Philippines Electric Motor Market (2025-2031) | Growth, Size, Value, Analysis, Revenue, Trends, Industry, Share, Segmentation, Outlook

Market Forecast By Motor Type (Alternate Current (AC) Motor, Direct Current (DC) Motor, Hermetic Motor), By Voltage Range (9 V & Below, 10-20 V, 21-60 V, 60 V & Above), By Application (Industrial machinery, Motor vehicles, Heating, ventilating, and cooling (HVAC) equipment, Aerospace & transportation, Household appliances, Other), By Speed (RPM) (Low-Speed Electric Motors (Less Than 1,000 RPM), Medium-Speed Electric Motors (1,001-25,000 RPM), High-Speed Electric Motors (25,001-75,000 RPM), Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM)) And Competitive Landscape

| Product Code: ETC041110 | Publication Date: Dec 2023 | Updated Date: Sep 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Philippines Electric Motor Market Growth Rate

According to 6Wresearch internal database and industry insights, the Philippines Electric Motor Market is projected to rise at a compound annual growth rate (CAGR) of 5.1% during the forecast period 2025-2031.

| Report Name | Philippines Electric Motor Market |

| Forecast Period | 2025-2031 |

| CAGR | 5.1% |

| Growing Sector | Infrastructure & Manufacturing |

Topics Covered in the Philippines Electric Motor Market Report

The Philippines Electric Motor Market report thoroughly covers the market by motor type, by output power, by voltage, by range, by application, and by speed (RPM). The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders to devise and align their market strategies according to the current and future market dynamics.

Philippines Electric Motor Market Synopsis

Philippines Electric Motor Market is experiencing stable growth over the years as the construction projects is growing, the boom in electronics manufacturing, and government-backed electrification programs across rural areas. The country's growing construction and manufacturing industries are the main drivers of the Philippines Electric Motor Market Growth. The electric motor market in the Philippines is expected to grow significantly in the next few years, as the country’s economy continues to grow and industrialize.

Evaluation of Growth Drivers in the Philippines Electric Motor Market

Below mentioned major drivers and their impacts on the market dynamics:

| Driver | Primary Segments Affected | Why it Matters |

| Expanding Manufacturing Clusters | Industrial machinery, Motor vehicles | In Luzon and Visayas, industrial zones are expanding and creating steady demand for motors in conveyor systems, assembly lines, and robotics. |

| Nationwide Infrastructure Build-Up | Utilities, HVAC, Industrial machinery | Initiative such as “Build Better More” drives installation of motors in water treatment plants, airports, and metro rail projects. |

| Rising Electronics & Appliance Exports | Household appliances, Other | Electronics and appliance assembly facilities require precision motors for cooling, compressors, and production equipment. |

| Public Transport Modernization | Motor vehicles, Aerospace & Transportation | E-jeepneys, e-tricycles, and light rail modernization projects increase the arrangements of traction and auxiliary motors. |

| Renewable Energy Integration | Utilities, Irrigation, Industrial machinery | Investments are increasing in wind, solar, and hydropower require motors for pumping, turbines, and grid-stabilizing applications. |

Philippines Electric Motor Market is predicted to rise at a CAGR of 5.1% during the forecast period 2025-2031. In Philippine, the market of electric motor is expanding steadily with factors such as increasing industrialization, growing manufacturing clusters, and the strong focus on modernizing infrastructure. Investments are increased in renewable energy and rural electrification projects which are boosting the use of efficient motors in pumping, utilities, and agricultural applications. Further, the demand for HVAC systems is growing in commercial buildings, combined with increasing awareness about energy efficiency, is pushing the adoption of IE2/IE3 class motors.

Evaluation of Restraints in the Philippines Electric Motor Market

Below mentioned some restraints and their influencing the market dynamics:

| Restraint | Primary Segments Affected | What this means |

| Import Dependency | All Segments | The dependency is high on imported motors raises exposure to forex volatility and shipping delays. |

| Cost Barriers for SMEs | Industrial machinery, HVAC | On account of high price, many SMEs hesitate to shift to IE3/IE4 efficiency class motors. |

| Infrastructure Bottlenecks | Industrial machinery, Utilities | Port crowding and logistics inefficiencies delay the availability of spare parts and equipment. |

| Rural Electrification Gaps | Utilities, Household appliances | There is limited grid stability in remote islands slows down the ***** of motors in agricultural and residential applications. |

| Skills Gap in Automation | Industrial machinery, HVAC | Lack of skilled workforce for advanced drives and VFD systems delays industrial automation adoption. |

Philippines Electric Motor Market Challenges

Philippines Electric Motor Market faces numerous challenges that could hamper the growth of market in the future such as high logistics costs due to archipelagic geography, dependency on foreign suppliers for advanced motors. Alongside, the high electricity costs discourage the adoption of high-power systems. Further, lengthy government procurement processes and delays in transport infrastructure projects hinder timely demand. Furthermore, there is limited R&D and lack of local assembly hubs restrict the scaling of premium-efficiency solutions.

Philippines Electric Motor Market Trends

Several emerging trends are reshaping the Philippine electric motor landscape:

- High Demand for Compact Motors: The preference of compact designs to maximize operational space in urban factories and logistics hubs.

- Electrification of Public Transport: The adoption of e-jeepneys and e-buses is growing, creating new demand for traction and auxiliary motors.

- IoT-Enabled Monitoring: Integrating with IoT-based monitoring systems are increasingly used for predictive maintenance of motors.

- Energy-Efficient Cooling Systems: The tropical climate and rising real estate push adoption of premium-efficiency HVAC motors.

- Local Service Partnerships: OEMs are expanding service tie-ups with local distributors to ensure availability of spare parts and maintenance.

Investment Opportunities in the Philippines Electric Motor Industry

There are some lucrative opportunities in the Philippines Electric Motor Industry include:

- After-Sales Solutions – Establishment of the regional repair hubs and predictive analytics services are occurring to minimize downtime.

- IE3 & IE4 Motors for Compliance – Energy-efficiency programs are gradually raising the demand for premium class motors in industrial retrofits.

- E-Mobility Motors – Expansion of motors is increasing such as used for e-trikes, e-jeepneys, and electric buses present a significant investment cluster.

- Industrial Automation Motors – Integrated motors with VFDs and smart controls for assembly lines, packaging, and robotics.

- Water Infrastructure Motors – The demand for motors in desalination plants, water pumping stations, and flood control projects is strong.

Top 5 Leading Players in the Philippines Electric Motor Market

Here are some top companies listed:

1. ABB

| Company Name | ABB |

| Established Year | 1988 |

| Headquarters | Zurich, Switzerland |

| Official Website | Click Here |

This company provides a wide range of IE2-IE4 motors and automation systems and widely used in utilities, metro rail projects, and industrial facilities with keen service partnerships.

2. Siemens

| Company Name | Siemens |

| Established Year | 1847 |

| Headquarters | Munich, Germany |

| Official Website | Click Here |

This company offers low-voltage and medium-voltage motors, drives, and digitalized automation platforms with a strong footprint in smart building solutions.

3. Mitsubishi Electric

| Company Name | Mitsubishi Electric |

| Established Year | 1921 |

| Headquarters | Tokyo, Japan |

| Official Website | Click Here |

This company provides motors for HVAC, industrial automation, and public transport systems, with a strong presence in Southeast Asian markets.

4. WEG

| Company Name | WEG |

| Established Year | 1961 |

| Headquarters | Jaragua do Sul, Brazil |

| Official Website | Click Here |

This company specializes in high-efficiency motors, gearboxes, and VFDs and recognized for supplying motors to manufacture the plants and renewable energy projects.

5. Schneider Electric

| Company Name | Schneider Electric |

| Established Year | 1836 |

| Headquarters | Rueil-Malmaison, France |

| Official Website | Click Here |

This company provides building automation systems and motors integrated into commercial towers, malls, and energy-saving infrastructure projects.

Government Regulations Introduced in the Philippines Electric Motor Market

According to Philippine Government Data, electric motors are becoming increasingly popular in the Philippines as the government implements policies and schemes to promote the use of clean energy sources. One significant policy is the Energy Efficiency and Conservation Act of 2019 (Republic Act 11285), which obliges companies operating in the country to implement energy efficiency practices. Moreover, the national transport modernization program under the Department of Transportation (DOTr) is promoting adoption of advanced motors in e-mobility solutions.

Future Insights of the Philippines Electric Motor Market

Philippines Electric Motor Market is expected for steady growth in the coming years due to gradual expansion of electrification of public transport, modernization of manufacturing zones, and aggressive renewable energy rollouts. Apart from this, the market started integrating with IoT-based monitoring, predictive analytics, and compact high-torque motors that will shape the dynamic expansion of the market. Local assembly of motors is likely to expand gradually, reducing reliance on imports. Further, the growth of logistics, cold storage, and water infrastructure will continue to drive sustainable demand.

Market Segmentation Analysis

Medium-Speed Motors to Dominate the Market - By Speed (RPM)

According to Anjali, Senior Research Analyst, 6Wresearch, medium-speed motors are set to capture the largest share since they are mostly used in fans, pumps, compressors, and transport systems. These motors offer the best balance of performance, cost, and maintenance, making them the preferred choice across industrial and utility applications.

1-100 kW to Dominate the Market - By Output Power

1-100 kW output power range is likely to lead the market as these motors are widely deployed in mid-sized industrial plants, transport systems, and commercial HVAC applications. Further, sub-1 kW motors will continue to support consumer appliances, while above-100 kW motors remain concentrated in specialized projects such as desalination and flood control.

60 V & Above to Dominate the Market - By Voltage Range

The 60 V & Above segment is predicted to hold the largest Philippines Electric Motor Market Share since high-voltage motors are critical for utilities, water pumping stations, and industrial drives. Lower-voltage categories cater to household appliances and electronics, but large-scale projects and transport systems will push demand toward higher ranges.

AC Motors to Dominate the Market - By Motor Type

Among types, alternate Current (AC) motors are expected to dominate the market due to their robustness, affordability, and broad application in pumps, conveyors, and HVAC systems. Due to compatibility with VFDs makes them highly suitable for industrial automation and public utilities, this is more preferred. DC and hermetic motors remain relevant in niche uses, but AC motors are set to retain leadership.

Industrial Machinery to Dominate the Market - By Application

In terms of applications, industrial machinery is the major place where electric motor is mostly used owing to the rapid expansion of manufacturing zones and government-backed industrial diversification. And, HVAC motors follow closely due to heavy demand from real estate, malls, and commercial buildings. Meanwhile, e-mobility is emerging as a rising application segment.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Philippines Electric Motor Market Outlook

- Market Size of Philippines Electric Motor Market, 2024

- Forecast of Philippines Electric Motor Market, 2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume for the Period 2021-2031

- Philippines Electric Motor Market Trend Evolution

- Philippines Electric Motor Market Drivers and Challenges

- Philippines Electric Motor Market Price Trends

- Philippines Electric Motor Market Porter's Five Forces

- Philippines Electric Motor Market Industry Life Cycle

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Motor Type for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Alternate Current (AC) Motor for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Direct Current (DC) Motor for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Hermetic Motor for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Voltage Range

- for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By 9 V & Below for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By 10-20 V for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By 21-60 V for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By 60 V & Above for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Industrial Machinery for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Motor Vehicles for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Heating for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Ventilating for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Cooling (HVAC) Equipment for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Aerospace & Transportation for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Household Appliances for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Other for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Speed (RPM) for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By (Low-Speed Electric Motors (Less Than 1,000 RPM) for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Medium-Speed Electric Motors (1,001-25,000 RPM) for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By High-Speed Electric Motors (25,001-75,000 RPM) for the Period 2021-2031

- Historical Data and Forecast of Philippines Electric Motor Market Revenues Volume By Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM) for the Period 2021-2031

- Philippines Electric Motor Market Import Export Trade Statistics

- Market Opportunity Assessment By Motor Types

- Market Opportunity Assessment By Voltage Range

- Market Opportunity Assessment By Applications

- Market Opportunity Assessment By Speed

- Philippines Electric Motor Market Top Companies Market Share

- Philippines Electric Motor Market Competitive Benchmarking By Motor Types , voltage Range, Application and Speed

- Philippines Electric Motor Market Company Profiles

- Philippines Electric Motor Market Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Motor Type

- Alternate Current (AC) Motor

- Direct Current (DC) Motor

- Hermetic Motor

By Voltage Range

- 9 V & Below

- 10-20 V

- 21-60 V

- 60 V & Above

By Application

- Industrial Machinery

- Motor Vehicles

- Heating

- Ventilating

- Cooling (HVAC) Equipment

- Aerospace & Transportation

- Household Appliances

- Other

By Speed (RPM)

- Low-Speed Electric Motors (Less Than 1,000 RPM)

- Medium-Speed Electric Motors (1,001-25,000 RPM)

- High-Speed Electric Motors (25,001-75,000 RPM)

- Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM)

Philippines Electric Motor Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Philippines Electric Motor Market Overview |

| 3.1 Philippines Country Macro Economic Indicators |

| 3.2 Philippines Electric Motor Market Revenues & Volume, 2021 & 2031F |

| 3.3 Philippines Electric Motor Market - Industry Life Cycle |

| 3.4 Philippines Electric Motor Market - Porter's Five Forces |

| 3.5 Philippines Electric Motor Market Revenues & Volume Share, By Motor Type, 2021 & 2031F |

| 3.6 Philippines Electric Motor Market Revenues & Volume Share, By Voltage Range, 2021 & 2031F |

| 3.7 Philippines Electric Motor Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 3.8 Philippines Electric Motor Market Revenues & Volume Share, By Speed (RPM), 2021 & 2031F |

| 4 Philippines Electric Motor Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Philippines Electric Motor Market Trends |

| 6 Philippines Electric Motor Market, By Types |

| 6.1 Philippines Electric Motor Market, By Motor Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Philippines Electric Motor Market Revenues & Volume, By Motor Type, 2021 - 2031F |

| 6.1.3 Philippines Electric Motor Market Revenues & Volume, By Alternate Current (AC) Motor, 2021 - 2031F |

| 6.1.4 Philippines Electric Motor Market Revenues & Volume, By Direct Current (DC) Motor, 2021 - 2031F |

| 6.1.5 Philippines Electric Motor Market Revenues & Volume, By Hermetic Motor, 2021 - 2031F |

| 6.2 Philippines Electric Motor Market, By Voltage Range |

| 6.2.1 Overview and Analysis |

| 6.2.2 Philippines Electric Motor Market Revenues & Volume, By 9 V & Below, 2021 - 2031F |

| 6.2.3 Philippines Electric Motor Market Revenues & Volume, By 10-20 V, 2021 - 2031F |

| 6.2.4 Philippines Electric Motor Market Revenues & Volume, By 21-60 V, 2021 - 2031F |

| 6.2.5 Philippines Electric Motor Market Revenues & Volume, By 60 V & Above, 2021 - 2031F |

| 6.3 Philippines Electric Motor Market, By Application |

| 6.3.1 Overview and Analysis |

| 6.3.2 Philippines Electric Motor Market Revenues & Volume, By Industrial machinery, 2021 - 2031F |

| 6.3.3 Philippines Electric Motor Market Revenues & Volume, By Motor vehicles, 2021 - 2031F |

| 6.3.4 Philippines Electric Motor Market Revenues & Volume, By Heating, ventilating, and cooling (HVAC) equipment, 2021 - 2031F |

| 6.3.5 Philippines Electric Motor Market Revenues & Volume, By Aerospace & transportation, 2021 - 2031F |

| 6.3.6 Philippines Electric Motor Market Revenues & Volume, By Household appliances, 2021 - 2031F |

| 6.3.7 Philippines Electric Motor Market Revenues & Volume, By Other, 2021 - 2031F |

| 6.4 Philippines Electric Motor Market, By Speed (RPM) |

| 6.4.1 Overview and Analysis |

| 6.4.2 Philippines Electric Motor Market Revenues & Volume, By Low-Speed Electric Motors (Less Than 1,000 RPM), 2021 - 2031F |

| 6.4.3 Philippines Electric Motor Market Revenues & Volume, By Medium-Speed Electric Motors (1,001-25,000 RPM), 2021 - 2031F |

| 6.4.4 Philippines Electric Motor Market Revenues & Volume, By High-Speed Electric Motors (25,001-75,000 RPM), 2021 - 2031F |

| 6.4.5 Philippines Electric Motor Market Revenues & Volume, By Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM), 2021 - 2031F |

| 7 Philippines Electric Motor Market Import-Export Trade Statistics |

| 7.1 Philippines Electric Motor Market Export to Major Countries |

| 7.2 Philippines Electric Motor Market Imports from Major Countries |

| 8 Philippines Electric Motor Market Key Performance Indicators |

| 9 Philippines Electric Motor Market - Opportunity Assessment |

| 9.1 Philippines Electric Motor Market Opportunity Assessment, By Motor Type, 2021 & 2031F |

| 9.2 Philippines Electric Motor Market Opportunity Assessment, By Voltage Range, 2021 & 2031F |

| 9.3 Philippines Electric Motor Market Opportunity Assessment, By Application, 2021 & 2031F |

| 9.4 Philippines Electric Motor Market Opportunity Assessment, By Speed (RPM), 2021 & 2031F |

| 10 Philippines Electric Motor Market - Competitive Landscape |

| 10.1 Philippines Electric Motor Market Revenue Share, By Companies, 2024 |

| 10.2 Philippines Electric Motor Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Motor Type (Alternate Current (AC) Motor, Direct Current (DC) Motor, Hermetic Motor), By Voltage Range (9 V & Below, 10-20 V, 21-60 V, 60 V & Above), By Application (Industrial machinery, Motor vehicles, Heating, ventilating, and cooling (HVAC) equipment, Aerospace & transportation, Household appliances, Other), By Speed (RPM) (Low-Speed Electric Motors (Less Than 1,000 RPM), Medium-Speed Electric Motors (1,001-25,000 RPM), High-Speed Electric Motors (25,001-75,000 RPM), Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM)) And Competitive Landscape

| Product Code: ETC041110 | Publication Date: Jan 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Philippines Electric Motor Market | Country-Wise Share and Competition Analysis

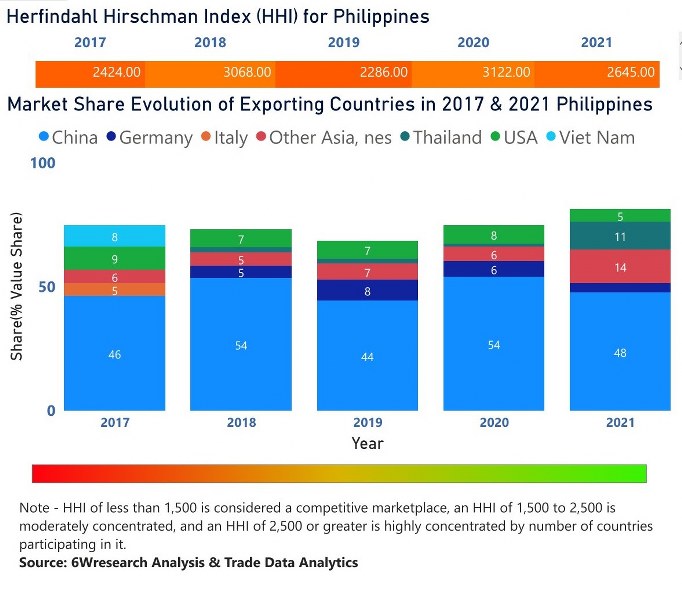

In the year 2021, China was the largest exporter in terms of value, followed by Other Asia, nes. It has registered a growth of 12.42% over the previous year. While Other Asia, nes registered a growth of 201.09% as compared to the previous year. In the year 2017, China was the largest exporter followed by the USA. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, the Philippines has a Herfindahl index of 2424 in 2017 which signifies moderately concentrated also in 2021 it registered a Herfindahl index of 2645 which signifies high concentration in the market.

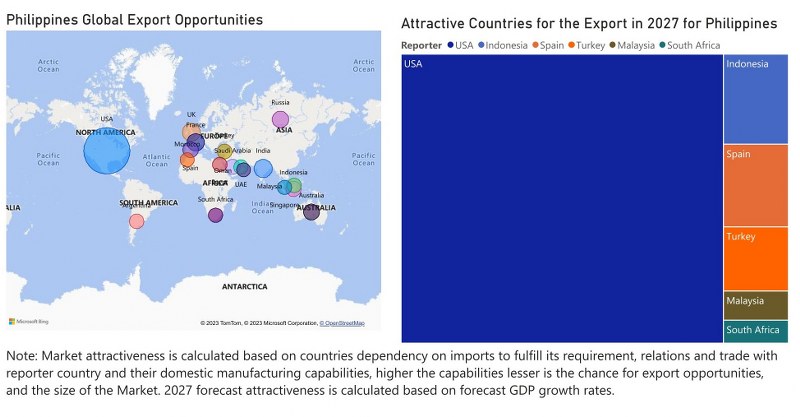

Philippines Electric Motor Market - Export Market Opportunities

Philippines Electric Motor Market - Export Market Opportunities

Topics Covered in the Philippines Electric Motor Market Report

Topics Covered in the Philippines Electric Motor Market Report

The Philippines Electric Motor Market report thoroughly covers the market by motor type, voltage range, applications, and speed. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Philippines Electric Motor Market is projected to grow over the coming year. The Philippines Electric Motor Market report is a part of our periodical regional publication Asia Pacific Electric Motor Market outlook report. 6W tracks the electric motor market for over 60 countries with individual country-wise market opportunity assessment and publishes with the report titled Global Electric Motor Market outlook report annually.

Latest 2023 Developments of the Philippines Electric Motor Market

The rising implementation of electric vevehiclesgovernment initiatives, growing awareness regarding renewable energy, industrial application and infrastructure development are some of the key developments that have been going on in the Philippines Electric Motor Market. The country has been witnessing a shift towards electric vehicles which includes electric scooters, motorcycles and tricycles and this shift is fueling the demand for electric motors. The government of the country has been adopting many initiatives in order to promote the use of these electric vehicles and reduce the nation’s carbon footprint, which helps in driving the Philippines Electric Motor Market Growth. Ongoing progress in electric motor technology, including the innovation of more efficient as well as compact motors, is expected to fuel the expansion of this market.

Philippines Electric Motor Market Synopsis

The Philippines Electric Motor Market is likely to register substantial growth during the upcoming period on account of increasing awareness about environment issues. The rising demand for superior machinery control beholds the increasing development in the market.

According to 6Wresearch, Philippines Electric Motor Market size is projected to register growth during 2020-2026. Rising disposable income couple with improvement in standard of living beholds the increasing growth of the market. Increasing government initiatives such as tax concession on electric vehicle is likely to propel the market. Automotive manufacturers are also promoting the electric vehicles in order to alleviate the usage fossil fuels. One of the significant restraining factors in the growth of the market is operating cost of electric vehicle. Additionally, the growing industrial sector along with increasing need for electric machine led to the development of the electric motor market. Rising urbanization creates the opportunity for adoption of electric vehicles further driving the growth of the market. The country has been witnessing a shift towards electric vehicle which includes electric scooters, motorcycle and tricycles and this shift is fueling the demand for electric motors.

COVID-19 Impact on Philippines Electric Motor Market

Reduced industrial demand, disruptions in supply chains, slowdown in infrastructure projects, and shift in the priorities of consumers were some of the challenges posed on the Electric Motor Market in the Philippines. The coronavirus pandemic led to many disruptions in supply chains, which affected the importation of electric motor parts as well as finished products. Limits on trade and transportation also resulted in shortages and delays, which affected the availability of electric motors in the industry. The COVID-19 pandemic resulted in decreased economic activity as well as slowdown in industrial sectors. A number of businesses comforted financial and operational difficulties, which led to a disruption in demand for these electric motors that are used in manufacturing, construction as well as other sectors. However, the outbreak of the pandemic led to the negative growth of the market backed by shutting down of manufacturing units. Nationwide lockdown further led to a disruption in the growth of the market.

Philippines Electric Motor Industry: Key Players

Some of the major key players operating in the market are:

- Teco Electric & Machinery Co., Ltd

- WEG Electric Motors and Drives Philippines, Inc.

- ABB Philippines

- Fuji Electric Philippines, Inc

- Siemens Philippines

- Mechatrends Contractors Corporation

- Hitachi Industrial Equipment Systems Co., Ltd

Market by Motor Type

Based on motor type, the sector is fragmented into Alternate Current (AC) Motor, Direct Current (DC) Motor, and Hermetic Motor. Among these, AC power segment will have largest share in the market due to its growing demand.

Market by Speed Type

According to Dhaval, Research Manager, 6Wresearch, high-speed segment is accounting the largest share and is expected to dominate during the forecast period as well.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Philippines Electric Motor Market Outlook

- Market Size of Philippines Electric Motor Market, 2019

- Forecast of Philippines Electric Motor Market, 2026

- Historical Data and Forecast of Philippines Electric Motor Revenues & Volume for the Period 2016 - 2026

- Philippines Electric Motor Market Trend Evolution

- Philippines Electric Motor Market Drivers and Challenges

- Philippines Electric Motor Price Trends

- Philippines Electric Motor Porter's Five Forces

- Philippines Electric Motor Industry Life Cycle

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Motor Type for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Alternate Current (AC) Motor for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Direct Current (DC) Motor for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Hermetic Motor for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Voltage Range for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By 9 V & Below for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By 10-20 V for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By 21-60 V for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By 60 V & Above for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Application for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Industrial machinery for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Motor vehicles for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Heating, ventilating, and cooling (HVAC) equipment for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Aerospace & transportation for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Household appliances for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Other for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Speed (RPM) for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Low-Speed Electric Motors (Less Than 1,000 RPM) for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Medium-Speed Electric Motors (1,001-25,000 RPM) for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By High-Speed Electric Motors (25,001-75,000 RPM) for the Period 2016 - 2026

- Historical Data and Forecast of Philippines Electric Motor Market Revenues & Volume By Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM) for the Period 2016 - 2026

- Philippines Electric Motor Import Export Trade Statistics

- Market Opportunity Assessment By Motor Type

- Market Opportunity Assessment By Voltage Range

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Speed (RPM)

- Philippines Electric Motor Top Companies Market Share

- Philippines Electric Motor Competitive Benchmarking By Technical and Operational Parameters

- Philippines Electric Motor Company Profiles

- Philippines Electric Motor Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Motor Type

- Alternate Current (AC) Motor

- Direct Current (DC) Motor

- Hermetic Motor

By Voltage Range

- 9 V & Below

- 10-20 V

- 21-60 V

- 60 V & Above

By Application

- Industrial Machinery

- Motor Vehicles

- Heating

- Ventilating, And Cooling (HVAC) Equipment

- Aerospace & Transportation

- Household Appliances

- Other

By Speed

- Low-Speed Electric Motors (Less Than 1,000 RPM)

- Medium-Speed Electric Motors (1,001-25,000 RPM)

- High-Speed Electric Motors (25,001-75,000 RPM)

- Ultrahigh-Speed Electric Motors (Greater Than 75,001 RPM))

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero