Saudi Arabia Air Compressor Market Outlook (2021-2027) | Size, Companies, Share, Revenue, Analysis, Value, Trends, Industry, Growth & Forecast

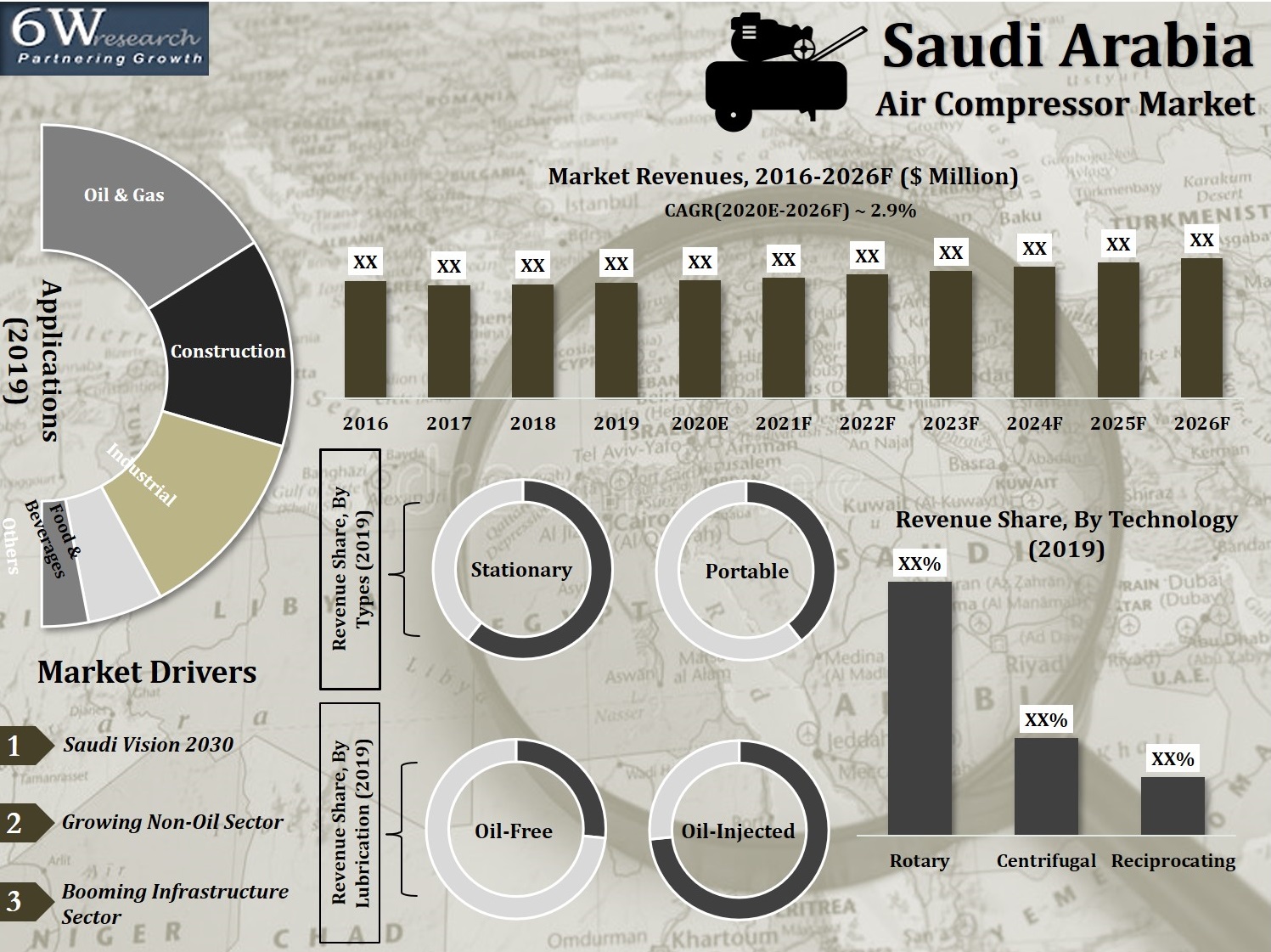

Market ForecastBy Types (Portable, Stationary), By Technology (Rotary (Up to 75kW, 76-160kW, Above 160kW), Centrifugal (Up to 500kW, Above 500kW), Reciprocating (Up to 10kW, Above 10kW)), By Lubrication (Oil Injected, Oil Free), By Applications (Oil & Gas, Construction, Industrial, Food & Beverages, Others), By Regions (Central, Western, Eastern, Southern) and Competitive Landscape

| Product Code: ETC001666 | Publication Date: Feb 2022 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 88 | No. of Figures: 21 | No. of Tables: 18 |

Saudi Arabia Air Compressor Market Size & Growth Rate

The Saudi Arabia Air Compressor Market is projected to grow at a CAGR of 3.6% during 2021–2027, driven by infrastructure expansion under Vision 2030, strong oil & gas sector activity, and increasing demand across construction, industrial, and petrochemical projects despite temporary setbacks from the COVID-19 pandemic.

Saudi Arabia Air Compressor market report thoroughly covers the market by types, lubrication, technology, applications and regions. The report provides an unbiased and detailed analysis of the on-going Saudi Arabia air compressor market trends, opportunities/high growth areas and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia Air Compressor Market Synopsis

In the recent past, Saudi Arabia air compressor market showed a decent growth on back of projects in oil & gas sector, industrial development, and growing construction sector over the years. Additionally, government reforms and mega developmental projects announced by the government in sectors such as educational institutions, hotels and office spaces are propelling the demand for air compressors in Saudi Arabia.

Moreover, reviving economic conditions due to changing government policies, establishment of special economic zones would further drive the demand for air compressors in the country over the coming years. However, the outbreak of the COVID-19 pandemic resulted in decline in the market revenues during the year 2020 as a result of the falling demand from the construction and manufacturing sector due to halt in the business operations owing to the stringent lockdown imposed across the country. Moreover, the supply chain across countries got disrupted due to the locked borders of exporting countries. Despite of the decline in market revenues during 2020, recovery is expected in market revenues by 2021, with gradual opening of economic activities and restart of construction projects.

Moreover, reviving economic conditions due to changing government policies, establishment of special economic zones would further drive the demand for air compressors in the country over the coming years. However, the outbreak of the COVID-19 pandemic resulted in decline in the market revenues during the year 2020 as a result of the falling demand from the construction and manufacturing sector due to halt in the business operations owing to the stringent lockdown imposed across the country. Moreover, the supply chain across countries got disrupted due to the locked borders of exporting countries. Despite of the decline in market revenues during 2020, recovery is expected in market revenues by 2021, with gradual opening of economic activities and restart of construction projects.

According to 6Wresearch, Saudi Arabia Air Compressor Market size is projected to grow at a CAGR of 3.6% during 2021-2027F. Saudi Vision 2030 is one of government mega initiatives which aims at developing and strengthening public service sectors such as healthcare, education, and infrastructure. The fulfilment of these initiatives would require the application of air compressors on large scale, and this would further spur the market growth for air compressors in the country. The Eastern region occupies maximum share of air compressor market due to the presence of major oil companies such as ARAMCO and SABIC. Moreover, ongoing and upcoming infrastructural advancement are escalating the growth of air compressor market in Saudi Arabia.

Market by Applications Analysis

In terms of Applications, Oil & gas sector in Saudi Arabia is expected to exhibit strong growth during the forecast period (2021-27) on account of various upcoming petrochemical and oil and gas projects. Additionally, upcoming projects such as SABIC - Oil-To-Chemicals Plant worth $30 Billion would be the primary reasons behind the dominance of oil & gas sector in the air compressor market in the country.

Market by Technology Analysis

In terms of Technology, Rotary air compressor is anticipated to witness healthy growth in the forecast period. Further, petrochemical projects such as Jizan Refinery Project and COTC (a crude-oil-to-chemicals project) along with upcoming construction projects in commercial, residential, and healthcare sectors, would surge the demand for centrifugal air compressors in the country in the forecast period (2021-27).

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2017 to 2020.

- Base Year: 2020

- Forecast Data until 2027.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Saudi Arabia Air Compressor Market Overview

- Saudi Arabia Air Compressor Market Outlook

- Saudi Arabia Air Compressor Market Forecast

- Historical & Forecast data of Saudi Arabia Air Compressor Market Revenues & Volume for the Period 2017-2027F

- Historical & Forecast data of Saudi Arabia Portable Air Compressor Market Revenues & Volume for the Period 2017-2027F

- Historical & Forecast data of Saudi Arabia Stationary Air Compressor Market Revenues & Volume for the Period 2017-2027F

- Historical & Forecast data of Saudi Arabia Oil Injected Air Compressor Market Revenues & Volume for the Period 2017-2027F

- Historical & Forecast data of Saudi Arabia Oil Free Air Compressor Market Revenues & Volume for the Period 2017-2027F

- Historical & Forecast data of Saudi Arabia Rotary Air Compressor Market Revenues & Volume for the Period 2017-2027F

- Historical & Forecast data of Saudi Arabia Centrifugal Air Compressor Market Revenues & Volume for the Period 2017-2027F

- Historical & Forecast data of Saudi Arabia Reciprocating Air Compressor Market Revenues & Volume for the Period 2017-2027F

- Historical & Forecast data of Saudi Arabia Air Compressor Applications Market Revenues for the period 2017-2027F

- Historical & Forecast data of Saudi Arabia Air Compressor Regional Market Revenues for the Period 2017-2027F

- Market Drivers and Restraints

- Industry Life Cycle & Porter’s Five Forces

- Opportunity Assessment and Competitive Benchmarking

- Saudi Arabia Air Compressor Market Share, By Technology

- Recent Market Trends

- Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

- By Types

- Portable

- Stationary

- By Technology

- Rotary

- Up to 75kW

- 76-160kW

- Above 160kW

- Centrifugal

- Up to 500kW

- Above 500kW

- Reciprocating

- Up to 10kW

- Above 10kW

- By Lubrication

- Oil Injected

- Oil Free

- By Applications

- Oil & Gas

- Construction

- Industrial

- Food & Beverages

- Others

- By Regions

- Central

- Western

- Eastern

- Southern

Saudi Arabia Air Compressor Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Key Highlights of the Report |

| 2.2. Report Description |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Saudi Arabia Air Compressor Market Overview |

| 3.1. Saudi Arabia Air Compressor Market Revenues & Volume, (2017-2027F) |

| 3.2. Saudi Arabia Air Compressor Market – Industry Life Cycle |

| 3.3. Saudi Arabia Air Compressor Market – Porter’s Five Forces |

| 3.4. Saudi Arabia Air Compressor Market Revenue & Volume Share, By Types, 2020 & 2027F |

| 3.5. Saudi Arabia Air Compressor Market Revenue & Volume Share, By Technology, 2020 & 2027F |

| 3.6. Saudi Arabia Air Compressor Market Revenue & Volume Share, By Lubrication, 2020 & 2027F |

| 3.7. Saudi Arabia Air Compressor Market Revenue Share, By Power Rating, 2020 & 2027F |

| 3.8. Saudi Arabia Air Compressor Market Revenue Share, By Applications, 2020 & 2027F |

| 3.9. Saudi Arabia Air Compressor Market Revenue Share, By Regions, 2020 & 2027F |

| 4. Saudi Arabia Air Compressor Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Ongoing industrialization and infrastructure development in Saudi Arabia leading to increased demand for air compressors. |

| 4.2.2 Growing investments in the oil gas sector driving the need for air compressors for various applications. |

| 4.2.3 Increasing focus on energy efficiency and sustainability, prompting the adoption of more efficient air compressor technologies. |

| 4.3. Market Restraints |

| 4.3.1 Economic fluctuations impacting capital expenditure and investment in industrial equipment like air compressors. |

| 4.3.2 Volatility in raw material prices affecting manufacturing costs of air compressors. |

| 4.3.3 Stringent regulations and environmental policies influencing the selection and usage of air compressors. |

| 5. Saudi Arabia Air Compressor Market Trends |

| 6. Saudi Arabia Air Compressor Market Overview, By Types |

| 6.1. Saudi Arabia Portable Air Compressor Market Revenues & Volume (2017-2027F) |

| 6.2. Saudi Arabia Stationary Air Compressor Market Revenues & Volume (2017-2027F) |

| 7. Saudi Arabia Air Compressor Market Overview, By Lubrication |

| 7.1. Saudi Arabia Oil Injected Air Compressor Market Revenues & Volume (2017-2027F) |

| 7.2. Saudi Arabia Oil Free Air Compressor Market Revenues & Volume (2017-2027F) |

| 8. Saudi Arabia Rotary Air Compressor Market Overview |

| 8.1. Saudi Arabia Rotary Air Compressor Market Revenues & Volume (2017-2027F) |

| 8.2. Saudi Arabia Rotary Air Compressor Market Overview, By Power Rating |

| 8.2.1. Saudi Arabia Up to 75kW Rotary Air Compressor Market Revenues & Volume (2017-2027F) |

| 8.2.2. Saudi Arabia 76-160kW Rotary Air Compressor Market Revenues & Volume (2017-2027F) |

| 8.2.3. Saudi Arabia Above 160kW Rotary Air Compressor Market Revenues & Volume (2017-2027F) |

| 9. Saudi Arabia Centrifugal Air Compressor Market Overview |

| 9.1. Saudi Arabia Centrifugal Air Compressor Market Revenues & Volume (2017-2027F) |

| 9.2. Saudi Arabia Centrifugal Air Compressor Market Overview, By Power Rating |

| 9.2.1. Saudi Arabia Up to 500kW Centrifugal Air Compressor Market Revenues & Volume (2017-2027F) |

| 9.2.2. Saudi Arabia Above 500kW Centrifugal Air Compressor Market Revenues & Volume (2017-2027F) |

| 10. Saudi Arabia Reciprocating Air Compressor Market Overview |

| 10.1. Saudi Arabia Reciprocating Air Compressor Market Revenues & Volume (2017-2027F) |

| 10.2. Saudi Arabia Reciprocating Air Compressor Market Overview, By Power Rating |

| 10.2.1. Saudi Arabia Up to 10kW Reciprocating Air Compressor Market Revenues & Volume (2017-2027F) |

| 10.2.2. Saudi Arabia Above 10kW Reciprocating Air Compressor Market Revenues & Volume (2017-2027F) |

| 11. Saudi Arabia Air Compressor Market Overview, By Applications |

| 11.1. Saudi Arabia Air Compressor Market Revenues, By Construction Application (2017-2027F) |

| 11.2. Saudi Arabia Air Compressor Market Revenues, By Oil & Gas Application (2017-2027F) |

| 11.3. Saudi Arabia Air Compressor Market Revenues, By Industrial Application (2017-2027F) |

| 11.4. Saudi Arabia Air Compressor Market Revenues, By Food & Beverages Application (2017-2027F) |

| 11.5. Saudi Arabia Air Compressor Market Revenues, By Other Applications (2017-2027F) |

| 12. Saudi Arabia Air Compressor Market Overview, By Regions |

| 12.1. Saudi Arabia Air Compressor Market Revenues, By Central Region (2017-2027F) |

| 12.2. Saudi Arabia Air Compressor Market Revenues, By Western Region (2017-2027F) |

| 12.3. Saudi Arabia Air Compressor Market Revenues, By Eastern Region (2017-2027F) |

| 12.4. Saudi Arabia Air Compressor Market Revenues, By Southern Region (2017-2027F) |

| 13. Saudi Arabia Air Compressor Market Key Performance Indicators |

| 13.1 Energy efficiency improvement rate of air compressors in the Saudi Arabian market. |

| 13.2 Adoption rate of advanced air compressor technologies in key industries. |

| 13.3 Maintenance cost reduction percentage for air compressors in Saudi Arabia. |

| 14. Saudi Arabia Air Compressor Market Opportunity Assessment |

| 14.1. Saudi Arabia Air Compressor Market Opportunity Assessment, By Technology |

| 14.2. Saudi Arabia Air Compressor Market Opportunity Assessment, By Applications |

| 15. Saudi Arabia Air Compressor Market Competitive Landscape |

| 15.1. Saudi Arabia Air Compressor Market Company Rankings (2020) |

| 15.2. Saudi Arabia Air Compressor Market Competitive Benchmarking, By Technical Parameters |

| 16. Company Profiles |

| 16.1. Atlas Copco AB |

| 16.2. Ingersoll Rand Inc. |

| 16.3. Doosan Portable Power |

| 16.4. Sullair LLC |

| 16.5. Kaeser Kompressoren FZE |

| 16.6. Gardner Denver FZE |

| 16.7. Elgi Gulf FZE |

| 16.8. BOGE Kompressoren Otto Boge GmbH & Co. KG |

| 16.9. Hokuetsu Industries Co. Ltd. |

| 16.10. FS-Elliott Saudi Arabia Ltd |

| 17. Key Strategic Recommendations |

| 18. Disclaimer |

| List of Figures |

| Figure 1. Saudi Arabia Air Compressor Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 2. Saudi Arabia Air Compressor Market Revenue Share, By Types, 2020 & 2027F |

| Figure 3. Saudi Arabia Air Compressor Market Volume Share, By Types, 2020 & 2027F |

| Figure 4. Saudi Arabia Air Compressor Market Revenue Share, By Technology, 2020 & 2027F |

| Figure 5. Saudi Arabia Air Compressor Market Volume Share, By Technology, 2020 & 2027F |

| Figure 6. Saudi Arabia Air Compressor Market Revenue Share, By Lubrication, 2020 & 2027F |

| Figure 7. Saudi Arabia Air Compressor Market Volume Share, By Types, 2020 & 2027F |

| Figure 8. Saudi Arabia Air Compressor Market Revenue Share, By Power Rating, 2020 & 2027F |

| Figure 9. Saudi Arabia Air Compressor Market Revenue Share, By Applications, 2020 & 2027F |

| Figure 10. Saudi Arabia Air Compressor Market Revenue Share, By Regions, 2020 & 2027F |

| Figure 11. Saudi Vision 2030 Goals for Non-Oil Sector |

| Figure 12. Saudi Arabia Rotary Air Compressor Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 13. Saudi Arabia Centrifugal Air Compressor Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 14. Saudi Arabia Reciprocating Air Compressor Market Revenues & Volume, 2017-2027F ($ Million, Units) |

| Figure 15. Saudi Arabia Office Supply Space, Q2 2020-2022F (Sq.mt. GLA) |

| Figure 16. Saudi Arabia Residential Supply Stock, Q2 2020-2022F (Million Units) |

| Figure 17. Saudi Arabia Retail Supply Stock, Q2 2020-2022F (Sq. mt. GLA) |

| Figure 18. Upcoming Power Plant Projects in Saudi Arabia |

| Figure 19. Saudi Arabia Air Compressor Market Opportunity Assessment, By Technology, 2027F |

| Figure 20. Saudi Arabia Air Compressor Market Opportunity Assessment, By Applications, 2027F |

| Figure 21. Saudi Arabia Air Compressor Market Revenue Ranking, By Companies, 2020 |

| List of Tables |

| Table 1. Saudi Arabia Upcoming Transportation Projects |

| Table 2. Saudi Arabia Upcoming Mega Projects |

| Table 3. Saudi Arabia Upcoming Skyscraper Projects |

| Table 4. Saudi Arabia Upcoming Medical Complex Projects |

| Table 5. Saudi Arabia Economic Cities |

| Table 6. Saudi Arabia Upcoming Industrial Projects |

| Table 7. Saudi Arabia Air Compressor Market Revenues, By Types, 2017-2027F ($ Million) |

| Table 8. Saudi Arabia Air Compressor Market Volume, By Types, 2017-2027F (Units) |

| Table 9. Saudi Arabia Air Compressor Market Revenues, By Lubrication, 2017-2027F ($ Million) |

| Table 10. Saudi Arabia Air Compressor Market Volume, By Lubrication, 2017-2027F (Units) |

| Table 11. Saudi Arabia Rotary Air Compressor Market Revenues, By Power Rating, 2017-2027F ($ Million) |

| Table 12. Saudi Arabia Rotary Air Compressor Market Volume, By Power Rating, 2017-2027F (Units) |

| Table 13. Saudi Arabia Centrifugal Air Compressor Market Revenues, By Power Rating, 2017-2027F ($ Million) |

| Table 14. Saudi Arabia Centrifugal Air Compressor Market Volume, By Power Rating, 2017-2027F (Units) |

| Table 15. Saudi Arabia Reciprocating Air Compressor Market Revenues, By Power Rating, 2017-2027F ($ Million) |

| Table 16. Saudi Arabia Reciprocating Air Compressor Market Volume, By Power Rating, 2017-2027F (Units) |

| Table 17. Saudi Arabia Air Compressor Market Revenues, By Applications, 2017- 2027F ($ Million) |

| Table 18. Saudi Arabia Air Compressor Market Revenues, By Regions, 2017- 2027F ($ Million) |

Market Forecast By Types (Portable and Stationary), By Lubrication Method (Oil-Injected and Oil Free), By Technology (Rotary (0-75kW, 76-160kW, and Above 160kW), Centrifugal (0-500kW and Above 500kW), Reciprocating (0-10kW and Above 10kW)), By Applications (Industrial, Construction, Oil & Gas, Food & Beverages and Others), By Regions (Central, Southern, Western and Eastern) and Competitive Landscape

| Product Code: ETC001666 | Publication Date: Dec 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 88 | No. of Figures: 36 | No. of Tables: 15 |

The Saudi Arabia Air Compressor Market report thoroughly covers the market by types, lubrication, technology, applications and regions. The Saudi Arabia Air compressor market outlook report provides an unbiased and detailed analysis of the Saudi Arabia Air compressor market trends, opportunities high growth areas, market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

Saudi Arabia Air Compressor Market Synopsis

Saudi Arabia Air Compressor Market is expected to grow at a steady rate during the forecast period. Government reforms and mega development projects announced by the government in sectors such as educational institutions, hotels and office spaces are propelling the demand for Air compressors in Saudi Arabia. Moreover, reviving economic conditions due to changing government policies, establishment of special economic zones, etc. would further drive the demand for Air compressors in the country over the coming years. The market has seen a substantial decline owing to the massive outbreak of COVID-19 as construction was halted to combat the spreads of the virus.

According to 6Wresearch, Saudi Arabia Air Compressor Market size is projected to grow at CAGR of 2.9% during 2020-2026. Saudi Vision 2030 and the National Transformation Programme 2020 are few of the government initiatives which aims at developing and strengthening public service sectors such as healthcare, education and infrastructure. The fulfilment of these initiatives would require the application of Air compressors on large scale and this would further spur the growth for Air compressors in the country. The Eastern region occupies maximum share of the Air compressor market due to presence of major oil companies such as ARAMCO and SABIC. Moreover, ongoing and upcoming infrastructural advancement are escalating the growth of Air compressor market in Saudi Arabia.

Market Analysis by Types

In Saudi Arabia, rotary Air compressor captured majority of the market revenue share in 2019 and is expected to dominate during the forecast period as well. By applications, oil & gas and construction application garnered maximum revenue share in the overall Air compressor market due to the steady growth of large-scale projects.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2019.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- Saudi Arabia Air Compressor Market Overview

- Saudi Arabia Air Compressor Market Outlook

- Saudi Arabia Air Compressor Market Forecast

- Saudi Arabia Air Compressor Market Size

- Historical & Forecast Data of Saudi Arabia Air Compressor Market Revenues & Volume for the Period 2016-2026

- Historical & Forecast Data of Saudi Arabia Portable Air Compressor Market Revenues & Volume for the Period 2016-2026

- Historical & Forecast Data of Saudi Arabia Stationary Air Compressor Market Revenues & Volume for the Period 2016-2026

- Historical & Forecast Data of Saudi Arabia Oil Injected Air Compressor Market Revenues & Volume for the Period 2016-2026

- Historical & Forecast Data of Saudi Arabia Oil Free Air Compressor Market Revenues & Volume for the Period 2016-2026

- Historical & Forecast Data of Saudi Arabia Rotary Air Compressor Market Revenues & Volume for the Period 2016-2026

- Historical & Forecast Data of Saudi Arabia Centrifugal Air Compressor Market Revenues & Volume for the Period 2016-2026

- Historical & Forecast Data of Saudi Arabia Reciprocating Air Compressor Market Revenues & Volume for the Period 2016-2026

- Historical & Forecast Data of Saudi Arabia Air Compressor Applications Market Revenues for the period 2016-2026

- Historical & Forecast Data of Saudi Arabia Air Compressor Regional Market Revenues for the Period 2016-2026

- Market Drivers and Restraints

- Saudi Arabia Air Compressor Market Trends & Industry Life Cycle

- Porter’s Five Forces Analysis

- Market Opportunity Assessment

- Saudi Arabia Air Compressor Market Overview, By Competitive Benchmarking

- Market Share, By Technology

- Recent Market Trends

- Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

- By Types

- Portable

- Stationary

- By Lubrication Method

- Oil-Injected

- Oil-Free

- By Technology

- Rotary

- Up to 75kW

- 76-160kW

- Above 160kW

- Centrifugal

- Up to 500kW

- Above 500kW

- Reciprocating

- Up to 10kW

- Above 10kW

- By Applications

- Industrial

- Construction

- Oil & Gas

- Food & Beverages

- Others (Petrochemicals and Mining)

- By Regions

- Central

- Western

- Eastern

- Southern

Frequently Asked Questions About the Market Study:

- Does the report consider COVID-19 impact?

The report not only has considered COVID-19 impact but also current Market dynamics, trends and KPIs into consideration. - How much growth is expected in the Saudi Arabia Air Compressor Market over the coming years?

The Saudi Arabia Air Compressor Market revenue is anticipated to record a CAGR of 2.9% during 2020-2026. - Which segment has captured key share of the Market?

Rotary Air compressor has dominated the overall Market revenues in the year 2020. - Which segment is exhibited to gain traction over the forecast period?

Oil & Gas segment is expected to record key growth throughout the forecast period 2020-2026. - Who are key the key players of the Market?

The key players of the Market include- C Atlas Copco AB, Ingersoll Rand PLC, Doosan Portable Power, SullAir LLC, Kaeser Kompressoren FZE, Gardner Denver FZE, Elgi Gulf FZE, BOGE Kompressoren Otto Boge GmbH & Co. KG, Hokuetsu Industries Co. Ltd., FS-Elliott Saudi Arabia Ltdentrifugal - Is customization available in the Market study?

Yes, we can do customization as per your requirements. Please feel free to write to us sales@6wresearch.com for any customized or any other requirements - We also want to have Market reports for other countries/regions.

6Wresearch has the database of more than 60 countries globally, which can make us your first choice of all your research needs.

Other Key Reports Available:

- Kuwait Air Compressor Market Report

- Qatar Air Compressor Market Report

- India Air Compressor Market Report

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero