Nigeria Farm Tractor Market (2020-26) | Trends, Outlook, Forecast, Share, Companies, Size, Industry, Analysis, Revenue, COVID-19 IMPACT, Growth & Value

Market Forecast By Horsepower Rating(Below 40 Hp, 40 Hp – 100 Hp, Above 100 Hp), By Drive Type (Two-wheel Drive, Four-wheel Drive) and competitive Landscape

| Product Code: ETC060906 | Publication Date: Jul 2021 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 72 | No. of Figures: 12 | No. of Tables: 5 | |

Nigeria Farm Tractor Market report comprehensively covers the Nigeria Farm Tractor market by Types, Product, End-Users and Application. Nigeria Farm Tractor market outlook report provides an unbiased and detailed analysis of the on-going Nigeria Farm Tractor market trends, Nigeria Farm Tractor market share, opportunities/high growth areas and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Nigeria Farm Tractor Market Synopsis

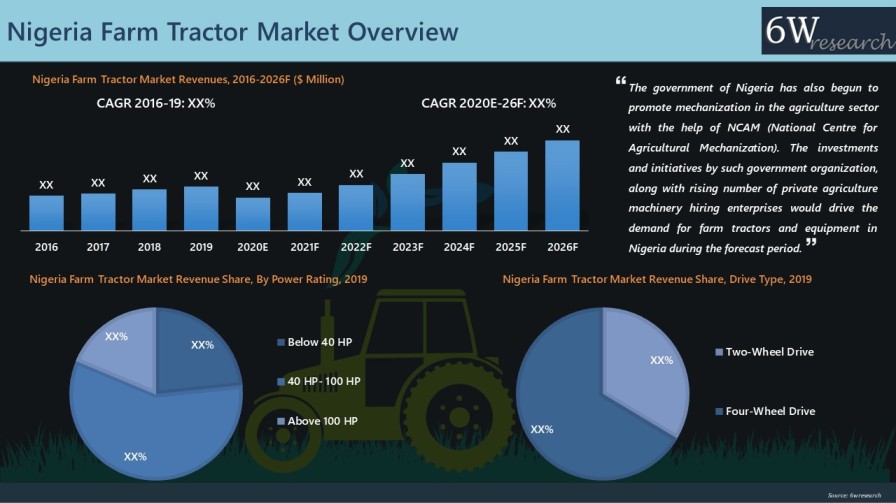

Nigeria Farm Tractor Market witnessed moderate growth during the period 2016-2019 due to the increasing government support in agriculture through numerous agricultural policies, programmes and projects for the country’s economic development. The agriculture sector grew by 2.2% in Q1 2020 from 2.31% in Q4 2019 and 3.2% in Q1 2019. Crop Production under the agriculture sector grew by 2.38% in Q1 2020 from 2.52% in Q4 2019 and 3.26% in Q1 2019. The lockdown imposed in Nigeria and several other countries on account of COVID-19 pandemic in 2020 resulted in supply chain disruptions, thereby, leading to a decline in market growth. However, recovery is expected in the market owing to various government initiatives including Agricultural Credit Guarantee Scheme (ACGSF) Amendment Act-2019, APPEALS Project, Zero Reject and The Buhari Administration’s Vision and Approach. The market has seen a halt owing to the massive outbreak of COVID-19 which resulted in nationwide lockdowns to combat the spread of the virus and has led to a decline in the overall market growth.

According to 6Wresearch, Nigeria Farm Tractor Market size is projected to grow at CAGR of 18.1% during 2020-2026. The primary reason for the growth in the Nigeria farm tractor industry can be attributed to the several policies being undertaken to ensure food security, increase farm productivity and increase farmers’ income. Several new enterprises are providing agriculture equipment to small farmers on rental basis, such as NAMEL and TOHFAN, intending to improve farm mechanization in Nigeria. The rising number of private sector agriculture machinery hiring centres along with government initiatives to boost farmers’ productivity via increasing farm mechanisation would drive the growth of farm tractors in the country over the coming years.

Market Analysis by Drive Type

Based on drive type, four-wheel drive dominated the Nigeria farm tractor market in 2019 and would continue to maintain its dominance during the forecast period as well on account of its suitability in wide of variety of applications including tillage, livestock operations, crop protection and mowing.

Market Analysis by Power Rating

40 HP- 100 HP segment contributed a major share in the Nigeria farm tractor market revenues during 2019 and is anticipated to maintain its dominance during the forecast period as well, on account of increasing usage of 40-100 HP tractors in farming activities. The 40 HP- 100 HP category comprises of the tractors that are most commonly purchased by the agriculture cooperatives and hiring centres. Owing to the growing focus of the government on improving the state of agriculture in Nigeria and increasing the rate of farm mechanization, the demand for 40 HP- 100 HP segment tractors would flourish over the coming years.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2020.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Nigeria Farm Tractor Market Overview

- Nigeria Farm Tractor Market Outlook

- Nigeria Farm Tractor Market Forecast

- Historical Data and Forecast of Nigeria Farm Tractor Market Revenues and Volume, for the Period 2016-2026F

- Historical Data and Forecast of Nigeria Farm Tractor Market Revenues & Volume, By Power Rating, for the Period 2016-2026F

- Historical Data and Forecast of Nigeria Farm Tractor Market Revenues & Volume, By Drive Type, for the Period 2016-2026F

- Nigeria Farm Tractor Market Revenue Share, By Market Players

- Market Drivers and Restraints

- Market Trends

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereport provides a detailed analysis of the following market segments:

By Horsepower Rating

- Below 40 Hp

- 40 Hp – 100 Hp

- Above 100 Hp

By Drive Type

- Two-wheel Drive

- Four-wheel Drive

Nigeria Farm Tractor Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Nigeria Farm Tractor Market Overview |

| 3.1 Nigeria Farm Tractor Market Revenues and Volume, 2016-2026F |

| 3.2 Nigeria Farm Tractor Market-Industry Life Cycle |

| 3.3 Nigeria Farm Tractor Market-Porter’s Five Forces |

| 4. Nigeria Farm Tractor Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Government initiatives and subsidies to promote mechanization in agriculture |

| 4.2.2 Increasing demand for higher productivity and efficiency in farming operations |

| 4.2.3 Growing adoption of modern farming techniques and technologies in Nigeria |

| 4.3 Market Restraints |

| 4.3.1 High initial investment cost of farm tractors |

| 4.3.2 Limited access to financing for small-scale farmers |

| 4.3.3 Lack of adequate infrastructure and support services in rural areas |

| 5. Nigeria Farm Tractor Market Trends |

| 6. Nigeria Farm Tractor Market Overview, By Power Rating |

| 6.1 Nigeria Farm Tractor Market Revenue Share and Revenues, By Power Rating |

| 6.2 Nigeria Farm Tractor Market Volume Share and Volume, By Power Rating |

| 7. Nigeria Farm Tractor Market Overview, By Drive Type |

| 7.1 Nigeria Farm Tractor Market Revenue Share and Revenues, By Drive Type |

| 7.2 Nigeria Farm Tractor Market Volume Share and Volume, By Drive Type |

| 8. Nigeria Farm Tractor Market Key Performance Indicators |

| 8.1 Average age of farm tractors in use |

| 8.2 Adoption rate of precision farming technologies |

| 8.3 Mechanization level in different crop segments |

| 8.4 Utilization rate of farm tractors |

| 8.5 Efficiency gains in farm operations |

| 9. Nigeria Farm Tractor Market Opportunity Assessment |

| 9.1 Nigeria Farm Tractor Market Opportunity Assessment, By Power Rating, 2026F |

| 9.2 Nigeria Farm Tractor Market Opportunity Assessment, By Drive Type, 2026F |

| 10. Nigeria Farm Tractor Market Competitive Landscape |

| 10.1 Nigeria Farm Tractor Market Revenue Share, By Company |

| 10.2 Nigeria Farm Tractor Market Competitive Benchmarking |

| 10.2.1 Nigeria Farm Tractor Market Competitive Benchmarking, By Technical Parameters |

| 10.2.2 Nigeria Farm Tractor Market Competitive Benchmarking, By Operating Parameters |

| 11. Company Profiles |

| 11.1 Deere & Company |

| 11.2 Agco Corporation |

| 11.3 Mahindra & Mahindra Ltd |

| 11.4 CNH Industrial |

| 11.5 CLAAS KGaA mbH |

| 11.6 Escorts Limited |

| 11.7 KUBOTA Corporation |

| 11.8 SDF S.p.A. |

| 11.9 Tractors and Farm Equipment Limited |

| 11.10 Yanmar Holdings Co., Ltd |

| 12. Key Strategic Recommendations |

| 13. Disclaimer |

| List of Figures: |

| 1. Nigeria Farm Tractor Market Revenues & Volume, 2016-2026F ($ Million, Units) |

| 2. Nigeria Farm Tractor Market Revenue Share, By Power Rating, 2019 & 2026F |

| 3. Nigeria Farm Tractor Market Volume Share, By Power Rating, 2019 & 2026F |

| 4. Nigeria Farm Tractor Market Revenue Share, By Drive Type, 2019 & 2026F |

| 5. Nigeria Farm Tractor Market Volume Share, By Drive Type, 2019 & 2026F |

| 6. Nigeria Agriculture Sector Contribution to GDP, Q1 2019- Q1 2020 |

| 7. Nigeria Agriculture Sector Growth Rate, Q1 2019- Q1 2020 |

| 8. Nigeria Crop Production Growth Rate, Q1 2019- Q1 2020 |

| 9. Share of Households Participating in Crop Farming in Nigeria, 2019 |

| 10. Nigeria Farm Tractor Market Opportunity Assessment, By Power Rating, 2026F |

| 11. Nigeria Farm Tractor Market Opportunity Assessment, By Drive Type, 2026F |

| 12. Nigeria Farm Tractor Market Revenue Share, By Companies, 2019 |

| List of Tables: |

| 1. Nigeria Farm Tractor Market Revenues, By Power Rating, 2016-2026F ($ Million) |

| 2. Nigeria Farm Tractor Market Volume, By Power Rating, 2016-2026F (Units) |

| 3. Nigeria Farm Tractor Market Revenues, By Drive Type, 2016-2026F ($ Million) |

| 4. Nigeria Farm Tractor Market Volume, By Drive Type, 2016-2026F (Units) |

| 5. Distribution and Status of Tractor According to Zonal Location and Ownership in Delta State of Nigeria, 2019 |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero