Malaysia Electrical Appliances Market (2025-2029) | Outlook, Value, Size, Share, Forecast, Companies, Analysis, Growth, Revenue, Industry & Trends

Market Forecast By Product Type (Audio & Video Equipment, Large Electronics Appliances, Small Electronics Appliances, Personal Care Products, Operation, Semi-automatic, Automatic), By End-User (Residential, Commercial), By Distribution Channel (Online, Offline) And Competitive Landscape

| Product Code: ETC261746 | Publication Date: Aug 2022 | Updated Date: Aug 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

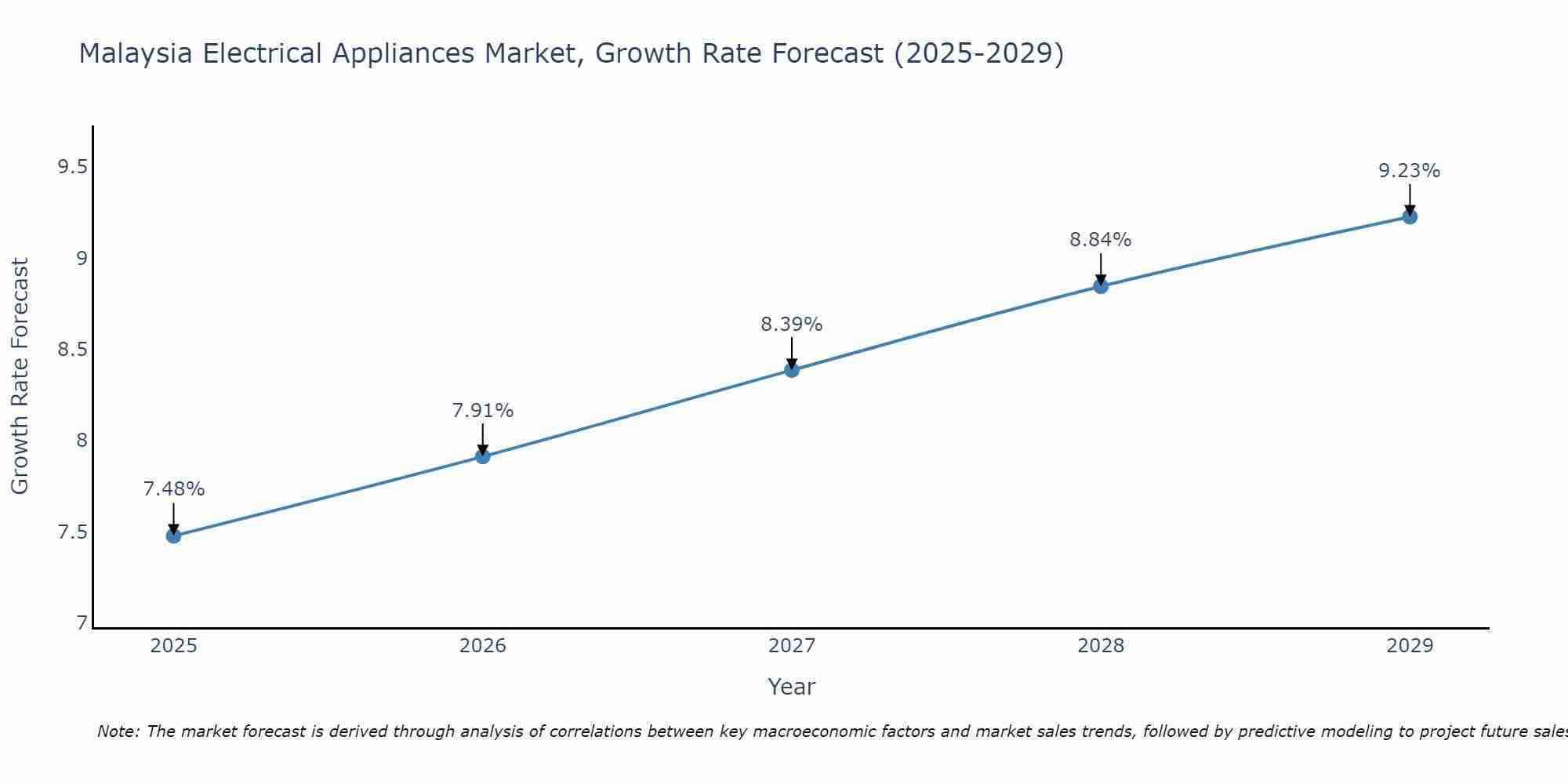

Malaysia Electrical Appliances Market Size Growth Rate

The Malaysia Electrical Appliances Market is poised for steady growth rate improvements from 2025 to 2029. From 7.48% in 2025, the growth rate steadily ascends to 9.23% in 2029.

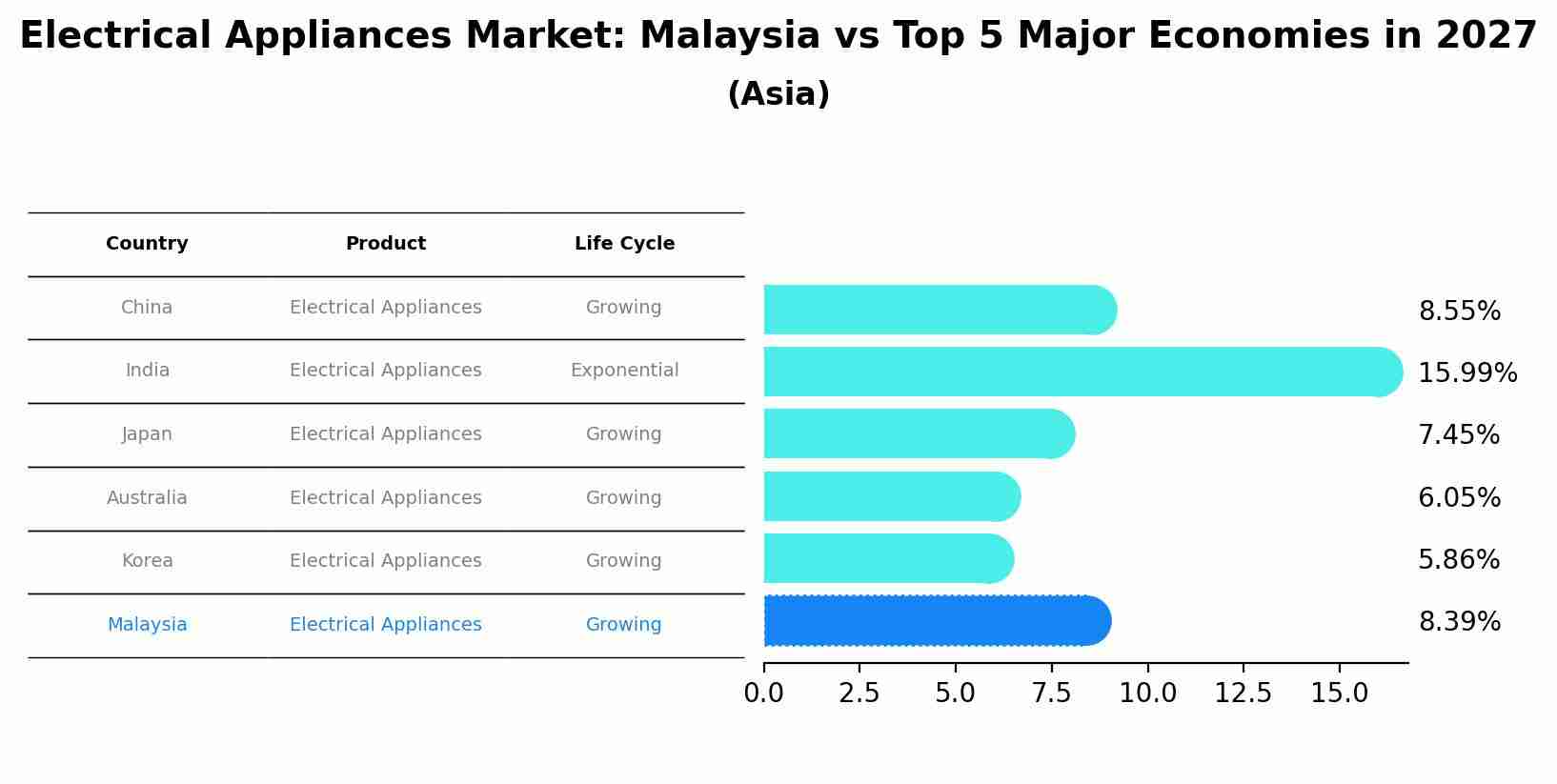

Electrical Appliances Market: Malaysia vs Top 5 Major Economies in 2027 (Asia)

In the Asia region, the Electrical Appliances market in Malaysia is projected to expand at a growing growth rate of 8.39% by 2027. The largest economy is China, followed by India, Japan, Australia and South Korea.

Malaysia Electrical Appliances Market Highlights

| Report Name | Malaysia Electrical Appliances Market |

| Forecast period | 2025-2029 |

| CAGR | 9.23% |

| Growing Sector | Residential |

Topics Covered in the Malaysia Electrical Appliances Market Report

The Malaysia Electrical Appliances Market report thoroughly covers the market by Product Type, End-User, and Distribution Channel. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high-growth areas, and market drivers to help stakeholders align their strategies with current and future market dynamics.

Malaysia Electrical Appliances Market Synopsis

The Malaysia electrical appliances market has been witnessing a massive growth over the years, influenced by growing urban population, rising income levels, and rising demand for modern living and convenience. Additionally, rising middle-class population in the country has boosted the adoption of electronics products, such as washing machines, refrigerators, air conditioners, and kitchen appliances. Furthermore, consumers focus has been shifting towards energy-efficient and environmentally friendly appliances, hence the demand for products integrated with advanced technologies and eco-friendly features is on the rise.

The Malaysia Electrical Appliances Market is anticipated to grow at a CAGR of 9.23% during the forecast period 2025-2029. Several factors are supporting the growth of the electrical appliances market in Malaysia. One of them is income level of the population is on the rise, which has enabled consumers to purchase modern and sophisticated appliances. Additionally, rapid urbanization in the country boosts the Malaysia Electrical Appliances Market growth, as more people are shifting and adopting urban lifestyles, which drive the demand for convenience-oriented appliances. Furthermore, the rising expansion of e-commerce and digital platforms has proliferated the accessibility, which allows consumers to explore and purchase a diverse range of products with more convenience.

Malaysia Electrical Appliances Market Challenges

The Malaysia electrical appliances market faces several challenges, including high competition from international companies, production costs are on the rise owing to changing raw material prices, and the rising need for innovation in the products to cater emerging consumer choices. Additionally, the market must encounter concerns such as rising consumer awareness about sustainability, coupled with energy efficiency rules, which demand investments in research and development.

Malaysia Electrical Appliances Market Trends

The Malaysia electrical appliances market witnesses several major trends that shape its growth. Such as, consumers are now aware of environmental impact and sustainability, hence the demand for energy-efficient appliances is increasing in the country. Another major trend is the rising popularity of smart homes, hence, the rising adoption of advanced household appliances combined with automated and interconnected devices improves convenience and functionality. Another major trend that is estimated to boost the growth of the market is rising shift towards multifunctional appliances, as increasing income of the population enables them to purchase quality products yet innovative.

Investment Opportunities in the Malaysia Electrical Appliances Market

The Malaysia electrical appliances market presents significant investment opportunities for both local and international brands. The rising focus on smart and energy efficient appliances has created an opportunity for the investors to invest in developing sustainable technologies and offering innovative products. Additionally, the rapid urbanization and government efforts to encourage digital transformation offer excellent opportunities for the development of the market. Investors can focus on different segments of the market, such as luxury kitchenware or small domestic appliances, which are popular among a discerning consumer base.

Leading Players of the Malaysia Electrical Appliances Market

The market is dominated by key players such as Panasonic, Samsung, and LG, who led through continuous innovation and high-quality products. Local companies also play an essential role by providing competitively priced alternatives tailored to the preferences of Malaysian consumers. These firms contribute to a vibrant and competitive market landscape.

Government Regulations Introduced in the Malaysia Electrical Appliances Market

The Malaysian government has implemented various regulations to promote sustainability and ensure the safety and quality of electrical appliances in the market. Key regulations include mandatory energy efficiency labels, such as the "Energy Efficiency Star Rating" system, which helps consumers make informed purchasing decisions while encouraging manufacturers to develop eco-friendly products. Additionally, the enforcement of the Electricity Supply Act 1990 ensures that all appliances meet stringent safety standards before entering the market. A recent example is the introduction of Minimum Energy Performance Standards (MEPS), which set baseline energy efficiency requirements for air conditioners and refrigerators, aiming to reduce energy consumption and carbon emissions.

Future Outlook of the Malaysia Electrical Appliances Market

The future of the Malaysia electrical appliances industry seems optimistic, influenced by technological advancements and the rising shift in consumer choices towards energy-efficient and smart products. Rapid urbanization and increasing disposable will likely to boost the demand for premium and innovative appliances. Furthermore, government has granted some incentives to promote green technology and digital transformation are likely to play a critical role in shaping the market's trajectory. Manufacturers focusing on smart home integration and sustainable solutions are anticipated to gain a comp`etitive edge.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories:

Large Electronic Appliances to Dominate – By Product Type

According to Ashutosh, Senior Research Analyst at 6Wresearch, large electronic appliances dominate the Malaysia Electrical Appliances Market. Products such as refrigerators, washing machines, and air conditioners are particularly in high demand due to their essential role in households and businesses. The surge in urbanization and the growing disposable income of the population continue to drive the sales of these large appliances.

Residential to Lead the Market – By End Users

The residential sector leads the market when segmented by end-user. With an increasing number of residential constructions and the rising adoption of modern lifestyles, consumers are investing heavily in electrical appliances to enhance convenience and improve overall living standards.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Malaysia Electrical Appliances Market Outlook

- Market Size of Malaysia Electrical Appliances Market, 2024

- Forecast of Malaysia Electrical Appliances Market, 2029

- Historical Data and Forecast of Malaysia Electrical Appliances Revenues & Volume for the Period 2019-2029

- Malaysia Electrical Appliances Market Trend Evolution

- Malaysia Electrical Appliances Market Drivers and Challenges

- Malaysia Electrical Appliances Price Trends

- Malaysia Electrical Appliances Porter's Five Forces

- Malaysia Electrical Appliances Industry Life Cycle

- Historical Data and Forecast of Malaysia Electrical Appliances Market Revenues & Volume By Product Type for the Period 2019-2029

- Historical Data and Forecast of Malaysia Electrical Appliances Market Revenues & Volume By Audio & Video Equipment for the Period 2019-2029

- Historical Data and Forecast of Malaysia Electrical Appliances Market Revenues & Volume By Large Electronics Appliances for the Period 2019-2029

- Historical Data and Forecast of Malaysia Electrical Appliances Market Revenues & Volume By Small Electronics Appliances for the Period 2019-2029

- Historical Data and Forecast of Malaysia Electrical Appliances Market Revenues & Volume By Personal Care Products for the Period 2019-2029

- Historical Data and Forecast of Malaysia Electrical Appliances Market Revenues & Volume By Operation for the Period 2019-2029

- Historical Data and Forecast of Malaysia Electrical Appliances Market Revenues & Volume By Semi-automatic for the Period 2019-2029

- Historical Data and Forecast of Malaysia Electrical Appliances Market Revenues & Volume By Automatic for the Period 2019-2029

- Historical Data and Forecast of Malaysia Electrical Appliances Market Revenues & Volume By End-User for the Period 2019-2029

- Historical Data and Forecast of Malaysia Electrical Appliances Market Revenues & Volume By Residential for the Period 2019-2029

- Historical Data and Forecast of Malaysia Electrical Appliances Market Revenues & Volume By Commercial for the Period 2019-2029

- Historical Data and Forecast of Malaysia Electrical Appliances Market Revenues & Volume By Distribution Channel for the Period 2019-2029

- Historical Data and Forecast of Malaysia Electrical Appliances Market Revenues & Volume By Online for the Period 2019-2029

- Historical Data and Forecast of Malaysia Electrical Appliances Market Revenues & Volume By Offline for the Period 2019-2029

- Malaysia Electrical Appliances Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By End-User

- Market Opportunity Assessment By Distribution Channel

- Malaysia Electrical Appliances Top Companies Market Share

- Malaysia Electrical Appliances Competitive Benchmarking By Technical and Operational Parameters

- Malaysia Electrical Appliances Company Profiles

- Malaysia Electrical Appliances Key Strategic Recommendations

Market Segmentation

The Market report covers a detailed analysis of the following market segments:

By Product Type

- Audio & Video Equipment

- Large Electronics Appliances

- Small Electronics Appliances

- Personal Care Products

- Operation

- Semi-automatic

- Automatic

By End-User

- Residential

- Commercial

By Distribution Channel

- Online

- Offline

Malaysia Electrical Appliances Market (2025-2029): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Malaysia Electrical Appliances Market Overview |

| 3.1 Malaysia Country Macro Economic Indicators |

| 3.2 Malaysia Electrical Appliances Market Revenues & Volume, 2019 & 2029F |

| 3.3 Malaysia Electrical Appliances Market - Industry Life Cycle |

| 3.4 Malaysia Electrical Appliances Market - Porter's Five Forces |

| 3.5 Malaysia Electrical Appliances Market Revenues & Volume Share, By Product Type, 2019 & 2029F |

| 3.6 Malaysia Electrical Appliances Market Revenues & Volume Share, By End-User, 2019 & 2029F |

| 3.7 Malaysia Electrical Appliances Market Revenues & Volume Share, By Distribution Channel, 2019 & 2029F |

| 4 Malaysia Electrical Appliances Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing disposable income in Malaysia leading to higher purchasing power for electrical appliances. |

| 4.2.2 Rapid urbanization and modernization driving the demand for energy-efficient and smart electrical appliances. |

| 4.2.3 Technological advancements in appliances leading to the introduction of innovative products in the market. |

| 4.3 Market Restraints |

| 4.3.1 Price sensitivity among consumers in Malaysia impacting the adoption of premium electrical appliances. |

| 4.3.2 Intense competition among key market players leading to pricing pressures and reduced profit margins. |

| 4.3.3 Volatility in raw material prices affecting the production costs of electrical appliances in Malaysia. |

| 5 Malaysia Electrical Appliances Market Trends |

| 6 Malaysia Electrical Appliances Market, By Types |

| 6.1 Malaysia Electrical Appliances Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Malaysia Electrical Appliances Market Revenues & Volume, By Product Type, 2019-2029F |

| 6.1.3 Malaysia Electrical Appliances Market Revenues & Volume, By Audio & Video Equipment, 2019-2029F |

| 6.1.4 Malaysia Electrical Appliances Market Revenues & Volume, By Large Electronics Appliances, 2019-2029F |

| 6.1.5 Malaysia Electrical Appliances Market Revenues & Volume, By Small Electronics Appliances, 2019-2029F |

| 6.1.6 Malaysia Electrical Appliances Market Revenues & Volume, By Personal Care Products, 2019-2029F |

| 6.1.7 Malaysia Electrical Appliances Market Revenues & Volume, By Operation, 2019-2029F |

| 6.1.8 Malaysia Electrical Appliances Market Revenues & Volume, By Semi-automatic, 2019-2029F |

| 6.2 Malaysia Electrical Appliances Market, By End-User |

| 6.2.1 Overview and Analysis |

| 6.2.2 Malaysia Electrical Appliances Market Revenues & Volume, By Residential, 2019-2029F |

| 6.2.3 Malaysia Electrical Appliances Market Revenues & Volume, By Commercial, 2019-2029F |

| 6.3 Malaysia Electrical Appliances Market, By Distribution Channel |

| 6.3.1 Overview and Analysis |

| 6.3.2 Malaysia Electrical Appliances Market Revenues & Volume, By Online, 2019-2029F |

| 6.3.3 Malaysia Electrical Appliances Market Revenues & Volume, By Offline, 2019-2029F |

| 7 Malaysia Electrical Appliances Market Import-Export Trade Statistics |

| 7.1 Malaysia Electrical Appliances Market Export to Major Countries |

| 7.2 Malaysia Electrical Appliances Market Imports from Major Countries |

| 8 Malaysia Electrical Appliances Market Key Performance Indicators |

| 8.1 Household penetration rate of energy-efficient electrical appliances. |

| 8.2 Adoption rate of smart electrical appliances in Malaysian households. |

| 8.3 Growth in the demand for eco-friendly electrical appliances. |

| 8.4 Number of new product launches in the Malaysian electrical appliances market. |

| 8.5 Customer satisfaction and loyalty metrics for leading electrical appliance brands in Malaysia. |

| 9 Malaysia Electrical Appliances Market - Opportunity Assessment |

| 9.1 Malaysia Electrical Appliances Market Opportunity Assessment, By Product Type, 2019 & 2029F |

| 9.2 Malaysia Electrical Appliances Market Opportunity Assessment, By End-User, 2019 & 2029F |

| 9.3 Malaysia Electrical Appliances Market Opportunity Assessment, By Distribution Channel, 2019 & 2029F |

| 10 Malaysia Electrical Appliances Market - Competitive Landscape |

| 10.1 Malaysia Electrical Appliances Market Revenue Share, By Companies, 2024 |

| 10.2 Malaysia Electrical Appliances Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero