North America Gas Genset Market (2018-2024) | Analysis, Size, Revenue, Trends, Growth, Forecast, Industry, Outlook, Value & Segmentation

Market Forecast By KVA Ratings (Up to 100 KVA, 100.1-375 KVA, 375.1-1000 KVA and Above 1000 KVA), By Applications (Residential, Industrial including Manufacturing and production, Commercial including Offices, Museum, Hospitality, Retail, Education and Data Centre, Power & Energy including Oil & Gas and Power Generation and Others including Transportation Infrastructure, Educational Buildings, Government Buildings, and Agriculture), By Countries (the United States, Canada and Rest of North America including Mexico, Panama, Cuba, Costa Rica, Dominic Republic, and others) and Competitive Landscape.

| Product Code: ETC000555 | Publication Date: Nov 2021 | Updated Date: May 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 160 | No. of Figures: 97 | No. of Tables: 46 | |

Latest 2023 Developments of the North America Gas Genset Market

North America Gas Genset Market has witnessed innovation due to some factors, such as increased knowledge of natural gas as a clean and reliable fuel, increased concerns about diesel maintenance and refuelling issues and a general desire to be more environmentally responsible. On July 15, 2019, Caterpillar introduced a new gas engine which can drop fuel use and cost drastically, broadens the range of fuels that can be used and maintains a greenhouse gas footprint. Last week the Wärtsilä 20DF dual-fuel engine has been improved to produce higher power while using less energy. U.S. Energy Development Corp. recently completed infrastructure development projects located in the Eagle Ford Shale.

Mergers and Acquisition:

- On Feb 02, 2021, Caterpillar acquired Weir Oil & Gas and launched SPM Oil & Gas.

North America Gas Genset Market Synopsis

The demand for gas Genset is primarily generated from power plants, oil & gas fields, and manufacturing industries. This has been primarily due to substantial investment in manufacturing industries and power plants. Furthermore, growing environmental concerns and stringent emission regulations for using diesel Genset as the primary source of power backup have driven the demand for gas Genset during the past few years.

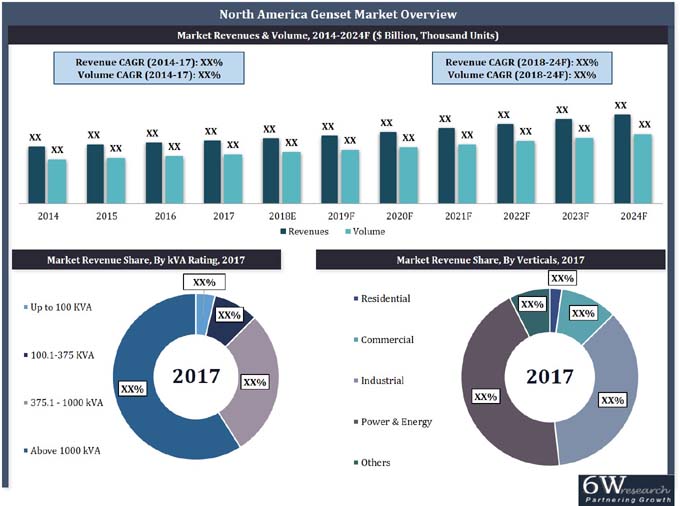

According to 6Wresearch, the North America Gas Genset market is projected to grow at a CAGR of 5.4% during 2018-2024. Growing electricity demand with rising population, industrialization, the low operational cost of gas Genset as well as growing demand for clean and reliable power supply and expansion of gas pipeline infrastructure in the United States, Canada, and Mexico would drive the growth of gas Genset market in the North America region. Moreover, high power losses in many North American countries due to the increasing frequency of grid failures on account of the inability to sustain amplified demand load and high susceptibility to extreme weather conditions would also augment the growth of the gas Genset market in the region. Additionally, upcoming projects such as Google Data Centre, Mountain Valley Pipeline Project, and Eagle Ford Shale would further drive the demand for gas Gensets in the region.

The United States captured the majority of the revenue share in the North America gas Genset market followed by Canada, on account of the rapid deployment of prime power gas Gensets in the industrial and power generation sector, while the residential and commercial sectors would drive the growth of standby Gas Gensets. Further, increasing the adoption of environment-friendly solutions, a rise in green manufacturing practices of industries, and increasing disposable income of the population are some of the key factors driving the growth of the gas Genset market in the region.

The report comprehensively covers the North America Gas Genset Market by kVA ratings, applications, verticals, and countries. The report provides an unbiased and detailed analysis of the ongoing trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics. North America Gas Genset market expansion in the manufacturing sector and growing electricity demand and developing gas Genset market in a few years. There are many factors increasing the awareness of the gas Genset market such as increasing awareness of gas Genset, high power demand, and more severe and unpredictable power outages due to the extremely bad weather conditions increase in the demand of the gas Genset in the forecast period. Growing demand for electricity due to rising population and the low operational cost of gas Genset.

In North America expansion in the different sectors of manufacturing will grow more electricity and demand also increase in the industrial sector and gas-related infrastructure is the growth factor in the North America gas Genset market. There are many factors such as Increasing the demand for gas Genset such as unreliable grid infrastructure, high power demand, and increasing awareness of the gas Genset. Natural gas transportation used gas for travelling prepared maintained the infrastructure in the countries such as Canada & Mexico it creates the demand for gas Genset in the region. The North America Gas Genset market is anticipated to witness potential growth during the forecast period 2020-26F owing to an increase in the adoption of standalone generators for efficient power supply across the North America region. The increasing reliability of the countries across the region such as the US and Canada on gas Genset for domestic as well as industrial use is anticipated to increase the adoption of the product in the coming years and benefit potential market growth in the coming years. Also, decarbonization policies introduced across the region along with a range of actions such as implementing standards for renewable portfolios are, further some of the industrial measures which would boost the North America Gas Genset market in the near future.

Key Highlights of the Report:

- Historical Data of North America Gas Genset Market Revenues for the Period 2014-2017.

- Market Size & Forecast Data of North America Gas Genset Market Revenues until 2024.

- Historical Data of the United States, Canada & Rest of North America Gas Genset Market Revenues for the

- Period 2014-2017, By Applications.

- Market Size & Forecast Data of the United States, Canada & Rest of North America Genset Market Revenues

- until 2024, By Applications.

- Historical Data of the United States, Canada & Rest of North America Gas Genset Market Revenues for the

- Period 2014-2017, By kVA Ratings.

- Market Size & Forecast Data of the United States, Canada & Rest of North America Gas Genset Market Revenues

- until 2024, By kVA Ratings.

- Historical Data of the United States, Canada & Rest of North America Gas Gensets Market Revenues for the

- Period 2014-2017, By Verticals.

- Market Size & Forecast Data of the United States, Canada & Rest of North America Gas Genset Market Revenues

- until 2024, By Verticals.

- Market Drivers and Restraints.

- Market Trends and Developments.

- Players Market Share and Competitive Landscape

- Company Profiles

- Strategic Recommendations

Markets Covered

The report provides a detailed analysis of the following market segments:

By KVA Ratings

- Up to 100 KVA

- 100.1-375 KVA

- 375.1-1000 KVA

- Above 1000 KVA

By Applications

- Standby

- Prime

By Verticals

- Residential

- Industrial (Manufacturing and production)

- Commercial (Offices, museum, hospitality, retail, education, Data Centre, etc.)

- Power & Energy (Oil & Gas, Power Generation)

- Others (Transportation Infrastructure, educational buildings, government buildings, agriculture, etc.)

By Countries

- United States

- Canada

- Rest of North America (Mexico, Panama, Cuba, Costa Rica, Dominic Republic, and others)

North America Gas Genset Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Global Gas Genset Market Overview |

| 3.1 Global Gas Genset Market Revenues and Volume, 2014-2024F |

| 3.2 Global Gas Genset Market Revenue and Volume Share, By Applications, 2017 & 2024F |

| 4. North America Gas Genset Market Overview |

| 4.1 North America Gas Genset Market Revenues and Volume, 2014-2024F |

| 4.2 North America Gas Genset Market Revenue and Volume Share, By Applications, 2017 & 2024F |

| 4.3 North America Gas Genset Market Revenue and Volume Share, By kVA Ratings, 2017 & 2024F |

| 4.4 North America Gas Genset Market Revenue and Volume Share, By Verticals, 2017 & 2024F |

| 4.5 North America Gas Genset Market Revenue and Volume Share, By Countries, 2017 & 2024F |

| 4.6 North America Gas Genset Market - Industry Life Cycle |

| 4.7 North America Gas Genset Market - Porter's Five Forces |

| 5. North America Gas Genset Market Overview, By Applications |

| 5.1 North America Standby Gas Genset Market Revenues and Volume, 2014-2024F |

| 5.1.1 North America Standby Gas Genset Market Revenue and Volume Share, By kVA Ratings, 2017 & 2024F |

| 5.1.2 North America Standby Gas Genset Market Revenue and Volume Share, By Verticals, 2017 & 2024F |

| 5.2 North America Prime Power Gas Genset Market Revenues and Volume, 2014-2024F |

| 5.2.1 North America Prime Power Gas Genset Market Revenue and Volume Share, |

| By kVA Ratings, 2017 & 2024F |

| 5.2.2 North America Prime Power Gas Genset Market Revenue and Volume Share, By Verticals, 2017 & 2024F |

| 6. North America Gas Genset Market Dynamics |

| 6.1 Impact Analysis |

| 6.2 Market Drivers |

| 6.3 Market Restraints |

| 7. North America Gas Genset Market Trends |

| 8. United States Gas Genset Market Overview |

| 8.1. United States Gas Genset Market Revenues and Volume, 2014-2024F |

| 8.2 United States Gas Genset Market Revenue and Volume Share, By kVA Ratings, 2017 & 2024F |

| 8.2.1 United States Gas Genset Market Revenues and Volume, By kVA Ratings, 2014-2024F |

| 8.3 United States Gas Genset Market Revenue and Volume Share, By Verticals, 2017 & 2024F |

| 8.3.1 United States Gas Genset Market Revenues and Volume, By Verticals, 2014-2024F |

| 8.4 United States Standby Gas Genset Market Revenues and Volume, 2014-2024F |

| 8.4.1. The United States Standby Gas Genset Market Revenue and Volume Share, By kVA Ratings, 2017 & 2024F |

| 8.4.2. United States Standby Gas Genset Market Revenues and Volume, By kVA Ratings, 2014-2024F |

| 8.4.3. The United States Standby Gas Genset Market Revenue and Volume Share, By Verticals, 2017 & 2024F |

| 8.4.4. United States Standby Gas Genset Market Revenues and Volume, By Verticals, 2014-2024F |

| 8.5 United States Prime Power Gas Genset Market Revenues and Volume, 2014-2024F |

| 8.5.1. The United States Prime Power Gas Genset Market Revenue and Volume Share, |

| By kVA Ratings, 2017 & 2024F |

| 8.5.2. The United States Prime Power Gas Genset Market Revenues and Volume, By kVA Ratings, 2014-2024F |

| 8.5.3. The United States Prime Power Gas Genset Market Revenue and Volume Share, By Verticals, 2017 & 2024F |

| 8.5.4. The United States Prime Power Gas Genset Market Revenues and Volume, By Verticals, 2014-2024F |

| 9. Canada Gas Genset Market Overview |

| 9.1. Canada Gas Genset Market Revenues and Volume, 2014-2024F |

| 9.2 Canada Gas Genset Market Revenue and Volume Share, By kVA Ratings, 2017 & 2024F |

| 9.2.1 Canada Gas Genset Market Revenues and Volume, By kVA Ratings, 2014-2024F |

| 9.3 Canada Gas Genset Market Revenue and Volume Share, By Verticals, 2017 & 2024F |

| 9.3.1 Canada Gas Genset Market Revenues and Volume, By Verticals, 2014-2024F |

| 9.4 Canada Standby Gas Genset Market Revenues and Volume, 2014-2024F |

| 9.4.1. Canada Standby Gas Genset Market Revenue and Volume Share, By kVA Ratings, 2017 & 2024F |

| 9.4.2. Canada Standby Gas Genset Market Revenues and Volume, By kVA Ratings, 2014-2024F |

| 9.4.3. Canada Standby Gas Genset Market Revenue and Volume Share, By Verticals, 2017 & 2024F |

| 9.4.4. Canada Standby Gas Genset Market Revenues and Volume, By Verticals, 2014-2024F |

| 9.5 Canada Prime Power Gas Genset Market Revenues and Volume, 2014-2024F |

| 9.5.1. Canada Prime Power Gas Genset Market Revenue and Volume Share, By kVA Ratings, 2017 & 2024F |

| 9.5.2. Canada Prime Power Gas Genset Market Revenues and Volume, By kVA Ratings, 2014-2024F |

| 9.5.3. Canada Prime Power Gas Genset Market Revenue and Volume Share, By Verticals, 2017 & 2024F |

| 9.5.4. Canada Prime Power Gas Genset Market Revenues and Volume, By Verticals, 2014-2024F |

| 10. Rest of North America Gas Genset Market Overview |

| 10.1. Rest of North America Gas Genset Market Revenues and Volume, 2014-2024F |

| 10.2 Rest of North America Gas Genset Market Revenue and Volume Share, By kVA Ratings, 2017 & 2024F |

| 10.2.1 Rest of North America Gas Genset Market Revenues and Volume, By kVA Ratings, 2014-2024F |

| 10.3 Rest of North America Gas Genset Market Revenue and Volume Share, By Verticals, 2017 & 2024F |

| 10.3.1 Rest of North America Gas Genset Market Revenues and Volume, By Verticals, 2014-2024F |

| 10.4 Rest of North America Standby Gas Genset Market Revenues and Volume, 2014-2024F |

| 10.4.1. Rest of North America Standby Gas Genset Market Revenue and Volume Share, |

| By kVA Ratings, 2017 & 2024F |

| 10.4.2. Rest of North America Standby Gas Genset Market Revenues and Volume, By kVA Ratings, 2014-2024F |

| 10.4.3. Rest of North America Standby Gas Genset Market Revenue and Volume Share, |

| By Verticals, 2017 & 2024F |

| 10.4.4. Rest of North America Standby Gas Genset Market Revenues and Volume, By Verticals, 2014-2024F |

| 10.5 Rest of North America Prime Power Gas Genset Market Revenues and Volume, 2014-2024F |

| 10.5.1. Rest of North America Prime Power Gas Genset Market Revenue and Volume Share, |

| By kVA Ratings, 2017 & 2024F |

| 10.5.2. Rest of North America Prime Power Gas Genset Market Revenues and Volume, |

| By kVA Ratings, 2014-2024F |

| 10.5.3. Rest of North America Prime Power Gas Genset Market Revenue and Volume Share, |

| By Verticals, 2017 & 2024F |

| 10.5.4. Rest of North America Prime Power Gas Genset Market Revenues and Volume, |

| By Verticals, 2014-2024F |

| 11. North America Gas Genset Market Price Trend, By kVA Ratings |

| 12. North America Gas Genset Market Key Performance Indicators |

| 12.1 North America Commercial Sector Outlook |

| 12.2 North America Residential Sector Outlook |

| 12.3 North America Industrial Sector Outlook |

| 12.4. North America Oil & Gas Sector Outlook |

| 12.5 North America Construction Industry Outlook |

| 12.6. North America Natural Gas Sector Outlook |

| 13. North America Gas Genset Market Opportunity Assessment |

| 13.1 North America Gas Genset Market Opportunity Assessment, By Countries, 2024F |

| 13.2 North America Gas Genset Market Opportunity Assessment, By Verticals, 2024F |

| 14. Competitive Landscape |

| 14.1 North America Gas Genset Market Revenues, By Company, 2017 |

| 14.2 Competitive Benchmarking, By kVA Ratings |

| 15. Company Profiles |

| 15.1. Briggs & Stratton Corporation |

| 15.2. Generac Power Systems, Inc |

| 15.3. MTU Onsite Energy Corporation |

| 15.4. GE Power |

| 15.5. Wartsila Corporation |

| 15.6. Himoinsa Power Systems Inc. |

| 15.7. Cummins Inc. |

| 15.8. Caterpillar Inc. |

| 15.9. Kohler Power Systems |

| 15.10. Siemens AG |

| 16. Strategic Recommendations |

| 17. Disclaimer |

| List of Figures |

| 1. Global Gas Genset Market Revenues and Volume, 2014 - 2024F ($ Billion, Thousand Units) |

| 2. Global Gas Genset Market Revenue Share, By Regions, 2017 |

| 3. North America Gas Genset Market Revenues and Volume, 2014 - 2024F ($ Million, Thousand Units) |

| 4. North America Gas Genset Market Revenue Share, By Applications, 2017 & 2024F |

| 5. North America Gas Genset Market Volume Share, By Applications, 2017 & 2024F |

| 6. North America Gas Genset Market Revenue Share, By kVA Ratings, 2017 & 2024F |

| 7. North America Gas Genset Market Volume Share, By kVA Ratings, 2017 & 2024F |

| 8. North America Gas Genset Market Revenue Share, By Verticals, 2017 & 2024F |

| 9. North America Gas Genset Market Volume Share, By Verticals, 2017 & 2024F |

| 10. North America Gas Genset Market Revenue Share, By Countries, 2017 & 2024F |

| 11. North America Gas Genset Market Volume Share, By Countries, 2017 & 2024F |

| 12. North America Standby Gas Genset Market Revenues and Volume, 2014 - 2024F ($ Million, Units) |

| 13. North America Standby Gas Genset Market Revenue Share, By kVA Ratings, 2017 & 2024F |

| 14. North America Standby Gas Genset Market Volume Share, By kVA Ratings, 2017 & 2024F |

| 15. North America Standby Gas Genset Market Revenue Share, By Verticals, 2017 & 2024F |

| 16. North America Standby Gas Genset Market Volume Share, By Verticals, 2017 & 2024F |

| 17. North America Prime Power Gas Genset Market Revenues and Volume, 2014 - 2024F ($ Million, Units) |

| 18. North America Prime Power Gas Genset Market Revenue Share, By kVA Ratings, 2017 & 2024F |

| 19. North America Prime Power Gas Genset Market Volume Share, By kVA Ratings, 2017 & 2024F |

| 20. North America Prime Power Gas Genset Market Revenue Share, By Verticals, 2017 & 2024F |

| 21. North America Prime Power Gas Genset Market Volume Share, By Verticals, 2017 & 2024F |

| 22. North America Projected Capital Infrastructure Investment for Oil & Gas, By Product Types, 2018-2035 |

| 23. Global Natural Gas Demand Growth Rate, By Regions, 2000-2040 |

| 24. Global Natural Gas Production, 2016-2024F |

| 25. United Gas Genset Market Revenues & Volume, 2014 - 2024F ($ Million, Units) |

| 26. United States Gas Genset Market Revenue Share, By kVA Ratings, 2017 & 2024F |

| 27. United States Gas Genset Market Volume Share, By kVA Ratings, 2017 & 2024F |

| 28. The United States Gas Genset Market Revenue Share, By Verticals, 2017 & 2024F |

| 29. United States Gas Genset Market Volume Share, By Verticals, 2017 & 2024F |

| 30. The United States Standby Gas Genset Market Revenues and Volume, 2014 - 2024F ($ Million, Units) |

| 31. The United States Standby Gas Genset Market Revenue Share, By kVA Ratings, 2017 & 2024F |

| 32. United States Standby Gas Genset Market Volume Share, By kVA Ratings, 2017 & 2024F |

| 33. The United States Standby Gas Genset Market Revenue Share, By Verticals, 2017 & 2024F |

| 34. United States Standby Gas Genset Market Volume Share, By Verticals, 2017 & 2024F |

| 35. The United States Prime Power Gas Genset Market Revenues and Volume, 2014 - 2024F ($ Million, Units) |

| 36. The United States Prime Power Gas Genset Market Revenue Share, By kVA Ratings, 2017 & 2024F |

| 37. The United States Prime Power Gas Genset Market Volume Share, By kVA Ratings, 2017 & 2024F |

| 38. The United States Prime Power Gas Genset Market Revenue Share, By Verticals, 2017 & 2024F |

| 39. The United States Prime Power Gas Genset Market Volume Share, By Verticals, 2017 & 2024F |

| 40. Canada Gas Genset Market Revenues & Volume, 2014 - 2024F ($ Million, Units) |

| 41. Canada Gas Genset Market Revenue Share, By kVA Ratings, 2017 & 2024F |

| 42. Canada Gas Genset Market Volume Share, By kVA Ratings, 2017 & 2024F |

| 43. Canada Gas Genset Market Revenue Share, By Verticals, 2017 & 2024F |

| 44. Canada Gas Genset Market Volume Share, By Verticals, 2017 & 2024F |

| 45. Canada Standby Gas Genset Market Revenues and Volume, 2014 - 2024F ($ Million, Units) |

| 46. Canada Standby Gas Genset Market Revenue Share, By kVA Ratings, 2017 & 2024F |

| 47. Canada Standby Gas Genset Market Volume Share, By kVA Ratings, 2017 & 2024F |

| 48. Canada Standby Gas Genset Market Revenue Share, By Verticals, 2017 & 2024F |

| 49. Canada Standby Gas Genset Market Volume Share, By Verticals, 2017 & 2024F |

| 50. Canada Prime Power Gas Genset Market Revenues and Volume, 2014 - 2024F ($ Million, Units) |

| 51. Canada Prime Power Gas Genset Market Revenue Share, By kVA Ratings, 2017 & 2024F |

| 52. Canada Prime Power Gas Genset Market Volume Share, By kVA Ratings, 2017 & 2024F |

| 53. Canada Prime Power Gas Genset Market Revenue Share, By Verticals, 2017 & 2024F |

| 54. Canada Prime Power Gas Genset Market Volume Share, By Verticals, 2017 & 2024F |

| 55. Rest of North America Gas Genset Market Revenues & Volume, 2014 - 2024F ($ Million, Units) |

| 56. Rest of North America Gas Genset Market Revenue Share, By kVA Ratings, 2017 & 2024F |

| 57. Rest of North America Gas Genset Market Volume Share, By kVA Ratings, 2017 & 2024F |

| 58. Rest of North America Gas Genset Market Revenue Share, By Verticals, 2017 & 2024F |

| 59. Rest of North America Gas Genset Market Volume Share, By Verticals, 2017 & 2024F |

| 60. Rest of North America Standby Gas Genset Market Revenues and Volume, 2014 - 2024F ($ Million, Units) |

| 61. Rest of North America Standby Gas Genset Market Revenue Share, By kVA Ratings, 2017 & 2024F |

| 62. Rest of North America Standby Gas Genset Market Volume Share, By kVA Ratings, 2017 & 2024F |

| 63. Rest of North America Standby Gas Genset Market Revenue Share, By Verticals, 2017 & 2024F |

| 64. Rest of North America Standby Gas Genset Market Volume Share, By Verticals, 2017 & 2024F |

| 65. Rest of North America Prime Power Gas Genset Market Revenues and Volume, 2014 - 2024F ($ Million, Units) |

| 66. Rest of North America Prime Power Gas Genset Market Revenue Share, By kVA Ratings, 2017 & 2024F |

| 67. Rest of North America Prime Power Gas Genset Market Volume Share, By kVA Ratings, 2017 & 2024F |

| 68. Rest of North America Prime Power Gas Genset Market Revenue Share, By Verticals, 2017 & 2024F |

| 69. Rest of North America Prime Power Gas Genset Market Volume Share, By Verticals, 2017 & 2024F |

| 70. North America Standby Gas Genset Market Average Selling Price, By kVA Ratings 2014 - 2024F ($/Unit) |

| 71. North America Prime Power Gas Genset Market Average Selling Price, By kVA Ratings 2014 - 2024F ($/Unit) |

| 72. North America Upcoming Data Centres |

| 73. United States Lodging Construction, 2014-2021F ($ Billion) |

| 74. United States Office Construction, 2014-2021F ($ Billion) |

| 75. United States Commercial Construction, 2014-2021F ($ Billion) |

| 76. United States Healthcare Construction, 2014-2021F ($ Billion) |

| 77. United States Transportation Construction, 2014-2021F ($ Billion) |

| 78. United States Manufacturing Facility Construction, 2014-2021F ($ Billion) |

| 79. United States Single & Multi-Family Residential Construction, 2014-2021F ($ Billion) |

| 80. Canada Housing Construction Starts, 2014-2021F (Thousand Units) |

| 81. United States Manufacturing Construction, 2014-2021F ($ Billion) |

| 82. United States Power Construction, 2014-2021F ($ Billion) |

| 83. North America Upcoming Oil & Gas Projects |

| 84. North America Construction Industry Value by Countries, 2015 & 2020F ($ Billion) |

| 85. North America Cumulative Infrastructure Investment, 2016 - 2040F ($ Billion) |

| 86. Canada Construction Permit Value, 2014 -2018E ($ Billion) |

| 87. United States Construction Put in Place, 2016 - 2021F ($ Billion) |

| 88. U.S. Construction Sector Top 4 End-Markets by Region, 2017 |

| 89. The United States Natural Gas Demand, By End User, 2015 & 2025 (Trillion Cubic Feet/year) |

| 90. North America Natural Gas Production, 20156& 2025F (Billion Cubic Meters) |

| 91. United States LNG Liquefication Capacity Addition, 2014-2021F (Billion Cubic Meters) |

| 92. The United States Natural Gas Production By Source, 2013-2023F (Billion Cubic Meters) |

| 93. North America Gas Genset Market Opportunity Assessment, By Countries, 2024F |

| 94. North America Gas Genset Market Opportunity Assessment, By Verticals, 2024F |

| 95. North America Gas Genset Market Revenues, By Company, 2017 (Million) |

| 96. Natural Gas Import Price in Selected Regions, 2016 & 2025 ($/MBtu) |

| 97. Global Technically Recoverable Shale Gas Reserves, 2017 (Trillion Cubic Feet) |

| List of Tables |

| 1. Annual Average U.S. and Canada Capital Expenditures for Oil & Gas Infrastructure, 2010-2035F ($ Billion) |

| 2. Global Gas Demand By Regions, 2016 & 2020F (Billion Cubic Meter) |

| 3. United States Gas Genset Market Revenues, By kVA Ratings, 2014 - 2024F ($ Million) |

| 4. United States Gas Genset Market Volume, By kVA Ratings, 2014 - 2024F (Units) |

| 5. United States Gas Genset Market Revenues, By Verticals, 2014 - 2024F ($ Million) |

| 6. United States Gas Genset Market Volume, By Verticals, 2014 - 2024F (Units) |

| 7. United States Standby Gas Genset Market Revenues, By kVA Ratings, 2014 - 2024F ($ Million) |

| 8. United States Standby Gas Genset Market Volume, By kVA Ratings, 2014 - 2024F (Units) |

| 9. United States Standby Gas Genset Market Revenues, By Verticals, 2014 - 2024F ($ Million) |

| 10. United States Standby Gas Genset Market Volume, By Verticals, 2014 - 2024F (Units) |

| 11. The United States Prime Power Gas Genset Market Revenues, By kVA Ratings, 2014 - 2024F ($ Million) |

| 12. The United States Prime Power Gas Genset Market Volume, By kVA Ratings, 2014 - 2024F (Units) |

| 13. The United States Prime Power Gas Genset Market Revenues, By Verticals, 2014 - 2024F ($ Million) |

| 14. The United States Prime Power Gas Genset Market Volume, By Verticals, 2014 - 2024F (Units) |

| 15. Canada Gas Genset Market Revenues, By kVA Ratings, 2014 - 2024F ($ Million) |

| 16. Canada Gas Genset Market Volume, By kVA Ratings, 2014 - 2024F (Units) |

| 17. Canada Gas Genset Market Revenues, By Verticals, 2014 - 2024F ($ Million) |

| 18. Canada Gas Genset Market Volume, By Verticals, 2014 - 2024F (Units) |

| 19. Canada Standby Gas Genset Market Revenues, By kVA Ratings, 2014 - 2024F ($ Million) |

| 20. Canada Standby Gas Genset Market Volume, By kVA Ratings, 2014 - 2024F (Units) |

| 21. Canada Standby Gas Genset Market Revenues, By Verticals, 2014 - 2024F ($ Million) |

| 22. Canada Standby Gas Genset Market Volume, By Verticals, 2014 - 2024F (Units) |

| 23. Canada Prime Power Gas Genset Market Revenues, By kVA Ratings, 2014 - 2024F ($ Million) |

| 24. Canada Prime Power Gas Genset Market Volume, By kVA Ratings, 2014 - 2024F (Units) |

| 25. Canada Prime Power Gas Genset Market Revenues, By Verticals, 2014 - 2024F ($ Million) |

| 26. Canada Prime Power Gas Genset Market Volume, By Verticals, 2014 - 2024F (Units) |

| 27. Rest of North America Gas Genset Market Revenues, By kVA Ratings, 2014 - 2024F ($ Million) |

| 28. Rest of North America Gas Genset Market Volume, By kVA Ratings, 2014 - 2024F (Units) |

| 29. Rest of North America Gas Genset Market Revenues, By Verticals, 2014 - 2024F ($ Million) |

| 30. Rest of North America Gas Genset Market Volume, By Verticals, 2014 - 2024F (Units) |

| 31. Rest of North America Standby Gas Genset Market Revenues, By kVA Ratings, 2014 - 2024F ($ Million) |

| 32. Rest of North America Standby Gas Genset Market Volume, By kVA Ratings, 2014 - 2024F (Units) |

| 33. Rest of North America Standby Gas Genset Market Revenues, By Verticals, 2014 - 2024F ($ Million) |

| 34. Rest of North America Standby Gas Genset Market Volume, By Verticals, 2014 - 2024F (Units) |

| 35. Rest of North America Prime Power Gas Genset Market Revenues, By kVA Ratings, 2014 - 2024F ($ Million) |

| 36. Rest of North America Prime Power Gas Genset Market Volume, By kVA Ratings, 2014 - 2024F (Units) |

| 37. Rest of North America Prime Power Gas Genset Market Revenues, By Verticals, 2014 - 2024F ($ Million) |

| 38. Rest of North America Prime Power Gas Genset Market Volume, By Verticals, 2014 - 2024F (Units) |

| 39. North America Upcoming Commercial Projects |

| 40. North America Upcoming Residential Projects |

| 41. North America Upcoming Industrial Projects |

| 42. North America Direct Capital Investment, 2014 - 2025 ($ Million) |

| 43. U.S. Construction Sector Growth Rate (2017& 2018), By Segment |

| 44. Canada Construction Sector Growth Rate (2017 & 2018) By Segment |

| 45. North America Natural Gas Pipeline Capacity Additions, 2014-2035F (Billion Cubic Feet per day) |

| 46. Canada Gas Infrastructure Projects |

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero