Middle East Electric Vehicle Market (2022-2028) | Trends, Size, Share, Revenue, Analysis, Forecast, Value, Growth, Industry, Outlook & COVID-19 IMPACT

Market Forecast By Vehicle Types (Two-Wheeler, Passenger Vehicle, Bus, Trucks), By Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, and Bahrain) And by Competitive Landscape.

| Product Code: ETC072115 | Publication Date: Feb 2023 | Updated Date: Jun 2024 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 113 | No. of Figures: 54 | No. of Tables: 14 | |

Middle East Electric Vehicle Market report comprehensively covers the market by vehicle types and by country. Middle East electric vehicle market report provides an unbiased and detailed analysis of the ongoing trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Latest 2024 Development of the Middle East Electric Vehicle Market

Middle East Electric Vehicle Market is experiencing massive growth owing to several growth factors. Also, the market has accomplished various developments over the years such as the launch of the Green Vehicle initiative to encourage the use of electric vehicles and to reduce the carbon footprint. In addition, Saudi Arabia has also announced its plans to launch a pilot project for electric vehicles and to promote the use of electric vehicles in the country. Bahrain is also planning to increase the use of electric vehicles and has announced plans to install charging stations in the country. In Qatar, the Ministry of Energy and Industry has launched the National Energy Strategy which aims to increase the use of renewable energy sources. The country is also developing a network of electric vehicle charging stations.

The charging infrastructure in the region is also being rapidly developed, with new charging stations to support the number of EVs on the road. There is a plan to establish cross-border charging networks to support long-distance travel by EVs.

Middle East Electric Vehicle Market Synopsis

Middle East Vehicle market witnessed steady growth during 2021 owing to government efforts of the Middle East countries to reduce the dependence on oil and facilitate the adoption of electric vehicles to reduce automobile emissions for meeting net zero targets set by the Middle East countries. Owing to COVID-19-led restrictions among the trade partner countries and a fall in fuel demand as well as prices around the world, the Middle Eastern countries witnessed the need for the development of the manufacturing sector and diversification of their economy. Hence, manufacturing, electric mobility and renewable energy in the Middle East are expected to gain momentum in the upcoming years. The market is estimated to experience improved demand for electric cars from the passenger vehicles segment owing to a high preference for luxury cars offered by brands such as Tesla, Lucid, BMW, among others. Government projects and policies are also affecting electric vehicle market’s growth and are estimated to upkeep the growth over the near future.

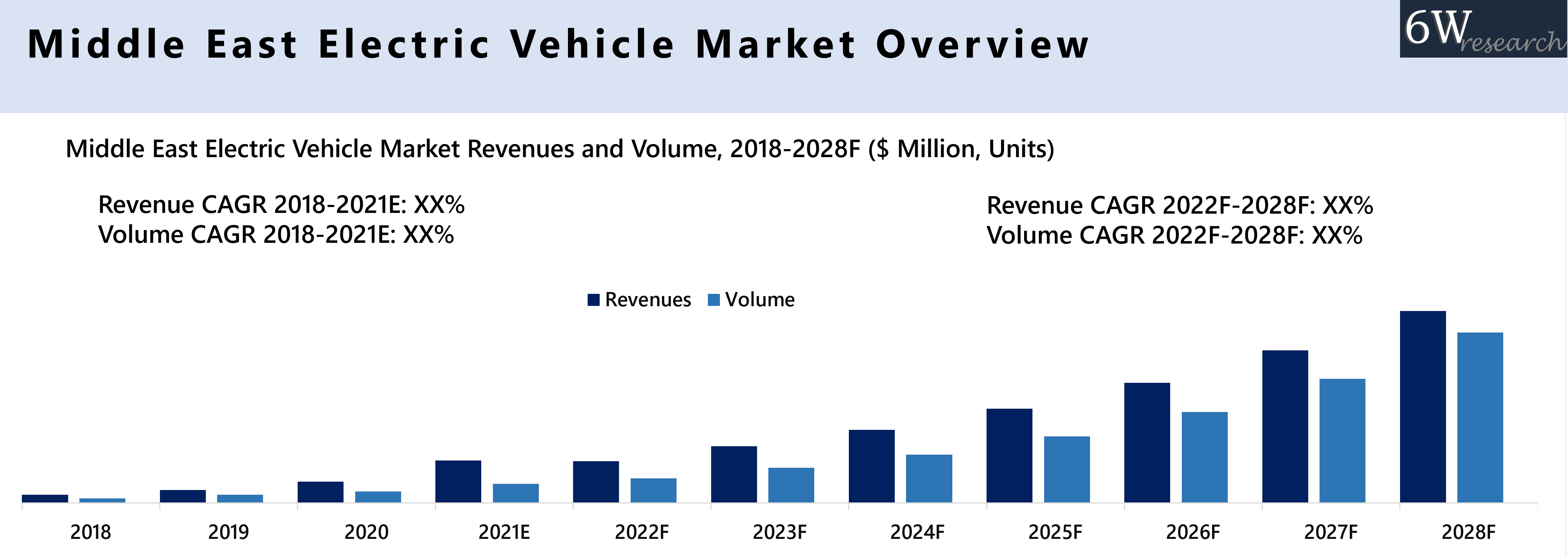

According to 6Wresearch, the Middle East electric vehicle market size grew at a CAGR of 28.9% during 2022-2028. Oil is one of the country's key sources of revenue, however, new renewable energy and sustainable transportation technologies are aiding the country's economic growth. The government strategies of the Middle East countries intend to lessen dependency on oil and diversify the economy while implementing a variety of reforms. As a result, the push to increase electric car sales would elevate the demand for efficient charging systems thus, boosting the electric vehicle industry.

Market Analysis By Vehicle Types

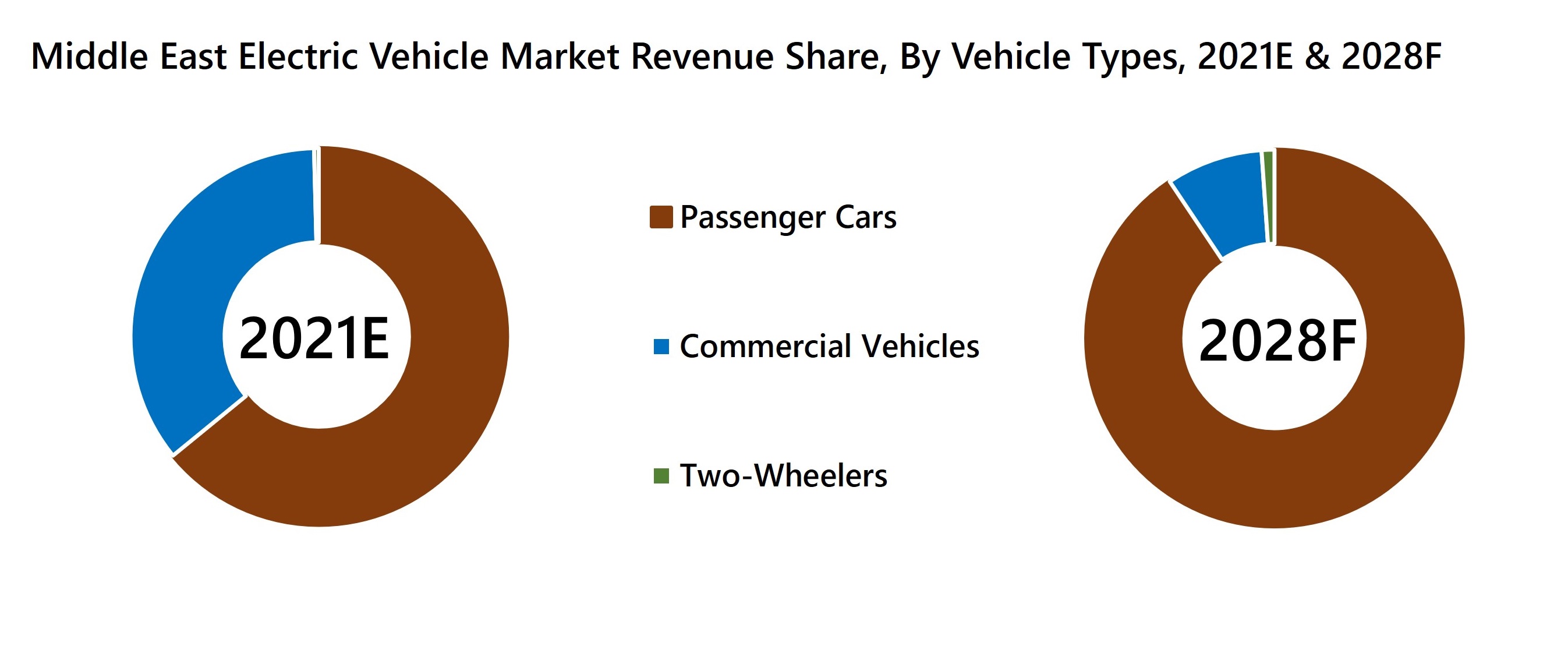

Passenger cars dominated the Middle East electric vehicle market in terms of revenue and volume during the year 2021 and a similar trend is expected to continue in the forthcoming years. The industry is innovative and constantly growing due to changing mobility needs and concepts, increasing demand for eco-friendly and efficient transportation, and improving technology. In recent years, a number of OEMs announced their intention to enhance their footprint in the Middle East electric vehicle industry.

Market Segmentation by Countries

By countries, UAE garnered the highest share in the Middle East Electric vehicle market majorly owing to incentive schemes such as free charging facilities and free of cost parking in regions such as Dubai and Abu Dhabi. On account of the presence of all major brands such as Tesla, BMW, Volkswagen, and General Motors, among others and the high preference for expensive automobiles driven by high-income of individuals is also expected to drive the future growth of the UAE electric vehicle market.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 6 Years Market Numbers.

- Estimated Data Starting from 2022F to 2028F.

- Base Year: 2021

- Forecast Data until 2028F.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Middle East Electric Vehicle Market Overview

- Middle East Electric Vehicle Market Outlook

- Middle East Electric Vehicle Market Forecast

- Historical Data and Forecast Middle East Electric Vehicle Market Revenues and Volume for the Period 2018-2028F

- Historical Data and Forecast of Middle East Electric Vehicle Market Revenues and Volume, By Vehicle Types, for the Period 2018-2028F

- Historical Data and Forecast of Middle East Electric Vehicle Market Revenues and Volume, By Countries, for the Period 2018-2028F

- Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- Impact Analysis of COVID-19

- Market Trends

- Middle East Vehicle Market Revenue Ranking, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Vehicle Types

- Passenger Cars

- Two Wheelers

- Commercial Vehicles

By Countries

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Oman

- Bahrain

Middle East Electric Vehicle Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3Market Scope and Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Middle East Electric Vehicle Market Overview |

| 3.1 Middle East Electric Vehicle Market Revenues and Volume (2018-2028F) |

| 3.2 Middle East Electric Vehicle Market Industry Life Cycle |

| 3.3 Middle East Electric Vehicle Market Porter’s Five Forces Model |

| 3.4 Middle East Electric Vehicle Market Revenue and Volume Share, By Vehicle Types (2021E & 2028F) |

| 3.5 Middle East Electric Vehicle Market Revenue Share, By Countries (2021E & 2028F) |

| 4. Impact Analysis of COVID-19 on Middle East Electric Vehicle Market |

| 5. Middle East Electric Vehicle Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.3 Market Restraints |

| 6. Middle East Electric Vehicle Market Trends & Evolution |

| 7. Saudi Arabia Electric Vehicle Market Overview |

| 7.1 Saudi Arabia Electric Vehicle Market Revenues and Volume (2018-2028F) |

| 7.2 Saudi Arabia Electric Vehicle Market Revenue and Volume Share, By Vehicle Types (2021E & 2028F) |

| 7.3 Saudi Arabia Electric Vehicle Market Revenues and Volume, By Vehicle Types (2018-2028F) |

| 7.3.1 Saudi Arabia Electric Vehicle Market Revenues and Volume, By Passenger Cars (2018-2028F) |

| 7.3.2 Saudi Arabia Electric Vehicle Market Revenues and Volume, By Commercial Vehicles (2018-2028F) |

| 7.3.3 Saudi Arabia Electric Vehicle Market Revenues and Volume, By Two Wheelers (2018-2028F) |

| 7.4 Saudi Arabia Electric Vehicle Market - Key Performance Indicators |

| 7.5 Saudi Arabia Electric Vehicle Market - Opportunity Assessment |

| 7.6 Saudi Arabia Electric Vehicle Market Revenue Share/Ranking, By Companies (2021E) |

| 8. UAE Electric Vehicle Market Overview |

| 8.1 UAE Electric Vehicle Market Revenues and Volume (2018-2028F) |

| 8.2 UAE Electric Vehicle Market Revenue and Volume Share, By Vehicle Types (2021E & 2028F) |

| 8.3 UAE Electric Vehicle Market Revenues and Volume, By Vehicle Types (2018-2028F) |

| 8.3.1 UAE Electric Vehicle Market Revenues and Volume, By Passenger Cars (2018-2028F) |

| 8.3.2 UAE Electric Vehicle Market Revenues and Volume, By Commercial Vehicles (2018-2028F) |

| 8.3.3 UAE Electric Vehicle Market Revenues and Volume, By Two Wheelers (2018-2028F) |

| 8.4 UAE Electric Vehicle Market - Key Performance Indicators |

| 8.5 UAE Electric Vehicle Market - Opportunity Assessment |

| 8.6 UAE Electric Vehicle Market Revenue Share/Ranking, By Companies (2021E) |

| 9. Qatar Electric Vehicle Market Overview |

| 9.1 Qatar Electric Vehicle Market Revenues and Volume (2018-2028F) |

| 9.2 Qatar Electric Vehicle Market Revenue and Volume Share, By Vehicle Types (2021E & 2028F) |

| 9.3 Qatar Electric Vehicle Market Revenues and Volume, By Vehicle Types (2018-2028F) |

| 9.3.1 Qatar Electric Vehicle Market Revenues and Volume, By Passenger Cars (2018-2028F) |

| 9.3.2 Qatar Electric Vehicle Market Revenues and Volume, By Commercial Vehicles (2018-2028F) |

| 9.3.3 Qatar Electric Vehicle Market Revenues and Volume, By Two Wheelers (2018-2028F) |

| 9.4 Qatar Electric Vehicle Market - Key Performance Indicators |

| 9.5 Qatar Electric Vehicle Market - Opportunity Assessment |

| 9.6 Qatar Electric Vehicle Market Revenue Share/Ranking, By Companies (2021E) |

| 10. Kuwait Electric Vehicle Market Overview |

| 10.1 Kuwait Electric Vehicle Market Revenues and Volume (2018-2028F) |

| 10.2 Kuwait Electric Vehicle Market Revenue and Volume Share, By Vehicle Types (2021E & 2028F) |

| 10.3 Kuwait Electric Vehicle Market Revenues and Volume, By Vehicle Types (2018-2028F) |

| 10.3.1 Kuwait Electric Vehicle Market Revenues and Volume, By Passenger Cars (2018-2028F) |

| 10.3.2 Kuwait Electric Vehicle Market Revenues and Volume, By Commercial Vehicles (2018-2028F) |

| 10.3.3 Kuwait Electric Vehicle Market Revenues and Volume, By Two Wheelers (2018-2028F) |

| 10.4 Kuwait Electric Vehicle Market - Key Performance Indicators |

| 10.5 Kuwait Electric Vehicle Market - Opportunity Assessment |

| 10.6 Kuwait Electric Vehicle Market Revenue Share/Ranking, By Companies (2021E) |

| 11. Oman Electric Vehicle Market Overview |

| 11.1 Oman Electric Vehicle Market Revenues and Volume (2018-2028F) |

| 11.2 Oman Electric Vehicle Market Revenue and Volume Share, By Vehicle Types (2021E & 2028F) |

| 11.3 Oman Electric Vehicle Market Revenues and Volume, By Vehicle Types (2018-2028F) |

| 11.3.1 Oman Electric Vehicle Market Revenues and Volume, By Passenger Cars (2018-2028F) |

| 11.3.2 Oman Electric Vehicle Market Revenues and Volume, By Commercial Vehicles (2018-2028F) |

| 11.3.3 Oman Electric Vehicle Market Revenues and Volume, By Two Wheelers (2018-2028F) |

| 11.4 Oman Electric Vehicle Market - Key Performance Indicators |

| 11.5 Oman Electric Vehicle Market - Opportunity Assessment |

| 11.6 Oman Electric Vehicle Market Revenue Share/Ranking, By Companies (2021E) |

| 12. Bahrain Electric Vehicle Market Overview |

| 12.1 Bahrain Electric Vehicle Market Revenues and Volume (2018-2028F) |

| 12.2 Bahrain Electric Vehicle Market Revenue and Volume Share, By Vehicle Types (2021E & 2028F) |

| 12.3 Bahrain Electric Vehicle Market Revenues and Volume, By Vehicle Types (2018-2028F) |

| 12.3.1 Bahrain Electric Vehicle Market Revenues and Volume, By Passenger Cars (2018-2028F) |

| 12.3.2 Bahrain Electric Vehicle Market Revenues and Volume, By Commercial Vehicles (2018-2028F) |

| 12.3.3 Bahrain Electric Vehicle Market Revenues and Volume, By Two Wheelers (2018-2028F) |

| 12.4 Bahrain Electric Vehicle Market - Key Performance Indicators |

| 12.5 Bahrain Electric Vehicle Market - Opportunity Assessment |

| 12.6 Bahrain Electric Vehicle Market Revenue Share/Ranking, By Companies (2021E) |

| 13. Middle East Electric Vehicle Market - Price Trend Analysis |

| 14. Middle East Electric Vehicle Market Competitive Landscape |

| 14.1 Middle East Electric Vehicle Market Competitive Benchmarking, By Operating Parameters |

| 15. Company Profiles |

| 15.1 Nissan Motor Co, Ltd. |

| 15.2 Tesla, Inc. |

| 15.3 Hyundai Motor Company |

| 15.4 Toyota Motor Corporation |

| 15.5 The Volkswagen AG |

| 15.6 General Motors Company |

| 15.7 Lucid Group, Inc., |

| 15.8 Zhengzhou Yutong Bus Co. Ltd. |

| 15.9 BMW Group |

| 15.10 MG Motors |

| 16. Key Strategic Recommendations |

| 17. Disclaimer |

| List of Figures |

| 1. Middle East Electric Vehicle Market Revenues and Volume, 2018-2028F ($ Million, Units) |

| 2. Middle East Electric Vehicle Market Revenue Share, By Vehicle Types, 2021E & 2028F |

| 3. Middle East Electric Vehicle Market Volume Share, By Vehicle Types, 2021E & 2028F` |

| 4. Middle East Electric Vehicle Market Revenue Share, By Countries, 2021E & 2028F |

| 5. GDP Share of Oil and Gas Sector in Middle East, 2020 |

| 6. PM2.5 concentration in Middle East countries, 2020 |

| 7. Electric car battery prices, 2015-2025F, USD/kWh |

| 8. Saudi Arabia Electric Vehicle Market Revenues and Volume, 2018-2028F ($ Million, Units) |

| 9. Saudi Arabia Electric Vehicle Market Revenues and Volume, 2018-2028F ($ Million, Units) |

| 10. Saudi Arabia Electric Vehicle Market Volume Share, By Vehicle Types, 2021E & 2028F |

| 11. Total Imports of Motor Vehicles in Saudi Arabia, 2017-2020 ($ Thousand) |

| 12. Distribution of EV Connectors in 2021 |

| 13. Saudi Arabia Electric Vehicle Market Opportunity Assessment, By Vehicle Types, 2028F |

| 14. Saudi Arabia Electric Vehicle Market Revenue Ranking, By Companies, 2021E |

| 15. UAE Electric Vehicle Market Revenues and Volume, 2018-2028F ($ Million, Units) |

| 16. UAE Electric Vehicle Market Revenue Share, By Vehicle Types, 2021E & 2028F |

| 17. UAE Electric Vehicle Market Volume Share, By Vehicle Types, 2021E & 2028F |

| 18. Distribution of EV Connectors in 2021 |

| 19. UAE Electric Vehicle Market Volume Opportunity Assessment, By Vehicle Types, 2028F |

| 20. UAE Electric Vehicle Market Revenue Ranking, By Companies, 2021E |

| 21. Qatar Electric Vehicle Market Revenues and Volume, 2019-2028F ($ Thousand, Units) |

| 22. Qatar Electric Vehicle Market Revenue Share, By Vehicle Types, 2021E & 2028F |

| 23. Qatar Electric Vehicle Market Volume Share, By Vehicle Types, 2021E & 2028F |

| 24. Distribution of Connectors in 2021 |

| 25. Qatar Electric Vehicle Market Opportunity Assessment, By Vehicle Types, 2028F |

| 26. Qatar Electric Vehicle Market revenue Ranking, by companies, 2021E |

| 27. Kuwait Electric Vehicle Market Revenues and Volume, 2018-2028F ($ Thousand, Units) |

| 28. Kuwait Electric Vehicle Market Revenue Share, By Vehicle Types, 2021E & 2028F |

| 29. Kuwait Electric Vehicle Market Volume Share, By Vehicle Types , 2021E & 2028F |

| 30. Kuwait Motor Vehicle Sales Growth, 2018-Q1 2021 (in %) |

| 31. Distribution of Connectors in 2021 |

| 32. Kuwait Electric Vehicle Market Opportunity Assessment, By Vehicle Types, 2028F |

| 33. Kuwait Electric Vehicle Market Revenue Ranking, By Companies, 2021E |

| 34. Oman Electric Vehicle Market Revenues and Volume, 2021E-2028F ($ Thousand, Units) |

| 35. Oman Electric Vehicle Market Revenue Share, By Vehicle Types, 2021E & 2028F |

| 36. Oman Electric Vehicle Market Volume Share, By Vehicle Types , 2021E & 2028F |

| 37. Oman Motor Vehicle Sales Growth, 2017-2019 (in %) |

| 38. Oman Total Registered Vehicles by Vehicle Type, 2020-2021 (August-November) |

| 39. Distribution of Connectors in 2021 |

| 40. Oman Electric Vehicle Market Opportunity Assessment, By Vehicle Types, 2028F |

| 41. Oman Electric Vehicle Market Revenue Ranking, By Companies, 2021E |

| 42. Bahrain Electric Vehicle Market Revenues and Volume, 2021E-2028F ($ Thousand, Units) |

| 43. Bahrain Electric Vehicle Market Revenue Share, By Vehicle Types, 2021E & 2028F |

| 44. Bahrain Electric Vehicle Market Volume Share, By Vehicle Types, 2021E & 2028F |

| 45. Bahrain Motor Vehicle Sales, 2015-2019 |

| 46. Distribution of Connectors in 2021 |

| 47. Bahrain Electric Vehicle Market Opportunity Assessment, By Vehicle Types, 2028F |

| 48. Bahrain Electric Vehicle Market Revenue Ranking, By Companies, 2021E |

| 49. Saudi Arabia Electric Vehicle Market Price Trend Analysis, By Vehicle Types($), 2018-2028F |

| 50. UAE Electric Vehicle Market Price Trend Analysis, By Vehicle Types($), 2018-2028F |

| 51. Qatar Electric Vehicle Market Price Trend Analysis, By Vehicle Types, 2018-2028F |

| 52. Kuwait Electric Vehicle Market Price Trend Analysis, By Vehicle Types, 2018-2028F |

| 53. Oman Electric Vehicle Market Price Trend Analysis, By Vehicle Types, 2018-2028F |

| 54. Bahrain Electric Vehicle Market Price Trend Analysis, By Vehicle Types, 2018-2028F |

| List of Tables |

| 1. Emission targets and carbon emission by Middle East countries in 2020 |

| 2. Fuel prices in different countries, 2021 |

| 3. Saudi Arabia Electric Vehicle Market Revenues, By Vehicle Types, 2018-2028F ($ Million) |

| 4. Saudi Arabia Electric Vehicle Market Volume, By Vehicle Types, 2018-2028F (Units) |

| 5. UAE Electric Vehicle Market Revenues, By Vehicle Types, 2018-2028F ($ Million) |

| 6. UAE Electric Vehicle Market Volume, By Vehicle Types, 2018-2028F (Units) |

| 7. Qatar Electric Vehicle Market Revenues, By Vehicle Types, 2019-2028F ($ Thousand) |

| 8. Qatar Electric Vehicle Market Volume, By Vehicle Types, 2019-2028F (Units) |

| 9. Kuwait Electric Vehicle Market Revenues, By Vehicle Types, 2018-2028F ($ Thousand) |

| 10. Kuwait Electric Vehicle Volume, By Vehicle Types, 2018-2028F ($ Thousand) |

| 11. Oman Electric Vehicle Market Revenues, By Vehicle Types, 2021E-2028F ($ Thousand) |

| 12. Oman Electric Vehicle Market Volume, By Vehicle Types, 2021E-2028F (Units) |

| 13. Bahrain Electric Vehicle Market Revenues, By Vehicle Types, 2021E-2028F ($ Thousand) |

| 14. Bahrain Electric Vehicle Market Volume, By Vehicle Types, 2021E-2028F (Units) |

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero