Philippines Epoxy Resin Market (2025-2031) | Outlook, Forecast, Industry, Analysis, Trends, Value, Share, Revenue, Growth, Companies & Size

Market Forecast By Physical Form (Liquid, Solid, Solution), By Application (Paints & Coatings, Adhesives & Sealants, Composites), By End Use (Building & Construction, Automotive, General Industrial, Others (Consumer Goods, Aerospace, etc)), And Competitive Landscape

| Product Code: ETC4511970 | Publication Date: Jul 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 63 | No. of Figures: 20 | No. of Tables: 5 |

Philippines Epoxy Resin Market

The Philippines saw a significant uptick in epoxy resin import shipments in 2024, with top exporters being Japan, Singapore, Taiwan, China, and South Korea. The high Herfindahl-Hirschman Index (HHI) indicates a concentrated market, suggesting strong competition among these key players. The compound annual growth rate (CAGR) from 2020 to 2024 stood at an impressive 31.75%, reflecting a robust market expansion. Moreover, the growth rate from 2023 to 2024 soared by 14.22%, showcasing a continued momentum in the importation of epoxy resin into the Philippines.

Philippines Epoxy Resin Market Size & Growth Rate Outlook along with Top Exporting Countries:

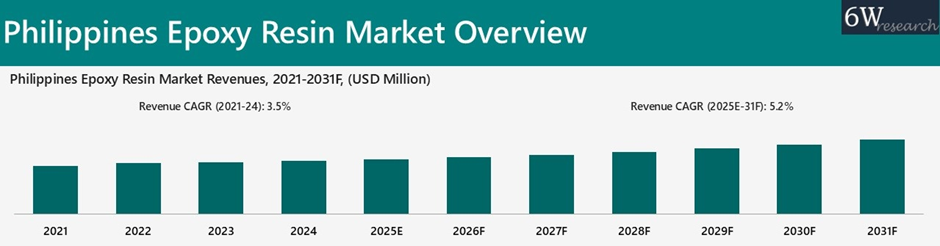

According to 6Wresearch, the Philippines Epoxy Resin Market was valued at USD 109.2 million in 2024, growing at an annual rate of 3.5%. The market is expected to reach USD 278.4 million by 2031, at a CAGR of 5.2% during the forecast period (2025–2031).

Here are some key exporting countries to Philippines Epoxy Resin Market:

- China – Due to China’s large production capacity, it remains a top exporter of epoxy resins to the Philippines.

- South Korea – South Korea offers high-quality epoxy resins that are suitable for certain sectors, such as electronics and construction.

- Japan – Japan majorly supplies advanced, high-purity epoxy resin products to fulfil the Philippines’ growing demand in automotive and electronics manufacturing.

Topics Covered in the Philippines Epoxy Resin Market Report

The Philippines Epoxy Resin Market Report thoroughly covers the market by physical form, application, and end use.The Philippines Epoxy Resin Market Outlook report provides an unbiased and detailed analysis of the ongoing Philippines Epoxy Resin Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Philippines Epoxy Resin Market Synopsis

The epoxy resin market in the Philippines has experienced steady growth from 2021 to 2024, largely driven by increased activity in the construction, industrial, automotive, and other sectors, including consumer goods, and marine applications. The Philippines Construction Industry Roadmap 2020–2030 laid the foundation for long-term infrastructure expansion, with rising investments in residential, commercial, and industrial projects boosting demand for high-performance materials such as epoxy resin which is widely used for flooring, structural adhesives, protective coatings, and composites.

In Q1 2024, the commercial real estate sector gained momentum, with transactions, particularly in key areas such as Bay Area, Fort Bonifacio, and Quezon City. By September 2024, some hotel projects were under construction. This surge in commercial and hospitality developments has significantly driven demand for epoxy resins, which are essential for durable flooring, structural bonding, and protective coatings in high-traffic environments. Simultaneously, rising automotive activity evident from increase in vehicle sales at the start of 2025, has driven demand for epoxy resins in underbody coatings, chassis protection, and EV component applications due to their durability and chemical resistance.

According to 6Wresearch, the Philippines Epoxy Resin Market is projected to grow at a CAGR of 5.2% from 2025-2031F, driven by strong growth in the construction and infrastructure sectors, along with expanding demand from the automotive industry. Large-scale commercial projects such as SM City Zamboanga (2025), South Coast City in Cebu, and Seda One Ayala, as well as upcoming retail centers such as SM City Bohol and KCC Mall of Cotabato, slated for completion between 2025 & 2026, exemplify the growing demand for durable flooring and coatings. The hospitality sector is also contributing, with major hotel openings such as Dusit Greenhills Manila (2026) and Hotel Okura Manila incorporating epoxy-based materials for aesthetics and performance.

In parallel, automotive sector in the Philippines is also experiencing strong growth, marked by a year-on-year increase in vehicle sales in early 2025 and rise in commercial vehicle sales in April. Additionally, the growing adoption of electric vehicles, on the road by March 2025, would drive demand for epoxy resins used in battery encapsulation, motor insulation, and protective coatings. This trend is further supported by upcoming industrial developments such as the expansion of the Hermosa Ecozone between 2025 and 2027, which is expected to boost manufacturing activity and reinforce epoxy resin’s essential role in the country's industrial and automotive growth.

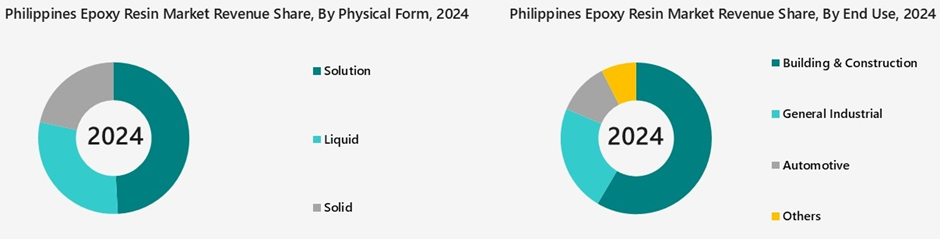

Market Segmentation By Physical Form

Solution-based epoxy resins are expected to witness highest growth rate in the Philippines epoxy resin market by 2031, driven by their strong presence across high-growth sectors, versatile applications, and compatibility with sustainability goals. Low-VOC and solvent-free solution-type formulations meet green building standards such as LEED and BERDE, making them a preferred choice for eco-compliant construction and reinforcing their market leadership.

Market Segmentation By Application

By 2031, composites are set to lead the Philippines epoxy resin market by application, supported by rising demand for strong, lightweight, and long-lasting materials in sectors such as construction, transport, energy, and electronics. With the Philippine Construction Industry Roadmap 2020–2030 targeting cumulative output, the market is shifting toward modern, high-performance infrastructure. This is driving the use of epoxy-based fiber-reinforced composites in applications such as bridges, retrofitting, modular systems, and prefabricated components, due to their durability, corrosion resistance, and structural efficiency.

Market Segmentation By End Use

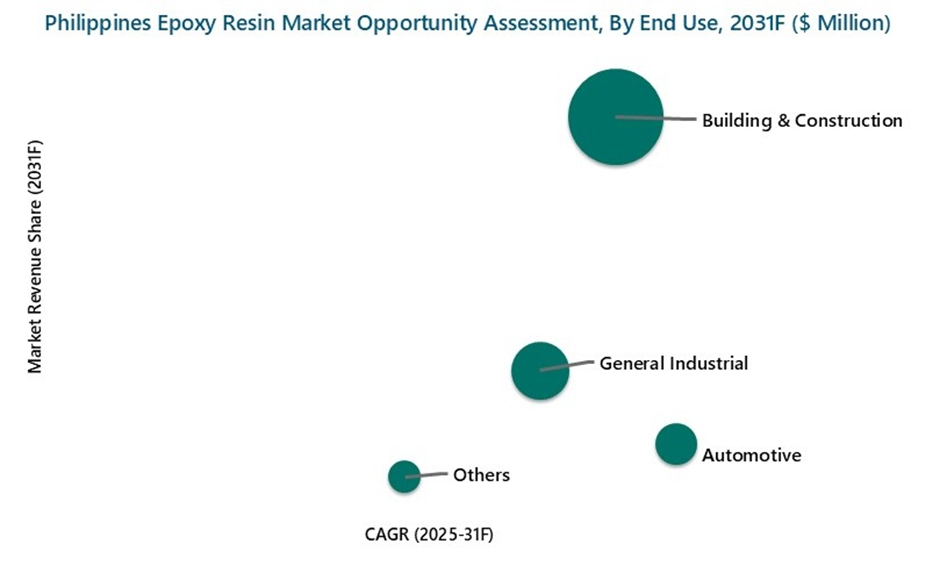

By 2031, the automotive sector is set to become the leading end-use segment in the Philippines epoxy resin market, supported by rising local production, EV growth, and demand for lightweight, durable materials. With an annual increase in production of light vehicles by 2030, epoxy resins would see increased use in structural bonding, coatings, and electronic insulation. Their strength, heat resistance, and weight-saving properties make them essential for meeting modern automotive performance and efficiency standards.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Philippines Epoxy Resin Market Overview

- Philippines Epoxy Resin Market Outlook

- Philippines Epoxy Resin Market Forecast

- Historical Data and Forecast of Philippines Epoxy Resin Market Revenues, By Physical Form for the Period 2021-2031F

- Historical Data and Forecast of Philippines Epoxy Resin Market Revenues, By Application for the Period 2021-2031F

- Historical Data and Forecast of Philippines Epoxy Resin Market Revenues, By End Use for the Period 2021-2031F

- Porter’s Five Force Analysis

- Philippines Epoxy Resin Market Drivers and Restraints

- Philippines Epoxy Resin Market Trends and Evolution

- Market Opportunity Assessment, By Physical Form

- Market Opportunity Assessment, By Application

- Market Opportunity Assessment, By End Use

- Philippines Epoxy Resin Market Revenue Ranking, By Top 3 Companies

- Market Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Physical Form

- Liquid

- Solid

- Solution

By Applications

- Paints & Coatings

- Adhesives & Sealants

- Composites

By End Use

- Building & Construction

- Automotive

- General Industrial

- Others (Consumers Goods, Aerospace, etc)

Philippines Epoxy Resin Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Philippines Epoxy Resin Market Overview |

| 3.1. Philippines Epoxy Resin Market Revenues, 2021-2031F |

| 3.2. Philippines Epoxy Resin Market Industry Life Cycle |

| 3.3. Philippines Epoxy Resin Market Porter's Five Forces |

| 4. Philippines Epoxy Resin Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Philippines Epoxy Resin Market Trends And Evolution |

| 6. Philippines Epoxy Resin Market Overview, By Physical Form |

| 6.1. Philippines Epoxy Resin Market Revenue Share, By Physical Form, 2024 & 2031F |

| 6.1.1. Philippines Epoxy Resin Market Revenues, By Solution, 2021-2031F |

| 6.1.2. Philippines Epoxy Resin Market Revenues, By Liquid, 2021-2031F |

| 6.1.3. Philippines Epoxy Resin Market Revenues, By Solid, 2021-2031F |

| 7. Philippines Epoxy Resin Market Overview, By Application |

| 7.1. Philippines Epoxy Resin Market Revenue Share, By Application, 2024 & 2031F |

| 7.1.1. Philippines Epoxy Resin Market Revenues, By Paints & Coatings, 2021-2031F |

| 7.1.2. Philippines Epoxy Resin Market Revenues, By Adhesives & Sealants, 2021-2031F |

| 7.1.3. Philippines Epoxy Resin Market Revenues, By Composites, 2021-2031F |

| 8. Philippines Epoxy Resin Market Overview, By End Use |

| 8.1. Philippines Epoxy Resin Market Revenue Share, By End Use, 2024 & 2031F |

| 8.1.1. Philippines Epoxy Resin Market Revenues, By Building & Construction, 2021-2031F |

| 8.1.2. Philippines Epoxy Resin Market Revenues, By General Industrial, 2021-2031F |

| 8.1.3. Philippines Epoxy Resin Market Revenues, By Automotive, 2021-2031F |

| 8.1.4. Philippines Epoxy Resin Market Revenues, By Others, 2021-2031F |

| 9. Philippines Epoxy Resin Market Key Performance Indicator |

| 10. Philippines Epoxy Resin Market Opportunity Assessment |

| 10.1. Philippines Epoxy Resin Market Opportunity Assessment, By Physical Form, 2031F |

| 10.2. Philippines Epoxy Resin Market Opportunity Assessment, By Application, 2031F |

| 10.3. Philippines Epoxy Resin Market Opportunity Assessment, By End Use, 2031F |

| 11. Philippines Epoxy Resin Market Competitive Landscape |

| 11.1. Philippines Epoxy Resin Market Revenue Ranking, By Top 3 Companies, 2024 |

| 11.2. Philippines Epoxy Resin Market Competitive Benchmarking, By Technical Parameters |

| 11.3. Philippines Epoxy Resin Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 12.1. Sika Philippines Inc |

| 12.2. SEA Olympus Marketing, Inc |

| 12.3. Majestic Chemicals Industries |

| 12.4. DJI International |

| 12.5. Prostech Philippines Inc |

| 12.6. RI Chemical Corporation |

| 12.7. Polymer Products (Phil.) Inc |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| 1. Philippines Epoxy Resin Market Revenues, 2021-2031F (USD Million) |

| 2. Philippines Vehicle Sales, By Type, April 2025 (units) |

| 3. Philippines Vehicles Sales, 2024-2025 (units) |

| 4. Philippines Motor Vehicles Assembly, 2023-2024 (units) |

| 5. Philippines Electric Vehicles Sales, Jan-March 2025 (units) |

| 6. Southeast Asia Bisphenol A Price, Jan-21-Jan-25 ($/Kg) |

| 7. Philippines Epoxy Resin Market Revenue Share, By Physical Form, 2024 & 2031F |

| 8. Philippines Epoxy Resin Market Revenue Share, By Application, 2024 & 2031F |

| 9. Philippines Epoxy Resin Market Revenue Share, By End Use, 2024 & 2031F |

| 10. Philippines Pre-selling Condominium Launches & Take-up, 2020-2024 (1000 Units) |

| 11. Philippines Approved Building Permits Oct 2023 & Oct 24, By Building Type |

| 12. Philippines Metro Manila Residential Stock Forecast, 2021 & 2024 (1000 Units) |

| 13. Philippines Metro Manila Annual Office Supply Forecast Per Submarket, 2023 & 2027F (Million Sq.m) |

| 14. Philippines Number of Tourist Arrival, 2023 & 2024 (Million) |

| 15. Philippines City Wise Hotel Room Count in Pipeline, As of Sep 2024 |

| 16. Philippines Epoxy Resin Market Opportunity Assessment, By Physical Form, 2031F ($ Million) |

| 17. Philippines Epoxy Resin Market Opportunity Assessment, By Application, 2031F ($ Million) |

| 18. Philippines Epoxy Resin Market Opportunity Assessment, By End Use, 2031F ($ Million) |

| 19. Philippines Epoxy Resin Market Revenue Ranking, By Top 3 Companies, 2024 |

| 20. Philippines SEZ, By Regions, As of Aug 2024 |

| List of tables |

| 1. New Industrial Supply, 2025-2027, Hectares |

| 2. Philippines Ongoing & Upcoming Government Infrastructure Projects, As of March 2025 |

| 3. Philippines Epoxy Resin Market Revenues, By Physical Form, 2021-2031F, ($ Million) |

| 4. Philippines Epoxy Resin Market Revenues, By Application, 2021-2031F, ($ Million) |

| 5. Philippines Epoxy Resin Market Revenues, By End Use, 2021-2031F, ($ Million) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero