North America Bearing Market (2019-2025) | Size, Industry, Revenue, Share, Analysis, Trends, Segmentation, Value, Growth & Outlook

Market Forecast By Types (Ball Bearings, Roller Bearings and Other Bearings including Pillow block and Mounted), By Roller Bearings Types (Ball Bearings, Roller Bearings, Other Bearings including Pillow Block and Mounted, Spherical Roller Bearings, and Other Roller Bearings), By Sales Channels (OEM’s and Aftermarket Sales), By Applications (Aerospace & Railway, Agricultural Equipment Machinery, Mining & Oilfield Equipment Machinery, Automotive Machinery, Construction Machinery and Other Machinery), By Countries (U.S. and Canada) and Competitive Landscape.

| Product Code: ETC001610 | Publication Date: Sep 2021 | Updated Date: Jun 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 200 | No. of Figures: 16 | No. of Tables: 4 | |

Latest Development (2023) of the North America Bearing Market

North America Bearing Market has seen the latest innovations which include the numerous developments of rolling element bearings in the automotive industry. Newer car models offer sealed units to keep the bearings away from dust, dirt, debris, and prevent contamination and reduce premature wear are in rising. However, it also limits servicing, cleaning, and greasing of bearings, which was accessible in the older model. Bearing manufacturers are also shifting their primary goal to improving strength and reducing unnecessary weight. To provide more durable bearings, many companies are developing bearing cages made of titanium alloys. Titanium alloyed bearings have proven to offer higher tensile strength with temperature resistance properties. Such an alloy is useful for high-acceleration applications. Environmental Protection Agency (EPA) proposed a life cycle assessment (LCA) for vehicles, due to which the automotive bearing manufacturers are adapting themselves to new forms of reusable alloys.

Mergers and Acquisitions:

- In December 2020, NSK Ltd. acquired the condition monitoring system business Brüel & Kjær from Spectris Plc.

- In July 2021, RBC Bearings Inc. announced that it has agreed to acquire the Dodge mechanical power transmission division of Asea Brown Boveri Ltd.

North America Bearing Market Synopsis

North America bearing market is anticipated to register growth over the coming years on account of significant demand from end-user applications such as automotive and industrial equipment. Further, the OEM distribution channel would increase in North America due to improvement and upgradation in production facilities in the US, thereby also boosting the demand for bearings in the region.

According to 6Wresearch, North America Bearing Market size is projected to grow at a CAGR of 4.1% during 2019–2025, due to increased production of heavy trucks and buses in the region as these vehicles utilize more bearings than passenger car vehicle types.

Automotive applications accounted for the highest market share in the overall North America bearing market in 2018 due to improvements in the motor vehicle manufacturing industries. However, the railway & aerospace and engine, turbine, and power transmission equipment application of bearing is expected to exhibit rapid growth over the next few years owing to continuous growth in the wind energy segment. Some of the key players in the bearing market are JTEKT, SKF, NTN Corporation, Timken, NSK Global, Schaeffler Group, and others.

The North America bearing market report thoroughly covers the market by types, by sales channels, by applications, and by countries including the US, Canada, and the Rest of North America. The North America bearing market outlook report provides an unbiased and detailed analysis of the ongoing North America bearing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

- North America Bearings Market Overview

- North America Bearings Market Outlook

- North America Bearings Market Forecast

- North America Bearings Market Size and Historical Data of North America Bearings Market Revenues for the Period 2015-2018

- North America Bearings Market Forecast of Revenues, Until 2025

- Historical Data of US and Canada Bearings Market Revenues for the Period 2015-2018

- Market Size & Forecast of US and Canada Bearings Market Revenues, Until 2025F

- Historical Data of US and Canada Bearings Market Revenues for the Period 2015-2018, By Types

- Market Size & Forecast of US and Canada Bearings Market Revenues, Until 2025F, By Types

- Historical Data of US and Canada Bearings Market Revenues for the Period 2015-2018, By Roller Bearing Types

- Market Size & Forecast of US and Canada Bearings Market Revenues, Until 2025F, By Roller Bearing Types

- Historical Data of US and Canada Bearings Market Revenues for the Period 2015-2018, By Sales Channels

- Market Size & Forecast of US and Canada Bearings Market Revenues until 2025F, By Sales Channels

- Historical Data of US and Canada Bearings Market Revenues for the Period 2015-2018, By Applications

- Market Size & Forecast of US and Canada Bearings Market Revenues until 2025F, By Applications

- North America Bearings Market Drivers

- North America Bearings Market Restraints

- North America Bearings Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- North America Bearings Market Share, By Players

- North America Bearings Market Share, By Countries

- North America Bearings Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

North America BearingMarketReport Covered:

The report provides a detailed analysis of the following market segments:

By Types

- Ball Bearings

- Roller Bearings

- Other Bearings (Pillow block, Mounted etc.)

By Roller Bearings Types:

- Cylindrical Roller Bearing

- Tapered Roller Bearing

- Spherical Roller Bearings

- Needle Roller Bearings

- Other Roller Bearings

By Sales Channels:

- OEM’s

- Aftermarket Sales

By Applications:

- Aerospace & Railway

- Agricultural Equipment Machinery

- Mining & Oilfield Equipment Machinery

- Automotive Machinery

- Construction Machinery

- Other Machinery

By Countries:

- US

- Canada

North America Bearing Market (2019-2025): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Key Highlights of the Report |

| 2.2. Report Description |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

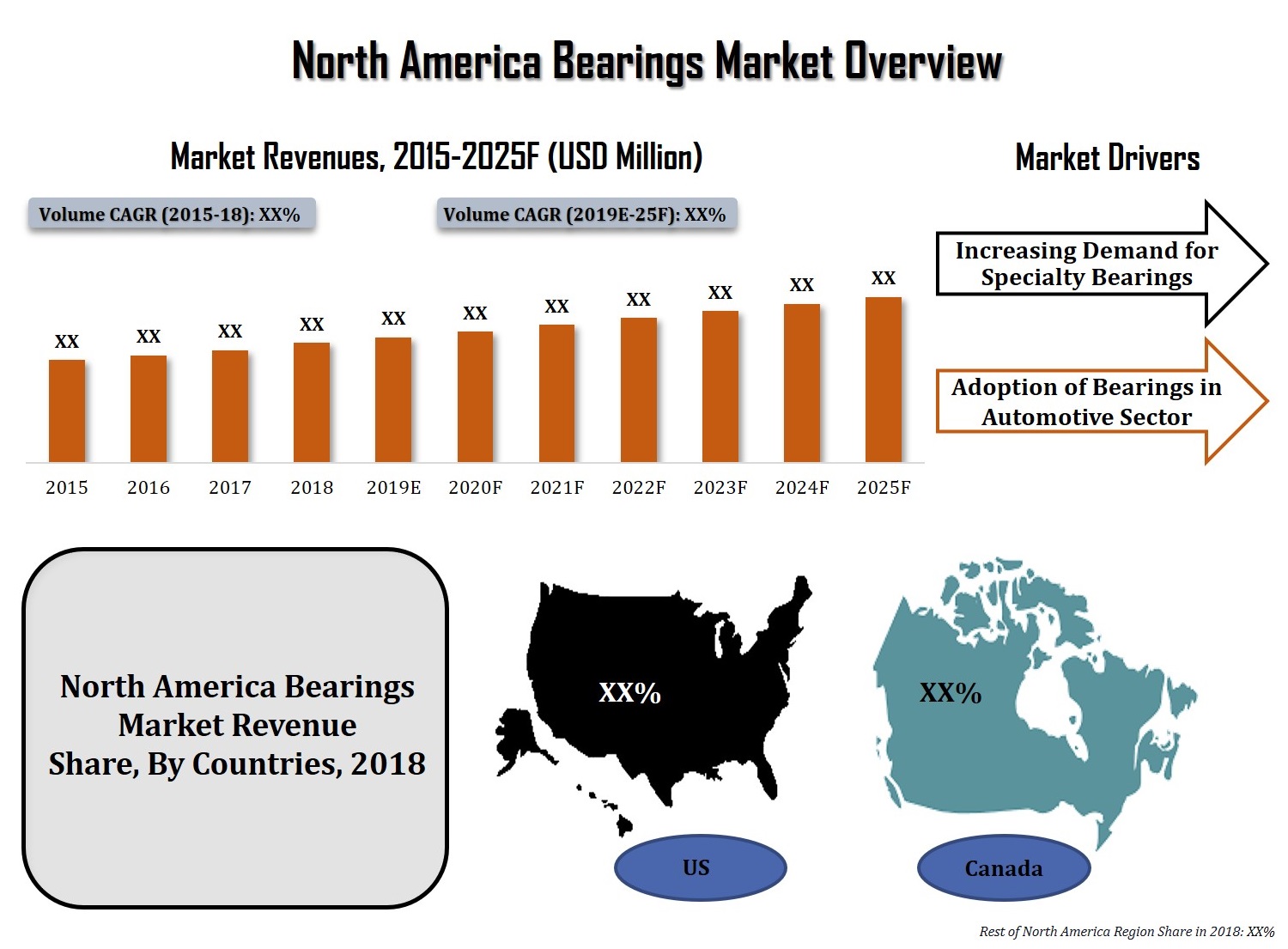

| 3. North America Bearings Market Overview |

| 3.1. North America Bearings Market Revenues, 2015-2025F |

| 3.2. North America Bearings Market - Industry Life Cycle, 2018 |

| 3.3. North America Bearings Market - Porter’s Five Forces |

| 3.4. North America Bearings Market Revenue Share, By Countries, 2018 & 2025F |

| 4. North America Bearings Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. North America Bearings Market Trends |

| 6. US Bearings Market Overview |

| 6.1. Country Overview |

| 6.2. US Bearings Market Revenues, 2015-2025F |

| 6.3. US Bearings Market Overview, By Types |

| 6.3.1. US Bearings Market Revenue share, By Types, 2018 & 2025F |

| 6.3.2. US Ball Bearings Market Revenues, 2015-2025F |

| 6.3.3. US Roller Bearings Market Revenues, 2015-2025F |

| 6.3.3.1. US Cylinderical Roller Bearings Market Revenues, 2015-2025F |

| 6.3.3.2. US Tapered Roller Bearings Market Revenues, 2015-2025F |

| 6.3.3.3. US Spherical Roller Bearings Market Revenues, 2015-2025F |

| 6.3.3.4. US Needle Roller Bearings Market Revenues, 2015-2025F |

| 6.3.3.5. US Other Roller Bearings Market Revenues, 2015-2025F |

| 6.3.4. US Other Bearings Market Revenues, 2015-2025F |

| 6.4. US Bearings Market Overview, By Sales Channel |

| 6.4.1. US Bearings Market Revenue Share, By Sales Channel, 2018 & 2025F |

| 6.4.2. US Bearings Market Reveneus, By OEM's, 2015-2025F |

| 6.4.3. US Bearings Market Reveneus, By Aftermarket Sales, 2015-2025F |

| 6.5. US Bearings Market Overview, By Applications |

| 6.5.1. US Bearings Market Revenue Share, By Applications, 2018 & 2025F |

| 6.5.2. US Railway & Aerospace Bearings Market Revenues, 2015-2025F |

| 6.5.3. US Agricultural Equipment Machinery Bearings Market Revenues, 2015-2025F |

| 6.5.4. US Construction Machinery Bearings Market Revenues, 2015-2025F |

| 6.5.5. US Oilfield Machinery Bearings Market Revenues, 2015-2025F |

| 6.5.6. US Automotive Bearings Market Revenues, 2015-2025F |

| 6.5.7. US Other Machinery Bearings Market Revenues, 2015-2025F |

| 6.6. US Bearings Market Key Performance Indicators |

| 6.7. US Bearings Market Opportunity Assessment |

| 6.7.1. US Bearings Market Opportunity Assessment, By Types, 2025F |

| 6.7.2. US Bearings Market Opportunity Assessment, By Sales Channel, 2025F |

| 6.7.3. US Bearings Market Opportunity Assessment, By Applications, 2025F |

| 7. Canada Bearings Market Overview |

| 7.1. Country Overview |

| 7.2. Canada Bearings Market Revenues, 2015-2025F |

| 7.3. Canada Bearings Market Overview, By Types |

| 7.3.1. Canada Bearings Market Revenue share, By Types, 2018 & 2025F |

| 7.3.2. Canada Ball Bearings Market Revenues, 2015-2025F |

| 7.3.3. Canada Roller Bearings Market Revenues, 2015-2025F |

| 7.3.3.1. Canada Cylinderical Roller Bearings Market Revenues, 2015-2025F |

| 7.3.3.2. Canada Tapered Roller Bearings Market Revenues, 2015-2025F |

| 7.3.3.3. Canada Spherical Roller Bearings Market Revenues, 2015-2025F |

| 7.3.3.4. Canada Needle Roller Bearings Market Revenues, 2015-2025F |

| 7.3.3.5. Canada Other Roller Bearings Market Revenues, 2015-2025F |

| 7.3.4. Canada Other Bearings Market Revenues, 2015-2025F |

| 7.4. Canada Bearings Market Overview, By Sales Channel |

| 7.4.1. Canada Bearings Market Revenue Share, By Sales Channel, 2018 & 2025F |

| 7.4.2. Canada Bearings Market Reveneus, By OEM's, 2015-2025F |

| 7.4.3. Canada Bearings Market Reveneus, By Aftermarket Sales, 2015-2025F |

| 7.5. Canada Bearings Market Overview, By Applications |

| 7.5.1. Canada Bearings Market Revenue Share, By Applications, 2018 & 2025F |

| 7.5.2. Canada Railway & Aerospace Bearings Market Revenues, 2015-2025F |

| 7.5.3. Canada Agricultural Equipment Machinery Bearings Market Revenues, 2015-2025F |

| 7.5.4. Canada Construction Machinery Bearings Market Revenues, 2015-2025F |

| 7.5.5. Canada Oilfield Machinery Bearings Market Revenues, 2015-2025F |

| 7.5.6. Canada Other Machinery Bearings Market Revenues, 2015-2025F |

| 7.5.7. Canada Automotive Bearings Market Revenues, 2015-2025F |

| 7.6. Canada Bearings Market Key Performance Indicators |

| 7.7. Canada Bearings Market Opportunity Assessment |

| 7.7.1. Canada Bearings Market Opportunity Assessment, By Types, 2025F |

| 7.7.2. Canada Bearings Market Opportunity Assessment, By Sales Channel, 2025F |

| 7.7.3. Canada Bearings Market Opportunity Assessment, By Applications, 2025F |

| 8. Rest Of North America Berings Market Overview |

| 8.1. Rest Of North America Bearings Market Revenues, 2015 - 2025F |

| 9. North America Bearings Market-Opportunity Assessment |

| 9.1. North America Bearings Market Opportunity Assessment, By Countries, 2025F |

| 10. North America Bearings Market-Competitive Landscape |

| 10.1. North America Bearings Market Competitive Benchmarking, By Types |

| 10.2. North America Bearings Market Revenue Share, By Company, 2018 |

| 10.2.1. US Bearings Market Revenue Share, By Company, 2018 |

| 10.2.2. Canada Bearings Market Revenue Share, By Company, 2018 |

| 11. Company Profiles |

| 12. Key Strategic Recommendations |

| 13. Disclaimer |

| List Of Figures |

| Figure 1. North America Bearings Market Revenues, 2015-2025F ($ Billion) |

| Figure 2. North America Bearings Market Industry Life Cycle |

| Figure 3. North America Bearings Market Revenue Share, By Countries, 2018 |

| Figure 4. North America Bearings Market Revenues, 2015-2025F ($ Million) |

| Figure 5. US Bearings Market Revenue Share, By Types, 2018 & 2025F |

| Figure 6. US Bearings Market Revenue Share, By Sales Channel, 2018 & 2025F |

| Figure 7. US Bearings Market Revenues, By OEM's,2015-2025F ($Million) |

| Figure 8. US Bearings Market Revenues, By Aftermarket Sales, 2015-2025F ($Million) |

| Figure 9. US Bearings Market Revenue Share, By Applications, 2018 & 2025F |

| Figure 10. US Bearings Market Opportunity Assessment, By Types, 2025F |

| Figure 11. Canada Bearings Market Revenue Share, By Types, 2018 & 2025F |

| Figure 12. Canada Bearings Market Revenue Share, By Sales Channel, 2018 & 2025F |

| Figure 13. Canada Bearings Market Revenues, By OEM's,2015-2025F ($Million) |

| Figure 14. Canada Bearings Market Revenues, By Aftermarket Sales, 2015-2025F ($Million) |

| Figure 15. Canada Bearings Market Revenue Share, By Applications, 2018 & 2025F |

| Figure 16. Canada Bearings Market Opportunity Assessment, By Types, 2025F |

| List Of Tables |

| Table 1. US Ball Bearings Market Revenues, 2015-2025F ($Million) |

| Table 2. US Bearings Market Revenues, By Applications, 2015-2025F ($Million) |

| Table 3. Canada Ball Bearings Market Revenues, 2015-2025F ($Million) |

| Table 4. Canada Bearings Market Revenues, By Applications, 2015-2025F ($Million) |

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Related Reports

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero