Mexico Plastic Straps Market (2025-2031) | Outlook, Companies, Size, Growth, Forecast, Share, Value, Revenue, Analysis, Trends & Industry

Market Forecast By Type (Polyester Straps, Polypropylene Straps, Nylon and Other Straps), By End-Use (Steel, Construction Materials, Paper & Cardboard, Textiles & Fiber, Others), And Competitive Landscape

| Product Code: ETC340203 | Publication Date: Aug 2022 | Updated Date: Oct 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 69 | No. of Figures: 16 | No. of Tables: 5 |

Mexico Plastic Straps Market Size, Drivers and Growth Rate

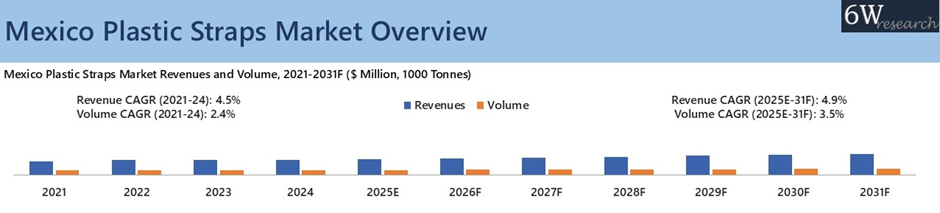

Mexico Plastic Straps Market is expected to reach a revenue of USD 188 million by 2031. A compound annual growth rate of 4.9% is expected of the Mexico plastic straps market from 2025 to 2031.

Mexico Plastic Straps Market is expanding steadily due to key growth factors which include e-commerce expansion and growing industrial investments.

Mexico Plastic Straps Market Highlights

- The size of Mexico Plastic Straps Market was demonstrated USD 135.7 million in 2024 and is expected to reach USD 188 million by 2031.

- The Mexico market was growing at a CAGR of 4.5% in 2024 and projected to grow at a CAGR of 4.9% from 2025 to 2031.

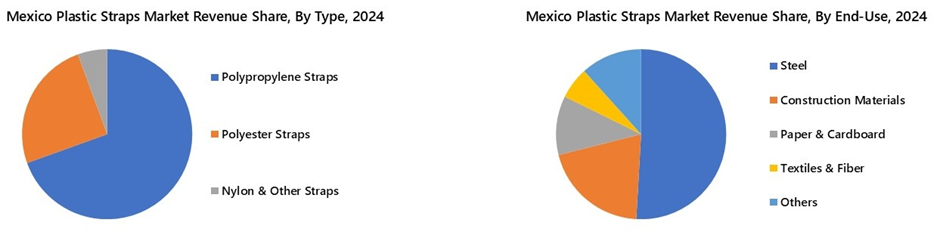

- In terms of material type, polypropylene (PP) straps accounted for the highest revenue share in 2024 due to their high flexibility, affordability, and widespread use in general packaging and logistics applications.

- Government policies are encouraging for sustainable packaging practices and investment in recycling infrastructure are encouraging manufacturers to adopt eco-friendly plastic strap production across Mexico.

Topics Covered in the Mexico Plastic Straps Market Report

Mexico Plastic Straps Market Report thoroughly covers the market by Type and End-Use. The Mexico Plastic Straps Market Outlook report provides an unbiased and detailed analysis of the ongoing Mexico Plastic Straps Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Mexico Plastic Straps Market Synopsis

Mexico Plastic Straps Market grew during 2021–2024, supported by the country’s rapid e-commerce expansion, rising packaging demand, and sustained foreign direct investment (FDI). In 2024, Mexico’s e-commerce sector was valued highly, with adults shopping online and online sales growing significantly in a single year. Retail dominated, accounting for all online sales, creating unprecedented demand for secure packaging and palletization solutions.

At the same time, FDI inflows reached more in 2024, the highest since 2013, with manufacturing attracting investments in Q1 2025, particularly in automotive, electronics, and food processing. These dynamics directly increased consumption of PP and PET strapping in warehouses, fulfillment centers, and export hubs, as companies prioritized load stability and protective packaging to manage surging shipment volumes.

According to 6Wresearch, the Mexico Plastic Straps Market is projected to grow at a CAGR of 4.9% in revenue and 3.5% in volume during 2025E-31F, driven by nearshoring-led industrial expansion, packaging sector modernization, and sustainability initiatives. Manufacturing exports have been forecasted to grow from 2024 to 2030, reinforcing the demand for heavy-duty strapping in automotive, ceramics, metals, and construction materials. The packaging sector itself is surging, with machinery demand projected to increase more by 2025, fueled by food, beverages, FMCG, and personal care.

Key investments, such as Constellation Brands' expansion and Grupo Bimbo’s modernization of bakery packaging lines, signal rising demand for advanced strapping solutions. Moreover, sustainability is also emerging as a growth pillar and Mexico’s leadership in PET recycling has been creating opportunities for rPET-based straps, as exporters align with U.S. and European ESG requirements. Together, these trends of e-commerce growth, industrial FDI, packaging sector modernization, and the transition to sustainable materials would underpin Mexico plastic straps market growth through 2031.

Market Segmentation By Type

By 2031, Polypropylene straps are expected to command the largest share in both revenue and volume in Mexico plastic straps market, supported by their expanding role in medium-duty packaging which is essential for cost efficiency and export-oriented bundling. PP straps are increasingly favored for their lightweight, flexible, and cost-effective properties, making them the preferred choice for high-speed automated lines in textiles, corrugated packaging, and consumer goods.

Market Segmentation By End-Use

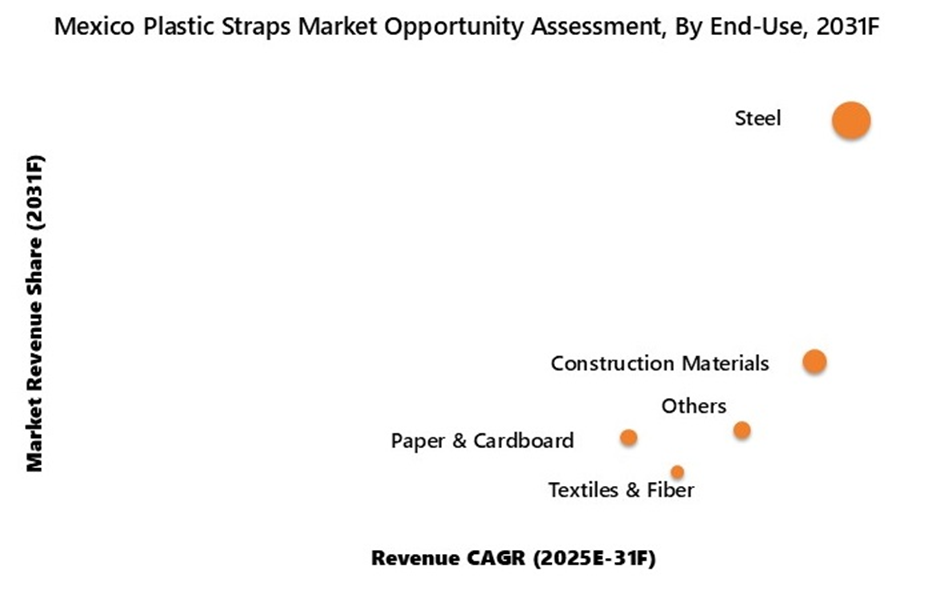

By 2031, the steel sector is expected to remain the largest end-use segment, holding the maximum revenue size due to Mexico’s strong industrial base and heavy reliance on steel-intensive sectors such as automotive, construction, and infrastructure. With manufacturing exports projected to grow from 2024 to 2030, demand for durable PET and polyester straps for bundling and stabilizing heavy-duty loads such as coils, beams, and automotive parts would continue to accelerate.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data: Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Mexico Plastic Straps Market Overview

- Mexico Plastic Straps Market Outlook

- Mexico Plastic Straps Market Forecast

- Historical Data and Forecast of Mexico Plastic Straps Market Revenues and Volume for the Period 2021-2031F

- Historical Data and Forecast of Mexico Plastic Straps Market Revenues and Volume, By Type, for the Period 2021-2031F

- Historical Data and Forecast of Mexico Plastic Straps Market Revenues, By End-Use, for the Period 2021-2031F

- Mexico Plastic Straps Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- Mexico Plastic Straps Market Trends

- Market Opportunity Assessment

- Mexico Plastic Straps Market Revenue Ranking, By Top 3 Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Type

- Polyester Straps

- Polypropylene Straps

- Nylon and Other Straps

By End-Use

- Steel

- Construction Materials

- Paper & Cardboard

- Textiles & Fiber

- Others

Mexico Plastic Straps Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Global Plastic Straps Market Overview |

| 3.1. Global Plastic Straps Market Revenues, 2021 - 2031F |

| 4. Mexico Plastic Straps Market Overview |

| 4.1. Mexico Plastic Straps Market Revenues and Volume, 2021 - 2031F |

| 4.2. Mexico Plastic Straps Market - Industry Life Cycle |

| 4.4. Mexico Plastic Straps Market - Porter's Five Forces |

| 4.4. Mexico Plastic Straps Market - Macroeconomic Indicators |

| 5. Mexico Plastic Straps Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.3 Market Restraints |

| 6. Mexico Plastic Straps Market Trends |

| 7. Mexico Plastic Straps Market Overview, By Type |

| 7.1 Mexico Plastic Straps Market Revenue Share and Volume Share, By Type, 2024 & 2031F |

| 7.2 Mexico Plastic Straps Market Revenues and Volume, By Type, 2021-2031F |

| 7.2.1 Mexico Plastic Straps Market Revenues and Volume, By Polyester Straps, 2021-2031F |

| 7.2.2 Mexico Plastic Straps Market Revenues and Volume, By Polypropylene Straps, 2021-2031F |

| 7.2.3 Mexico Plastic Straps Market Revenues and Volume, By Nylon and Other Straps, 2021-2031F |

| 8. Mexico Plastic Straps Market Overview, By End-Use |

| 8.1 Mexico Plastic Straps Market Revenue Share, By End-Use, 2024 & 2031F |

| 8.1.1 Mexico Plastic Straps Market Revenues, By Steel, 2021-2031F |

| 8.1.2 Mexico Plastic Straps Market Revenues, By Construction Materials, 2021-2031F |

| 8.1.3 Mexico Plastic Straps Market Revenues, By Paper & Cardboard, 2021-2031F |

| 8.1.4 Mexico Plastic Straps Market Revenues, By Textiles & Fiber, 2021-2031F |

| 8.1.5 Mexico Plastic Straps Market Revenues, By Others, 2021-2031F |

| 9. Mexico Plastic Straps Market Key Performance Indicators |

| 10. Mexico Plastic Straps Market Opportunity Assessment |

| 10.1 Mexico Plastic Straps Market Opportunity Assessment, By Type, 2031F |

| 10.2 Mexico Plastic Straps Market Opportunity Assessment, By End-Use, 2031F |

| 11. Mexico Plastic Straps Market Competitive Landscape |

| 11.1 Mexico Plastic Straps Market Top 3 Companies Revenue Ranking, 2024 |

| 11.2 Mexico Plastic Straps Market Competitive Landscape, By Technical Parameter |

| 11.3 Mexico Plastic Straps Market Competitive Landscape, By Operating Parameter |

| 12. Company Profiles |

| 12.1 Greenbridge |

| 12.2 Toyokasei México |

| 12.3 MOSCA GmbH |

| 12.4 Signode Industrial Group México |

| 12.5 Garibaldi S.A |

| 12.6 The Strapping Company |

| 12.7 FROMM Holding AG |

| 12.8 Cordstrap Group |

| 12.9 Polipak Plastic Packaging Ltd. |

| 12.10 Linyi GUDE Packaging Products Co LTD |

| 12.11 Teufelberger Holding |

| 12.12 Messersì Packaging S.r.l. |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| 1: Global Plastic Straps Market Revenues, 2021-2031F ($ Billion) |

| 2: Mexico Plastic Straps Market Revenues and Volume, 2021-2031F ($ Million, Tonnes) |

| 3: Mexico Inflation Rate, Average Consumer Prices, YOY Change, 2021-2026F & 2030F (%) |

| 4: Mexico Primary Net Lending/Borrowing, 2021-2026F, (% of GDP) |

| 5: Mexico Ecommerce Market Size, 2024 and 2027F ($ Billion) |

| 6: Ecommerce Spend in Each Consumer Goods Category in Mexico, 2024 and 2025 (US$ Billion) |

| 7: Mexico FDI Inflow in Manufacture Sector, 3Q23 and 3Q24 ($ Billion) |

| 8: Mexico Exports of Manufacturing Goods, 2023 and 2024 ($ Billion) |

| 9: Mexico Plastic Straps Market Revenue Share, By Type, 2024 & 2031F |

| 10: Mexico Plastic Straps Market Volume Share, By Type, 2024 & 2031F |

| 11: Mexico Plastic Straps Market Revenue Share, By End-Use, 2024 & 2031F |

| 12: Mexico Packaging Machinery Market Size, 2023 ($ Millions) |

| 13: Mexico Plastic Straps Market Opportunity Assessment, By Type-Revenue Outlook, 2031F |

| 14: Mexico Plastic Straps Market Opportunity Assessment, By Type-Volume Outlook, 2031F |

| 15: Mexico Plastic Straps Market Opportunity Assessment, By End-Use, 2031F |

| 16: Mexico Plastic Strap Market Revenue Ranking, By Companies, CY2024 |

| List of table |

| 1: Mexico Economy Key Figures, 2024-2025E & 2030F |

| 2: Mexico Plastic Straps Market Revenues, By Type, 2021-2031F ($ Million) |

| 3: Mexico Plastic Straps Market Volume, By Type, 2021-2031F (Tonnes) |

| 4: Mexico Plastic Straps Market Revenues, By End-Use, 2021-2031F ($ Million) |

| 5: Key Packaging and Manufacturing Investments in Mexico (2023–2024) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero