive Type, 2029F

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Power rating

- Below 40 HP

- 40 HP-100 HP

- Above 100 HP

By Drive Type

- 2 Wheel Drive

- 4 Wheel Drive

Kenya Farm Tractor Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Kenya Farm Tractor Market Overview |

| 3.1. Kenya Farm Tractor Market Revenues (2019-2029F) |

| 3.2. Kenya Farm Tractor- Industry Life Cycle |

| 3.3. Kenya Farm Tractor- Porter’s Five Forces |

| 4. Kenya Farm Tractor Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Government initiatives and subsidies to promote mechanization in agriculture |

| 4.2.2 Increasing demand for food security and modern farming techniques |

| 4.2.3 Growth in commercial farming and agribusiness sector |

| 4.3. Market Restraints |

| 4.3.1 High initial investment and maintenance costs of farm tractors |

| 4.3.2 Lack of access to financing for small-scale farmers |

| 4.3.3 Limited availability of skilled operators and technicians for farm machinery |

| 5. Kenya Farm Tractor Market Overview, By Power Rating |

| 5.1 Kenya Farm Tractor Market Revenue Share & Revenue, By Power Rating |

| 5.1.1 Kenya Farm Tractor Market Revenue Share & Revenues, By Below 40 HP (2019-2029F) |

| 5.1.2 Kenya Farm Tractor Market Revenue Share & Revenues, By 40 HP-100 HP (2019-2029F) |

| 5.1.3 Kenya Farm Tractor Market Revenues Share & Revenue, By Above 100 HP (2019-2029F) |

| 5.2 Kenya Farm Tractor Market Volume Share & Volume, By Power Rating |

| 5.2.1 Kenya Farm Tractor Market Volume Share & Revenues, By Below 40 HP (2019-2029F) |

| 5.2.2 Kenya Farm Tractor Market Volume Share & Revenues, By 40 HP-100 HP (2019-2029F) |

| 5.2.3 Kenya Farm Tractor Market Volume Share & Revenue, By Above 100 HP (2019-2029F) |

| 6. Kenya Farm Tractor Market Overview, By Drive Type |

| 6.1 Kenya Farm Tractor Market Revenue Share & Revenue, By Drive Type |

| 6.1.1 Kenya Farm Tractor Market Revenues, By 2-Wheel Drive (2019-2029F) |

| 6.1.2 Kenya Farm Tractor Market Revenues, By 4-Wheel Drive (2019-2029F) |

| 6.2 Kenya Farm Tractor Market Volume Share & Volume, By Drive Type |

| 6.2.1 Kenya Farm Tractor Market Volume, By 2-Wheel Drive (2019-2029F) |

| 6.2.2 Kenya Farm Tractor Market Volume, By 4 Wheel Drive (2019-2029F) |

| 7. Kenya Farm Tractor Market Key Performance Indicators |

| 7.1 Average age of farm tractors in operation |

| 7.2 Adoption rate of precision agriculture technologies |

| 7.3 Percentage of agricultural land using mechanized farming techniques |

| 8. Kenya Farm Tractor Market Opportunity Assessment |

| 8.1 Kenya Farm Tractor Market Opportunity Assessment, By Power Rating (2029F) |

| 8.2 Kenya Farm Tractor Market Opportunity Assessment, By Drive Type (2029F) |

| 9. Kenya Farm Tractor Market Competitive Landscape |

| 9.1 Kenya Farm Tractor Market Revenue Ranking, By Companies (2022) |

| 9.2 Kenya Farm Tractor Market Competitive Benchmarking, By Technical Parameter |

| 9.3 Kenya Farm Tractor Market Competitive Benchmarking, By Operating Parameter |

| 10. Company Profiles |

| 10.1 Eicher Tractors Ltd |

| 10.2 New Holland Agriculture |

| 10.3 Massey Ferguson |

| 10.4 Kubota Kenya Limited |

| 10.5 Mahindra & Mahindra Kenya (Pty) Ltd |

| 10.6 S.A.M.E Deutz Fahr Tractor |

| 10.7 Deere & Company |

| 11. Key Strategic Recommendations |

| 12. Disclaimer |

| List of Figures |

| 1. Kenya Farm Tractor Market Revenues and Volume, 2019-2029F ($ Million, Units) |

| 2. Kenya Agriculture Sector Contribution To GDP, 2018-2022, (%) |

| 3. Kenya Population, (2015-2022) |

| 4. Kenya Prevalence of Severe Food Insecurity (2015-2022) |

| 5. Kenya Exchange Rate, (2016-2022), LCU per USD |

| 6. Kenya Farm Tractor Market Revenue Share, By Power Rating, 2022 & 2029F |

| 7. Kenya Farm Tractor Market Volume Share, By Power Rating, 2022 & 2029F |

| 8. Kenya Farm Tractor Market Revenue Share, By Drive Type, 2022 & 2029F |

| 9. Kenya Farm Tractor Market Volume Share, By Drive Type, 2022 & 2029F |

| 10. Kenya Agriculture, Forestry, and Fishing Output, 2018-2022 |

| 11. Kenya Farming Composition |

| 12. Kenya Farm Tractor Market Opportunity Assessment, By Power Rating, 2026F |

| 13. Kenya Farm Tractor Market Opportunity Assessment, By Drive Type, 2026F |

| 14. Kenya Farm Tractor Market Revenue Ranking, By Companies, 2022 |

| 15. Kenya Agriculture Produce, 2018 |

| 16. Kenya Sugarcane Production, (2018-2021) |

| 17. Kenya Corn production, (2022 & 2023E) |

| List of Tables |

| 1. Kenya Key Program/Schemes for Agriculture Sector |

| 2. Kenya National Budget FY2022-23 Agriculture Allocations |

| 3. Kenya Farm Tractor Market Revenues, By Power Rating, 2019-2029F ($ Million) |

| 4. Kenya Farm Tractor Market Volume, By Power Rating, 2019-2029F ($ Million) |

| 5. Kenya Farm Tractor Market Revenues, By Drive Type, 2019-2029F ($ Million) |

| 6. Kenya Farm Tractor Market Volume, By Drive Type, 2019-2029F ($ Million) |

Market Forecast By Horsepower Rating (Below 40 Hp, 40 Hp – 100 Hp, Above 100 Hp), By Drive Type (Two-wheel Drive, Four-wheel Drive) and competitive Landscape

| Product Code: ETC002117 | Publication Date: Apr 2020 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Kenya Farm Tractor Market is anticipated to witness growth during the forecast period 2020-26F owing to development in the agricultural sector in the country coupled with improving farm mechanization and production of fuel-efficient tractors by the domestic OEMs backed by rapid industrialization in the country. However, rising effects of the COVID-19 virus is likely to disturb agricultural activities in the country in the first few months of 2020, coupled with an expected reduction in consumer spending is likely to restrain the growth of the Kenya Farm Tractor market, but as the disease outbreak registers slowdown the Kenya farm tractor market is anticipated to regain market value in the latter part of 2020.

According to 6Wresearch, Kenya Farm Tractor Market is anticipated to witness potential growth during the forecast period 2020-26F. Increasing government efforts towards bringing instability in the agriculture sector in the country backed by agriculture development programs at the regional and national level are expected to, further, assist the growth of Kenya farm tractor market in the upcoming six years. The Support to Farmer’s Organizations in Africa Programme (SFOAP) is helping the farm labor organizations to provide assistance to the farm laborers by way of cheap loan facilities for the procurement of farm equipment is one such program in the country working towards the betterment and development of the agriculture sector.

The Kenya Agricultural Sector possesses great potential for growth and development with a major portion of arable land still left unutilized. Rising efforts of the government towards increasing the use of land for cultivation coupled with providing a spur towards agricultural mechanization in Kenya would benefit the development of the agriculture sector in the country and is anticipated to further trigger the growth of the Kenya farm tractor market in the near future.

The Kenya Farm Tractor report thoroughly covers the market by Horsepower rating and by Drive type. Kenya Farm Tractor outlook report provides an unbiased and detailed analysis of the on-going Kenya Farm Tractor trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies accordingly to the current and future market dynamics.

Kenya farm tractor market is expected to gain traction during the forecast period 2020-26F on the back of the rising potential growth of the agriculture sector at the fastest pace. Further, rising agricultural export practices and the main agriculture product exports are black tea and cut flower which is expected to Instigate the use of farm tractor machinery and would benefit the enormous growth of Kenya farm tractor market in the upcoming six years. Additionally, Kenya has arable land along with high production practices in the country is estimated to pioneer explosive growth of Kenya farm tractor market in the coming years.

Key Highlights of the Report

- Kenya Farm Tractor Market Overview

- Kenya Farm Tractor Market Outlook

- Kenya Farm Tractor Market Forecast

- Kenya Farm Tractor Market Size

- Historical & Forecast Data of Kenya Farm Tractor Market Revenues & Volume for the Period 2016-2026

- Historical & Forecast Data of Kenya Farm Tractor Market Revenues, by horsepower rating, for the period 2016-2026

- Historical & Forecast Data of Kenya Farm Tractor Market Revenues, by drive type, for the period 2016-2026

- Market Drivers and Restraints

- Kenya Farm Tractor Market Trends & Industry Life Cycle

- Porter’s Five Forces Analysis

- Market Opportunity Assessment

- Kenya Farm Tractor Market Overview, By Competitive Benchmarking

- Market Share, By Technology

- Recent Market Trends

- Recommendations

Markets Covered

The report provides a detailed analysis of the following market segments:

- By Horsepower rating

- Below 40 Hp

- 40 Hp – 100 Hp

- Above 100 Hp

- By Drive type

- Two-wheel Drive

- Four-wheel Drive

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero