Oman Air Conditioner Market (2023-2029) | Industry, Size, Growth, Analysis, Revenue, Share, Trends, Value, Outlook, Segmentation

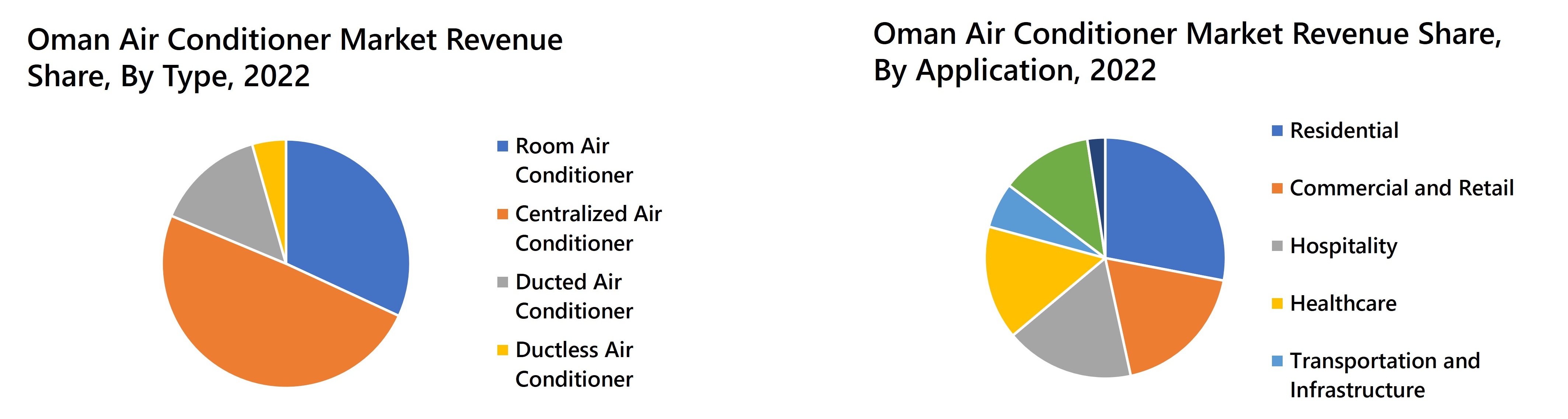

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality,Oil & Gas,Others (Education, BFSI, Manufacturing, etc)), And Competitive Landscape

| Product Code: ETC090102 | Publication Date: Sep 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 77 | No. of Figures: 18 | No. of Tables: 17 | |

Oman Air Conditioner Market Size & Growth Rate

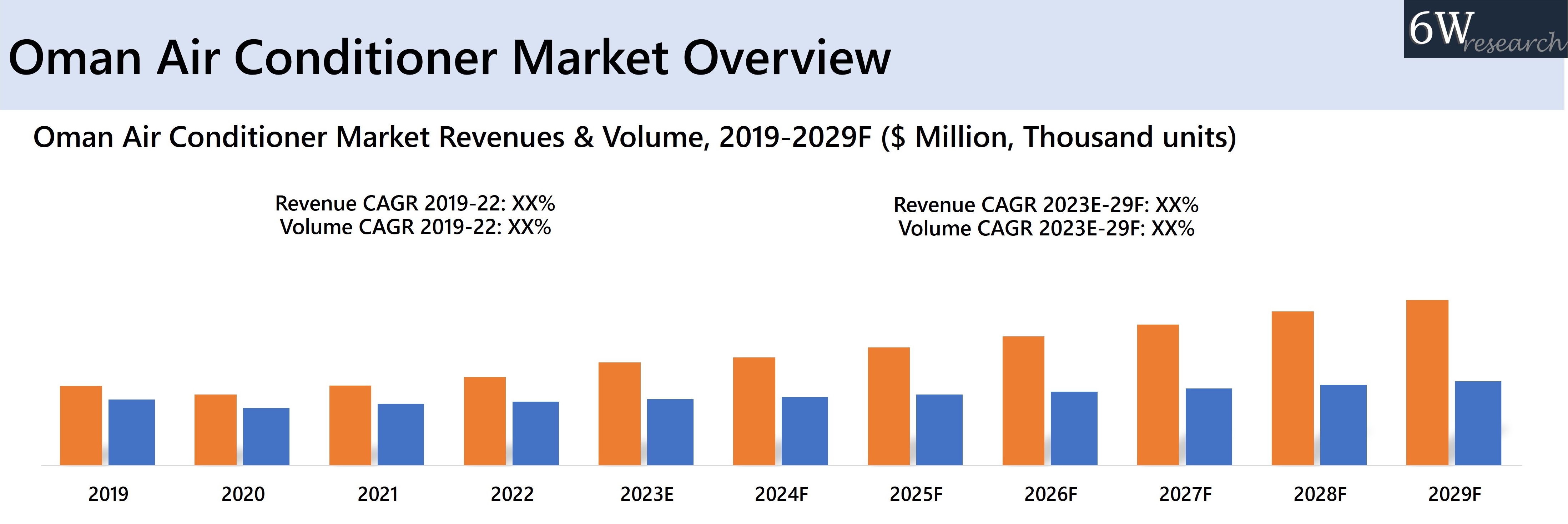

The Oman Air Conditioner Market is projected to grow at a CAGR of 8.2% from 2023 to 2029. Growth is being driven by the expansion of the residential, commercial, and infrastructure sectors, supported by rising real estate values and major retail developments such as the Mall of Oman.

Oman Air Conditioner Market Synopsis

Oman Air Conditioner Market witnessed steady growth in recent years owing to growth in the residential, commercial, and infrastructure sectors. However, the Oman air conditioner market was negatively impacted in 2020 by the COVID-19 pandemic as a result of the complete lockdown brought in force by the Government to prevent the spread of coronavirus which disrupted the supply chain, manufacturing processes and put a halt to all the developmental activities across all the sectors. However, the phase of decline was temporary, and the market recovered in 2021 and returned to a healthy growth rate, thereafter on account of the resumption of all developmental activities. Oman’s value of real estate increased by 6% to $7.03 billion in 2022, compared to $6.63 billion in 2021. In 2021, Majid Al Futtaim Properties opened the Mall of Oman in Muscat, the biggest mall in the Sultanate, with an investment of approximately $ 467.5 million, thereby contributing to the retail sector of Oman. Also, Oman’s construction market is anticipated to register a CAGR of more than 5 percent from 2021 to 2026, and with the country’s new five-year development plan (2021-2025), the market would register growth, thereby contributing to the demand for air conditioners.

According to 6Wresearch, the Oman Air Conditioner Market Revenues is projected to grow at a CAGR of 8.2% during 2023-29. Oman government will invest $963.3 million into various development projects by the year 2024. Moreover, in 2020, Muscat had the largest hotel stock in Oman with 298 hotel establishments, and is expected to have an additional 11,000 keys by 2025. Additionally, Oman unveiled its National Strategy for Tourism 2040 with an objective to increase the international tourist arrivals in Oman to almost 12 million visitors per annum by 2040, which would drive investment in tourism and thereby increase the demand for air conditioners. Also, Oman’s Madayn Vision 2040 targets to complete 10,000 projects with an investment of $39 billion. These initiatives would contribute to the growth of the Air Conditioner Market in Oman.

According to 6Wresearch, the Oman Air Conditioner Market Revenues is projected to grow at a CAGR of 8.2% during 2023-29. Oman government will invest $963.3 million into various development projects by the year 2024. Moreover, in 2020, Muscat had the largest hotel stock in Oman with 298 hotel establishments, and is expected to have an additional 11,000 keys by 2025. Additionally, Oman unveiled its National Strategy for Tourism 2040 with an objective to increase the international tourist arrivals in Oman to almost 12 million visitors per annum by 2040, which would drive investment in tourism and thereby increase the demand for air conditioners. Also, Oman’s Madayn Vision 2040 targets to complete 10,000 projects with an investment of $39 billion. These initiatives would contribute to the growth of the Air Conditioner Market in Oman.

![Oman Air Conditioner Market Revenue Share]() Market by Types

Market by Types

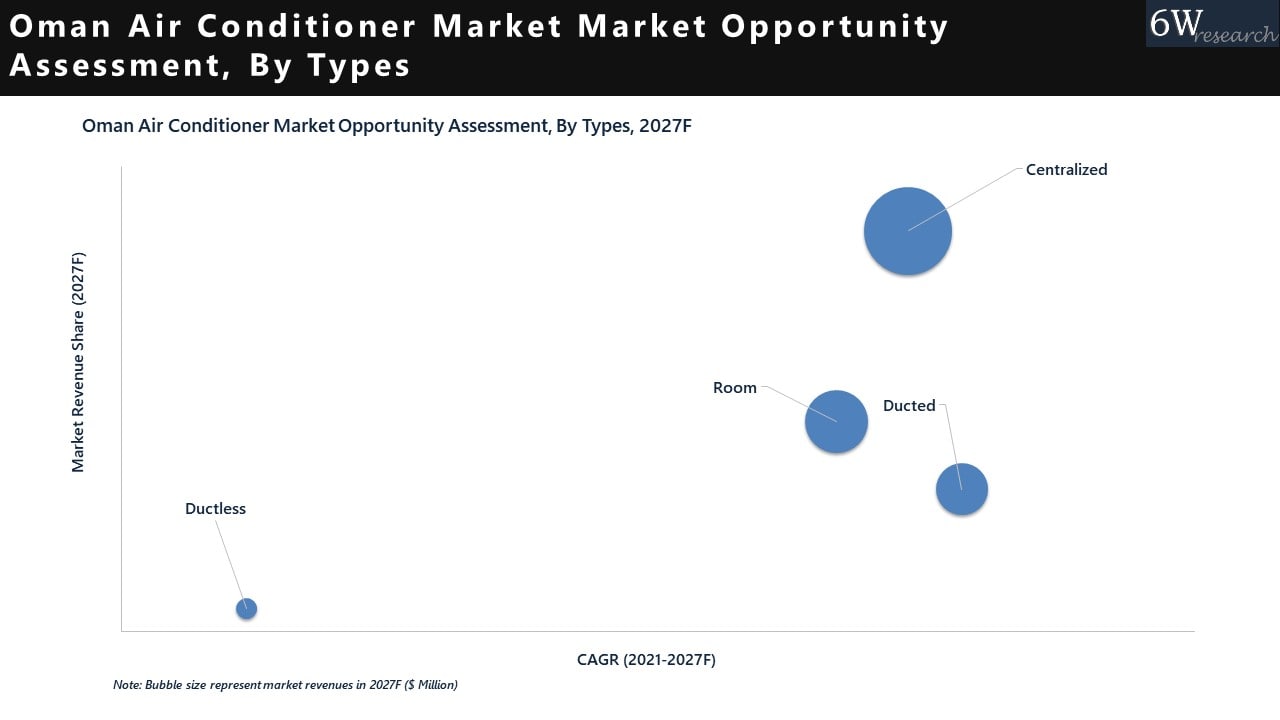

The centralized air conditioner is expected to register the highest growth rate in the forecast period owing to a variety of benefits such as a centralized thermostat, enabling more accurate temperature control and energy management. They are mostly used in large-scale commercial or residential buildings as they are more dependable and require less upkeep than standalone room air conditioners.

Market by Application

The residential segment is expected to witness significant growth in the forecast period followed by the hospitality sector owing to Oman Vision 2040 by developing infrastructure projects and the Omani government has launched several initiatives to promote affordable housing sales. Further, projects such as Yenkit Hills: Phase 1, 3, Sohar three-star hotel, and others would also contribute to their growth.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Oman Air Conditioner Market Outlook

- Historical Data and Forecast of Oman Air Conditioner Revenues & Volume for the Period 2019 – 2029F

- Oman Air Conditioner Market Trend Evolution

- Oman Air Conditioner Market Drivers and Restraints

- Oman Air Conditioner Porter's Five Forces

- Oman Air Conditioner Industry Life Cycle

- Historical Data and Forecast of Oman Air Conditioner Market Revenues & Volume By Type for the Period 2019 – 2029F

- Historical Data and Forecast of Oman Air Conditioner Market Revenues By Application for the Period 2019 – 2029F

- Key Performance Indicators

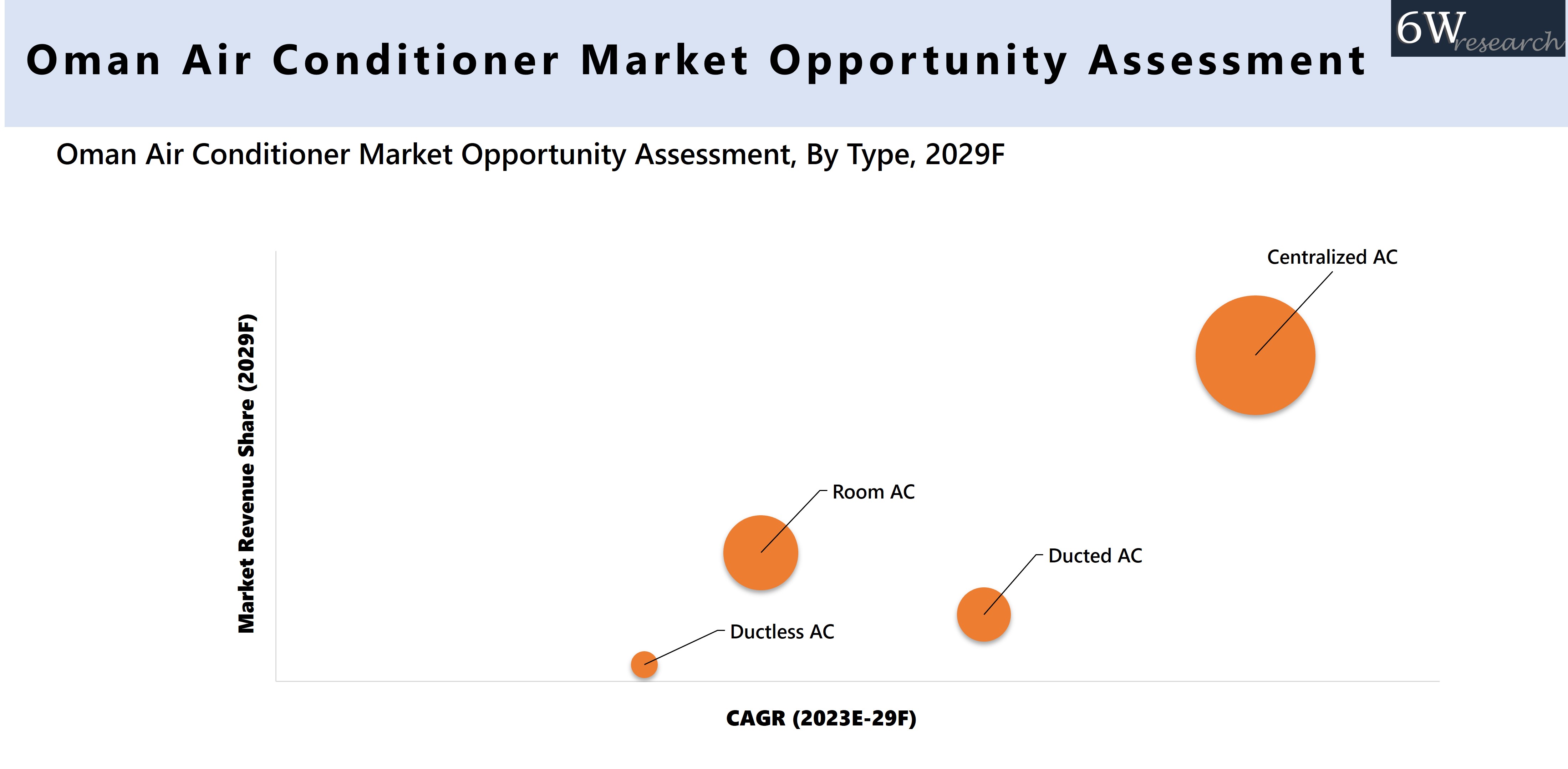

- Oman Air Conditioner Market Opportunity Assessment

- Oman Air Conditioner Top Companies Market Share

- Oman Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereport provides a detailed analysis of the following market segments:

By Type

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Application

- Residential

- Healthcare

- Commercial & Retail

- Transportation & Infrastructure

- Hospitality

- Oil & Gas

- Others (Education, BFSI, Manufacturing, etc)

Oman Air Conditioner (AC) Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Oman Air Conditioner Market Overview |

| 3.1 Oman Air Conditioner Market Revenues and Volume, 2019–2029F |

| 3.2 Oman Air Conditioner Market- Industry Life Cycle |

| 3.3 Oman Air Conditioner Market- Porter's Five Forces |

| 4. Oman Air Conditioner Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for air conditioning units due to rising temperatures in Oman |

| 4.2.2 Growth in commercial and residential construction projects driving the need for air conditioning systems |

| 4.2.3 Technological advancements leading to energy-efficient and smart air conditioner solutions |

| 4.3 Market Restraints |

| 4.3.1 High initial cost of purchasing and installing air conditioning units |

| 4.3.2 Fluctuating raw material prices impacting manufacturing costs |

| 4.3.3 Seasonal nature of demand for air conditioners in Oman affecting sales cycles |

| 5. Oman Air Conditioner Market Trends and Evolution |

| 6. Oman Air Conditioner Market Overview, By Type |

| 6.1 Oman Air Conditioner Market Revenues and Revenue share, 2019-2029F |

| 6.1.1 Oman Air Conditioner Market Volume and Volume share, 2019-2029F |

| 6.2 Oman Air Conditioner Market Revenues and Revenue share, By Room Air Conditioner 2019-2029F |

| 6.2.1 Oman Air Conditioner Market Volume and Volume share, By Room Air Conditioner 2019-2029F |

| 6.2 Oman Air Conditioner Market Revenues and Revenue share, By Ducted Air Conditioner 2019-2029F |

| 6.2.1 Oman Air Conditioner Market Volume and Volume share, By Ducted Air Conditioner 2019-2029F |

| 6.2 Oman Air Conditioner Market Revenues and Revenue share, By Ductless Air Conditioner 2019-2029F |

| 6.2.1 Oman Air Conditioner Market Volume and Volume share, By Ductless Air Conditioner 2019-2029F |

| 6.2 Oman Air Conditioner Market Revenues and Revenue share, By Centralized Air Conditioner 2019-2029F |

| 6.2.1 Oman Air Conditioner Market Volume and Volume share, By Centralized Air Conditioner 2019-2029F |

| 7. Oman Air Conditioner Market Overview, By Applications |

| 7.1 Oman Air Conditioner Market Revenues, By Residential 2019-2029F |

| 7.1 Oman Air Conditioner Market Revenues, By Healthcare 2019-2029F |

| 7.1 Oman Air Conditioner Market Revenues, By Commercial & Retail 2019-2029F |

| 7.1 Oman Air Conditioner Market Revenues, By Transportation & Infrastructure 2019-2029F |

| 7.1 Oman Air Conditioner Market Revenues, By Hospitality 2019-2029F |

| 7.1 Oman Air Conditioner Market Revenues, By Others (Educational Institute, Manufacturing units) 2019-2029F |

| 8. Oman Air Conditioner Market Key Performance Indicators |

| 8.1 Energy efficiency rating of air conditioning units sold in the market |

| 8.2 Adoption rate of smart air conditioning solutions in residential and commercial buildings |

| 8.3 Number of new construction permits issued in Oman, indicating potential demand for air conditioning systems |

| 8.4 Average lifespan of air conditioning units in the market |

| 8.5 Percentage of households in Oman with air conditioning installed |

| 9. Oman Air Conditioner Market - Opportunity Assessment |

| 9.1 Oman Air Conditioner Market Opportunity Assessment, By Type |

| 9.2 Oman Air Conditioner Market Opportunity Assessment, By Applications |

| 10. Oman Air Conditioner Market, Competitive Landscape |

| 10.1 Oman Air Conditioner Market Revenue Ranking, By Companies, 2022 |

| 10.2 Oman Air Conditioner Market Competitive Benchmarking, By Technical Parameters |

| 10.3 Oman Air Conditioner Market Competitive Benchmarking, By Operating Parameters |

| 11. Company Profiles |

| 11.1 LG Electronic Inc. |

| 11.2 Carrier Corporation |

| 11.3 Daikin Industries Ltd. |

| 11.4 Mitsubishi Electric Corporation |

| 11.5 Fujitsu General Ltd. |

| 11.6 Trane Inc. |

| 11.7 Gree Electrical Appliances Inc. |

| 11.8 Johnson Controls |

| 11.9 Panasonic Corporation |

| 11.10 S.K.M Air Conditioning |

| 12. Key Strategic Recommendation |

| 13. Disclaimer |

| List of Figures |

| 1. Oman Air Conditioner Market Revenue and Volume, 2019-2029F ($ Million, Thousand Units) |

| 2. Oman Hotel Room Capacity, 2017-2021 (in Thousand) |

| 3. Oman Air Conditioner Market Revenue Share, By Types, 2022 & 2029F |

| 4. Oman Air Conditioner Market Volume Share, By Types, 2022 & 2029F |

| 5. Oman Room Air Conditioner Market Revenue Share, By Types, 2022 & 2029F |

| 6. Oman Room Air Conditioner Market Volume Share, By Types, 2022 & 2029F |

| 7. Oman Ducted Air Conditioner Market Revenue Share, By Types, 2022 & 2029F |

| 8. Oman Ducted Air Conditioner Market Volume Share, By Types, 2022 & 2029F |

| 9. Oman Ductless Air Conditioner Market Revenue Share, By Types, 2022 & 2029F |

| 10. Oman Ductless Air Conditioner Market Volume Share, By Types, 2022 & 2029F |

| 11. Oman Centralized Air Conditioner Market Revenue Share, By Types, 2022 & 2029F |

| 12. Oman Centralized Air Conditioner Market Volume Share, By Types, 2022 & 2029F |

| 13. Oman Air Conditioner Market Revenue Share, By Application, 2022 & 2029F |

| 14. Top Future Oman Hotel Projects, By Operator ($ Million), 2022 |

| 15. Oman Number of Tourist Arrival, 2022-2023 |

| 16. Oman Air Conditioner Market Opportunity Assessment, By Type, 2029F |

| 17. Oman Air Conditioner Market Opportunity Assessment, By Application, 2029F |

| 18. Oman Air Conditioner Market Revenue Ranking, By Companies, 2022 |

| List of Tables |

| 1. Oman Hospitality Market Forecast |

| 2. Oman Future Hotel Pipeline |

| 3. Oman Upcoming Retail, Corporate and Mixed Use Projects |

| 4. Oman Air Conditioner Market Revenues, By Types, 2019-2029F |

| 5. Oman Air Conditioner Market Volume, By Types, 2019-2029F |

| 6. Oman Room Air Conditioner Market Revenues, By Types, 2022 & 2029F |

| 7. Oman Room Air Conditioner Market Volume, By Types, 2022 & 2029F |

| 8. Oman Ducted Air Conditioner Market Revenues, By Types, 2022 & 2029F |

| 9. Oman Ducted Air Conditioner Market Volume, By Types, 2022 & 2029F |

| 10. Oman Ductless Air Conditioner Market Revenues, By Types, 2022 & 2029F |

| 11. Oman Ductless Air Conditioner Market Volume, By Types, 2022 & 2029F |

| 12. Oman Centralized Air Conditioner Market Revenues, By Types, 2022 & 2029F |

| 13. Oman Centralized Air Conditioner Market Volumes, By Types, 2022 & 2029F |

| 14. Oman Air Conditioner Market Revenues, By Application, 2019-2029F |

| 15. Upcoming Residential Projects in Oman, 2023-2024 |

| 16. Future Hotel Pipeline: Top Future Hotels And Operators |

| 17. Oman Upcoming Healthcare and Transportation Projects |

Market Forecast By Type (Room Air Conditioner, Ducted Air Conditioner, Ductless Air Conditioner, Centralized Air Conditioner), By Application (Residential, Healthcare, Commercial & Retail, Transportation & Infrastructure, Hospitality, Others), And Competitive Landscape

| Product Code: ETC090102 | Publication Date: Aug 2021 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

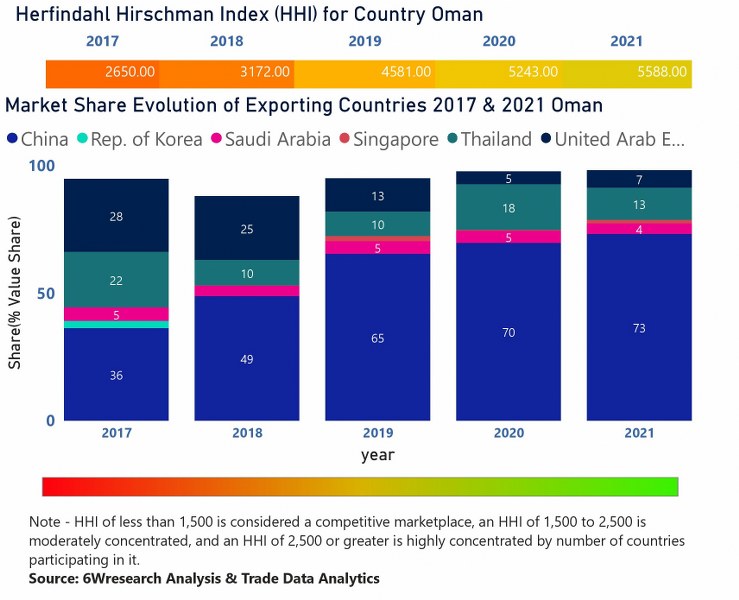

Oman Air Conditioner (AC) Market | Country-Wise Share and Competition Analysis

In the year 2021, China was the largest exporter in terms of value, followed by Thailand. It has registered a growth of 10.58% over previous year. While Thailand registered a decline of -25.54% over previous year. While in 2017 China was the largest exporter followed by United Arab Emirates. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Oman has Herfindahl index of 2650 in 2017 which signifies high concentration while in 2021 it registered a Herfindahl index of 5588 which signifies high concentration in the market

Oman Air Conditioner (AC) Market - Export Market Opportunities

Oman Air Conditioner (AC) Market - Export Market Opportunities

Topics Covered in the Oman Air Conditioner (AC) Market

Oman Air Conditioner (AC) Market report thoroughly covers the market by type and by application. The market outlook report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Oman Air Conditioner (AC) Market is projected to grow over the coming years. Oman Air Conditioner (AC) Market report is a part of our periodical regional publication Middle East Air Conditioner (AC) Market Outlook report. 6W tracks the air conditioner market for over 60 countries with individual country-wise market opportunity assessment and publishes with the report titled Global Air Conditioner (AC) Market outlook report annually.

Oman Air Conditioner (AC) Market Synopsis

Oman Air Conditioner (AC) Market is projected to experience rapid growth over the years, driven by a rising population, rapidly growing urbanization, and an increase in construction activities. Oman is one of the most water-scarce countries and has been facing an acute water shortage which has led to a ban on the use of air conditioners by the government during the daytime. In general, air conditioners come in a variety of types and sizes. The most common type of air conditioner in the country is the split-system air conditioner. Other types of air conditioners in Oman include ducted air conditioners, portable ACs, and window ACs.

According to 6Wresearch, the Oman Air Conditioner (AC) Market is expected to grow at a CAGR of 3.2% during 2021- 2027 and decline by -0.5% in 2017- 2020. The market is anticipated to secure tremendous growth during the forecast period. The growing construction industry and rising discretionary expenses are some of the key factors driving the Oman Air Conditioner Market Growth over the years. However, high installation and maintenance costs are restraining the growth of this industry. Moreover, high import duties make imported ACs more expensive than those of locally produced and limits the ability of major companies to compete in the market. The Oman air conditioner (AC) industry presents a great opportunity for players in the market, driven by growing economy and a large population.

COVID-19 Impact on the Oman Air Conditioner (AC) Market

The COVID-19 pandemic has had an adverse impact on the Oman Air Conditioner (AC) Market size. The pandemic has resulted in a reduced demand for air conditioning units in Oman. The pandemic has created economic uncertainty, which has impacted the purchasing power of consumers. Due to this, many people have postponed their plans to buy new air conditioning units. The pandemic has led to changes in consumer behavior, with people becoming more conscious about indoor air quality and the need for ventilation.

Key Players in the Oman Air Conditioner (AC) Market

The Oman Air Conditioner (AC) industry has several key players which include;

- LG Electronics

- Daikin

- Mitsubishi Electric

- Midea

- Gree

- York

- Carrier

Market Analysis by Types

In terms of market by types, Centralized Air Conditioner dominates the market and is expected to remain in a dominant position in the coming years. However, Ducted Air Conditioner is expected to have the fastest growth rate among all types.

Market Analysis by Application

Market Analysis by Application

In terms of application, Commercial & Retail dominates the market and is expected to remain in a dominant position in the coming years. However, Hospitality is expected to have the fastest growth rate among all applications.

Key attractiveness of the report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020.

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Oman Air Conditioner Market Outlook

- Market Size of Oman Air Conditioner Market, 2020

- Forecast of Oman Air Conditioner Market, 2027

- Historical Data and Forecast of Oman Air Conditioner Revenues & Volume for the Period 2017 - 2027

- Oman Air Conditioner Market Trend Evolution

- Oman Air Conditioner Market Drivers and Challenges

- Oman Air Conditioner Price Trends

- Oman Air Conditioner Porter's Five Forces

- Oman Air Conditioner Industry Life Cycle

- Historical Data and Forecast of Oman Air Conditioner Market Revenues & Volume By Type for the Period 2017 - 2027

- Historical Data and Forecast of Oman Air Conditioner Market Revenues & Volume By Room Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Oman Air Conditioner Market Revenues & Volume By Ducted Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Oman Air Conditioner Market Revenues & Volume By Ductless Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Oman Air Conditioner Market Revenues & Volume By Centralized Air Conditioner for the Period 2017 - 2027

- Historical Data and Forecast of Oman Air Conditioner Market Revenues & Volume By Application for the Period 2017 - 2027

- Historical Data and Forecast of Oman Air Conditioner Market Revenues & Volume By Residential for the Period 2017 - 2027

- Historical Data and Forecast of Oman Air Conditioner Market Revenues & Volume By Healthcare for the Period 2017 - 2027

- Historical Data and Forecast of Oman Air Conditioner Market Revenues & Volume By Commercial & Retail for the Period 2017 - 2027

- Historical Data and Forecast of Oman Air Conditioner Market Revenues & Volume By Transportation & Infrastructure for the Period 2017 - 2027

- Historical Data and Forecast of Oman Air Conditioner Market Revenues & Volume By Hospitality for the Period 2017 - 2027

- Historical Data and Forecast of Oman Air Conditioner Market Revenues & Volume By Others for the Period 2017 - 2027

- Oman Air Conditioner Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Oman Air Conditioner Top Companies Market Share

- Oman Air Conditioner Competitive Benchmarking By Technical and Operational Parameters

- Oman Air Conditioner Company Profiles

- Oman Air Conditioner Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Room Air Conditioner

- Ducted Air Conditioner

- Ductless Air Conditioner

- Centralized Air Conditioner

By Application

- Residential

- Healthcare

- Commercial & Retail

- Transportation & Infrastructure

- Hospitality

- Others

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- UAE Building Thermal Insulation Market Outlook (2025-2031) | Revenue, Companies, Share, Trends, Growth, Size, Forecast, Industry, Analysis & Value

- Portugal Electronic Document Management Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero