Nigeria UPS Systems Market (2023-2029) | Share, Size, Industry, Value, Trends, Growth, Outlook, Analysis, Revenue, Segmentation & COVID-19 IMPACT

Market Forecast By KVA Rating (Up to 1kVA, 1.1- 5kVA, 5.1- 20kVA, 20.1- 50kVA, 50.1- 200kVA, Above 200kVA),By Phases (1 Phase, 3 Phase),By Applications (Residential, Industrial, Commercial),By Types (Online, Offline),By Regions (North-East, North-West, Central, South-West, South-East) And Competitive Landscape

| Product Code: ETC4378004 | Publication Date: Mar 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 100 | No. of Figures: 27 | No. of Tables: 14 |

Nigeria UPS Systems Market Synopsis

Nigeria UPS Systems Market is anticipated to register significant growth in the coming years owing to surging development in commercial and industrial sector along with increasing number of data centres and colocation facilities in the country. Also, demand for continuous power supply from end user industries is driving the UPS Systems Market in Nigeria as Nigeria suffers annual losses of $26 billion annually due to power cuts which is equivalent to 2% of its GDP. However, COVID-19 pandemic led to lockdown restrictions in 2020, which caused a decline in the UPS market due to the closure of commercial spaces such as hospitality, industrial, and manufacturing facilities. However, the market reached its pre-COVID levels in 2021 due to the emergence of new small and medium-sized enterprises (SMEs) and the increase in electronic fund transfers, which require a reliable power supply.

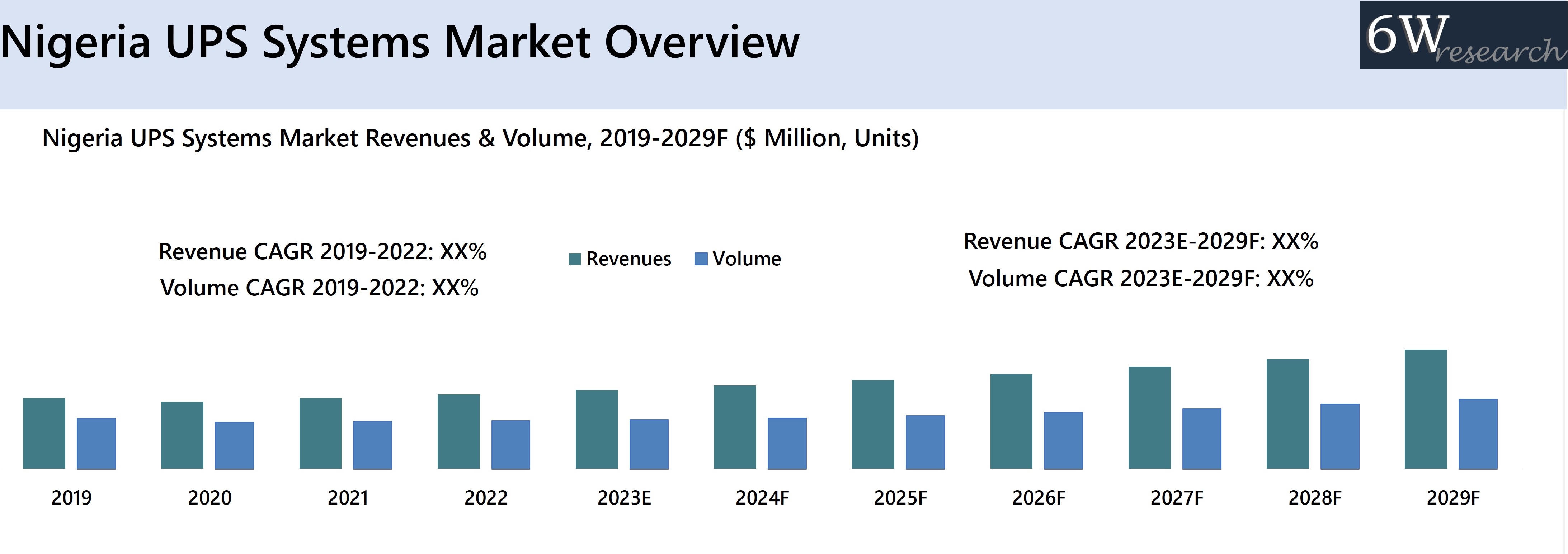

According to 6Wresearch, Nigeria UPS systems market size is projected to grow at a CAGR of 7.1% during 2023-2029. Nigeria government has taken various initiatives to increase digitalization such as National Digital Economy Policy and Strategy (2020-2030) and Cloud Computing Policy, which is expected to generate large volume of data and anticipated to gain attention of international data center provider to host in the country, thereby expected to increase the demand for uninterrupted power supply systems in the coming years. Rising tech startups in country has surged the demand for zero power downtime as most industries and businesses in the Nigeria have begun to implement UPS systems. Further, the PC sales in Nigeria grew by 12.7% during pandemic and the market is expected to grow by 32% in 2023 as compared to 2022 owing to the rise in remote working culture which would also impact the demand for UPS in Nigeria positively.

According to 6Wresearch, Nigeria UPS systems market size is projected to grow at a CAGR of 7.1% during 2023-2029. Nigeria government has taken various initiatives to increase digitalization such as National Digital Economy Policy and Strategy (2020-2030) and Cloud Computing Policy, which is expected to generate large volume of data and anticipated to gain attention of international data center provider to host in the country, thereby expected to increase the demand for uninterrupted power supply systems in the coming years. Rising tech startups in country has surged the demand for zero power downtime as most industries and businesses in the Nigeria have begun to implement UPS systems. Further, the PC sales in Nigeria grew by 12.7% during pandemic and the market is expected to grow by 32% in 2023 as compared to 2022 owing to the rise in remote working culture which would also impact the demand for UPS in Nigeria positively.

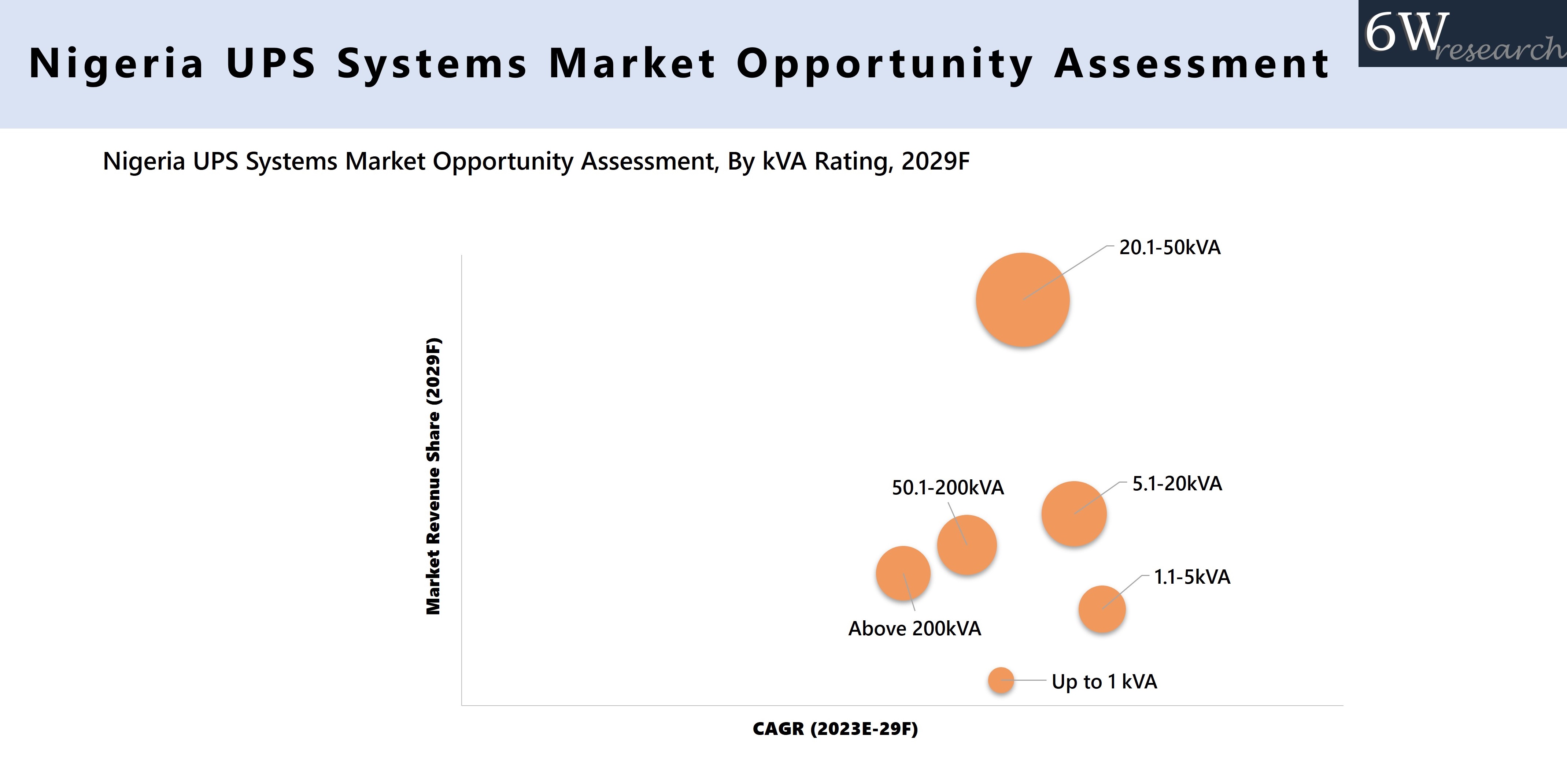

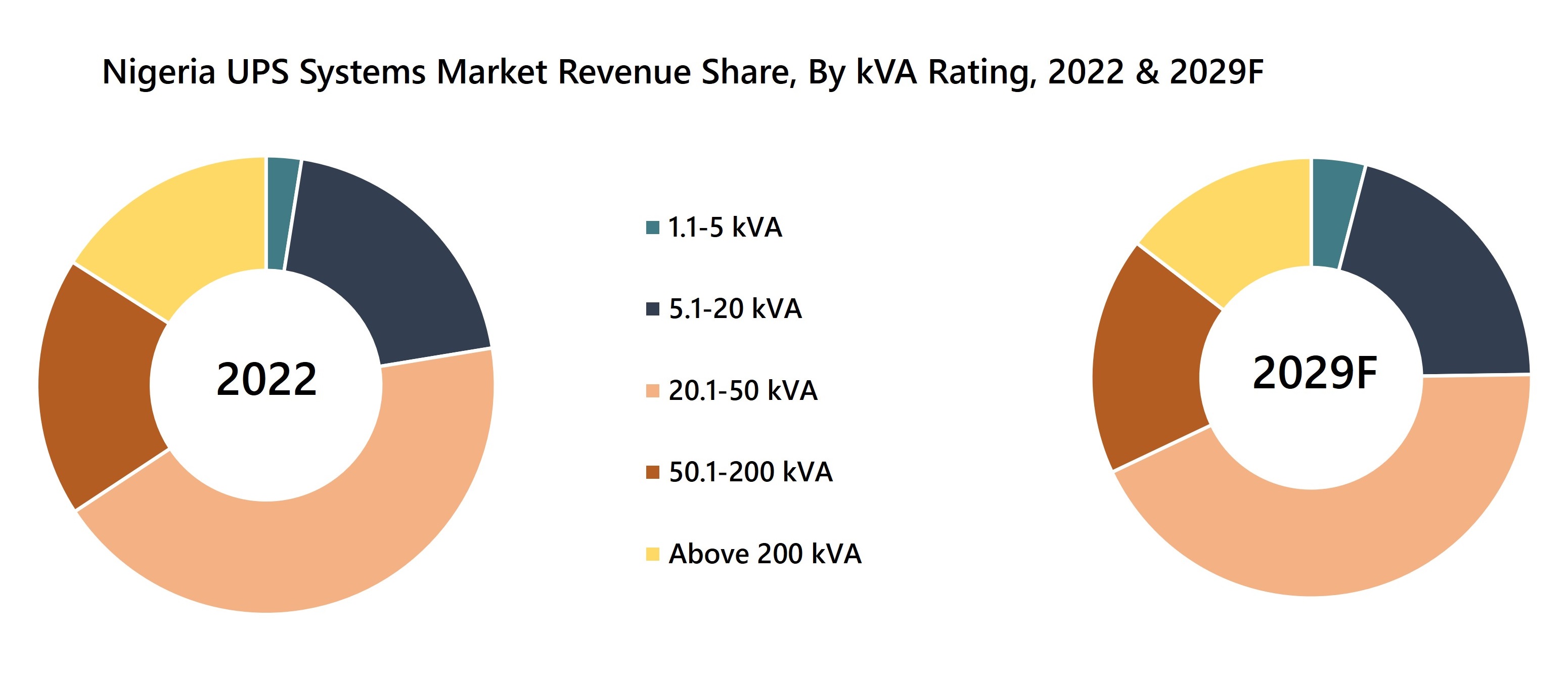

Market by KVA Rating

20.1-50 kVA segment garnered majority market revenue share in 2022 on account of rising number of electronic fund transactions which rose by 613.1% from 2018 to 2022 and is expected to boost further owing to growing digitalization under the Digital Economy initiative on that account several banks demand for zero power downtime for reducing transaction failure because of power cut, thereby increasing the demand for 20.1-50 kVA UPS systems.

Market by Phases

3 phase UPS systems dominated the market revenue share in 2022, owing to growing number of data centers and the growing industrial sector which grew by from 1.44% in 2021 as compared to 2020. The segment is expected to continue to lead the market in the coming years due to its wider application in BFSI sectors, data centers, and industries, it is expected to grow the majorly in the coming years.

Market by Applications

The commercial segment acquired highest share in Nigeria UPS Systems Industry revenues as several data centers operators started their operation in Nigeria such as rack centers, MDXi, OCCA among others which resulted in increase in demand for Uninterrupted power supply in the country. Moreover, secondary and tertiary hospitals which accounts for approximately 14% of the total hospital establishment in Nigeria, need constant electricity for daily operation, is contributing to the growing demand for UPS in healthcare sector

Market by Types

Online UPS systems garnered the majority of revenue share in Nigeria UPS market owing to colocation of data centers along with growing IT infrastructure in the country. Owing to National Digital Economy Policy and Strategy (2020-2030) initiative by Nigerian government, volume of data and IT infrastructure is expected to grow, which would impact the growth of online segment in the coming years.

Market by Regions

Southwest region acquired the major revenue share in Nigeria UPS market in 2022 owing to the presence of Nigeria Tech Hub in Lagos along with 88.4% of the startup's setup in 2022 lies in this region. Southwest region is expected to dominate the market in the future as well on account of upcoming data centers investment in the city of Lagos such as Kasi cloud with the investment of $250 Million.

![Nigeria UPS Systems Market Opportunity Assessment]() Key Attractiveness of the Report

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Nigeria UPS Systems Market Overview

- Nigeria UPS Systems Market Outlook

- Nigeria UPS Systems Market Forecast

- Historical Data and Forecast of Nigeria UPS Systems Market Revenues and Volume, for the Period 2019-2029F

- Historical Data and Forecast of Nigeria UPS Systems Market Revenues and Volume, By kVA Rating, for the Period 2019-2029F

- Historical Data and Forecast of Nigeria UPS Systems Market Revenues, By Phases, for the Period 2019-2029F

- Historical Data and Forecast of Nigeria UPS Systems Market Revenues, By Applications, for the Period 2019-2029F

- Historical Data and Forecast of Nigeria UPS Systems Market Revenues, By Types, for the Period 2019-2029F

- Historical Data and Forecast of Nigeria UPS Systems Market Revenues, By Regions, for the Period 2019-2029F

- Market Drivers and Restraints

- Nigeria UPS Systems Market Trends

- Porter’s Five Forces Analysis

- Market Opportunity Assessment

- Nigeria UPS Systems Market Revenue Ranking, By Companies, 2022

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By KVA Rating

- Up to 1kVA

- 1.1- 5kVA

- 5.1- 20kVA

- 20.1- 50kVA

- 50.1- 200kVA

- Above 200kVA

By Phases

- 1 Phase

- 3 Phase

By Applications

- Residential

- Industrial

- Commercial

By Types

- Online

- Offline

By Regions

- North-East

- North-West

- Central

- South-West

- South-East

Nigeria UPS Systems Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Methodology |

| 2.5 Assumptions |

| 3. Nigeria UPS Systems Market Overview |

| 3.1 Nigeria UPS Systems Market Revenues & Volume, 2019-2029F |

| 3.2 Nigeria UPS Systems Market Industry Life Cycle |

| 3.4 Nigeria UPS Systems Market Porter’s Five Forces |

| 3.4 Nigeria UPS Systems Market Pestle Analysis |

| 3.5 Nigeria UPS Systems Market SWOT Analysis |

| 4. Nigeria UPS Systems Market COVID-19 Impact Analysis |

| 5. Nigeria UPS Systems Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.2.1 Increasing demand for uninterrupted power supply due to frequent power outages in Nigeria |

| 5.2.2 Growth in IT and telecommunication sectors driving the need for reliable power backup solutions |

| 5.2.3 Government initiatives to improve infrastructure and promote industrial growth |

| 5.3 Market Restraints |

| 5.3.1 High initial investment costs associated with UPS systems |

| 5.3.2 Lack of awareness about the benefits of UPS systems among small and medium-sized enterprises |

| 5.3.3 Limited availability of skilled workforce for installation and maintenance of UPS systems |

| 6. Nigeria UPS Systems Market Evolution & Trends |

| 7 Nigeria UPS Systems Market Overview, By kVA Ratings |

| 7.1 Nigeria UPS Systems Market Revenue Share and Revenues, By kVA Ratings, 2019-2029F |

| 7.1.1 Nigeria UPS Systems Market Revenues, By Up to 1kVA, 2019-2029F |

| 7.1.2 Nigeria UPS Systems Market Revenues, By 1.1- 5kVA, 2019-2029F |

| 7.1.3 Nigeria UPS Systems Market Revenues, By 5.1-20kVA, 2019-2029F |

| 7.1.4 Nigeria UPS Systems Market Revenues, By 20.1-50kVA, 2019-2029F |

| 7.1.5 Nigeria UPS Systems Market Revenues, By 50.1-200kVA, 2019-2029F |

| 7.1.6 Nigeria UPS Systems Market Revenues, By Above 200kVA, 2019-2029F |

| 7.2 Nigeria UPS Systems Market Volume Share and Volume, By kVA Ratings, 2019-2029F |

| 7.2.1 Nigeria UPS Systems Market Volume, By Up to 1kVA, 2019-2029F |

| 7.2.2 Nigeria UPS Systems Market Volume, By 1.1- 5kVA, 2019-2029F |

| 7.2.3 Nigeria UPS Systems Market Volume, By 5.1-20kVA, 2019-2029F |

| 7.2.4 Nigeria UPS Systems Market Volume, By 20.1-50kVA, 2019-2029F |

| 7.2.5 Nigeria UPS Systems Market Volume, By 50.1-200kVA, 2019-2029F |

| 7.2.6 Nigeria UPS Systems Market Volume, By Above 200kVA, 2019-2029F |

| 8. Nigeria UPS Systems Market Overview, By Phase |

| 8.1 Nigeria UPS Systems Market Revenue Share & Revenues, By Phase, 2019-2029F |

| 8.1.1 Nigeria UPS Systems Market Revenues, By Phase 1, 2019-2029F |

| 8.1.2 Nigeria UPS Systems Market Revenues, By Phase 3, 2019-2029F |

| 9. Nigeria UPS Systems Market Overview, By Applications |

| 9.1 Nigeria UPS Systems Market Revenue Share & Revenues, By Applications, 2019-2029F |

| 9.1.1 Nigeria UPS Systems Market Revenues, By Residential, 2019-2029F |

| 9.1.2 Nigeria UPS Systems Market Revenues, By Industrial, 2019-2029F |

| 9.1.3 Nigeria UPS Systems Market Revenues, By Commercial, 2019-2029F |

| 9.2 Nigeria UPS Systems Market Revenue Share & Revenues, By Commercial Applications, 2019-2029F |

| 9.2.1 Nigeria UPS Systems Market Revenues, By Data Center, 2019-2029F |

| 9.2.2 Nigeria UPS Systems Market Revenues, By BFSI, 2019-2029F |

| 9.2.3 Nigeria UPS Systems Market Revenues, By Healthcare, 2019-2029F |

| 9.2.4 Nigeria UPS Systems Market Revenues, By Government Offices and Building, 2019-2029F |

| 9.2.5 Nigeria UPS Systems Market Revenues, By Hospitality, 2019-2029F |

| 9.2.6 Nigeria UPS Systems Market Revenues, By Others, 2019-2029F |

| 10. Nigeria UPS Systems Market Overview, By Types |

| 10.1 Nigeria UPS Systems Market Revenue Share & Revenues, By Types, 2019-2029F |

| 10.1.1 Nigeria UPS Systems Market Revenue Share and Revenues, By Online, 2019-2029F |

| 10.1.2 Nigeria UPS Systems Market Revenue Share and Revenues, By Online, 2019-2029F |

| 10.1.1.1 Nigeria Online UPS Systems Market Revenue Share and Revenues, By kVA ratings, 2019-2029F |

| 10.1.2.1 Nigeria Offline UPS Systems Market Revenue Share and Revenues, By kVA ratings, 2019-2029F |

| 11. Nigeria UPS Systems Market Overview, By Regions |

| 11.1 Nigeria UPS Systems Market Revenue Share & Revenues, By Region, 2019-2029F |

| 11.1.1 Nigeria UPS Systems Market Revenue Share & Revenues, By North East Region, 2019-2029F |

| 11.1.2 Nigeria UPS Systems Market Revenue Share & Revenues, By North West Region, 2019-2029F |

| 11.1.4 Nigeria UPS Systems Market Revenue Share & Revenues, By South West Region, 2019-2029F |

| 11.1.5 Nigeria UPS Systems Market Revenue Share & Revenues, By South East Region, 2019-2029F |

| 12. Nigeria UPS Systems Market Key Performance Indicators |

| 12.1 Average downtime reduction percentage after UPS system implementation |

| 12.2 Number of new installations in key industries such as IT, telecommunications, and healthcare |

| 12.3 Percentage increase in government spending on infrastructure development related to power supply |

| 12.4 Energy efficiency improvement rate of UPS systems |

| 12.5 Percentage increase in demand for UPS systems in residential applications |

| 13. Nigeria UPS Systems Market Opportunity Assessment |

| 13.1 Nigeria UPS Systems Market Opportunity Assessment, By kVA Rating, 2028F |

| 13.2 Nigeria UPS Systems Market Opportunity Assessment, By Phases, 2028F |

| 13.4 Nigeria UPS Systems Market Opportunity Assessment, By Applications, 2028F |

| 13.1 Nigeria UPS Systems Market Opportunity Assessment, By Types, 2028F |

| 13.2 Nigeria UPS Systems Market Opportunity Assessment, By Regions, 2028F |

| 14. Nigeria UPS Systems Market Competitive Landscape |

| 14.1 Nigeria UPS Systems Market Revenue and Volume Share, By Top 5 Companies, 2022 |

| 14.2 Nigeria Online and Online UPS Systems Market Revenue Share, By Top 3 Companies, 2022 |

| 14.3 Nigeria UPS Systems Market 14.3 Nigeria UPS Systems Market |

| 14.4 Nigeria UPS Systems Market Competition Pricing Analysis 14.4 Nigeria UPS Systems Market Competition Pricing Analysis |

| 14.5 Nigeria UPS Systems Market Competitive Benchmarking, By Operating Parameters |

| 14.6 Nigeria UPS Systems Market Channel Partners |

| 15. Nigeria UPS Market - Key UPS Brands in Nigeria along with Target Industries |

| 16. Nigeria UPS Market –Key Industries and their Preferred Brands in Nigeria |

| 17. Company Profiles |

| 17.1 Eaton Corporation PLC |

| 17.2 Emerson Electric Co. |

| 17.3 Schneider Electric SE. 17.3 Schneider Electric SE. |

| 17.4 Vertiv group Corp. |

| 17.5 Riello Industries S.R.L |

| 17.6 Huwaei Technologies Co. Ltd. 17.6 Huwaei Technologies Co. Ltd. |

| 14.7 Socomec Group S.A. |

| 17.8 Fuji Electric Co. Ltd. |

| 17.9 Blue Gate World 17.9 Blue Gate World |

| 17.10 Mercury Direct |

| 17.11 Vectronic 17.11 Vectronic |

| 18. Key Strategic Recommendations |

| 19. Disclaimer |

| List of Figures |

| 1. Nigeria UPS Systems Market Revenues & Volume, 2019-2029F ($ Million, Units) |

| 2. Lead Prices (USD/ Metric Ton), (2021-2022E) |

| 3. Nigeria UPS Systems Market Revenue Share, By kVA Rating, 2022 & 2029F |

| 4. Nigeria UPS Systems Market Volume Share, By kVA Rating, 2022 & 2029F |

| 5. Nigeria UPS Systems Market Revenue Share, By Phases, 2022 & 2029F |

| 6. Nigeria UPS Systems Market Revenue Share, By Application, 2022 & 2029F |

| 7. Nigeria UPS Systems Market Revenue Share, By Commercial Applications, 2022 & 2029F |

| 8. Nigeria UPS Systems Market Revenue Share, By Types, 2022 & 2029F |

| 9. Nigeria Online UPS Systems Market Revenue Share, By kVA Rating, 2022 & 2029F |

| 10. Nigeria Offline UPS Systems Market Revenue Share, By kVA Rating, 2022 & 2029F |

| 11. Nigeria UPS Systems Market Revenue Share, By Regions, 2022 & 2029F |

| 12. Nigeria Spending on ICT Sector, 2020 & 2023F ($ Billion) |

| 13. Nigeria ICT Sector GDP Contribution, 2019-Q2’2022 |

| 14. Nigeria Volume of Electronic Funds Transfer, 2018-2022 (Billions) |

| 15. Number of Fintech Start-Ups in Nigeria, 2017-2021 |

| 16. Nigeria classification of hospitals (number of establishments), 2022 |

| 17. Nigeria Manufacturing Sector Revenues, 2020-2021 (Billion) |

| 18. Nigeria UPS Systems Market Opportunity Assessment, By kVA Rating, 2029F |

| 19. Nigeria UPS Systems Market Opportunity Assessment, By Phases, 2029F |

| 20. Nigeria UPS Systems Market Opportunity Assessment, By Application, 2029F |

| 21. Nigeria UPS Systems Market Opportunity Assessment, By Types, 2029F |

| 22. Nigeria UPS Systems Market Opportunity Assessment, By Regions, 2029F |

| 23. Nigeria UPS Systems Market Revenue Share, By Companies, 2022 |

| 24. Nigeria UPS Systems Market Volume Share, By Companies, 2022 |

| 25. Nigeria Online UPS Systems Market Revenue Share, By Companies, 2022 |

| 26. Nigeria Offline UPS Systems Market Revenue Share, By Companies, 2022 |

| 27. Start-ups in the Nigerian Ecosystem, By Location |

| List of Tables |

| 1. Nigeria Upcoming Nigeria Data Center |

| 2. Nigeria UPS Systems Market Revenues, By kVA Rating, 2019-2029F ($ Million) |

| 3. Nigeria UPS Systems Market Volume, By kVA Rating, 2019-2029F (Units) |

| 4. Nigeria UPS Systems Market Revenues, By Phases, 2019-2029F ($ Million) |

| 5. Nigeria UPS Systems Market Revenues, By Application , 2019-2029F ($ Million) |

| 6. Nigeria UPS Systems Market Revenues, By Commercial Applications, 2019-2029F ($ Million) |

| 7. Nigeria UPS Systems Market Revenues, By Types, 2019-2029F ($ Million) |

| 8. Nigeria Online UPS Systems Market Revenues, By kVA Rating, 2019-2029F ($ Million) |

| 9. Nigeria Offline UPS Systems Market Revenues, By Types, 2019-2029F ($ Million) |

| 10. Nigeria UPS Systems Market Revenues, By Regions, 2019-2029F ($ Million) |

| 11. Nigeria Number of Hospitals in Top 5 Cities, 2022 |

| 12. Nigeria Major Ongoing Industrial Construction Projects |

| 13: Nigeria UPS Systems ASP, By Brands, 2022 ($/Unit) |

| 14. Data centers Launched in 2022, Lagos |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero