Middle East Power Rental Market (2019-2025) | Size, Revenue, Industry, Outlook, Share, Value, Analysis, Growth, Trends, Companies & Forecast

Market Forecast By Types (Diesel and Gas), By kVA Rating (Below 100 kVA, 100.1 to 350 kVA, 350.1 to 750 kVA, 750.1 to 1000 kVA and Above 1000 kVA), By Applications (Power Utilities, Oil and Gas, Construction, Manufacturing, Quarrying and Mining and Others including Events, Retail and Commercial), By Countries (Turkey, Qatar, United Arab Emirates, Saudi Arabia, Kuwait, Oman, Bahrain and Rest of Middle East including Lebanon and Jordan) and Competitive Landscape.

| Product Code: ETC000687 | Publication Date: Feb 2022 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 270 | No. of Figures: 180 | No. of Tables: 29 |

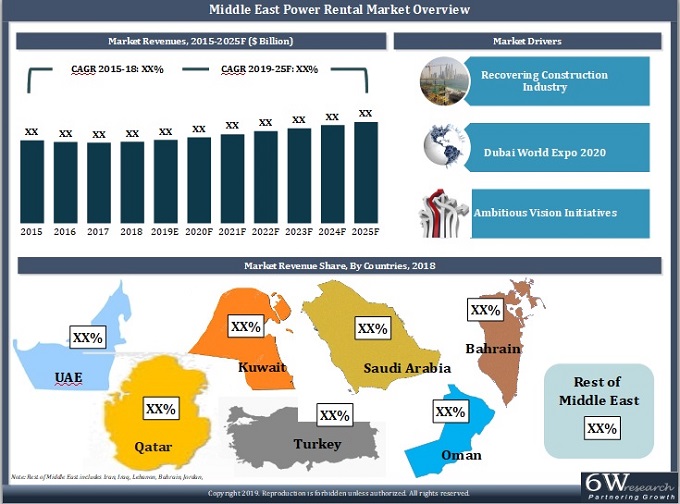

Middle East Power Rental Market is expected to register substantial growth on account of increasing demand for regular power. Fall in crude oil prices led to halting or cancellation of several large-scale construction projects due to reduced government expenditure, thereby affecting Middle East Power Rental Market Growth. However, growth in the construction sector on account of increased infrastructure spending in UAE and Qatar for upcoming events such as Dubai Expo 2020 and FIFA world cup 2022 are driving the Middle East Power Rental Market revenues.

According to 6Wresearch, the Middle East power rental market size is projected to grow at a CAGR of 3.1% during 2019-25. Government initiatives such as Saudi Vision 2030, UAE Vision 2021, Bahrain Vision 2030, and Turkey Vision 2023 would spur the Middle east power rental market share. These initiatives include the expansion of metros and airports, along with the construction of new hotels and shopping malls, these initiatives would boost the demand for power rental in the Middle East region during the forecast period.

The construction application segment is expected to demonstrate significant growth over the coming years owing to a large number of upcoming infrastructure projects in the region. Additionally, expanding power utilities and manufacturing sectors in the Middle East region would also play an important role in the Middle East power rental market revenue as the majority of the countries in the Middle East are diversifying their economies and strengthening the non-oil sectors. Some of the major companies acquiring the Middle East power rental market share include- Aggreko, Byrne Equipment Rental, Rental Solutions & Services LLC, Altaaqa Global, Peax Equipment Rental, and Atlas Copco.

The Middle East Power Rental Market report comprehensively covers the market by types, applications, kVA rating, and countries. The Middle East power rental market outlook report provides an unbiased and detailed analysis of the Middle East Power Rental Market trends, opportunities, high growth areas, and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Key Highlights of the Middle East Power Rental Market Report:

- Middle East Power Rental Market Overview

- Middle East Power Rental Market Outlook

- Middle East Power Rental Market Size and Middle East Power Rental Market Forecast, until 2025

- Historical Data of UAE, Saudi Arabia, Turkey, Qatar, Kuwait, Bahrain, and Oman Power Rental Market Revenues by kVA Rating for the Period, 2015-2018

- Market Size & Forecast of UAE, Saudi Arabia, Turkey, Qatar, Kuwait, Bahrain, and Oman Power Rental Market Revenues by kVA Rating, until 2025F

- Historical Data of UAE, Saudi Arabia, Turkey, Qatar, Kuwait, Bahrain, and Oman Power Rental Market Revenues by Applications for the Period, 2015-2018

- Historical Data of UAE, Saudi Arabia, Turkey, Qatar, Kuwait, Bahrain, and Oman Power Rental Market Revenues for the Period, 2015-2018

- Market Size & Forecast of UAE, Saudi Arabia, Turkey, Qatar, Kuwait, Bahrain, and Oman Power Rental Market Revenues, until 2025F

- Historical Data of UAE, Saudi Arabia, Turkey, Qatar and Oman Power Rental Market Revenues by Type, 2018

- Market Size & Forecast of UAE, Saudi Arabia, Turkey, Qatar, Kuwait, Bahrain, and Oman Power Rental Market Revenues by Applications, until 2025F

- Market Drivers and Restraints

- Middle East Power Rental Market Trends

- Middle East Power Rental Market Overview on Competitive Benchmarking

- Competitive Landscape

- Middle East Power Rental Market Share, By Players

- Company Profiles

- Key Strategic Recommendations

Markets Covered:

The Middle East Power Rental Market report provides a detailed analysis of the following market segments:

By Types:

- Diesel

- Gas

By kVA Rating (Only Diesel)

- Below 100 kVA

- 1 to 350 kVA

- 1 to 750 kVA

- 1 to 1000 kVA

- Above 1000 kVA

By Countries

- Turkey

- Qatar

- United Arab Emirates

- Saudi Arabia

- Kuwait

- Oman

- Bahrain

- Rest of the Middle East (Lebanon, Jordan, etc)

By Applications

- Power Utilities

- Oil and Gas

- Construction

- Manufacturing

- Quarrying and Mining

- Others (Events, Retail, Commercial, etc)

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Middle East Power Rental Market Overview |

| 3.1 Middle East Power Rental Market Revenues, 2015-2025F |

| 3.2 Middle East Power Rental Market Revenue Share By Countries, 2018 & 2025F |

| 3.3 Middle East Power Rental Market - Industry Life Cycle, 2018 |

| 3.4 Middle East Power Rental Market - Porter's Five Forces |

| 4. Middle East Power Rental Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Middle East Power Rental Market Trends |

| 6. Saudi Arabia Power Rental Market Overview |

| 6.1 Saudi Arabia Country Indicators |

| 6.2 Saudi Arabia Power Rental Market Revenues, 2015-2025F |

| 6.3 Saudi Arabia Power Rental Market Revenue Share, By Types |

| 6.4 Saudi Arabia Diesel Genset Rental Market Revenues, 2015-2025F |

| 6.5 Saudi Arabia Diesel Genset Rental Market Revenue Share, By kVA Rating |

| 6.5.1 Saudi Arabia Below 100 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 6.5.2 Saudi Arabia 100-350 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 6.5.3 Saudi Arabia 350-750 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 6.5.4 Saudi Arabia 750-1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 6.5.5 Saudi Arabia Above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 6.6 Saudi Arabia Diesel Genset Rental Market Revenue Share, By Applications |

| 6.6.1 Saudi Arabia Power Utilities Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 6.6.2 Saudi Arabia Oil and Gas Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 6.6.3 Saudi Arabia Construction Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 6.6.4 Saudi Arabia Manufacturing Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 6.6.5 Saudi Arabia Quarrying and Mining Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 6.6.6 Saudi Arabia Other Applications Diesel Genset Rental Market Revenues, 2015-2025F |

| 6.7 Saudi Arabia Power Rental Market Key Performance Indicators |

| 6.8 Saudi Arabia Power Rental Market Opportunity Assessment |

| 6.8.1 Saudi Arabia Power Rental Market Opportunity Assessment. By kVA Rating |

| 6.8.2 Saudi Arabia Power Rental Market Opportunity Assessment, By Applications |

| 7. UAE Power Rental Market Overview |

| 7.1 UAE Country Indicators |

| 7.2 UAE Power Rental Market Revenues, 2015-2025F |

| 7.3 UAE Power Rental Market Revenue Share, By Types |

| 7.4 UAE Diesel Genset Rental Market Revenues, 2015-2025F |

| 7.5 UAE Diesel Genset Rental Market Revenue Share, By kVA Rating |

| 7.5.1 UAE Below 100 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 7.5.2 UAE 100-350 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 7.5.3 UAE 350-750 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 7.5.4 UAE 750-1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 7.5.5 UAE Above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 7.6 UAE Diesel Genset Rental Market Revenue Share, By Applications |

| 7.6.1 UAE Power Utilities Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 7.6.2 UAE Oil and Gas Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 7.6.3 UAE Construction Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 7.6.4 UAE Manufacturing Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 7.6.5 UAE Quarrying and Mining Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 7.6.6 UAE Other Applications Diesel Genset Rental Market Revenues, 2015-2025F |

| 7.7 UAE Power Rental Market Key Performance Indicators |

| 7.8 UAE Power Rental Market Opportunity Assessment |

| 7.8.1 UAE Power Rental Market Opportunity Assessment. By kVA Rating |

| 7.8.2 UAE Power Rental Market Opportunity Assessment, By Applications |

| 8. Qatar Power Rental Market Overview |

| 8.1 Qatar Country Indicators |

| 8.2 Qatar Power Rental Market Revenues, 2015-2025F |

| 8.3 Qatar Power Rental Market Revenue Share, By Types |

| 8.4 Qatar Diesel Genset Rental Market Revenues, 2015-2025F |

| 8.5 Qatar Diesel Genset Rental Market Revenue Share, By kVA Rating |

| 8.5.1 Qatar Below 100 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 8.5.2 Qatar 100-350 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 8.5.3 Qatar 350-750 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 8.5.4 Qatar 750-1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 8.5.5 Qatar Above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 8.6 Qatar Diesel Genset Rental Market Revenue Share, By Applications |

| 8.6.1 Qatar Power Utilities Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 8.6.2 Qatar Oil and Gas Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 8.6.3 Qatar Construction Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 8.6.4 Qatar Manufacturing Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 8.6.5 Qatar Quarrying and Mining Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 8.6.6 Qatar Other Applications Diesel Genset Rental Market Revenues, 2015-2025F |

| 8.7 Qatar Power Rental Market Key Performance Indicators |

| 8.8 Qatar Power Rental Market Opportunity Assessment |

| 8.8.1 Qatar Power Rental Market Opportunity Assessment. By kVA Rating |

| 8.8.2 Qatar Power Rental Market Opportunity Assessment, By Applications |

| 9. Kuwait Power Rental Market Overview |

| 9.1 Kuwait Country Indicators |

| 9.2 Kuwait Power Rental Market Revenues, 2015-2025F |

| 9.3 Kuwait Diesel Genset Rental Market Revenues, 2015-2025F |

| 9.4 Kuwait Diesel Genset Rental Market Revenue Share, By kVA Rating |

| 9.4.1 Kuwait Below 100 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 9.4.2 Kuwait 100-350 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 9.4.3 Kuwait 350-750 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 9.4.4 Kuwait 750-1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 9.4.5 Kuwait Above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 9.5 Kuwait Diesel Genset Rental Market Revenue Share, By Applications |

| 9.5.1 Kuwait Power Utilities Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 9.5.2 Kuwait Oil and Gas Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 9.5.3 Kuwait Construction Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 9.5.4 Kuwait Manufacturing Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 9.5.5 Kuwait Quarrying and Mining Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 9.5.6 Kuwait Other Applications Diesel Genset Rental Market Revenues, 2015-2025F |

| 9.6 Kuwait Power Rental Market Key Performance Indicators |

| 9.7 Kuwait Power Rental Market Opportunity Assessment |

| 9.7.1 Kuwait Power Rental Market Opportunity Assessment. By kVA Rating |

| 9.7.2 Kuwait Power Rental Market Opportunity Assessment, By Applications |

| 10. Oman Power Rental Market Overview |

| 10.1 Oman Country Indicators |

| 10.2 Oman Power Rental Market Revenues, 2015-2025F |

| 10.3 Oman Power Rental Market Revenue Share, By Types |

| 10.4 Oman Diesel Genset Rental Market Revenues, 2015-2025F |

| 10.5 Oman Diesel Genset Rental Market Revenue Share, By kVA Rating |

| 10.5.1 Oman Below 100 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 10.5.2 Oman 100-350 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 10.5.3 Oman 350-750 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 10.5.4 Oman 750-1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 10.5.5 Oman Above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 10.6 Oman Diesel Genset Rental Market Revenue Share, By Applications |

| 10.6.1 Oman Power Utilities Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 10.6.2 Oman Oil and Gas Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 10.6.3 Oman Construction Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 10.6.4 Oman Manufacturing Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 10.6.5 Oman Quarrying and Mining Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 10.6.6 Oman Other Applications Diesel Genset Rental Market Revenues, 2015-2025F |

| 10.7 Oman Power Rental Market Key Performance Indicators |

| 10.8 Oman Power Rental Market Opportunity Assessment |

| 10.8.1 Oman Power Rental Market Opportunity Assessment. By kVA Rating |

| 10.8.2 Oman Power Rental Market Opportunity Assessment, By Applications |

| 11. Turkey Power Rental Market Overview |

| 11.1 Turkey Country Indicators |

| 11.2 Turkey Power Rental Market Revenues, 2015-2025F |

| 11.3 Turkey Power Rental Market Revenue Share, By Types |

| 11.4 Turkey Diesel Genset Rental Market Revenues, 2015-2025F |

| 11.5 Turkey Diesel Genset Rental Market Revenue Share, By kVA Rating |

| 11.5.1 Turkey Below 100 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 11.5.2 Turkey 100-350 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 11.5.3 Turkey 350-750 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 11.5.4 Turkey 750-1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 11.5.5 Turkey Above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 11.6 Turkey Diesel Genset Rental Market Revenue Share, By Applications |

| 11.6.1 Turkey Power Utilities Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 11.6.2 Turkey Oil and Gas Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 11.6.3 Turkey Construction Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 11.6.4 Turkey Manufacturing Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 11.6.5 Turkey Quarrying and Mining Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 11.6.6 Turkey Other Applications Diesel Genset Rental Market Revenues, 2015-2025F |

| 11.7 Turkey Power Rental Market Key Performance Indicators |

| 11.8 Turkey Power Rental Market Opportunity Assessment |

| 11.8.1 Turkey Power Rental Market Opportunity Assessment. By kVA Rating |

| 11.8.2 Turkey Power Rental Market Opportunity Assessment, By Applications |

| 12. Bahrain Power Rental Market Overview |

| 12.1 Bahrain Country Indicators |

| 12.2 Bahrain Power Rental Market Revenues, 2015-2025F |

| 12.3 Bahrain Diesel Genset Rental Market Revenues, 2015-2025F |

| 12.4 Bahrain Diesel Genset Rental Market Revenue Share, By kVA Rating |

| 12.4.1 Bahrain Below 100 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 12.4.2 Bahrain 100-350 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 12.4.3 Bahrain 350-750 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 12.4.4 Bahrain 750-1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 12.4.5 Bahrain Above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F |

| 12.5 Bahrain Diesel Genset Rental Market Revenue Share, By Applications |

| 12.5.1 Bahrain Power Utilities Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 12.5.2 Bahrain Oil and Gas Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 12.5.3 Bahrain Construction Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 12.5.4 Bahrain Manufacturing Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 12.5.5 Bahrain Quarrying and Mining Application Diesel Genset Rental Market Revenues, 2015-2025F |

| 12.5.6 Bahrain Other Applications Diesel Genset Rental Market Revenues, 2015-2025F |

| 12.6 Bahrain Power Rental Market Key Performance Indicators |

| 12.7 Bahrain Power Rental Market Opportunity Assessment |

| 12.7.1 Bahrain Power Rental Market Opportunity Assessment. By kVA Rating |

| 12.7.2 Bahrain Power Rental Market Opportunity Assessment, By Applications |

| 13. Rest of Middle East Power Rental Market Overview |

| 13.1 Middle East Other Countries Power Rental Market Revenues, 2015-2025F |

| 14. Middle East Power Rental Market Competitive Landscape |

| 14.1 Competitive Benchmarking, By kVA Rating |

| 14.2 Saudi Arabia Power Rental Market Revenue Share, By Company, 2018 |

| 14.3 UAE Power Rental Market Revenue Share, By Company, 2018 |

| 14.4 Qatar Power Rental Market Revenue Share, By Company, 2018 |

| 14.5 Turkey Power Rental Market Revenue Share, By Company, 2018 |

| 14.6 Oman Power Rental Market Revenue Share, By Company, 2018 |

| 14.7 Kuwait Power Rental Market Revenue Share, By Company, 2018 |

| 14.8 Bahrain Power Rental Market Revenue Share, By Company, 2018 |

| 15. Company Profiles |

| 15.1 Aggreko Middle East Ltd. |

| 15.2 Byrne Equipment Rental LLC |

| 15.3 Rental Solutions & Services LLC |

| 15.4 Altaaqa Global |

| 15.5 Al Faris Equipment Rentals LLC |

| 15.6 Nour Energy Co. Ltd. |

| 15.7 Peax Equipment Rental |

| 15.8 Atlas Copco. |

| 15.9 Apr. Energy Plc. |

| 15.10 SES SMART Energy Solutions FZCO |

| 16. Key Strategic Recommendations |

| 17. Disclaimer |

| List of Figures |

| Figure1. Middle East Power Rental Market Revenue Share, By Countries, 2018 & 2025F |

| Figure2. Middle East Power Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure3. Middle East Power Rental Market Revenue Share, By Countries, 2018 & 2025F |

| Figure4. Middle East Power Rental Market - Industry Life Cycle, 2018 |

| Figure5. GCC and Middle East Construction Contract Awards 2018 |

| Figure6. Saudi Vision 2030 Goals for Non-Oil Sector |

| Figure7. GCC Value of Planned, Unawarded Projects, By Country, 2018 ($ Billion) |

| Figure8. Carbon Dioxide Emissions of Middle East, By Countries, 2017 (Million Tonnes) |

| Figure9. Saudi Arabia Power Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure10. Saudi Arabia Power Rental Market Revenue Share, By Type, 2018 & 2025F |

| Figure11. Saudi Arabia Diesel Genset Rental Market Revenue Share, By kVA Rating, 2018 & 2025F |

| Figure12. Saudi Arabia Below 100 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure13. Saudi Arabia 100.1-350 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure14. Saudi Arabia 350.1-750 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure15. Saudi Arabia 750.1-1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure16. Saudi Arabia Above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure17. Saudi Arabia Diesel Genset Rental Market Revenue Share, By Applications, 2018 & 2025F |

| Figure18. Saudi Arabia Power Utilities Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure19. Saudi Arabia Oil and Gas Application Diesel Genset Market Revenues, 2015-2025F ($ Million) |

| Figure20. Saudi Arabia Construction Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure21. Saudi Arabia Manufacturing Application Diesel Genset Market Revenues, 2015-2025F ($ Million) |

| Figure22. Saudi Arabia Quarrying and Mining Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure23. Saudi Arabia Others Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure24. Saudi Arabia Actual Government Spending Vs Actual Government Revenues, 2016-2024F (SAR Billion) |

| Figure25. Saudi Arabia Government Budget Spending Outlook, 2019E (SAR Billion) |

| Figure26. Upcoming Power Plant Projects in Saudi Arabia |

| Figure27. Production of Refined Products in Saudi Arabia, 2016-2017 (Million Barrels) |

| Figure28. Upcoming Economic Cities in Saudi Arabia |

| Figure29. Riyadh Office Supply, 2014-2019F ('000 Sq. m.) |

| Figure30. Jeddah Office Supply, 2014-2019F ('000 Sq. m.) |

| Figure31. Riyadh Retail Supply, 2014-2019F ('000 Sq. m.) |

| Figure32. Jeddah Retail Supply, 2014-2019F ('000 Sq. m.) |

| Figure33. Riyadh Hotel Supply, 2014-2019F (No. of Rooms) |

| Figure34. Jeddah Hotel Supply, 2014-2019F (No. of Rooms) |

| Figure35. Major Upcoming Healthcare Projects in Saudi Arabia |

| Figure36. Saudi Arabia Power Rental Market Opportunity Assessment, By Applications, 2025F |

| Figure37. Saudi Arabia Power Rental Market Opportunity Assessment, By kVA Rating, 2025F |

| Figure38. UAE Power Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure39. UAE Power Rental Market Revenue Share, By Type, 2018 & 2025F |

| Figure40. UAE Diesel Genset Rental Market Revenue Share, By kVA Rating, 2018 & 2025F |

| Figure41. UAE Below 100 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure42. UAE 100.1-350 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure43. UAE 350.1-750 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure44. UAE 750.1-1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure45. UAE Above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure46. UAE Diesel Genset Rental Market Revenue Share, By Applications, 2018 & 2025F |

| Figure47. UAE Power Utilities Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure48. UAE Oil and Gas Application Diesel Genset Market Revenues, 2015-2025F ($ Million) |

| Figure49. UAE Construction Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure50. UAE Manufacturing Application Diesel Genset Market Revenues, 2015-2025F ($ Million) |

| Figure51. UAE Quarrying and Mining Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure52. UAE Others Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure53. UAE Actual Government Spending Vs Actual Government Revenues, 2015-2024F (AED Billion) |

| Figure54. UAE Federal Budget Allocation for Financial Year 2018 (AED Billion) |

| Figure55. UAE Budget Allocation for Financial Year 2019 ($ Billion) |

| Figure56. UAE Budget Allocation for Financial Year 2018 ($ Billion) |

| Figure57. Upcoming Industrial Projects in UAE |

| Figure58. Dubai Office Supply, 2015-2020 (Million Sq m of GLA) |

| Figure59. Abu Dhabi Office Supply, 2014-2019 (Million Sq m of GLA) |

| Figure60. Dubai Residential Supply, 2015- 2020 (000’ Units) |

| Figure61. Abu Dhabi Residential Supply, 2014-2019 (000’ Units) |

| Figure62. UAE Power Rental Market Opportunity Assessment, By Applications, 2025F |

| Figure63. UAE Power Rental Market Opportunity Assessment, By kVA Rating, 2025F |

| Figure64. Qatar Power Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure65. Qatar Power Rental Market Revenue Share, By Type, 2018 & 2025F |

| Figure66. Qatar Diesel Genset Rental Market Revenue Share, By kVA Rating, 2018 & 2025F |

| Figure67. Qatar Below 100 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure68. Qatar 100.1-350 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure69. Qatar 350.1-750 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure70. Qatar 750.1-1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure71. Qatar Above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure72. Qatar Diesel Genset Rental Market Revenue Share, By Applications, 2018 & 2025F |

| Figure73. Qatar Power Utilities Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure74. Qatar Oil and Gas Application Diesel Genset Market Revenues, 2015-2025F ($ Million) |

| Figure75. Qatar Construction Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure76. Qatar Manufacturing Application Diesel Genset Market Revenues, 2015-2025F ($ Million) |

| Figure77. Qatar Quarrying and Mining Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure78. Qatar Others Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure79. Qatar Actual Government Spending Vs Actual Government Revenues, 2016-2024F (QAR Billion) |

| Figure80. Qatar Budget Allocation for Financial Year 2019 ($ Billion) |

| Figure81. Qatar Organized Retail Supply, 2012-2019 ('000 Sq.m. GLA) |

| Figure82. Upcoming Malls in Qatar |

| Figure83. Qatar Upcoming Major Infrastructure Projects |

| Figure84. Qatar Power Rental Market Opportunity Assessment, By Applications, 2025F |

| Figure85. Qatar Power Rental Market Opportunity Assessment, By kVA Rating, 2025F |

| Figure86. Kuwait Power Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure87. Kuwait Diesel Genset Rental Market Revenue Share, By kVA Rating, 2018 & 2025F |

| Figure88. Kuwait Below 100 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure89. Kuwait 100.1-350 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure90. Kuwait 350.1-750 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure91. Kuwait 750.1-1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure92. Kuwait Above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure93. Kuwait Diesel Genset Rental Market Revenue Share, By Applications, 2018 & 2025F |

| Figure94. Kuwait Power Utilities Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure95. Kuwait Oil and Gas Application Diesel Genset Market Revenues, 2015-2025F ($ Million) |

| Figure96. Kuwait Construction Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure97. Kuwait Manufacturing Application Diesel Genset Market Revenues, 2015-2025F ($ Million) |

| Figure98. Kuwait Quarrying and Mining Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure99. Kuwait Others Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure100. Kuwait Actual Government Spending Vs Actual Government Revenues, 2015-2024F (KWD Billion) |

| Figure101. Kuwait Power Rental Market Opportunity Assessment, By Applications, 2025F |

| Figure102. Kuwait Power Rental Market Opportunity Assessment, By kVA Rating, 2025F |

| Figure103. Oman Power Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure104. Oman Power Rental Market Revenue Share, By Type, 2018 & 2025F |

| Figure105. Oman Diesel Genset Rental Market Revenue Share, By kVA Rating, 2018 & 2025F |

| Figure106. Oman Below 100 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure107. Oman 100.1-350 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure108. Oman 350.1-750 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure109. Oman 750.1-1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure110. Oman Above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure111. Oman Diesel Genset Rental Market Revenue Share, By Applications, 2018 & 2025F |

| Figure112. Oman Power Utilities Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure113. Oman Oil and Gas Application Diesel Genset Market Revenues, 2015-2025F ($ Million) |

| Figure114. Oman Construction Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure115. Oman Manufacturing Application Diesel Genset Market Revenues, 2015-2025F ($ Million) |

| Figure116. Oman Quarrying and Mining Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure117. Oman Others Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure118. Oman Actual Government Spending Vs Actual Government Revenues, 2016-2024F (OMR Billion) |

| Figure119. Oman Government Budget Spending Outlook, 2018 (OMR Million) |

| Figure120. Oman Government Budget Spending Outlook, 2018E (OMR Million) |

| Figure121. Oman Electricity Demand, 2015-2022 (GW) |

| Figure122. Oman Electricity Consumption, By Sectors (GWh), 2012-2016 |

| Figure123. Oman Sector Wise Investment in Oil Exploration, 2016 & 2021 |

| Figure124. Oman Area-Wise Under Construction Industrial Projects, 2017 |

| Figure125. Oman Power Rental Market Opportunity Assessment, By Applications, 2025F |

| Figure126. Oman Power Rental Market Opportunity Assessment, By kVA Rating, 2025F |

| Figure127. Turkey Power Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure128. Turkey Power Rental Market Revenue Share, By Type, 2018 & 2025F |

| Figure129. Turkey Diesel Genset Rental Market Revenue Share, By kVA Rating, 2018 & 2025F |

| Figure130. Turkey Below 100 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure131. Turkey 100.1-350 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure132. Turkey 350.1-750 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure133. Turkey 750.1-1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure134. Turkey Above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure135. Turkey Diesel Genset Rental Market Revenue Share, By Applications, 2018 & 2025F |

| Figure136. Turkey Power Utilities Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure137. Turkey Oil and Gas Application Diesel Genset Market Revenues, 2015-2025F ($ Million) |

| Figure138. Turkey Construction Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure139. Turkey Manufacturing Application Diesel Genset Market Revenues, 2015-2025F ($ Million) |

| Figure140. Turkey Quarrying and Mining Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure141. Turkey Others Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure142. Turkey Actual Government Spending Vs Actual Government Revenues, 2015-2024F (Billion Turkish Lira) |

| Figure143. Turkey Oil Consumption, 2014–2017 (Thousand Barrels/Day) |

| Figure144. Turkey Natural Gas Production, 2014–2017 (Billion Cubic Meter) |

| Figure145. Turkey Value Added Through Manufacturing, 2010-2017 ($ Billion) |

| Figure146. Turkey Power Rental Market Opportunity Assessment, By Applications, 2025F |

| Figure147. Turkey Power Rental Market Opportunity Assessment, By kVA Rating, 2025F |

| Figure148. Bahrain Power Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure149. Bahrain Power Rental Market Revenue Share, By Type, 2018 & 2025F |

| Figure150. Bahrain Diesel Genset Rental Market Revenue Share, By kVA Rating, 2018 & 2025F |

| Figure151. Bahrain Below 100 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure152. Bahrain 100.1-350 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure153. Bahrain 350.1-750 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure154. Bahrain 750.1-1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure155. Bahrain Above 1000 kVA Rating Diesel Genset Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure156. Bahrain Diesel Genset Rental Market Revenue Share, By Applications, 2018 & 2025F |

| Figure157. Bahrain Power Utilities Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure158. Bahrain Oil and Gas Application Diesel Genset Market Revenues, 2015-2025F ($ Million) |

| Figure159. Bahrain Construction Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure160. Bahrain Manufacturing Application Diesel Genset Market Revenues, 2015-2025F ($ Million) |

| Figure161. Bahrain Quarrying and Mining Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure162. Bahrain Others Application Diesel Genset Rental Market Revenues, 2015-2025F ($ Million) |

| Figure163. Bahrain Actual Government Spending Vs Actual Government Revenues, 2015-2024F (BHD Billion) |

| Figure164. Bahrain Forecasted Project Awards, 2018-2022 ($ Billion) |

| Figure165. Bahrain Upcoming Projects, By Sectors ($ Billion) |

| Figure166. Overview Of The Retail Market In Bahrain ('000 sqm.) |

| Figure167. Bahrain Retail Market Size, Gross Leasable Area, 2007-2019 ('000 sqm.) |

| Figure168. Bahrain Retail Market Size, Gross Leasable Area By Grade, 2007-2019 (sq.m.) |

| Figure169. Phase-wise Plans Under Bahrain Public Transport Masterplan |

| Figure170. Bahrain Power Rental Market Opportunity Assessment, By Applications, 2025F |

| Figure171. Bahrain Power Rental Market Opportunity Assessment, By kVA Rating, 2025F |

| Figure172. Bahrain Power Rental Market Revenues, 2015 - 2025F ($ Million) |

| Figure173. Saudi Arabia Power Rental Market Revenue Share, By Company, 2018 |

| Figure174. UAE Power Rental Market Revenue Share, By Company, 2018 |

| Figure175. Qatar Power Rental Market Revenue Share, By Company, 2018 |

| Figure176. Turkey Power Rental Market Revenue Share, By Company, 2018 |

| Figure177. Oman Power Rental Market Revenue Share, By Company, 2018 |

| Figure178. Bahrain Power Rental Market Revenue Share, By Company, 2018 |

| Figure179. Kuwait Power Rental Market Revenue Share, By Company, 2018 |

| Figure180. GCC Construction Output, 2016 - 2020 (Annual Percentage Change) |

| List Of Tables |

| Table1. Upcoming Construction Projects in the Middle East |

| Table2. Saudi Arabia Budget Expenses By Sectors, 2018 & 2019 ($ Billion) |

| Table3. List of Major Infrastructure Projects in Saudi Arabia |

| Table4. Saudi Arabia Upcoming Oil & Gas Projects |

| Table5. Saudi Arabia Upcoming Petrochemical Projects |

| Table6. Upcoming Hotel Projects in Saudi Arabia |

| Table7. List of Major Infrastructure Projects in Saudi Arabia |

| Table8. Upcoming Oil & Gas Projects in UAE |

| Table9. Upcoming Hospitality Projects in UAE |

| Table10. Upcoming Construction Projects in UAE |

| Table11. List of Major Infrastructure Projects in UAE |

| Table12. Qatar Ongoing and Planned Projects Value Estimation, By Sub Sectors |

| Table13. Upcoming Oil & Gas Projects in Qatar |

| Table14. Qatar e-Government 2020 Targets |

| Table15. Qatar Upcoming Commercial Building Projects |

| Table16. Qatar Under Development Commercial Infrastructure Projects |

| Table17. Qatar Upcoming Residential Projects |

| Table18. Upcoming Industrial Projects In Kuwait |

| Table19. Upcoming Power Projects In Kuwait |

| Table20. Kuwait Upcoming Industrial Projects |

| Table21. Kuwait Upcoming Hospitality Projects |

| Table22. Kuwait Upcoming Residential Projects |

| Table23. Oman Upcoming Hotel Projects |

| Table24. Oman Upcoming Power Projects |

| Table25. Oman Upcoming Residential Projects |

| Table26. Oman Upcoming Industrial Projects |

| Table27. Bahrain Power Generation Per Station, 2017 (GWh) |

| Table28. Bahrain Upcoming Power & Energy Sector Projects |

| Table29. Upcoming GCC Construction Projects |

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Related Reports

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero