Philippines Clay Market (2025-2029) | Outlook, Forecast, Companies, Analysis, Share, Industry, Value, Trends, Revenue, Size & Growth

Market Forecast By Application (Tableware, Sanitary ware, Medical applications), By End Use (Ceramic and, Non-ceramic) And Competitive Landscape

| Product Code: ETC318989 | Publication Date: Aug 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

Philippines Clay Market Top 5 Importing Countries and Market Competition (HHI) Analysis

The Philippines clay import market in 2024 continues to be dominated by top exporting countries such as China, USA, Thailand, Japan, and Australia. Despite a slight decline in growth rate from 2023 to 2024, the market has maintained a healthy Compound Annual Growth Rate (CAGR) of 6.33% from 2020 to 2024. The high concentration of the Herfindahl-Hirschman Index (HHI) indicates a competitive market landscape in the Philippines clay import sector, providing opportunities and challenges for market players to navigate in the coming years.

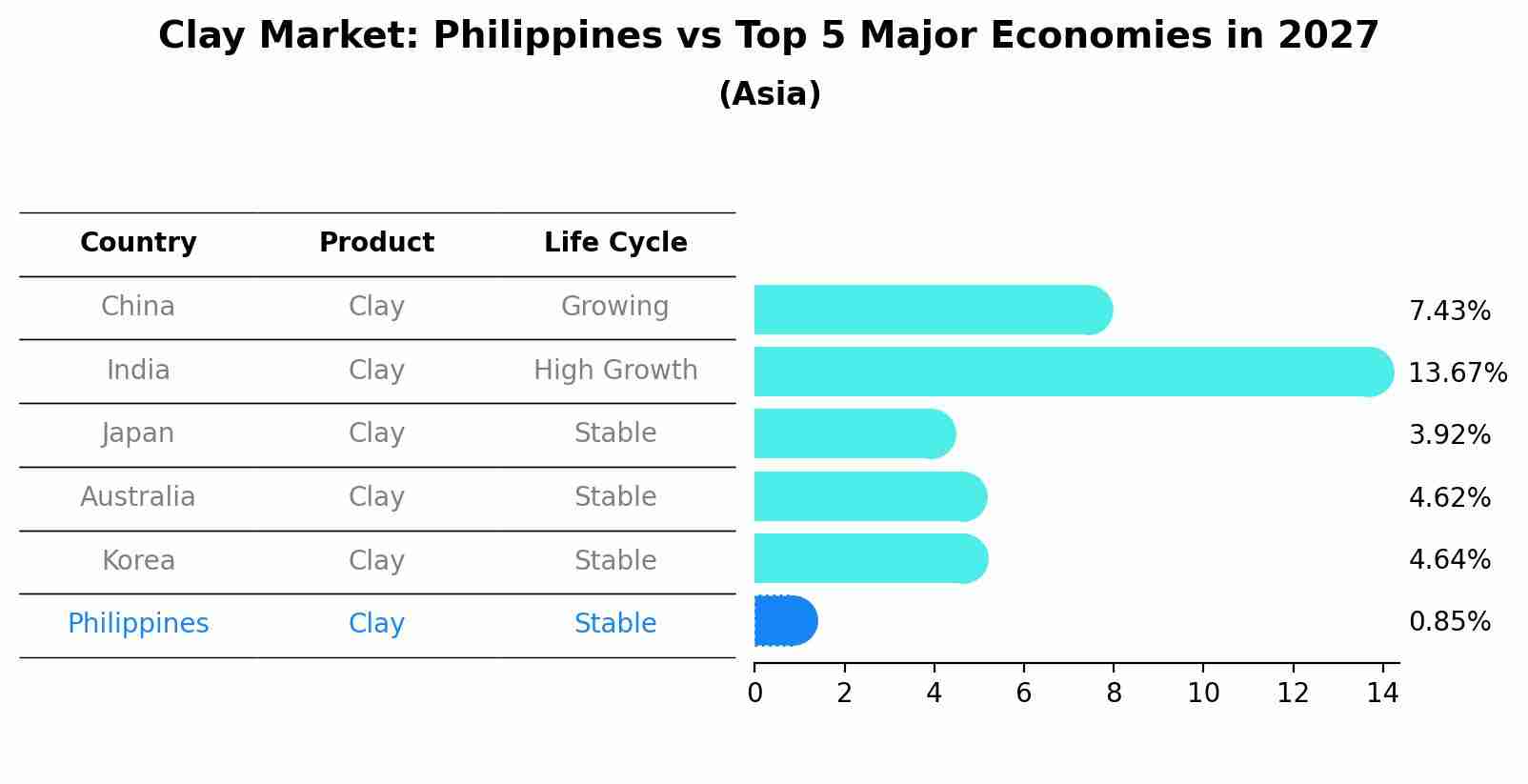

Clay Market: Philippines vs Top 5 Major Economies in 2027 (Asia)

By 2027, the Clay market in Philippines is anticipated to reach a growth rate of 0.85%, as part of an increasingly competitive Asia region, where China remains at the forefront, supported by India, Japan, Australia and South Korea, driving innovations and market adoption across sectors.

Philippines Clay Market Highlights

| Report Name | Philippines Clay Market |

| Forecast Period | 2025 2029 |

| CAGR | 1.07% |

| Growing Sector | Agriculture & Packaging |

Topics Covered in the Philippines Clay Market Report

Philippines Clay Market report comprehensively covers the market by application and end use. The report provides an unbiased and insightful analysis of current market trends, growth opportunities, challenges, and key drivers. It serves as a valuable resource for stakeholders to align their strategies with evolving market dynamics.

Philippines Clay Market Synopsis

The Philippines Clay Market is steadily growing as clay plays an important role in ceramics, sanitary ware, medical applications, and construction. Demand for pottery and tableware remains strong, especially among local artisans, while the use of sanitary ware is increasing in new residential projects. Medical uses, particularly in pharmaceuticals and laboratories, are also expanding. With a construction boom, rising urbanization, and a growing focus on sustainable, locally sourced materials, the market shows great potential. However, challenges like inconsistent clay quality and limited processing technologies still need to be addressed.

The Philippines Clay Market size is expected to grow at a significant CAGR of 1.07% during the forecast period 2025–2029. Market drivers include rapid growth in construction and infrastructure, rising ceramic and sanitary ware manufacturing, and expanding medical applications. Philippines Clay Market Growth is fueled by increased demand for artisanal and industrial ceramics, growing healthcare uses, and government-led affordable housing initiatives. Additionally, rising urbanization and boosted domestic tableware production further support steady market expansion, highlighting diverse applications and strong local consumption as key growth factors.

Challenges Faced by the Market

The Philippines Clay Market Industry faces several challenges, such as varying clay quality across different regions, which affects product consistency. Growth is also limited by underdeveloped processing facilities and strong competition from materials like polymers and metals. High energy costs and slow adoption of modern refining technologies make production less efficient. Moreover, strict regulations on mining and environmental sustainability add extra hurdles, making it harder for the market to expand smoothly and operate steadily.

Philippines Clay Market Trends

One key trend in the Philippines Clay Industry is digital transformation in production and manufacturers are adopting data analytics, IoT sensors, and automation to increase quality control in ceramic and sanitary ware production. AI driven predictive maintenance improves equipment uptime and output. Another trend is omnichannel retail: consumer behaviour shifts toward seamless integration of physical pottery shops and online platforms offering personalized shopping experiences, click and collect, and curated local tableware via mobile apps.

Investment Opportunities in the Philippines Clay Market

Expansion of digital commerce offers investment opportunities in e commerce platforms selling artisan clay tableware and sanitary products, logistics solutions supporting last mile delivery, and fintech services facilitating micropayments for local crafts. Low current adoption in rural areas and rising demand for ceramics present growth potential. Upgrading retail infrastructure is another avenue: modernizing pottery centres, sanitary ware stores, logistics hubs, and distribution networks can improve operational efficiency and meet rising demand in construction and hospitality sectors.

Leading players in the Philippines Clay Market

Leading players in the Philippines Clay Market Share include Mariwasa Siam Ceramics, Formosa Ceramic Tiles, Eurotiles Industrial, Machuca Tile, Riviera Clay Phils., and Hind Exports. These companies drive growth through quality ceramic and clay products for construction, tableware, and artisanal uses.

Government Regulations Introduced in the Philippines Clay Market

The government enforces environmental and mining regulations to oversee sustainable extraction and processing. The Department of Environment and Natural Resources (DENR) regulates clay mining via permits and environmental compliance certificates. The Clean Air Act and Water Code govern emissions and runoff from clay processing plants. The Bureau of Mines guidelines require sustainable mining practices. Furthermore, industry promotion programs encourage use of local materials in housing and infrastructure, indirectly boosting clay demand.

Future Insights of the Philippines Clay Market

The Philippines Clay Market industry is projected to see growth through innovation and sustainability. Demand for eco friendly clay tableware and sanitary ware will rise, supported by clean extraction techniques and refined processing technologies. Medical sector integration and ceramic innovation will open new applications. Dealers investing in automation and digital platforms will lead. Yet quality standardization and competition from composites remain challenges. With enduring applications across construction and ceramics, the clay market is poised for resilient development.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Sanitary Ware to Dominate the Market – By Application

According to Guneet Kaur, Senior Research Analyst, 6Wresearch, the sanitary ware segment is the fastest-growing due to rising construction activities and increased demand for modern, durable bathroom fixtures. Its essential role in infrastructure development and growing urbanization drives sustained market preference and expansion.

Ceramic to Dominate the Market – By End Use

The ceramic segment leads growth, driven by its widespread use in tableware, sanitary ware, and medical applications. Ceramic’s durability, aesthetic appeal, and heat resistance make it the preferred choice for both industrial and household purposes, supporting steady market demand and expansion.

Key Attractiveness of the Report

- 10 Years of Market Numbers

- Historical Data Starting from 2021 to 2024

- Base Year 2024

- Forecast Data until 2029

- Key Performance Indicators Impacting the Market

- Major Upcoming Developments and Projects

Key Highlights of the Report:

- Philippines Clay Market Outlook

- Market Size of Philippines Clay Market, 2024

- Forecast of Philippines Clay Market, 2029

- Historical Data and Forecast of Philippines Clay Revenues & Volume for the Period 2019-2029F

- Philippines Clay Market Trend Evolution

- Philippines Clay Market Drivers and Challenges

- Philippines Clay Price Trends

- Philippines Clay Porter's Five Forces

- Philippines Clay Industry Life Cycle

- Historical Data and Forecast of Philippines Clay Market Revenues & Volume By Application for the Period 2019-2029F

- Historical Data and Forecast of Philippines Clay Market Revenues & Volume By Tableware for the Period 2019-2029F

- Historical Data and Forecast of Philippines Clay Market Revenues & Volume By Sanitary ware for the Period 2019-2029F

- Historical Data and Forecast of Philippines Clay Market Revenues & Volume By Medical applications for the Period 2019-2029F

- Historical Data and Forecast of Philippines Clay Market Revenues & Volume By End Use for the Period 2019-2029F

- Historical Data and Forecast of Philippines Clay Market Revenues & Volume By Ceramic and for the Period 2019-2029F

- Historical Data and Forecast of Philippines Clay Market Revenues & Volume By Non-ceramic for the Period 2019-2029F

- Philippines Clay Import Export Trade Statistics

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By End Use

- Philippines Clay Top Companies Market Share

- Philippines Clay Competitive Benchmarking By Technical and Operational Parameters

- Philippines Clay Company Profiles

- Philippines Clay Key Strategic Recommendations

Markets Covered

The report offers a comprehensive study of the subsequent market segments:

By Application

- Tableware

- Sanitary ware

- Medical applications

By End Use

- Ceramic

- Non ceramic

Philippines Clay Market (2025-2029): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Philippines Clay Market Overview |

| 3.1 Philippines Country Macro Economic Indicators |

| 3.2 Philippines Clay Market Revenues & Volume, 2019 & 2029F |

| 3.3 Philippines Clay Market - Industry Life Cycle |

| 3.4 Philippines Clay Market - Porter's Five Forces |

| 3.5 Philippines Clay Market Revenues & Volume Share, By Application, 2019 & 2029F |

| 3.6 Philippines Clay Market Revenues & Volume Share, By End Use, 2019 & 2029F |

| 4 Philippines Clay Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Growing construction industry in the Philippines, leading to increased demand for clay for building materials. |

| 4.2.2 Rising disposable income levels among the population, driving the demand for clay products such as pottery and ceramics. |

| 4.2.3 Government initiatives and investments in infrastructure projects boosting the demand for clay for construction purposes. |

| 4.3 Market Restraints |

| 4.3.1 Environmental regulations and concerns regarding clay mining and extraction impacting the supply chain. |

| 4.3.2 Competition from alternative materials like plastic and metal affecting the market for clay products. |

| 4.3.3 Fluctuations in raw material prices impacting the production costs of clay products. |

| 5 Philippines Clay Market Trends |

| 6 Philippines Clay Market, By Types |

| 6.1 Philippines Clay Market, By Application |

| 6.1.1 Overview and Analysis |

| 6.1.2 Philippines Clay Market Revenues & Volume, By Application, 2019-2029F |

| 6.1.3 Philippines Clay Market Revenues & Volume, By Tableware, 2019-2029F |

| 6.1.4 Philippines Clay Market Revenues & Volume, By Sanitary ware, 2019-2029F |

| 6.1.5 Philippines Clay Market Revenues & Volume, By Medical applications, 2019-2029F |

| 6.2 Philippines Clay Market, By End Use |

| 6.2.1 Overview and Analysis |

| 6.2.2 Philippines Clay Market Revenues & Volume, By Ceramic and, 2019-2029F |

| 6.2.3 Philippines Clay Market Revenues & Volume, By Non-ceramic, 2019-2029F |

| 7 Philippines Clay Market Import-Export Trade Statistics |

| 7.1 Philippines Clay Market Export to Major Countries |

| 7.2 Philippines Clay Market Imports from Major Countries |

| 8 Philippines Clay Market Key Performance Indicators |

| 8.1 Average selling price of clay products in the Philippines market. |

| 8.2 Number of infrastructure projects utilizing clay materials. |

| 8.3 Export volume of clay products to other countries from the Philippines. |

| 9 Philippines Clay Market - Opportunity Assessment |

| 9.1 Philippines Clay Market Opportunity Assessment, By Application, 2019 & 2029F |

| 9.2 Philippines Clay Market Opportunity Assessment, By End Use, 2019 & 2029F |

| 10 Philippines Clay Market - Competitive Landscape |

| 10.1 Philippines Clay Market Revenue Share, By Companies, 2024 |

| 10.2 Philippines Clay Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero