Malaysia Paint And Coating Market (2025-2029) | Outlook, Size, Industry, Companies, Forecast, Share, Value, Trends, Revenue, Growth & Analysis

Market Forecast By Product (Waterborne Coatings, Solvent-borne Coatings, Powder Coatings, High Solids/radiation Curing, Others), By Material (Acrylic, Polyester, Alkyd, Polyurethane, Epoxy, Others), By Application (Architectural & Decorative, Non-architectural) And Competitive Landscape

| Product Code: ETC336806 | Publication Date: Aug 2022 | Updated Date: Aug 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 | |

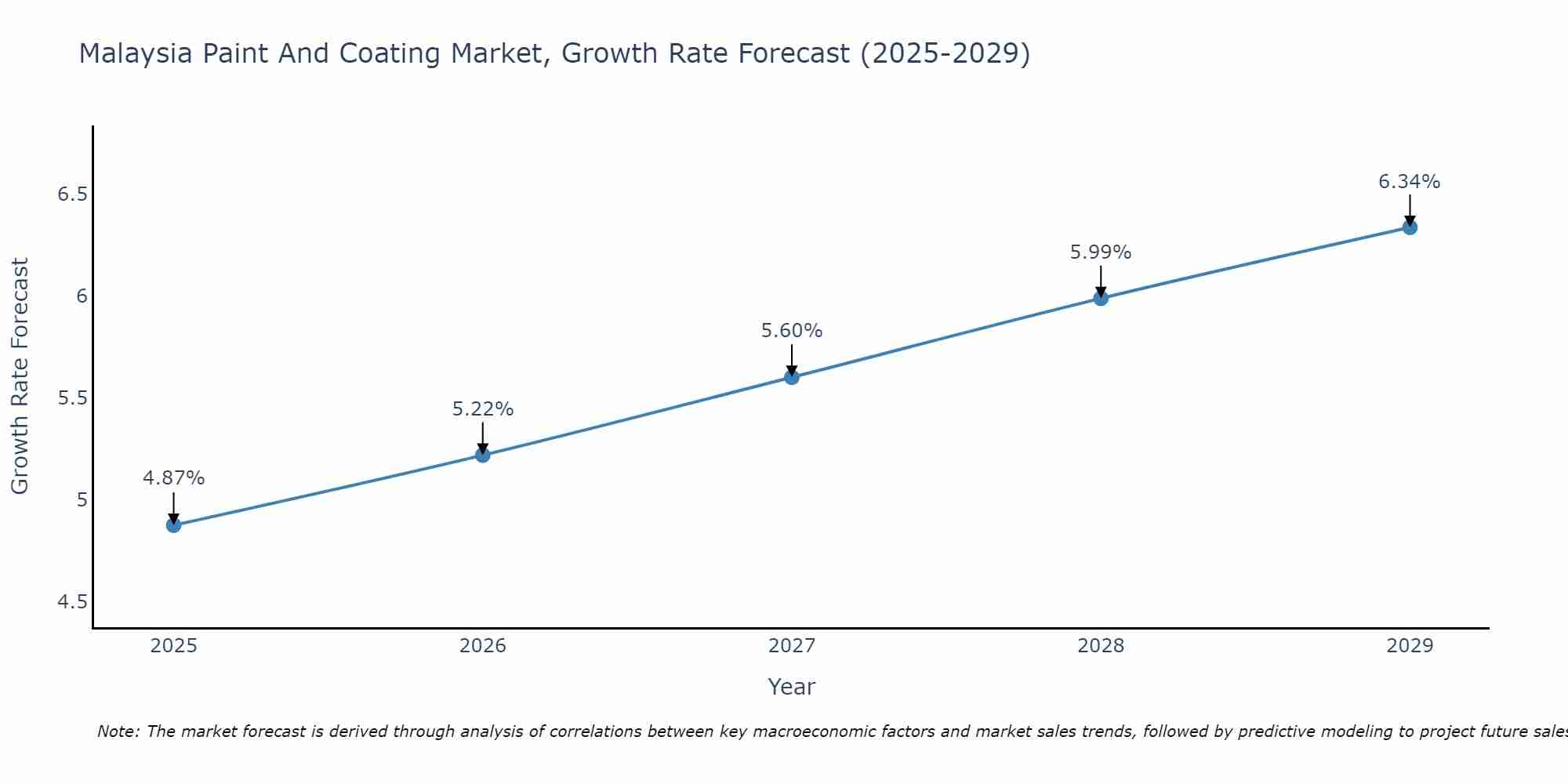

Malaysia Paint And Coating Market Size Growth Rate

The Malaysia Paint And Coating Market is poised for steady growth rate improvements from 2025 to 2029. Commencing at 4.87% in 2025, growth builds up to 6.34% by 2029.

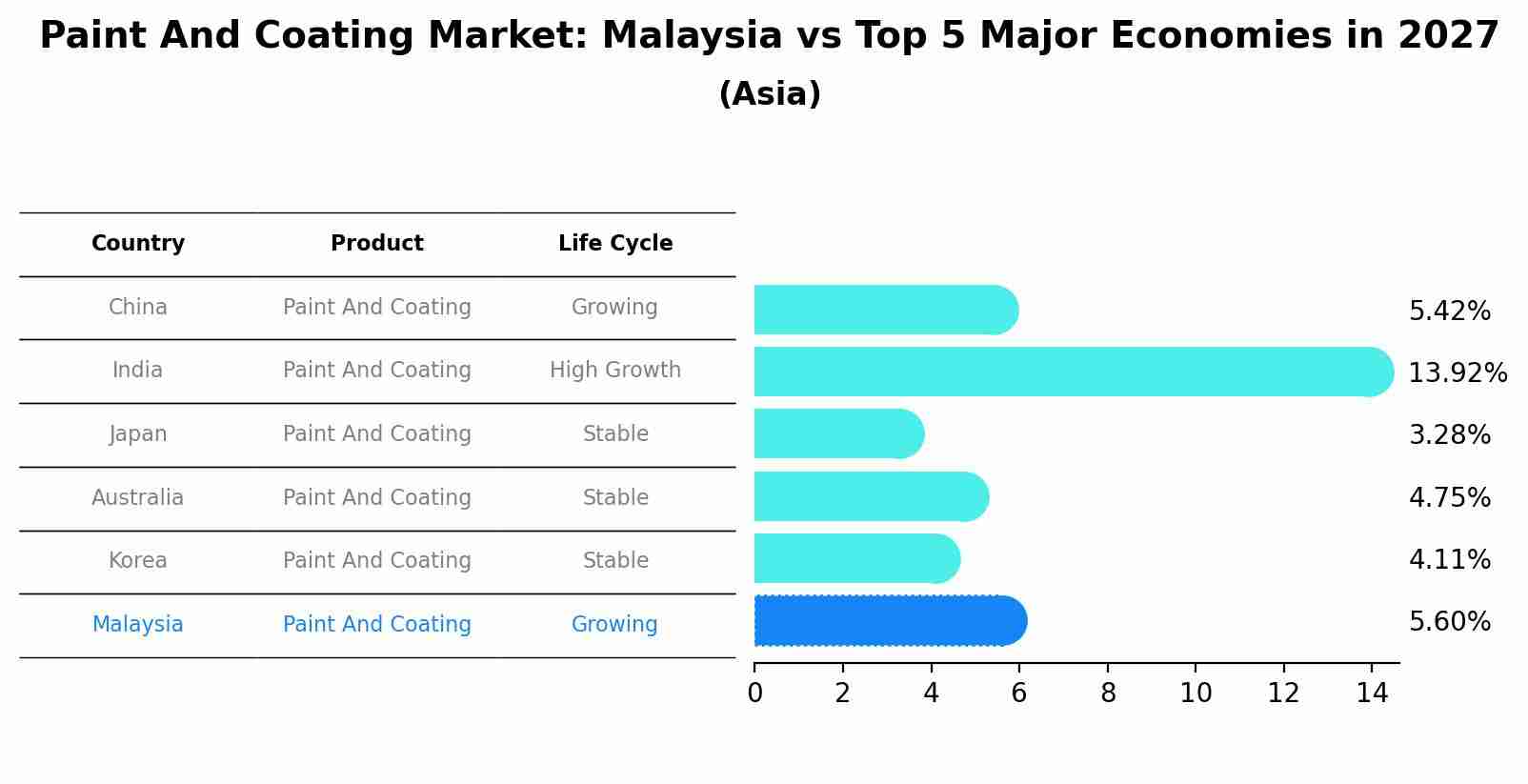

Paint And Coating Market: Malaysia vs Top 5 Major Economies in 2027 (Asia)

By 2027, the Paint And Coating market in Malaysia is anticipated to reach a growth rate of 5.60%, as part of an increasingly competitive Asia region, where China remains at the forefront, supported by India, Japan, Australia and South Korea, driving innovations and market adoption across sectors.

Malaysia Paint And Coating Market Highlights

| Report Name | Malaysia Paint And Coating Market |

| Forecast Period | 2025–2029 |

| CAGR | 6.34% |

| Growing Sector | Construction and Automotive |

Topics Covered in the Malaysia Paint And Coating Market Report

The Malaysia Paint And Coating Market report thoroughly covers the market by product , by material, and by application. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high-growth areas, and market drivers to help stakeholders align their strategies with current and future market dynamics.

Malaysia Paint And Coating Market Synopsis

Malaysia Paint and Coating Market is growing continuously due to the country’s urban development, ongoing infrastructure projects, and rising vehicle production. There is rising demand for both protective and decorative coatings, especially in housing and commercial spaces. Innovations such as smart and environmentally friendly coatings are also fueling market expansion. Due to continuous government support for construction and industrial growth, Malaysia is emerging as a key player in the Southeast Asian paint and coating sector with promising future opportunities.

The Malaysia Paint And Coating Market is anticipated to grow at a CAGR of 6.34% during the forecast period 2025-2029. The market is expanding steadily due to rapid urbanization, ongoing infrastructure projects, and a rise in automotive manufacturing. The rising need for decorative paints in residential and commercial construction, supported by various government housing programs, continues to boost demand. Rising environmental concerns have led to a stronger preference for low-VOC and water-based coatings. The Malaysia Paint and Coating Market Growth is further driven by advancements in technology, particularly in durable and specialized coatings, especially for industrial and marine applications.

Malaysia Paint and Coating Market: Business Adoption Playbook (2025–2031)

The Malaysia Paint and Coating Market Playbook (2025–2031) represents tailored adoption strategies, rising investments & technologies, and risks for several businesses entering or growing in the market.

| Business Type | Risk Factor | Adoption Strategy | Recommended Investment (USD) | Product Focus | Target Segments | Distribution Model |

| Local Paint Retailer | Price war with low-cost competitors | Franchise/Distributor Tie-up | USD 20K–50K | Decorative Paints, Wall Primers | Homeowners, Small Contractors | In-store, Regional Wholesalers |

| SME Manufacturer | Raw material price fluctuation, quality control | Expand into Niche Industrial Paints | USD 100K–250K | Epoxy, Polyurethane, Anti-corrosion Coating | Automotive Workshops, Factories | B2B + Project Supply Chain |

| Construction Firm | Skilled labor shortages, application wastage | Integrate In-house Coating Services | USD 150K–300K | Exterior Emulsions, Floor Coatings | Residential + Commercial Projects | In-house + Contractor Network |

| E-commerce Startup | Customer trust & limited offline visibility | Launch Private Label Paint Brand | USD 60K–120K | Low-VOC Paints, Quick-dry Finishes | DIY Enthusiasts, Urban Consumers | Online + Retail Aggregators |

| Global Brand (New Entry) | Regulatory barriers, localization challenges | JV with Local Manufacturer | USD 500K–1M | Full Portfolio: Decorative + Industrial | Real Estate, Industrial, Marine | Omni-channel |

Note: The above mentioned strategic table is based on 6Wresearch internal database and industry insights, actual investment and risk factors may vary.

Malaysia Paint and Coating Market Challenges

Despite continuous growth, the Malaysia Paint and Coating Market faces several hurdles. Unstable raw material prices, rising manufacturing expenses and reduce profit potential. Small manufacturers, in particular, struggle with the high costs of complying with environmental standards. Reduce cost imported products and an inconsistent supply chain add competitive and logistical challenges. The Demand can also be affected by delays in major construction and infrastructure developments. However, limited availability of skilled labour for advanced coating applications restricts growth in specialized market segments.

Malaysia Paint and Coating Market Trends

The Malaysia Paint and Coating Industry is evolving continuously with several prominent trends. The demand for environmentally friendly products such as water-based and low-VOC coatings is rising in popularity due to regulatory requirements. There is a noticeable rise in demand for specialty coatings with anti-bacterial and heat-resistant properties, particularly in homes and medical facilities. Innovations such as digital colour-matching and increased online sales are transforming consumer engagement. Moreover, manufacturers are prioritizing the development of sustainable, efficient products that support national green building strategies and respond to shifting market expectations.

Investment Opportunities in the Malaysia Paint and Coating Market

The Malaysia Paint and Coatings Market is benefiting from the country ongoing infrastructure boom. Due to expanding Urban development, public housing schemes and smart city projects are creating a surge in demand for decorative and industrial coatings. Investors focused on sustainable technologies have a growing market to serve, as Malaysia strengthens its environmental policies to meet global benchmarks. The integration of nanotechnology and intelligent material positions the market foe high value and advanced coatings aligned with global innovations trend.

Leading Players in the Malaysia Paint and Coating Market

The major key players in the Malaysia Paint and Coating Market is dominated by major players such as Kansai Paint, Nippon Paint Malaysia, Jotun, AkzoNobel, and PPG Industries. These companies dominate the market through strong brand presence, extensive distribution networks, and innovative product lines including decorative, eco- friendly and industrial coatings.

Government regulations in Malaysia Paint and Coating Market

The Malaysia Paint and Coating Market is shaped by severe government regulations prioritizing product safety, environmental sustainability, and public health. Policies emphasized by the government are reducing VOC emissions and promoting water based, non -toxic coatings. The Department of Environment (DOE) enforces compliance through testing, licensing, and product certification. Malaysia continues to align its standards with international environmental protocols, encouraging manufacturers to embrace eco- friendly practices, boosting sustainable innovation and reinforcing accountability across the coating industry.

Future Insights of the Malaysia Paint and Coating Market

The future of the Malaysian paint and coating market is poised for strong growth, driven by sustainability, technological innovation, and digital transformation. Rising demand for eco- friendly buildings and smart cities, will accelerate the demand for advanced coatings like thermal-insulating and anti-pollution products will rise. Expansion in automotive and marine sectors will also boost demand for protective coatings. The market will see increased consolidation and automation in manufacturing. Overall, Malaysia is set to emerge as a regional hub for innovative, sustainable, and value-driven coating solutions.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories:

Waterborne Coatings to Dominate the Market- By Product

According to Ritika Kalra, Senior Research Analyst at 6Wresearch, In the Malaysia Paint and Coating Market, waterborne coatings hold the largest market share due to growing environmental awareness and stricter VOC regulations. These coatings are widely used in architectural applications, offering low toxicity, easy cleanup, and improved air quality. Their rapid adoption is driven by rising demand for eco-friendly and sustainable solutions in both residential and commercial construction.

Acrylic to Dominate the Market-By Material

Acrylic coatings dominate the Malaysian paint and coating material segment, largely due to their versatility, affordability, and excellent weather resistance. Widely used in both decorative and industrial applications, acrylic-based formulations are favored for their quick-drying properties and strong adhesion on various surfaces. They are particularly prevalent in exterior and interior architectural paints.

Architectural & Decorative to Dominate the Market- By Application

The architectural and decorative segment holds the largest share in the Malaysia Paint and Coating Market, driven by ongoing urbanization, real estate development, and renovation projects. This includes coatings for interior walls, exterior finishes, primers, and decorative paints. With strong government support for housing and infrastructure development, demand remains high in both residential and commercial sectors.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Malaysia Paint And Coating Market Outlook

- Market Size of Malaysia Paint And Coating Market, 2024

- Forecast of Malaysia Paint And Coating Market, 20

- Historical Data and Forecast of Malaysia Paint And Coating Revenues & Volume for the Period 2019-2029

- Malaysia Paint And Coating Market Trend Evolution

- Malaysia Paint And Coating Market Drivers and Challenges

- Malaysia Paint And Coating Price Trends

- Malaysia Paint And Coating Porter's Five Forces

- Malaysia Paint And Coating Industry Life Cycle

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By Product for the Period 2019-2029

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By Waterborne Coatings for the Period 2019-2029

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By Solvent-borne Coatings for the Period 2019-2029

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By Powder Coatings for the Period 2019-2029

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By High Solids/radiation Curing for the Period 2019-2029

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By Others for the Period 2019-2029

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By Material for the Period 2019-2029

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By Acrylic for the Period 2019-2029

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By Polyester for the Period 2019-2029

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By Alkyd for the Period 2019-2029

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By Polyurethane for the Period 2019-2029

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By Epoxy for the Period 2019-2029

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By Others for the Period 2019-2029

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By Application for the Period 2019-2029

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By Architectural & Decorative for the Period 2019-2029

- Historical Data and Forecast of Malaysia Paint And Coating Market Revenues & Volume By Non-architectural for the Period 2019-2029

- Malaysia Paint And Coating Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Material

- Market Opportunity Assessment By Application

- Malaysia Paint And Coating Top Companies Market Share

- Malaysia Paint And Coating Competitive Benchmarking By Technical and Operational Parameters

- Malaysia Paint And Coating Company Profiles

- Malaysia Paint And Coating Key Strategic Recommendations

Market Segmentation

The Market report covers a detailed analysis of the following market segments:

By Product

- Waterborne Coatings

- Solvent-borne Coatings

- Powder Coatings

- High Solids / Radiation Curing

- Others

By Material

- Acrylic

- Polyester

- Alkyd

- Polyurethane

- Epoxy

- Others

By Application

- Architectural & Decorative

- Non-Architectural

Malaysia Paint And Coating Market (2025-2029): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Malaysia Paint And Coating Market Overview |

| 3.1 Malaysia Country Macro Economic Indicators |

| 3.2 Malaysia Paint And Coating Market Revenues & Volume, 2021 & 2031F |

| 3.3 Malaysia Paint And Coating Market - Industry Life Cycle |

| 3.4 Malaysia Paint And Coating Market - Porter's Five Forces |

| 3.5 Malaysia Paint And Coating Market Revenues & Volume Share, By Product, 2021 & 2031F |

| 3.6 Malaysia Paint And Coating Market Revenues & Volume Share, By Material, 2021 & 2031F |

| 3.7 Malaysia Paint And Coating Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 4 Malaysia Paint And Coating Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Growing construction industry in Malaysia leading to increased demand for paints and coatings. |

| 4.2.2 Rising disposable income and changing lifestyle preferences driving the demand for decorative and protective coatings. |

| 4.2.3 Increasing focus on infrastructure development and government initiatives boosting the market for industrial coatings. |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating raw material prices impacting the cost of production for paint and coating manufacturers. |

| 4.3.2 Stringent environmental regulations leading to the need for eco-friendly and sustainable paint and coating solutions. |

| 4.3.3 Intense competition in the market leading to pricing pressures for companies. |

| 5 Malaysia Paint And Coating Market Trends |

| 6 Malaysia Paint And Coating Market, By Types |

| 6.1 Malaysia Paint And Coating Market, By Product |

| 6.1.1 Overview and Analysis |

| 6.1.2 Malaysia Paint And Coating Market Revenues & Volume, By Product, 2021-2031F |

| 6.1.3 Malaysia Paint And Coating Market Revenues & Volume, By Waterborne Coatings, 2021-2031F |

| 6.1.4 Malaysia Paint And Coating Market Revenues & Volume, By Solvent-borne Coatings, 2021-2031F |

| 6.1.5 Malaysia Paint And Coating Market Revenues & Volume, By Powder Coatings, 2021-2031F |

| 6.1.6 Malaysia Paint And Coating Market Revenues & Volume, By High Solids/radiation Curing, 2021-2031F |

| 6.1.7 Malaysia Paint And Coating Market Revenues & Volume, By Others, 2021-2031F |

| 6.2 Malaysia Paint And Coating Market, By Material |

| 6.2.1 Overview and Analysis |

| 6.2.2 Malaysia Paint And Coating Market Revenues & Volume, By Acrylic, 2021-2031F |

| 6.2.3 Malaysia Paint And Coating Market Revenues & Volume, By Polyester, 2021-2031F |

| 6.2.4 Malaysia Paint And Coating Market Revenues & Volume, By Alkyd, 2021-2031F |

| 6.2.5 Malaysia Paint And Coating Market Revenues & Volume, By Polyurethane, 2021-2031F |

| 6.2.6 Malaysia Paint And Coating Market Revenues & Volume, By Epoxy, 2021-2031F |

| 6.2.7 Malaysia Paint And Coating Market Revenues & Volume, By Others, 2021-2031F |

| 6.3 Malaysia Paint And Coating Market, By Application |

| 6.3.1 Overview and Analysis |

| 6.3.2 Malaysia Paint And Coating Market Revenues & Volume, By Architectural & Decorative, 2021-2031F |

| 6.3.3 Malaysia Paint And Coating Market Revenues & Volume, By Non-architectural, 2021-2031F |

| 7 Malaysia Paint And Coating Market Import-Export Trade Statistics |

| 7.1 Malaysia Paint And Coating Market Export to Major Countries |

| 7.2 Malaysia Paint And Coating Market Imports from Major Countries |

| 8 Malaysia Paint And Coating Market Key Performance Indicators |

| 8.1 Research and development investment in innovative coatings technology. |

| 8.2 Adoption rate of eco-friendly and sustainable paint and coating products in the market. |

| 8.3 Number of new construction projects and infrastructure developments in Malaysia. |

| 9 Malaysia Paint And Coating Market - Opportunity Assessment |

| 9.1 Malaysia Paint And Coating Market Opportunity Assessment, By Product, 2021 & 2031F |

| 9.2 Malaysia Paint And Coating Market Opportunity Assessment, By Material, 2021 & 2031F |

| 9.3 Malaysia Paint And Coating Market Opportunity Assessment, By Application, 2021 & 2031F |

| 10 Malaysia Paint And Coating Market - Competitive Landscape |

| 10.1 Malaysia Paint And Coating Market Revenue Share, By Companies, 2024 |

| 10.2 Malaysia Paint And Coating Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero