Romania Circuit Breaker Market (2025-2031) | Outlook, Growth, Size, Analysis, Companies, Forecast, Share, Revenue, Value, Industry & Trends

Market Forecast By Insulation Type (Vacuum Circuit Breaker, Air Circuit Breaker, Gas Circuit Breaker, Oil Circuit Breaker), By Voltage (Medium Voltage, High Voltage), By Installation (Indoor, Outdoor), By End User (T&D Utilities, Power Generation, Renewables, Railways) And Competitive Landscape

| Product Code: ETC431414 | Publication Date: Aug 2024 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Romania Circuit Breaker Market Highlights

| Report Name | Romania Circuit Breaker Market |

| Forecast period | 2025-2031 |

| CAGR | 7.4% |

| Growing Sector | Energy and Power |

Topics Covered in Romania Circuit Breaker Market Report

Romania Circuit Breaker Market report thoroughly covers the market by voltage, types and applications. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Romania Circuit Breaker Market Synopsis

Romania Circuit Breaker Market is experiencing significant growth and projected to attain more growth in the coming years due to increase in infrastructural development and the rising demand for reliable electricity distribution. Circuit breakers, crucial components in safeguarding electrical systems from damage caused by overload or short circuits, have become more essential with the expansion of residential, commercial, and industrial sectors. The market is characterized by a surge in both investments and technological advancements, with key players focusing on innovative products that enhance safety and efficiency.

According to 6Wresearch, Romania Circuit Breaker Market size is expected to grow at a CAGR of 7.4% during 2025-2031. Several factors are driving the growth of Romania Circuit Breaker Market such as the expansion of the construction sector, including both residential and commercial projects, has significantly increased the demand for reliable electrical infrastructure. Apart from this, modernization efforts in the country's power grid aim to enhance efficiency and integrate renewable energy sources, thus requiring advanced circuit breaker technologies. Additionally, government initiatives that incentivize the adoption of smart grid solutions and renewable energy systems are further propelling market growth. The rising awareness about electrical safety and the need to prevent electrical failures also contribute to the higher adoption of circuit breakers.

However, Romania Circuit Breaker Market faces few restraints such as the high initial cost associated with advanced circuit breaker technologies, which can be a deterrent for smaller enterprises and residential consumers. Additionally, the complexities involved in the installation and maintenance of modern circuit breakers require skilled personnel, and the shortage of such expertise may slow market adoption. Furthermore, the volatility of raw material prices, which can impact production costs and ultimately influence market prices. Moreover, regulatory and compliance issues can pose hurdles, as navigating the bureaucratic landscape to meet stringent standards might delay projects.

Romania Circuit Breaker Market Trends

Key trends shaping the market include:

- Growing Demand for Smart Circuit Breakers: IoT-based monitoring and AI-powered predictive maintenance are gaining traction.

- Renewable Energy Expansion: Increased deployment of circuit breakers for wind and solar power integration.

- Advancements in Arc-Fault Protection: Enhanced safety measures to reduce electrical hazards.

- Government Policies Promoting Grid Modernization: Initiatives supporting investments in efficient power distribution.

Investment Opportunities in the Romania Circuit Breaker Market

Key investment areas include:

- Development of Digital Circuit Breakers: Rising need for intelligent energy management solutions.

- Industrial Power Infrastructure Expansion: Increased adoption in manufacturing and energy-intensive sectors.

- Sustainable and SF6-Free Circuit Breakers: Growing emphasis on eco-friendly alternatives.

Romania Circuit Breaker Market Leading Players

Key players include Schneider Electric, ABB, Siemens AG, Eaton Corporation, Legrand, General Electric. These companies are known for their cutting-edge technologies, offer a comprehensive range of circuit breakers designed to protect electrical installations in various sectors.

Romania Circuit Breaker Market Government Regulations

Romania Circuit Breaker Market is growing and government’s regulation and policies are helping in extension of the market. One of the primary areas of focus is the modernization of the national power grid, which involves substantial investments in smart grid solutions and integrating renewable energy sources such as wind and solar power. These efforts are not only aimed at enhancing the efficiency and reliability of the electricity supply but also at reducing the carbon footprint and promoting sustainable energy practices. Additionally, the government has introduced financial incentives and subsidies to encourage both residential and commercial entities to adopt advanced electrical safety measures.

Future Insights of the Market

The future of Romania Circuit Breaker Market looks promising due to various factors such as the increasing adoption of smart circuit breakers equipped with IoT capabilities and advanced monitoring systems. These smart solutions enable real-time data collection and analytics, allowing for predictive maintenance and enhanced operational efficiency. Additionally, as the world moves towards decarbonization, Romania is poised to invest more heavily in green energy infrastructure. This shift will create new opportunities for circuit breaker manufacturers to develop products that can handle alternative energy sources' unique demands, such as variable frequencies and higher power ratings.

Market Segmentation by Voltage

According to Ravi Bhandari, Research Head, 6Wresearch, medium voltage circuit breaker segment is poised for significant growth in coming years due to the ongoing expansion of industrial and infrastructure projects. Medium voltage breakers are essential in sectors like manufacturing, utilities, and transportation.

Market Segmentation by Types

High voltage circuit breakers are expected to grow significantly in coming years due to their reliability and efficiency in handling high loads typical of large-scale renewable energy projects. Investments in upgrading ageing electrical grids and the development of new transmission lines to support renewable energy initiatives.

Market Segmentation by Applications

Power utilities sector is project to grow robustly in the future attributed to their need to ensure grid stability, manage fluctuating renewable energy inputs, and upgrade ageing infrastructure will spur significant investment in circuit breaker technology.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Romania Circuit Breaker Market Outlook

- Market Size of Romania Circuit Breaker Market, 2024

- Forecast of Romania Circuit Breaker Market, 2031

- Historical Data and Forecast of Romania Circuit Breaker Revenues & Volume for the Period 2021-2031

- Romania Circuit Breaker Market Trend Evolution

- Romania Circuit Breaker Market Drivers and Challenges

- Romania Circuit Breaker Price Trends

- Romania Circuit Breaker Porter's Five Forces

- Romania Circuit Breaker Industry Life Cycle

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Insulation Type for the Period 2021-2031

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Vacuum Circuit Breaker for the Period 2021-2031

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Air Circuit Breaker for the Period 2021-2031

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Gas Circuit Breaker for the Period 2021-2031

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Oil Circuit Breaker for the Period 2021-2031

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Voltage for the Period 2021-2031

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Medium Voltage for the Period 2021-2031

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By High Voltage for the Period 2021-2031

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Installation for the Period 2021-2031

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Indoor for the Period 2021-2031

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Outdoor for the Period 2021-2031

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By End User for the Period 2021-2031

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By T&D Utilities for the Period 2021-2031

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Power Generation for the Period 2021-2031

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Renewables for the Period 2021-2031

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Railways for the Period 2021-2031

- Romania Circuit Breaker Import Export Trade Statistics

- Market Opportunity Assessment By Insulation Type

- Market Opportunity Assessment By Voltage

- Market Opportunity Assessment By Installation

- Market Opportunity Assessment By End User

- Romania Circuit Breaker Top Companies Market Share

- Romania Circuit Breaker Competitive Benchmarking By Technical and Operational Parameters

- Romania Circuit Breaker Company Profiles

- Romania Circuit Breaker Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments

By Voltage

- Low Voltage Circuit Breaker (< 1.1 KV)

- Medium Voltage Circuit Breaker (1.1 KV - 36 KV)

- High Voltage Circuit Breaker (> 36 KV)

By Types

- Low Voltage (MCB, MCCB, ACB, Others (RCB, ELCB))

- Medium Voltage (Gas Circuit Breaker, Vacuum Circuit Breaker)

- High Voltage (Gas Circuit Breaker, Others (Oil, Hybrid))

By Applications

- Commercial

- Residential

- Industrial

- Power Utilities

- Others (Transport, Government, Etc.)

Romania Circuit Breaker Market (2025-2031); FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Romania Circuit Breaker Market Overview |

| 3.1 Romania Country Macro Economic Indicators |

| 3.2 Romania Circuit Breaker Market Revenues & Volume, 2021 & 2031F |

| 3.3 Romania Circuit Breaker Market - Industry Life Cycle |

| 3.4 Romania Circuit Breaker Market - Porter's Five Forces |

| 3.5 Romania Circuit Breaker Market Revenues & Volume Share, By Insulation Type, 2021 & 2031F |

| 3.6 Romania Circuit Breaker Market Revenues & Volume Share, By Voltage, 2021 & 2031F |

| 3.7 Romania Circuit Breaker Market Revenues & Volume Share, By Installation, 2021 & 2031F |

| 3.8 Romania Circuit Breaker Market Revenues & Volume Share, By End User, 2021 & 2031F |

| 4 Romania Circuit Breaker Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing investments in infrastructure projects in Romania |

| 4.2.2 Growing demand for electricity in residential, commercial, and industrial sectors |

| 4.2.3 Stringent regulations regarding electrical safety and compliance |

| 4.3 Market Restraints |

| 4.3.1 Economic downturn impacting construction and industrial activities |

| 4.3.2 Competition from alternative technologies such as smart grids |

| 4.3.3 Volatility in raw material prices affecting manufacturing costs |

| 5 Romania Circuit Breaker Market Trends |

| 6 Romania Circuit Breaker Market, By Types |

| 6.1 Romania Circuit Breaker Market, By Insulation Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Romania Circuit Breaker Market Revenues & Volume, By Insulation Type, 2021 - 2031F |

| 6.1.3 Romania Circuit Breaker Market Revenues & Volume, By Vacuum Circuit Breaker, 2021 - 2031F |

| 6.1.4 Romania Circuit Breaker Market Revenues & Volume, By Air Circuit Breaker, 2021 - 2031F |

| 6.1.5 Romania Circuit Breaker Market Revenues & Volume, By Gas Circuit Breaker, 2021 - 2031F |

| 6.1.6 Romania Circuit Breaker Market Revenues & Volume, By Oil Circuit Breaker, 2021 - 2031F |

| 6.2 Romania Circuit Breaker Market, By Voltage |

| 6.2.1 Overview and Analysis |

| 6.2.2 Romania Circuit Breaker Market Revenues & Volume, By Medium Voltage, 2021 - 2031F |

| 6.2.3 Romania Circuit Breaker Market Revenues & Volume, By High Voltage, 2021 - 2031F |

| 6.3 Romania Circuit Breaker Market, By Installation |

| 6.3.1 Overview and Analysis |

| 6.3.2 Romania Circuit Breaker Market Revenues & Volume, By Indoor, 2021 - 2031F |

| 6.3.3 Romania Circuit Breaker Market Revenues & Volume, By Outdoor, 2021 - 2031F |

| 6.4 Romania Circuit Breaker Market, By End User |

| 6.4.1 Overview and Analysis |

| 6.4.2 Romania Circuit Breaker Market Revenues & Volume, By T&D Utilities, 2021 - 2031F |

| 6.4.3 Romania Circuit Breaker Market Revenues & Volume, By Power Generation, 2021 - 2031F |

| 6.4.4 Romania Circuit Breaker Market Revenues & Volume, By Renewables, 2021 - 2031F |

| 6.4.5 Romania Circuit Breaker Market Revenues & Volume, By Railways, 2021 - 2031F |

| 7 Romania Circuit Breaker Market Import-Export Trade Statistics |

| 7.1 Romania Circuit Breaker Market Export to Major Countries |

| 7.2 Romania Circuit Breaker Market Imports from Major Countries |

| 8 Romania Circuit Breaker Market Key Performance Indicators |

| 8.1 Number of new infrastructure projects initiated in Romania |

| 8.2 Electricity consumption growth rate in key sectors |

| 8.3 Percentage of circuit breaker installations meeting regulatory standards |

| 9 Romania Circuit Breaker Market - Opportunity Assessment |

| 9.1 Romania Circuit Breaker Market Opportunity Assessment, By Insulation Type, 2021 & 2031F |

| 9.2 Romania Circuit Breaker Market Opportunity Assessment, By Voltage, 2021 & 2031F |

| 9.3 Romania Circuit Breaker Market Opportunity Assessment, By Installation, 2021 & 2031F |

| 9.4 Romania Circuit Breaker Market Opportunity Assessment, By End User, 2021 & 2031F |

| 10 Romania Circuit Breaker Market - Competitive Landscape |

| 10.1 Romania Circuit Breaker Market Revenue Share, By Companies, 2024 |

| 10.2 Romania Circuit Breaker Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Market Forecast By Insulation Type (Vacuum Circuit Breaker, Air Circuit Breaker, Gas Circuit Breaker, Oil Circuit Breaker), By Voltage (Medium Voltage, High Voltage), By Installation (Indoor, Outdoor), By End User (T&D Utilities, Power Generation, Renewables, Railways) And Competitive Landscape

| Product Code: ETC431414 | Publication Date: Oct 2022 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

Romania Circuit Breaker Market| Country-Wise Share and Competition Analysis

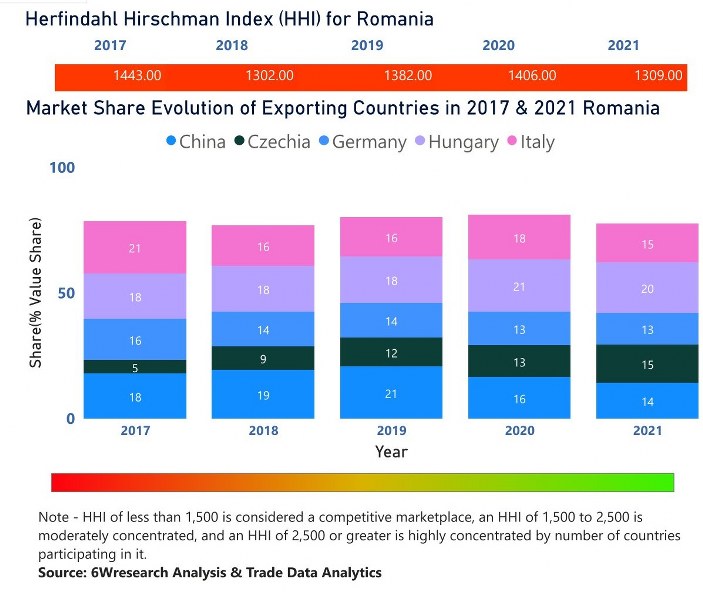

In the year 2021, Hungary was the largest exporter in terms of value, followed by Italy. It has registered a growth of 21.13% over the previous year. While Italy registered a growth of 10.12% as compare to the previous year. In the year 2017 Italy was the largest exporter followed by Hungary. In term of Herfindahl Index, which measures the competitiveness of countries exporting, Romania has the Herfindahl index of 1443 in 2017 which signifies high competitiveness also in 2021 it registered a Herfindahl index of 1309 which signifies high competitiveness in the market.

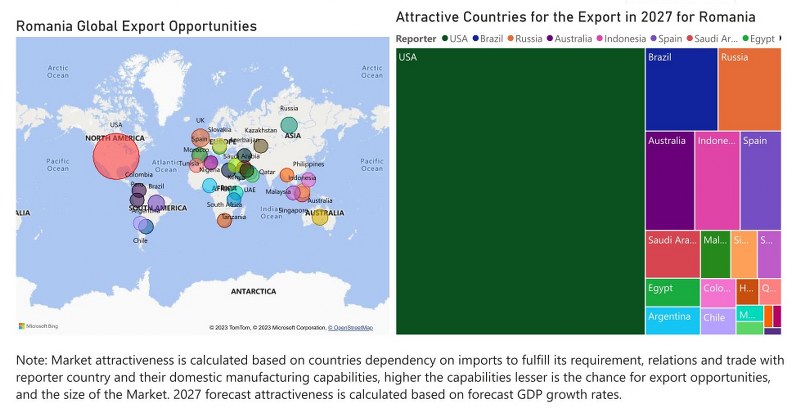

Romania Circuit Breaker Market - Export Market Opportunities

Key Highlights of the Report:

- Romania Circuit Breaker Market Outlook

- Market Size of Romania Circuit Breaker Market, 2021

- Forecast of Romania Circuit Breaker Market, 2028

- Historical Data and Forecast of Romania Circuit Breaker Revenues & Volume for the Period 2018 - 2028

- Romania Circuit Breaker Market Trend Evolution

- Romania Circuit Breaker Market Drivers and Challenges

- Romania Circuit Breaker Price Trends

- Romania Circuit Breaker Porter's Five Forces

- Romania Circuit Breaker Industry Life Cycle

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Insulation Type for the Period 2018 - 2028

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Vacuum Circuit Breaker for the Period 2018 - 2028

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Air Circuit Breaker for the Period 2018 - 2028

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Gas Circuit Breaker for the Period 2018 - 2028

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Oil Circuit Breaker for the Period 2018 - 2028

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Voltage for the Period 2018 - 2028

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Medium Voltage for the Period 2018 - 2028

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By High Voltage for the Period 2018 - 2028

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Installation for the Period 2018 - 2028

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Indoor for the Period 2018 - 2028

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Outdoor for the Period 2018 - 2028

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By End User for the Period 2018 - 2028

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By T&D Utilities for the Period 2018 - 2028

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Power Generation for the Period 2018 - 2028

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Renewables for the Period 2018 - 2028

- Historical Data and Forecast of Romania Circuit Breaker Market Revenues & Volume By Railways for the Period 2018 - 2028

- Romania Circuit Breaker Import Export Trade Statistics

- Market Opportunity Assessment By Insulation Type

- Market Opportunity Assessment By Voltage

- Market Opportunity Assessment By Installation

- Market Opportunity Assessment By End User

- Romania Circuit Breaker Top Companies Market Share

- Romania Circuit Breaker Competitive Benchmarking By Technical and Operational Parameters

- Romania Circuit Breaker Company Profiles

- Romania Circuit Breaker Key Strategic Recommendations

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero